MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG”

or the

“Company”) announces the Company’s

unaudited financial results for the three and six months ended June

30, 2021. For details of the unaudited condensed interim

consolidated financial statements and Management's Discussion and

Analysis for the three and six months ended June 30, 2021, please

see the Company’s filings on SEDAR (www.sedar.com) or on EDGAR

(www.sec.gov).

All amounts herein are reported in $000s

of United States dollars (“US$”) unless otherwise

specified.

HIGHLIGHTS – JUNE 30, 2021 AND EVENTS

SUBSEQUENT TO THE QUARTER END

OPERATIONAL

- Positive progress was achieved

during the quarter ended June 30, 2021 on the construction of the

4,000 tpd Juanicipio processing plant and civil works:

- Mechanical installation of the flotation cells and filters were

completed during the Q2 2021;

- The SAG and ball mills were installed during Q2 2021; and,

- Underground development has reached approximately 40 km (25

miles), and the first cut and fill stope has been opened and a

trial longhole stope is being tested.

- As reported by the operator Fresnillo, the Juanicipio plant is

expected to come in on budget and as scheduled to commence

commissioning in Q4 2021, reaching 40 to 50% of its 4,000 tonnes

per day (“tpd”) nameplate capacity by the end of 2021 and reaching

90 to 95% of its nameplate capacity in 2022.

- A regularly updated photo gallery of construction progress at

Juanicipio is available at

https://magsilver.com/projects/photo-gallery/#photo-gallery.

- Batch processing of mineralized material from development

headings continues through the nearby Fresnillo plant at a targeted

two days per month of continuous processing for a nominal expected

rate of 16,000 tonnes per month.

- For the three months ended June 30, 2021, on a 100% basis:

- 44,435 tonnes of mineralized material were processed through

the Fresnillo plant, with 404,518 payable silver ounces, 709

payable gold ounces, 133 tonnes of lead and 209 tonnes of zinc

produced and sold; and,

- Pre-commercial production sales totaled $11,256 for the quarter

(net of treatment and processing costs), less $2,373 in mining and

transportation costs, netting $8,883 recorded as gross profit by

Minera Juanicipio in the quarter.

- For the six months ended June 30, 2021, on a 100% basis:

- 80,830 tonnes of mineralized material were processed through

the Fresnillo plant, with 835,706 payable silver ounces, 1,340

payable gold ounces, 270 tonnes of lead and 408 tonnes of zinc

produced and sold;

- Average silver head grade of 405 grams per tonne (“g/t”) of the

material processed; and

- Pre-commercial production sales of $21,341 for the six month

period (net of treatment and processing costs) less $4,259 in

mining and transportation costs, netting $17,082 recorded as year

to date gross profit by Minera Juanicipio.

- Since August 2020, 152,689 tonnes of mineralized development

material have been processed through the Fresnillo plant, which is

expected to:

- contribute cash-flow to offset some of the initial project

capital; and

- significantly speed up project ramp-up due to the de-risking of

Juanicipio’s metallurgical performance.

- Juanicipio capex is estimated at

$440,000 (100% basis) as of January 1, 2018, less approximately

$313,400 in development expenditures incurred from then to June 30,

2021 leaving approximately $126,600 of remaining initial capital on

a 100% basis (MAG’s 44% estimated at $55,704) as at June 30, 2021.

The cash required will be reduced by:

- Existing cash held in Minera Juanicipio as at June 30, 2021

($15,107 on a 100% basis); and,

- Expected cashflow generated from mineralized material being

processed through the Fresnillo plant up until the Juanicipio plant

commences commissioning in Q4 2021.

- A further 14,207 tonnes of

development material were processed in July 2021.

EXPLORATION

- In spite of temporary COVID-19 restrictions established by the

Mexican Government in 2020, the full Juanicipio 2020 exploration

program was completed as planned with 33 surface holes (27,900

metres (“m”)) and 77 underground definition holes (11,800 m)

completed. Assays were reported subsequent to the quarter end (see

Press Release dated August 5, 2021), and the program successfully:

- Confirms, and allows modeling with greater detail and

confidence of the high-grade silver resource within the upper parts

of the Valdecañas Bonanza Zone (as defined in the 2017 PEA) where

the first several years of mining will occur;

- Confirms, expands, and allows improved modeling of the

continuous wide mineralization of the Valdecañas Deep Zone (as

defined in the 2017 PEA); and,

- Confirms, expands, and allows improved modeling of the

ever-growing Anticipada Vein.

