Prairie Provident Resources Inc. (“Prairie Provident”, “PPR” or the

“Company”) announces that the Company has reached agreements with

its lenders providing for the renewal of its current credit

facilities, an issue of US$11.4 million principal amount of 6-year

senior subordinated notes with proceeds applied against its

revolving facility, amendments to its existing credit agreements

to, among other things, reduce cash interest costs and reset

financial covenants, and an issue of warrants to purchase up to

34,292,360 common shares (representing 19.9% of the total number of

shares outstanding) at a price of $0.0192 per share.

The transactions and amendments provided for in

the agreements are anticipated to be completed and become effective

on Monday, December 21, 2020.

Overall, the agreements will extend the term of

the Company’s debt instruments, provide additional liquidity, and

reduce annual cash interest expenses.

Revolving Facility

The agreements will renew PPR’s senior secured

revolving note facility (the “Revolving Facility”) and extend the

revolving period and maturity date from April 30, 2021 to December

31, 2022, with a borrowing base of US$57.7 million. The borrowing

base is subject to reduction to US$53.8 million on December 31,

2021 and to semi-annual redeterminations thereafter, but without

limiting the lenders' right to require a redetermination at any

time. The next scheduled borrowing base redetermination is in

Spring 2022 based on a year-end 2021 reserves evaluation.

Borrowings under the Revolving Facility are

repayable at the Company’s election. Repayments generally will not

affect the aggregate commitment or borrowing base under the

Revolving Facility, except in certain limited circumstances where a

repayment will reduce the borrowing base.

The margin on amounts borrowed under the Senior

Facility will be 650 bps per annum above benchmark prime, Libor or

CDOR rates, as applicable. Financial

covenant ratios will be relaxed and reset to thresholds that

reflect current circumstances and provide Prairie Provident with

comfort on its compliance expectations over future periods.

Covenants under the Revolving Facility are otherwise substantially

unchanged, except that capital expenditures and acquisitions will

generally be limited to consistency with PPR’s annual capital

development plan, as created and updated by the Company from time

to time and approved by the lenders.

Net proceeds from the issue and sale of the New

Notes described below will be applied on closing against borrowings

under the Revolving Facility. Thereafter, the undrawn capacity

under the Revolving Facility is expected to be available to finance

PPR’s ongoing capital expenditures and for general corporate

purposes. Upon closing, the Revolving Facility will be

approximately Cdn$62 million or US$47 million drawn against the

US$57.7 million borrowing base.

Senior Subordinated Notes

The agreed amendments will extend the maturity

date and reduce the interest rate on Prairie Provident’s

outstanding US$28.5 million original principal amount of senior

subordinated notes due October 2021 (the “Original Notes”),

including with respect to past interest amounts thereon paid in

kind. The renewal will extend the maturity date to June 30,

2023. The annual interest rate on the

Original Notes is also being reduced from 15% to nil until June 30,

2021, and will thereafter rise to 4% at the earlier of 15 months

after closing (March 2022) and the last day of the fiscal quarter

for which the Company's trailing 12-month senior leverage ratio is

2.5 or less, and to 8% at the earlier of 20 months after closing

(August 2022) and the last day of the fiscal quarter for which the

Company's trailing 12-month senior leverage ratio is 2.0 or

less.

Additionally, the holders of the Original Notes

will purchase an additional US$11.4 million principal amount of 12%

senior subordinated notes due December 2026 (the “New Notes”), the

net proceeds of which will be applied against borrowings under the

Revolving Facility. Upon closing, an aggregate of approximately

Cdn$60 million or US$47 million will be outstanding under the

Original Notes and the New Notes (collectively, the “Notes”).

The agreements will further provide that, until

certain financial criteria are met, PPR may elect to pay in kind

all interest due on the Notes. The terms of the Revolving Facility

require that the Company make this election and not pay cash

interest on the Notes until these criteria are satisfied. Prairie

Provident will thereafter be permitted to elect to pay in kind up

to 4.00% per annum of interest on the Notes.

As with the Revolving Facility, financial

covenants under the Notes will be relaxed and reset to thresholds

that reflect current circumstances and provide the Company with

comfort on its compliance expectations over future periods, with a

15% cushion relative to covenant ratios under the Revolving

Facility. Covenants under the Notes are otherwise substantially

unchanged, except that capital expenditures and acquisitions will

generally be limited to consistency with the Company's annual

development plan, as created and updated by the Company from time

to time and approved by the lenders.

