MAG Silver Corp. (TSX / NYSE American: MAG)

(“

MAG” or the “

Company”)

announced today that it is has entered into an agreement with a

syndicate of underwriters (the “

Underwriters”) led

by

BMO Capital Markets and Raymond James Ltd.

under which the Underwriters have agreed to buy on a bought deal

basis 2,735,000 common shares (the “

Common

Shares”) at a price of US$14.65 per Common Share for

gross proceeds of approximately US$40 million (the “

Public

Offering”). The Company has granted the Underwriters an

option, exercisable at the offering price for a period of 30 days

following the closing of the Public Offering, to purchase up to an

additional 15% of the Public Offering to cover over-allotments, if

any.

The Company concurrently announced that it is

undertaking a bought deal private placement of 843,000 common

shares to be issued on a flow-through basis under the Income Tax

Act (Canada) (the “Flow-Through Shares”) at a

price of C$23.75 per Flow-Through Share for aggregate gross

proceeds of C$20 million (the “Flow-Through Private

Placement”). The Company has granted the Underwriters an

option exercisable, in whole or in part, at any time up to 48 hours

prior to the closing of the Flow-Through Private Placement, to

purchase an additional 15% of the Flow-Through Private Placement to

cover over-allotments, if any.

Public Offering

The Common Shares will be offered by way of a

short form prospectus in all provinces and territories of Canada,

other than Quebec, and will be offered in the United States

pursuant to a prospectus filed as part of a registration statement

under the Canada/U.S. multi-jurisdictional disclosure system. A

registration statement on Form F-10, including the U.S. preliminary

prospectus (together with any amendments thereto, the

“Registration Statement”), registering the Common

Shares under the U.S. Securities Act of 1933, as amended (the

“U.S. Securities Act”) has been filed with the

United States Securities and Exchange Commission (the

“SEC”) but has not yet become effective. The

preliminary short form prospectus and Registration Statement are

subject to completion and amendment. Such documents contain

important information about the Public Offering. This news release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the Common Shares in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of that jurisdiction.

The net proceeds of the Public Offering will be

used to fund exploration on Juanicipio and MAG’s other projects

including Deer Trail, certain sustaining and development capital

requirements at the Juanicipio Project not included in the initial

project capital estimates, and for working capital and general

corporate purposes.

The Public Offering is expected to close on or

about February 7, 2023 and is subject to the Company receiving all

necessary regulatory approvals, including conditional acceptance of

the Toronto Stock Exchange and approval by the NYSE American. The

completion of the Public Offering is not conditional upon the

completion of the Flow-Through Private Placement. The preliminary

short form prospectus is available on SEDAR at www.sedar.com. The

Registration Statement is available on the SEC’s website at

www.sec.gov. The Common Shares to be sold in the Public Offering

described in this document may not be sold nor may offers to buy be

accepted prior to the time the Registration Statement becomes

effective. Before readers invest, they should read the prospectus

in the Registration Statement and other documents the Company has

filed with Canadian regulatory authorities and the SEC for more

complete information about the Company and the Public Offering.

Potential investors may get any of these documents for free by

visiting EDGAR on the SEC website at www.sec.gov or, when such

documents become available, via SEDAR at www.sedar.com. Copies of

the prospectus relating to the Public Offering may be obtained for

free upon request in Canada by contacting BMO Nesbitt Burns Inc.

(“BMO Capital Markets”), Brampton Distribution Centre C/O The Data

Group of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2

by telephone at 905-791-3151 Ext 4312 or by email at

torbramwarehouse@datagroup.ca, and in the United States by

contacting BMO Capital Markets Corp., Attn: Equity Syndicate

Department, 151 W 42nd Street, 32nd Floor, New York, NY 10036, or

by telephone at (800) 414-3627 or by email at

bmoprospectus@bmo.com.

Flow-Through Private

Placement

The total gross proceeds from the Flow-Through

Private Placement will be used to incur expenses that are eligible

“Canadian exploration expenses” that will qualify as “flow-through

mining expenditures”, as such terms are defined in the Income Tax

Act (Canada) (the “Qualifying Expenditures”),

related to the Company’s Larder Project located in Ontario, Canada.

The Company will have until December 31, 2024 to incur and renounce

the Qualifying Expenditures using the proceeds of the Flow-Through

Private Placement.

The Flow-Through Private Placement is expected

to close on or about February 16, 2023 and will be subject to

customary conditions including, but not limited to, the receipt of

all necessary regulatory approvals, including conditional

acceptance of the Toronto Stock Exchange and approval by the NYSE

American. The completion of the Flow-Through Private Placement is

not conditional upon the completion of the Public Offering.

