Western Forest Products Inc. (TSX: WEF) (“Western” or the

“Company”) reported a net loss of $8.0 million in the first quarter

of 2024, as compared to a net loss of $17.7 million in the first

quarter of 2023, and a net loss of $14.3 million in the fourth

quarter of 2023.

Adjusted EBITDA was negative $4.2 million in the

first quarter of 2024, as compared to negative $5.0 million in the

first quarter of 2023, and negative $1.2 million in the fourth

quarter of 2023.

| |

|

|

|

|

|

| (millions of Canadian dollars

except per share amounts and where otherwise noted) |

Q12024 |

|

Q12023 |

|

Q42023 |

|

Revenue |

$ |

239.5 |

|

|

$ |

263.8 |

|

|

$ |

246.6 |

|

| Adjusted EBITDA(1) |

|

(4.2 |

) |

|

|

(5.0 |

) |

|

|

(1.2 |

) |

| Adjusted EBITDA margin(1) |

|

(2% |

) |

|

|

(2% |

) |

|

|

(0% |

) |

| Operating loss prior to

restructuring and other items |

$ |

(17.3 |

) |

|

$ |

(18.1 |

) |

|

$ |

(14.4 |

) |

| Net loss |

|

(8.0 |

) |

|

|

(17.7 |

) |

|

|

(14.3 |

) |

| Loss per share, diluted |

|

(0.02 |

) |

|

|

(0.05 |

) |

|

|

(0.04 |

) |

| Net debt(2), end of

period |

|

83.6 |

|

|

|

24.3 |

|

|

|

82.4 |

|

| Liquidity(1), end of

period |

|

142.1 |

|

|

|

205.4 |

|

|

|

147.8 |

|

| Net debt to

capitalization |

|

13% |

|

|

|

4% |

|

|

|

13% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) Refer to Adjusted EBITDA,

Adjusted EBITDA margin, Liquidity and Net debt to capitalization in

the Non-GAAP Financial Measures section.(2) Net debt, a

supplemental measure, is defined as cash and cash equivalents less

long-term debt and bank indebtedness.

First Quarter 2024 Financial and

Operational Summary

- Lumber shipments of 131 million

board feet (versus 170 million board feet in Q1 2023)

- Japan lumber shipments of 29

million board feet (versus 15 million board feet in Q1 2023)

- Specialty lumber mix of 61% (versus

40% in Q1 2023)

- Average lumber selling price of

$1,351 per mfbm (versus $1,241 per mfbm in Q1 2023), benefiting

from a stronger sales mix, but offset by lower lumber prices

Indigenous Relationships

- Completed the sale of a 34%

ownership interest in the newly formed La-kwa sa muqw Forestry

Limited Partnership (“LFLP”) for gross proceeds of $35.9 million to

the Tlowitsis, We Wai Kai, Wei Wai Kum and K’ómoks First Nations.

The LFLP is comprised of certain assets and liabilities of

Western’s former Mid-Island Forest Operation, including the

newly-established Tree Farm Licence (“TFL”) 64, created through the

subdivision of Block 2 from TFL 39. The current allowable annual

cut (“AAC”) of TFL 64 represents approximately 16% of Western’s

total AAC.

- In collaboration with the ‘Namgis

First Nation, we released a draft of the first Forest Landscape

Plan (“FLP”) in British Columbia (“BC”) for public comment. The FLP

covers approximately 89% of the area of TFL 37 and offers the

opportunity for greater certainty for a stable long-term fibre

supply within TFL 37. Western’s current AAC in TFL 37 represents

approximately 14% of our total AAC.

Accelerating the Transition to Higher

Value Products

- Completed and commissioned the

first continuous dry kiln on the BC Coast at our Saltair sawmill.

The new continuous kiln, which has a capacity of approximately 70

million board feet, will support increased production of higher

valued products and also contributes to our environmental

objectives by reducing energy consumption.

- Advanced permitting related to two

previously announced continuous dry kilns, one at our Duke Point

sawmill in Nanaimo, BC and one at our Value-Added Division in

Chemainus, BC. Each kiln will have a capacity of approximately 70

million board feet and we expect to complete these two additional

kilns by the end of 2025.