- The 2021 Juanicipio Exploration

program is budgeted at $6 million on a 100% basis, and is to be

evenly allocated between continued step-out and infill drilling of

the Valdecañas Vein System (including independent targeting of the

Venadas Vein family and the Anticipada Vein) and three principal

target areas elsewhere in the Joint Venture ground.

- Five drill rigs are presently on

surface running concurrently with continued underground definition

drilling.

- Deer Trail Project in Utah:

- Phase I drilling was completed in

Q2 2021 with assays pending and expected to be released during the

third quarter of 2021.

- Subsequent to the quarter end, a 5

hole/5,000 metre Phase II drill program commenced and is in

process.

LIQUIDITY AND CAPITAL

RESOURCES

- As at June 30, 2021, MAG held cash

of $66,342 while Minera Juanicipio had cash on hand on a 100% basis

of $15,107.

CORPORATE

- MAG continues to refresh its board, as Mr. Derek White did not

stand for re-election at the Company’s Annual General and Special

Meeting on June 21, 2021, and subsequent to the quarter end on

August 3, 2021, Mr. Dale Peniuk was appointed to the board.

- Mr. Peniuk is a Chartered Professional Accountant (CPA, CA) and

corporate director. Mr. Peniuk currently serves on the board and as

audit committee chair of Lundin Mining Corporation, Capstone Mining

Corp. and Argonaut Gold Inc., and has been on the board and chair

of the audit committee of numerous other Canadian public mining

companies since 2006. Mr. Peniuk obtained his Bachelor of Commerce

degree from the University of British Columbia in 1982 and his

Chartered Accountant designation from the Institute of Chartered

Accountants of British Columbia (now the Chartered Professional

Accountants of British Columbia) in 1986, and spent more than 20

years with KPMG LLP Chartered Accountants and predecessor firms,

the last 10 of which as an assurance partner with a focus on mining

companies, including leading KPMG’s Vancouver office mining

industry group.

JUANICIPIO PROJECT UPDATE

Processing Plant Construction and

Commissioning

During Q2 2021, continued progress was achieved

on the construction of the Juanicipio processing plant. The SAG and

ball mills were installed during the quarter, and mechanical

installation of the flotation cells and filters were completed

during the Q2 2021. All major mechanical pieces have now been

installed. The tailings and concentrate thickeners are nearing

completion. Significant progress has occurred on the initial

tailings storage facility, and on the fine ore bin and stockpile

dust cover. The lead and zinc flotation cell lines have been

installed and are now piped in for air, water and froth flow.

Underground development to date at Juanicipio is now approximately

40 km (25 miles) with access to the upper portion of the resource

now achieved. Underground development priorities include continuing

advance of the three internal spiral footwall production ramps

designed to access the full strike length of the Valdecañas Vein

system. Initial development indicates that the grade and width of

the vein are in line with previous drilling-derived estimates.

According to Fresnillo, the operator, the

Juanicipio processing plant is expected to come in on budget and as

scheduled to commence commissioning in fourth quarter 2021 reaching

40 to 50% of nameplate capacity by the end of 2021 and achieving 90

to 95% of nameplate capacity in 2022.

The estimated project capital cost on a 100%

basis, as estimated from January 1, 2018 is $440,000 less

approximately $313,400 in development expenditures incurred from

then to June 30, 2021 leaving approximately $126,600 of remaining

capital cost (MAG’s 44% estimated at $55,704) as at June 30, 2021.

This remaining funding requirement will be reduced by both:

existing cash held in Minera Juanicipio as at June 30, 2021

($15,107 on a 100% basis); and, expected cash flows generated from

mineralized development material processed at a targeted average

nominal rate of 16,000 tonnes per month through the Fresnillo

processing plant until the Juanicipio plant is commissioned (see

Underground Mine Production below).

