Magna International Inc. (TSX: MG; NYSE: MGA) today reported

financial results for the second quarter ended June 30, 2024.

Please click HERE for full second quarter

MD&A and Financial Statements.

|

|

|

THREE MONTHS ENDED JUNE 30, |

|

SIX MONTHS ENDED JUNE 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Reported |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales |

|

$ |

10,958 |

|

$ |

10,982 |

|

$ |

21,928 |

|

$ |

21,655 |

|

|

|

|

|

|

|

|

|

|

|

Income from operations before income taxes |

|

$ |

427 |

|

$ |

483 |

|

$ |

461 |

|

$ |

758 |

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Magna International Inc. |

|

$ |

313 |

|

$ |

339 |

|

$ |

322 |

|

$ |

548 |

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

1.09 |

|

$ |

1.18 |

|

$ |

1.12 |

|

$ |

1.91 |

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Measures(1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBIT |

|

$ |

577 |

|

$ |

616 |

|

$ |

1,046 |

|

$ |

1,065 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings per share |

|

$ |

1.35 |

|

$ |

1.54 |

|

$ |

2.44 |

|

$ |

2.69 |

|

|

|

|

|

|

|

|

|

|

| All

results are reported in millions of U.S. dollars, except per share

figures, which are in U.S. dollars |

| |

|

(1) Adjusted EBIT and Adjusted diluted earnings per

share are Non-GAAP financial measures that have no standardized

meaning under U.S. GAAP, and as a result may not be comparable to

the calculation of similar measures by other companies. Effective

July 1, 2023, we revised our calculations of Adjusted EBIT and

Adjusted diluted earnings per share to exclude the amortization of

acquired intangible assets. The historical presentation of these

Non-GAAP measures within this press release has also been updated

to reflect the revised calculations. Further information and a

reconciliation of these Non-GAAP financial measures is included in

the back of this press release. |

|

|

“Overall, our second quarter operating performance largely met our

expectations, despite lower than anticipated volumes on certain key

vehicle programs in North America. Our focus remains on factors we

can control, including operational excellence, cost reductions, and

flawless launches. These efforts, together with ongoing

customer commercial discussions are enabling us to substantially

maintain our 2024 Adjusted EBIT margin range. Our updated

2026 Outlook reflects customer program updates and a tempered view

on mid-term electric vehicle penetration rates, particularly in

North America. While we have reduced our sales forecast, we are

taking a number of concrete actions to mitigate the sales impacts

and continue to expect margin expansion and strong free cash flow

growth.”- Swamy Kotagiri, Chief Executive Officer |

THREE MONTHS ENDED JUNE 30, 2024

We posted sales of $11.0 billion for the second

quarter of 2024, essentially unchanged from the second quarter of

2023, which compares to a 2% increase in global light vehicle

production, including 6% and 1% higher production in China and

North America, respectively, partially offset by 5% lower

production in Europe. Our sales were negatively impacted by the end

of production of certain programs, lower Complete Vehicle assembly

volumes, including as a result of the end of production of the BMW

5-Series, and the net weakening of foreign currencies against the

U.S. dollar. These were offset by higher global light vehicle

production, the launch of new programs, and acquisitions, net of

divestitures, during or subsequent to the second quarter of

2023.

Adjusted EBIT was $577 million in the second

quarter of 2024 compared to $616 million in the second quarter of

2023. The decrease in Adjusted EBIT reflects reduced earnings on

lower assembly volumes in Complete Vehicles, higher net warranty

costs, the unfavourable impact of foreign exchange losses in the

second quarter of 2024 compared to foreign exchange gains in the

second quarter of 2023 related to the re-measurement of net

deferred tax assets that are maintained in a currency other than

their functional currency, lower equity income, and higher

restructuring costs. These were partially offset by commercial

items in the second quarters of 2024 and 2023, which had a net

favourable impact on a year over year basis, productivity and

efficiency improvements, including lower costs at certain

underperforming facilities and lower net engineering costs,

including spending related to our electrification and active safety

businesses.

