MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG” “MAG

Silver” or the

“Company”) announces the

Company’s unaudited financial results for the three and nine months

ended September 30, 2021. For details of the unaudited condensed

interim consolidated financial statements and Management's

Discussion and Analysis for the three and nine months ended

September 30, 2021, please see the Company’s filings on SEDAR

(www.sedar.com) or on EDGAR (www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise

specified.

HIGHLIGHTS – SEPTEMBER 30, 2021 AND

EVENTS SUBSEQUENT TO THE QUARTER END

OPERATIONAL - Minera Juanicipio

S.A. de C.V. (“Minera Juanicipio”) owned 44% by MAG Silver

- Positive progress was achieved during the quarter ended

September 30, 2021 on the construction of the 4,000 tonne per day

(“tpd”) Juanicipio processing plant and civil works, and the focus

now turns to transitioning from construction to commissioning

activities.

- Pre-commissioning has commenced for key process systems as the

process plant approaches mechanical completion.

- As reported by the operator and 56% owner Fresnillo plc

(“Fresnillo), the Juanicipio plant is expected to come in on budget

and is expected to be commissioned by year end, subject to timely

connection to the power grid.

- A regularly updated photo gallery of construction progress at

Juanicipio is available at

https://magsilver.com/projects/photo-gallery/#photo-gallery.

- Batch processing of mineralized material from development

headings continues through the nearby Fresnillo plant at a targeted

two days per month of continuous processing for a nominal expected

rate of 16,000 tonnes per month (19,042 tonnes per month was

averaged during Q3 2021).

- For the three months ended September 30, 2021, on a 100% basis:

- 57,127 tonnes of mineralized material were batch processed

through the Fresnillo plant, with 619,791 payable silver ounces,

993 payable gold ounces, 232 tonnes of lead and 312 tonnes of zinc

produced and sold;

- Average silver head grade was 418 grams per tonne (“g/t”) in

the development material processed; and

- Pre-commercial production sales totaled $14,684 for the quarter

(net of treatment and processing costs), less $3,477 in mining and

transportation costs, netting $11,207 in gross profit by Minera

Juanicipio in the quarter.

- For the nine months ended September 30, 2021, on a 100% basis:

- 137,957 tonnes of mineralized material were batch processed

through the Fresnillo plant, with 1,455,497 payable silver ounces,

2,334 payable gold ounces, 502 tonnes of lead and 719 tonnes of

zinc produced and sold;

- Average silver head grade was 410 g/t in the development

material processed; and

- Pre-commercial production sales of $36,025 (net of treatment

and processing costs) less $7,736 in mining and transportation

costs, netting $28,289 year to date gross profit in Minera

Juanicipio.

- Since commencing batch processing of Juanicipio mineralized

material from development headings in August of 2020, a total of

209,816 tonnes of mineralized development material have been

processed through the nearby Fresnillo plant:

- contributing cash-flow to offset some of the initial project

capital; and

- de-risking Juanicipio’s metallurgical performance, which is

expected to significantly speed up project ramp-up.

- Juanicipio initial project capital is estimated at $440,000

(100% basis) as of January 1, 2018, less approximately $350,738 in

development expenditures incurred from then to September 30, 2021

leaving approximately $89,262 of remaining initial capital on a

100% basis (MAG’s 44% estimated at $39,275) as at September 30,

2021. The cash required will be reduced by:

- Existing cash held in Minera Juanicipio as at September 30,

2021 ($34,180 on a 100% basis); and,

- Expected cashflow generated from mineralized development

material being processed through the Fresnillo plant up until the

Juanicipio plant is commissioned.

- A further 33,663 tonnes of mineralized development material

with a silver head grade of 550 g/t were processed in October 2021

thought the Fresnillo plant.

EXPLORATION

- The 2021 Juanicipio exploration program is budgeted at $6,000

on a 100% basis and has been focused on continued step-out and

infill drilling of the Valdecañas Vein System (including

independent targeting of the Venadas Vein family and the Anticipada

Vein).

