Updated PFS Confirms KSM Reserves

Economic at Current Metal Prices

Seabridge Gold Inc. (TSX:SEA) (NYSE:SA) announced today that it has

filed a NI 43-101 Technical Report at www.sedar.com for its

100%-owned KSM project located in northern British Columbia,

Canada. The Technical Report includes previously announced results

from an updated Preliminary Feasibility Study (the “PFS”) and a new

Preliminary Economic Assessment (the “PEA”). The 2016 PFS was

prepared by Tetra Tech, Inc. and the PEA was prepared by Amec

Foster Wheeler Americas Limited. Both studies estimate operating

and total costs for KSM that are well below industry averages for

producing mines.

The 2016 PFS incorporates KSM’s Measured and

Indicated Mineral Resources into mine plans generating Proven and

Probable Mineral Reserves of 2.2 billion tonnes grading 0.55 grams

per tonne gold, 0.21% copper and 2.6 grams per tonne silver (38.8

million ounces of gold, 10.2 billion pounds of copper and 183

million ounces of silver). (For details see

http://seabridgegold.net/News/Article/626/) The 2016 PFS does not

include the higher grade resources delineated at Deep Kerr and the

Iron Cap Lower Zone as they are in the Inferred Mineral Resources

category which cannot be considered as Mineral Reserves required

for inclusion in a PFS.

The project design in the PEA includes the

higher grade resources from Deep Kerr and the Iron Cap Lower Zone,

enabling the mining method to shift from predominantly open pit in

the PFS to primarily low cost block cave mining. This design

significantly reduces the number and size of the open pits and the

project’s environmental impact. The net result is a substantial

improvement in estimated economic returns. (For details see

http://seabridgegold.net/News/Article/630/). Note that Inferred

Mineral Resources are considered too speculative geologically to

have the economic considerations applied to them that would enable

them to be categorized as Mineral Reserves, and there is no

certainty that the results of the PEA will be realized. Mineral

Resources that are not Mineral Reserves do not have demonstrated

economic viability.

Seabridge Chairman and CEO Rudi Fronk commented

that “the PFS remains a viable option for developing the KSM

Project. However, the PEA is a creative response to our recent

higher-grade discoveries and the industry’s successful development

of more efficient and cost-effective underground mining

technologies. Although the PEA is more conceptual in nature than

the PFS and includes Inferred Mineral Resources, we believe its

approach is an important step forward for KSM, offering greater

rewards both economically and environmentally.”

To compare the economic projections of the 2016

PFS and the PEA, three cases were presented. A Base Case economic

evaluation was undertaken incorporating historical three-year

trailing averages for metal prices as of July 31, 2016. This

approach adheres to United States Securities and Exchange

Commission policy and is consistent with industry practice. Two

alternate cases were constructed: (i) a Recent Spot Case

incorporating recent spot prices for gold, copper, silver and the

US$/Cdn$ exchange rate; and (ii) an Alternate Case that

incorporates higher metal prices to demonstrate the project’s

sensitivity to rising prices.

The pre-tax and post-tax estimated economic

results in U.S. dollars for all three cases are as follows:

Projected Economic Results

(US$)