Income from operations before income taxes was

$427 million for the second quarter of 2024 compared to $483

million in the second quarter of 2023, which includes Other

expense, net(2) and Amortization of acquired intangibles of $96

million and $99 million in the second quarters of 2024 and 2023,

respectively. Excluding Other expense, net and Amortization of

acquired intangibles from both periods, income from operations

before income taxes decreased $59 million in the second quarter of

2024 compared to the second quarter of 2023.

Net income attributable to Magna International

Inc. was $313 million for the second quarter of 2024 compared to

$339 million in the second quarter of 2023, which includes Other

expense, net(2), after tax and Amortization of acquired intangibles

of $76 million and $102 million in the second quarters of 2024 and

2023, respectively. Excluding Other expense, net, after tax and

Amortization of acquired intangibles from both periods, net income

attributable to Magna International Inc. decreased $52 million in

the second quarter of 2024 compared to the second quarter of

2023.

Diluted earnings per share were $1.09 in the

second quarter of 2024, compared to $1.18 in the second quarter of

2023, and Adjusted diluted earnings per share were $1.35 in the

second quarter of 2024 compared to $1.54 in the second quarter of

2023.

(2) Other expense (income), net is comprised of

restructuring and impairment costs relating to Fisker Inc.

["Fisker"], net losses on the revaluation of certain public company

warrants and equity investments, gain on business combination,

restructuring activities and transaction costs relating to the

acquisition of Veoneer Active Safety Business ["Veoneer AS"] during

the three and six months ended June 30, 2023 & 2024. A

reconciliation of these Non-GAAP financial measures is included in

the back of this press release.

In the second quarter of 2024, we generated cash

from operations before changes in operating assets and liabilities

of $681 million and generated $55 million in operating assets and

liabilities. Investment activities for the second quarter of 2024

included $500 million in fixed asset additions, a $170 million

increase in investments, other assets and intangible assets, and

$56 million for acquisitions.

SIX MONTHS ENDED JUNE 30, 2024

We posted sales of $21.9 billion for the six

months ended June 30, 2024, an increase of 1% from the six months

ended June 30, 2023, as global light vehicle production increased

1%, including 7% and 2% higher production in China and North

America, respectively, partially offset by 5% lower production in

Europe.

Adjusted EBIT decreased to $1.05 billion for the

six months ended June 30, 2024, compared to $1.06 billion for the

six months ended June 30, 2023, primarily due to reduced earnings

on lower assembly volumes in Complete Vehicles, the unfavourable

impact of foreign exchange losses in the first six months of 2024

compared to foreign exchange gains in the first six months of 2023

related to the re-measurement of net deferred tax assets that are

maintained in a currency other than their functional currency,

higher production input costs net of customer recoveries, lower

equity income, acquisitions, net of divestitures, during or

subsequent to the second quarter of 2023, and higher restructuring

costs. These were largely offset by productivity and efficiency

improvements, including lower costs at certain underperforming

facilities, commercial items in the first six months of 2024 and

2023, which had a net favourable impact on a year over year basis,

lower net engineering costs, including spending related to our

electrification and active safety businesses and lower launch,

engineering and other costs associated with our assembly

business.

During the six months ended June 30, 2024,

income from operations before income taxes was $461 million, net

income attributable to Magna International Inc. was $322 million

and diluted earnings per share was $1.12, decreases of $297

million, $226 million, and $0.79, respectively, each compared to

the first six months of 2023.

During the first six months ended June 30, 2024,

Adjusted diluted earnings per share were $2.44, compared to $2.69

in the first six months of 2023.

For the six months ended June 30, 2023, we

generated cash from operations before changes in operating assets

and liabilities of $1.3 billion and used $275 million in operating

assets and liabilities. Investment activities for the six months

ended June 30, 2024 included $993 million in fixed asset additions,

a $295 million increase in investments, other assets and intangible

assets, $86 million for acquisitions, and $21 million in public and

private equity investments.

RETURN OF CAPITAL TO SHAREHOLDERS

During the three months ended June 30, 2024, we

paid $134 million in dividends.

