Prairie Provident Provides Correction to 2017 Year-End Reserves and 2018 Budget News Release

February 06 2018 - 5:07PM

Prairie Provident Resources Inc. (“Prairie Provident” or the

“Company”) (TSX:PPR) corrects an inadvertent typographical error

appearing in its news release dated January 29, 2018, Prairie

Provident Announces 2017 Year-End Reserves and 2018 Budget and

Posts Updated Presentation (“Original News Release”).

In the "2018 Budget and Guidance Summary" table

at page 5 of the Original News Release, 2018 operating

expenses and 2018 operating netbacks were transposed. That

error is corrected in the table below, which is otherwise the same

as the table appearing in the Original News Release. An updated

version of the Original News Release reflecting the correction is

available on the Company’s website at www.ppr.ca. The

transposition error did not affect any other information in the

Original News Release.

2018 BUDGET AND GUIDANCE

SUMMARY

|

Production guidance |

5,200 - 5,600 boe/d |

| Liquids weighting |

68 -

71% |

| Capital expenditures

(excluding abandonment and reclamation expenditures and capitalized

G&A) |

$26

million |

| Operating expense |

$17.00

- 18.50/boe |

| Operating netback |

$20.50

– 22.00/boe |

| 2018 year-end long-term

debt (net of cash collateralized for letters of credit) |

$58

million |

|

|

|

|

Financial Assumptions |

|

| Oil (WTI) |

US$63.00/bbl |

| Oil (WCS) |

C$51.50/bbl |

| Natural gas (AECO) |

C$1.40/mcf |

| Edmonton Light/WTI

differential |

C$6.00 |

| USD/CAD exchange

rate |

0.81 |

| |

|

ABOUT PRAIRIE PROVIDENT

Prairie Provident is a Calgary-based company

engaged in the exploration and development of oil and natural gas

in Canada. The Company's strategy is to combine organic growth with

accretive acquisitions of conventional oil prospects that bring

additional development potential. The Company’s operations are

primarily focused at Wheatland and Princess in Southern Alberta,

where we are targeting the Lower Mannville formation; along with an

early stage waterflood project at Evi in the Peace River Arch. The

Company also holds a large acreage position of approximately

240,000 net acres in the Utica shale in Quebec's Saint Lawrence

lowlands. Prairie Provident protects its income statement

through an active hedging program and manages risk by allocating

capital to opportunities offering maximum shareholder returns.

For further information, please contact:

Tim Granger President & Chief Executive Officer

Tel: (403) 292-8110 Email: tgranger@ppr.ca Web: www.ppr.ca

CAUTIONARY STATEMENTS

Forward-looking

information

Certain information included in this news

release constitutes forward-looking information within the meaning

of applicable Canadian securities laws. Statements that

constitute forward-looking information relate to future

performance, events or circumstances, and are based upon internal

assumptions, plans, intentions, expectations and beliefs. All

statements other than statements of current or historical fact

constitute forward-looking information. Forward-looking

information is typically, but not always, identified by words such

as "anticipate", "believe", "expect", "intend", "plan", "budget",

"forecast", "target", "estimate", "propose", "potential",

"project", "continue", "may", "will", "should" or similar

expressions suggesting future outcomes or events or statements

regarding an outlook. In particular, this news release

includes forward-looking information regarding: budgeted

capital expenditure amounts for 2018; the volume and product mix of

Prairie Provident's future oil and gas production, including

expected average 2018 production volumes and liquids weighting

thereof; future oil and natural gas prices; future results from

operations and operating metrics, including forecast 2018 operating

expenses and operating netback; and the Company's forecast

long-term debt level at year-end 2018;.

Forward-looking information is based on a number

of material factors, expectations or assumptions of Prairie

Provident, which have been used to develop such information but

which may prove to be incorrect. Although Prairie Provident

believes that the expectations and assumptions reflected in such

forward-looking information are reasonable, undue reliance should

not be placed on forward-looking information, which is inherently

uncertain and depends upon the accuracy of such expectations and

assumptions. Prairie Provident can give no assurance that the

forward-looking information contained herein will prove to be

correct or that the expectations and assumptions upon which they

are based will occur or be realized. Actual results or events

will differ, and the differences may be material and adverse to the

Company. In addition to other factors and assumptions which

may be identified herein, assumptions have been made regarding,

among other things: future commodity prices and costs; the timing

and success of future drilling and development activities (and the

extent to which the results thereof meet Management's

expectations); that Prairie Provident will continue to conduct its

operations in a manner consistent with past operations; results

from drilling and development activities consistent with past

operations; the quality of the reservoirs in which Prairie

Provident operates and continued performance from existing wells;

