National Bank of Canada (“National Bank”) (TSX: NA) and Canadian

Western Bank (“CWB”) (TSX: CWB) today announced they have entered

into a definitive agreement (the “Agreement”) for National Bank to

acquire CWB, a diversified financial services institution based in

Edmonton, Alberta. The transaction brings together two

complementary banks with growing businesses, enabling the united

bank to enhance services to customers by offering a comprehensive

product and service platform at national scale, with a regionally

focused service model.

National Bank will acquire all of the issued and

outstanding common shares of CWB (the “CWB Shares”) by way of a

share exchange (the “Transaction”), valuing CWB at

approximately $5.0 billion (the “CWB Equity Value”).

“This transaction is about growth and brings

together two great banks with a complementary footprint in personal

and commercial banking, and supports our objectives in Western

Canada and across the country,” said Laurent Ferreira, President

and CEO of National Bank. “CWB has developed an attractive banking

franchise with a reputation for exceptional service with deep

customer relationships across a number of priority industries and

service lines. This combination will provide customers with access

to a broader range of services, expertise and products, along with

the benefits of supporting technological investment and innovation.

When we combine these strengths with our commercial and retail

banking offering, leading wealth management and capital markets

franchises, we will be able to do more for clients, both existing

and new, and unlock significant value creation opportunities. I

look forward to joining forces with the CWB team so that together,

we deliver a stronger banking choice for all Canadians and Canadian

businesses.”

“We are proud to come together with National

Bank and are confident that this combination will create incredible

value for our clients, teams, communities and our shareholders.

Together, we can offer Canadians more choice by combining CWB’s

four-decade legacy of serving business owners and their families

with National Bank’s scale, complementary market expertise and the

technological capabilities necessary to accelerate our growth,”

said Chris Fowler, CEO of CWB. “Our two organizations share similar

values grounded in an unwavering commitment to our clients, a deep

history of entrepreneurship and a commitment to giving back in the

communities we serve. We’re excited to build on this legacy

together.”

Transaction Benefits

- Creating a Canadian banking

leader with growth priorities from coast-to-coast – The

combination brings together complementary banks with complementary

footprints and established positions in Western Canada. The united

bank’s growth objectives in the region will be supported by

executive and operational leaders based out of Edmonton, Alberta.

National Bank will increase banking services across CWB’s existing

network. CWB customers will continue to have access to branches in

the communities where they typically bank across Canada, as well as

additional locations in National Bank’s network. As part of the

transaction, National Bank’s board of directors will be

strengthened by the addition of two CWB nominees.

- Expanding services for

Canadian banking and wealth management customers – With a

larger network and the joint resources of both banks, National Bank

can increase its banking and wealth management activities, and

offer more competitive products and services to provide customers

with more options and better value. CWB retail customers will

benefit from a larger product offering and digital platform, small

business clients can utilize National Bank’s cash and risk

management solutions, and commercial clients will benefit from

access to National Bank’s leading capital markets franchise. This

combination adds more full-service choice to Canadian businesses

and individual customers across Canada.

- Investing in the future of

the Western Canadian economy – National Bank has a strong

track record of investing in both the Alberta and Western Canadian

economies, with leading franchises in energy, agriculture, and

affordable housing lending, as well as a top position in

renewables. Today, Alberta and British Columbia represent

approximately 24% of National Bank’s assets under administration,

including managing more than $24 billion in client assets, and more

than $25 billion in authorized credit for Western Canadian

businesses. Western Canada is already a priority growth market for

National Bank and the combination with CWB’s small and mid-market

business and exposure in growing sectors such as equipment finance

will contribute to National Bank becoming an even more valuable

partner to Canadian banking and wealth management customers.

- Deepening commitments to

communities – National Bank takes pride in its active

participation in the communities where it operates. For example, in

2023 National Bank partnered with local tech accelerators to

establish the National Bank Investor Hub to improve connections

between investors and Calgary technology startups, and 2024 will

mark the fifth year of the National Bank Challenger in Calgary, one

of the largest international tennis tournaments in Canada. Through

this combination, National Bank will add to its existing national

investments and expand its support to western communities by

doubling CWB’s community investment program to more than $3 million

annually. Building on CWB’s longstanding relationships, the

combined bank will increase its support to Indigenous communities

across its banking, wealth management and capital markets

franchises.

