Peyto Exploration & Development Corp. (TSX: PEY) ("Peyto"

or the "Company") is pleased to report operating and financial

results for the second quarter of 2024.

Q2 2024 Highlights:

- Delivered $154.8 million in funds from operations1,2 ("FFO"),

or $0.79/diluted share, generated earnings of $51.4 million, or

$0.26/diluted share, and returned $64.4 million of dividends to

shareholders.

- Production volumes averaged 122,299 boe/d (642.8 MMcf/d of

natural gas, 15,174 bbls/d of NGLs), a 24% increase year over year,

mainly due to the Repsol Canada Energy Partnership acquisition that

closed in the fourth quarter of 2023 (the "Repsol Acquisition" or

"Repsol Assets").

- The successful drilling program on the Repsol Assets continued

during the quarter with sustained increases to average well

productivity of approximately 30% above Peyto's recent annual

drilling programs.

- The Company's disciplined hedging and diversification program

protected second quarter revenues from the lowest AECO daily

benchmark natural gas prices since 2019. Peyto's realized natural

gas price for the quarter of $2.87/Mcf (or $2.50/GJ) was more than

double the average AECO daily price of $1.12/GJ. The Company exited

the quarter with a strong hedge position, which currently protects

approximately 449 MMcf/d, 455 MMcf/d and 260 MMcf/d of gas

production for the second half of 2024, calendar 2025, and calendar

2026, respectively, at an average gas price near $4/Mcf. The

securing of future revenues supports the sustainability of the

Company's dividends, capital program, and continued strengthening

of the balance sheet.

- Quarterly cash costs3 totaled $1.50/Mcfe, including royalties

of $0.26/Mcfe, operating costs of $0.52/Mcfe, transportation of

$0.30/Mcfe, G&A of $0.06/Mcfe and interest expense of

$0.36/Mcfe. Peyto's operating costs have decreased 5% from the

first quarter of 2024, and are on target to achieve a 10% reduction

by the end of 2024. Peyto continues to have the lowest cash costs

in the Canadian oil and natural gas industry.

- Total capital expenditures were $100.5 million in the

quarter. Peyto drilled 20 wells (18.8 net), completed 19

wells (17.5 net), and brought 13 wells (13.0 net) on production.

- Peyto delivered a 62% operating margin4 and a 19% profit

margin5, resulting in a 9% return on capital employed6 ("ROCE") and

a 11% return on equity8 ("ROE"), on a trailing 12-month

basis.

Second Quarter 2024 in Review

Natural gas prices sunk to near five-year lows

across North America in the second quarter as storage inventories

remain elevated coming out of a warm winter season. The AECO daily

benchmark averaged just $1.12/GJ, while Peyto realized $2.50/GJ on

account of the Company’s disciplined hedging strategy that

delivered $71.4 million of natural gas hedging gains for the

quarter. Peyto's operating costs of $0.52/Mcfe were reduced by 5%

from Q1 2024, partially due to the redirection of natural gas

volumes from a third-party operated, deep-cut facility to Peyto's

owned and operated Edson gas plant, which resulted in a reduction

of approximately 2,000 bbl/d of NGLs that were primarily low value

liquid ethane. The Company remains committed to its goal to reduce

operating costs by 10% from first quarter levels by the end of

2024. Peyto's strong hedge book and low-cost structure combined to

deliver FFO of $154.8 million ($0.79/diluted share) and free funds

flow7 totaling $54.0 million despite the downward pressure on

natural gas prices. Peyto's profit margin of 19% drove quarterly

earnings of $51.4 million ($0.26/diluted share). First half

2024 FFO of $359.5 million and free funds flow of $140.7 million

exceeded dividends of $128.5 million allowing for continued debt

reduction.

__________________________________________________________

1 This press release contains certain non-GAAP

and other financial measures to analyze financial performance,

financial position, and cash flow including, but not limited to

"operating margin", "profit margin", "return on capital", "return

on equity", "netback", "funds from operations", "free funds flow",

"total cash costs", and "net debt". These non-GAAP and other

financial measures do not have any standardized meaning prescribed

under IFRS and therefore may not be comparable to similar measures

presented by other entities. The non-GAAP and other financial

measures should not be considered to be more meaningful than GAAP

measures which are determined in accordance with IFRS, such as

earnings, cash flow from operating activities, and cash flow used

in investing activities, as indicators of Peyto’s performance. See

"Non-GAAP and Other Financial Measures" included at the end of this

press release and in Peyto's most recently filed MD&A for an

explanation of these financial measures and reconciliation to the

most directly comparable financial measure under IFRS.2 Funds from

operations is a non-GAAP financial measure. See "non-GAAP and Other

Financial Measures" in this news release and in the Q2 2024

MD&A.3 Cash costs is a non-GAAP financial measure. See

"non-GAAP and Other Financial Measures" in this news release.4

Operating Margin is a non-GAAP financial ratio. See "non-GAAP and

Other Financial Measures" in this news release.5 Profit Margin is a

non-GAAP financial ratio. See "non-GAAP and Other Financial

Measures" in this news release.6 Return on capital employed and

return on equity are non-GAAP financial ratios. See "non-GAAP and

Other Financial Measures" in this news release and in the Q2 2024

MD&A.7 Free funds flow is a non-GAAP financial measure. See

"non-GAAP and Other Financial Measures" in this news release and in

the Q2 2024 MD&A.

