INTERFOR CORPORATION (“Interfor” or the “Company”)

(TSX: IFP) announced today its intention to commence a substantial

issuer bid (the “Offer”) pursuant to which the Company will offer

to purchase up to $100,000,000 in value of its outstanding common

shares (the “Shares”) for cancellation from holders of Shares (the

“Shareholders”) for cash. The Offer will proceed by way of a

“modified Dutch auction” procedure with a tender price range from

$29.00 to $34.00 per Share, representing a 3.5% to a 21.3% premium

over the Company’s volume-weighted average price on the Toronto

Stock Exchange over the last 20 trading days.

As of July 25, 2022, there were 54,787,641 Shares issued and

outstanding. The Offer would be for approximately 6.3% of the total

number of issued and outstanding Shares if the purchase price is

determined to be $29.00 (which is the minimum price per Share under

the Offer) or approximately 5.4% of the total number of issued and

outstanding Shares if the purchase price is determined to be $34.00

(which is the maximum price per Share under the Offer).

Holders of Shares wishing to tender to the Offer will be

entitled to do so pursuant to: (i) auction tenders in which they

will specify the number of Shares being tendered at a price of not

less than $29.00 and not more than $34.00 per Share in increments

of $0.10 per Share, or (ii) purchase price tenders in which they

will not specify a price per Share, but will rather agree to have a

specified number of Shares purchased at the purchase price to be

determined by auction tenders. Shareholders who validly deposit

Shares without specifying the method in which they are tendering

their Shares will be deemed to have made a purchase price

tender.

The purchase price to be paid by the Company for each validly

deposited Share will be based on the number of Shares validly

deposited pursuant to auction tenders and purchase price tenders,

and the prices specified by Shareholders making auction tenders.

The purchase price will be the lowest price which enables the

Company to purchase the maximum number of Shares not exceeding an

aggregate of $100,000,000 in value based on valid auction tenders

and purchase price tenders, determined in accordance with the terms

of the Offer. Shares deposited at or below the finally determined

purchase price will be purchased at such purchase price. Shares

that are not taken up in connection with the Offer, including

Shares deposited pursuant to auction tenders at prices above the

purchase price, will be returned to Shareholders that tendered to

the Offer.

If the aggregate purchase price for Shares validly tendered

pursuant to auction tenders and purchase price tenders is greater

than the amount available for auction tenders and purchase price

tenders, the Company will purchase Shares from the holders of

Shares who made purchase price tenders or tendered at or below the

finally determined purchase price on a pro rata basis, except that

“odd lot” holders (holders of less than 100 Shares) will not be

subject to proration.

The Offer will commence on August 2, 2022 and expire at 5:00

p.m. (Eastern time) on September 8, 2022 (the “Expiration Time”),

unless withdrawn or extended. The Offer will not be conditional

upon any minimum number of Shares being tendered. The Offer will,

however, be subject to other conditions and the Company will

reserve the right, subject to applicable laws, to withdraw or amend

the Offer, if, at any time prior to the payment of deposited

Shares, certain events occur.

Under the Company’s normal course issuer bid that commenced on

November 11, 2021 (the “NCIB”), the Company purchased for

cancellation an aggregate of 6,041,701 Shares, being the maximum

allowable number of Shares that may be purchased under the NCIB.

Accordingly, the Company will not be making further acquisitions of

Shares pursuant to the NCIB prior to its expiry on November 10,

2022.

The Board of Directors of the Company believes that the Offer is

a prudent use of the Company's financial resources given the

Company's business profile and assets, the current market price of

the Shares and the Company's ongoing cash requirements. The Board

of Directors of the Company also believes the Offer will provide

Shareholders with the option to access liquidity with respect to

their Shares that may not otherwise be available on the TSX. The

Company plans to fund repurchases of Shares through available cash

on hand. The Offer is optional for all shareholders, who are free

to choose whether to participate, how many Shares to tender and, in

the case of auction tenders, at what price to tender within the

specified range. Any shareholders who do not deposit their Shares

(or whose Shares are not repurchased under the Offer) will realize

a proportionate increase in their equity interest in the Company,

to the extent that Shares are purchased under the Offer.

Interfor directors and officers do not have a present intention

to tender any Shares pursuant to the Offer.

