Ackroo Announces 2023 Audited Financial Results

April 30 2024 - 8:00AM

Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the “Company”), a gift card,

loyalty marketing, payments and point-of-sale technology

consolidator and services provider, is pleased to report audited

annual revenues of $6,977,597 for the year ended December 31st,

2023 including $6,086,981 of annual recurring revenue. This

represents an 11% increase in total revenue and a 14% increase in

recurring revenue over the same period in 2022. The Company also

achieved $1,722,102 of positive adjusted EBITDA during the year

representing a 23% increase over 2022 and equates to 27% of total

revenues. The Company improved their balance sheet, completed its

thirteenth acquisition, divested of a non-core point-of-sale

product, paid down debt, bought back shares, improved operations

and continued the development of their core AckrooMKTG platform.

The Company delivered their strongest year to date on many fronts

and is very optimistic about what the future holds for Ackroo.

The complete financial results for the year

ended December 31, 2023 will be available under the profile for

Ackroo on SEDAR+ at www.sedarplus.com. Highlights include:

2023 vs. 2022 annual results:

|

|

Year ended Dec 31, 2023 |

Year ended Dec 31, 2022 |

YoY growth |

|

Total Revenue |

$6,977,596 |

$6,264,107 |

+ 11% |

|

Subscription Rev |

$6,086,981 |

$5,350,098 |

+ 14% |

|

Gross Margins |

$6,230,869 (89%) |

$5,685,210 (91%) |

+ 10% |

|

Adjusted EBITDA |

$1,722,102 |

$1,403,546 |

+ 23% |

|

EBITDA % of Rev |

27% |

22% |

+ 5% |

|

Net Income |

$843,370 |

-$2,036,940 |

|

|

EPS |

$0.007 |

-$0.018 |

|

2023 quarterly results:

|

|

Q1 - March 31, 2023 |

Q2 - June 30, 2023 |

Q3 - September 30, 2023 |

Q4 - December 31, 2023 |

2023 TOTALS |

|

Total Revenue |

$1,825,485 |

$1,610,841 |

$1,624,001 |

$1,917,269 |

$6,977,596 |

|

Subscription Rev |

$1,612,799 |

$1,408,516 |

$1,397,281 |

$1,668,385 |

$6,086,981 |

|

Gross Margins |

$1,607,582 (88%) |

$1,387,805 (86%) |

$1,477,437 (91%) |

$1,758,052 (92%) |

$6,230,870 (89%) |

|

Adjusted EBITDA |

$451,424 |

$241,838 |

$394,155 |

$634,685 |

$1,722,102 |

|

EBITDA % of Rev |

25% |

15% |

24% |

33% |

27% |

“We delivered another great earnings and

acquisition year” said Steve Levely, CEO of Ackroo. “We effectively

closed two new transactions and divested of one distracting asset

resulting in an 11% revenue growth year for the business. We

increased our recurring revenue by 14% and adjusted EBITDA by a

great 26% allowing us to deliver a solid 28% adjusted EBITDA as a

percentage of revenue in the process. We believe our earnings

growth is key to our short and long-term success and will remain a

core focus for the business as we move forward. The Company also

continued to make significant advancements in our operations and

technology in order to help bring more value to our growing

merchant base and to help further simplify our business. As an

operator of our acquired assets it’s critical that we have simple

and efficient operations and a core technology platform that is

built for integration and scale in order to succeed. We plan to

continue to improve in these areas while also maintain a very

disciplined capital allocation strategy. We are very pleased with

the many decisions we made and the earnings results we delivered in

2023 and are excited for a very prosperous year in 2024.”

Disclosure in this news release contains certain

non-GAAP financial measures which include: “annual recurring

revenue”, “gross margins” and “adjusted EBITDA”. These measures are

used by the Company to provide investors with supplemental

information to measure operating performance and highlight trends

in the business which may not otherwise be apparent. These measures

should not be considered in isolation or as a substitute for

analysis of the financial information of the Company reported under

IFRS. For information on the derivation of these non-GAAP financial

measures, readers are encouraged to review managements’ discussion

and analysis for the year ended December 31, 2023.

About Ackroo

As an industry consolidator, Ackroo acquires,

integrates and manages gift card, loyalty marketing, payment and

point-of-sale solutions used by merchants of all sizes. Ackroo’s

self-serve, data driven, cloud-based marketing platform helps

merchants in-store and online process and manage loyalty, gift card

and promotional transactions at the point of sale. Ackroo’s

acquisition of payment ISO’s affords Ackroo the ability to resell

payment processing solutions to their growing merchant base through

some of the world’s largest payment technology and service

providers. As a third revenue stream Ackroo has acquired certain

custom software products including hybrid management and

point-of-sale solutions that help manage and optimize the general

operations for niche industry’s including automotive dealers and

more. All solutions are focused on helping to consolidate, simplify

and improve the merchant marketing, payments and point-of sale

ecosystem for their clients. Ackroo is headquartered in Hamilton,

Ontario, Canada. For more information, visit: www.ackroo.com.

For further information, please contact:

Steve LevelyChief Executive

Officer | AckrooTel: 416-360-5619 x730Email: slevely@ackroo.com

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking StatementsThis

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

Company’s ability to raise enough capital to support the Company’s

go forward plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

Company operates; projected capital expenditures and liquidity;

changes in the Company’s strategy; government regulations and

approvals; changes in customers’ budgeting priorities; plus other

factors that may arise. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

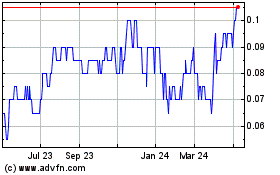

Ackroo (TSXV:AKR)

Historical Stock Chart

From Oct 2024 to Nov 2024

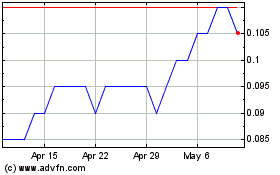

Ackroo (TSXV:AKR)

Historical Stock Chart

From Nov 2023 to Nov 2024