High Arctic Energy Services Inc. (TSX: HWO) ("High Arctic" or the

"Corporation") announces that, further to the Corporation’s news

releases dated May 11, 2024 and May 21, 2024, and the management

information circular of the Corporation dated May 9, 2024 (the

“Information Circular”), which was mailed to shareholders of the

Corporation, the Corporation has filed the management’s discussion

and analysis for High Arctic Energy Services Cyprus Limited (“HAES

Cyprus”) for the years ended December 31, 2023, 2022 and 2021 (the

“MD&A”) on the Corporation's profile on SEDAR+ at

www.sedarplus.ca. The MD&A was not included in the Information

Circular as a result of a clerical error made on compiling the

Information Circular.

As previously announced, the Information

Circular relates to, among other things, a proposed plan of

arrangement (the "Arrangement") between the Corporation and High

Arctic Overseas Holdings Corp. (“SpinCo”) and a proposed return

of capital to shareholders of the Corporation ("Return of

Capital").

The Corporation will provide, free of charge, a

copy of the omitted MD&A upon request by any interested party.

Please request a copy of the MD&A by sending an email to

info@haes.ca. In the subject line of the email state "MD&A" and

in the body of the email please provide your full name and mailing

address, or email address if an emailed copy is requested, to

ensure your request will be expedited.

The following is a summary of the highlights of

the MD&A. This summary is qualified in its entirety by the full

text of the MD&A.

The following is a summary review of risks, the

results of operations, liquidity, and capital resources of HAES

Cyprus and should be read in conjunction with the audited

consolidated financial statements and notes of HAES Cyprus for the

years ended December 31, 2023, 2022 and 2021, and the full text of

the MD&A.

CORPORATE PROFILEHeadquartered

in Nicosia, HAES Cyprus provides services in Papua New Guinea

(“PNG”) through its wholly owned subsidiaries to the extractive

industries with particular focus on exploration and production

companies operating in the energy sector. HAES Cyprus conducts its

business operations in three separate operating segments: Drilling

Services, Ancillary Services and Production Services.

Select Comparative Financial

Information

The following is a summary of select financial

information for HAES Cyprus:

|

|

Years ended Dec 31, |

|

|

(thousands of USD) |

|

2023 |

|

2022 |

|

2021 |

|

|

Operating results |

|

|

|

|

| Revenue |

|

43,380 |

|

29,929 |

|

11,750 |

|

| Net loss (2) |

|

(8,623 |

) |

(4,958 |

) |

(5,021 |

) |

| Oilfield services operating

margin (1) |

|

14,416 |

|

5,598 |

|

3,730 |

|

|

Oilfield services operating margin as a % of revenue (1) |

|

33.2 |

% |

18.7 |

% |

31.7 |

% |

| EBITDA (1) (2) |

|

(4,002 |

) |

3,065 |

|

2,004 |

|

| Adjusted EBITDA (1) |

|

11,354 |

|

5,517 |

|

1,975 |

|

|

Adjusted EBITDA as a % of revenue (1) |

|

26.2 |

% |

18.4 |

% |

16.8 |

% |

|

Operating income (loss) (1) |

|

4,575 |

|

(5,753 |

) |

(7,033 |

) |

|

Cash flow from operations: |

|

|

|

|

| Cash flow from (used in)