Our Board of Directors declared a second quarter

dividend of $0.475 per Common Share, payable on August 30, 2024 to

shareholders of record as of the close of business on August 16,

2024.

SEGMENT SUMMARY

| ($Millions unless

otherwise noted) |

For the three months ended June 30, |

|

Sales |

|

Adjusted EBIT |

|

|

|

2024 |

|

|

2023 |

|

Change |

|

|

2024 |

|

|

2023 |

|

Change |

|

Body Exteriors & Structures |

$ |

4,465 |

|

$ |

4,540 |

|

$ |

(75 |

) |

|

$ |

341 |

|

$ |

394 |

|

$ |

(53 |

) |

| Power & Vision |

|

3,926 |

|

|

3,462 |

|

|

464 |

|

|

|

198 |

|

|

124 |

|

|

74 |

|

| Seating Systems |

|

1,455 |

|

|

1,603 |

|

|

(148 |

) |

|

|

53 |

|

|

67 |

|

|

(14 |

) |

| Complete Vehicles |

|

1,242 |

|

|

1,526 |

|

|

(284 |

) |

|

|

20 |

|

|

34 |

|

|

(14 |

) |

|

Corporate and Other |

|

(130 |

) |

|

(149 |

) |

|

19 |

|

|

|

(35 |

) |

|

(3 |

) |

|

(32 |

) |

|

Total Reportable Segments |

$ |

10,958 |

|

$ |

10,982 |

|

$ |

(24 |

) |

|

$ |

577 |

|

$ |

616 |

|

$ |

(39 |

) |

| |

For the three months ended June 30, |

|

|

|

Adjusted EBIT as a percentage of

sales |

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

Change |

|

Body Exteriors & Structures |

|

|

|

|

|

7.6 |

% |

|

8.7 |

% |

|

(1.1 |

)% |

| Power & Vision |

|

|

|

|

|

5.0 |

% |

|

3.6 |

% |

|

1.4 |

% |

| Seating Systems |

|

|

|

|

|

3.6 |

% |

|

4.2 |

% |

|

(0.6 |

)% |

|

Complete Vehicles |

|

|

|

|

|

1.6 |

% |

|

2.2 |

% |

|

(0.6 |

)% |

|

Consolidated Average |

|

|

|

|

|

5.3 |

% |

|

5.6 |

% |

|

(0.3 |

)% |

|

|

|

| ($Millions unless

otherwise noted) |

For the six months ended June 30, |

|

Sales |

|

Adjusted EBIT |

|

|

|

2024 |

|

|

2023 |

|

Change |

|

|

2024 |

|

|

2023 |

|

Change |

|

Body Exteriors & Structures |

$ |

8,894 |

|

$ |

8,979 |

|

$ |

(85 |

) |

|

$ |

639 |

|

$ |

666 |

|

$ |

(27 |

) |

| Power & Vision |

|

7,768 |

|

|

6,785 |

|

|

983 |

|

|

|

296 |

|

|

216 |

|

|

80 |

|

| Seating Systems |

|

2,910 |

|

|

3,089 |

|

|

(179 |

) |

|

|

105 |

|

|

104 |

|

|

1 |

|

| Complete Vehicles |

|

2,625 |

|

|

3,152 |

|

|

(527 |

) |

|

|

47 |

|

|

86 |

|

|

(39 |

) |

|

Corporate and Other |

|

(269 |

) |

|

(350 |

) |

|

81 |

|

|

|

(41 |

) |

|

(7 |

) |

|

(34 |

) |

|

Total Reportable Segments |

$ |

21,928 |

|

$ |

21,655 |

|

$ |

273 |

|

|

$ |

1,046 |

|

$ |

1,065 |

|

$ |

(19 |

) |

| |

For the six months ended June 30, |

|

|

|

Adjusted EBIT as a percentage of

sales |

|

|

|

|

|

|

2024 |

|

2023 |

|

Change |

|

Body Exteriors & Structures |

|

|

|

|

7.2 |

% |

7.4 |

% |

(0.2 |

)% |

| Power & Vision |

|

|

|

|

3.8 |

% |

3.2 |

% |

0.6 |

% |

| Seating Systems |

|

|

|

|

3.6 |

% |

3.4 |

% |

0.2 |

% |

| Complete Vehicles |

|

|

|

|

1.8 |

% |

2.7 |

% |

(0.9 |

)% |

|

Consolidated Average |

|

|

|

|

4.8 |

% |

4.9 |

% |

(0.1 |

)% |

|

|

For further details on our segment results,

please see our Management’s Discussion and Analysis of Results of

Operations and Financial Position and our Interim Financial

Statements.