- Welcoming new and diverse

talent to the National Bank family – National Bank’s tools

and investments in innovation will provide exciting and rewarding

career opportunities for CWB team members as both organizations

come together in serving clients coast-to-coast in a unified way.

In addition to benefiting from strong regional leadership across

corporate and client-facing functions in Alberta, the united bank

will grow in areas such as customer experience and services.

TRANSACTION

DETAILS

With $37 billion in loans, CWB is a full-service

bank in Canada focused on servicing businesses, their owners and

their families, offering services in business and personal banking,

equipment financing, trust services and wealth management through

its 39 branches located across Western Canada and Ontario. CWB will

increase National Bank’s commercial banking portfolio by

approximately 52%, adding domestic earning power and enhancing loan

and revenue diversification.

The Transaction is expected to be accretive to

adjusted EPS on run-rate cost and funding synergies. National Bank

has identified $270 million of pre-tax annual cost and funding

synergies, with upside from revenue opportunities. National Bank

expects to maintain a CET1 ratio above 12.75% at close.

Each CWB Share, other than those held by

National Bank, will be exchanged for 0.450 of a common share (the

“National Bank Shares”) of National Bank (the “Exchange Ratio”).

Based on the 20-day volume weighted average trading price of the

National Bank Shares on the TSX as of June 11, 2024, the Exchange

Ratio values each CWB Share at $52.24, representing a 110% premium

to the closing price of the CWB Shares on the TSX of $24.89 as of

June 11, 2024, and a 100% premium to the volume weighted average

trading price of the CWB Shares over the last 20 days. The National

Bank Shares to be issued upon closing of the Transaction will

represent a pro forma ownership of approximately 10.5% of National

Bank by CWB shareholders, taking into account the Private Placement

and the Public Offering (as defined below).

The Transaction is subject to approval of 662/3%

of the votes cast by CWB shareholders at a special meeting of

shareholders (the "Meeting") expected to be held in September 2024

to approve an amendment to CWB’s by-laws to provide for the share

exchange. The Agreement contains customary non-solicitation

covenants on the part of CWB, subject to customary “fiduciary out”

provisions, as well as “right to match” provisions in favour of

National Bank. A termination fee equivalent to 4% of the CWB Equity

Value would be payable by CWB to National Bank in certain

circumstances, including in the context of a superior proposal

supported by CWB’s board of directors. A reverse termination fee

equivalent to 4% of the CWB Equity Value would be payable by

National Bank to CWB in certain circumstances where key regulatory

approvals are not obtained prior to the outside date.

The CWB board has evaluated the Agreement with

CWB’s management and legal and financial advisors and has

unanimously determined that the Transaction is in the best

interests of CWB and is fair to the CWB shareholders. All directors

and executives of CWB have entered into support and voting

agreements pursuant to which they have agreed to vote their CWB

Shares in favour of the Transaction, subject to certain

conditions.

In connection with their review and

consideration of the Transaction, the CWB board engaged J.P. Morgan

as its exclusive financial advisor. J.P. Morgan provided an opinion

to the CWB board that, subject to the assumptions, limitations and

qualifications set out in its opinion, as of June 11, 2024 the

Exchange Ratio in the proposed Transaction is fair, from a

financial point of view, to holders of CWB Shares.

The board of directors of National Bank has

evaluated the Agreement with National Bank’s management and legal

and financial advisors and has unanimously determined that the

Transaction is in the best interests of National Bank. National

Bank shareholder approval is not required in connection with the

Transaction.

The Transaction is expected to close by the end

of 2025, subject to approval by CWB shareholders and receipt of

required regulatory approvals. The Transaction is not subject to

any financing condition.