| |

Three Months Ended June 30 |

% |

Six Months Ended June 30 |

% |

|

|

2024 |

2023 |

Change |

2024 |

2023 |

Change |

| Operations |

|

|

|

|

|

|

| Production |

|

|

|

|

|

|

|

Natural gas (Mcf/d) |

642,754 |

526,732 |

22% |

644,994 |

535,457 |

20% |

|

NGLs (bbl/d) |

15,174 |

10,989 |

38% |

16,159 |

11,593 |

39% |

|

Thousand cubic feet equivalent (Mcfe/d @ 1:6) |

733,796 |

592,665 |

24% |

741,951 |

605,017 |

23% |

|

Barrels of oil equivalent (boe/d @ 6:1) |

122,299 |

98,777 |

24% |

123,658 |

100,836 |

23% |

| Production per million common

shares (boe/d) |

627 |

565 |

11% |

635 |

577 |

10% |

| Product prices |

|

|

|

|

|

|

|

Realized natural gas price – after hedging and diversification

($/Mcf) |

2.87 |

3.13 |

-8% |

3.47 |

3.53 |

-2% |

|

Realized NGL price – after hedging ($/bbl) |

69.44 |

69.28 |

0% |

64.62 |

74.38 |

-13% |

| Net Sales Price ($/Mcfe) |

3.95 |

4.07 |

-3% |

4.42 |

4.55 |

-3% |

| Operating expenses

($/Mcfe) |

0.52 |

0.47 |

11% |

0.53 |

0.49 |

8% |

| Royalties ($/Mcfe) |

0.26 |

0.18 |

44% |

0.25 |

0.36 |

-31% |

| Transportation ($/Mcfe) |

0.30 |

0.29 |

3% |

0.30 |

0.27 |

11% |

| Field netback(1)($/Mcfe) |

2.90 |

3.15 |

-8% |

3.37 |

3.49 |

-3% |

| General & administrative

expenses ($/Mcfe) |

0.06 |

0.05 |

20% |

0.06 |

0.04 |

50% |

| Interest expense ($/Mcfe) |

0.36 |

0.22 |

64% |

0.36 |

0.22 |

64% |

| Financial ($000,

except per share) |

|

|

|

|

|

|

| Natural gas and NGL sales

including realized hedging gains (losses)(2) |

263,832 |

219,409 |

20% |

596,373 |

497,742 |

20% |

| Funds from operations(1) |

154,835 |

142,354 |

9% |

359,461 |

322,171 |

12% |

| Funds from operations per

share - basic(1) |

0.79 |

0.81 |

-2% |

1.85 |

1.84 |

1% |

| Funds from operations per

share - diluted(1) |

0.79 |

0.81 |

-2% |

1.83 |

1.83 |

0% |

| Total dividends |

64,365 |

57,715 |

12% |

128,523 |

115,393 |

11% |

| Total dividends per share |

0.33 |

0.33 |

0% |

0.66 |

0.66 |

0% |

| Earnings |

51,437 |

57,415 |

-10% |

151,313 |

147,396 |

3% |

| Earnings per share –

basic |

0.26 |

0.33 |

-21% |

0.78 |

0.84 |

-7% |

| Earnings per share –

diluted |

0.26 |

0.33 |

-21% |

0.77 |

0.84 |

-8% |

| Total capital

expenditures(1) |

100,451 |

82,319 |

22% |

214,214 |

204,121 |

5% |

| Decommissioning

expenditures |

391 |

- |

- |

4,597 |

- |

- |

| Total payout ratio(1) |

107% |

98% |

9% |

97% |

99% |

-2% |

| Weighted average common shares

outstanding - basic |

195,045,669 |

174,895,215 |

12% |

194,731,189 |

174,836,955 |

11% |

| Weighted average common shares

outstanding - diluted |

196,520,101 |

176,305,942 |

11% |

195,967,653 |

176,460,770 |

11% |

| |

|

|

|

|

|

|

| Net debt(1) |

|

|

|

1,337,577 |

869,550 |

54% |

| Shareholders' equity |

|

|

|

2,691,716 |

2,309,845 |

17% |

| Total

assets |

|

|

|

5,393,524 |

4,093,448 |

32% |

| |

|

|

|

|

|

|

(1) This is a Non-GAAP financial measure or ratio. See "non-GAAP

and Other Financial Measures" in this news release and in the Q2

2024 MD&A(2) Excludes revenue from sale of third-party

volumes

Capital Expenditures

Peyto drilled 20 wells (18.8 net), completed 19

wells (17.5 net) and brought 13 wells (13.0 net) on production for

total drilling, completion, equipping and tie-in costs of $86.6

million in the quarter. Facilities and pipeline projects

totaled $13.3 million in the quarter, which included the first

phase of the Edson gas plant turnaround, continued Repsol gas

gathering system integration, and several pipeline debottlenecking

projects. The Company operated four drilling rigs

during the quarter that were situated on three-well pads to

minimize equipment moves through the wet spring-breakup period and

was prudent with timing of completions and tie-ins to avoid

incremental costs during low natural gas prices. Peyto's drilling

program featured 16 Wilrich, 1 Falher, 2 Notikewin, and 1 Dunvegan

well. Twelve of the 20 wells drilled in the quarter were drilled on

the Repsol Assets, with all twelve wells being drilled to the

deeper Wilrich formation which helps further define many additional

shallower targets. The results from these wells are largely

outperforming previous wells in the area, mostly due to the