future capital expenditure requirements and the sufficiency thereof

to achieve the Company's objectives; the continued and timely

development of infrastructure in areas of new production; the

accuracy of the estimates of Prairie Provident's reserves volumes;

certain commodity price and other cost assumptions; continued

availability of external financing and cash flow to fund Prairie

Provident's current and future plans and expenditures, with

financing on acceptable terms; the impact of increasing

competition; the general stability of the economic and political

environment in which Prairie Provident operates; the general

continuance of current industry conditions; the timely receipt of

any required regulatory approvals; the ability of Prairie Provident

to obtain qualified staff, equipment and services in a timely and

cost efficient manner; drilling results; the ability of the

operator of the projects in which Prairie Provident has an interest

in to operate the field in a safe, efficient and effective manner;

field production rates and decline rates; the ability to replace

and expand oil and natural gas reserves through acquisition,

development and exploration; the timing and cost of pipeline,

storage and facility construction and expansion and the ability of

Prairie Provident to secure adequate product transportation; future

commodity prices; currency, exchange and interest rates; regulatory

framework regarding royalties, taxes and environmental matters in

the jurisdictions in which Prairie Provident operates; and the

ability of Prairie Provident to successfully market its oil and

natural gas products. The forward-looking information included in

this news release are not guarantees of future performance and

should not be unduly relied upon. Such information, including the

assumptions made in respect thereof, involve known and unknown

risks, uncertainties and other factors, many of which are beyond

the Company's control, that may cause actual results or events to

differ materially from those indicated or suggested in the

forward-looking information, including, without limitation: changes

in commodity prices; changes in the demand for or supply of Prairie

Provident's products, the early stage of development of some of the

evaluated areas and zones; the potential for variation in the

quality of the lithic gluconate formation; unanticipated

operating results or production declines; changes in tax or

environmental laws, royalty rates or other regulatory matters;

changes in development plans of Prairie Provident or by third party

operators of Prairie Provident's properties, increased debt levels

or debt service requirements; inaccurate estimation of Prairie

Provident's oil and gas reserve volumes; limited, unfavourable or a

lack of access to capital markets; increased costs; a lack of

adequate insurance coverage; the impact of competitors; and other

risks detailed from time-to-time in Prairie Provident's public

disclosure documents (including, without limitation, those risks

identified in Prairie Provident's current Annual Information Form),

copies of which are available electronically under the Company's

issuer profile on the SEDAR website and on its website at

www.ppr.ca. This list is not exhaustive.

The forward-looking information contained in

this news release speak only as of the date of this news release,

and Prairie Provident does not assume any obligation to publicly

update or revise any of the included forward-looking information,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities laws.

OTHER

ADVISORIES

We have adopted the industry-standard conversion

ratio of six Mcf to one bbl when converting natural gas quantities

to "barrels of oil equivalent" (BOEs). BOEs may be

misleading, though, particularly if used in isolation. A BOE

conversion ratio of 6 mcf: 1 bbl is based on an energy equivalency

conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Although

the six-to-one conversion factor is an industry accepted norm, it

is not reflective of price or market value differentials between

product types. Based on current commodity prices, the value

ratio between natural gas and oil is significantly different than

the 6:1 ratio based on energy equivalency. Accordingly, a 6:1

conversion ratio may be misleading as an indication of value.

Non-IFRS

Measures

The Company uses certain terms in this news

release that do not have a standardized or prescribed meaning or

methods of calculation under IFRS, Prairie Provident's measurement

of these terms may not be comparable with the calculation of

similar terms used by other companies and therefore should not be

used to make such comparisons.

“Operating netback” – This is a non-IFRS measure

commonly used in the oil and gas industry. Operating netback

assists management and investors to evaluate the specific operating

performance at the oil and gas lease level. Operating netbacks

included in this news release were determined by taking (oil and

gas revenues less royalties less operating costs) divided by gross

working interest production. Operating netback, including realized

commodity (loss) and gain, adjusts the operating netback for only

realized gains and losses on derivative instruments.

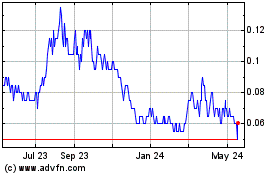

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Dec 2024 to Jan 2025

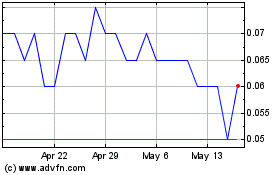

Prairie Provident Resour... (TSX:PPR)

Historical Stock Chart

From Jan 2024 to Jan 2025