Balance Sheet and Cash Flow

- Near-term priority is maintaining a

strong balance sheet and financial flexibility

- Ended the quarter with liquidity of

$142.1 million and a net debt to capitalization ratio of 13%

- Expect an income tax refund of

approximately $23 million in the second or third quarter of

2024

- Reducing capital expenditure

spending to approximately $50 million in 2024. This includes

approximately $13 million of spending related to two new continuous

dry kilns, which are expected to be completed over 2024 and 2025 at

an estimated total cost of approximately $35 million.

- Cumulative duties of US Dollar

(“USD”) $168.8 million ($228.5 million) held in trust by U.S.

Customs and Border Protection as at March 31, 2024, or

approximately $0.53 per share on an after-tax basis

Other Updates

- Announced the indefinite

curtailment of our Alberni Pacific Division facility

Market Outlook

We are seeing some positive signs of improving

demand and prices in certain lumber products relative to the first

quarter of 2024. However, lumber demand and prices in the second

half of 2024 will vary based on product lines and be dependent on

global macroeconomic conditions.

Demand and prices for Cedar timber and premium

appearance products are expected to remain stable. Demand and price

for Cedar decking products are firming up as we head into the

spring, while demand for Cedar trim and fencing products is

expected to remain soft until market inventory rebalances.

In Japan, we anticipate quarterly lumber volumes

to remain near those achieved in the first quarter of 2024. Lumber

prices are expected to remain stable but may be impacted by further

weakness in the Japanese yen to USD exchange rate.

Demand for our Industrial lumber products is

generally expected to remain stable over the near-term. North

American demand and prices for our commodity products should

marginally improve in the second quarter of 2024 but are expected

to remain volatile through the second half of 2024. In China,

lumber demand and prices may slightly weaken as we progress through

2024.

We expect sawlog markets to follow conditions in

the lumber markets, while residual chip pricing is expected to

slightly improve in the near-term and will continue to follow the

northern bleached softwood kraft price to China.

Management Discussion & Analysis

("MD&A")

Readers are encouraged to read our Q1 2024

MD&A and interim consolidated financial statements and

accompanying notes which are available on our website at

www.westernforest.com and “SEDAR+” at www.sedarplus.ca.

Risks and Uncertainties

Risk and uncertainty disclosures are included in

our 2023 Annual MD&A, as updated in the disclosures in our Q1

2024 MD&A, as well as in our public filings with securities

regulatory authorities. See also the discussion of “Forward-Looking

Statements” below.

Non-GAAP Financial Measures

Reference is made in this press release to the

following non-GAAP measures: Adjusted EBITDA, Adjusted EBITDA

margin, Net debt to capitalization, and total Liquidity are used as

benchmark measurements of our operating results and as benchmarks

relative to our competitors. These non-GAAP measures are commonly

used by securities analysts, investors and other interested parties

to evaluate our financial performance. These non-GAAP measures do

not have any standardized meaning prescribed by IFRS and may not be

comparable to similar measures presented by other issuers. The

following table provides a reconciliation of these non-GAAP

measures to figures as reported in our audited annual consolidated

financial statements:

(millions of Canadian dollars except where otherwise

noted)