Details of the Offer, including instructions for tendering

Shares to the Offer and the factors considered by the Board of

Directors in making its decision to approve the Offer, will be

included in the formal offer to purchase and issuer bid circular

and other related documents (the “Offer Documents”). The Offer

Documents will be mailed to Shareholders, filed with applicable

Canadian securities regulatory authorities and made available

without charge on SEDAR at www.sedar.com, and posted on the

Company’s website at www.interfor.com.

Interfor has engaged RBC Capital Markets (“RBC”) as financial

advisor to the Offer. The Board of Directors of the

Company has obtained a liquidity opinion, on a voluntary basis,

from RBC to the effect that, based on and subject to the

qualifications, assumptions and limitations stated in such opinion,

a liquid market for the Shares exists as of July 25, 2022, and that

it is reasonable to conclude that, following the completion of the

Offer in accordance with its terms, there will be a market for the

holders of Shares who do not tender to the Offer that is not

materially less liquid than the market that existed at the time of

the making of the Offer. A copy of the opinion of RBC will be

included in the Offer Documents.

Computershare Investor Services Inc. has been engaged by

Interfor to act as depository for the Offer. Shareholders who have

questions regarding the Offer or require any assistance tendering

Shares may contact Computershare Investor Services by telephone at

1-800-564-6253 (North America) or 514-982-7555 (International), or

by e-mail at corporateactions@computershare.com.

Interfor has not engaged a dealer manager for the Offer but

reserves the right to do so before the Offer expires.

The Board of Directors of the Company has approved the Offer.

However, none of the Company, its Board of Directors, RBC or

Computershare makes any recommendation to any Shareholder as to

whether to deposit or refrain from depositing Shares under the

Offer. Shareholders are urged to evaluate carefully all information

in the Offer Documents, consult their own financial, legal,

investment and tax advisors and make their own decisions as to

whether to deposit Shares under the Offer, and, if so, how many

Shares to deposit and at what price(s).

The Offer referred to in this news release has not yet

commenced. This news release is for informational purposes only and

does not constitute an offer to buy or the solicitation of an offer

to sell Shares. The solicitation and the offer to buy Shares will

only be made pursuant to the Offer Documents that are filed with

the Canadian securities regulatory authorities. The offer will not

be made to, nor will tenders be accepted from or on behalf of,

holders of Shares in any jurisdiction in which the making or

acceptance of offers to sell Shares would not be in compliance with

the laws of that jurisdiction.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking information about the

Company’s current intentions regarding commencement of the Offer,

the timing of the Offer, terms and conditions of the Offer, the

ultimate purchase price, the number of Shares to be purchased and

the amount of capital to be returned to shareholders under the

Offer. Any such forward-looking information is based on information

currently available to Interfor and is based on assumptions and

analyses made in light of Interfor’s experience and perception of

historical trends and current conditions. Readers are cautioned

that actual results may vary from the forward-looking information,

and undue reliance should not be placed on such forward-looking

information. Risk factors that could cause actual results to differ

materially from the forward-looking information in this release are

described in Interfor’s most recent first quarter and annual

Management’s Discussion and Analysis under the heading “Risks and

Uncertainties”, which are available on www.interfor.com and under

Interfor’s profile on www.sedar.com. Unless otherwise indicated,

the forward-looking statements in this release are based on the

Company’s expectations at the date of this release. Interfor

undertakes no obligation to update such forward-looking information

or statements, except as required by law.

ABOUT INTERFOR

Interfor is a growth-oriented forest products company with

operations in Canada and the United States. The Company has annual

lumber production capacity of approximately 4.7 billion board feet

and offers a diverse line of lumber products to customers around

the world. For more information about Interfor, visit our website

at www.interfor.com.

Investor Contacts:

Rick Pozzebon, Senior Vice President & Chief Financial

Officer(604) 689-6804

Mike Mackay, Vice President of Corporate Development &

Strategy (604) 689-6846

Media Contact:

Svetlana Kayumova, Manager of Corporate Affairs(604)

422-7329svetlana.kayumova@interfor.com

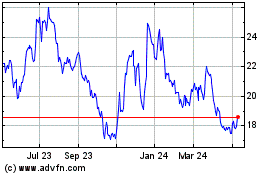

Interfor (TSX:IFP)

Historical Stock Chart

From Dec 2024 to Jan 2025

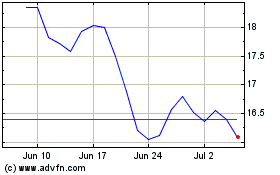

Interfor (TSX:IFP)

Historical Stock Chart

From Jan 2024 to Jan 2025