MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG”

or “MAG Silver”) is pleased to announce that it has entered into a

Definitive Arrangement Agreement (the “Definitive Agreement”) with

Gatling Exploration Inc. (TSXV: GTR, OTCQB: GATGF) (“Gatling”)

pursuant to which MAG will acquire all of the issued and

outstanding common shares of Gatling (the “Transaction”) in an

all-share transaction. Each Gatling shareholder will be entitled to

receive 0.01702627 (the “Exchange Ratio”) of a common share of MAG

for each share of Gatling held (the “Consideration”).

The Consideration values Gatling at

approximately C$0.40 per share, representing a premium of

approximately 47.4% to Gatling shareholders, based on the 5-day

volume weighted average price (VWAP) of each company as of the

close of trading on March 10, 2022. Upon completion of the

Transaction, it is expected that Gatling shareholders will hold

approximately 0.79% of MAG shares on an outstanding basis.

Highlights of the Transaction:

Gatling is a Canadian gold exploration company

focused on advancing the Larder Gold Project, located in the

prolific Abitibi greenstone belt in Northern Ontario, Canada. The

Larder project hosts three high-grade gold deposits along the

Cadillac-Larder Lake Break, 35 km east of Kirkland Lake. The

project is 100% owned by Gatling and is comprised of patented and

unpatented claims, leases and mining licenses of occupation within

the McVittie and McGarry Townships. The 3,370 ha project area lies

7 kilometers west of the Kerr Addison Mine. All parts of the Larder

property are readily accessible and MAG expects to engage the

existing exploration team going forward.

“Gatling's Larder property gives us a

substantial toe hold along this regionally productive gold-bearing

structure where we believe more gold should be findable,” said

George Paspalas, MAG Silver’s President and CEO. “We are very

impressed with the geological abilities of the Gatling field team

and look forward to applying some new takes on where mineralization

occurs in Abitibi orogenic gold systems.”

Transaction Details

The Definitive Agreement for the Transaction

includes customary provisions, including non-solicitation, right to

match, and fiduciary out provisions, as well as certain

representations, covenants and conditions which are customary for a

transaction of this nature. The Definitive Agreement provides for a

C$1.0 million termination fee payable by Gatling to MAG in certain

circumstances or an expense reimbursement fee of C$600,000 payable

by Gatling to MAG under certain circumstances. The Transaction is

expected to be completed by way of a court-approved Plan of

Arrangement under the Business Corporations Act (British Columbia)

(the “Arrangement”) and will be subject to shareholder approval at

a meeting of Gatling securityholders. MAG and Gatling have also

entered into a loan agreement pursuant to which MAG has agreed to

provide Gatling with a C$3 million secured convertible bridge loan

to finance Gatling’s accounts payable and operating expenses, with

all such payments subject to the prior approval of MAG.

The Definitive Agreement also includes a

condition to closing that certain consultants of Gatling who are

entitled to receive change of control payments in connection with

the Transaction agree to amend such payments, including to permit

payment of such amounts in MAG shares (the “Compensation

Amendments”). The issuance of MAG shares pursuant to the

Compensation Amendments will be subject approval of the TSX.

Closing of the Transaction is subject to the receipt of applicable

regulatory approvals, including approval of the TSX, and the

satisfaction of certain other closing conditions customary in

transactions of this nature and is anticipated to be completed by

late May 2022.

It is anticipated that any securities to be

issued under the Arrangement will be offered and issued in reliance

upon the exemption from the registration requirements of the U.S.

Securities Act of 1933 provided by Section 3(a)(10) thereof. This

press release does not constitute an offer to sell, or the

solicitation of an offer to buy, any securities.

Board of Director’s Recommendation and

Voting Support

The Arrangement has been unanimously approved by

the board of directors of both MAG and Gatling. Directors and

officers of Gatling along with Gatling’s largest shareholder,

Sprott Asset Management LP, holding in the aggregate 15.19% of the

outstanding Gatling shares, have each entered into customary voting

and support agreements to, amongst other things, vote in favour of

the Arrangement at the special meeting of Gatling securityholders

to be held to consider the Transaction.

About MAG Silver Corp.

(www.magsilver.com )

MAG Silver Corp. is a Canadian development and

exploration company focused on becoming a top-tier primary precious

metals mining company by exploring and advancing high-grade,

district scale, silver-gold dominant projects in the Americas. Its

principal focus and asset is the Juanicipio Project (44%), being

developed with Fresnillo Plc (56%), the operator. The Project is

located in the Fresnillo Silver Trend in Mexico, the world's

premier silver mining camp, where the operator is currently

developing an underground mine and constructing a 4,000 tonnes per

day processing plant. Underground mine production of mineralized

development material commenced in Q3 2020 and is being processed

through adjacent Fresnillo-operated plants. An expanded exploration

program is in place targeting multiple highly prospective targets

at Juanicipio. MAG is also executing a multi-phase exploration

program at the Deer Trail 100% earn-in project in Utah.

Neither the Toronto Stock Exchange nor the NYSE American has

reviewed or accepted responsibility for the accuracy or adequacy of

this press release, which has been prepared by management.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements that

address our expectations with respect to any anticipated benefits

of the Transaction, beliefs that there is more gold findable at the

Larder property, new takes on the location of mineralization in

Abitibi orogenic gold systems, the closing of the Transaction, the

bridge loan, MAG’s ability to complete the proposed Transaction;

Gatling and MAG’s ability to secure the necessary shareholder,

securityholder, legal and regulatory approvals required to complete

the Transaction, the timing of the Transaction, the timing and

success of plant pre-commissioning and commissioning activities,

processing rates of development materials, future

mineral production, and events or developments.

Forward-looking statements are often, but not always, identified by

the use of words such as "seek", "anticipate", "plan", "continue",

"estimate", "expect", "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions. These statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking statements. Although MAG

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance and actual results or

developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include, but are not limited to, impacts (both direct and indirect)

of COVID-19, timing of receipt of required permits, changes in

applicable laws, changes in commodities prices, changes

in mineral production performance, exploitation and

exploration successes, continued availability of capital and

financing, and general economic, market or business conditions,

political risk, currency risk and capital cost inflation. In

addition, forward-looking statements are subject to various risks,

including that data is incomplete and considerable additional work

will be required to complete further evaluation, including but not

limited to drilling, engineering and socio-economic studies and

investment. The reader is referred to the MAG Silver’s filings

with the SEC and Canadian securities regulators for disclosure

regarding these and other risk factors. There is no certainty that

any forward-looking statement will come to pass, and investors

should not place undue reliance upon forward-looking

statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov.

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, VP Investor Relations and Communications

Phone: (604) 630-1399

Toll Free: (866) 630-1399

Website: www.magsilver.com

Email: info@magsilver.com

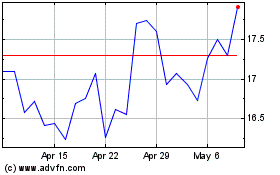

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

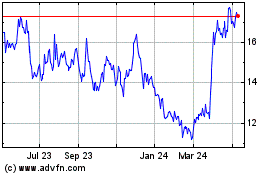

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024