The Flow-Through Shares issued pursuant to the

Flow-Through Private Placement will be subject to a hold period

expiring four months and one day from the date of issuance in

accordance with applicable Canadian securities laws. The

Flow-Through Shares have not been, and will not be, registered

under the U.S. Securities Act and are not permitted to be offered

or sold within the United States absent such registration or an

applicable exemption from the registration requirements

therein.

About MAG Silver Corp.

MAG Silver Corp. is a growth-oriented Canadian

development and exploration company focused on becoming a top-tier

primary silver mining company by exploring and advancing

high-grade, district scale, precious metals projects in the

Americas. Its principal focus and asset is the Juanicipio Project

(44%), being developed with Fresnillo Plc (56%), the operator. The

project is located in the Fresnillo Silver Trend in Mexico, the

world's premier silver mining camp, where the operator is currently

advancing underground mine development and commissioning a 4,000

tonnes per day processing plant. Underground mine production of

mineralized development material commenced in Q3 2020, and an

expanded exploration program is in place targeting multiple highly

prospective targets at Juanicipio. MAG is also executing

multi-phase exploration programs at the Deer Trail 100% earn-in

Project in Utah and the recently acquired Larder Project, located

in the historically prolific Abitibi region of Canada.

For further information on behalf of MAG Silver

Corp.Contact Michael J. Curlook, VP Investor Relations and

Communications

Phone: (604) 630-1399Website:

www.magsilver.comToll Free: (866) 630-1399Email:

info@magsilver.com

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

Cautionary Note Regarding

Forward-Looking Statements

This news release includes certain statements

that may be deemed to be “forward-looking information” within the

meaning of applicable Canadian securities legislation or

“forward-looking statements” within the meaning of the US Private

Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”). All statements in this release,

other than statements of historical facts, are forward-looking

statements, including statements regarding the anticipated

financial and other impacts of the Public Offering and Flow-Through

Private Placement, the anticipated completion and expected timing

for closing of the Public Offering and Flow-Through Private

Placement, expected use of proceeds and receipt of regulatory

approvals. Forward-looking statements are often, but not always,

identified by the use of words such as "seek", "anticipate",

"plan", "continue", "estimate", "expect", "may", "will", "project",

"predict", "potential", "targeting", "intend", "could", "might",

"should", "believe" and similar expressions. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements.

Forward-looking statements are necessarily based upon estimates and

assumptions, which are inherently subject to significant business,

economic and competitive uncertainties and contingencies, many of

which are beyond the Company’s control and many of which, regarding

future business decisions, are subject to change. Assumptions

underlying the Company’s expectations regarding forward-looking

statements contained in this news release include, amongst other

things, that the Company will be able to raise sufficient equity

under the Public Offering and/or Flow-Through Private Placement to

support its intended use of proceeds and future growth; that the

global financial markets and general economic conditions will be

stable and conducive to equity financings of this nature and the

business of the Company generally; and that the Company’s mineral

projects will not experience any significant disruptions that would

materially affect operations. Although MAG believes the

expectations expressed in such forward-looking statements are based

on reasonable assumptions, such statements are not guarantees of

future performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors

that could cause actual results to differ materially from those in

forward-looking statements include, but are not limited to: risks

related to the Company’s ability to arrange financing under the

Public Offering and/or Flow-Through Private Placement on favourable

terms, if at all; general economic, market or business conditions;

political risk, currency risk and capital cost inflation;

volatility of the common shares in the capital of the Company and

risks related to a change in the intended use of proceeds from the

Public Offering and/or Flow-Through Private Placement. The reader

is referred to the Company’s filings with the SEC and Canadian

securities regulators for disclosure regarding these and other risk

factors. There is no certainty that any forward-looking statement

will come to pass, and investors should not place undue reliance

upon forward-looking statements. Investors are urged to consider

closely the disclosures in MAG's annual and quarterly reports and

other public filings, accessible through the Internet at

www.sedar.com and www.sec.gov.

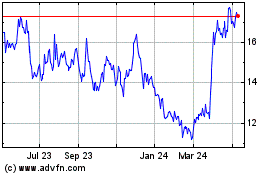

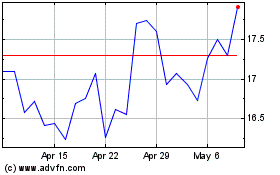

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024