Estimated inferred gold resources

increase 302% to 20.0 million ouncesEstimated

inferred copper resources grow 379% to 8.6 billion

poundsInferred copper grade jumps 36%, inferred

gold grade rises 14%

Seabridge Gold Inc. (TSX:SEA) (NYSE:SA) announced today that an

updated independent mineral resource estimate for the Iron Cap

deposit has increased its size and grade. Iron Cap is one of four

large gold/copper porphyry deposits within Seabridge’s 100%-owned

KSM Project located in northwestern British Columbia. The updated

resource estimate, dated as at February 9, 2018, incorporates all

previous drilling plus 10,383 meters of diamond core drilling

completed in 11 holes drilled in 2017. All 11 holes returned wide

zones of significant grade.

A comparison of the previous Iron Cap resource

estimate to the updated resource estimate is as follows:

Iron Cap Undiluted Mineral Resources at

C$16 NSR Cutoff

| |

|

|

|

|

| Date of Estimate |

ResourceCategory |

Tonnes(millions) |

Average Grades |

Contained Metal |

|

Gold(gpt) |

Copper(%) |

Silver(gpt) |

Moly(ppm) |

Gold(000ounces) |

Copper(millionpounds) |

Silver(000ounces) |

Moly(millionpounds) |

| September 2016 |

Indicated |

347 |

0.51 |

0.23 |

4.5 |

14 |

5,686 |

1,758 |

50,174 |

11 |

|

Inferred |

369 |

0.42 |

0.22 |

2.2 |

21 |

4,987 |

1,791 |

26,121 |

17 |

| February 2017 |

Indicated |

370 |

0.43 |

0.23 |

4.2 |

48 |

5,112 |

1,874 |

49,931 |

39 |

|

Inferred |

1,297 |

0.48 |

0.30 |

2.9 |

34 |

20,023 |

8,579 |

120,970 |

34 |

Note: Mineral Resources which are not Mineral

Reserves do not have demonstrated economic viability. Drill spacing

in the 2017 program was designed to meet two objectives: expand the

known size of the Iron Cap deposit while also meeting the

requirements of an inferred resource estimate. Based on the

relatively consistent nature of the deposit and extensive drilling

at Iron Cap, the Company believes it is reasonable to expect that

the majority of Inferred Mineral Resources could be upgraded to

Indicated Mineral Resources with continued exploration.

All resource estimates have been constrained by

conceptual block cave shapes. The 2016 resource estimates were

incorporated into the National Instrument 43-101 Technical Report

on KSM announced on September 19, 2016. Drilling results from 2016

and 2017 coupled with selected re-logging of older core holes

resulted in an updated geologic model for the entire Iron Cap

deposit. This new interpretation places more emphasis on

steeper structurally controlled intrusions as one of the key

controls to mineralization. Grade envelopes were developed

for the current block model that constrained the mineralization

with these structural controls, resulting in about a 10% decrease

in gold grade for Indicated Mineral Resources. Updated

molybdenum grade envelopes and domaining resulted in an increase in

the estimated molybdenum grade, although those values contribute

very little to the NSR value. Future infill drilling programs

will focus on testing the higher grade, intrusive dominated north

area with expectations of increasing the overall confidence in the

mineralized system and beginning the process of converting Inferred

Mineral Resources to Indicated Mineral Resources.

Seabridge Chairman and CEO Rudi Fronk confirmed

that “all our objectives at Iron Cap were more than accomplished

last year. A larger, richer Iron Cap deposit is expected to take a

more prominent place in our mine planning. We believe Iron

Cap has the potential to make a strong contribution to improving

project economics thanks to its higher grade and its favorable

capital and operating costs due to its location close to planned

infrastructure,” Fronk said. “Although we think that a 16 dollar

NSR is the right cutoff in the current environment, we are pleased

to see that substantial tonnages at much higher grades are also

possible if required in the future. Furthermore, we think that the

size and grade of this deposit can continue to grow with further

drilling.”

Fronk also noted that “these resource additions

once again have met our annual corporate objective of increasing

gold ownership on a per share basis. We added over 15 million

inferred resource ounces of gold in our 2017 program, while losing

600 thousand ounces of indicated resources. In 2017, our shares

outstanding increased by 3.36 million shares resulting from new

financings to fund our programs, acquisitions of new projects and

other share issuances. Enhancing shareholder ownership of gold

resources remains a governing principle for our Company and 2017

marks the 18th successive year that we have achieved this

self-imposed discipline.”