2024 OUTLOOK

We first disclose a full-year Outlook annually

in February, with quarterly updates. The following 2024 Outlook is

an update to our previous Outlook in May 2024.

Updated 2024 Outlook

Assumptions

| |

2024 |

|

|

Current |

|

Previous |

| Light Vehicle Production

(millions of

units) North

America Europe China |

15.717.129.0 |

|

15.717.429.0 |

| |

|

|

|

| Average Foreign exchange rates:1

Canadian dollar equals1 euro equals |

U.S. $0.733U.S. $1.080 |

|

U.S. $0.725U.S. $1.065 |

2024 Outlook

| |

2024 |

|

|

Current |

|

Previous |

| Segment

Sales Body Exteriors

& Structures

Power &

Vision Seating

Systems Complete

Vehicles |

$17.3 - $17.9 billion$15.3 - $15.7 billion$5.5 - $5.8 billion$4.9 -

$5.2 billion |

|

$17.3 - $17.9 billion$15.4 - $15.8 billion$5.4 - $5.7 billion$5.0 -

$5.3 billion |

| Total Sales |

$42.5 - $44.1 billion |

|

$42.6 - $44.2 billion |

| |

|

|

|

| Adjusted EBIT Margin(3) |

5.4% - 5.8% |

|

5.4% - 6.0% |

| |

|

|

|

| Equity Income (included in

EBIT) |

$100 - $130 million |

|

$120 - $150 million |

| |

|

|

|

| Interest Expense, net |

Approx. $220 million |

|

Approx. $230 million |

| |

|

|

|

| Income Tax Rate(4) |

Approx. 22% |

|

Approx. 22% |

| |

|

|

|

| Adjusted Net Income

attributable to Magna(5) |

$1.5 - $1.7 billion |

|

$1.5 - $1.7 billion |

| |

|

|

|

| Capital Spending |

$2.3 - $2.4 billion |

|

$2.4 - $2.5 billion |

| |

|

|

|

|

Notes:(3) Adjusted EBIT Margin is the ratio of Adjusted

EBIT to Total Sales. Refer to the reconciliation of Non-GAAP

financial measures in the back of this press release for further

information(4) The Income Tax Rate has been calculated

using Adjusted EBIT and is based on current tax

legislation(5) Adjusted Net Income attributable to Magna

represents Net Income excluding Other expense, net and amortization

of acquired intangible assets, net of tax |

2026 OUTLOOK

In the normal course, we do not update the third

year of the Outlook we provide in February of each year. However,

given the magnitude of the changes that are taking place in the

automotive industry and the potential impacts on our business,

management prepared a top-level analysis to update our 2026 Outlook

provided in February 2024 for projected Sales, Adjusted EBIT

Margin, Equity Income, and Capital Spending.

Given the higher-level nature and timing of this

analysis, management is not currently able to provide 2026

forecasts with the same granularity as that provided in February

2024, particularly: Sales and Adjusted EBIT margin ranges by

Segment for 2026; Megatrend Sales and Adjusted EBIT for the years

2024 to 2026; and 2027 Sales for Battery Enclosures, Powertrain

Electrification and ADAS. Accordingly, investors should not rely on

the forecasts for these measures provided in our February 2024

Outlook or other Investor presentations.