Warrants

Contemporaneously with closing, the Company will

issue warrants to purchase up to 34,292,360 common shares

(representing 19.9% of the total number of shares outstanding) at a

price of Cdn$0.0192 per share (subject to adjustment in certain

circumstances) for an 8-year term expiring in December 2028. The

exercise price is based on the volume-weighted average trading

price of the common shares on the Toronto Stock Exchange over the

past five trading days. Outstanding warrants to purchase up to an

aggregate of 8,318,000 common shares, which were previously issued

in conjunction with the closings of the Original Note transactions

in 2017 and 2018, will be cancelled in full.

Outlook

During 2020, the downturn in commodity prices

necessitated suspension of the Company’s capital program. Also,

during the year approximately 200 boe/d of marginal production was

permanently shut in. In spite of those challenges, current

production of approximately 4,400 boe/d is only down by 20% from

year ago levels. The Company’s low decline rate can be credited to

initiatives to waterflood core properties over the last number of

years. The priority in 2020 has been cost containment. PPR

conducted a bottom-up review of all of our expenses and moved

forward with immediate reduction opportunities through rate

negotiations, workforce optimizations, and deferral of workover

activities. Compared to 2019, operating costs for the first nine

months of 2020 reduced by over $7 million and gross G&A

expenses reduced by over $2.5 million. Additional costs savings are

expected in 2021 as the Company realizes the full-year benefits

from our cost reduction initiatives. Prior to 2020, Prairie

Provident had excellent results from its drilling program at

Princess Alberta. The Company has an inventory of additional

Princess drills that have highly attractive economics based on

current commodity prices. The renewal of our credit facilities and

additional financing position the Company to proceed with those

developments. The Company will release a detailed capital budget in

the new year and expects to commence drilling its first well early

in the first quarter of 2021.

ABOUT PRAIRIE PROVIDENT:

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

properties in Alberta. The Company's strategy is to grow

organically in combination with accretive acquisitions of

conventional oil prospects, which can be efficiently developed.

Prairie Provident's operations are primarily focused at the

Princess and Michichi areas in Southern Alberta targeting the

Ellerslie, the Lithic Glauconite and the Banff formations, along

with an established and proven waterflood project at our Evi area

in the Peace River Arch.

For further information, please contact:

Prairie Provident Resources Inc.Tony van WinkoopPresident and

Chief Executive OfficerTel: (403) 292-8071Email:

tvanwinkoop@ppr.ca

No offer or solicitation

This news release does not constitute an offer

to sell or the solicitation of an offer to buy any securities in

the United States or in any other jurisdiction in which any such

offer, solicitation or sale would be unlawful. The securities

issued on closing of or contemporaneously with the financing, and

securities issued in the future pursuant to the Revolving Facility

or an exercise of warrants, including the notes of PPR and the

common shares and warrants of the Company, have not been and will

not be registered under the United States Securities Act of 1933,

as amended (the “1933 Act”) or any state securities laws, and may

not be offered or sold in the United States or to U.S. persons (as

that term is defined in Regulation S under the 1933 Act) except in

transactions exempt from the registration requirements of the 1933

Act and applicable state securities laws.

Forward-Looking Statements

This news release contains certain statements

("forward-looking statements") that constitute forward-looking

information within the meaning of applicable Canadian securities

laws. Forward-looking statements relate to future performance,

events or circumstances, are based upon internal assumptions,

plans, intentions, expectations and beliefs, and are subject to

risks and uncertainties that may cause actual results or events to

differ materially from those indicated or suggested therein. All

statements other than statements of current or historical fact

constitute forward-looking statements. Forward-looking statements

are typically, but not always, identified by words such as

“anticipate”, “believe”, “expect”, “intend”, “plan”, “budget”,

“forecast”, “target”, “estimate”, “propose”, “potential”,

“project”, “continue”, “may”, “will”, “should” or similar words

suggesting future outcomes or events or statements regarding an

outlook.