Gold, copper, silver and molybdenum grades in

the resource were estimated by Resource Modeling Inc. (“RMI”) using

inverse distance weighting methods. Independently designed

gold, copper, silver, and molybdenum grade envelopes provided the

primary constraint in the grade estimation plan. Those grade

envelopes were updated using the new structural/lithologic model

that has been developed for the Iron Cap deposit. A

multi-pass inverse distance cubed estimation plan was developed

using two steeply oriented search ellipses to select eligible

composites for block grade estimation.

The grade models were validated visually and by

comparisons with nearest neighbor models. The drill hole database

that was used for the estimate of the Iron Cap mineral resources

consisted primarily of data collected by Seabridge from 75 core

drill holes totaling more than 45,000 meters of core drilling

completed between 2005 and 2017. RMI reviewed the quality

assurance/quality control protocols and results associated with the

Seabridge drilling and has concluded that the number and type of

gold and copper standard reference materials (standards, blanks,

and duplicates) were reasonable. Based on the performance of those

standard reference materials, RMI believes that the Seabridge drill

samples are reproducible and suitable for estimating mineral

resources.

Block net smelter return values (“NSR” values)

were calculated by Moose Mountain Technical Services using metal

recovery projection formulae developed by Tetra Tech from

metallurgical test work. This NSR value, stated in terms of

Canadian dollars, reflects metal prices, a US$/C$ currency exchange

rate of 0.80, and offsite transportation, smelting, and refining

charges.

Iron Cap was treated as a potential block cave

(bulk underground) mining target. The lateral and vertical

continuity of the zone provides a geometric configuration that is

likely to be amenable to these mining methods. Seabridge has

retained Golder Associates, a leading industry expert in

underground mining, to undertake bulk underground mining studies

for KSM. Golder used the block model prepared by RMI to establish

three separate draw point elevations at an NSR shutoff value of

C$16, and the conceptual cave footprints of these three elevations

were extruded upward by 500 meters and then clipped against one

another. Resources within the extruded shapes were tabulated for

each of the three hypothetical draw point elevations using an NSR

cutoff value of C$16, consistent with last year’s resource

statement in the Technical Report. Evaluation of the economic

potential of Iron Cap was based on metal prices of US$3.00 per

pound of copper, US$1300 per ounce of gold, US$20 per ounce of

silver, US$9.70 per pound of molybdenum and a US$/C$ exchange rate

of 0.83 together with estimated metal recoveries from metallurgical

test work. These metal prices are generally in line with, or lower

than, the metal prices used by major mining companies for their

current resource disclosure for similar types of projects.

The 2017 drill program at Iron Cap confirmed

that the grade of the deposit is increasing down dip and to the

northwest. As a result, within the C$16 NSR cave shapes there exist

large, higher grade zones that could be exploited to drive

economics (see attached long section and cross section). In an

effort to show the potential of these higher grade zones, the

following table compares the undiluted tonnes and grades of the

updated Iron Cap resource at various NSR cutoffs:

| |

|

|

|

|

| NSR Cutoff (C$) |

ResourceCategory |

Tonnes(millions) |

Average Grades |

Contained Metal |

|

Gold(gpt) |

Copper(%) |

Silver(gpt) |

Moly(ppm) |

Gold(000ounces) |

Copper(millionpounds) |

Silver(000ounces) |

Moly(millionpounds) |

| 8 |

Indicated |

428 |

0.40 |

0.22 |

4.0 |

46 |

5,506 |

2,076 |

55,061 |

46 |

|

Inferred |

1,462 |

0.44 |

0.28 |

2.8 |

33 |

20,685 |

9,024 |

131,634 |

33 |

| 12 |

Indicated |

413 |

0.41 |

0.22 |

4.0 |

47 |

5,445 |

2,003 |

53,119 |

47 |

|

Inferred |

1,411 |

0.45 |

0.29 |

2.8 |

34 |

20,413 |

9,018 |

127,015 |

34 |

| 16 |

Indicated |

370 |

0.43 |

0.23 |

4.2 |

48 |

5,112 |

1,874 |

49,931 |

48 |

|

Inferred |

1,297 |

0.48 |

0.30 |

2.9 |

34 |

20,023 |

8,579 |

120,970 |

34 |

| 20 |

Indicated |

298 |

0.49 |

0.24 |

4.4 |

50 |

4,688 |

1,574 |

42,095 |

50 |

|

Inferred |

1,098 |

0.52 |

0.32 |

3.0 |

33 |

18,364 |

7,747 |

105,948 |

33 |

| 24 |

Indicated |

227 |

0.55 |

0.26 |

4.5 |

46 |

4,007 |

1,299 |

32,785 |

46 |

|

Inferred |

875 |

0.58 |

0.35 |

3.0 |

32 |

16,318 |

6,751 |

84,405 |

32 |

| 28 |

Indicated |

166 |

0.62 |

0.27 |

4.7 |

35 |

3,302 |

986 |

25,029 |

35 |

|

Inferred |

670 |

0.65 |

0.39 |

3.0 |

29 |

13,999 |

5,758 |

64,608 |

29 |

| 32 |

Indicated |

118 |

0.70 |

0.29 |

4.6 |

26 |

2,666 |

757 |

17,519 |

26 |

|

Inferred |

517 |

0.73 |

0.42 |

3.0 |

27 |

12,131 |

4,784 |

49,851 |

31 |

The lines bolded in the table above

represent the updated undiluted mineral resource tonnes, grade, and

contained metal at C$16 cutoff within the three cave footprints.

The tonnes, grade, and contained metal for the other NSR cutoffs

are shown to provide a relative sense of the distribution of

materials within the conceptual block cave shapes.

Resource estimates included herein were prepared

by RMI under the direction of Michael Lechner, who is independent

of Seabridge and a Qualified Person as defined by National

Instrument 43-101. Mr. Lechner has reviewed and approved this news

release.

Exploration activities by Seabridge at the KSM

Project are conducted under the supervision of William E.

Threlkeld, Registered Professional Geologist, Senior Vice President

of the Company and a Qualified Person as defined by National

Instrument 43-101. Mr. Threlkeld has reviewed and approved this

news release. An ongoing and rigorous quality control/quality

assurance protocol is employed in all Seabridge drilling campaigns.

This program includes blank and reference standards; in addition,

all copper assays exceeding 0.25% Cu are re-analyzed using ore

grade analytical techniques. Random cross-check analyses are

conducted at a second external laboratory on at least 10% of the

drill samples. Samples are assayed at ISO and ASTM certified

laboratories in Vancouver, B.C., using fire assay atomic adsorption

methods for gold and ICP methods for other elements.

Seabridge Gold holds a 100% interest in several

North American gold resource projects. The Company’s principal

assets are the KSM and Iskut properties located near Stewart,

British Columbia, Canada and the Courageous Lake gold project

located in Canada’s Northwest Territories. For a breakdown of

Seabridge’s mineral reserves and resources by project and category

please visit the Company’s website at

http://www.seabridgegold.net/resources.php.

Neither the Toronto Stock Exchange, New

York Stock Exchange, nor their Regulation Services Providers

accepts responsibility for the adequacy or accuracy of this

release.

All reserve and resource estimates

reported by the Corporation were calculated in accordance with the

Canadian National Instrument 43-101 and the Canadian Institute of

Mining and Metallurgy Classification system. These standards differ

significantly from the requirements of the U.S. Securities and

Exchange Commission. Mineral resources which are not mineral

reserves do not have demonstrated economic viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to: (i) the Company

believing it is reasonable to expect that the majority of Inferred

Mineral Resources could be upgraded to Indicated Mineral Resources

with continued exploration; (ii) Iron Cap having

the potential to make a strong contribution to improving project

economics thanks to its higher grade and its favorable capital and

operating costs due to its location close to planned

infrastructure; (iii) that the

size and grade of the Iron Cap deposit as well as confidence in the

mineral system can continue to grow with further

drilling; (iv) the Seabridge drill samples being

reproducible and suitable for estimating mineral resources; (v)

lateral and vertical continuity of the mineralized zone providing a

geometric configuration that is likely to be amenable to block cave

mining methods; and (vi) the estimated amount and grade of mineral

resources at KSM’s Iron Cap deposit. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives or future events or

performance (often, but not always, using words or phrases such as

"expects", "anticipates", "plans", "projects", "estimates",

"envisages", "assumes", "intends", "strategy", "goals",

"objectives" or variations thereof or stating that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and

may be forward-looking statements.

