MAG Silver Corp. (TSX / NYSE American: MAG)

(“MAG”, or the

“Company”) announces the

Company’s unaudited financial results for the three months ended

June 30, 2023. For details of the unaudited condensed interim

consolidated financial statements and Management's Discussion and

Analysis for the three and six months ended June 30, 2023, please

see the Company’s filings on SEDAR+ (www.sedarplus.ca) or on EDGAR

(www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise specified (C$

refers to Canadian dollars).

KEY HIGHLIGHTS (on a 100% basis unless

otherwise noted)

- Concentrate production at the

high-grade Juanicipio mine commenced in Q1 2023.

- Following the successful

commissioning phase at Juanicipio, the processing facility has been

operating at or above 85% of its design capacity of 4,000 tonnes

per day (“tpd”) with silver recovery consistently above 88%.

- On June 5, 2023, the Company

announced that the Juanicipio mine, processing facility and other

vital systems were operating in line with, or rapidly approaching

design capacity, and therefore declared full commercial production

effective June 1, 2023. All major construction activities have now

been completed and Juanicipio is demonstrating its ability to

sustain ongoing production levels.

- During Q2 2023, as a result of the

successful commissioning of the Juanicipio processing facility,

processing of higher-grade material commenced with commensurate

improvements in silver recovery and associated concentrate grades.

Average head grade for Q2 2023 was 498 grams per tonne (“g/t”)

- After completion of the start-up

phase, approximately 4.4 million ounces of silver have been

produced from the Juanicipio processing facility from March 2023 to

the end of June 2023, and production is expected to continue to

increase steadily through Q3 2023 where it is envisioned the

processing facility will be running at nameplate.

- MAG was included in the NYSE Arca

Gold Miners Index which is tracked by the VanEck Vectors Gold

Miners ETF (“GDX”) effective June 20, 2023.

- MAG reported net income of $19,390

or $0.19 per share for the three months ended June 30, 2023 ($7,562

or $0.08 per share for the three months ended June 30, 2022).

OPERATIONAL (on a 100% basis unless

otherwise noted)

- As reported by the operator,

Fresnillo, the Juanicipio operation remains on track to reach

nameplate production in Q3 2023. Excess mineralized material from

Juanicipio continues to be processed through the nearby Saucito and

Fresnillo beneficiation plants (100% owned by Fresnillo) on an

available capacity basis.

-

For the three months ended June 30, 2023:

-

377,718 tonnes of mineralized material were processed through the

Juanicipio, Fresnillo and Saucito plants, with 4,877,460 payable

silver ounces, 9,537 payable gold ounces, 3,066 payable lead tonnes

and 4,582 payable zinc tonnes sold;

-

average silver head grade was 498 g/t; and

-

revenue (net of treatment and processing costs) totalled $134,775,

less $54,571 in production and transportation costs and $17,400 in

depreciation and amortization charges, netting $62,804 in gross

profit by Juanicipio.

-

At the end of the quarter, Juanicipio held cash balances of $8,539,

flat relative to the first quarter. Strong operating cash flows

driven by higher milling rates, higher feed grade and stronger

metal prices were offset by ramp up of working capital requirements

and ongoing underground development expenditures.

CORPORATE

- The Company is progressing its

second annual sustainability report (the “2022 Sustainability

Report”). The 2022 Sustainability Report will reinforce the

Company’s environmental, social and governance (ESG) commitments

and provide updates to the Company’s ESG practices and performance

for the 2022 year. In October 2022, MAG submitted its inaugural

sustainability report for the 2021 year (the “2021 Sustainability

Report”) and its Communication on Progress (“CoP”) to the United

Nations Global Compact (“UNGC”) and is completing the subsequent

CoP for 2022 to reaffirm its commitment to the 10 Principles of the

UNGC. MAG’s 2021 Sustainability Report is available on the

Company’s website at https://magsilver.com/esg/reports/.

- The Company announced the

appointment of Gary Methven as Vice President, Technical Services

effective May 1, 2023, and the promotion of Jill Neff to Vice

President, Governance and Company Secretary effective May 1,

2023.

