High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) released its’ fourth quarter and year-end results

today. The audited consolidated financial statements, management

discussion & analysis (“MD&A”), and annual information form

for the year ended December 31, 2023 will be available on SEDAR at

www.sedar.com, and on High Arctic’s website at www.haes.ca. All

amounts are denominated in Canadian dollars (“CAD”), unless

otherwise indicated.

The Corporation provided an update today on the

intention to issue shareholders a tax efficient return of capital

to a maximum of $38.2 million and plan to reorganize the

Corporation at a special meeting of the Shareholders. The

recommendation to reorganize is expected to include the following

elements:

- a spinoff of the international business to shareholders as a

Canadian publicly listed company,

- maintaining the Corporation as a Canadian publicly listed

company focused on growing the Canadian business,

- distribution of a return of capital to shareholders of between

$33.0 million and $38.2 million before July 26, 2024, and

- right-sizing the general and administrative infrastructure to

align with the new corporate structure.

The Corporation is working with DLA Piper

(Canada) LLP as legal advisor and Lightyear Capital Inc. as

financial advisor on the revised reorganization plan. The

completion of which will be subject to Board, stock exchange,

applicable regulatory and shareholder approval at a special meeting

of the Shareholders to be held before the end of June 2024.

Mike Maguire, Chief Executive Officer commented:

“Our businesses in both Canada and PNG have

finished the year with a solid quarter and we made an exciting

acquisition with the purchase and amalgamation of Delta Rental

Services in Canada.

Following the receipt of feedback from our

shareholders and consultation with our advisors, I am excited to

provide today’s update on the path the Board intends to take in

order to reorganize the Corporation and release a tax-efficient

return of cash to shareholders.

The proposed spin-off of the Papua New Guinean

business as a publicly listed Canadian company will allow senior

management to concentrate where we have had the most success in the

past. The remaining publicly listed company with the Canadian

assets has been further strengthened with the addition of Delta

Rental Services and becomes an attractive vehicle for future growth

and transactions.

I continue to believe our customers and

employees in both PNG and Canada will appreciate and benefit from

locally managed businesses.”

Expectations that Rig 103 drilling activity will

be concluded by the end of June 2024 have been confirmed with the

receipt of formal notice from High Arctic’s principal customer in

PNG of its intention to suspend drilling operations and cold stack

Rig 103 at the conclusion of this final approved well on the Rig

103 drilling schedule. The Corporation remains engaged with its

principal customer on planning for 2025 drilling activity. Further,

the PNG Government and Papua-LNG operator TotalEnergies have

released a joint statement advising that the FID of the Papua-LNG

project is now expected in 2025.

In the following discussion, the three months

ended December 31, 2023 may be referred to as the

“Quarter” or “Q4 2023”, and

similarly the year ended December 31, 2022 may be referred to as

“YTD 2022”. The comparative three months ended

December 31, 2022 may be referred to as “Q4 2022”

and similarly the year ended December 31, 2022 may be referred to

as “YTD 2022”. References to other quarters may be

presented as “QX 20XX” with X

being the quarter/year to which the commentary relates.

2023 HighlightsThe following

highlights the Corporation’s results for Q4 2023 and YTD 2023:

- Acquired Delta late in Q4 2023

which expanded High Arctic’s geographical coverage in Alberta and

offers both operational synergies and potential for cross

deployment of underutilized assets in the Canadian rentals

business.

- Realized a third continuous quarter

of full utilization of PNG Rig 103 in Q4 2023, pursuant to a 3-year

contract that was renewed in 2022.

- Improved liquidity with a working

capital balance of $63.0 million, which includes a cash balance of

$50.3 million, and long-term debt of $3.5 million.

- Generated Adjusted EBITDA from

continuing operations of $11.8 million in FY 2023 and $3.2 million

in Q4 2023.

- Realized a net loss from continuing

operations of $12.8 million in FY 2023 and net income from

continuing operations of $2.7 million in Q4 2023. The loss was

primarily due to a non-cash impairment loss of $20.5 million on PNG

asset carrying values.

- Sold the Corporation’s Canadian

Nitrogen transportation, hauling and pumping services business for

cash consideration of $1.35 million.