|

Adjusted EBITDA |

|

Q12024 |

|

Q12023 |

|

Q42023 |

|

Net loss |

|

$ |

(8.0 |

) |

|

$ |

(17.7 |

) |

|

$ |

(14.3 |

) |

|

Add: |

|

|

|

|

|

Amortization |

|

|

13.2 |

|

|

|

13.1 |

|

|

|

13.3 |

|

|

Operating restructuring items |

|

|

(0.2 |

) |

|

|

5.2 |

|

|

|

0.9 |

|

|

Other (income) expense |

|

|

(1.8 |

) |

|

|

0.1 |

|

|

|

2.5 |

|

|

Finance costs |

|

|

2.1 |

|

|

|

0.2 |

|

|

|

1.8 |

|

|

Income tax recovery |

|

|

(9.4 |

) |

|

|

(5.9 |

) |

|

|

(5.3 |

) |

|

Adjusted EBITDA |

|

$ |

(4.2 |

) |

|

$ |

(5.0 |

) |

|

$ |

(1.2 |

) |

|

Adjusted EBITDA margin |

|

|

|

|

|

Total revenue |

|

$ |

239.5 |

|

|

$ |

263.8 |

|

|

$ |

246.6 |

|

|

Adjusted EBITDA |

|

|

(4.2 |

) |

|

|

(5.0 |

) |

|

|

(1.2 |

) |

|

Adjusted EBITDA margin |

|

|

(2% |

) |

|

|

(2% |

) |

|

|

(0% |

) |

|

Net debt to capitalization |

|

|

|

|

|

Net debt |

|

|

|

|

|

Total debt |

|

$ |

85.6 |

|

|

$ |

25.6 |

|

|

$ |

83.8 |

|

|

Bank indebtedness |

|

|

0.5 |

|

|

|

1.0 |

|

|

|

0.9 |

|

|

Cash and cash equivalents |

|

|

(2.5 |

) |

|

|

(2.3 |

) |

|

|

(2.3 |

) |

|

|

|

$ |

83.6 |

|

|

$ |

24.3 |

|

|

$ |

82.4 |

|

|

Capitalization |

|

|

|

|

|

Net debt |

|

$ |

83.6 |

|

|

$ |

24.3 |

|

|

$ |

82.4 |

|

|

Total equity attributable to equity shareholders of the

Company |

|

|

578.3 |

|

|

|

626.5 |

|

|

|

565.0 |

|

|

|

|

$ |

661.9 |

|

|

$ |

650.8 |

|

|

$ |

647.4 |

|

|

Net debt to capitalization |

|

|

13% |

|

|

|

4% |

|

|

|

13% |

|

|

Total liquidity |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

2.5 |

|

|

$ |

2.3 |

|

|

$ |

2.3 |

|

|

Available credit facility |

|

|

250.0 |

|

|

|

250.0 |

|

|

|

250.0 |

|

|

Bank indebtedness |

|

|

(0.5 |

) |

|

|

(1.0 |

) |

|

|

(0.9 |

) |

|

Credit facility drawings |

|

|

(85.7 |

) |

|

|

(25.9 |

) |

|

|

(84.0 |

) |

|

Outstanding letters of credit |

|

|

(24.2 |

) |

|

|

(20.0 |

) |

|

|

(19.6 |

) |

|

|

|

$ |

142.1 |

|

|

$ |

205.4 |

|

|

$ |

147.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Figures in the table above may not equal or sum

to figures presented in the table and elsewhere due to

rounding.

Forward Looking Statements and Information

This press release contains statements that may

constitute forward-looking statements under the applicable

securities laws. Readers are cautioned against placing undue

reliance on forward-looking statements. All statements herein,

other than statements of historical fact, may be forward-looking

statements and can be identified by the use of words such as

“will”, “commit”, “project”, “estimate”, “expect”, “anticipate”,

“plan”, “forecast”, “intend”, “believe”, “seek”, “could”, “should”,

“may”, “likely”, “continue”, “maintain”, “pursue” and similar

references to future periods. Forward-looking statements in this

press release include, but are not limited to, statements relating

to our current intent, belief or expectations with respect to:

domestic and international market conditions, demands and growth;

economic conditions; our growth, marketing, product, wholesale,

operational and capital allocation plans and strategies, demand and

prices for lumber products; the availability, stability and

certainty of the Company’s fibre supply; the capacity of the

Company’s facilities and assets including its continuous dry kilns;

the completion of the Company’s capital projects and the expected

timing thereof; the Company’s balance sheet and financial

flexibility; the Company’s receipt of an income tax refund and the

expected timing thereof; and the amount and timing of the Company’s

capital expenditures. Although such statements reflect management’s

current reasonable beliefs, expectations and assumptions as to,

amongst other things, the future supply and demand of forest

products, global and regional economic activity and the consistency

of the regulatory framework within which the Company currently

operates, there can be no assurance that forward-looking statements

are accurate, and actual results and performance may materially

vary.

Many factors could cause our actual results or

performance to be materially different including: economic and

financial conditions including inflation, international demand for

forest products, the Company’s ability to export its products, cost

and availability of shipping carrier capacity, competition and

selling prices, international trade disputes and sanctions, changes

in foreign currency exchange rates, labour disputes and

disruptions, natural disasters, the impact of climate change,

relations with First Nations groups, First Nations’ claims and

settlements, the availability of fibre and allowable annual cut,

the ability to obtain operational permits, development and changes

in laws and regulations affecting the forest industry, changes in

the price of key materials for our products, changes in

opportunities, information systems security, future developments in

COVID-19 and other factors referenced under the “Risks and

Uncertainties” section of our MD&A in our 2023 Annual Report

dated February 13, 2024. The foregoing list is not exhaustive, as

other factors could adversely affect our actual results and

performance. Forward-looking statements are based only on

information currently available to us and refer only as of the date

hereof. Except as required by law, we undertake no obligation to

update forward-looking statements.