Additional details regarding the Transaction

will be set out in CWB’s management information circular to be

prepared and made available to the CWB shareholders in advance of

the Meeting. Copies of the Agreement and the circular will be

available on SEDAR+ at www.sedarplus.ca and on the CWB website at

www.cwb.com.

ACQUISITION FINANCING

National Bank also announced today that it

intends to complete an equity financing in connection with the

Transaction. The equity financing is comprised of a public offering

(the “Public Offering”) and concurrent private placement (the

“Private Placement”) of subscription receipts (the “Subscription

Receipts”) for gross proceeds totaling approximately $1.0 billion

before giving effect to the Over-Allotment Option and the

Additional Subscription Option (as defined below).

Pursuant to the Public Offering, National Bank

has agreed to issue and sell 4,453,000 Subscription Receipts at a

price of $112.30 for total gross proceeds of approximately $500

million. The Public Offering is being underwritten on a bought-deal

basis by a syndicate of underwriters led by National Bank Financial

Inc. (“NBF”). National Bank has granted the underwriters an option

(the “Over-Allotment Option”) to purchase up to an additional

667,950 Subscription Receipts at the public offering price

exercisable up to 30 days after closing of the public offering.

Pursuant to the concurrent Private Placement,

National Bank has agreed to issue and sell 4,453,000 Subscription

Receipts at the public offering price to Caisse de dépôt et

placement du Québec or an affiliate thereof (“CDPQ”) for gross

proceeds of approximately $500 million. All of CDPQ’s Subscription

Receipts will be subject to a statutory hold period of four months

plus one day from the date of their issuance. CDPQ will have the

right to purchase up to an additional 667,950 Subscription

Receipts, to maintain its pro-rata ownership and subject to, and in

the same proportion as, the Over-Allotment Option being exercised

by the underwriters (the “Additional Subscription Option”).

National Bank intends to use the net proceeds

from the equity financing to support strong regulatory capital

ratios following the closing of the Transaction, to fund any cash

consideration under the terms of the Transaction and to pay the

Transaction expenses.

The Subscription Receipts to be issued pursuant

to the Public Offering and the Over-Allotment Option will be

offered in all provinces and territories of Canada by way of a

prospectus supplement to the short form base shelf prospectus of

National Bank dated August 22, 2022. The Subscription Receipts to

be issued pursuant to the Public Offering will also be offered in

the United States concurrently to “qualified institutional buyers”

in reliance upon the exemption from registration provided by Rule

144A under the U.S. Securities Act of 1933 (the “U.S. Securities

Act”).

The issuance of the Subscription Receipts under

the Public Offering and the Private Placement is subject to the

approval of the TSX.

It is expected that the closing of the Private

Placement will occur concurrently with the closing of the Public

Offering. However, the Private Placement is not conditional upon

the completion of the Public Offering, and the Public Offering is

not conditional upon the completion of the Private Placement.

Closing of both offerings is expected to occur on or about June 17,

2024.

No securities regulatory authority has either

approved or disapproved the contents of this press release. The

Subscription Receipts to be issued as part of the Public Offering

have not been, and will not be, registered under the U.S.

Securities Act, or any state securities laws. Accordingly, the

Subscription Receipts may not be offered or sold within the United

States unless registered under the U.S. Securities Act and

applicable state securities laws or pursuant to exemptions from the

registration requirements of the U.S. Securities Act and applicable

state securities laws. This press release shall not constitute an

offer to sell or the solicitation of an offer to buy, nor shall

there be any sale of the Subscription Receipts in any jurisdiction

in which such offer, solicitation or sale would be unlawful.

ADVISORS

NBF is acting as lead financial advisor to

National Bank in connection with the Transaction. McCarthy Tétrault

LLP and Mayer Brown LLP are acting as legal advisors to National

Bank. Jefferies Securities, Inc. provided a fairness opinion to the

board of National Bank. J.P. Morgan is acting as exclusive

financial advisor to CWB and is providing a fairness opinion to the

board of directors of CWB. Torys LLP is acting as legal advisor to

CWB. Fasken Martineau DuMoulin LLP is acting as legal advisor to

CDPQ.