All forward-looking statements are based

on Seabridge's or its consultants' current beliefs as well as

various assumptions made by them and information currently

available to them. The principle assumptions are listed above, but

others include: (i) the presence of and continuity of metals at the

Project between drill holes, including at modeled grades; (ii) that

costs of mining the Iron Cap deposit will be comparable to mining

the Kerr deposit; (iii) the capacities of various machinery and

equipment; (iv) the availability of personnel, machinery and

equipment at estimated prices; (v) exchange rates; (vi) metals

sales prices; (vii) block net smelter return values; (viii)

conceptual cave footprints, draw points and heights; (ix)

appropriate discount rates; (x) tax rates and royalty rates

applicable to the proposed mining operation; (xi) financing

structure and costs; (xii) anticipated mining losses and dilution;

(xiii) metallurgical performance; (xiv) reasonable contingency

requirements; (xv) success in realizing proposed operations; (xvi)

receipt of regulatory approvals on acceptable terms; and (xvii) the

negotiation of satisfactory terms with impacted Treaty and First

Nations groups. Although management considers these assumptions to

be reasonable based on information currently available to it, they

may prove to be incorrect. Many forward-looking statements are made

assuming the correctness of other forward looking statements, such

as statements of net present value and internal rates of return,

which are based on most of the other forward-looking statements and

assumptions herein. The cost information is also prepared using

current values, but the time for incurring the costs will be in the

future and it is assumed costs will remain stable over the relevant

period.

By their very nature, forward-looking

statements involve inherent risks and uncertainties, both general

and specific, and risks exist that estimates, forecasts,

projections and other forward-looking statements will not be

achieved or that assumptions do not reflect future experience. We

caution readers not to place undue reliance on these

forward-looking statements as a number of important factors could

cause the actual outcomes to differ materially from the beliefs,

plans, objectives, expectations, anticipations, estimates

assumptions and intentions expressed in such forward-looking

statements. These risk factors may be generally stated as the risk

that the assumptions and estimates expressed above do not occur,

but specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

mineral reserves or mineral resources from that predicted;

variations in rates of recovery and extraction; developments in

world metals markets; risks relating to fluctuations in the

Canadian dollar relative to the US dollar; increases in the

estimated capital and operating costs or unanticipated costs;

difficulties attracting the necessary work force; increases in

financing costs or adverse changes to the terms of available

financing, if any; tax rates or royalties being greater than

assumed; changes in development or mining plans due to changes in

logistical, technical or other factors; changes in project

parameters as plans continue to be refined; risks relating to

receipt of regulatory approvals or settlement of an agreement with

impacted First Nations groups; the effects of competition in the

markets in which Seabridge operates; operational and infrastructure

risks and the additional risks described in Seabridge's Annual

Information Form filed with SEDAR in Canada (available at

www.sedar.com) for the year ended December 31, 2016 and in

the Corporation's Annual Report Form 40-F filed with the U.S.

Securities and Exchange Commission on EDGAR (available at

www.sec.gov/edgar.shtml). Seabridge cautions that the

foregoing list of factors that may affect future results is not

exhaustive.

When relying on our forward-looking

statements to make decisions with respect to Seabridge, investors

and others should carefully consider the foregoing factors and

other uncertainties and potential events. Seabridge does not

undertake to update any forward-looking statement, whether written

or oral, that may be made from time to time by Seabridge or on our

behalf, except as required by law.

ON BEHALF OF THE BOARD

"Rudi Fronk" Chairman and C.E.O.

For further information, please contact:Rudi P. Fronk, Chairman

and C.E.O.Tel: (416) 367-9292 · Fax: (416)

367-2711Email: info@seabridgegold.net

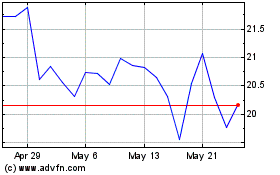

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

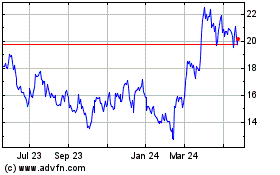

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2023 to Dec 2024