-

On April 29, 2023, the Mexican Senate approved material amendments

to the Federal Mining Law (as defined herein), which amendments

were approved by Mexico’s Federal Executive Branch. The amendments

were published in the Official Gazette of the Mexican Federation on

May 8, 2023 bringing the amendments into law on May 9, 2023. The

Company is facilitating a thorough review and evaluation of

potential implications specifically concerning our 44% interest in

Juanicipio, including the treatment of concessions issued under

previous legislation.

EXPLORATION

- Juanicipio Project, Mexico:

- Infill drilling at Juanicipio continued in Q2 2023, with three

rigs on surface and three underground with the goals of upgrading

and expanding the Valdecañas Vein system at depth and further

defining areas to be mined in the near to mid term. During the

quarter, 5,814 metres (9,924 metres year to date (“ytd”)) and 5,926

metres, (10,455 metres ytd) were drilled from surface and

underground respectively.

- Deer Trail Project, Utah:

- Results from the 12,157 metres in surface-based Phase 2

drilling on the Deer Trail Carbonate Replacement Deposit (“CRD”)

project were reported on January 17 and August 3, 2023 (see Press

Releases under the Company’s SEDAR+ profile at

www.sedarplus.ca).

- The overall results continue to reinforce MAG’s CRD exploration

model and suggest multiple mineralization channel-ways extend from

the inferred Deer Trail Mountain porphyry center. Multiple fluid

channel-ways are a characteristic of many major CRD systems. The

distinctly different mineralization styles of the separate zones

are hallmark indicators of a significant, long-lived, multi-stage

CRD, potentially sourced from a productive Porphyry

Copper-Molybdenum intrusive center. Results obtained provide strong

support for Phase 3 drilling, currently underway to seek that

porphyry center.

- MAG has started drilling the first of up to three porphyry

“hub” targets thought to be the source of the manto, skarn and

epithermal mineralization and extensive alteration throughout the

project area including that at Deer Trail and Carissa. Future

drilling is planned to offset Carissa and test other high-potential

targets.

- Larder Project, Ontario:

- In 2022 MAG initiated a comprehensive data review and initial

drilling on the Larder Project. The drilling program focused below

and lateral to potential mineralization shoots.

- In total, 10 holes (10,413 metres) were drilled in 2022 by the

Company on the Cadillac-Larder Break East zone. The campaign proved

favourable stratigraphy exists at depth and has allowed for the

acquisition of the deepest structural data recorded in the history

of the property. Assay results extended the Bear East

mineralization to a depth of 600 metres from surface with isolated

gold values up to 5.9 g/t gold.

- Drilling in January 2023 focused in the previously

underexplored Swansea area on the west side of the property, that

tested and confirmed a 730 metres East – West trending geophysical

anomaly coincident with the Cadillac-Larder Break (as defined

herein). In total 4,562 metres in 7 holes were completed with all

holes intercepting up to 50 metres of pervasive sericite +/-

fuchsite/carbonate alteration and silicification within and

surrounding the Cadillac-Larder Break. Gold mineralization was

encountered in 6 of 7 drillholes across the 730 metres strike

length with isolated values ranging from 1.0 to 4.8 g/t gold.

- After completing the initial drilling campaign, the geological

team embarked on a comprehensive property-wide data re-evaluation

which included review of all historic drilling, selective

relogging, re-assaying all available pulps with 4-acid digestion,

additional geophysics, field mapping and sampling. These datasets

are now undergoing systematic reinterpretation to build a unified

project model for developing a well-defined pipeline of drill

targets to be tested by multiple rigs turning over the next year

and a half.

- On July 12, 2023, drilling resumed at the Larder Project to

test additional targets by the end of the year on the Cheminis and

Bear areas. A minimum of 17,000 metres of drilling is planned.

