Coro Signs Binding Heads of Agreement for San Jorge

December 09 2013 - 6:30AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce

that it has signed a binding Heads of Agreement ("HOA") with a group comprised

of Aterra Investments Ltd. ("Aterra") and Solway Industries Ltd. ("Solway"),

(collectively, the "Group") for them to have rights to acquire an interest in

the Company's San Jorge project (the "Project"), located in the province of

Mendoza, Argentina. The Group has the right to acquire a 70% interest in the

Project, with the provision for an early buy-out of Coro's interest subject to

Coro's retention of a 2.5% Net Smelter Return ("NSR") on the production of all

payable metals from the Project, except gold. Coro and the Group will work

diligently to structure and execute a Definitive Agreement ("DA") expeditiously.

Alan Stephens, President and CEO of Coro commented, "Coro has been seeking a

partner for San Jorge for some time and we are very pleased to have now reached

agreement with Aterra and Solway for them to acquire a 70% interest in the

Project. We firmly believe that the introduction of these two well-funded and

experienced companies to the Project will be well received by the provincial and

national governments in Argentina and result in its accelerated development.

This agreement will allow our shareholders to participate in the future

development and operation of San Jorge, either through our 30% interest or by

ownership of a valuable NSR.

We are now fully focused on advancing our Chilean assets, particularly the

development of our Berta project, where we recently announced a preliminary

agreement with a third party to treat pregnant leach solution at their plant. We

also plan to further drill test our exciting El Desesperado project, located in

the Chuquicamata district, and we are looking forward to the results of our

partner's work at Payen over the coming months. This year of very difficult

market conditions has been one of transition for Coro, and we end it having

successfully brought in partners for San Jorge, Berta and Payen, which is a

testament to the quality of our projects."

Principal Terms of the HOA

-- The Group may acquire a 70% interest in the Project by; paying Coro

US$200,000 upon signing the HOA, US$300,000 within 6 months from signing

the DA, US$500,000 within 12 months from signing the DA, and US$500,000

within 24 months from signing the DA; funding all of the costs required

to advance the Project to the Exercise Date, including an independent,

bankable Definitive Feasibility Study, completed to NI43-101 standards

("the BFS"); keeping the Project and Minera San Jorge in good standing;

and, prior to the Exercise Date, paying all of the advance royalty

payments pursuant to the underlying San Jorge Purchase and Royalty

Agreements between Coro and its subsidiaries, and Franco-Nevada

Corporation and Franco-Nevada LRC Holdings Corp (together "Franco-

Nevada").

-- The Exercise Date is the date that the Group informs Coro of its

decision to place the Project into commercial production or the

completion of the BFS.

-- The Group will be appointed Operator from the date of signature of the

HOA and for the duration of the Option Period.

-- After the Exercise Date, the parties shall finance the further

development of the Project pro-rata to their interest in the Project. In

the event that Coro elects not to contribute its 30% share of the costs

of further development of the Project, its interest will be subject to

dilution. In the event that Coro's interest is diluted to 10%, its

interest shall immediately be converted to a 2% NSR on the production of

all metals from the Project, except gold.

-- The Group will have the option to acquire 100% of the Project by paying

Coro US$3,000,000 in cash at any time within 6 months from signing the

DA or US$5,000,000 in cash at any time within 18 months from signing the

DA. The outstanding cash payments referred to above would also become

due and payable upon exercise of either of these options to acquire 100%

of the Project. In the event that the Group elects to exercise its

option to acquire a 100% interest in the Project, Coro will retain a

2.5% NSR on the production of all metals from the Project, except gold.

-- Prior to the Exercise Date and upon the Group's completion of an

expenditure of US$10,000,000 on Project development and other costs, the

Group will earn a 50% interest in the Project. If the Group elects not

to proceed to the Exercise Date at its sole cost, Coro and the Group

shall form a 50/50 Joint Venture and may elect to fund the outstanding

Project costs on a pro-rata basis, with both Parties being subject to

dilution. In the event that either Party's interest is diluted to 10%,

its interest shall immediately be converted to a 2% NSR on the

production of all metals from the Project, except gold.

-- Franco-Nevada's consent, as required under the underlying San Jorge

Purchase and Royalty Agreements, is a condition precedent to the

occurrence of the earlier of (i) the execution of the DA, and (ii) the

Group earning or acquiring an interest in the Project or MSJ. In the

event that Franco-Nevada's consent is unreasonably withheld, Coro shall

be required to reimburse the Group for all payments made to Franco-

Nevada by the Investor and all payments made to Coro by the Group, and

other reasonable and verifiable costs incurred directly on the Project

under this HOA and the Group shall have no further interest in the

Project.

About Aterra Investments Ltd

Aterra Investments Ltd is a privately-held, investment management firm, which

invests in metals and mining projects from late stage exploration to

pre-production. Aterra's investment portfolio is geographically diversified with

projects in both developed countries and frontier regions and includes more than

10 exploration, development and producing companies. Commodity focus includes

copper, silver, phosphates, zinc, lead, diamonds and mineral sands.

About Solway Industries Ltd.

Solway Industries Ltd. is a subsidiary of the Solway Group, which comprises a

number of diversified companies with core activities in mining, non-ferrous

metals, chemicals, the cement industry and real estate. Solway operates a

ferronickel plant in Ukraine, is developing nickel laterite projects in

Indonesia and Guatemala, and operates an open pit copper mine in Macedonia.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's properties

include the advanced Berta copper leach project and the Payen, El Desesperado,

Llancahue, and Celeste copper exploration properties, all located in Chile, and

the advanced San Jorge copper-gold project, located in Argentina.

For further information please visit the Company's website at www.coromining.com.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to execution of agreements and

future payments involve known and unknown risks, uncertainties, and other

factors which may cause the actual results, performance or achievements of the

Company to be materially different from any future results, performance or

achievements expressed or implied by such forward-looking statements or

information. Such factors include, among others, the actual prices of copper,

the factual results of current exploration, development and mining activities,

changes in project parameters as plans continue to be evaluated, as well as

those factors disclosed in the Company's documents filed from time to time with

the securities regulators in the Provinces of British Columbia, Alberta,

Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward

Island and Newfoundland and Labrador.

FOR FURTHER INFORMATION PLEASE CONTACT:

Coro Mining Corp.

Michael Philpot

Executive Vice-President

(604) 682 5546

investor.info@coromining.com

www.coromining.com

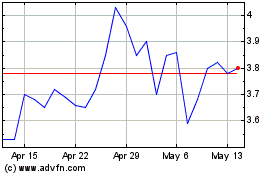

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

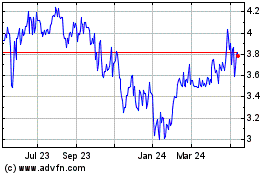

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024