Prairie Provident Resources Inc. ("Prairie Provident", "PPR" or the

"Company") today announces our financial and operating results for

the three and six months ended June 30, 2021. PPR’s unaudited

condensed interim consolidated financial statements for the three

and six months ended June 30, 2021 and related Management’s

Discussion and Analysis (“MD&A”) for the same periods are

available on our website at www.ppr.ca and filed on SEDAR.

MESSAGE TO SHAREHOLDERS

Tony Berthelet, President & Chief Executive

Officer commented: “The second quarter results demonstrate the

underlying value of the portfolio, with strong well results and

improved operating netback. The team continues to make significant

progress on our decommissioning program helping to address overall

liabilities. We remain excited about the remaining inventory in our

portfolio and look to build on recent drilling success in the

Princess area in the second half of 2021.”

Q2 2021 HIGHLIGHTS

- Net earnings amidst

commodity price recovery: Net earnings totaled $24.0

million for Q2 2021, compared to a net loss of $11.5 million for Q1

2021. The increase in net earnings was primarily driven by a $35.0

million impairment reversal recognized in Q2 2021 related to our

Evi and Princess CGUs as a result of significant increases in

forecast benchmark commodity prices.

- Improved

adjusted funds flow

("AFF")1: AFF for Q2

2021, excluding $0.1 million of decommissioning settlements, was

$4.3 million ($0.03 per basic and diluted share), a 103% or $2.2

million increase from Q1 2021 reflecting improved netbacks and

higher production. While PPR benefited from the improving commodity

price environment, our AFF was impacted by realized losses on

required derivative contracts arising from mandatory hedge

positions pursuant to credit facility covenants which were entered

when pricing environment was volatile. Approximately 50% of our

second half 2021 forecast production is hedged with 3-way collars

on 1,675 bbl/d capped at an average ceiling price of WTI

US$60.80/bbl.

-

Production: Production during the quarter averaged

4,354 boe/d (65% liquids) in Q2 2021, a 7% or 283 boe/d increase

from Q1 2021, primarily driven by additional production from our

2021 drilling program.

- Higher

operating netback1:

Operating netback for Q2 2021 was $22.16/boe before realized loss

on derivatives, the highest level since 2018. PPR generated cash

flow of $8.8 million at the field level, representing a 48%

increase from Q1 2021. After realized derivative losses, we

recognized $6.5 million ($16.46/boe) of operating netback,

reflecting a 35% increase from Q1 2021. Compared to Q1 2021, on a

per boe basis, operating netback before and after the realized

derivative losses increased by 37% and 24%, respectively,

reflecting higher realized prices and lower operating

expenses.

- Successful

drilling program: During Q2 2021, we incurred $2.1 million

of Net Capital Expenditures1. We brought on production our first

Ellerslie well in Princess on April 29, 2021 with an IP30(2) rate

of approximately 210 boe/d, proving an emerging play. In addition,

we successfully, completed, equipped and tied-in a Glauconite well

in Princess that commenced production on May 20, 2021 with an

IP30(3) rate of approximately 529 boe/d. These two wells are

currently producing approximately 460(4) boe/d, and contributed

approximately 390(5) boe/d of incremental production for Q2 2021.

PPR commenced the drilling of two additional wells in the Princess

area in July and August 2021 with expected on-stream timing for

both around September 2021.

-

Net debt1: Net debt at

June 30, 2021 totaled $116.8 million, an increase of $0.8

million from December 31, 2020 primarily due to $0.9 million

deferred interest accrued on the Company's subordinated senior

notes.

