Seabridge Gold (TSX:SEA) (NYSE:SA) today announced that

results from the final three core holes drilled this year at Deep

Kerr successfully filled in the gaps required to support a southern

extension of the deposit. The five holes completed in 2016 are

expected to expand the known resource about 500 meters along strike

to the south at grades consistent with the deposit’s inferred

resource. The shape and orientation of the extension are expected

to expand the block cave designs in the proposed mine plan. Deep

Kerr is located on Seabridge’s 100%-owned KSM Project in

northwestern British Columbia, Canada.

Over the past three years, Seabridge’s

exploration programs have successfully targeted higher grade zones

beneath KSM’s near-surface porphyry deposits, resulting in the

discovery of Deep Kerr and the Iron Cap Lower Zone, two copper-rich

deposits that have added more than one billion tonnes of inferred

resources to the project at a higher average grade. The Deep Kerr

deposit contains an inferred resource of 1.61 billion tonnes

grading 0.31 g/T gold, 0.43% copper and 1.8 g/T silver (16.0

million ounces of gold, 15.2 billion pounds of copper and 93

million ounces of silver). In the three years since its discovery,

Deep Kerr has taken its place among the world’s largest undeveloped

gold-copper deposits.

Drill hole results described here are daughter

holes from the original drill collars on holes K-16-51 and 52

(reported August 30, 2016). Hole K-16-51A was steered to the south

of K-16-51 and provided an intersection of the Deep Kerr deposit

about 200 meters south of, and slightly above, the original drill

hole. Hole K-16-52A was steered to cut the target zone directly

below the original hole. Hole K-16-52B was drilled to intersect the

zone below, and north from, K-16-52. Results from these drill holes

continue to show that Deep Kerr is a robust and extensive

copper-gold deposit with a north-south strike extent approaching

2.0 kilometers and more than 1.5 kilometers of vertical continuity.

(See http://seabridgegold.net/pdf/NNov15-16-maps.pdf.)

Seabridge Chairman and CEO Rudi Fronk commented

that “these drill results should contribute to another increase in

the Deep Kerr inferred resource estimate. This year’s drill program

was carefully designed to optimize the prospective mine plan at

Deep Kerr and thereby improve the KSM project’s potential

economics. The mineralized intervals encountered in this year’s

drilling are effectively oriented for efficient extraction and

should support an expanded rate of daily production. Overall, Deep

Kerr is once again demonstrating that it has very few equals for

size and grade.”

The following table summarizes the drill hole intersections for

K-16-51A. K-16-52A and K-16-52B.

|

Drill Hole ID |

Total Depth |

From (meters) |

To (meters) |

Interval (meters) |

Gold (g/T) |

Copper % |

Silver(g/T) |

| K-16-51A |

1696.0 including |

858.3 |

983.4 |

125.1 |

0.47 |

0.34 |

2.7 |

|

1129.4 |

1171.1 |

41.7 |

0.55 |

0.61 |

2.6 |

|

1210.31210.3 |

1378.61284.2 |

168.373.9 |

0.350.38 |

0.520.71 |

2.42.2 |

| K-16-52A |

1746.3 |

1379.7 |

1531.1 |

151.4 |

0.21 |

0.35 |

1.1 |

|

|

1575.21644.1 |

1666.11657.0 |

90.912.9 |

0.381.08 |

0.310.12 |

4.15.3 |

|

including |

| K-16-52B |

1716.9 including |

1367.1 |

1430.5 |

63.4 |

0.23 |

0.35 |

1.3 |

|

1481.31613.6 |

1716.91711.7 |

235.698.1 |

0.320.34 |

0.530.78 |

2.02.9 |

Drill holes were oriented using historical

information and were designed to intercept the mineralized target

at right angles to the strike of the zone. The orientation will be

refined with additional drilling but current information indicates

the intervals listed above approximate the true thickness of the

mineralized zones.

Exploration activities by Seabridge at the KSM

Project are conducted under the supervision of William E.

Threlkeld, Registered Professional Geologist, Senior Vice President

of the Company and a Qualified Person as defined by National

Instrument 43-101. Mr. Threlkeld has reviewed and approved this

news release. An ongoing and rigorous quality control/quality

assurance protocol is employed in all Seabridge drilling campaigns.

This program includes blank and reference standards, and in

addition all copper assays that exceed 0.25% Cu are re-analyzed

using ore grade analytical techniques. Cross-check analyses are

conducted at a second external laboratory on at least 10% of the

drill samples. Samples are assayed at ALS Chemex Laboratory,

Vancouver, B.C., using fire assay atomic adsorption methods for

gold and ICP methods for other elements.

Seabridge holds a 100% interest in several North

American gold projects. The Company’s principal assets are the KSM

Project and Iskut Project located near Stewart, British Columbia,

Canada and the Courageous Lake gold project located in Canada’s

Northwest Territories. For a full breakdown of Seabridge’s mineral

reserves and mineral resources by category please visit the

Company’s website at

http://www.seabridgegold.net/resources.php.

Neither the Toronto Stock Exchange, New York

Stock Exchange, nor their Regulation Services Providers accepts

responsibility for the adequacy or accuracy of this release.