JUANICIPIO PROJECT UPDATE

Underground Mine Production

On a 100% basis, after completion of the

start-up phase, approximately 4.4 million ounces of silver have

been produced from the Juanicipio processing facility from March

2023 to the end of June 2023, and production is expected to

continue to increase steadily through Q3 2023 where it is

envisioned the processing facility will be running at nameplate of

4,000 tpd. An Operator Services Agreement became effective upon the

declaration of commercial production, whereby Fresnillo and its

affiliates will continue to operate the mine. Subject to available

capacity, excess mineralized material from Juanicipio may continue

to be processed at the Fresnillo and Saucito processing plants

(both 100% owned by Fresnillo), with the lead (silver-rich) and

zinc concentrates treated at market terms under offtake agreements

with Met-Mex (an affiliate of Fresnillo).

In the three months ended June 30, 2023, a total

of 377,018 tonnes of mineralized development and stope material

were processed through the Juanicipio, Saucito and Fresnillo

plants. The resulting payable metals sold and associated processing

details are summarized in Table 1 below. The sales

and treatment charges for tonnes processed in Q2 2023 were recorded

on a provisional basis and will be adjusted in the third quarter of

2023 based on final assay and pricing adjustments in accordance

with the offtake contracts.

Table 1: Mineralized Material Processed

at Juanicipio, Saucito and Fresnillo Plants (100%

basis)

|

Three Months Ended June 30, 2023 (377,018 tonnes

processed) |

Q2 2022Amount$ |

|

|

Payable Metals |

Quantity |

|

Average Per Unit$ |

|

Amount$ |

|

|

|

Silver |

4,877,460 ounces |

|

23.69 per oz |

|

115,555 |

|

47,070 |

|

|

Gold |

9,537 ounces |

|

1,957.47 per oz |

|

18,668 |

|

9,388 |

|

|

Lead |

3,066 tonnes |

|

0.94 per lb. |

|

6,367 |

|

2,135 |

|

|

Zinc |

4,582 tonnes |

|

1.07 per lb. |

|

10,807 |

|

6,199 |

|

|

TCRCs and other processing costs |

(16,622 |

) |

(9,568 |

) |

|

Net Revenue |

134,775 |

|

55,224 |

|

|

Production and transportation costs |

(57,571 |

) |

(12,717 |

) |

|

Depreciation and amortization (1) |

(17,400 |

) |

(5,245 |

) |

|

Gross Profit |

62,804 |

|

37,262 |

|

(1) The underground mine was considered readied

for its intended use on January 1, 2022, whereas the Juanicipio

processing facility started commissioning and ramp-up activities in

January 2023, achieving commercial production status on June 1,

2023.

The average silver head grade for the

mineralized material processed in the three months ended June 30,

2023 was 498 g/t (three months ended June 30, 2022: 567 g/t). The

lower head grade was impacted by lower development material as well

as the processing of lower grade stockpiles which were earmarked

for the commissioning and ramp-up phase of the Juanicipio

processing facility. Since completing its start-up phase in March

2023, the Juanicipio processing facility has been operating at

approximately 85% of its design capacity of 4,000 tpd with silver

recovery consistently above 88%.

Processing Facility Construction &

Outlook

Commissioning commenced in early January 2023

with feed of lower grade mineralized material to the grinding

mills. Processing of higher-grade material commenced in April with

commensurate improvements in silver recovery and associated

concentrate grades. The Juanicipio processing facility has been

operating at approximately 85% of its nameplate of 4,000 tpd with

silver recovery consistently above 88%. On June 5, 2023 the Company

announced that following a successful commissioning period, the

Juanicipio mine, processing facility and other vital systems were

operating in line with, or rapidly approaching design capacity, and

therefore declared full commercial production effective June 1,

2023.

With the processing facility completed and

commercial production declared on June 1, 2023, all major

construction activities have now been completed and Juanicipio is

demonstrating its ability to sustain ongoing production levels.

Additional funding requirements related to market conditions (i.e.

lower metal prices or higher inflation driving higher costs for

instance), or for additional capital in excess of the operating

cash flow generated may need to be funded by further cash calls

required from Fresnillo and MAG.

FINANCIAL RESULTS – THREE MONTHS ENDED

JUNE 30, 2023

As at June 30, 2023, MAG had working capital of

$51,600 (December 31, 2022: $29,232) including cash of $52,664

(December 31, 2022: $29,955) and no long-term debt. As well, as at

June 30, 2023, Juanicipio had working capital of $94,289 including

cash of $8,539 (MAG’s attributable share is 44%).