application of the Company's current drilling and completion

methodology. Additionally, the drilling program near Edson has been

a key contributor to increasing utilization at the nearby Edson gas

plant as part of Peyto's plan to reduce operating costs where plant

inlet production has increased from 85 MMcf/d to over 125 MMcf/d by

the end of the second quarter. Since the acquisition, Peyto has

brought on production a total of 21 wells drilled on the Repsol

Assets. These wells continue to exhibit a sustained average

productivity increase of approximately 30% as compared to Peyto's

recent annual drilling programs. The Company continues to drill

longer horizontal wells to increase reserves recovery efficiencies

with average horizontal length of wells in the quarter extended to

2,350 meters, or 6% longer than Q1 2024. Peyto improved drilling

and completion costs per meter in the quarter by 8%, as compared to

Q1 2024, summarized in the following table.

|

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2023 Q1 |

2023 Q2 |

2023 Q3 |

2023 Q4 |

2024 Q1 |

2024 Q2(1) |

|

Gross Hz Spuds |

135 |

70 |

61 |

64 |

95 |

95 |

72 |

19 |

15 |

19 |

19 |

18 |

20 |

| Measured

Depth (m) |

4,229 |

4,020 |

3,848 |

4,247 |

4,453 |

4,611 |

4,891 |

5,198 |

4,768 |

4,728 |

4,868 |

5,220 |

5,364 |

| Drilling

($MM/well) |

$1.90 |

$1.71 |

$1.62 |

$1.68 |

$1.89 |

$2.56 |

$2.85 |

$3.05 |

$2.74 |

$2.64 |

$2.94 |

$3.05 |

$2.89 |

| $ per

meter |

$450 |

$425 |

$420 |

$396 |

$424 |

$555 |

$582 |

$587 |

$574 |

$559 |

$603 |

$585 |

$539 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Completion ($MM/well) |

$1.00 |

$1.13 |

$1.01(2) |

$0.94 |

$1.00 |

$1.35 |

$1.54 |

$1.73 |

$1.64 |

$1.38 |

$1.48 |

$1.80 |

$1.75 |

| Hz

Length (m) |

1,241 |

1,348 |

1,484 |

1,682 |

1,612 |

1,661 |

1,969 |

1,947 |

2,140 |

1,853 |

1,949 |

2,223 |

2,350 |

| $ per Hz

Length (m) |

$803 |

$751 |

$679 |

$560 |

$620 |

$813 |

$781 |

$888 |

$776 |

$743 |

$759 |

$809 |

$744 |

|

$ ‘000 per Stage |

$81 |

$51 |

$38 |

$36 |

$37 |

$47 |

$52 |

$59 |

$50 |

$46 |

$53 |

$55 |

$49 |

| |

(1) Based on field estimates and may be subject to minor

adjustments going forward. (2) Peyto’s Montney well is

excluded from drilling and completion cost comparison.

In addition to the capital program, Peyto

incurred $0.4 million on decommissioning expenditures in the

quarter as part of the Company's 2024 responsible asset retirement

plan, bringing the total to $4.6 million for the year to date.

Commodity Prices and

Realizations

In the second quarter, Peyto realized a natural

gas price after hedging and diversification of $2.87/Mcf, or

$2.50/GJ, 123% higher than the average AECO daily benchmark of

$1.12/GJ. Peyto’s natural gas hedging activity resulted in a

realized gain of $1.22/Mcf ($71.4 million) due to the sharp decline

in AECO and Henry Hub natural gas prices over the past year.

Condensate and pentanes averaged $103.97/bbl in

the quarter, up 14% year over year, while Canadian dollar WTI ("WTI

CAD") increased 11% to $110.25/bbl over the same period.

Butane, and propane volumes were sold in combination at an average

price of $35.69/bbl, or 32% of WTI CAD, up 27% from $28.11/bbl in

Q2 2023. Peyto's combined realized NGL price in the quarter

was $71.86/bbl before hedging, and $69.44/bbl including a hedging

loss of $2.42/bbl.

Netbacks

The Company’s realized natural gas and NGL sales

yielded a combined revenue stream of $2.93/Mcfe before hedging

gains of $1.02/Mcfe, resulting in a net sales price of $3.95/Mcfe

in the quarter. Peyto's net sales price was 3% lower than the

$4.07/Mcfe realized in Q2 2023 due to lower natural gas prices,

partially offset by increased realized hedging gains. Total cash

costs of $1.50/Mcfe were consistent with $1.51/Mcfe in Q1 2024, as

the $0.03/Mcfe decrease in operating expenses was partially offset

by higher royalties in the quarter from a gas cost allowance

adjustment, related to the Repsol Assets, totaling

$0.05/Mcfe. Peyto's cash netback (net sales price including

other income, third-party sales net of purchases, realized gain on

foreign exchange, less total cash costs), was $2.47/Mcfe resulting

in a 62% operating margin which allowed the Company to fund the

capital program, and pay dividends to shareholders in the quarter.

