MAG Silver Corp. (TSX / NYSE American: MAG)

(“MAG”, or the

“Company”) announces the

Company’s unaudited financial results for the three months ended

September 30, 2022. For details of the unaudited condensed interim

consolidated financial statements and Management's Discussion and

Analysis for the three months ended September 30, 2022, please see

the Company’s filings on SEDAR (www.sedar.com) or on EDGAR

(www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise

specified.

KEY HIGHLIGHTS

- MAG reported net income of $8,227

or $0.08 per share for the three months ended September 30, 2022

(net loss of $2,280 or ($0.02) per share for the three months ended

September 30, 2021).

- As at September 30, 2022, MAG held

cash of $39,507 and Juanicipio had cash on hand of $18,176.

-

The Sustainalytics ESG risk rating for MAG improved 27% to 33.5

from 46.0, over the last twelve months. Since the initiation of

Sustainalytics coverage of MAG in April 2019 the overall score has

improved by 46%.

Operational –

Juanicipio owned 44% by MAG

-

Fresnillo continues to make available excess processing plant

capacity at its nearby Saucito and Fresnillo operations. Campaign

processing of mineralized material from development headings and

stopes continues through these facilities and is expected to

continue until the Juanicipio plant is commissioned.

-

For the three months ended September 30, 2022, on a 100% basis:

-

A record 180,808 tonnes of mineralized development and stope

material were campaign processed through the Fresnillo and Saucito

plants, with 2,425,256 payable silver ounces, 4,901 payable gold

ounces, 1,347 payable lead tonnes and 2,038 payable zinc tonnes

produced and sold;

-

Average silver head grade for the quarter was 513 grams per tonne

(“g/t”); and

-

Pre-commercial production sales (net of treatment and processing

costs) totaled $49,715 for the quarter, less $18,127 in mining and

transportation costs and $6,376 in depreciation and amortization

charges, netting $25,212 in gross profit by Juanicipio.

-

At the end of the quarter, Juanicipio held cash balances of $18,176

down from $37,504 at the end of Q2 impacted by lower margins as a

result of lower metal prices, marginally lower head grade and

ongoing capital expenditures.

-

As reported by the operator Fresnillo, electrical commissioning of

the processing plant is expected in the coming weeks.

- Campaign processing benefits

include the cash flow being used to offset some of the initial and

sustaining capital, and the de-risking of Juanicipio’s

metallurgical performance which is expected to significantly speed

up project ramp-up.

-

Approximately 70% of the tonnes processed in Q3 2022 were processed

at the Saucito plant, where the flowsheet more closely resembles

that of the Juanicipio plant. It is expected these results will

provide further valuable metallurgical benefits when milling

production commences at Juanicipio.

-

Metal recovery and concentrate grades continue to fall in line with

expectations from the initial metallurgical test work conducted on

Valdecañas.

Corporate

-

On October 5, 2022, MAG published its inaugural Sustainability

Report underscoring MAG’s ongoing and fundamental commitment to

transparency with its stakeholders while providing a comprehensive

overview of the Company's ESG commitments, practices, and

performance for the 2021 year.

EXPLORATION

-

The Juanicipio 2022 exploration program is currently in progress

with five drill rigs on surface running concurrently with continued

underground definition and geotechnical drilling, and one rig

testing the new Los Tajos target (previously known as the Cesantoni

target) in the northwest part of the Juanicipio concession.

-

MAG has initiated a comprehensive data review and drilling campaign

on the acquired Larder Project. The drilling program is focused

below and lateral to the previously identified mineralization.

-

The Deer Trail Project 5,000m Phase II exploration program is in

progress with one drill and all assays pending.

-

During the nine months ended September 30, 2022, the Company

recorded a write down of $10,471 on its option earn-in project on a

prospective land claim package in the Black Hills of South

Dakota.

LIQUIDITY AND CAPITAL

RESOURCES

- The expected cash flow from the

ongoing campaign processing until the Juanicipio plant is

commissioned, along with the working capital held by Juanicipio at

September 30, 2022 are projected to substantially fund remaining

capital requirements at Juanicipio (a cash call has not been needed

since mid-December 2021 which was $21,000 on a 100% basis).