| |

Base Case |

Recent Spot |

Alternate |

| 2016 PEA |

2016 PFS |

2016 PEA |

2016 PFS |

2016 PEA |

2016 PFS |

|

Metal Prices: |

|

|

|

|

Gold ($/ounce) |

|

1,230 |

|

|

1,350 |

|

|

1,500 |

|

|

Copper ($/pound) |

|

2.75 |

|

|

2.20 |

|

|

3.00 |

|

|

Silver ($/ounce) |

|

17.75 |

|

|

20.00 |

|

|

25.00 |

|

|

US$/Cdn$ Exchange Rate: |

|

0.80 |

|

|

0.77 |

|

|

0.80 |

|

|

Cost Summary: |

|

|

|

|

|

|

|

Operating Costs Per Oz of Gold (life of mine) |

-$ |

179 |

|

$ |

277 |

|

$ |

32 |

|

$ |

404 |

|

-$ |

319 |

|

$ |

183 |

|

|

Total Cost Per Ounce of Gold Produced |

$ |

358 |

|

$ |

673 |

|

$ |

553 |

|

$ |

787 |

|

$ |

218 |

|

$ |

580 |

|

|

Copper Credits Per Oz Gold Included in Costs |

-$ |

1,328 |

|

-$ |

795 |

|

-$ |

1,104 |

|

-$ |

636 |

|

-$ |

1,449 |

|

-$ |

868 |

|

|

Silver Credits per Oz Gold Included in Costs |

-$ |

83 |

|

-$ |

71 |

|

-$ |

97 |

|

-$ |

80 |

|

-$ |

117 |

|

-$ |

100 |

|

|

Initial Capital (includes pre-production mining) |

$5.5 billion |

$5.0 billion |

$5.3 billion |

$4.8 billion |

$5.5 billion |

$5.0 billion |

|

Sustaining Capital |

$10.0 billion |

$5.5 billion |

$9.7 billion |

$5.3 billion |

$10.0 billion |

$5.5 billion |

|

Unit Operating Cost On-site (US$/tonne) |

$ |

11.61 |

|

$ |

12.36 |

|

$ |

11.17 |

|

$ |

12.09 |

|

$ |

11.61 |

|

$ |

12.36 |

|

|

Pre-Tax Results: |

|

|

|

|

|

|

|

Net Cash Flow |

$26.3 billion |

$15.9 billion |

$24.1 billion |

$16.1 billion |

$38.7 billion |

$26.3 billion |

|

NPV @ 5% Discount Rate |

$6.1 billion |

$3.3 billion |

$5.7 billion |

$3.5 billion |

$10.2 billion |

$6.5 billion |

|

Internal Rate of Return |

|

12.7 |

% |

|

10.4 |

% |

|

12.9 |

% |

|

11.1 |

% |

|

16.9 |

% |

|

14.6 |

% |

|

Payback Period (years) |

|

5.6 |

|

|

6.0 |

|

|

5.3 |

|

|

5.6 |

|

|

3.9 |

|

|

4.1 |

|

|

Post-Tax Results: |

|

|

|

|

|

|

|

Net Cash Flow |

$16.7 billion |

$10.0 billion |

$15.3 billion |

$10.1 billion |

$24.7 billion |

$16.7 billion |

|

NPV @ 5% Discount Rate |

$3.4 billion |

$1.5 billion |

$3.2 billion |

$1.7 billion |

$6.0 billion |

$3.7 billion |

|

Internal Rate of Return |

|

10.0 |

% |

|

8.0 |

% |

|

10.1 |

% |

|

8.5 |

% |

|

13.4 |

% |

|

11.4 |

% |

|

Payback Period (years) |

|

6.4 |

|

|

6.8 |

|

|

6.1 |

|

|

6.4 |

|

|

4.7 |

|

|

4.9 |

|

Note: Operating and total cost

per ounce of gold are after copper and silver credits. Total cost

per ounce includes all start-up capital, sustaining capital and

reclamation/closure costs. The post-tax results include the B.C.

Mineral Tax and corporate provincial and federal taxes. The

projected economic results do not give effect to a third party

option to acquire a 2% royalty on gold and silver production for a

payment to Seabridge of $160 million nor the expenses associated

with agreements which have been or in future may be concluded with

aboriginal groups in the vicinity of the Project.

The NI 43-101 Technical Report includes

sensitivity analyses illustrating the impact on project economics

from positive and negative changes to metal prices, capital costs

and operating costs.

National Instrument 43-101

Disclosure The KSM 2016 PFS update was prepared by Tetra

Tech, and the KSM 2016 PEA was prepared by Amec Foster Wheeler as

principal consultants for their respective studies. Both studies

incorporate the work of a number of industry-leading consulting

firms as identified in the news releases of September 19 and

October 6, 2016. This news release has been reviewed and approved

by Qualified Persons from the principal consultants. Qualified

Persons (as defined under National Instrument 43-101) are

independent of Seabridge. The principal consultants, and their

Qualified Persons are listed below:

- Tetra Tech, under the direction of Hassan Ghaffari P. Eng.

(PFS content)

- Amec Foster Wheeler, under the direction of Simon Allard P.Eng.

(PEA content)

Seabridge Gold holds a 100% interest in several

North American gold resource projects. The Company’s principal

assets are the KSM property located near Stewart, British Columbia,

Canada and the Courageous Lake gold project located in Canada’s

Northwest Territories. For a breakdown of Seabridge Gold’s mineral

reserves and resources by project and category please visit the

Company’s website at

http://www.seabridgegold.net/resources.php.

All Mineral Reserve and Mineral

Resources estimates reported by the Corporation were estimated in

accordance with the Canadian National Instrument 43-101 and the

Canadian Institute of Mining and Metallurgy Definition Standards

for Mineral Resources and Mineral Reserves. These standards differ

significantly from the requirements of the U.S. Securities and

Exchange Commission. Mineral Resources which are not Mineral

Reserves do not have demonstrated economic viability.

This document contains "forward-looking

information" within the meaning of Canadian securities legislation

and “forward-looking statements” within the meaning of the United

States Private Securities Litigation Reform Act of 1995. This

information and these statements, referred to herein as

“forward-looking statements” are made as of the date of this

document. Forward-looking statements relate to future events or

future performance and reflect current estimates, predictions,

expectations or beliefs regarding future events and include, but

are not limited to, statements with respect to: (i) the estimated

amount and grade of Mineral Resources and Mineral Reserves; (ii)

both the PFS and the PEA representing viable development options

for the Project and the PEA being an important step forward for

KSM, offering greater rewards both economically and

environmentally; (iii) estimates of the capital costs of

constructing mine facilities and bringing a mine into production,

of sustaining capital and the duration of financing payback

periods; (iv) the estimated amount of future production, both

tonnes and grade produced and metal recovered; and (v) estimates of

operating costs and total costs, net cash flow, net present value

and economic returns from an operating mine; and (vi) estimated

operating and total costs for KSM being well below industry

averages for producing mines. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives or future events or

performance (often, but not always, using words or phrases such as

“expects”, “anticipates”, “plans”, “projects”, “estimates”,

“envisages”, “assumes”, “intends”, “strategy”, “goals”,

“objectives” or variations thereof or stating that certain actions,

events or results “may”, “could”, “would”, “might” or “will” be

taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and

may be forward-looking statements.