Despite the challenging natural gas market over the past six

quarters, Peyto has achieved an average operating margin of 68%

over the period, from its marketing and diversification strategy

and its low-cost assets. Historical cash costs and operating

margins are shown in the following table:

|

|

2021 |

2022 |

2023 |

2024 |

|

($/Mcfe) |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

Q3 |

Q4 |

Q1 |

Q2 |

|

Revenue(1) |

3.70 |

2.92 |

3.33 |

4.42 |

5.25 |

5.48 |

5.01 |

5.74 |

5.10 |

4.07 |

4.32 |

4.83 |

4.92 |

3.97 |

| Royalties |

0.29 |

0.26 |

0.36 |

0.53 |

0.60 |

0.95 |

0.70 |

0.72 |

0.53 |

0.18 |

0.29 |

0.30 |

0.24 |

0.26 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Op Costs |

0.36 |

0.35 |

0.35 |

0.32 |

0.41 |

0.39 |

0.38 |

0.41 |

0.50 |

0.47 |

0.44 |

0.55 |

0.55 |

0.52 |

| Transportation |

0.17 |

0.22 |

0.23 |

0.23 |

0.28 |

0.27 |

0.26 |

0.22 |

0.24 |

0.29 |

0.29 |

0.26 |

0.30 |

0.30 |

| G&A |

0.04 |

0.05 |

0.02 |

0.02 |

0.03 |

0.02 |

0.02 |

0.02 |

0.03 |

0.05 |

0.04 |

0.06 |

0.06 |

0.06 |

| Interest |

0.38 |

0.33 |

0.26 |

0.22 |

0.21 |

0.20 |

0.21 |

0.21 |

0.22 |

0.22 |

0.28 |

0.40 |

0.36 |

0.36 |

| Cash cost

pre-royalty |

0.95 |

0.95 |

0.86 |

0.79 |

0.93 |

0.88 |

0.87 |

0.86 |

0.99 |

1.03 |

1.05 |

1.27 |

1.27 |

1.24 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Cash Costs8 |

1.24 |

1.21 |

1.22 |

1.32 |

1.53 |

1.83 |

1.57 |

1.58 |

1.52 |

1.21 |

1.34 |

1.57 |

1.51 |

1.50 |

|

Cash Netback9 |

2.46 |

1.71 |

2.11 |

3.10 |

3.72 |

3.65 |

3.44 |

4.16 |

3.58 |

2.86 |

2.98 |

3.26 |

3.41 |

2.47 |

|

Operating Margin |

67% |

59% |

63% |

70% |

71% |

67% |

69% |

72% |

71% |

70% |

69% |

67% |

69% |

62% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Revenue includes other income, net third party sales

and realized gains on foreign exchange.

Depletion, depreciation, and amortization

charges of $1.38/Mcfe, along with provisions for current tax,

deferred tax and stock-based compensation payments resulted in

earnings of $0.77/Mcfe, or a 19% profit margin. Dividends to

shareholders totaled $0.96/Mcfe.

Hedging and Marketing

The Company has been active in hedging future

production with financial and physical fixed price contracts to

protect a portion of its future revenue from commodity price and

foreign exchange volatility. The following table summarizes Peyto's

hedge position for the second half of 2024, calendar 2025, and

calendar 2026.

|

|

Q3 2024 |

Q4 2024 |

2025 |

2026 |

|

Natural Gas |

|

|

|

|

|

Volume (MMcf/d) |

462 |

436 |

455 |

260 |

|

Average Fixed Price ($/Mcf) |

3.56 |

4.12 |

4.11 |

4.07 |

|

WTI Swaps |

|

|

|

|

|

Volume (bbls/d) |

4,500 |

3,900 |

1,418 |

- |

|

Average Fixed Price ($/bbl) |

102.90 |

101.87 |

99.53 |

- |

|

WTI Collars |

|

|

|

|

|

Volume (bbls/d) |

500 |

500 |

497 |

- |

|

Put–Call ($/bbl) |

85.00–95.00 |

90.00–104.50 |

88.33–104.29 |

- |

|

Propane |

|

|

|

|

|

Volume (bbls/d) |

500 |

500 |

123 |

- |

|

Average Fixed Price (US$/bbl) |

33.86 |

33.86 |

33.86 |

- |

|

USD FX Contracts |

|

|

|

|

|

Amount sold (USD 000s) |

81,000 |

62,000 |

245,000 |

91,500 |

|

Rate (CAD/USD) |

1.3484 |

1.3421 |

1.3509 |

1.3546 |

| |

|

|

|

|

The Company's fixed price contracts combined

with its diversification to the Cascade power plant and other

premium market hubs in North America allow for revenue security and

support continued shareholder returns through dividends and debt

reduction. Details of Peyto’s ongoing marketing and

diversification efforts are available on Peyto’s website at

https://www.peyto.com/Marketing.aspx

Activity Update

Peyto continues to operate four drilling rigs

across all core areas with 8 wells (8 net) drilled, 4 wells (3.8

net) completed, and 8 wells (6.5 net) brought on production since

the start of the third quarter. While spot gas prices remain low,

Peyto plans to continue to build productive capability while

maximizing operational efficiency. For example, additional wells

have been added to drilling pads to increase cost efficiencies

despite delaying initial production timing. Additionally,

several new wells have been brought on at restricted rates to

minimize low natural gas price exposure. The Company will also use

the opportunity to test the capability of gathering systems to

identify optimization projects deemed necessary to coincide with

future improved prices. This may include incremental compression,

additional pipelines, and or wellsite optimizations for improved

production rates later in the year.