-

Maintained liquidity: At June 30, 2021, PPR

had US$12.3 million (CAN$15.2(6) million equivalent)

(December 31, 2020 — US$11.2 million) of available borrowing

capacity under the Company's senior secured revolving note

facility.

|

1 |

Non-IFRS measure – see below under “Non-IFRS Measures” |

|

2 |

Average initial production over a 30-day period commencing April

29, 2021, during which the well produced an average of 129 bbl/d of

heavy crude oil and 483 Mcf/d of conventional natural gas from the

Ellerslie formation. Readers are cautioned that short-term initial

production rates are preliminary in nature and may not be

indicative of stabilized on-stream production rates, future product

types, long-term well or reservoir performance, or ultimate

recovery. Actual future results will differ from those realized

during an initial short-term production period, and the difference

may be material. |

|

3 |

Average initial production over a 30-day period commencing May 20,

2021, during which the well produced an average of 221 bbl/d of

heavy crude oil and 1,849 Mcf/d of conventional natural gas from

the Glauconite formation. Readers are cautioned that short-term

test rates are preliminary in nature and may not be indicative of

stabilized on-stream production rates, future product types,

long-term well or reservoir performance, or ultimate recovery.

Actual future results will differ from those realized during an

initial short-term test period, and the difference may be

material. |

|

4 |

Comprised of average production of approximately 250 bbl/d of heavy

crude oil and 1,260 Mcf/d of conventional natural gas based on

field estimates. |

|

5 |

Comprised of average production of approximately 210 bbl/d of heavy

crude oil and 1,080 Mcf/d of conventional natural gas. |

|

6 |

Converted using the month end exchange rate of $1.00 USD to $1.24

CAD as at June 30, 2021. |

FINANCIAL AND OPERATING

SUMMARY

|

|

Three Months Ended |

Six months ended |

| ($000s

except per unit amounts) |

June 30, 2021 |

June 30, 2020 |

March 31, 2021 |

June 30, 2021 |

June 30, 2020 |

| Production

Volumes |

|

|

|

|

|

|

Light & medium crude oil (bbl/d) |

2,514 |

|

2,996 |

|

2,453 |

|

2,483 |

|

3,080 |

|

| Heavy crude oil (bbl/d) |

179 |

|

183 |

|

117 |

|

149 |

|

238 |

|

| Conventional natural gas

(Mcf/d) |

9,122 |

|

9,351 |

|

8,233 |

|

8,680 |

|

9,768 |

|

| Natural

gas liquids (bbl/d) |

140 |

|

141 |

|

129 |

|

135 |

|

134 |

|

| Total

(boe/d) |

4,354 |

|

4,879 |

|

4,071 |

|

4,213 |

|

5,080 |

|

| %

Liquids |

65% |

|

68% |

|

66% |

|

66% |

|

68% |

|

| Average Realized

Prices |

|

|

|

|

|

| Light & medium crude oil

($/bbl) |

71.00 |

|

23.05 |

|

60.34 |

|

65.78 |

|

32.42 |

|

| Heavy crude oil ($/bbl) |

63.72 |

|

12.55 |

|

51.76 |

|

58.70 |

|

30.58 |

|

| Conventional natural gas

($/Mcf) |

2.81 |

|

1.93 |

|

3.48 |

|

3.13 |

|

2.02 |

|

| Natural

gas liquids ($/bbl) |

50.55 |

|

15.35 |

|

44.79 |

|

47.64 |

|

21.12 |

|

| Total

($/boe) |

51.13 |

|

18.77 |

|

46.31 |

|

48.82 |

|

25.53 |

|

| Operating Netback

($/boe)1 |

|

|

|

|

|

| Realized price |

51.13 |

|

18.77 |

|

46.31 |

|

48.82 |

|

25.53 |

|

| Royalties |

(5.87 |

) |

(2.33 |

) |

(3.34 |

) |

(4.65 |

) |

(2.51 |

) |

|

Operating costs |

(23.10 |

) |

(18.09 |

) |

(26.80 |

) |

(24.88 |

) |

(20.35 |

) |

| Operating netback |

22.16 |

|

(1.65 |

) |

16.17 |

|

19.29 |

|

2.67 |

|

|

Realized gains (losses) on derivatives |

(5.70 |

) |

18.21 |

|

(2.94 |

) |

(4.37 |

) |

10.90 |

|

|

Operating netback, after realized gains (losses) on

derivatives |

16.46 |

|

16.56 |

|

13.23 |

|

14.92 |

|

13.57 |

|

|

1 Operating netback is a non-IFRS measure (see

“Non-IFRS Measures” below). |

|

Capital Structure($000s) |

June 30, 2021 |

December 31, 2020 |

|

Working capital1 |

1.9 |

|

5.3 |

|

|

Borrowings outstanding (principal plus deferred interest) |

(118.7 |

) |

(121.3 |

) |

| Total net debt2 |

(116.8 |

) |

(115.9 |

) |

| Debt capacity3 |

15.2 |

|

14.3 |

|

| Common

shares outstanding (in millions) |

128.4 |

|

172.3 |

|

|

1 Working capital is a non-IFRS measure (see "Non-IFRS