2024 StrategyHigh Arctic’s 2024

Strategic Objectives build on the platforms created and directions

taken in 2023, and include:

- Continued relentless focus on

safety excellence and quality service delivery,

- Distribute surplus capital and

prepare for the spin out of the PNG Business to shareholders,

- Create appropriate capital and

corporate structures for the current businesses, that provide the

opportunity to consider transactions which would create value for

the Corporation’s shareholders,

- Grow the core businesses through

selective and opportunistic investments,

- Steward capital to preserve balance

sheet strength and financial flexibility, and

- Accretive acquisitions in Canada

that allow the Corporation to optimize its available tax loss

carry-forwards.

2023 Strategic Objectives and

AccomplishmentsThrough 2023, High Arctic continued its

relentless focus on quality and remains driven to be recognized as

a trusted service provider in the energy industry. High Arctic

works towards this by defining and measuring results against

strategic priorities. Our 2023 strategic priorities and highlights

of progress include:

- Safety excellence and quality

service delivery:

- High Arctic extended its recordable

incident free activity in PNG to 7 years and over 3.5 million work

hours.

- In Canada, High Arctic completed

2023 without any recordable incidents, contributing to the

Corporation’s first calendar year with a zero Total Recordable

Incident Frequency (“TRIF”) Rate.

- Return idled assets to service in

PNG:

- Successfully reactivated Rig 103

and returned it to continuous reliable service.

- Returned idled rental assets to

service in PNG including cranes, trucks and material handling

equipment.

- Scaling our Canadian business:

- High Arctic completed the

acquisition of Delta, representing a multi-fold increase in the

Canadian rentals business in terms of revenue, deployable assets,

personnel and geographic coverage.

- Opportunities for growth and

corporate transactions that enhance shareholder value:

- Acquired Delta, immediately adding

free cash flow and operational synergies to the Canadian Rentals

business.

- Leveraged the Corporation’s

capability in the provision and development of labour and skilled

personnel through the re-launch of the PNG Industry Manpower

Solutions brand in PNG.

- Announced an intention to

reorganize and separate the Canadian and PNG businesses under

focused local leadership and open up the separated businesses to a

wider array of regional transaction opportunities in their

respective markets.

- Examination of the Corporation’s

optimal capital structure and dividend policy:

- Pursuant to the intended

reorganization, the Corporation announced an intention to

distribute surplus cash to shareholders by way of a tax-efficient

return of capital.

- Intended spin-out of the PNG

Business from the Corporation to the Corporation’s shareholders is

anticipated to improve access to broader sources of cost-efficient

capital for growth.

- High Arctic paid out dividends of

$2.2 million in 2023 and repurchased 18,296 shares for

cancellation. Monthly dividends were suspended on October 23, 2023

to preserve cash to maximize the opportunity to tax-efficiently

return capital.

RESULTS OVERVIEWThe following is a summary of

select financial information of the Corporation:

|

|

Three months ended Dec 31, |

Year ended Dec 31, |

|

|

(thousands of Canadian Dollars, except per share amounts) |

2023 |

2022 |

2023 |

2022 |

|

|

Operating results from continuing operations: |

|

|

|

|

|

|

Revenue – continuing operations |

18,114 |

12,090 |

61,933 |

77,368 |

|

|

Net income (loss) - continuing operations |

2,745 |

(9,229) |

(12,834) |

(36,127) |

|

|

Per share (basic & diluted) |

0.06 |

(0.09) |

(0.25) |

(0.74) |

|

|

Oilfield services operating margin - continuing operations |

6,048 |

(3,242) |

21,263 |

11,126 |

|

|

Oilfield services operating margin as a % of revenue |

33.4% |

(26.8%) |

34.3% |

14.4% |

|

|

EBITDA - continuing operations |

2,982 |

(5,860) |

(8,126) |

(8,859) |

|

|

Adjusted EBITDA - continuing operations |

3,240 |

(1,168) |

11,797 |

5,519 |

|

|

Adjusted EBITDA as a % of revenue |

17.9% |

(9.7%) |

19.0% |

7.1% |

|

|

Operating income (loss) - continuing operations |

1,720 |

(8,127) |

1,348 |

(16,233) |

|

|

Cash flow from continuing operations: |

|

|

|

|

|

|

Cash flow from continuing operating activities |

8,002 |

227 |

11,394 |

7,717 |

|

|

Per share (basic & diluted) |

0.16 |

0.00 |

0.23 |

0.16 |

|

|

Funds flow from continuing operating activities |

3,452 |

(8,315) |

11,922 |

(3,125) |

|

|

Per share (basic & diluted) |

0.07 |

(0.17) |

0.24 |

(0.06) |

|

|

Dividends declared |

- |

975 |

2,190 |

2,193 |

|

|

Per share (basic & diluted) |

- |

0.02 |

0.05 |

0.05 |

|

|

Capital expenditures |

130 |

97 |

1,959 |

4,037 |

|

|

As at December 31 |

|

|

(thousands of Canadian Dollars, except per share amounts) |

|

2023 |

2022 |

2021 |

|

|

Financial position: |

|

|

|

|

|

|

Working capital |

|

62,985 |

59,461 |

29,724 |

|

|

Cash and cash equivalents |

|

50,331 |

19,559 |

12,037 |

|

|

Total assets |

|

123,137 |

133,957 |

185,452 |

|

|

Long-term debt (non-current) |

|

3,352 |

4,028 |

7,779 |

|

|

Shareholders’ equity |

|

99,332 |

115,231 |

148,851 |

|

|

Per share (basic) |

|

2.04 |

2.37 |

3.05 |

|

|

Common shares outstanding |

|

49,122,302 |

48,691,864 |

48,733,145 |

|

|

|

|

|

|

|

|

Three-month period ended December 31, 2023

Summary:

- Drilling Rig 103 operated

continuously through Q4 2023 driving substantive increases in both

the Drilling Services and Ancillary Services segments from pull

through rentals associated with drilling activity coupled with

increased contribution from Canadian rentals. This delivered the

following financial results:

- Revenue for the quarter from

continuing operations was $18,114, up marginally from Q3 2023 and

an increase of $6,024 compared to Q4 2022 at $12,090, and

- Adjusted EBITDA from continuing

operations of $3,240 was achieved in Q4 2023, comparable to Q3 2023

and an increase of $4,408 over Q4 2022.

- The improved operations in Q4 2023

combined with increased investment income in the quarter and the

impact of PNG inventory adjustment and obsolescence provision of

$3,704 recorded in Q4 2022 drove the following improved financial

results for the Corporation:

- Net income of $2,745 from

continuing operations in Q4 2023 compared to a net loss from

continuing operations of $9,229 realized in Q4 2022, and

- Increased oilfield services

operating margins from (26.8%) in Q4 2022 to 33.4% in Q4 2023.

Year ended December 31, 2023

Summary:

- Revenue from continuing operations

for 2023 was $61,933, a decrease of $15,435 compared to the revenue

from continuing operations for 2022 at $77,368. The decrease is a

result of revenue increases in the Drilling Services and Ancillary

Services segments partially offsetting a revenue decrease of

$36,100 in the Production Services segment as a result of the 2022

Sale Transactions’ impact on Production Services segment

results.

- Adjusted EBITDA from continuing

operations was $11,797 in 2023, a significant increase of $6,278,

or 114% when compared to 2022. This increase is primarily

attributable to the 2022 Sale Transactions as the sale of these

underperforming businesses has positively impacted the

EBITDA-generating capability of High Arctic. Additionally,

meaningful EBITDA was generated in FY 2023 with the increase in

active drilling in PNG and the increased deployment of rental

equipment in PNG.

- High Arctic generated a net loss of

$12,834 from continuing operations in 2023 compared to a net loss

of $36,127 in the corresponding period of 2022. This reduction in

net loss was primarily attributable to improved PNG operating

results and the sale of the underperforming Canadian assets and

business disposed of in both 2022 and 2023. The Corporation would

have recorded positive net income in 2023 had it not recorded an

impairment loss of $20,500 in Q3 2023 on its PNG Operations cash

generating unit (“CGU”).

- Oilfield services operating margins

improved as a percent of revenue from 14.4% in 2022 to 34.3% in

2023. This improvement is primarily a result of the strength in the

Ancillary Services segment and the 2022 Sale Transactions impact on

Production Services segment results and the impact of the inventory

adjustment and obsolescence provision of $3,704 recorded in Q4

2022.

- Supported by operational

performance during 2023, High Arctic strengthened its balance sheet

as working capital increased by $3,524 and $2,190 was returned to

shareholders in the form of dividends.