“In anticipation of the commencement of milling

operations at Juanicipio, Q3 continued the trend of strong

operational performance with record milling at the Saucito and

Fresnillo operations, delivering over 2.4 million payable silver

ounces. This brings our year-to-date payable silver production to

over 6.8 million ounces” said George Paspalas, MAG’s President and

CEO. “As reported by Fresnillo to us, electrical commissioning is

expected in the coming weeks and a target ramp-up to 85-90% of

nameplate capacity is envisioned within months of commissioning.

Juanicipio is well positioned to take its place as a significant

and responsible silver producer whilst we continue to progress our

exciting exploration programs at Juanicipio, Deer Trail and

Larder.”

JUANICIPIO PROJECT UPDATE

Underground Mine Production

In Q3 2022, a total of 180,808 tonnes of

mineralized development and stope material were processed through

the Fresnillo plants, realizing commercial and operational

de-risking opportunities for the Juanicipio Project. The resulting

payable metals sold and processing details on a 100% basis for Q3

2022 are summarized in Table 1 below. The sales

and treatment charges for tonnes processed in the quarter were

recorded on a provisional basis and will be adjusted in the fourth

quarter of 2022 based on final assay and pricing adjustments in

accordance with the offtake agreements.

Table 1: Q3 2022 Mineralized Material

Processed at Fresnillo’s Processing Plants (100%

basis)

|

Three Months Ended September 30, 2022 (180,808 tonnes

processed) |

Q3 2021 Amount$ |

|

Payable Metals |

Quantity |

Average Per Unit$ |

Amount$ |

|

Silver |

2,425,256 ounces |

18.36 per oz |

44,518 |

|

14,344 |

|

|

Gold |

4,901 ounces |

1,677 per oz |

8,219 |

|

1,761 |

|

|

Lead |

1,347 tonnes |

0.87 per lb. |

2,578 |

|

529 |

|

|

Zinc |

2,038 tonnes |

1.45 per lb. |

6,511 |

|

947 |

|

|

Treatment and refining charges (“TCRCs”) and other processing

costs |

(12,111 |

) |

(2,897 |

) |

|

Net Sales |

25,212 |

|

11,207 |

|

|

Mining and transportation costs |

(18,127 |

) |

(3,477 |

) |

|

Depreciation and amortization |

(6,376) (1) |

- |

|

|

Gross Profit |

25,212 |

|

11,207 |

|

(1) The

underground mine is now in stopes with mineralized and development

material being processed through Fresnillo’s plants and refined and

sold. The mine was effectively readied for its intended use on

January 1, 2022.

The average silver head grade for the

mineralized development and initial stope material processed in Q3

2022 was 513 g/t (Q2 2022 567 g/t).

Processing Plant Construction & Outlook

The Juanicipio project team delivered the 4,000

tpd processing plant for commissioning in the fourth quarter of

2021. However, according to the operator Fresnillo and as

previously reported, the state-owned electrical company (Comision

Federal de Electricidad “CFE”), notified Fresnillo late in December

2021 that the regulatory approval to complete the tie-in to the

national power grid could not yet be granted and that the

Juanicipio plant commissioning timeline was therefore extended. As

reported more recently by the operator Fresnillo, commencement of

electrical commissioning of the Juanicipio processing plant is

expected to occur in the coming weeks. It is expected that the

plant will ramp up to 85-90% of the nameplate 4,000 tpd capacity

within months of commissioning.

Should there be additional funding requirements

related to further commissioning delays or to additional sustaining

capital that is being brought forward in excess of the cash flow

generated prior to attaining commercial production, there may still

be further cash calls required from Fresnillo and MAG.

FINANCIAL RESULTS – THREE MONTHS ENDED

SEPTEMBER 30, 2022

As at September 30, 2022, MAG had working

capital of $42,434 (June 30, 2022: $47,673) including cash of

$39,507 (June 30, 2022: $44,655) and no long-term debt. As well, as

at September 30, 2022, Juanicipio had working capital of $9,954

including cash of $18,176 (MAG’s attributable share is 44%).

The Company’s net income for three months ended

September 30, 2022 amounted to $8,227 (September 30, 2021: $2,280

net loss) or $0.08/share (September 30, 2021: ($0.02)/share). MAG

recorded its 44% income from equity accounted investment in

Juanicipio of $11,781 (September 30, 2021: $1,457) which included

MAG’s 44% share of net income from the sale of mineralised

development and stope material as well as loan interest earned on

mining assets brought into use (see Table 2

below).