Measures" below) calculated as current assets less current portion

of derivative instruments, minus accounts payable and accrued

liabilities. 2 Net debt is a non-IFRS measure (see

"Non-IFRS Measures" below), calculated by adding working capital

and long-term debt. 3 Debt capacity reflects the

undrawn capacity of the Company's revolving facility of USD$57.7

million at June 30, 2021 and December 31, 2020, converted

at an exchange rate of $1.00 USD to $1.24 CAD on June 30, 2021

and $1.00 USD to $1.27 CAD on December 31, 2020. |

|

|

Three Months Ended June 30, |

Six Months Ended June 30, |

|

Drilling Activity |

2021 |

2020 |

2021 |

2020 |

| Gross wells |

0.0 |

0.0 |

2.0 |

1.0 |

| Net (working interest)

wells |

N/A |

N/A |

2.0 |

1.0 |

| Success

rate, net wells (%) |

N/A |

N/A |

100 % |

100 % |

ENVIRONMENTAL SOCIAL AND GOVERNANCE

UPDATE

PPR continues with efforts towards reducing the

Company's environmental impact through ongoing internal emission

reduction initiatives and through participation in government

programs that provide cost incentives or grants for environmental

stewardship.

PPR employs a rigorous pipeline integrity

program to mitigate the risk of environmental impact and maintains

top tier regulatory compliance approval level relative to

industry.

PPR is a participant in Alberta’s Area Based

Closure ("ABC") program, under which upstream oil and gas companies

are encouraged to work together to decommission, remediate and

reclaim groups of inactive sites, providing operational

efficiencies and cost reductions due to economies of scale and

regulatory incentives.

We have qualified for $6.1 million of government

funding under Alberta’s Site Rehabilitation Program, which provides

grants to oil field service contractors to perform well, pipeline,

and oil and gas site closure and reclamation work, and have

allocated an additional $3.5 million of 2021 internal funding

towards the retirement of inactive assets, with the majority of the

decommissioning activities occurring in the second half of 2021.

PPR anticipates that it will abandon over 150 gross wells during

2021, representing approximately 14% of our gross inactive well

count, in addition to the abandonment of numerous inactive

pipelines and significant reclamation progress on inactive

sites.

We have also received funding through Alberta’s

Baseline and Reduction Opportunity Assessment Program, which offers

financial support to small and medium conventional oil and gas

operators to assess and reduce on-site methane emissions. We are

continuously working towards identification and implementation of

emission reduction initiatives. Current reduction projects include

replacing controllers with improved technology and low-bleed models

at 58 of our existing sites.

OUTLOOK

For the second half of 2021, we expect to focus

our drilling efforts in the Princess area, while monitoring our

pilot waterflood program at Michichi. Prairie Provident's full-year

2021 guidance estimates remain unchanged from those presented in

the Company’s news release dated March 26, 2021. Additional details

on Prairie Provident's 2021 capital program and guidance can be

found on the Company’s website at www.ppr.ca.

To prioritize balance sheet strength and protect

shareholder value, the scale and pace of our capital program is

grounded on commodity market fundamentals, instead of short-term

commodity price movements. As we gain assurance on global economic

recovery and longer term commodity price stability, we will adjust

our capital program accordingly. We have capital project inventory

ready to execute upon available funding so that we can take

advantage of commodity price recovery.

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at the

Michichi and Princess areas in Southern Alberta targeting the

Banff, the Ellerslie and the Lithic Glauconite formations, along

with an established and proven waterflood project at our Evi area

in the Peace River Arch. Prairie Provident protects our balance

sheet through an active hedging program and manages risk by

allocating capital to opportunities offering maximum shareholder

returns.

For further information, please contact:

Prairie Provident Resources Inc.