__________________________________________________________

8 Total Cash costs is a non-GAAP financial ratio. See "non-GAAP

and Other Financial Measures" in this news release.9 Cash netback

is a non-GAAP financial ratio. See "non-GAAP and Other Financial

Measures" in this news release and in the Q2 2024 MD&A.

In early July, Peyto began the orderly shutdown

of the hydrogen sulphide, ("sour gas") processing and sulphur

recovery units at the Edson gas plant. This initiative, initially

planned for later this year, was accelerated due to low summer

natural gas prices. The higher operating cost nature and dependency

on third-party volumes to run the sour gas units was a major factor

in the decision. The shutdown of this portion of the plant is a key

part of Peyto's plan to simplify operations to further reduce

operating costs in 2024 and also serves to increase reliability,

lower emissions, and improve safety risks. The removal of sour

inlet gas also serves to free up the 100% owned, 180 km large

diameter Central Foothills Gas Gathering System, that runs

northwest of the plant, and will allow for greater sweet gas

interconnectivity of Peyto's approximately 1 BCF/d of total owned

processing complex in the Greater Sundance area.

The Edson gas plant will undergo the second and

final phase of the major 2024 turnaround for upgrades and

maintenance in September, focused on the sweet gas processing

units. Efforts will be made to re-direct gas volumes to other

operated gas plants during the turnaround in the area to minimize

production impacts and is timed when gas prices are projected to

remain lower.

Since the start of the third quarter, Peyto has

been consistently supplying natural gas to the Cascade

combined-cycle power plant, for the purposes of testing and

commissioning, through the directly connected pipeline built from

the Company's operated Swanson gas plant. Peyto's 15 year, 60,000

GJ/d supply contract is expected to commence on or before September

1, 2024.

Extreme heat in Alberta during July has caused

some of the Company's natural gas compressors to run less

efficiently, reducing throughput, which has resulted in

approximately 2,000 boe/d to be deferred during the month. The

recent return to normal seasonal weather has alleviated these

issues and allowed operating conditions to return to normal.

Outlook

Peyto expects weaker spot natural gas prices

will continue to prevail during the summer across North America as

storage inventories remain elevated and supply and demand remain

imbalanced. Natural gas future markets have softened recently but

the Company remains well protected with large portions of future

natural gas volumes hedged at prices near $4/Mcf.

The Company remains on track to execute a 2024

capital program targeting the lower end of Peyto's guidance range

between $450 to $500 million but is poised to respond as market

conditions improve. In the meantime, Peyto will continue to drill

and complete wells but will manage production at current levels and

build productive capability in anticipation of a higher winter gas

price market. The Company's low-cost operations and disciplined

hedging program secure cash flows to support future dividends and

continued strengthening of the balance sheet over the balance of

2024 and beyond.

The significant construction of new liquefied

natural gas facilities with an additional 12 BCF/d of capacity

coming online in the next few years in Canada and the USA, along

with the prospects of future natural gas fired power demand to meet

expanding data centre and artificial intelligence requirements are

encouraging for natural gas producers and their

investors.

Conference Call and Webcast

A conference call will be held with senior

management of Peyto to answer questions with respect to the

Company’s Q2 2024 results on Wednesday, August 14, 2024, at 9:00

a.m. Mountain Time (MT), or 11:00 a.m. Eastern Time (ET).

Access to the webcast can be found at:

https://edge.media-server.com/mmc/p/mqjc4gd6.

To participate in the call, please register for the event at:

https://register.vevent.com/register/BId85d42c533b444bbacbd79c521f67842.

Participants will be issued a dial in number and PIN to join the

conference call and ask questions. Alternatively, questions can be

submitted prior to the call at info@peyto.com. The conference call

will be available on the Peyto Exploration & Development

website at www.peyto.com.

Management’s Discussion and Analysis

A copy of the second quarter report to

shareholders, including the MD&A, unaudited consolidated

financial statements and related notes, is available at

http://www.peyto.com/Files/Financials/2024/Q22024FS.pdf and at

http://www.peyto.com/Files/Financials/2024/Q22024MDA.pdf and will

be filed at SEDAR+, www.sedarplus.com at a later date.

Jean-Paul

Lachance

President & Chief Executive OfficerPresident and Chief

Executive OfficerPhone: (403) 261-6081Fax:

(403) 451-4100info@peyto.com

August 13, 2024

Cautionary Statements

Forward-Looking Statements

This news release contains certain

forward-looking statements or information ("forward-looking

statements") as defined by applicable securities laws that involve

substantial known and unknown risks and uncertainties, many of

which are beyond Peyto's control. These statements relate to future

events or the Company's future performance. All statements other

than statements of historical fact may be forward-looking

statements. The use of any of the words "plan", "expect",

"prospective", "project", "intend", "believe", "should",

"anticipate", "estimate", or other similar words or statements that

certain events "may" or "will" occur are intended to identify

forward-looking statements. The projections, estimates and beliefs

contained in such forward-looking statements are based on

management's estimates, opinions, and assumptions at the time the

statements were made, including assumptions relating to:

macro-economic conditions, including public health concerns and

other geopolitical risks, the condition of the global economy and,

specifically, the condition of the crude oil and natural gas

industry, and the ongoing significant volatility in world markets;

other industry conditions; changes in laws and regulations

including, without limitation, the adoption of new environmental

laws and regulations and changes in how they are interpreted and

enforced; increased competition; the availability of qualified

operating or management personnel; fluctuations in other commodity

prices, foreign exchange or interest rates; stock market volatility

and fluctuations in market valuations of companies with respect to

announced transactions and the final valuations thereof; results of

exploration and testing activities; and the ability to obtain

required approvals and extensions from regulatory authorities.