operating activities |

|

8,906 |

|

2,632 |

|

(1,898 |

) |

| Funds flow from operating

activities (1) |

|

10,273 |

|

512 |

|

1,682 |

|

| Capital

expenditures |

|

1,080 |

|

401 |

|

1,870 |

|

|

|

|

As at December 31 |

|

|

(thousands of USD) |

|

2023 |

|

2022 |

|

2021 |

|

|

Financial position: |

|

|

|

|

| Working capital (1) |

|

20,335 |

|

12,173 |

|

12,442 |

|

| Cash and cash equivalents |

|

10,958 |

|

3,846 |

|

1,886 |

|

| Total assets |

|

43,374 |

|

50,570 |

|

68,462 |

|

|

Shareholder’s equity |

|

33,112 |

|

41,734 |

|

57,445 |

|

|

(1) |

Oilfield services operating margin, EBITDA (Earnings before

interest, tax, depreciation, and amortization), Adjusted EBITDA,

Operating loss, Funds flow from operating activities and Working

capital do not have a standardized meanings prescribed by IFRS –

see “Non IFRS Measures”. |

| (2) |

Net loss, EBITDA and other financial results presented were

impacted by a ($2,858) inventory adjustment in 2022 and by

($15,200) asset impairment in 2023. |

| |

|

Operating Results

Drilling services segment

|

|

Years ended Dec 31, |

|

|

(thousands of USD, unless otherwise noted) |

|

2023 |

|

2022 |

|

2021 |

|

| Revenue |

|

35,494 |

|

23,600 |

|

8,456 |

|

|

Oilfield services expense |

|

26,980 |

|

22,399 |

|

7,139 |

|

|

Oilfield services operating margin(1) |

|

8,514 |

|

1,201 |

|

1,317 |

|

|

Operating margin (%) |

|

24.0 |

% |

5.1 |

% |

15.6 |

% |

(1) See “Non-IFRS Measures”

Revenues for FY 2023 increased over the

comparable period in 2022 and 2021 primarily as revenues generated

from the reactivation of Rig 103 in mid-March of 2023 far exceeded

revenues earned in 2022 from the short-term contract awarded to Rig

115, and the lack of any meaningful drilling activity in 2021.

Slightly offsetting the increased revenue from the higher drilling

rig utilization in FY 2023 was a reduced level of revenue from the

provision of manpower as personnel were allocated to roles in or

supporting the increased drilling operations.

Operating margin as a percentage of revenues

increased in FY 2023. This was attributable to increased activity

resulting from the full utilization of PNG Rig 103 from mid-March

2023 to the end of 2023. 2022 margins were negatively impacted by

the inventory adjustment and obsolescence provision of $2,858

recorded and low margin reimbursable expenses incurred on behalf of

HAES Cyprus’ customer in preparation for reactivating Rig 103 the

following year.

Ancillary services segment

|

|

Years ended Dec 31, |

|

|

(thousands of USD, unless otherwise noted) |

|

2023 |

|

2022 |

|

2021 |

|

| Revenue |

|

7,886 |

|

6,329 |

|

3,294 |

|

|

Oilfield services expense |

|

1,937 |

|

1,866 |

|

806 |

|

|

Oilfield services operating margin(1) |

|

5,949 |

|

4,463 |

|

2,488 |

|

|

Operating margin (%) |

|

75.4 |

% |

70.5 |

% |

75.5 |

% |

(1) See “Non-IFRS Measures”

The Ancillary services segment consists of HAES

Cyprus’ oilfield rental equipment in PNG. In 2023, rental services

revenue increased over FY 2022 as additional rental equipment was

deployed with the Rig 103 drilling operations in PNG.

Operating margin as a percentage of revenues

increased in FY 2023 from 70.5% in FY 2022 to 75.4%. This was

attributable to higher revenue results being spread over the

relatively fixed cost base inherent in HAES Cyprus’ Ancillary

services segment.

General and Administrative (“G&A”)

|

|

Years ended Dec 31, |

|

|

(thousands of USD, unless otherwise noted) |

|

2023 |

|

2022 |

|

2021 |

|

|

G&A |

|

3,619 |

|

3,657 |

|

2,420 |

|

|

Percent of revenue (%) |

|

8.3 |

% |

12.2 |

% |

20.6 |

% |

| |

|

|

|

|

|

|

|

G&A expenses totaled $3,619 for FY 2023,

consistent with the $3,657 incurred in 2022 which itself was up 51%

from 2021 as PNG exited the deepest restrictions imposed to attempt

to control the spread of COVID-19 and HAES Cyprus returned

personnel to full time employment. When compared to 2022 G&A,

costs were relatively flat as headcount remained consistent

throughout the two years.

Non-IFRS MeasuresThis summary

contains references to certain financial measures that do not have

a standardized meaning prescribed by IFRS and may not be comparable

to the same or similar measures used by other companies. HAES

Cyprus uses these financial measures to assess performance and

believes these measures provide useful supplemental information to

shareholders and investors. These financial measures are computed

on a consistent basis for each reporting period and include

earnings from operations before interest, taxes, depreciation, and

amortization ("EBITDA), adjusted EBITDA, oilfield services

operating margin, oilfield services operating margin %, operating

income (loss), funds flow from operations, and working capital.

Please refer to the "Non-IFRS Measures" section

of the MD&A for a full description of each non-IFRS measure and

the assumptions and limitations of each measure.