The Company’s net income for the three months

ended June 30, 2023 amounted to $19,390 (June 30, 2022: $7,562) or

$0.19/share (June 30, 2022: $0.08/share). MAG recorded its 44%

income from equity accounted investment in Juanicipio of $22,419

(June 30, 2022: $12,347) which included MAG’s 44% share of net

income from operations as well as loan interest earned on loans

advanced to Juanicipio (see Table 2

below).

Table 2: MAG’s share of income from its

equity accounted Investment in Juanicipio

|

|

Three months ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

2023 |

|

2022 |

|

|

|

$ |

|

$ |

|

|

Sales |

134,775 |

|

55,224 |

|

|

Cost of sales: |

|

|

|

Production cost |

(54,571 |

) |

(12,717 |

) |

|

Depreciation and amortization |

(17,400 |

) |

(5,245 |

) |

|

Gross profit (see Underground Mine Production – Juanicipio

Project above) |

62,804 |

|

37,262 |

|

|

Consulting and administrative expenses |

(4,158 |

) |

(1,376 |

) |

|

Extraordinary mining and other duties |

(1,377 |

) |

(109 |

) |

|

Interest expenses |

(4,886 |

) |

(740 |

) |

|

Exchange gains (losses) and other |

32 |

|

763 |

|

|

Net income before tax |

52,415 |

|

35,800 |

|

|

Income tax (expense) benefit |

(6,349 |

) |

(8,439 |

) |

|

Net income (100% basis) |

46,066 |

|

27,361 |

|

|

MAG’s 44% portion of net income |

20,269 |

|

12,039 |

|

|

Interest on Juanicipio loans - MAG's 44% |

2,150 |

|

308 |

|

|

MAG’s 44% equity income |

22,419 |

|

12,347 |

|

Qualified Person: All

scientific or technical information in this press release including

assay results referred to, and Mineral Resource estimates, if

applicable, is based upon information prepared by or under the

supervision of, or has been approved by Dr. Peter Megaw, Ph.D.,

C.P.G., a Certified Professional Geologist who is a “Qualified

Person” for purposes of National Instrument 43-101, Standards of

Disclosure for Mineral Projects (“National Instrument 43-101” or

“NI 43-101”). Dr. Megaw is not independent as he is an officer and

a paid consultant of MAG.

About MAG Silver Corp.

(www.magsilver.com)

MAG Silver Corp. is a growth-oriented Canadian

exploration company focused on advancing high-grade, district scale

precious metals projects in the Americas. MAG is emerging as a

top-tier primary silver mining company through its (44%) joint

venture interest in the 4,000 tonnes per day Juanicipio Mine,

operated by Fresnillo plc (56%). The mine is located in the

Fresnillo Silver Trend in Mexico, the world's premier silver mining

camp, where in addition to underground mine production and

processing of high-grade mineralised material, an expanded

exploration program is in place targeting multiple highly

prospective targets. MAG is also executing multi-phase exploration

programs at the Deer Trail 100% earn-in Project in Utah and the

100% owned Larder Project, located in the historically prolific

Abitibi region of Canada.

Neither the Toronto Stock Exchange nor the NYSE American has

reviewed or accepted responsibility for the accuracy or adequacy of

this press release, which has been prepared by management.

Certain information contained in this release,

including any information relating to MAG’s future oriented

financial information, are “forward-looking information” and

“forward-looking statements” within the meaning of applicable

Canadian and United States securities legislation (collectively

herein referred as “forward-looking statements”), including the

“safe harbour” provisions of provincial securities legislation, the

U.S. Private Securities Litigation Reform Act of 1995, Section 21E

of the U.S. Securities Exchange Act of 1934, as amended and Section

27A of the U.S. Securities Act. Such forward-looking statements

include, but are not limited to:

-

statements regarding the anticipated time and capital schedule to

nameplate production capacity at the Juanicipio Project;

-

statements that address our expectations with respect to the timing

and success of processing facility commissioning activities,

including the anticipated ramp-up of the processing facility at the

Juanicipio Project;

-

estimated future exploration and development expenditures and other

expenses for specific operations;

-

the potential for additional capital, sustaining capital and

working capital requirements to achieve commercial production at

the Juanicipio Project in excess of cashflow generated, including

the potential for additional cash calls;

-

expected upside from additional exploration; and

-

other future events or developments.