- Five drill rigs are presently on surface running concurrently

with continued underground definition and geotechnical drilling.

- Results of the Juanicipio 2020 exploration program were

reported in the quarter (see Press Release dated August 5, 2021),

and the program successfully:

- Confirms, and allows modeling with greater detail and

confidence of the high-grade silver resource within the upper parts

of the Valdecañas Bonanza Zone (as defined in the 2017 PEA) where

the first several years of mining is expected to occur;

- Confirms, expands, and allows improved modeling of the

continuous wide mineralization of the Valdecañas Deep Zone (as

defined in the 2017 PEA); and

- Confirms, expands, and allows improved modeling of the

ever-growing Anticipada Vein.

- Deer Trail Project in Utah:

- Assays were released in Q3 2021 for the Phase I drill program

(see Press Release dated September 7, 2021), which successfully

fulfilled all three of its planned objectives by:

- Confirming the presence of a thick section of more favorable

carbonate host rocks (the predicted “Redwall Limestone” or

“Redwall”) below the Deer Trail mine;

- Confirming and projecting two suspected mineralization feeder

structures to depth; and

- Intercepting high-grade mineralization related to those

structures in host rocks below what was historically known.

- A follow up 5 hole/5,000 metre Phase II drill program commenced

in Q3 2021 and is in process.

LIQUIDITY AND CAPITAL

RESOURCES

- As at September 30, 2021, MAG held cash of $31,707 while Minera

Juanicipio had cash on hand of $34,180 on a 100% basis.

- Estimated remaining initial project capital cost of the

Juanicipio Project is $89,262 (MAG’s 44% share estimated at

$39,275) which is expected to be funded by MAG’s cash, cash held in

Minera Juanicipio and expected cash flows generated from

mineralized development material processed at the Fresnillo plant.

- Subsequent to the quarter end, MAG signed a commitment letter

with the Bank of Montreal for a fully underwritten $40,000

revolving credit facility to provide MAG with additional liquidity

should it be required.

CORPORATE

- MAG continues to refresh its board, as Mr. Dale Peniuk was

appointed to the board on August 3, 2021.

- Subsequent to the quarter end, MAG announced that Mr. W.J.

(Jim) Mallory joined the Company as Chief Sustainability Officer

(“CSO”).

SUSTAINABILITY AND ESG

Achieving excellence in Environmental, Social

and Governance (“ESG”) practices is a core component of MAG’s

business– it is not only the right thing to do, but also essential

to the future growth and success of the Company. MAG is committed

to maintaining best-in-class corporate governance practices and

having a positive environmental and social impact. MAG’s commitment

to ‘zero harm’ prioritizes the health, safety and well-being of its

people and the communities in which they live and work.

At the Juanicipio project, MAG maintains regular

communications with safety and sustainability staff at Fresnillo,

the project operator, and is committed to promoting responsible ESG

practices at Juanicipio. Additionally, MAG participates in both the

Juanicipio Project board and technical committee meetings. Monthly

health and safety reporting packages, and environmental and

community updates are provided to MAG by Fresnillo.

At the Deer Trail Project, MAG has a robust

stakeholder management program which includes ongoing engagement

with local stakeholders, municipal and regional leaders, and

government agencies. MAG is committed to wise environmental

stewardship that fully complies with and strives to exceed all

applicable laws and regulations.

JUANICIPIO PROJECT UPDATE

Processing Plant Construction, Underground

Development and Commissioning

Construction of the Juanicipio 4,000 tpd

processing plant continued to make good progress in the quarter

ended September 30, 2021, with the focus subsequent to the quarter

on transitioning from construction to commissioning activities.

Pre-commissioning testing has already begun for key process plant

systems as the plant approaches mechanical completion. No-load

testing of the facility with progression to water testing is

expected during November. The plant is expected to be commissioned

by year end according to operator Fresnillo, subject to timely

connection to the national electricity transmission grid of Mexico.

