Goldstone Resources Inc. (TSX:GRC)(PINK SHEETS:GRSZF) today announced that it,

together with its joint venture partner and operator Premier Gold Mines Limited

(TSX:PG), has received an updated National Instrument (NI) 43-101 compliant

mineral resource estimate from Micon International Limited for the Hardrock

Project in which Goldstone holds a 30 percent carried interest. The estimate

reports a significant increase in all categories, including the use of a

measured category for the first time and is summarized in Table 1. All final

data available as of February 28, 2011 were used in completing the estimate. In

2010, there were 114,000 metres of drilling at Hardrock, located near Geraldton

in Northwestern Ontario, on multiple near surface and deeper zones. Many of

these remain open for expansion and are the subject of an ongoing drill program

in 2011.

Highlights of Micon's new mineral resource estimate include:

-- A 269% increase in Measured and Indicated resources to 2.5 million

ounces.

-- A 164% increase in Inferred resources to 1.1 million ounces.

-- A 30% increase in the "potential open pit" Measured and Indicated

resource grade to 2.37 grams per tonne gold (g/t Au).

-- A 37% increase in the "potential open pit" Inferred resource grade to

2.48 g/t Au.

-- Some 40% of the Measured and Indicated resource ounces are categorized

as "Measured."

-- A "Whittle-Pit" analysis suggesting a strip ratio on potential open pit

mineral resources of 2.1 to 1.

-- The Kailey ("potential open pit") Deposit resource is included and

contains 127,000 ounces of Measured and Indicated Resources at 1.57 g/t

Au and 10,000 ounces of Inferred resources at 1.48 g/t Au

"We are very pleased with progress at the Hardrock Project and support Premier's

goal of developing a significant gold deposit potentially capable of mid-tier

production," said Phil Cunningham, Goldstone Chairman and Interim CEO. "At the

same time we continue to conduct an aggressive exploration program on our 100

percent-owned Key Lake property which is contiguous to Hardrock."

In 2011, more than 70,000 metres of drilling is planned to continue to expand

and upgrade these resources. Additionally, regional exploration in the search of

the "next one" in the Hardrock area is underway. The near-term goal is to secure

permits for Advanced Exploration, which will include de- watering of the

historic mine workings and the construction of an Exploration Ramp. The ramp

will allow underground drilling to be completed in support of a preliminary

economic assessment to evaluate the potential for a future mining operation to

be established at Hardrock.

The mineral resources estimated for the Hardrock project (both the Hardrock and

Kailey Deposits) are set out in Table 1 below. They have been subdivided into

potentially underground or open pit mineable resources and reported using

different cutoff grades.

Table 1 - Hardrock Project Indicated & Inferred Mineral Resources

----------------------------------------------------------------------------

Cut-off Grade Resource Contained

Material Classification (au g/t) Estimate Tonnes Au Ozs

(Au g/t)

----------------------------------------------------------------------------

Open Pit Measured 0.83 2.446 6,865,000 540,000

Open Pit Indicated 0.83 2.280 5,833,000 427,500

Open Pit Measured + Indicated 0.83 2.370 12,698,000 967,500

Open Pit Inferred 0.83 2.483 615,000 49,200

----------------------------------------------------------------------------

Underground Measured 2.80 5.993 2,312,000 445,800

Underground Indicated 2.80 5.827 5,757,000 1,078,500

Underground Measured + Indicated 2.80 5.875 8,069,000 1,524,300

Underground Inferred 2.80 5.397 6,187,000 1,073,500

----------------------------------------------------------------------------

OP + UG Measured --- 3.340 9,177,000 985,800

OP + UG Indicated --- 4.042 11,590,000 1,506,000

OP + UG Measured + Indicated --- 3.732 20,767,000 2,491,800

OP + UG Inferred --- 5.133 6,802,000 1,122,700

----------------------------------------------------------------------------

(i) Figures may not sum due to rounding

(1) Mineral resources which are not mineral reserves do not have

demonstrated economic viability. The estimate of mineral resources may

be materially affected by environmental, permitting, legal, title,

socio-political, marketing, or other relevant issues.

(2) The mineral resources were estimated using a block model with parent

blocks of 25x30x10 sub-blocked to a minimum size of 5x3x2 and using

Inverse Distance Cubed methods for grade estimation. A total of 12

individual mineralized domains were identified and estimated using an

average top cut of 48 g/t Au. For a "potential open pit" mineral

resource a cut-off grade of 0.83 g/t Au is based on a Whittle optimized

pit shell and a mining recovery of 100%. For potential underground

mineral resources a cut-off grade of 2.80 g/t Au and an assumed mining

recovery of 100% outside of the potential open pit mining areas was

used.