Tony BertheletPresident and Chief Executive Officer Tel: (403)

292-8125Email: tberthelet@ppr.ca

Mimi LaiEVP and Chief Financial Officer Tel: (403)

292-8171Email: mlai@ppr.ca

Forward-Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein. All

statements other than statements of current or historical fact

constitute forward-looking statements. Forward-looking statements

are typically, but not always, identified by words such as

“anticipate”, “believe”, “expect”, “intend”, “plan”, “budget”,

“forecast”, “target”, “estimate”, “propose”, “potential”,

“project”, “continue”, “may”, “will”, “should” or similar words

suggesting future outcomes or events or statements regarding an

outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to: expected

on-stream timing for the two wells drilled in Princess in the third

quarter of 2021; the scale and timing of planned decommissioning

activities for 2021, including that most will occur in the second

half of 2021 and the expected number of gross wells to be abandoned

during 2021; emission reduction initiatives; potential adjustment

in our capital program; and continued focus on Princess development

while monitoring our pilot waterflood program at Michichi.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements but which

may prove to be incorrect. Although the Company believes that the

expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and assumptions.

Prairie Provident can give no assurance that the forward-looking

statements contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. Actual results or events will differ, and the

differences may be material and adverse to the Company. In addition

to other factors and assumptions which may be identified herein,

assumptions have been made regarding, among other things: that

Prairie Provident will continue to conduct its operations in a

manner consistent with past operations; results from drilling and

development activities, and their consistency with past operations;

the quality of the reservoirs in which Prairie Provident operates

and continued performance from existing wells (including with

respect to production profile, decline rate and product type mix);

the continued and timely development of infrastructure in areas of

new production; the accuracy of the estimates of Prairie

Provident's reserves volumes; future commodity prices; future

operating and other costs; future USD/CAD exchange rates; future

interest rates; continued availability of external financing and

cash flow to fund Prairie Provident's current and future plans and

expenditures, with external financing on acceptable terms; the

impact of competition; the general stability of the economic and

political environment in which Prairie Provident operates; the

general continuance of current industry conditions; the timely

receipt of any required regulatory approvals; the ability of

Prairie Provident to obtain qualified staff, equipment and services

in a timely and cost efficient manner; drilling results; the

ability of the operator of the projects in which Prairie Provident

has an interest in to operate the field in a safe, efficient and

effective manner; field production rates and decline rates; the

ability to replace and expand oil and natural gas reserves through

acquisition, development and exploration; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Prairie Provident to secure adequate product

transportation; the regulatory framework regarding royalties, taxes

and environmental matters in the jurisdictions in which Prairie

Provident operates; and the ability of Prairie Provident to

successfully market its oil and natural gas products.

The forward-looking statements included in this

news release are not guarantees of future performance or promises

of future outcomes, and should not be relied upon. Such statements,

including the assumptions made in respect thereof, involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements including, without

limitation: changes in realized commodity prices; changes in the

demand for or supply of Prairie Provident's products; the early

stage of development of some of the evaluated areas and zones; the

potential for variation in the quality of the geologic formations

targeted by Prairie Provident’s operations; unanticipated operating

results or production declines; changes in tax or environmental

laws, royalty rates or other regulatory matters; changes in

development plans of Prairie Provident or by third party operators;

increased debt levels or debt service requirements; inaccurate

estimation of Prairie Provident's oil and gas reserves volumes;

limited, unfavourable or a lack of access to capital markets;

increased costs; a lack of adequate insurance coverage; the impact

of competitors; and such other risks as may be detailed from

time-to-time in Prairie Provident's public disclosure documents

(including, without limitation, those risks identified in this news

release and Prairie Provident's current Annual Information Form as

filed with Canadian securities regulators and available from the

SEDAR website (www.sedar.com) under Prairie Provident's issuer

profile).