CONFERENCE CALL

- National Bank will host a

conference call on June 11, 2024 at 16:45 EDT.

- All participants may access the call

listen-mode only by dialing 1-800-806-5484 or 416-340-2217. The

access code is 8107433#.

- A recording of the conference call can

be heard until September 5, 2024 by dialing 1-800-408-3053 or

905-694-9451. The access code is 2139106#.

INVESTOR PRESENTATION

An investor presentation is available at

https://www.nbc.ca/about-us/investors.html.

ABOUT NATIONAL BANK

With $442 billion in assets as at April 30,

2024, National Bank is one of Canada's six systemically important

banks. National Bank has approximately 30,000 employees in

knowledge-intensive positions and operates through three business

segments in Canada: Personal and Commercial Banking, Wealth

Management and Financial Markets. A fourth segment, U.S. Specialty

Finance and International, complements the growth of its domestic

operations. Its securities are listed on the Toronto Stock Exchange

(TSX: NA). Follow National Bank’s activities at nbc.ca or via

social media.

ABOUT CWB

CWB is the only full-service bank in Canada with

a strategic focus to meet the unique financial needs of businesses

and their owners. CWB provides its nation-wide clients with

full-service business and personal banking, specialized financing,

comprehensive wealth management offerings, and trust services.

Clients choose CWB for a differentiated level of service through

specialized expertise, customized solutions, and faster response

times relative to the competition. CWB people take the time to

understand its clients and their business, and work as a united

team to provide holistic solutions and advice.

As a public company on the TSX, CWB trades under

the symbols "CWB" (common shares), "CWB.PR.B" (Series 5 preferred

shares) and "CWB.PR.D" (Series 9 preferred shares). CWB is firmly

committed to the responsible creation of value for all its

stakeholders and its approach to sustainability will support its

continued success. Learn more at www.cwb.com.

FORWARD-LOOKING

INFORMATION

Certain statements in this press release are

forward-looking statements. All such statements are made in

accordance with applicable securities legislation in Canada and the

United States. Forward-looking statements in this press release may

include, but are not limited to, statements made about the

anticipated benefits and synergies for National Bank resulting from

the Transaction; statements regarding the anticipated effect of the

Transaction on National Bank’s strategy, operations and financial

performance, including accelerating growth across all business

lines, expanded product and service offerings, cost and funding

synergies, impact on adjusted earnings per share, revenue

opportunities, benefits of scale, branch network, and the combined

entity’s increased competitive strength within the Canadian banking

sector; community investment programs; support to Indigenous

communities; the location of executive and operational leadership;

the anticipated timing for the special meeting of the CWB

shareholders and the anticipated timing for the completion of the

Transaction, statements about the Public Offering and the Private

Placement, including in respect of the use of proceeds therefrom

and the anticipated closing date of the Public Offering and the

Private Placement. These forward-looking statements are typically

identified by verbs or words such as “outlook”, “believe”,

“foresee”, “forecast”, “anticipate”, “estimate”, “project”,

“expect”, “intend” and “plan”, in their future or conditional

forms, notably verbs such as “will”, “may”, “should”, “could” or

“would”, as well as similar terms and expressions. Such

forward-looking statements are made for the purpose of assisting

the holders of National Bank’s securities in understanding National

Bank’s vision, strategic objectives, and performance targets, and

may not be appropriate for other purposes.

These forward-looking statements are based on

current expectations, estimates, assumptions and intentions

believed by National Bank to be reasonable as at the date of this

press release and are subject to uncertainty and inherent risks,

many of which are beyond National Bank’s control. Assumptions about

the performance of the Canadian and U.S. economies in 2024, and how

that performance will affect National Bank’s business are among the

factors considered in setting National Bank’s strategic priorities

and objectives. Assumptions underlying forward-looking statements

included in this press release also include the expected timing of

completion of the Transaction and the conditions precedent to the

closing of the Transaction (including the required approvals); that

the Transaction will be completed on the terms currently

contemplated; National Bank’s ability to retain and attract new

business, achieve synergies and maintain market position arising

from successful integration plans relating to the Transaction;