(3) The quantity and grade of reported inferred resources in this estimation

are uncertain in nature and there has been insufficient exploration to

define these inferred resources as an indicated or measured mineral

resource and it is uncertain if further exploration will result in

upgrading them to an indicated or measured mineral resource category.

(4) The mineral resources in this press release were estimated using the

Canadian Institute of Mining, Metallurgy and Petroleum (CIM), CIM

Standards on Mineral Resources and Reserves, Definitions and Guidelines

prepared by the CIM Standing Committee on Reserve Definitions and

adopted by CIM Council November 27, 2010.

Tables 3 and 4 below, present the tonnes and grades from the block model used

for the Mineral Resource estimate at a range of cut-off grades in order to

demonstrate the sensitivity of the estimates. The cut-off value of 0.83 g/t Au

for "potential open pit" and 2.80 g/t Au for deeper, potential underground

mineralization, was derived using the parameters listed in Table 2 below.

Table 2 - Assumed operating costs, metal pricing, and metallurgical recovery

used to determine cut-off grades for the Hardrock Mineral Resource

Estimate.

----------------------------------------------------------------------------

Item Units Cost

----------------------------------------------------------------------------

Open Pit Mining Cost CAN$/All Material Tonne $3.00

Underground Mining Cost CAN$/Ore Tonne $60.00

Processing Cost CAN$/Ore Tonne $20.00

G&A Cost CAN$/Ore Tonne $1.00

Gold Price US$/Troy Ounce $1,000.00

Mill Recovery Percent 90%

Exchange Rate US$ to CAN$ 1.000

----------------------------------------------------------------------------

Table 3 - Sensitivity of the "Potential Open Pit"

Resource Estimates at Various Cutoff Grades

Measured and Indicated Resources

-------------------------------------------------------

Cutoff Au Resource Contained

(Au g/t) (g/t) Tonnes Au Ozs

-------------------------------------------------------

0.5 1.848 18,201,000 1,081,500

0.8 2.327 13,055,000 976,900

1.0 2.611 10,896,000 914,600

1.5 3.422 6,871,000 756,100

2.0 4.181 4,744,000 637,800

2.5 4.890 3,480,000 547,200

3.0 5.591 2,626,000 472,200

3.5 6.269 2,040,000 411,100

4.0 6.961 1,601,000 358,500

4.5 7.703 1,259,000 311,800

5.0 8.456 1,004,000 273,000

-------------------------------------------------------

Inferred Resources

-------------------------------------------------------

Cutoff Au Resource Contained

(Au g/t) (g/t) Tonnes Au Ozs

-------------------------------------------------------

0.5 1.848 937,000 55,700

0.8 2.437 633,000 49,600

1.0 2.681 547,000 47,100

1.5 3.629 328,000 38,300

2.0 4.969 193,000 30,800

2.5 6.745 117,000 25,400

3.0 8.792 78,000 22,000

3.5 11.318 53,000 19,500

4.0 13.473 42,000 18,000

4.5 16.179 32,000 16,800

5.0 18.646 27,000 15,900

-------------------------------------------------------

Table 4 - Sensitivity of the Potential Underground

Resource Estimates at Various Cutoff Grades

Measured and Indicated Resources

-------------------------------------------------------

Cutoff Resource Contained

(Au g/t) Au (g/t) Tonnes Au Ozs

-------------------------------------------------------

2.0 4.567 12,848,000 1,886,500

2.5 5.389 9,497,000 1,645,700

3.0 6.222 7,226,000 1,445,700

3.5 7.074 5,623,000 1,278,900

4.0 7.864 4,547,000 1,149,600

4.5 8.719 3,678,000 1,031,300

5.0 9.548 3,044,000 934,500

-------------------------------------------------------

Inferred Resources

-------------------------------------------------------

Cutoff Resource Contained

(Au g/t) Au (g/t) Tonnes Au Ozs

-------------------------------------------------------

2.0 4.410 9,145,000 1,296,600

2.5 5.080 6,989,000 1,141,500

3.0 5.690 5,533,000 1,012,500

3.5 6.302 4,428,000 897,400

4.0 6.904 3,588,000 796,600

4.5 7.698 2,763,000 683,800

5.0 8.342 2,272,000 609,400

-------------------------------------------------------

Hardrock Deposit

The Hardrock Project is located approximately 4 kilometres south of the town of

Geraldton, Ontario and is host to several past-producing mines which

collectively produced more than 3 million ounces of gold from depths primarily

within 600 metres of surface between 1938 and 1968. Underground resources are

located proximal to and below the historic mine workings. New discoveries

including the High-Grade North Zone and the F2 East Zone will be the focus of

the planned underground drill program. The current Mineral Resource estimate

uses 11 identified mineralized domains to develop a combination potential open

pit and underground mineral resource. The Hardrock Project benefits from

development advantages with the Trans-Canada Highway, Trans-Canada Pipeline, and

major power lines running through, or in close proximity to, the Project site.