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

Barrels of Oil Equivalent

The oil and gas industry commonly expresses

production volumes and reserves on a “barrel of oil equivalent”

basis (“boe”) whereby natural gas volumes are converted at the

ratio of six thousand cubic feet to one barrel of oil. The

intention is to sum oil and natural gas measurement units into one

basis for improved analysis of results and comparisons with other

industry participants. A boe conversion ratio of six thousand cubic

feet to one barrel of oil is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead nor at the plant

gate, which is where Prairie Provident sells its production

volumes. Boes may therefore be a misleading measure, particularly

if used in isolation. Given that the value ratio based on the

current price of crude oil as compared to natural gas is

significantly different from the energy equivalency ratio of 6:1,

utilizing a 6:1 conversion ratio may be misleading as an indication

of value.

Non-IFRS Measures

The Company uses certain terms in this news

release and within the MD&A that do not have a standardized or

prescribed meaning under International Financial Reporting

Standards (IFRS), and, accordingly these measurements may not be

comparable with the calculation of similar measurements used by

other companies. For a reconciliation of each non-IFRS measure to

its nearest IFRS measure, please refer to the “Non-IFRS Measures”

section in the MD&A. Non-IFRS measures are provided as

supplementary information by which readers may wish to consider the

Company's performance but should not be relied upon for comparative

or investment purposes. The non-IFRS measures used in this news

release are summarized as follows:

Working Capital – Working capital is calculated

as current assets excluding the current portion of derivative

instruments, less accounts payable and accrued liabilities. This

measure is used to assist management and investors in understanding

liquidity at a specific point in time. The current portion of

derivatives instruments is excluded as management intends to hold

derivative contracts through to maturity rather than realizing the

value at a point in time through liquidation. The current portion

of decommissioning expenditures is excluded as these costs are

discretionary and warrant liabilities are excluded as it is a

non-monetary liability. Lease liabilities have historically been

excluded as they were not recorded on the balance sheet until the

adoption of IFRS 16 – Leases on January 1, 2019.

Net Debt – Net debt is defined as borrowings

under long-term debt plus working capital surplus. Net debt is

commonly used in the oil and gas industry for assessing the

liquidity of a company.

Operating Netback – Operating netback is a

non-IFRS measure commonly used in the oil and gas industry. This

measurement assists management and investors to evaluate the

specific operating performance at the oil and gas lease level.

Operating netbacks included in this news release were determined as

oil and gas revenues less royalties less operating costs. Operating

netback may be expressed in absolute dollar terms or a per unit

basis. Per unit amounts are determined by dividing the absolute

value by gross working interest production. Operating netback after

gains or losses on derivative instruments, adjusts the operating

netback for only realized gains and losses on derivative

instruments.

Adjusted Funds Flow (AFF) – Adjusted funds flow

is calculated based on cash flow from operating activities before

changes in non-cash working capital, transaction costs,

restructuring costs, and other non-recurring items. Management

believes that such a measure provides an insightful assessment of

PPR’s operational performance on a continuing basis by eliminating

certain non-cash charges and charges that are non-recurring or

discretionary, and utilizes the measure to assess the Company's

ability to finance capital expenditures and debt repayments. AFF as

presented does not and is not intended to represent cash flow from

operating activities, net earnings or other measures of financial

performance calculated in accordance with IFRS. AFF per share is

calculated based on the weighted average number of common shares

outstanding consistent with the calculation of earnings per

share.

Net Capital Expenditures – Net capital

expenditures is a non-IFRS measure commonly used in the oil and gas

industry. The measurement assists management and investors to

measure PPR’s investment in the Company’s existing asset base. Net

capital expenditures is calculated by taking total capital

expenditures, which is the sum of property and equipment and

exploration and evaluation expenditures from the consolidated

statement of cash flows, plus capitalized stock-based compensation,

plus acquisitions from business combinations, which is the outflow

cash consideration paid to acquire oil and gas properties, less

asset dispositions (net of acquisitions), which is the cash

proceeds from the disposition of producing properties and

undeveloped lands.

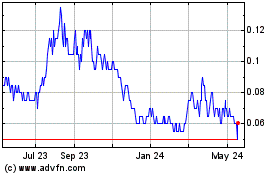

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

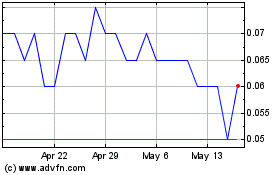

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2023 to Dec 2024