The connection to the grid is the last step prior to feeding lower

grade mineralized material through the grinding mills and

mineralized material has been conveyed to the fine ore bin in

preparation for processing. It has been difficult for the

regulators to travel to site for the final connection due to COVID

travel restrictions, but these have now been lifted and additional

electrical supply protection equipment is being installed as a

priority ahead of the tie-in. Fresnillo expects to obtain the

authorization to connect to the power grid on schedule, which

should allow full load commissioning by year end, but there is no

assurance that the connection will be timely, which could result in

delays to commissioning and achieving commercial production. The

project operator, Fresnillo, has indicated that if there is a delay

to the commissioning schedule due to the timing of the tie-in, the

amount of mineralized material that was schedule to be processed

through the commissioning period will be processed at the nearby

Fresnillo Plant, generating comparable cash flow expected during

commissioning.

A regularly updated photo gallery of

construction progress at Juanicipio is available at

https://magsilver.com/projects/photo-gallery/#photo-gallery.

Underground development to date at Juanicipio is

now approximately 42 km (26 miles) and underground mine

infrastructure is well advanced. Underground development priorities

include continuing advance of the three internal spiral footwall

production ramps designed to access the full strike length of the

Valdecañas Vein system. Due to the poor rock quality on the western

section of the upper Valdecañas Vein, cut and fill will be the

chosen mining method for the higher levels in this section. A trial

longhole stope has been in operation for the past six months, and

this will be the preferred mining method through the main central

section and eastern side of Valdecañas Vein.

The estimated initial project capital cost on a

100% basis as estimated from January 1, 2018 is $440,000 less

approximately $350,738 expended since then, leaving an estimated

$89,262 of remaining initial capital (MAG’s 44% estimated remaining

share is $39,275) as at September 30, 2021. This remaining funding

requirement will be reduced by both: existing cash held in Minera

Juanicipio as at September 30, 2021 ($34,180 on a 100% basis); and,

expected cash flows generated from mineralized development material

being processed through the Fresnillo processing plant until the

Juanicipio plant is commissioned (see Underground Mine Production

below).

Labour reform legislation on subcontracting and

outsourcing in Mexico was published on April 23, 2021 and came into

effect on September 1, 2021. With various restrictions on hiring

contractors, Fresnillo, as operator, has indicated a need to

internalize a portion of its contractor workforce and perform much

of the development work directly rather than outsourcing it to

contractors, and hence invest in equipment either not previously in

the project scope or not envisaged to be required until later in

the mine life, to be utilized in underground operations. As well,

certain underground development expenditures related to processing

development material and some small items brought forward from

project investments planned in the future are considered sustaining

capital by Fresnillo. The costs incurred are expected to reduce

future sustaining capital costs and totaled approximately $16,637

on a 100% basis for the quarter ended September 30, 2021. These

costs are included in the current Juanicipio development costs but

are not considered by the operator as part of the $440,000 initial

project capital.

Subsequent to the quarter end, MAG signed a

binding commitment letter with the Bank of Montreal for a fully

underwritten $40,000 revolving credit facility (“Facility”). The

Facility will be available for general corporate purposes, further

exploration of its properties, and for further investment in Minera

Juanicipio. The Facility will have a maturity date of December 31,

2024 and is subject to definitive documentation and conditions to

advances thereunder customary for transactions of this nature.

Underground Mine Production

As of August of 2020, mineralized development

material is being batch processed, refined and sold on commercial

terms at a targeted rate of 16,000 tonnes per month at the nearby

Fresnillo plant. The actual amount of material processed on a

monthly basis fluctuates due to the variability of mineralization

encountered in the development headings from month to month. In the

three and nine months ended September 30, 2021, 57,127 and 137,957

tonnes of mineralized development material respectively, were

processed through the Fresnillo plant, realizing commercial and

operational de-risking opportunities for the Juanicipio Project.