A regularly updated photo gallery of

construction progress at Juanicipio is available at

https://magsilver.com/projects/photo-gallery/#photo-gallery.

Underground Mine Production

As of August of 2020, mineralized material from

development is being batch processed, refined and sold on

commercial terms at a targeted rate of 16,000 tonnes per month at

the nearby Fresnillo plant. The actual amount of material processed

on a monthly basis fluctuates due to the variability of

mineralization encountered in the development headings from month

to month. In the three and six months ended June 30, 2021, 44,435

and 80,830 tonnes of mineralized material respectively, were

processed through the Fresnillo plant, realizing commercial and

operational de-risking opportunities for the Juanicipio joint

venture. The average silver head grade for the development material

processed in the three and six months ended June 30, 2021 was 361

grams per tonne (“g/t”) and 405 g/t respectively. The sales and

treatment charges for tonnes processed in Q2 2021 were recorded on

a provisional basis and will be adjusted in Q3 2021 based on final

assay and pricing adjustments in accordance with the offtake

contracts. The resulting payable metals sold and processing details

on a 100% basis for the 3 months ended June 30, 2021 are summarized

in Table 1 below.

Table 1: Development Material Processed

at Fresnillo’s Processing Plant (100% basis)

|

Payable Metals |

Quantity 3 months, June

30, 2021 |

Average Per Unit (1) 3 months

June 30, 2021 |

$ Amount 3 months June

30, 2021 |

$ Amount 6 months June

30, 2021 |

$ Amount 3 months & 6

months June 30, 2020(2) |

|

Silver |

404,518 ounces |

$27.17 per oz |

$10,991 |

$22,148 |

- |

|

Gold |

709 ounces |

$1,861.27 per oz |

$1,320 |

$2,410 |

- |

|

Lead |

133 tonnes |

$0.99 per lb |

$290 |

$557 |

- |

|

Zinc |

209 tonnes |

$1.34 per lb |

$619 |

$1,174 |

- |

|

Treatment and refining and other processing charges |

$(1,964) |

$(3,802) |

- |

|

Provisional sales adjustment related to prior periods (3) |

- |

$(1,146) |

|

|

Net Sales |

$11,256 |

$21,341 |

- |

|

Mining and transportation costs |

$(2,373) |

$(4,259) |

- |

|

Gross Profit |

$8,883 |

$17,082 |

- |

|

(1) |

Ounces (“oz”) for silver and gold; and, pounds (“lb”) for lead and

zinc. |

|

(2) |

Underground mine production of development material commenced in

August of 2020, so there are no comparable 2020. |

|

(3) |

Provisional sales for 2020 were finalized in Q1 2021 resulting in

negative adjustment to net sales revenue of $1,146. |

By bringing forward the start-up of the

underground mine and processing mineralized development material at

the Fresnillo plant in advance of commissioning the Juanicipio

plant, MAG and Fresnillo expect to secure several positive outcomes

for the Juanicipio Project:

- generating cash-flow from production to offset some of the cash

requirements of the initial project capital;

- de-risking the flotation process through a better understanding

of the metallurgical characteristics and response of the Juanicipio

mineralization;

- increased certainty around the geological block model prior to

start-up of the processing plant; and

- allowing for a faster and more certain ramp-up to the nameplate

4,000 tpd plant design.

Juanicipio Exploration Update

Despite a temporary COVID-19 exploration halt

imposed by the Mexican Government in 2020, the full Juanicipio 2020

drilling program was completed as planned in 2020, although

processing of assays was delayed and only released subsequent to

the quarter ended June 30, 2021 (see Press Release dated August 5,

2021). A total of 33 surface holes (27,900 m) and 77 underground

definition holes (11,800 m) were completed with the primary

objectives of: infilling and expanding the Valdecañas Deep Zone

(“Deep Zone”) to optimize its planned extraction; and underground

definition drilling of the upper high-grade Valdecañas Bonanza Zone

(“Bonanza Zone”) where test mining has already begun and the focus

for the first several years of mining lies.