Drilling services segment

|

|

Three months ended Dec 31, |

Year ended Dec 31, |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2023 |

2022 |

2023 |

2022 |

|

|

Revenue |

14,257 |

10,126 |

47,910 |

30,671 |

|

|

Oilfield services expense |

(11,122) |

(13,498) |

(36,597) |

(29,330) |

|

|

Oilfield services operating margin |

3,135 |

(3,372) |

11,313 |

1,341 |

|

|

Operating margin (%) |

22.0% |

(33.3%) |

23.6% |

4.4% |

|

|

|

|

|

|

|

|

Ancillary services segment

|

|

Three months ended Dec 31, |

Year ended Dec 31, |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2023 |

2022 |

2023 |

2022 |

|

|

Revenue – continuing operations |

3,857 |

1,963 |

14,023 |

12,198 |

|

|

Oilfield services expense – continuing operations |

(925) |

(1,422) |

(4,016) |

(4,882) |

|

|

Oilfield services operating margin |

2,932 |

541 |

10,007 |

7,316 |

|

|

Operating margin (%) |

76.0% |

27.6% |

71.4% |

60.0% |

|

|

|

|

|

|

|

|

Production services segment

|

|

Three months ended Dec 31, |

Year ended Dec 31, |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2023 |

2022 |

2023 |

2022 |

|

|

Revenue |

- |

1 |

- |

36,100 |

|

|

Oilfield services expense |

(19) |

(412) |

(57) |

(33,631) |

|

|

Oilfield services operating margin |

(19) |

(411) |

(57) |

2,469 |

|

|

Operating margin (%) |

nm |

nm |

nm |

6.8% |

|

|

|

|

|

|

|

|

Liquidity and capital resources

|

|

Three months ended Dec 31, |

Year ended Dec 31, |

|

|

(thousands of Canadian Dollars) |

2023 |

2022 |

2023 |

2022 |

|

|

Cash provided by (used in) continued operations: |

|

|

|

|

|

|

Operating activities |

8,002 |

227 |

11,394 |

7,717 |

|

|

Investing activities |

(3,825) |

(61) |

24,180 |

6,684 |

|

|

Financing activities |

76 |

(4,523) |

(3,933) |

(6,737) |

|

|

Effect of exchange rate changes on cash |

(723) |

256 |

(720) |

(256) |

|

|

Increase (decrease) in cash from continuing operations |

3,530 |

(4,101) |

30,921 |

7,408 |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

As at Dec 31, 2023 |

As at Dec 31, 2022 |

|

|

Current assets |

79,438 |

69,278 |

|

|

Working capital |

62,985 |

59,461 |

|

|

Working capital ratio |

4.8:1 |

7.1:1 |

|

|

Cash and cash equivalents |

50,331 |

19,559 |

|

|

Net cash |

46,804 |

15,345 |

|

|

|

|

|

|

The Bank of PNG (“BPNG”) continues to encourage

the use of the local market currency, Kina, or PGK. Due to High

Arctic’s requirement to transact with international suppliers and

customers, High Arctic has received approval from the BPNG to

maintain its USD account within the conditions of the BPNG currency

regulations. The Corporation continues to use PGK for local

transactions when practical. Included in the BPNG’s conditions is

for PNG drilling contracts to be settled in PGK, unless otherwise

approved by the BPNG for the contracts to be settled in USD. The

Corporation has historically received such approval for its

contracts with its key customers in PNG. The Corporation will

continue to seek BPNG of PNG approval for contracts to be settled

in USD on a contract-by-contract basis, however, there is no

assurance the BPNG will grant these approvals.

If such approvals are not received, the

Corporation’s PNG drilling contracts will be settled in PGK which

would expose the Corporation to exchange rate fluctuations related

to the PGK. In addition, this may delay the Corporation’s ability

to receive USD which may impact the Corporation’s ability to settle

USD denominated liabilities and repatriate funds from PNG on a

timely basis. The Corporation also requires the approval from the

PNG Internal Revenue Commission (“IRC”) to repatriate funds from

PNG and make payments to non-resident PNG suppliers and service

providers. While delays can be experienced for the IRC approvals,

all such approvals have eventually been received in the past.