Management of the Company believes the expectations reflected in

those forward-looking statements are reasonable, but no assurances

can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do so, what benefits that Peyto will derive from them. As

such, undue reliance should not be placed on forward-looking

statements. Forward-looking statements contained herein include,

but are not limited to, statements regarding: management's

assessment of Peyto's future plans and operations, including the

2024 capital expenditure program; the commencement date of the

Cascade Power Plant; the sustainability of the Company's dividend;

expectations regarding cost reductions with continued optimization

and increased utilization of the acquired gas processing plants;

the Company's target of at least a 10% reduction in per unit

operating costs by the end of 2024; Peyto's outlook on North

American natural gas prices and supply/demand fundamentals; and the

Company's overall strategy and focus.

The forward-looking statements contained herein

are subject to numerous known and unknown risks and uncertainties

that may cause Peyto's actual financial results, performance or

achievement in future periods to differ materially from those

expressed in, or implied by, these forward-looking statements,

including but not limited to, risks associated with: continued

changes and volatility in general global economic conditions

including, without limitations, the economic conditions in North

America and public health concerns; continued fluctuations and

volatility in commodity prices, foreign exchange or interest rates;

continued stock market volatility; imprecision of reserves

estimates; competition from other industry participants; failure to

secure required equipment; increased competition; the lack of

availability of qualified operating or management personnel;

environmental risks; changes in laws and regulations including,

without limitation, the adoption of new environmental and tax laws

and regulations and changes in how they are interpreted and

enforced; the results of exploration and development drilling and

related activities; and the ability to access sufficient capital

from internal and external sources. In addition, to the

extent that any forward-looking statements presented herein

constitutes future-oriented financial information or financial

outlook, as defined by applicable securities legislation, such

information has been approved by management of Peyto and has been

presented to provide management's expectations used for budgeting

and planning purposes and for providing clarity with respect to

Peyto's strategic direction based on the assumptions presented

herein and readers are cautioned that this information may not be

appropriate for any other purpose. Readers are encouraged to

review the material risks discussed in Peyto's latest annual

information form under the heading "Risk Factors" and in Peyto's

annual management's discussion and analysis under the heading "Risk

Management".

The Company cautions that the foregoing list of

assumptions, risks and uncertainties is not exhaustive. Readers are

cautioned that the assumptions used in the preparation of such

information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance

should not be placed on forward-looking statements. Peyto's actual

results, performance or achievement could differ materially from

those expressed in, or implied by, these forward-looking statements

and, accordingly, no assurance can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits Peyto will derive

there from. The forward-looking statements, including any

future-oriented financial information or financial outlook,

contained in this news release speak only as of the date hereof and

Peyto does not assume any obligation to publicly update or revise

them to reflect new information, future events or circumstances or

otherwise, except as may be required pursuant to applicable

securities laws.

Barrels of Oil Equivalent

To provide a single unit of production for

analytical purposes, natural gas production and reserves volumes

are converted mathematically to equivalent barrels of oil (BOE).

Peyto uses the industry-accepted standard conversion of six

thousand cubic feet of natural gas to one barrel of oil (6 Mcf = 1

bbl). The 6:1 BOE ratio is based on an energy equivalency

conversion method primarily applicable at the burner tip. It does

not represent a value equivalency at the wellhead and is not based

on current prices. While the BOE ratio is useful for comparative

measures and observing trends, it does not accurately reflect

individual product values and might be misleading, particularly if

used in isolation. As well, given that the value ratio, based on

the current price of crude oil to natural gas, is significantly

different from the 6:1 energy equivalency ratio, using a 6:1

conversion ratio may be misleading as an indication of value.

Thousand Cubic Feet Equivalent

(Mcfe)

Natural gas volumes recorded in thousand cubic

feet (mcf) are converted to barrels of oil equivalent (boe) using

the ratio of six (6) thousand cubic feet to one (1) barrel of oil

(bbl). Natural gas liquids and oil volumes in barrel of oil

(bbl) are converted to thousand cubic feet equivalent (Mcfe) using

a ratio of one (1) barrel of oil to six (6) thousand cubic

feet. This could be misleading, particularly if used in

isolation as it is based on an energy equivalency conversion method

primarily applied at the burner tip and does not represent a value

equivalency at the wellhead.

Non-GAAP and Other Financial

Measures

Throughout this press release, Peyto employs

certain measures to analyze financial performance, financial

position, and cash flow. These non-GAAP and other financial

measures do not have any standardized meaning prescribed under IFRS

and therefore may not be comparable to similar measures presented

by other entities. The non-GAAP and other financial measures should

not be considered to be more meaningful than GAAP measures which

are determined in accordance with IFRS, such as net income (loss),

cash flow from operating activities, and cash flow used in

investing activities, as indicators of Peyto’s performance.

Non-GAAP Financial Measures

Funds from Operations"Funds

from operations" is a non-GAAP measure which represents cash flows

from operating activities before changes in non-cash operating

working capital, decommissioning expenditure, provision for future

performance-based compensation and transaction costs.