A complete set of tables by vein of the 2020

drilling results is available at:

https://magsilver.com/site/assets/files/5810/nr-mar3-2020-table1-sdadds.pdf

along with a new 3D video displaying the entire Valdecañas Vein

System, available at:

https://magsilver.com/site/assets/files/5810/SSMovieHQ2_3-Mar3-2019-sdsawe.mp4

.

The 2020 drilling program successfully:

- Confirms, and allows modeling with greater detail and

confidence of the high-grade silver resource within the upper parts

of the Valdecañas Bonanza Zone where the first several years of

mining will occur;

- Confirms, expands, and allows improved modeling of the

continuous wide mineralization of the Valdecañas Deep Zone;

and,

- Confirms, expands, and allows improved modeling of the

ever-growing Anticipada Vein.

DEER TRAIL PROJECT UPDATE

A Phase I surface-based core drilling program

was completed during Q2 2021. Assays and interpretations are

expected to be released during Q3 2021. A follow-up Phase II drill

program was planned as interpretation of the incoming core and

draft lab results were incorporated into the district geological

model. Phase II drilling commenced subsequent to the quarter end in

July 2021 and is planned for 5,000 metres over 5 holes.

Qualified Person: Dr. Peter

Megaw, Ph.D., C.P.G., has acted as the Qualified Person as defined

in National Instrument 43-101 for this disclosure and supervised

the preparation of the technical information in this release. Dr.

Megaw has a Ph.D. in geology and more than 38 years of relevant

experience focused on ore deposit exploration worldwide. He is a

Certified Professional Geologist (CPG 10227) by the American

Institute of Professional Geologists and an Arizona Registered

Geologist (ARG 21613). Dr. Megaw is not independent as he is Chief

Exploration Officer and a Shareholder of MAG.

FINANCIAL RESULTS – THREE AND SIX MONTHS

ENDED JUNE 30, 2021

As at June 30, 2021, the Company had working

capital of $68,374 (December 31, 2020: $94,513) including cash of

$66,342 (December 31, 2020: $94,008) and no long-term debt. As

well, as at June 30, 2021, Minera Juanicipio had cash of $15,107

(MAG’s attributable 44% share of $6,647). The Company makes cash

advances to Minera Juanicipio as ‘cash called’ by the operator

Fresnillo, based on approved joint venture budgets. In the three

and six months ended June 30, 2021, the Company funded advances to

Minera Juanicipio, which combined with MAG’s Juanicipio

expenditures on its own account, totaled $23,809 and $23,910

respectively (June 30, 2020: $23,284 and $23,456 respectively).

Subsequent to June 30, 2021, the Company advanced an additional

$15,884 to Minera Juanicipio representing its 44% share of a

$36,100 cash call to fund process plant construction and further

underground development of the Juanicipio property.

The Company’s net income for three months ended

June 30, 2021 amounted to $3,305 and net loss for the six months

ended June 30, 2021 amounted to $357 or $0.03/share and

$(0.00)/share respectively (June 30, 2020: $1,297 net income and

$13,601 net loss respectively or $0.01/share or $(0.15)/share

respectively). The Company recorded its 44% share of income from

its equity investment in Juanicipio of $4,820 and $5,452

respectively for the three and six months ended June 30, 2021 (June

30, 2020: $1,189 income and $3,498 loss, respectively) which

included MAG’s 44% share of net income from the sale of

pre-production development material (see Table 2

below). Share based payment expense (a non-cash item) recorded in

the three months and six months ended June 30, 2021 amounted to

$1,485 and $2,678 respectively (June 30, 2020: $1,230 and $1,708

respectively).