Operating ActivitiesIn Q4 2023,

cash generated from operating activities from continuing operations

was $8,002, as compared with $227 of cash generated from operating

activities from continuing operations in Q4 2022. Funds flow from

continuing operations totaled $3,452 in the quarter whereas $8,315

of funds were used in continuing operations in Q4 2022 (see

“Non-IFRS Measures”). In Q4 2023, changes in non-cash working

capital totaled $4,550 versus $8,542 in Q4 2022.

For the year ended December 31, 2023, cash

generated from operating activities from continuing operations was

$11,394, up from $7,717 in the corresponding period of 2022. Funds

flow from continuing operations totaled $11,922 in the year ended

December 31, 2023 whereas $3,125 of cash was used in continuing

operations in 2022 (see “Non-IFRS Measures”). In 2023, there was a

$528 cash outflow from working capital changes compared to an

inflow of $10,842 in 2022.

Investing ActivitiesDuring the

year ended December 31, 2023, the Corporation’s cash from investing

activities from continuing operations was $24,180 (2022: $6,684)

reflecting the receipt of the final cash proceeds of $28,000 from

the Well Servicing Transaction in Q1 2023, and $1,598 proceeds on

disposal of property and equipment (2022: $11,397) offset by $3,430

of cash used to acquire Delta and capital expenditures totaling

$1,959 (2022: $4,037) and a cash outflow of $Nil relating to

working capital balance changes for investing activities (2022:

$676 outflow).

Financing ActivitiesDuring the

year ended December 31, 2023, the Corporation’s cash used in

financing activities was $3,933 (2022: $6,737). During the period,

the Corporation paid $2,190 in dividends (2022: $2,193), $687

(2022: $3,861) towards principal payments on its mortgage financing

(see “Mortgage Financing” below), $1,148 against lease liability

payments (2022: $866), $25 towards the purchase of common shares

for cancellation (2022: $60) and a $243 outflow relating to

non-cash working capital balance changes (2022: $243 inflow).

During 2022, the Corporation incurred higher long-term debt

repayments with the Sale Transactions.

Mortgage financing

|

(thousands of Canadian Dollars) |

As at Dec 31, 2023 |

As at Dec 31, 2022 |

|

|

Current |

175 |

186 |

|

|

Non-current |

3,352 |

4,028 |

|

|

Total |

3,527 |

4,214 |

|

|

|

|

|

|

The Corporation has mortgage financing secured

by lands and buildings owned by High Arctic located within Alberta,

Canada. The mortgage has a remaining term of 3 years with a fixed

interest rate of 4.30% with payments occurring monthly.

The Corporation’s mortgage financing contains

certain non-financial covenants requiring lenders consent including

changes to the underlying business. In conjunction with the sale of

the Corporation’s Nitrogen business, the terms of the Corporation’s

mortgage financing were amended. The amendments resulted in a

one-time repayment of $500 of mortgage principal on July 28, 2023,

the release of the sold assets from the general security of the

mortgage and reduced reporting obligations.

Intention to Return Capital and

ReorganizeOn May 11, 2023, the Corporation announced that

the Board of Directors intended to recommend to shareholders a

tax-efficient return of capital to a maximum of $38.2 million

relating to the Q3 2022 sale of High Arctic’s Canadian well

servicing assets, and a reorganization of the Corporation.

After receipt of feedback from our shareholders

and in consultation with its advisors, the Corporation has

determined that a split of High Arctic into two publicly listed

companies would meet both the goals of strategic business

management and the governance concerns of High Arctic’s

stakeholders. The Corporation is now working on a plan to

reorganize and if it meets board, stock exchange and regulatory

approvals, it would be put forward for consideration and approval

at a special meeting of the Shareholders. The plan to reorganize is

expected to include the following key elements:

- a spinoff of the international

business to shareholders as a Canadian publicly listed

company,

- maintaining the Corporation as a

Canadian publicly listed company focused on growing the Canadian

business,

- distribution of a return of capital

to shareholders of between $33.0 million and $38.2 million before

July 26, 2024, and

- the further right sizing of the

general and administrative infrastructure to align with the new

corporate structure.

OutlookHigh Arctic has begun to

refocus its Canadian business. The acquisition of Delta in December

and its integration with our legacy rentals business in Canada, has

delivered scale for a cash-positive operation. Over the past two

years, the Corporation has divested underperforming and non-core

assets and business. Now the Corporation’s Canadian business

consists of a high-margin equipment rental business centered upon

pressure control, a minority interest in Canada’s largest oilfield

snubbing services business, Team Snubbing Services Inc., and

industrial properties at Clairmont and Whitecourt in Alberta,

Canada.