All forward-looking statements are based

on Seabridge's or its consultants' current beliefs as well as

various assumptions made by them and information currently

available to them. The most significant assumptions are set forth

above, but generally these assumptions include: (i) the presence of

and continuity of metals at the Project at estimated grades; (ii)

the geotechnical and metallurgical characteristics of rock

conforming to sampled results; (iii) the quantities of water and

the quality of the water that must be diverted or treated during

mining operations; (iv) the capacities, efficiencies and durability

of various machinery and equipment, including the rates at which

drawpoints can be established and mucked; (v) the availability of

personnel, machinery and equipment at estimated prices and within

the estimated delivery times; (vi) currency exchange rates; (vii)

metals sales prices and exchange rate assumed; (viii) appropriate

discount rates applied to the cash flows in the economic analysis;

(ix) tax rates and royalty rates applicable to the proposed mining

operation; (x) the availability of acceptable financing under

assumed structure and costs; (xi) anticipated mining losses and

dilution; (xii) metallurgical performance; (xiii) reasonable

contingency requirements; (xiv) success in realizing proposed

operations; (xv) receipt of permits and other regulatory approvals

on acceptable terms; and (xvi) the negotiation of satisfactory

terms with impacted Treaty and First Nations groups. Although

management considers these assumptions to be reasonable based on

information currently available to it, they may prove to be

incorrect. Many forward-looking statements are made assuming the

correctness of other forward looking statements, such as statements

of net present value and internal rates of return, which are based

on most of the other forward-looking statements and assumptions

herein. The cost information is also prepared using current values,

but the time for incurring the costs will be in the future and it

is assumed costs will remain stable over the relevant

period.

By their very nature, forward-looking

statements involve inherent risks and uncertainties, both general

and specific, and risks exist that estimates, forecasts,

projections and other forward-looking statements will not be

achieved or that assumptions do not reflect future experience. We

caution readers not to place undue reliance on these

forward-looking statements as a number of important factors could

cause the actual outcomes to differ materially from the beliefs,

plans, objectives, expectations, anticipations, estimates

assumptions and intentions expressed in such forward-looking

statements. These risk factors may be generally stated as the risk

that the assumptions and estimates expressed above do not occur as

forecast, but specifically include, without limitation: risks

relating to variations in the mineral content within the material

identified as Mineral Resources from that predicted; variations in

rates of recovery and extraction; the geotechnical characteristics

of the rock mined or through which infrastructure is built

differing from that predicted, the quantity of water that will need

to be diverted or treated during mining operations being different

from what is expected to be encountered during mining operations or

post closure, or the rate of flow of the water being different;

developments in world metals markets; risks relating to

fluctuations in the Canadian dollar relative to the US dollar;

increases in the estimated capital and operating costs or

unanticipated costs; difficulties attracting the necessary work

force; increases in financing costs or adverse changes to the terms

of available financing, if any; tax rates or royalties being

greater than assumed; changes in development or mining plans due to

changes in logistical, technical or other factors; changes in

project parameters as plans continue to be refined; risks relating

to receipt of regulatory approvals or settlement of an agreement

with impacted First Nations groups; changes in regulations applying

to the development, operation, and closure of mining operations

from what currently exists; the effects of competition in the

markets in which Seabridge operates; operational and infrastructure

risks and the additional risks described in Seabridge's

Annual Information Form filed

with SEDAR in Canada (available at www.sedar.com) for the year

ended December 31, 2015 and in the Corporation’s Annual Report Form

40-F filed with the U.S. Securities and Exchange Commission on

EDGAR (available at www.sec.gov/edgar.shtml).

Seabridge cautions that the foregoing list of factors that

may affect future results is not exhaustive.

When relying on our forward-looking

statements to make decisions with respect to Seabridge, investors

and others should carefully consider the foregoing factors and

other uncertainties and potential events. Seabridge does not

undertake to update any forward-looking statement, whether written

or oral, that may be made from time to time by Seabridge or on our

behalf, except as required by law.

ON BEHALF OF THE BOARD

"Rudi Fronk" Chairman and C.E.O.

For further information, please contact:

Rudi P. Fronk, Chairman and C.E.O.

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

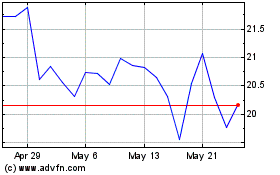

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Nov 2024 to Dec 2024

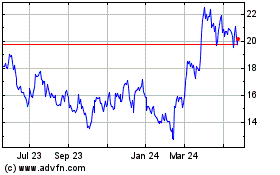

Seabridge Gold (TSX:SEA)

Historical Stock Chart

From Dec 2023 to Dec 2024