Management considers funds from operations and per share

calculations of funds from operations to be key measures as they

demonstrate the Company’s ability to generate the cash necessary to

pay dividends, repay debt and make capital investments.

Management believes that by excluding the temporary impact of

changes in non-cash operating working capital, funds from

operations provides a useful measure of Peyto’s ability to generate

cash that is not subject to short-term movements in operating

working capital. The most directly comparable GAAP measure is

cash flows from operating activities.

| |

Three Months Ended June 30 |

Six Months Ended June 30 |

|

($000) |

2024 |

2023 |

2024 |

2023 |

| Cash flows from

operating activities |

141,934 |

148,608 |

338,765 |

332,214 |

| Change in non-cash

working capital |

10,010 |

(6,254) |

13,599 |

(10,043) |

| Decommissioning

expenditures |

391 |

- |

4,597 |

- |

|

Performance based compensation |

2,500 |

- |

2,500 |

- |

| Funds

from operations |

154,835 |

142,354 |

359,461 |

322,171 |

| |

|

|

|

|

Free Funds FlowPeyto uses "free

funds flow" as an indicator of the efficiency and liquidity of

Peyto’s business, measuring its funds after capital investment

available to manage debt levels, pay dividends, and return capital

to shareholders through activities such as share repurchases. In

reporting for prior periods, decommissioning expenditures incurred

were excluded from the Company's free funds flow non-GAAP financial

measure as they were insignificant. Peyto has changed the reporting

of free funds flow to no longer exclude decommissioning

expenditures in the non-GAAP financial measure as the Company

expects an increase in abandonment and reclamation projects going

forward associated with the Repsol Assets. Peyto calculates

free funds flow as cash flows from operating activities before

changes in non-cash operating working capital less total capital

expenditures, allowing Management to monitor its free funds flow to

inform its capital allocation decisions. The most directly

comparable GAAP measure to free funds flow is cash from operating

activities. The following table details the calculation of free

funds flow and the reconciliation from cash flow from operating

activities to free funds flow.

|

|

Three Months Ended June 30 |

Six Months Ended June 30 |

|

($000) |

2024 |

2023 |

2024 |

2023 |

| Cash flows from

operating activities |

141,934 |

148,608 |

338,765 |

332,214 |

| Change in non-cash

working capital |

10,010 |

(6,254) |

13,599 |

(10,043) |

| Performance based

compensation |

2,500 |

- |

2,500 |

- |

| Total

capital expenditures |

(100,451) |

(82,319) |

(214,214) |

(204,121) |

| Free

funds flow |

53,993 |

60,035 |

140,650 |

118,050 |

| |

|

|

|

|

Total Capital Expenditures

Peyto uses the term "total capital expenditures"

as a measure of capital investment in exploration and production

activity, as well as property acquisitions and divestitures, and

such spending is compared to the Company's annual budgeted capital

expenditures. The most directly comparable GAAP measure for total

capital expenditures is cash flow used in investing activities. The

following table details the calculation of cash flow used in

investing activities to total capital expenditures.

|

|

Three Months Ended June 30 |

Six Months Ended June 30 |

|

($000) |

2024 |

2023 |

2024 |

2023 |

| Cash flows used in

investing activities |

80,901 |

102,071 |

178,535 |

228,321 |

| Change in prepaid

capital |

5,512 |

3,549 |

857 |

3,387 |

| Change

in non-cash working capital relating to investing activities |

14,038 |

(23,301) |

34,822 |

(27,587) |

| Total

capital expenditures |

100,451 |

82,319 |

214,214 |

204,121 |

| |

Net Debt "Net debt" is a

non-GAAP financial measure that is the sum of long-term debt and

working capital excluding the current financial derivative

instruments, current portion of lease obligations and current

portion of decommissioning provision. It is used by

management to analyze the financial position and leverage of the

Company. Net debt is reconciled to long-term debt which is the most

directly comparable GAAP measure.

|

($000) |

As atJune 30, 2024 |

As atDecember 31, 2023 |

As atJune 30, 2023 |

|

Long-term debt |

1,214,633 |

1,340,881 |

747,960 |

|

Current assets |

(396,588) |

(490,936) |

(225,642) |

|

Current liabilities |

345,875 |

279,903 |

235,103 |

|

Financial derivative instruments - current |

180,769 |

238,865 |

114,938 |

|

Current portion of lease obligation |

(1,334) |

(1,310) |

(1,288) |

|

Decommissioning provision - current |

(5,778) |

(4,626) |

(1,521) |

|

Net debt |

1,337,577 |

1,362,777 |

869,550 |

| |

|

|

|

Third-Party Sales Net of

PurchasesPeyto uses the term "third-party sales net of

purchases" to evaluate the profitability of natural gas and NGLs

purchased from third parties. Third-party sales net of purchases is

calculated as sales of natural gas and NGLs from third parties less

natural gas and NGLs purchased from third parties.

|

|

Three Months Ended June 30 |

Six Months Ended June 30 |

|

($000) |

2024 |

2023 |

2024 |

2023 |

| Sales of natural

gas and NGLs from third parties |

8,404 |

- |

34,255 |

- |

| Natural gas and

NGLs purchased from third parties |

(7,854) |

- |

(34,091) |

- |

|

Third-party sales net of purchases |

550 |

- |

164 |

- |

| |

|

|

|

|

Third party sales net of purchases per

Mcfe"Third party sales net of purchases per Mcfe" is

comprised of sales of natural gas from third parties less natural

gas purchased from third parties, as determined in accordance with

IFRS, divided by the Company's total production.