High Arctic’s investment in Team Snubbing

positively impacted our financial results. In Canada, Team Snubbing

has reported consistent growth in service hours and revenue

generation quarter over quarter in 2023 and the outlook for Q1 2024

and into the traditional spring break-up is for a continuation of

this positive trend. Team’s Snubbing’s international partnership is

planning with customers for high utilization operations for its two

snubbing packages in 2024 as Alaska heads into spring. Coupling the

outlook for Team Snubbing with the strategic growth of our rentals

business through the acquisition of Delta, the Corporation

anticipates strong demand for its equipment in 2024 and the

delivery of improved financial performance in 2024.

During 2024, Canada is poised to expand oil and

gas takeaway capacity to global markets. This is being accomplished

through pipeline projects that finally access tidewater markets.

These developments are expected to add a degree of prosperity and

stability to the upstream energy services activity. So too, the

evolving attitudes to energy security and decarbonization are

stimulating investment in both alternative energy supply and carbon

sequestration. Our Canadian business is now well positioned to

benefit from these positive developments.

The outlook for the Corporation’s PNG business

in 2024 remains subdued. In the Drilling Services segment Rig 103

realized full utilization in Q4 2023 and it is expected to continue

to operate through the first half of 2024. On Friday April 5, 2024,

the Corporation received notice from its principal customer

requesting High Arctic to suspend and cold-stack Rig 103 following

the completion of the remaining approved well on their drilling

schedule. The Ancillary Services segment’s rental fleet of

equipment continues to generate strong utilization and pricing and

our manpower solutions continues to contribute a strong revenue

stream at appropriate margins. With no additional wells for Rig

103, the Corporation expects associated PNG rental revenues to

scale back in the second half of 2024 as well.

In the longer term, PNG is on the precipice of a

new round of large-scale projects in the natural resources sector.

The New-Porgera gold mine has recently commenced mining activity,

representing the first of the major international investment

projects. The others include the Papua LNG project headed up by

French super-major TotalEnergies, which is anticipated to be the

next major project. A final investment decision on Papua-LNG is

progressing slowly with TotalEnergies and the PNG Government

releasing a joint statement on April 7, 2024 guiding towards a

decision in 2025. There is expectation for increased drilling

activity through the latter half of this decade, not only to

develop wells for the supply of gas to the Papua-LNG export

facility, but also to explore for and appraise other discoveries.

The recent signing of a fiscal stability agreement between the

P’nyang gas field joint venture and the government of PNG is

another positive signal for that project to follow Papua-LNG.

There are a number of other petroleum projects

and substantive nation-building projects including infrastructure,

electrification, telecommunications and defense projects planned

for the development of PNG. These projects will require access to

transport and material handling machinery, quality worksite mats

and temporary road mats and a substantive amount of labour

including skilled equipment operators, qualified tradespeople and

engineers, geoscientists and other professionals. High Arctic’s

PNG business continues to position itself to be a meaningful

supplier of services, equipment and manpower for this market.

Recent civil unrest in PNG has led to extra

security measures and to this point, our operations have not been

directly impacted.

Cost discipline and growth in Canada is

supporting the Corporation’s aims to optimize a tax-efficient

return of capital to shareholders. High Arctic is moving to set a

new direction in Canada as we prepare towards a recommendation for

the reorganization and separation of the PNG and Canadian

businesses.

NON - IFRS MEASURESThis press

release contains references to certain financial measures that do

not have a standardized meaning prescribed by International

Financial Reporting Standards (“IFRS”) and may not be comparable to

the same or similar measures used by other companies High Arctic

uses these financial measures to assess performance and believes

these measures provide useful supplemental information to

shareholders and investors. These financial measures are computed

on a consistent basis for each reporting period and include

Oilfield services operating margin, EBITDA (Earnings before

interest, tax, depreciation, and amortization), Adjusted EBITDA,

Operating loss, Funds flow from operating activities, Working

capital and Long-term financial liabilities. These do not have

standardized meanings.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at www.sedar.com

and through High Arctic’s website at www.haes.ca.