2026 Outlook Assumptions

| |

2026 |

|

|

Current |

|

Previous |

| Light Vehicle Production

(millions of

units) North

America Europe China |

16.117.330.6 |

|

16.117.330.6 |

| |

|

|

|

| Average Foreign exchange rates:1

Canadian dollar equals1 euro equals |

U.S. $0.74U.S. $1.08 |

|

U.S. $0.74U.S. $1.08 |

2026 Outlook

| |

2026 |

|

|

Current |

|

Previous |

| |

|

|

|

| Total Sales |

$44.0 - $46.5 billion |

|

$48.8 - $51.2 billion |

| |

|

|

|

| Adjusted EBIT Margin(6) |

6.7% - 7.4% |

|

7.0% - 7.7% |

| |

|

|

|

| Equity Income (included in

EBIT) |

$125 - $170 million |

|

$165 - $210 million |

| |

|

|

|

| Capital Spending |

$1.6 - $1.8 billion |

|

|

| |

|

|

|

|

Notes:(6) Adjusted EBIT Margin is the ratio of Adjusted

EBIT to Total Sales. Refer to the reconciliation of Non-GAAP

financial measures in the back of this press release for further

information |

|

|

Our Outlook is intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Although considered reasonable by

Magna as of the date of this document, the 2024 and 2026 Outlooks

above and the underlying assumptions may prove to be inaccurate.

Accordingly, our actual results could differ materially from our

expectations as set forth herein. The risks identified in the

“Forward-Looking Statements” section below represent the primary

factors which we believe could cause actual results to differ

materially from our expectations.Key Drivers of Our

Business

Our operating results are primarily dependent on

the levels of North American, European, and Chinese car and light

truck production by our customers. While we supply systems and

components to every major original equipment manufacturer ("OEM"),

we do not supply systems and components for every vehicle, nor is

the value of our content consistent from one vehicle to the next.

As a result, customer and program mix relative to market trends, as

well as the value of our content on specific vehicle production

programs, are also important drivers of our results.

OEM production volumes are generally aligned

with vehicle sales levels and thus affected by changes in such

levels. Aside from vehicle sales levels, production volumes are

typically impacted by a range of factors, including: labour

disruptions; free trade arrangements and tariffs; relative currency

values; commodities prices; supply chains and infrastructure;

availability and relative cost of skilled labour; regulatory

frameworks; and other factors.

Overall vehicle sales levels are significantly

affected by changes in consumer confidence levels, which may in

turn be impacted by consumer perceptions and general trends related

to the job, housing, and stock markets, as well as other

macroeconomic and political factors. Other factors which typically

impact vehicle sales levels and thus production volumes include:

vehicle affordability; interest rates and/or availability of

credit; fuel and energy prices; relative currency values;

uncertainty as to consumer acceptance of EVs; government subsidies

to consumers for the purchase of low- and zero-emission vehicles;

and other factors.NON-GAAP FINANCIAL MEASURES

RECONCILIATION

Effective July 1, 2023, we revised our

calculations of Adjusted EBIT and Adjusted diluted earnings per

share to exclude the amortization of acquired intangible assets.

Revenue generated from acquired intangible assets is included

within revenue in determining net income attributable to Magna. We

believe that excluding the amortization of acquired intangible

assets from these Non-GAAP measures helps management and investors

in understanding our underlying performance and improves

comparability between our segmented results of operations and our

peers.

The historical presentation of these Non-GAAP

measures within this press release has also been updated to reflect

the revised calculations.

| The reconciliation

of Non-GAAP financial measures is as follows: |

|

|

THREE MONTHS ENDED JUNE 30, |

|

SIX MONTHS ENDED JUNE 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBIT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Income |