National Bank’s ability to otherwise complete the integration of

CWB within anticipated time periods and at expected cost levels;

National Bank’s ability to attract and retain key employees in

connection with the Transaction; management’s estimates and

expectations in relation to future economic and business conditions

and other factors in relation to the Transaction and resulting

impact on growth and various financial metrics; the realization of

the expected strategic, financial and other benefits of the

Transaction in the timeframe anticipated; the accuracy and

completeness of public and other disclosure (including financial

disclosure) by CWB; the absence of significant undisclosed costs or

liabilities associated with the Transaction; assumptions about

future events, including economic conditions and proposed courses

of action, based on management's assessment of the relevant

information available as of the date hereof; assumptions about the

satisfaction of all closing conditions and the successful

completion of the Public Offering and the Private Placement within

the anticipated timeframe. Additional assumptions relating to

National Bank appear in the Economic Review and Outlook section

and, for each business segment, in the Economic and Market Review

sections of National Bank’s annual report for the year ended

October 31, 2023 (the “2023 Annual Report”) and in the Economic

Review and Outlook section of National Bank’s report to

shareholders for the three and six-month periods ended April 30,

2024, and may be updated in the quarterly reports to shareholders

filed thereafter.

Forward-looking statements in press release are

based on a number of assumptions and are subject to risk factors,

many of which are beyond National Bank’s control and the impacts of

which are difficult to predict. These risk factors include, among

others, risks and uncertainties relating to the expected

competition and regulatory processes and outcomes in connection

with the Transaction; National Bank’s inability to successfully

integrate CWB upon completion of the Transaction; the possible

delay or failure to close the Transaction; the potential failure to

realize anticipated benefits from the Transaction; the potential

failure to obtain the required approvals to the Transaction in a

timely manner or at all; National Bank’s reliance upon publicly

available information of CWB; potential undisclosed costs or

liability associated with the Transaction; National Bank or CWB

being adversely impacted during the pendency of the Transaction,

the dilutive effect of the Public Offering and Private Placement;

the general economic environment and financial market conditions in

Canada, the United States, and the other countries where National

Bank operates; the impact of upheavals in the U.S. banking

industry; exchange rate and interest rate fluctuations; inflation;

global supply chain disruptions; higher funding costs and greater

market volatility; changes made to fiscal, monetary, and other

public policies; changes made to regulations that affect National

Bank’s business; geopolitical and sociopolitical uncertainty;

climate change, including physical risks and those related to the

transition to a low-carbon economy, and National Bank’s ability to

satisfy stakeholder expectations on environmental and social

issues; significant changes in consumer behaviour; the housing

situation, real estate market, and household indebtedness in

Canada; National Bank’s ability to achieve its key short-term

priorities and long-term strategies; the timely development and

launch of new products and services; National Bank’s ability to

recruit and retain key personnel; technological innovation,

including advances in artificial intelligence and the open banking

system, and heightened competition from established companies and

from competitors offering non-traditional services; changes in the

performance and creditworthiness of National Bank’s clients and

counterparties; National Bank’s exposure to significant regulatory

matters or litigation; changes made to the accounting policies used

by National Bank to report financial information, including the

uncertainty inherent to assumptions and critical accounting

estimates; changes to tax legislation in the countries where

National Bank operates; changes made to capital and liquidity

guidelines as well as to the presentation and interpretation

thereof; changes to the credit ratings assigned to National Bank by

financial and extra-financial rating agencies; potential

disruptions to key suppliers of goods and services to National

Bank; the potential impacts of disruptions to National Bank’s

information technology systems, including cyberattacks as well as

identity theft and theft of personal information; the risk of

fraudulent activity; possible impacts of major events affecting the

economy, market conditions of National Bank’s outlook, including

international conflicts, natural disasters, public health crises,

and the measures taken in response to these events; and other risk

factors described in the Risk Management section of the 2023 Annual

Report and in the Risk Management section of the Report to

Shareholders for the second quarter of 2024, as well as other risks

detailed from time to time in reports filed by National Bank with

securities regulators or securities commissions or other documents

that National Bank makes public, which may cause events or results

to differ materially from the results expressed or implied in any

forward-looking statement.