Non-GAAP Financial Ratios

Funds from Operations per

SharePeyto presents funds from operations per share by

dividing funds from operations by the Company's diluted or basic

weighted average common shares outstanding. "Funds from operations"

is a non-GAAP financial measure. Management believes that funds

from operations per share provides investors an indicator of funds

generated from the business that could be allocated to each

shareholder's equity position.

Netback per MCFE and

BOE"Netback" is a non-GAAP measure that represents the

profit margin associated with the production and sale of petroleum

and natural gas. Peyto computes "field netback per Mcfe" as

commodity sales from production, plus third party sales net of

purchases, if any, plus other income, less royalties, operating,

and transportation expense divided by production. "Cash

netback" is calculated as "field netback" less interest, less

general and administration expense and plus or minus realized gain

on foreign exchange, divided by production. Netbacks are

before tax, per unit of production measures used to assess Peyto’s

performance and efficiency. The primary factors that produce

Peyto’s strong netbacks and high margins are a low-cost structure

and the high heat content of its natural gas that results in higher

commodity prices.

|

|

Three Months Ended June 30 |

Six Months Ended June 30 |

|

($/Mcfe) |

2024 |

2023 |

2024 |

2023 |

| Gross Sale Price |

2.93 |

3.18 |

3.22 |

4.73 |

|

Realized hedging gain (loss) |

1.02 |

0.89 |

1.20 |

(0.18) |

| Net Sale Price |

3.95 |

4.07 |

4.42 |

4.55 |

| Third party sales net of

purchases |

0.01 |

- |

- |

- |

| Other income |

0.02 |

0.02 |

0.03 |

0.06 |

| Royalties |

(0.26) |

(0.18) |

(0.25) |

(0.36) |

| Operating costs |

(0.52) |

(0.47) |

(0.53) |

(0.49) |

|

Transportation |

(0.30) |

(0.29) |

(0.30) |

(0.27) |

| Field netback(1) |

2.90 |

3.15 |

3.37 |

3.49 |

| Net general and

administrative |

(0.06) |

(0.05) |

(0.06) |

(0.04) |

|

Interest on long-term debt |

(0.36) |

(0.22) |

(0.36) |

(0.22) |

|

Realized loss on foreign exchange |

(0.01) |

(0.02) |

- |

(0.01) |

| Cash netback(1)($/Mcfe) |

2.47 |

2.86 |

2.95 |

3.22 |

| Cash

netback(1)($/boe) |

14.84 |

17.13 |

17.70 |

19.34 |

| |

|

|

|

|

Total Payout Ratio"Total payout

ratio" is a non-GAAP measure which is calculated as the sum of

dividends declared plus total capital expenditures and

decommissioning expenditures, divided by funds from

operations. In reporting for prior periods, decommissioning

expenditures incurred were excluded from the Company's total payout

ratio as they were insignificant. Peyto has changed the reporting

of total payout ratio to no longer exclude decommissioning

expenditures in the non-GAAP financial ratio as the Company expects

an increase in abandonment and reclamation projects going forward

associated with the Repsol Assets. This ratio represents the

percentage of the capital expenditures, decommissioning

expenditures and dividends that is funded by cashflow.

Management uses this measure, among others, to assess the

sustainability of Peyto’s dividend and capital program.

|

|

Three Months Ended June 30 |

Six Months Ended June 30 |

|

($000, except total payout ratio) |

2024 |

2023 |

2024 |

2023 |

| Total dividends declared |

64,365 |

57,715 |

128,523 |

115,393 |

| Total capital

expenditures |

100,451 |

82,319 |

214,214 |

204,121 |

| Decommissioning

expenditures |

391 |

- |

4,597 |

- |

|

Total payout |

165,207 |

140,034 |

347,334 |

319,514 |

| Funds

from operations |

154,835 |

142,354 |

359,461 |

322,171 |

| Total

payout ratio (%) |

107% |

98% |

97% |

99% |

| |

|

|

|

|

Operating Margin Operating

Margin is a non-GAAP financial ratio defined as funds from

operations, before current tax, divided by revenue before royalties

but including realized hedging gains/losses and third-party sales

net of purchases.

Profit Margin Profit Margin is

a non-GAAP financial ratio defined as net earnings divided by

revenue before royalties but including realized hedging

gains/losses and third-party sales net of purchases.

Cash CostsCash costs is a

non-GAAP financial ratio defined as the sum of royalties, operating

expenses, transportation expenses, G&A and interest, on a per

Mcfe basis. Peyto uses total cash costs to assess operating

margin and profit margin.

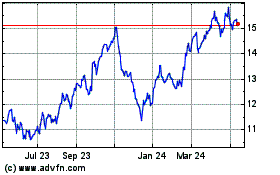

Peyto Exploration and De... (TSX:PEY)

Historical Stock Chart

From Dec 2024 to Jan 2025

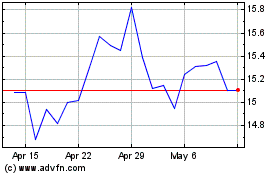

Peyto Exploration and De... (TSX:PEY)

Historical Stock Chart

From Jan 2024 to Jan 2025