Without limiting the foregoing, this news

release contains forward-looking statements pertaining to: the

anticipated timing for closing the New Note financing and other

transactions described herein, and the announced amendments

becoming effective; the anticipated availability of undrawn

capacity under the Revolving Facility in future periods; expected

additional cost savings in 2021; future development plans and the

Company's ability to pursue them; and the anticipated timing for

release of a capital budget. Completion of the transactions and

amendments announced in this news release is subject to

satisfaction of certain conditions, including final approvals of

the Toronto Stock Exchange with respect to the warrants to be

granted. Although the Company expects that all such conditions will

be satisfied on December 21, 2020, no assurance can be provided as

to completion or that there will not be any delay.

Forward-looking statements are based on a number

of material factors, expectations or assumptions of Prairie

Provident which have been used to develop such statements but which

may prove to be incorrect. Although the Company believes that the

expectations and assumptions reflected in such forward-looking

statements are reasonable, undue reliance should not be placed on

forward-looking statements, which are inherently uncertain and

depend upon the accuracy of such expectations and assumptions.

Prairie Provident can give no assurance that the forward-looking

statements contained herein will prove to be correct or that the

expectations and assumptions upon which they are based will occur

or be realized. Actual results or events will differ, and the

differences may be material and adverse to the Company. In addition

to other factors and assumptions which may be identified herein,

assumptions have been made regarding, among other things: future

commodity prices and currency exchange rates, including consistency

of future prices with current price forecasts; the economic impacts

of the COVID-19 pandemic, including the adverse effect on global

energy demand, and the oversupply of oil production; results from

development activities, and their consistency with past operations;

the quality of the reservoirs in which Prairie Provident operates

and continued performance from existing wells, including production

profile, decline rate and product mix; the accuracy of the

estimates of Prairie Provident's reserves volumes; operating and

other costs, including the ability to achieve and maintain cost

improvements; continued availability of external financing and cash

flow to fund Prairie Provident's current and future plans and

expenditures, with external financing on acceptable terms; the

impact of competition; the general stability of the economic and

political environment in which Prairie Provident operates; the

general continuance of current industry conditions; the timely

receipt of any required regulatory approvals; the ability of

Prairie Provident to obtain qualified staff, equipment and services

in a timely and cost efficient manner; drilling results; the

ability of the operator of the projects in which Prairie Provident

has an interest in to operate the field in a safe, efficient and

effective manner; field production rates and decline rates; the

ability to replace and expand oil and natural gas reserves through

acquisition, development and exploration; the timing and cost of

pipeline, storage and facility construction and expansion and the

ability of Prairie Provident to secure adequate product

transportation; regulatory framework regarding royalties, taxes and

environmental matters in the jurisdictions in which Prairie

Provident operates; and the ability of Prairie Provident to

successfully market its oil and natural gas products.

Forward-looking statements are not guarantees of

future performance or promises of future outcomes, and should not

be relied upon. Such statements, including the assumptions made in

respect thereof, involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements including, without limitation: changes in realized

commodity prices; changes in the demand for or supply of Prairie

Provident's products; the potential for variation in the quality of

the geologic formations targeted by Prairie Provident’s operations;

the early stage of development of some of the evaluated areas and

zones; unanticipated operating results or production declines;

changes in tax or environmental laws, royalty rates or other

regulatory matters; changes in development plans of Prairie

Provident or by third party operators; increased debt levels or

debt service requirements; inaccurate estimation of Prairie

Provident's oil and gas reserves volumes; limited, unfavourable or

no access to capital markets; increased costs; a lack of adequate

insurance coverage; the impact of competitors; and such other risks

as may be detailed from time-to-time in Prairie Provident's public

disclosure documents (including, without limitation, those risks

identified in this news release and Prairie Provident's current

Annual Information Form and annual and quarterly Management's

Discussion and Analysis), copies of which are available on the

SEDAR website at www.sedar.com.

The forward-looking statements contained in this

news release speak only as of the date of this news release, and

Prairie Provident assumes no obligation to publicly update or

revise them to reflect new events or circumstances, or otherwise,

except as may be required pursuant to applicable laws. All

forward-looking statements contained in this news release are

expressly qualified by this cautionary statement.

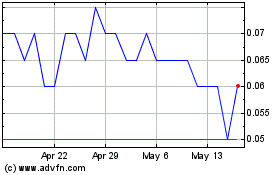

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

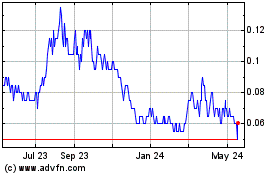

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2023 to Dec 2024