Glacier Media Inc. (“Glacier” or the “Company”) (TSX: GVC)

announced today that the TSX has accepted its notice of intention

to make a normal course issuer bid (the “

Bid”).

The notice provides that Glacier may, during the

twelve-month period commencing April 4, 2022 and ending April 3,

2023 purchase up to 5,300,000 common shares representing 10% of the

“public float” (as defined in the TSX Company Manual) as of the

date hereof (each a “Share”). Daily purchases of

Shares under the Bid will be limited to 20,016 Shares (which is

equal to 25% of the average daily trading volume of Glacier’s

common shares for the most recently completed six calendar months),

subject to certain exceptions. As at the date hereof, there are

132,755,559 common shares of Glacier issued and outstanding and

53,228,912 common shares estimated in the “public float”.

Glacier believes that its Shares are currently

trading, or due to market volatility, may trade, in a price range

that does not adequately reflect their underlying value based on

Glacier’s assets, business prospects and financial positon.

Accordingly, the purchase of Shares will increase the proportionate

Share interest of, and be advantageous to, all remaining

shareholders.

Purchases subject to the Bid will be carried out

pursuant to open market transactions through the facilities of the

TSX by CIBC Capital Markets Inc. on behalf of Glacier in accordance

with applicable regulatory requirements. All Shares purchased by

Glacier under the Bid will be returned to treasury and cancelled.

Glacier has not purchased any of its common shares within the last

12 months.

To the knowledge of the Company, no director,

senior officer or other insider of the Company currently intends to

sell any common shares under this Bid. However, sales by such

persons through the facilities of the TSX may occur if the personal

or corporate circumstances of any such person change or any such

person makes a decision unrelated to the Bid. The Company has

reserved the right to stop the Bid in the event market conditions

justify it.

Glacier also announces that in connection with

the Bid, it has entered into an Automatic Securities Purchase Plan

(“ASPP”) with a designated broker. The ASPP is

intended to allow for the purchase of Shares under the Bid when the

Company would ordinarily not be permitted to purchase shares due to

regulatory restrictions and customary self-imposed blackout

periods.

Pursuant to the ASPP, the Company has provided

instructions to the designated broker to make purchases under the

NCIB in accordance with the terms of the ASPP, which may not be

varied or suspended during the term of the ASPP. Such purchases

will be determined by the designated broker at its sole discretion

based on purchasing parameters set by the Company in accordance

with the rules of the TSX, applicable securities laws and the terms

of the ASPP. Shares will be purchased through the facilities of the

TSX. The ASPP has been pre-cleared by the TSX and will be

implemented on April 4, 2022, and if not terminated sooner based on

the terms of the ASPP, will end on April 3, 2023.

Outside of pre-determined blackout periods,

Shares may be purchased under the Bid based on management’s

discretion, in compliance with TSX rules and applicable securities

laws. All purchases made under the ASPP will be included in

computing the number of Shares purchased under the Bid.

About Glacier

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. The Company’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

Forward Looking Statements

This news release contains forward-looking

statements that relate to, among other things, the Company’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to the Company’s

expectations regarding its share price, assets, business prospects

proposed investments, revenues, expenses, cash flows and future

profitability and the effect of Glacier’s strategic initiatives,

including its expectations to grow its digital media business, to

develop and provide proprietary products and broaden marketing

services, to extend its audience and products, to increase its

scale, competitiveness and operating strength, and to maintain

lower debt levels. These forward looking statements are based on

certain assumptions, including continued economic growth and

recovery and the realization of cost savings in a timely manner and

in the expected amounts, and are subject to risks, uncertainties

and other factors which may cause results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements, and undue reliance should not be

placed on such statements.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

Readers are cautioned not to place undue

reliance on forward-looking statements, as there can be no

assurance that the future circumstances, outcomes or results

anticipated or implied by such forward-looking statements will

occur or that plans, intentions or expectations upon which the

forward-looking statements are based will occur.

All forward-looking statements included in and

incorporated into this press release are qualified by these

cautionary statements. Unless otherwise indicated, the

forward-looking statements contained herein are made as of the date

of this press release, and except as required by applicable law,

the Company does not undertake any obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

Readers are cautioned that the actual results

achieved may vary from the information provided herein and that

such variations may be material. Consequently, there are no

representations by Glacier that actual results achieved will be the

same in whole or in part as those set out in the forward-looking

statements.

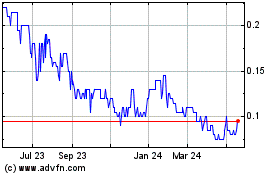

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

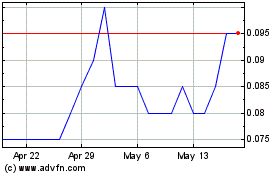

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024