$ |

328 |

|

|

$ |

354 |

|

|

$ |

354 |

|

|

$ |

571 |

|

|

Add: |

|

|

|

|

|

|

|

|

Amortization of acquired intangible assets |

|

28 |

|

|

|

13 |

|

|

|

56 |

|

|

|

25 |

|

|

Interest expense, net |

|

54 |

|

|

|

34 |

|

|

|

105 |

|

|

|

54 |

|

|

Other expense, net |

|

68 |

|

|

|

86 |

|

|

|

424 |

|

|

|

228 |

|

|

Income taxes |

|

99 |

|

|

|

129 |

|

|

|

107 |

|

|

|

187 |

|

|

Adjusted EBIT |

$ |

577 |

|

|

$ |

616 |

|

|

$ |

1,046 |

|

|

$ |

1,065 |

|

|

|

| Adjusted

EBIT as a percentage of sales (“Adjusted EBIT

margin”) |

|

|

|

|

|

|

|

|

|

|

Sales |

$ |

10,958 |

|

|

$ |

10,982 |

|

|

$ |

21,928 |

|

|

$ |

21,655 |

|

|

Adjusted EBIT |

$ |

577 |

|

|

$ |

616 |

|

|

$ |

1,046 |

|

|

$ |

1,065 |

|

|

Adjusted EBIT as a percentage of sales |

|

5.3 |

% |

|

|

5.6 |

% |

|

|

4.8 |

% |

|

|

4.9 |

% |

|

|

|

|

|

|

|

|

|

| |

| Adjusted

diluted earnings per share |

|

|

|

|

|

|

|

|

|

| Net

income attributable to Magna International Inc. |

$ |

313 |

|

|

$ |

339 |

|

|

$ |

322 |

|

|

$ |

548 |

|

| Add

(deduct): |

|

|

|

|

|

|

|

|

Amortization of acquired intangible assets |

|

28 |

|

|

|

13 |

|

|

|

56 |

|

|

|

25 |

|

|

Other expense, net |

|

68 |

|

|

|

86 |

|

|

|

424 |

|

|

|

228 |

|

|

Tax effect on Amortization of acquired intangible assets and Other

expense, net |

|

(20 |

) |

|

|

3 |

|

|

|

(102 |

) |

|

|

(31 |

) |

|

Adjusted net income attributable to Magna International Inc. |

$ |

389 |

|

|

$ |

441 |

|

|

$ |

700 |

|

|

$ |

770 |

|

|

Diluted weighted average number of Common Shares outstanding

during the period (millions): |

|

287.3 |

|

|

|

286.3 |

|

|

|

287.2 |

|

|

|

286.4 |

|

|

Adjusted diluted earnings per shares |

$ |

1.35 |

|

|

$ |

1.54 |

|

|

$ |

2.44 |

|

|

$ |

2.69 |

|

Certain of the forward-looking financial

measures above are provided on a Non-GAAP basis. We do not provide

a reconciliation of such forward-looking measures to the most

directly comparable financial measures calculated and presented in

accordance with U.S. GAAP. To do so would be potentially misleading

and not practical given the difficulty of projecting items that are

not reflective of on-going operations in any future period. The

magnitude of these items, however, may be significant.

This press release together with our

Management’s Discussion and Analysis of Results of Operations and

Financial Position and our Interim Financial Statements are

available in the Investor Relations section of our website at

www.magna.com/company/investors and filed electronically through

the System for Electronic Document Analysis and Retrieval +

(SEDAR+) which can be accessed at http://www.sedarplus.ca as well

as on the United States Securities and Exchange Commission’s

Electronic Data Gathering, Analysis and Retrieval System (EDGAR),

which can be accessed at www.sec.gov.

We will hold a conference call for interested

analysts and shareholders to discuss our second quarter ended June

30, 2024 results on Friday, August 2, 2024, at 8:00 a.m. ET. The

conference call will be chaired by Swamy Kotagiri, Chief Executive

Officer. Please register for the webcast here or through our

website www.magna.com. If unable to join the webcast, North

American callers can dial 1-800-715-9871 and International callers

can dial 1-646-307-1963, conference ID 9829976. The slide

presentation accompanying the conference call as well as our

financial review summary will be available on our website Friday

prior to the call.