Adjusted EBITDA The following

table provides a quantitative reconciliation of consolidated net

loss, as disclosed in the consolidated statements of loss and

comprehensive loss, to EBITDA and Adjusted EBITDA for the years

ended December 31, 2023, 2022 and 2021:

|

|

Years ended Dec 31, |

|

|

(thousands of USD) |

|

2023 |

|

2022 |

|

2021 |

|

| Net loss |

|

(8,623 |

) |

(4,958 |

) |

(5,021 |

) |

| Add: |

|

|

|

|

| Interest income |

|

- |

|

(586 |

) |

(389 |

) |

| Bank charges and finance

expenses |

|

243 |

|

107 |

|

20 |

|

| Income tax expense

(recovery) |

|

(1,844 |

) |

808 |

|

(949 |

) |

|

Depreciation |

|

6,222 |

|

7,694 |

|

8,343 |

|

|

EBITDA |

|

(4,002 |

) |

3,065 |

|

2,004 |

|

| Adjustments to EBITDA: |

|

|

|

|

| Inventory adjustments |

|

- |

|

2,858 |

|

- |

|

| Asset impairment expense |

|

15,200 |

|

- |

|

- |

|

| Loss (gain) on sale of

property and equipment |

|

13 |

|

(416 |

) |

(39 |

) |

| Foreign

exchange loss |

|

143 |

|

10 |

|

10 |

|

|

Adjusted EBITDA |

|

11,354 |

|

5,517 |

|

1,975 |

|

|

|

|

|

|

|

|

|

|

Oilfield services operating

marginThe table under “Oilfield services operating margin

%” below provides a quantitative reconciliation of revenue, as

disclosed in the consolidated statements of loss and comprehensive

loss, to oilfield services operating margin and oilfield operating

margin % for the years ended December 31, 2023, 2022 and 2021.

Oilfield services operating margin

% The following table provides a quantitative calculation

of oilfield services operating margin and %:

|

|

Years ended Dec 31, |

|

|

(thousands of USD, unless otherwise noted) |

|

2023 |

|

2022 |

|

2021 |

|

| Revenue |

|

43,380 |

|

29,929 |

|

11,750 |

|

|

Oilfield services expenses |

|

(28,964 |

) |

(24,331 |

) |

(8,020 |

) |

|

Oilfield services operating margin |

|

14,146 |

|

5,598 |

|

3,730 |

|

|

Oilfield services operating margin % |

|

33.2 |

% |

18.7 |

% |

31.7 |

% |

| |

|

|

|

|

|

|

|

Operating income (loss)

The table disclosed below provides a

quantitative reconciliation of revenue, as disclosed in the

consolidated statements of comprehensive loss to operating income

(loss) for the years ended December 31, 2023, 2022 and 2021:

|

|

Years ended Dec 31, |

|

|

(thousands of USD) |

|

2023 |

|

2022 |

|

2021 |

|

| Revenue |

|

43,380 |

|

29,929 |

|

11,750 |

|

| Oilfield services

expenses |

|

(28,964 |

) |

(24,331 |

) |

(8,020 |

) |

| G&A expenses |

|

(3,619 |

) |

(3,657 |

) |

(2,420 |

) |

|

Depreciation |

|

(6,222 |

) |

(7,694 |

) |

(8,343 |

) |

|

Operating income (loss) |

|

4,575 |

|

(5,753 |

) |

(7,033 |

) |

| |

|

|

|

|

|

|

|

Percentage of revenueCertain

figures are stated as a percentage of revenue and are used by

management to analyze individual components of expenses to evaluate

HAES Cyprus’ performance from prior periods and to compare its

performance to other companies.

Funds flow from operationsThe

following tables provide a quantitative reconciliation of net cash

generated from (used in) operating activities, as disclosed in the

consolidated statements of cash flows, to funds flow from (used in)

operations for years ended December 31, 2023, 2022 and 2021:

|

|

Years ended Dec 31, |

|

|

(thousands of USD) |

|

2023 |

|

2022 |

|

2021 |

|

| Net cash generated from (used

in) operating activities |

|

8,906 |

|

2,632 |

|

(1,898 |

) |

| Less: |

|

|

|

|

|

| Changes

in non-cash working capital balances - operating |

|

(1,367 |

) |

2,120 |

|

(3,580 |

) |

|

Funds flow from operations |

|

10,273 |

|

512 |

|

1,682 |

|

|

|

|

|

|

|

|

|

|

Working capital

The following tables provide a quantitative

reconciliation of current assets, as disclosed in the consolidated

statements of financial position, to working capital as at December

31, 2023, 2022 and 2021:

|

(thousands of USD) |

As at Dec 31, 2023 |

|

As at Dec 31, 2022 |

|

As at Dec 31, 2021 |

|

|

Current assets |

30,090 |

|

17,905 |

|

18,687 |

|

| Current

liabilities |

(9,755 |

) |

(5,732 |

) |

(6,245 |

) |

|

Working capital |

20,335 |

|

12,173 |

|

12,442 |

|

|

Working capital ratio |

3.1:1 |

|

3.1:1 |

|

3.0:1 |

|

| |

|

|

|

|

|

|

For more information on the Arrangement and the

Return of Capital, please see the Information Circular and the

Corporation's news releases dated May 11, 2024 and May 24, 2024,

available on the Company’s SEDAR+ profile at www.sedarplus.com.

About High ArcticHigh Arctic is

an energy services provider. High Arctic is a market leader in

Papua New Guinea providing drilling and specialized well completion

services and supplies rental equipment including rig matting,

camps, material handling and drilling support equipment. In western

Canada, High Arctic provides pressure control and other oilfield

equipment on a rental basis to exploration and production

companies, from its bases in Whitecourt and Red Deer, Alberta.

For further information, please contact:

Lonn BateInterim

Chief Financial Officer1.587.318.22181.800.668.7143

High Arctic Energy Services Inc.Suite

2350, 330–5th Avenue SWCalgary, Alberta, Canada T2P 0L4website:

www.haes.caEmail: info@haes.ca

Forward-Looking Statements

Forward-Looking Statements. Certain statements

contained in this press release may constitute forward-looking

statements. These statements relate to future events. All

statements other than statements of historical fact may be

forward-looking statements. Forward-looking statements are often,

but not always, identified by the use of words such as "seek",

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", "predict", "potential", "targeting", "intend",

"could", "might", "should", "believe" and similar expressions.

These statements involve known and unknown risks, uncertainties

and other factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. High Arctic believes that the expectations reflected

in those forward-looking statements are reasonable, but no

assurance can be given that these expectations will prove to be

correct and such forward-looking statements included in this press

release should not be unduly relied upon by investors. These

statements speak only as of the date of this press release and are

expressly qualified, in their entirety, by this cautionary

statement.

In particular, this press release contains

forward-looking statements, pertaining to the following: the

timing and anticipated receipt of required regulatory (including

stock exchange), court, and shareholder approvals for the

Arrangement; the ability of High Arctic to satisfy the other

conditions to, and to complete, the Arrangement; and the closing

of the Arrangement, the approval by the Board and the amount and

payment of the Return of Capital.

In respect of the forward-looking statements and

information concerning the anticipated completion of the proposed

Arrangement and related transactions, High Arctic has provided

them in reliance on certain assumptions that it believes are

reasonable at this time, including assumptions as to the ability

of the parties to receive, in a timely manner, the necessary

regulatory, court, shareholder and other third party approvals;

and the ability of the parties to satisfy, in a timely manner, the

other conditions to the closing of the Arrangement. These dates

may change for a number of reasons, including unforeseen delays in

preparing meeting material; inability to secure necessary

shareholder, regulatory, court or other third-party approvals in

the time assumed or the need for additional time to satisfy the

other conditions to the completion of the Arrangement. Accordingly,

readers should not place undue reliance on the forward-looking

statements and information contained in this news release

concerning these times.

This forward-looking information represents High

Arctic’s views as of the date of this document and such

information should not be relied upon as representing its views as

of any date subsequent to the date of this document. High Arctic

has attempted to identify important factors that could cause

actual results, performance or achievements to vary from those

current expectations or estimates expressed or implied by the

forward-looking information. However, there may be other factors

that cause results, performance or achievements not to be as

expected or estimated and that could cause actual results,

performance or achievements to differ materially from current

expectations. There can be no assurance that forward-looking

information will prove to be accurate, as results and future events

could differ materially from those expected or estimated in such

statements. Accordingly, readers should not place undue reliance

on forward-looking information. Except as required by law, High

Arctic undertakes no obligation to publicly update or revise any

forward-looking statements.

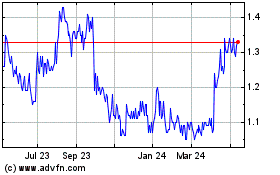

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

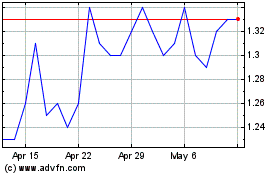

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Dec 2023 to Dec 2024