When used in this release, any statements that

express or involve discussions with respect to predictions,

beliefs, plans, projections, objectives, assumptions or future

events of performance (often but not always using words or phrases

such as “anticipate”, “believe”, “estimate”, “expect”, “intend”,

“plan”, “strategy”, “goals”, “objectives”, “project”, “potential”

or variations thereof or stating that certain actions, events, or

results “may”, “could”, “would”, “might” or “will” be taken, occur

or be achieved, or the negative of any of these terms and similar

expressions), as they relate to the Company or management, are

intended to identify forward-looking statements. Such statements

reflect the Company’s current views with respect to future events

and are subject to certain known and unknown risks, uncertainties

and assumptions.

Forward-looking statements are necessarily based

upon estimates and assumptions, which are inherently subject to

significant business, economic and competitive uncertainties and

contingencies, many of which are beyond the Company’s control and

many of which, regarding future business decisions, are subject to

change. Assumptions underlying the Company’s expectations regarding

forward-looking statements contained in this release include, among

others: MAG’s ability to carry on its various exploration and

development activities including project development timelines, the

timely receipt of required approvals and permits, the price of the

minerals produced, the costs of operating, exploration and

development expenditures, the impact on operations of the Mexican

tax regime, MAG’s ability to obtain adequate financing, outbreaks

or threat of an outbreak of a virus or other contagions or epidemic

disease will be adequately responded to locally, nationally,

regionally and internationally.

Although MAG believes the expectations expressed

in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in the forward-looking statements. These

forward-looking statements involve known and unknown risks,

uncertainties and many factors could cause actual results,

performance or achievements to be materially different from any

future results, performance or achievements that may be expressed

or implied by such forward-looking statements including amongst

other: commodities prices; changes in expected mineral production

performance; unexpected increases in capital costs or cost

overruns; exploitation and exploration results; continued

availability of capital and financing; general economic, market or

business conditions; risks relating to the Company’s business

operations; risks relating to the financing of the Company’s

business operations; risks relating to the development of the

Juanicipio Project and the minority interest investment in the

same; risks relating to the Company’s property titles; risks

related to receipt of required regulatory approvals; pandemic risks

(and COVID-19); supply chain constraints and general costs

escalation in the current inflationary environment heightened by

the invasion of Ukraine by Russia; risks relating to the Company’s

financial and other instruments; operational risk; environmental

risk; political risk; currency risk; market risk; capital cost

inflation risk; risk relating to construction delays; the risk that

data is incomplete or inaccurate; the risks relating to the

limitations and assumptions within drilling, engineering and

socio-economic studies relied upon in preparing economic

assessments and estimates, including the 2017 PEA; as well as those

risks more particularly described under the heading “Risk Factors”

in the Company’s most recent Annual Information Form dated March

27, 2023 available under the Company’s profile on SEDAR at

www.sedar.com.

Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those described

herein. This list is not exhaustive of the factors that may affect

any of the Company’s forward-looking statements. The Company’s

forward-looking statements are based on the beliefs, expectations

and opinions of management on the date the statements are made and,

other than as required by applicable securities laws, the Company

does not assume any obligation to update forward-looking statements

if circumstances or management’s beliefs, expectations or opinions

should change. For the reasons set forth above, investors should

not attribute undue certainty to or place undue reliance on

forward-looking statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov.

LEI: 254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, Vice President, Investor Relations and Communications

Phone: (604) 630-1399

Website:www.magsilver.com

Toll Free:(866) 630-1399

Email: info@magsilver.com

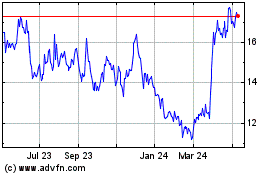

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

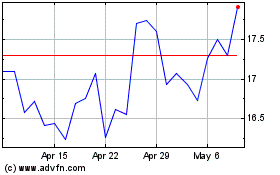

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024