FORWARD-LOOKING STATEMENTSThis

press release contains forward-looking statements. When used in

this document, the words “may”, “would”, “could”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”,

“expect”, and similar expressions are intended to identify

forward-looking statements. Such statements reflect the

Corporation’s current views with respect to future events and are

subject to certain risks, uncertainties, and assumptions. Many

factors could cause the Corporation’s actual results, performance,

or achievements to vary from those described in this press

release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, among

others, statements pertaining to the following: general economic

and business conditions which will include, among other things, the

outlook for energy services; continued impact of Russia-Ukraine

conflict; the impact of conflict in the middle east; the

Corporation’s ability to maintain a USD bank account and conduct

its business in USD in PNG; market fluctuations in interest rates,

commodity prices, and foreign currency exchange rates; restrictions

to repatriate funds held in PGK; expectations regarding the

Corporation’s ability to manage its liquidity risk; raise capital

and manage its debt finance agreements; projections of market

prices and costs; factors upon which the Corporation will decide

whether or not to undertake a specific course of operational action

or expansion; the Corporation’s ongoing relationship with its major

customers; the return of capital to the Corporation’s shareholders

and reorganization including spinoff of the PNG Business to

shareholders as a Canadian publicly listed company, distribution of

a return of capital to shareholders, and obtaining applicable

regulatory and shareholder approvals; right sizing of the general

and administrative infrastructure to align with the new corporate

structure; expansion of Canadian oil and gas takeaway capacity to

global markets; the performance of the Corporation’s investment in

Team Snubbing, and whether Team can realize high utilization

operations for its two snubbing packages in 2024 in Alaska; strong

demand for the Corporations Canadian rental equipment in 2024 and

the delivery of improved financial performance in 2024, Papua New

Guinea being on the precipice of a new round of large-scale

projects in the natural resources sector; if and the timing of when

a final investment decision will be made on the Papua-LNG project;

whether the development of the P’nyang gas field will follow

Papua-LNG; whether Rig 103 will continue to operate through the

first half of 2024 and beyond that through the term of its

contract; if the Corporation’s primary customers will add approved

wells to its current drilling schedule, and the corporation’s

expectation of maintaining current financial performance if they

do; the Corporation’s ability to position itself to be a

significant supplier of services, equipment and manpower for other

projects in PNG deploying idle heli-portable drilling rigs 115 and

116; future work with other exploration companies in PNG; scaling

the Canadian business; executing on one or more corporate

transactions; estimated credit risks and the utilization of tax

losses.

With respect to forward-looking statements

contained in this press release, the Corporation has made

assumptions regarding, among other things, its ability to: maintain

its ongoing relationship with major customers; successfully market

its services to current and new customers; devise methods for, and

achieve its primary objectives; source and obtain equipment from

suppliers; successfully manage, operate, and thrive in an

environment which is facing much uncertainty; remain competitive in

all its operations; attract and retain skilled employees; and

obtain equity and debt financing on satisfactory terms.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release, along with the risk factors set

out in the most recent Annual Information Form filed on SEDAR+ at

www.sedarplus.ca.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

ServicesHigh Arctic is an oilfield services company

currently operating in PNG and Western Canada. In PNG, the product

line consists of drilling services, workover services and equipment

rental including rig mats, cranes, and oilfield related equipment.

In Canada, the product line consists primarily of oilfield

equipment and pressure control rentals. The Corporation also offers

snubbing and well servicing activities through its interests in

Team Snubbing Services Inc. and in the Seh’ Chene Well Services

Limited Partnership.

For further information contact:

Mike MaguireChief

Executive OfficerP: +1 (403) 508-7836P: +1 (800) 688 7143

High Arctic Energy Services Inc.Suite

2350, 330 – 5th Ave SWCalgary, Alberta, Canada T2P 0L4

website: www.haes.caEmail:

info@haes.ca

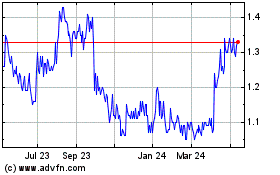

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Nov 2024 to Dec 2024

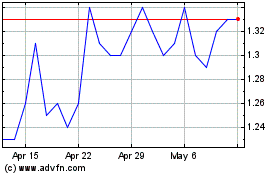

High Arctic Energy Servi... (TSX:HWO)

Historical Stock Chart

From Dec 2023 to Dec 2024