TAGSQuarterly earnings, financial results,

vehicle production

INVESTOR CONTACTLouis Tonelli, Vice-President,

Investor Relations louis.tonelli@magna.com │ 905.726.7035

MEDIA CONTACT Tracy Fuerst, Vice-President,

Corporate Communications & PR tracy.fuerst@magna.com │

248.761.7004

TELECONFERENCE CONTACTNancy Hansford, Executive Assistant,

Investor Relations nancy.hansford@magna.com │ 905.726.7108

OUR BUSINESS (7)Magna is more than one of the

world’s largest suppliers in the automotive space. We are a

mobility technology company built to innovate, with a global,

entrepreneurial-minded team of over 177,000(8) employees across 345

manufacturing operations and 105 product development, engineering

and sales centres spanning 28 countries. With 65+ years of

expertise, our ecosystem of interconnected products combined with

our complete vehicle expertise uniquely positions us to advance

mobility in an expanded transportation landscape.

For further information about Magna (NYSE:MGA; TSX:MG), please

visit www.magna.com or follow us on social.

(7) Manufacturing operations,

product development, engineering and sales centres include certain

operations accounted for under the equity method.(8)

Number of employees includes over 165,000 employees at our wholly

owned or controlled entities and over 12,000 employees at certain

operations accounted for under the equity method.FORWARD-LOOKING

STATEMENTS

Certain statements in this press release

constitute "forward-looking information" or "forward-looking

statements" (collectively, "forward-looking statements"). Any such

forward-looking statements are intended to provide information

about management's current expectations and plans and may not be

appropriate for other purposes. Forward-looking statements may

include financial and other projections, as well as statements

regarding our future plans, strategic objectives or economic

performance, or the assumptions underlying any of the foregoing,

and other statements that are not recitations of historical fact.

We use words such as "may", "would", "could", "should", "will",

"likely", "expect", "anticipate", “assume”, "believe", "intend",

"plan", "aim", "forecast", "outlook", "project", “potential”,

"estimate", "target" and similar expressions suggesting future

outcomes or events to identify forward-looking statements. The

following table identifies the material forward-looking statements

contained in this document, together with the material potential

risks that we currently believe could cause actual results to

differ materially from such forward-looking statements. Readers

should also consider all of the risk factors which follow below the

table:

|

Material Forward-Looking Statement |

Material Potential Risks Related to Applicable

Forward-Looking Statement |

|

Light Vehicle Production |

- Light vehicle sales levels

- Production disruptions, including

as a result of labour disruptions

- Supply disruptions

- Production allocation decisions by

OEMs

- Free trade arrangements and

tariffs

- Relative currency values

- Commodities prices

- Availability and relative cost of

skilled labour

|

|

Total SalesSegment Sales |

- Same risks as for Light Vehicle

Production above

- The impact of elevated interest

rates and availability of credit on consumer confidence and in turn

vehicle sales and production

- The impact of deteriorating vehicle

affordability on consumer demand, and in turn vehicle sales and

production

- Alignment of our product mix with

production demand

- Customer Concentration

- Shifts in market shares among

vehicles or vehicle segments

- Shifts in consumer “take rates” for

products we sell

|

|

Adjusted EBIT Margin, Free Cash Flow, and Net Income Attributable

to Magna |

- Same risks as for Total Sales and

Segment Sales above

- Successful execution of critical

program launches

- Operational underperformance

- Product warranty/recall risk

- Restructuring costs

- Impairments

- Inflationary pressures

- Our ability to secure cost

recoveries from customers and/or otherwise offset higher input

costs

- Price concessions

- Risks of conducting business with

newer EV-focused OEMs

- Commodity cost volatility

- Scrap steel price volatility

- Higher labour costs

- Tax risks

|

|

Equity Income |

- Same risks as Adjusted EBIT Margin,

Free Cash Flow, and Net Income Attributable to Magna

- Risks related to conducting

business through joint ventures

- Risks of doing business in foreign

markets

|

Forward-looking statements are based on

information currently available to us and are based on assumptions

and analyses made by us in light of our experience and our

perception of historical trends, current conditions and expected

future developments, as well as other factors we believe are

appropriate in the circumstances. While we believe we have a

reasonable basis for making any such forward-looking statements,

they are not a guarantee of future performance or outcomes. In

addition to the factors in the table above, whether actual results

and developments conform to our expectations and predictions is

subject to a number of risks, assumptions and uncertainties, many

of which are beyond our control, and the effects of which can be

difficult to predict, including, without limitation:

Macroeconomic, Geopolitical and Other Risks

- inflationary pressures;

- interest rates;

- geopolitical risks;

Risks Related to the Automotive Industry

- economic cyclicality;

- regional production volume declines;

- deteriorating vehicle affordability;

- misalignment between EV production and sales;

- intense competition;

Strategic Risks

- alignment with "Car of the Future";

- evolving business risk profile;

- technology and innovation;

- investments in mobility and technology companies;

Customer-Related Risks

- customer concentration;

- growth with Asian OEMs;

- growth of EV-focused OEMs;

- risks of conducting business with newer EV-focused OEMs;

- Fisker bankruptcy;

- dependence on outsourcing;

- customer cooperation and consolidation;

- Program cancellations, deferrals and reductions in production

volumes;

- Complete vehicle assembly business;

- market shifts;

- consumer take rate shifts;

- quarterly sales fluctuations;

- customer purchase orders;

- potential OEM production-related disruptions;

Supply Chain Risks

- semiconductor chip supply disruptions and price increases;

- supply chain disruptions;

- regional energy supply and pricing;

- supply base condition;

Manufacturing/Operational Risks

- product launch;

- operational underperformance;

- restructuring costs;

- impairments;

- labour disruptions;

- skilled labour

attraction/retention;

- leadership expertise and

succession;

|

Pricing Risks

- quote/pricing assumptions;

- customer pricing pressure/contractual

arrangements;

- commodity cost volatility;

- scrap steel/aluminum price

volatility;

Warranty/Recall Risks

- repair/replace costs;

- warranty provisions;

- product liability;

Climate Change Risks

- transition risks and physical risks;

- strategic and other risks;

IT Security/Cybersecurity Risks

- IT/cybersecurity breach;

- product cybersecurity;

Acquisition Risks

- acquisition of strategic targets;

- inherent merger and acquisition risks;

- acquisition integration and synergies;

Other Business Risks

- joint ventures;

- intellectual property;

- risks of doing business in foreign markets;

- relative foreign exchange rates;

- currency devaluation in Argentina;

- pension risks;

- tax risks;

- returns on capital investments;

- financial flexibility;

- credit ratings changes;

- stock price fluctuation;

- dividends;

Legal, Regulatory and Other Risks

- antitrust proceedings;

- legal and regulatory proceedings;

- changes in laws;

- trade agreements;

- trade disputes/tariffs; and

- environmental compliance.

|

In evaluating forward-looking statements or forward-looking

information, we caution readers not to place undue reliance on any

forward-looking statement. Additionally, readers should

specifically consider the various factors which could cause actual

events or results to differ materially from those indicated by such

forward-looking statements, including the risks, assumptions and

uncertainties above which are:

- discussed under the “Industry

Trends and Risks” heading of our Management’s Discussion and

Analysis; and

- set out in our Annual Information

Form filed with securities commissions in Canada, our annual report

on Form 40-F filed with the United States Securities and Exchange

commission, and subsequent filings.

Readers should also consider discussion of our

risk mitigation activities with respect to certain risk factors,

which can be also found in our Annual Information Form. Additional

information about Magna, including our Annual Information Form, is

available through the System for Electronic Data Analysis and

Retrieval + (SEDAR+) at www.sedarplus.ca, as well as on the United

States Securities and Exchange Commission’s Electronic Data

Gathering, Analysis and Retrieval System (EDGAR), which can be

accessed at www.sec.gov.

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9b3e4579-1ecc-4bb5-b770-e53f2a426a7c

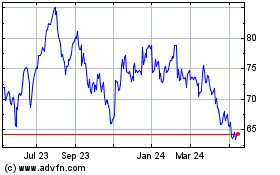

Magna (TSX:MG)

Historical Stock Chart

From Dec 2024 to Jan 2025

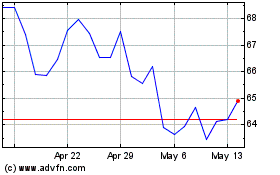

Magna (TSX:MG)

Historical Stock Chart

From Jan 2024 to Jan 2025