Coro Reports Resource Estimate for Berta Sur

December 06 2012 - 10:56AM

Marketwired Canada

Coro Mining Corp. ("Coro" or the "Company") (TSX:COP) is pleased to announce the

results of an independent National Instrument 43-101 compliant resource estimate

for the Berta Sur deposit on its Berta property, located approximately 20km west

of the village of Inca de Oro, in the III Region of Chile. Coro announced

preliminary metallurgical results from Berta Sur on November 5th 2012. The

resource estimate was completed by Propipe SA, an engineering firm based in

Santiago, Chile at a variety of total copper (%CuT) grades, as shown on Table 1,

below.

Table 1: Resource Estimate

---------------------------------------------------------------------------

Measured &

Cutoff Measured Indicated Indicated Inferred

------ ----------------- ---------------- ----------------- ---------------

%CuT kt %CuT %CuS kt %CuT %CuS kt %CuT %CuS kt %CuT %CuS

---------------------------------------------------------------------------

0.10 10,672 0.32 0.21 7,725 0.17 0.10 18,397 0.26 0.17 6,465 0.16 0.10

---------------------------------------------------------------------------

0.15 8,498 0.37 0.25 4,250 0.21 0.13 12,748 0.31 0.21 3,705 0.19 0.12

---------------------------------------------------------------------------

0.20 6,736 0.42 0.29 1,814 0.25 0.16 8,550 0.38 0.26 1,363 0.23 0.14

---------------------------------------------------------------------------

0.25 5,254 0.47 0.33 691 0.31 0.20 5,945 0.45 0.31 265 0.27 0.17

---------------------------------------------------------------------------

0.30 4,170 0.53 0.37 261 0.37 0.24 4,431 0.52 0.36 21 0.32 0.20

---------------------------------------------------------------------------

In order to demonstrate the potential economic viability of the Berta Sur

resource, a series of pit optimizations using the Lersch & Grossmann algorithm

was then completed utilizing appropriate operating costs, results obtained from

the Company's previously announced preliminary metallurgical test work, and a

variety of copper prices. For a $3.00/lb copper price, the optimum pit was

determined to contain 6,101,000t at a grade of 0.40%CuT and a stripping ratio of

0.04:1. An upside case pit at $3.825/lb Cu contains 9,687,000t at 0.34%CuT and a

stripping ratio of 0.16:1. The two pit outlines are shown on Figure 1, together

with the Berta Central oxide zones, not included in the current resource

estimate. A typical block model cross section is shown on Figure 2.

To view Figures 1 and 2 please click on the following link:

http://media3.marketwire.com/docs/COP1206.pdf

Alan Stephens, President and CEO of Coro commented, "We are pleased with the

continued progress of our Berta project, where we have now demonstrated that the

Berta Sur resource, while modest in size, has a negligible stripping ratio, with

the further advantage that the preliminary metallurgy indicates quick copper

recoveries and low acid consumptions. We see potential for additional resources

on the property in the Berta Central deposits, and believe there may be

potential elsewhere on the property and the surrounding district to augment

these. Coro now intends to advance the project to the completion, by mid-late

2013, of a feasibility study for a standalone SXEW project with planned

production of 5,000 tpy copper in cathode, with attached acid plant to supply

all project power requirements."

Parameters Used in the Construction of the Mineral Resource

The NI 43-101 compliant mineral resource estimate was based on a total of

14,362.45 meters of drilling in 91 holes, (including reverse circulation (RC)

drilling completed by 2 major companies in the 1990's (23 holes); diamond

drilling completed by Grancru Resources in 2007 (2 holes); and RC drilling (66

holes) completed by the Company in 2011-12); and a total of 938.6m of surface

trenching in 11 trenches completed by one of the aforementioned major companies.

The mineral resource estimate has been generated from drill hole and trench

sample assay results and the interpretation of a geologic model which relates to

the spatial distribution of copper in the deposit. Grade estimates were made

using ordinary kriging with nominal block size measuring 2.5 meters long, 2.5

meters wide and 2.5 meters in height. Resources have been classified by their

proximity to sample locations and are reported according to CIM standards on

Mineral Resources and Reserves.

The in pit mineral resource was constructed according to technical and economic

parameters in Table 2, assuming the construction of a sulphur burning acid plant

capable of generating the project's power requirement.