Significant services and a skilled labour pool exist with several communities

located within 30 kilometres. The Hardrock Project is operated under a joint

venture with Goldstone Resources Inc. (TSX:GRC).

Kailey Deposit

The Kailey deposit is located about 2 km north of the Hardrock deposit at the

location of the former historically operated Little Long Lac gold mine. The

Kailey mineralized zone is a small lower-grade potential open pit mineral

resource.

Resource Statement

The mineral resource estimates in this press release use the Canadian Institute

of Mining, Metallurgy and Petroleum (CIM), Standards on Mineral Resources and

Reserves, Definitions and Guidelines prepared by CIM Standing Committee on

Reserve Definitions and adopted by CIM Council on November 27, 2010. The mineral

resource estimates provided in this report are classified as "measured",

"indicated", or "inferred" as defined by CIM.

According to the CIM definitions, a Mineral Resource must be potentially

economic in that it must be "in such form and quantity and of such grade or

quality that it has reasonable prospects for economic extraction". For the

Hardrock deposit, a gold cut-off grade was assigned based on economic

assumptions and was used in the resource estimations. Table 2 above shows the

economic parameters used in the gold cut-off grade calculation.

The estimated costs for the Hardrock deposit, mined as an open pit, are $3.00 +

$20.00 + $1.00 = $24.00/t milled which works out to an estimated gold cut-off of

0.83 g/t. The estimated costs for the Hardrock deposit, mined as an underground,

are $60.00 + $20.00 + $1.00 = $81.00/t milled which works out to an estimated

gold cut-off of 2.80 g/t. Resources reported in this press release use an

estimated potential open pit gold cut-off of 0.83 g/t and for a potential

underground use 2.80 g/t.

The mineral resource estimate presented in Table 1 is effective as of 5 April

2011. The mineral resources listed in Table 1 were estimated by Sam J.

Shoemaker, Jr., M.AusIMM, and Registered Member-SME. Mr. Shoemaker is a QP as

defined in NI 43-101 and is independent of Premier Gold.

Stephen McGibbon, P. Geo., is the Qualified Person for the information contained

in this press release and is a Qualified Person within the meaning of National

Instrument 43-101.

About Goldstone

Formed by a late 2009 merger of Ontex Resources and Roxmark Mines, Goldstone

Resources is a gold exploration and development company operating in the

historically significant Geraldton- Beardmore camp of Northwestern Ontario and

focused on gold exploration and deposit delineation at its Key Lake, Brookbank,

Northern Empire and Leitch-Sand River gold properties, and as a partner in the

Hardrock Project joint venture with Premier Gold Mines Limited. The camp is host

to several past producers in a district that has historical production of more

than 4.1 million ounces of gold from high grade ore before being shut down

primarily as a result of a $35 gold price-and to Goldstone's fully permitted,

expandable 200-TPD Northern Empire mill.

Further information is available on the Company's website at www.grcmines.com

and on SEDAR under the Company's profile at www.sedar.com.

Forward-Looking Statements

This news release may contain forward-looking information under applicable

securities laws concerning Goldstone's business, operations, financial

performance, condition and prospects, as well as management's objectives,

strategies, beliefs and intentions. Forward looking information is frequently

identified by such words as "may", "will", "plan", "expect", "anticipate",

"intend" and similar words referring to future events and results. This

forward-looking information is subject to known and unknown risks, uncertainties

and other factors that may cause actual results to differ materially from those

implied by the forward-looking information. Factors that may cause actual

results to vary materially include, but are not limited to, inaccurate

assumptions concerning the exploration for and development of mineral deposits,

delay or inability to raise additional financing on satisfactory terms,

unanticipated operational or technical difficulties, changes in laws or

regulations, the risks of obtaining necessary licenses and permits, changes in

general economic conditions and changes in conditions in the financial markets.

Readers are cautioned not to place undue reliance on this forward-looking

information as actual results may differ materially from those expressed or

implied in the forward looking information. Goldstone does not assume the

obligation to revise or update this forward-looking information after the date

of this release or to revise such information to reflect the occurrence of

future unanticipated events, except as may be required under applicable

securities laws.

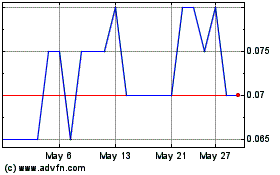

Gold Springs Resource (TSX:GRC)

Historical Stock Chart

From Nov 2024 to Dec 2024

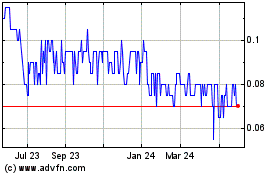

Gold Springs Resource (TSX:GRC)

Historical Stock Chart

From Dec 2023 to Dec 2024