Table 2: MAG’s 44% share of income from

its equity investment in Juanicipio

|

|

Three Months June 30, 2021 |

Three Months June 30,

2020 |

Six Months June 30, 2021 |

Six Months June 30, 2020 |

|

Gross Profit from processing development material

(see Underground Mine Production – Juanicipio Project above) |

$8,883 |

|

|

Nil (1) |

|

$17,082 |

|

|

Nil (1) |

|

|

Administrative expenses |

$(287 |

) |

|

Nil |

|

$(655 |

) |

|

Nil |

|

|

Foreign exchange and other |

$1,199 |

|

$317 |

|

$124 |

|

$(3,558 |

) |

|

Net income (loss) before tax |

$9,795 |

|

$317 |

|

$16,551 |

|

$(3,558 |

) |

|

Income tax benefit (expense) (including deferred income tax) |

$1,160 |

|

$2,384 |

|

$(4,160 |

) |

$(4,392 |

) |

|

Net income (loss) for the period (100% basis) |

$10,955 |

|

$2,701 |

|

$ 12,391 |

|

$(7,950 |

) |

|

MAG’s 44% income (loss) - equity investment in

Juanicipio |

$4,820 |

|

$1,189 |

|

$5,452 |

|

$(3,498 |

) |

About MAG Silver Corp.

(www.magsilver.com)

MAG Silver Corp. (MAG: TSX / NYSE A) is a

Canadian development and exploration company focused on becoming a

top-tier primary silver mining company by exploring and advancing

high-grade, district scale, silver-dominant projects in the

Americas. Its principal focus and asset is the Juanicipio Project

(44%), being developed in a Joint Venture partnership with

Fresnillo Plc (56%), the Operator. Juanicipio is located in the

Fresnillo Silver Trend in Mexico, the world's premier silver mining

camp, and the Joint Venture is currently developing an underground

mine and constructing a 4,000 tonnes per day processing plant which

is expected to commence commissioning in Q4-2021. Underground mine

production of development material commenced in Q3-2020, and an

expanded exploration program is in place targeting multiple highly

prospective targets both at Juanicipio by the Joint Venture and by

MAG at the Deer Trail 100% earn-in project in Utah.

Neither the Toronto Stock Exchange nor the NYSE

American has reviewed or accepted responsibility for the accuracy

or adequacy of this press release, which has been prepared by

management.

This release includes certain statements that

may be deemed to be “forward-looking statements” within the meaning

of the US Private Securities Litigation Reform Act of 1995. All

statements in this release, other than statements of historical

facts are forward looking statements, including statements that

address future mineral production, reserve potential,

exploration drilling, exploitation activities and events or

developments. Forward-looking statements are often, but not always,

identified by the use of words such as "seek", "anticipate",

"plan", "continue", "estimate", "expect", "may", "will", "project",

"predict", "potential", "targeting", "intend", "could", "might",

"should", "believe" and similar expressions. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements.

Although MAG believes the expectations expressed in such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance and actual

results or developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include, but are not limited to, changes in

commodities prices, changes in mineral

production performance, exploitation and exploration

successes, continued availability of capital and financing, and

general economic, market or business conditions, political risk,

currency risk and capital cost inflation. In addition,

forward-looking statements are subject to various risks, including

that data is incomplete and considerable additional work will be

required to complete further evaluation, including but not limited

to drilling, engineering and socio-economic studies and

investment. The reader is referred to the MAG’s filings with

the SEC and Canadian securities regulators for disclosure regarding

these and other risk factors. There is no certainty that any

forward-looking statement will come to pass and investors should

not place undue reliance upon forward-looking statements.

Please Note: Investors are urged to consider

closely the disclosures in MAG's annual and

quarterly reports and other public filings, accessible through

the Internet at www.sedar.com and www.sec.gov LEI:

254900LGL904N7F3EL14

For further information on behalf of MAG Silver Corp.

Contact Michael J. Curlook, VP Investor Relations and Communications

Phone: (604) 630-1399

Toll Free: (866) 630-1399

Website: www.magsilver.com

Email: info@magsilver.com

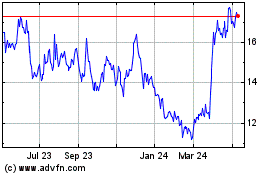

MAG Silver (TSX:MAG)

Historical Stock Chart

From Nov 2024 to Dec 2024

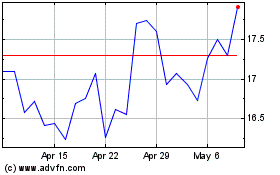

MAG Silver (TSX:MAG)

Historical Stock Chart

From Dec 2023 to Dec 2024