Table 2: Technical and Economic Parameters

----------------------------------------

Mining $2.09/t

----------------------------------------

Processing $4.74/t

----------------------------------------

SX EW Cost $0.102/lb

----------------------------------------

G&A $0.045/lb

----------------------------------------

Sales and marketing $0.041/lb

----------------------------------------

Recovery 80%

----------------------------------------

Inter ramp pit slope 50 degrees

----------------------------------------

Copper Price $3.00/lb

----------------------------------------

An updated NI 43-101 technical report detailing the mineral resource estimate

will be completed and filed on SEDAR (www.sedar.com), and Coro's website

(www.coromining.com), within 45 days.

El Inca Project

Results have now been received from a program of reverse circulation and diamond

drilling at the Company's El Inca project, located approximately 4km northeast

of the village of Inca de Oro. A total of 7 reverse circulation holes (1,633m)

were completed, with two of these holes deepened by diamond drilling (470m).

Propylitic alteration with only sub-anomalous Cu and Au geochemistry, possibly

indicative of the margins of a porphyry system, was encountered in all holes

under thick gravel. No further work is planned.

Qualified Person Notes

The mineral resource estimates contained in this news release have been prepared

in accordance with National Instrument 43-101 Standards of Disclosure for

Mineral Projects ("NI 43-101"). The technical information in this news release,

including the information that relates to geology, mineralization, drilling, and

mineral resource estimates on the Berta deposit, is based on information

prepared under the supervision of, or has been reviewed by Sergio Rivera, Vice

President of Exploration, Coro Mining Corp, a geologist with more than 30 years

of experience and a member of the Colegio de Geologos de Chile and of the

Instituto de Ingenieros de Minas de Chile. The foregoing person is a "qualified

person" for the purposes of NI 43-101 with respect to the geology,

mineralization and drilling being reported on. The "qualified person"

responsible for the independent resource estimate at Berta Sur was Sergio

Alvarado Casas, a Consultant Geologist with more than 27 years of experience. He

is General Manager and partner of Geoinvestments SpA and served as associated

consultant for Propipe SA. He is a member of CIM, the Chilean Mining Commission,

and the Instituto de Ingenieros de Minas de Chile. The technical information has

been included herein with the consent and prior review of the above noted

qualified persons. The qualified persons have verified the data disclosed,

including sampling, analytical and test data underlying the information or

opinions contained herein.

All mineral resources have been estimated in accordance with the definition

standards on mineral resources and mineral reserves of the Canadian Institute of

Mining, Metallurgy and Petroleum (CIM) referred to in National Instrument

43-101, commonly referred to as NI 43-101. U.S. reporting requirements for

disclosure of mineral properties are governed by the United States Securities

and Exchange Commission (SEC) Industry Guide 7. Canadian and Guide 7 standards

are substantially different. This News Release uses the terms "measured,"

"indicated" and "inferred" resources. Mineral resources which are not mineral

reserves do not have demonstrated economic viability. We advise investors that

while those terms are recognized and required by Canadian regulations, the SEC

does not recognize them. Inferred mineral resources are considered too

speculative geologically to have economic considerations applied to them that

enable them to be categorized as mineral reserves.

CORO MINING CORP.

Alan Stephens, President and CEO

About Coro Mining Corp.:

The Company was founded with the goal of building a mining company focused on

medium-sized base and precious metals deposits in Latin America. The Company

intends to achieve this through the exploration for, and acquisition of,

projects that can be developed and placed into production. Coro's properties

include the advanced San Jorge copper-gold project, in Argentina, and the Berta,

El Desesperado, Payen, Chacay, Llancahue, and Celeste copper exploration

properties located in Chile.

This news release includes certain "forward-looking statements" under applicable

Canadian securities legislation. Such forward-looking statements or information,

including but not limited to those with respect to the prices of copper,

metallurgical results and resources, mining and processing costs involve known

and unknown risks, uncertainties, and other factors which may cause the actual

results, performance or achievements of the Company to be materially different

from any future results, performance or achievements expressed or implied by

such forward-looking statements or information. Such factors include, among

others, the actual prices of copper, the factual results of current exploration,

development and mining activities, changes in project parameters as plans

continue to be evaluated, as well as those factors disclosed in the Company's

documents filed from time to time with the securities regulators in the

Provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, New

Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

FOR FURTHER INFORMATION PLEASE CONTACT:

Coro Mining Corp.

Michael Philpot

Executive Vice-President

(604) 682 5546

investor.info@coromining.com

www.coromining.com

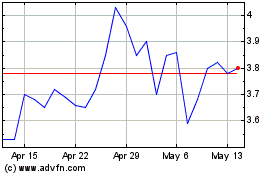

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jun 2024 to Jul 2024

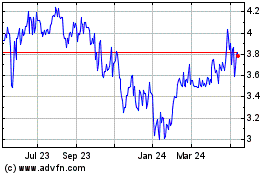

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jul 2023 to Jul 2024