The average silver head grade for the mineralized development

material processed in the three and nine months ended September 30,

2021 was 418 g/t and 410 g/t respectively. The sales and treatment

charges for tonnes processed in Q3 2021 were recorded on a

provisional basis and will be adjusted in Q4 2021 based on final

assay and pricing adjustments in accordance with the offtake

contracts. The processing details and the resulting payable metals

sold on a 100% basis for the 3 months ended September 30, 2021 are

summarized in Table 1 below.

By bringing forward the start-up of the

underground mine and processing mineralized development material at

the Fresnillo plant in advance of commissioning the Juanicipio

plant, MAG and Fresnillo expect to secure several positive outcomes

for the Juanicipio Project:

- generating cash-flow from production to offset some of the cash

requirements of the initial project capital;

- de-risking the flotation process through a better understanding

of the metallurgical characteristics and response of the Juanicipio

mineralization;

- increased certainty around the geological block model prior to

start-up of the processing plant; and

- allowing for a faster and more certain ramp-up to the nameplate

4,000 tpd plant design.

Table 1: Development

Material Processed at Fresnillo’s Processing Plant (100%

basis)

|

Metals |

Payable Production 3 months,

September 30, 2021 |

Average Price Per Unit (1) 3

months September 30, 2021 |

$ Amount 3 months

September 30, 2021 |

$ Amount 9 months

September 30, 2021 |

$ Amount 3 months & 9

months September 30, 2020 (2) |

|

Silver |

619,791 ounces |

$23.14 per oz |

$14,344 |

$36,492 |

$9,537 |

|

Gold |

993 ounces |

$1,772.71 per oz |

1,761 |

4,171 |

1,065 |

|

Lead |

232 tonnes |

$1.04 per lb |

529 |

1,087 |

221 |

|

Zinc |

312 tonnes |

$1.38 per lb |

947 |

2,120 |

355 |

|

Treatment and refining and other processing charges |

(2,897) |

(6,699) |

(1,653) |

|

Provisional sales adjustment related to prior periods (3) |

- |

(1,146) |

- |

|

Net Sales |

14,684 |

36,025 |

9,525 |

|

Mining and transportation costs |

(3,477) |

(7,736) |

(1,531) |

|

Gross Profit |

$11,207 |

$28,289 |

$7,994 |

(1) Ounces (“oz”) for silver and gold and pounds

(“lb”) for lead and zinc. (2) Processing of Juanicipio mineralized

development material at the Fresnillo plant commenced in August of

2020, with no prior processing. (3) Provisional sales for 2020 were

finalized in Q1 2021 resulting in negative adjustment to net sales

revenue of $1,146.

Juanicipio Exploration Update

The 2021 approved Juanicipio exploration program

is currently in progress and is budgeted at $6,000 ($4,200 incurred

actual to September 30, 2021) on a 100% basis and has been focused

on continued step-out and infill drilling of the Valdecañas Vein

System (including independent targeting of the Venadas Vein family

and the Anticipada Vein). Permit applications for drilling other

exploration targets on the property have been submitted or are in

the process of being generated pending surface access arrangements.

Meanwhile, detailed mapping and sampling of these targets is

underway. All aspects of the exploration work continue to be done

under strict COVID-19 protocols.

Assays for the Juanicipio 2020 drill program

were released in the Q3 2021 (see Press Release dated August 5,

2021). A total of 33 surface holes (27,900 m) and 77 underground

definition holes (11,800 m) were completed with the primary

objectives of: infilling and expanding the Valdecañas Deep Zone

(“Deep Zone”) to optimize its planned extraction; and underground

definition drilling of the upper high-grade Valdecañas Bonanza Zone

(“Bonanza Zone”) where test mining has already begun and the focus

for the first several years of mining lies.

