Sale of JWN Energy Business

March 09 2021 - 8:30AM

Glacier Media Inc. (“Glacier”) announced today that its affiliate

GVIC Communications Corp. (“GVIC” or the “Company”) has entered

into an agreement to sell its JWN Energy information business

(“JWN”) to geoLOGIC systems ltd (“geoLOGIC”) for $4.5 million in

cash at closing plus an earn-out of up to $3.5 million, for a total

of up to $8.0 million. The earn-out is revenue based and payable

over three years (the “Transaction”).

geoLOGIC is an energy information business based

in Calgary. It is significantly larger than JWN and is backed by BV

Investment Partners, a large global private equity firm. geoLOGIC

brings synergies to JWN through its data and software products,

sales and development resources that can be leveraged to improve

JWN’s products and performance, and potentially result in the

realization of the earn-out proceeds.

JWN operates in the Canadian oil & gas

sector. The industry has been significantly challenged, and while

it is expected to recover to some degree, GVIC determined that this

segment of the Company’s business would be better served and

positioned to realize its potential by combining with geoLOGIC. The

upfront capital and potential earn-out proceeds can be used to

invest in the Company’s core growth opportunities.

The Transaction remains subject to customary

closing conditions and is expected to close on or about March 12,

2021.

Shares in Glacier are traded on the Toronto

Stock Exchange under the symbol GVC.

For further information please contact Mr. Orest

Smysnuik, Chief Financial Officer, at 604-708-3264.

ABOUT THE COMPANY

Glacier Media Inc. is an information &

marketing solutions company pursuing growth in sectors where the

provision of essential information and related services provides

high customer utility and value. The Company’s products and

services are focused in two areas: 1) data, analytics and

intelligence; and 2) content & marketing solutions.

FORWARD LOOKING STATEMENTS

This news release contains forward-looking

statements that relate to, among other things, the Company’s

objectives, goals, strategies, intentions, plans, beliefs,

expectations and estimates. These forward-looking statements

include, among other things, statements relating to our

expectations regarding the terms of and the completion of the

Transaction. These forward-looking statements are based on certain

assumptions, including the satisfaction of the conditions precedent

to the completion of the Transaction , which are subject to risks,

uncertainties and other factors which may cause results,

performance or achievements of the Company to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements, and undue

reliance should not be placed on such statements.

Important factors that could cause actual

results to differ materially from these expectations include

failure to satisfy the conditions precedent to the completion of

the Transaction, the future financial performance of the RIG Energy

Assets and the other risk factors listed in our Annual Information

Form under the heading “Risk Factors” and in our MD&A under the

heading “Business Environment and Risks”, many of which are out of

our control. These other risk factors include, but are not limited

to, the impact of Coronavirus, that future cash flow from

operations and the availability under existing banking arrangements

are believed to be adequate to support financial liabilities and

that the Company expects to be successful in its objection with

CRA, the ability of the Company to sell advertising and

subscriptions related to its publications, foreign exchange rate

fluctuations, the seasonal and cyclical nature of the agricultural

and energy sectors, discontinuation of government grants, general

market conditions in both Canada and the United States, changes in

the prices of purchased supplies including newsprint, the effects

of competition in the Company’s markets, dependence on key

personnel, integration of newly acquired businesses, technological

changes, tax risk, financing risk, debt service risk and

cybersecurity risk.

The forward-looking statements made in this news

release relate only to events or information as of the date on

which the statements are made. Except as required by law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made or to reflect the occurrence of unanticipated events.

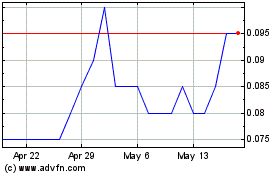

Glacier Media (TSX:GVC)

Historical Stock Chart

From Nov 2024 to Dec 2024

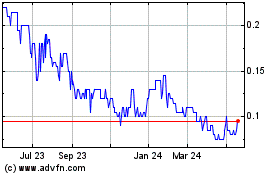

Glacier Media (TSX:GVC)

Historical Stock Chart

From Dec 2023 to Dec 2024