GVIC Communications Corp. (TSX: GCT) (“GVIC”) announces that today

shareholders of GVIC approved the previously announced plan of

arrangement (the “Arrangement”) with Glacier Media Inc. (TSX: GVC)

(“Glacier”) at a special meeting of GVIC shareholders (the

“Meeting”).

At the Meeting, the holders of Class B common

voting shares (“GVIC B Shares”) and Class C non-voting shares

(“GVIC C Shares”) of GVIC voted to approve the acquisition by

Glacier of all of the GVIC B Shares and GVIC C Shares not currently

held by Glacier and its subsidiary, or by a wholly-owned limited

partnership of GVIC, resulting in GVIC becoming a subsidiary of

Glacier. Each GVIC B Share and GVIC C Share will be exchanged for

0.8 of a common share of Glacier (“Glacier Shares”). The

Arrangement will be effected on March 31, 2021, subject to GVIC

obtaining the final order (the “Final Order”) from the British

Columbia Supreme Court approving the Arrangement, and the

satisfaction or waiver of other customary closing conditions.

MEETING RESULTS

A total of 3,966,695 GVIC B Shares (representing

94.26% of the GVIC B Shares) and 292,223,717 GVIC C Shares

(representing 98.65% of the GVIC C Shares, excluding those held by

a wholly-owned limited partnership of GVIC) were present virtually

in person or by proxy at the Meeting. The percentage of the votes

that were cast in favour of the arrangement resolutions are

summarized as follows:

|

|

Votes For |

Votes Against |

|

GVIC B Shares |

# |

% |

# |

% |

|

Including GVIC B Shares voted insiders(1) |

3,966,695 |

99.9% |

15 |

0% |

|

Excluding GVIC B Shares voted by insiders(2) |

2,374,071 |

99.9% |

15 |

0% |

|

GVIC C Shares |

# |

% |

# |

% |

|

Including GVIC C Shares voted by insiders(3) |

292,223,717 |

99.9% |

8 |

0% |

(1) Includes an aggregate of 1,594,609 GVIC B

Shares voted by Glacier and its subsidiary (2) Excludes an

aggregate of 1,594,609 GVIC B Shares voted by Glacier and its

subsidiary (3) Includes an aggregate of 289,402,651 GVIC C Shares

voted by Glacier and its subsidiary, and excludes 7,377,214 GVIC C

Shares held by a wholly-owned limited partnership of GVIC, which

GVIC C Shares were not voted at the Meeting

A report of voting results will be made

available on SEDAR at www.sedar.com.

STATUS OF CLOSING

CONDITIONS

GVIC is scheduled to seek the Final Order from

the British Columbia Supreme on March 22, 2021.

Completion of the Arrangement is subject to the

satisfaction or waiver of other closing conditions, including the

receipt of the Final Order and approval of the listing of the

Glacier Shares issued as consideration under the Arrangement on the

TSX. Assuming that the remaining conditions to closing are

satisfied, it is expected that the Arrangement will be effected on

March 31, 2021. On completion of the Arrangement, it is anticipated

that the GVIC B Shares and the GVIC C Shares will be delisted from

the TSX.

Enclosed with the management proxy circular of

GVIC dated February 8, 2021 and sent to the shareholders of GVIC in

connection with the Arrangement was a letter of transmittal

explaining how registered shareholders of GVIC can submit their

GVIC B Shares and GVIC C Shares in order to receive Glacier Shares.

GVIC shareholders who have questions or require assistance with

submitting their GVIC B Shares or GVIC C Shares may direct their

questions to Computershare Investor Services Inc., by telephone at

1-800-564-6253 (toll free in Canada and the United States) or

514-982-7555 (international direct dial) or by email at

corporateactions@computershare.com.

The Toronto Stock Exchange has neither reviewed

nor accepts responsibility for the adequacy or accuracy of this

news release.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, GVIC and Glacier’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to GVIC and

Glacier’s expectations regarding the anticipated completion of the

Arrangement and timing for such completion, obtaining approvals and

satisfying closing conditions, the listing of Glacier Shares on the

TSX, the applicability of the exemption under Section 3(a)(10) of

the United States Securities Act of 1933, as amended to the

securities issuable in the Arrangement, reduction of costs, the

effect of marketing efforts, any increase in market demand, the

ability to resolve intercompany loans and the terms of and the

completion of the Arrangement. These forward-looking statements are

based on certain assumptions, including the implementation of cost

reductions and marketing efforts, resolution of intercompany loans

and the satisfaction of the conditions precedent to the completion

of the Arrangement, which are subject to risks, uncertainties and

other factors which may cause results, performance or achievements

of GVIC and Glacier to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements, and undue reliance should not be placed

on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to implement or achieve intended results from cost

reduction and marketing efforts, to resolve intercompany loans,

failure to satisfy the conditions precedent to the completion of

the Arrangement, the ability to consummate the Arrangement, the

satisfaction of other conditions to the consummation of the

Arrangement, general economic, business and political conditions,

including changes in the financial markets, changes in applicable

laws, approval by the TSX for the listing of Glacier Shares,

failure to implement or achieve the intended results from cost

reduction and marketing initiatives, the failure to resolve

intercompany loans and the other risk factors listed in each of

GVIC and Glacier’s Annual Information Forms under the heading “Risk

Factors” and in their respective MD&A under the heading

“Business Environment and Risks”, many of which are out of GVIC and

Glacier’s control. These other risk factors include, but are not

limited to, the impact of Coronavirus, that future cash flow from

operations and the availability under existing banking arrangements

are believed to be adequate to support financial liabilities and

that GVIC expects to be successful in its objection with CRA, the

ability of Glacier and GVIC to sell advertising and subscriptions

related to its publications, foreign exchange rate fluctuations,

the seasonal and cyclical nature of the agricultural and energy

sectors, discontinuation of government grants, general market

conditions in both Canada and the United States, changes in the

prices of purchased supplies including newsprint, the effects of

competition in Glacier’s and GVIC’s markets, dependence on key

personnel, integration of newly acquired businesses, technological

changes, tax risk, financing risk, debt service risk and

cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, neither

GVIC nor Glacier undertakes any obligation to update or revise

publicly any forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made or to reflect the occurrence of

unanticipated events.

ABOUT GLACIER

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. Glacier’s products and services

are focused in two areas: 1) data, analytics and intelligence; and

2) content & marketing solutions.

ABOUT GVIC

GVIC Communications Corp. is an information

& marketing solutions company pursuing growth in sectors where

the provision of essential information and related services

provides high customer utility and value. GVIC’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Mr. Orest Smysnuik, Chief Financial Officer,

Glacier Media Inc. 604-708-3264. Mr. Jon Kennedy, President &

Chief Executive Officer, GVIC Communications Corp.

604-708-3276.

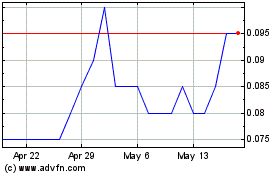

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

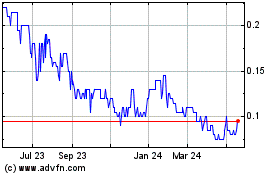

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024