A complete set of tables by vein of the 2020

drilling results is available at:

https://magsilver.com/site/assets/files/5810/nr-mar3-2020-table1-sdadds.pdf

along with a new 3D video displaying the entire Valdecañas Vein

System, available

at: https://magsilver.com/site/assets/files/5810/SSMovieHQ2_3-Mar3-2019-sdsawe.mp4

.

The 2020 drilling program successfully:

- Confirms, and allows modeling with greater detail and

confidence of the high-grade silver resource within the upper parts

of the Valdecañas Bonanza Zone where the first several years of

mining will occur;

- Confirms, expands, and allows improved modeling of the

continuous wide mineralization of the Valdecañas Deep Zone;

and,

- Confirms, expands, and allows improved modeling of the

ever-growing Anticipada Vein.

DEER TRAIL PROJECT UPDATE

Phase I drilling commenced in November 2020 and

was completed in Q2 2021 with assays and interpretations released

in the third quarter of 2021 (see Press Release September 7, 2021).

Phase I saw the completion of three holes and 3,927 metres drilled

from surface and successfully fulfilled all three of its planned

objectives by:

- Confirming the presence of a thick section of more favorable

carbonate host rocks (the predicted “Redwall Limestone” or

“Redwall”) below the Deer Trail mine;

- Confirming and projecting two suspected mineralization feeder

structures to depth; and

- Intercepting high-grade mineralization related to those

structures in host rocks below what was historically known.

A follow-up Phase II drill program commenced at

the Deer Trail Project on August 20, 2021, and is planned for 5,000

metres of drilling over 5 holes. Deviation/directional drilling is

expected to be used in Phase II to make the drilling more efficient

and accurate.

Qualified Person: Dr. Peter

Megaw, Ph.D., C.P.G., has acted as the Qualified Person as defined

in National Instrument 43-101 for this disclosure and supervised

the preparation of the technical information in this release. Dr.

Megaw has a Ph.D. in geology and more than 38 years of relevant

experience focused on ore deposit exploration worldwide. He is a

Certified Professional Geologist (CPG 10227) by the American

Institute of Professional Geologists and an Arizona Registered

Geologist (ARG 21613). Dr. Megaw is not independent as he is Chief

Exploration Officer and a Shareholder of MAG.

FINANCIAL RESULTS – THREE AND NINE

MONTHS ENDED SEPTEMBER 30, 2021

As at September 30, 2021, MAG had working

capital of $33,977 (December 31, 2020: $94,513) including cash of

$31,707 (December 31, 2020: $94,008) and no long-term debt. As

well, as at September 30, 2021, Minera Juanicipio had cash of

$34,180 (MAG’s attributable 44% share of $15,039). The Company

makes cash advances to Minera Juanicipio as ‘cash called’ by the

operator Fresnillo, based on approved budgets. In the three and

nine months ended September 30, 2021, the Company funded advances

to Minera Juanicipio, which combined with MAG’s Juanicipio

expenditures on its own account, totaled $31,884 and $55,794

respectively (September 30, 2020: $173 and $23,629

respectively).

The Company’s net loss for three and nine months

ended September 30, 2021 amounted to $2,280 and $2,637 respectively

or $(0.02)/share and $(0.03)/share respectively (September 30,

2020: $89 and $13,690 respectively or $(0.00)/share or

$(0.15)/share respectively). MAG recorded its 44% share of income

from its equity investment in Juanicipio of $1,457 and $6,909

respectively for the three and nine months ended September 30, 2021

(September 30, 2020: $126 income and $3,372 loss, respectively)

which included MAG’s 44% share of net income from the sale of

pre-production mineralized development material (see Table

2 below). Share based payment expense (a non-cash item)

recorded in the three months and nine months ended September 30,

2021 amounted to $896 and $3,574 respectively (September 30, 2020:

$554 and $2,262 respectively). MAG also recorded a deferred income

tax expense of $1,482 and $1,724 for the three and nine months

ended September 30, 2021 respectively (September 30, 2020: $1,229

deferred income tax benefit and $4,949 expense respectively),

related to the devaluation of the Mexican peso during the

periods.