Table 2: MAG’s share of income from its

equity accounted Investment in Juanicipio

|

|

3 Months ended September 30, 2022 |

3 months ended September 30, 2021 |

|

Gross profit from processing mineralized material

(see Underground Mine Production – Juanicipio Project above) |

$ 25,212 |

|

$ 11,207 |

|

|

Administrative expenses |

|

(1,192 |

) |

|

(490 |

) |

|

Extraordinary mining duty |

|

(64 |

) |

|

(70 |

) |

|

Foreign exchange and other |

|

1,584 |

|

|

(956 |

) |

|

Income before tax |

$ 25,540 |

|

$ 9,692 |

|

|

Income tax expense (including deferred income tax) |

|

825 |

|

|

(6,379 |

) |

|

Income for the period (100% basis) |

$ 26,365 |

|

$ 3,312 |

|

|

MAG’s 44% share of income from equity accounted investment

in JuanicipioLoan interest on mining assets – MAG’s 44%

share |

11,601180 |

|

1,457- |

|

|

MAG’s 44% equity income |

$ 11,781 |

|

$ 1,457 |

|

Qualified Person: All

scientific or technical information in this press release including

assay results referred to, and Mineral Resource estimates, if

applicable, is based upon information prepared by or under the

supervision of, or has been approved by Dr. Peter Megaw, Ph.D.,

C.P.G., a Certified Professional Geologist who is

a “Qualified Person” for purposes of National Instrument 43-101,

Standards of Disclosure for Mineral Projects (“National Instrument

43-101” or “NI 43-101”). Dr. Megaw is not independent as he is an

officer and a paid consultant of MAG.

About MAG Silver Corp.

(www.magsilver.com)

MAG Silver Corp. is a growth-oriented Canadian

development and exploration company focused on becoming a top-tier

primary silver mining company by exploring and advancing

high-grade, district scale, precious metals projects in the

Americas. Its principal focus and asset is the Juanicipio Project

(44%), being developed with Fresnillo Plc (56%), the operator. The

project is located in the Fresnillo Silver Trend in Mexico, the

world's premier silver mining camp, where the operator is currently

advancing underground mine development and commissioning a 4,000

tonnes per day processing plant. Underground mine production of

mineralized development material commenced in Q3 2020, and an

expanded exploration program is in place targeting multiple highly

prospective targets at Juanicipio. MAG is also executing

multi-phase exploration programs at the Deer Trail 100% earn-in

Project in Utah and the recently acquired Larder Project, located

in the historically prolific Abitibi region of Canada.

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements

regarding the anticipated time and capital schedule to production;

anticipated electrical hook-up of the processing plant and impact

on commissioning; statements that address our expectations with

respect to the timing and success of plant commissioning

activities; processing rates of mineralized materials, estimated

project economics, including but not limited to, plant or mill

recoveries, payable metals produced, underground mining rates;

production rates, expected upside from additional exploration;

expected capital requirements and adequacy of current working

capital for the next year; and other future events or developments.

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "plan", "continue",

"estimate", "expect", "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Although MAG

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results or

developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include, but are not limited to, impacts (both direct and indirect)

of COVID-19, supply chain constraints and general costs escalation

in the current inflationary environment heightened by the invasion

of Ukraine by Russia, timing of receipt of required permits,

changes in applicable laws, changes in

commodities prices, changes in mineral

production performance, exploitation and exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions, political risk,

currency risk and capital cost inflation. In addition,

forward-looking statements are subject to various risks, including

that data is incomplete and considerable additional work will be

required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and

investment. The reader is referred to the MAG Silver’s filings

with the SEC and Canadian securities regulators for disclosure

regarding these and other risk factors. There is no certainty that

any forward-looking statement will come to pass, and investors

should not place undue reliance upon forward-looking

statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov.

LEI: 254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, VP Investor Relations and Communications

Phone: (604) 630-1399

Website:www.magsilver.com

Toll Free:(866) 630-1399

Email: info@magsilver.com

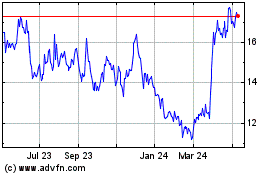

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

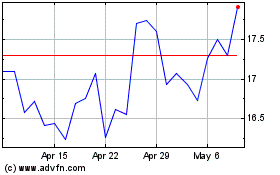

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024