There is a strong possibility that National

Bank’s express or implied predictions, forecasts, projections,

expectations or conclusions will not prove to be accurate, that its

assumptions may not be confirmed and that its vision, strategic

objectives, and performance targets will not be achieved. Thus,

National Bank recommends that readers not place undue reliance on

these forward-looking statements, as a number of factors could

cause actual results to differ significantly from the expectations,

estimates, or intentions expressed in these forward-looking

statements. The foregoing list of risk factors is not exhaustive,

and the forward-looking statements made in this press release are

also subject to credit risk, market risk, liquidity and funding

risk, operational risk, regulatory compliance risk, reputation

risk, strategic risk, and social and environmental risk, as well as

certain emerging risks or risks deemed significant.

Additional information about these and other

factors is provided in the 2023 Annual Report and the Report to

Shareholders for the second quarter of 2024 and may be updated in

the quarterly reports to shareholders filed thereafter. Investors

and others who rely on National Bank’s forward-looking statements

should carefully consider the above factors as well as the

uncertainties they represent and the risk they entail. Except as

required by law, National Bank does not undertake to update any

forward-looking statements, whether written or oral, that may be

made from time to time, by it or on its behalf. National Bank

cautions investors that these forward-looking statements are not

guarantees of future performance and that actual events or results

may differ significantly from these statements due to a number of

factors.

NO OFFER OR SOLICITATION

This press release is for informational purposes

only and shall not constitute an offer to purchase or a

solicitation of an offer to sell any securities, or a solicitation

of a proxy of any securityholder of any person in any jurisdiction.

Any offers or solicitations will be made in accordance with the

requirements under applicable law. Shareholders are advised to

review any documents that may be filed with securities regulatory

authorities and any subsequent announcements because they will

contain important information regarding the Transaction and the

terms and conditions thereof. The circulation of this press release

and the Transaction may be subject to a specific regulation or

restrictions in some countries. Consequently, persons in possession

of this press release must familiarize themselves and comply with

any restrictions that may apply to them.

NOTICE TO U.S. HOLDERS

National Bank is planning to file a registration

statement on Form F-8 or F-80, which will include CWB’s management

information circular and related documents, with the United States

Securities and Exchange Commission (“SEC”) in respect of National

Bank Shares to be offered or issued in the Transaction to U.S.

holders of CWB common shares. INVESTORS AND SHAREHOLDERS ARE URGED

TO READ SUCH REGISTRATION STATEMENT AND ALL OTHER RELEVANT

DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE

OFFER AS THEY BECOME AVAILABLE, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY CONTAIN OR WILL

CONTAIN IMPORTANT INFORMATION. You will be able to obtain a free

copy of such registration statement, as well as other related

filings, at the SEC’s website (www.sec.gov).

INFORMATION

|

Marianne Ratté |

Chris Williams |

| Vice-President and Head, Investor

Relations |

AVP, Investor Relations |

| National Bank |

Canadian Western Bank |

| Tel.: 1-866-517-5455 |

Tel.: 780-508-8229 |

| investorrelations@nbc.ca |

chris.williams@cwbank.com |

|

Debby Cordeiro |

Angela Saveraux |

| Senior Vice-President,

Communications, Marketing, ESG |

SAVP, Marketing and Public

Relations |

| National Bank |

Canadian Western Bank |

| Tel.: 514-412-0538 |

Tel.: 780-722-3578 |

| ap@bnc.ca |

angela.saveraux@cwbank.com |

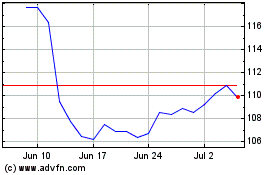

National Bank of Canada (TSX:NA)

Historical Stock Chart

From Dec 2024 to Jan 2025

National Bank of Canada (TSX:NA)

Historical Stock Chart

From Jan 2024 to Jan 2025