Table 2: MAG’s 44% share of income

(loss) from its equity investment in Juanicipio

|

|

Three months ended |

Nine months ended |

|

September 30, |

September 30, |

|

2021 |

2020 |

2021 |

2020 |

|

Gross Profit from processing mineralized

development material (see Underground Mine Production –

Juanicipio Project above) |

$11,207 |

$7,994 |

$28,289 |

$7,994 |

|

Administrative expenses |

(560) |

Nil |

(1,215) |

Nil |

|

Foreign exchange and other |

(956) |

95 |

(832) |

(3,463) |

|

Net income before tax |

9,691 |

8,089 |

26,242 |

4,531 |

|

Income tax expense (including deferred income tax) |

(6,379) |

(7,803) |

(10,539) |

(12,195) |

|

Net income (loss) for the period (100% basis) |

$3,312 |

$286 |

$15,703 |

$(7,664) |

|

MAG’s 44% income (loss) - equity investment in

Juanicipio |

$1,457 |

$126 |

$6,909 |

$(3,372) |

About MAG Silver Corp.

(www.magsilver.com )

MAG Silver Corp. is a Canadian development and

exploration company focused on becoming a top-tier primary silver

mining company by exploring and advancing high-grade, district

scale, silver-dominant projects in the Americas. Its principal

focus and asset is the Juanicipio Project (44%), being developed

with Fresnillo Plc (56%), the operator. The project is located in

the Fresnillo Silver Trend in Mexico, the world's premier silver

mining camp, where the operator is currently developing an

underground mine and constructing a 4,000 tonnes per day processing

plant expected to be commissioned by the end of 2021. Underground

mine production of mineralized development material commenced

in Q3 2020, and an expanded exploration program is in place

targeting multiple highly prospective targets at Juanicipio.

Concurrently, MAG is executing a multi-phase exploration program at

the Deer Trail 100% earn-in project in Utah.

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements that

address our expectations with respect to the timing and success of

plant pre-commissioning and commissioning activities, processing

rates of development materials, future mineral production, and

events or developments. Forward-looking statements are often, but

not always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", "predict", "potential", "targeting", "intend",

"could", "might", "should", "believe" and similar expressions.

These statements involve known and unknown risks, uncertainties and

other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. Although MAG believes the expectations expressed

in such forward-looking statements are based on reasonable

assumptions, such statements are not guarantees of future

performance and actual results or developments may differ

materially from those in the forward-looking statements. Factors

that could cause actual results to differ materially from those in

forward-looking statements include, but are not limited to, impacts

(both direct and indirect) of COVID-19, timing of receipt of

required permits, changes in applicable laws, changes in

commodities prices, changes in mineral

production performance, exploitation and exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions, political risk,

currency risk and capital cost inflation. In addition,

forward-looking statements are subject to various risks, including

that data is incomplete and considerable additional work will be

required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and

investment. The reader is referred to the MAG Silver’s filings

with the SEC and Canadian securities regulators for disclosure

regarding these and other risk factors. There is no certainty that

any forward-looking statement will come to pass, and investors

should not place undue reliance upon forward-looking

statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov LEI:

254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, VP Investor Relations and Communications

Phone: (604) 630-1399

Toll Free: (866) 630-1399

Website: www.magsilver.com

Email: info@magsilver.com

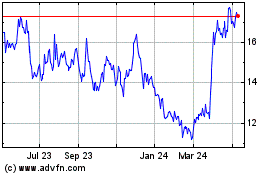

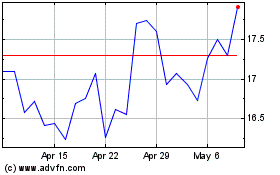

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024