All reserve and resource estimates

reported by the Corporation were calculated in accordance with the

Canadian National Instrument 43-101 and the Canadian Institute of

Mining and Metallurgy Classification system. These standards differ

significantly from the requirements of the U.S. Securities and

Exchange Commission. Mineral resources which are not mineral

reserves do not have demonstrated economic viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and "forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

"forward-looking statements" are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to: (i) the expected

expansion of the Deep Kerr inferred resource to the south at grades

consistent with the deposit’s inferred resource; (ii) the shape and

orientation of the extension are expected to support the block cave

designs in the proposed mine plan; (iii) the expected expansion of

the Deep Kerr resource should support an expanded rate of daily

production at Deep Kerr; and (iv) the estimated amount and grade of

mineral resources at Deep Kerr. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives or future events or

performance (often, but not always, using words or phrases such as

"expects", "anticipates", "plans", "projects", "estimates",

"envisages", "assumes", "intends", "strategy", "goals",

"objectives" or variations thereof or stating that certain actions,

events or results "may", "could", "would", "might" or "will" be

taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and

may be forward-looking statements.

All forward-looking statements are based

on Seabridge's or its consultants' current beliefs as well as

various assumptions made by them and information currently

available to them. The principle assumptions are listed above, but

others include: (i) the block cave shapes in the Deep Kerr resource

being limited by drill data, not geology; (ii) the presence of and

continuity of metals at the Project between drill holes, including

at modeled grades; (iii) the capacities of various machinery and

equipment; (iv) the availability of personnel, machinery and

equipment at estimated prices; (v) exchange rates; (vi) metals

sales prices; (vii) block net smelter return values; (viii)

conceptual cave footprints, draw points and heights; (ix)

appropriate discount rates; (x) tax rates and royalty rates

applicable to the proposed mining operation; (xi) financing

structure and costs; (xii) anticipated mining losses and dilution;

(xiii) metallurgical performance; (xiv) reasonable contingency

requirements; (xv) success in realizing proposed operations; (xvi)

receipt of regulatory approvals on acceptable terms; and (xvii) the

negotiation of satisfactory terms with impacted Treaty and First

Nations groups. Although management considers these assumptions to

be reasonable based on information currently available to it, they

may prove to be incorrect. Many forward-looking statements are made

assuming the correctness of other forward looking statements, such

as statements of net present value and internal rates of return,

which are based on most of the other forward-looking statements and

assumptions herein. The cost information is also prepared using

current values, but the time for incurring the costs will be in the

future and it is assumed costs will remain stable over the relevant

period.

By their very nature, forward-looking

statements involve inherent risks and uncertainties, both general

and specific, and risks exist that estimates, forecasts,

projections and other forward-looking statements will not be

achieved or that assumptions do not reflect future experience. We

caution readers not to place undue reliance on these

forward-looking statements as a number of important factors could

cause the actual outcomes to differ materially from the beliefs,

plans, objectives, expectations, anticipations, estimates

assumptions and intentions expressed in such forward-looking

statements. These risk factors may be generally stated as the risk

that the assumptions and estimates expressed above do not occur,

but specifically include, without limitation: risks relating to

variations in the mineral content within the material identified as

mineral reserves or mineral resources from that predicted;

variations in rates of recovery and extraction; developments in

world metals markets; risks relating to fluctuations in the

Canadian dollar relative to the US dollar; increases in the

estimated capital and operating costs or unanticipated costs;

difficulties attracting the necessary work force; increases in

financing costs or adverse changes to the terms of available

financing, if any; tax rates or royalties being greater than

assumed; changes in development or mining plans due to changes in

logistical, technical or other factors; changes in project

parameters as plans continue to be refined; risks relating to

receipt of regulatory approvals or settlement of an agreement with

impacted First Nations groups; the effects of competition in the

markets in which Seabridge operates; operational and infrastructure

risks and the additional risks described in Seabridge's Annual

Information Form filed with SEDAR in Canada (available at

www.sedar.com) for the year ended December 31, 2014 and in the

Corporation's Annual Report Form 40-F filed with the U.S.

Securities and Exchange Commission on EDGAR (available at

www.sec.gov/edgar.shtml). Seabridge cautions that the foregoing

list of factors that may affect future results is not

exhaustive.

When relying on our forward-looking statements to make

decisions with respect to Seabridge, investors and others should

carefully consider the foregoing factors and other uncertainties

and potential events. Seabridge does not undertake to update any

forward-looking statement, whether written or oral, that may be

made from time to time by Seabridge or on our behalf, except as

required by law.

ON BEHALF OF THE BOARD"Rudi Fronk" Chairman

& C.E.O.

For further information please contact:

Rudi P. Fronk, Chairman and C.E.O.

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

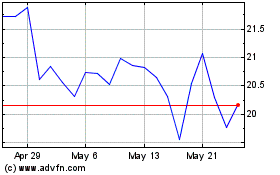

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

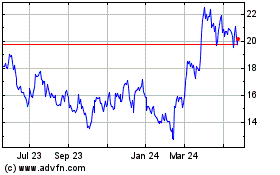

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2023 to Dec 2024