Reference is made in this press release to

adjusted EBITDA which is defined as operating income prior to

operating restructuring items and other income (expense) plus

amortization of plant, equipment and intangible assets, impairment

adjustments, and changes in fair value of biological assets.

Adjusted EBITDA margin is adjusted EBITDA as a proportion of

revenue. Western uses adjusted EBITDA and adjusted EBITDA margin as

benchmark measurements of our own operating results and as

benchmarks relative to our competitors. We consider adjusted EBITDA

to be a meaningful supplement to operating income as a performance

measure primarily because amortization expense, impairment

adjustments and changes in the fair value of biological assets are

non-cash costs, and vary widely from company to company in a manner

that we consider largely independent of the underlying cost

efficiency of their operating facilities. Further, the inclusion of

operating restructuring items which are unpredictable in nature and

timing may make comparisons of our operating results between

periods more difficult. We also believe adjusted EBITDA and

adjusted EBITDA margin are commonly used by securities analysts,

investors and other interested parties to evaluate our financial

performance.

Adjusted EBITDA does not represent cash

generated from operations as defined by IFRS and it is not

necessarily indicative of cash available to fund cash needs.

Furthermore, adjusted EBITDA does not reflect the impact of certain

items that affect our net income. Adjusted EBITDA and adjusted

EBITDA margin are not measures of financial performance under IFRS,

and should not be considered as alternatives to measures of

performance under IFRS. Moreover, because all companies do not

calculate adjusted EBITDA and adjusted EBITDA margin in the same

manner, these measures as calculated by Western may differ from

similar measures calculated by other companies. A reconciliation

between the Company’s net income as reported in accordance with

IFRS and adjusted EBITDA is included in this press release.

Also in this press release management may use

key performance indicators such as net debt, net debt to

capitalization, and current assets to current liabilities. Net debt

is defined as long-term debt less cash and cash equivalents. Net

debt to capitalization is a ratio defined as net debt divided by

capitalization, with capitalization being the sum of net debt and

equity. Current assets to current liabilities is defined as total

current assets divided by total current liabilities. These key

performance indicators are non-GAAP financial measures that do not

have a standardized meaning and may not be comparable to similar

measures used by other issuers. They are not recognized by IFRS,

however, they are meaningful in that they indicate the Company’s

ability to meet their obligations on an ongoing basis, and indicate

whether the Company is more or less leveraged than the prior

year.

Conference Call

Wednesday, May 8, 2024 at 12:00 p.m. PDT

(3:00 p.m. EDT).

To participate in the teleconference please dial

416-340-2217 or 1-800-952-5114 (passcode: 7950035#). This call will

be taped, available one hour after the teleconference, and on

replay until June 8, 2024 at 8:59 p.m. PDT (11:59 p.m. EDT). To

hear a complete replay, please call 905-694-9451 / 1-800-408-3053

(passcode: 1087490#).

About Western Forest Products Inc.

Western is an integrated forest products company

building a margin-focused log and lumber business to compete

successfully in global softwood markets. With operations and

employees located primarily on the coast of British Columbia and

Washington State, Western is a premier supplier of high-value,

specialty forest products to worldwide markets. Western has a

lumber capacity of 885 million board feet from six sawmills, as

well as operates four remanufacturing facilities and two glulam

manufacturing facilities. The Company sources timber from its

private lands, long-term licenses, First Nations arrangements, and

market purchases. Western supplements its production through a

wholesale program providing customers with a comprehensive range of

specialty products.

For further information, please contact:Stephen

WilliamsExecutive Vice President & Chief Financial Officer(604)

648-4500

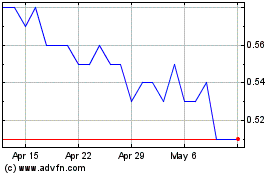

Western Forest Products (TSX:WEF)

Historical Stock Chart

From Dec 2024 to Jan 2025

Western Forest Products (TSX:WEF)

Historical Stock Chart

From Jan 2024 to Jan 2025