NanoXplore Inc. (“NanoXplore” or “the Corporation”) (TSX: GRA and

OTCQX: NNXPF), a world-leading graphene company, reported

today financial results for the three and six-month period ended

December 31, 2023.

All amounts in this press release are in

Canadian dollars, unless otherwise stated.

HIGHLIGHTS

- Total revenues of $29,063,024 in

Q2-2024 compared to $31,725,122 in Q2-2023, representing an 8%

decrease due to a 6-week strike at one of our major customers;

- Gross margin on revenues from

customers of 19.4% in Q2-2024 compared to 17.8% in Q2-2023 and of

19.5% for YTD 2024 compared to 14.9% for YTD 2023;

- Adjusted EBITDA* of $416,000 in

Q2-2024 compared to $141,300 in Q2-2023 for the advanced materials,

plastics and composite products;

- Adjusted EBITDA* of -$508,806 in

Q2-2024 compared to nil in Q2-2023 for the battery cells segment

(VoltaXplore initiative);

- Net adjusted EBITDA* in Q2-2024 of

-$92,806 compared to $141,300 in Q2-2023 and net adjusted EBITDA*

of -$541,138 for YTD 2024 compared to -$1,835,732 for YTD

2023;

- Total liquidity of $37,880,673 as

at December 31, 2023, including cash and cash equivalents of

$27,558,073;

- Total long-term debt of $7,072,298

as at December 31, 2023, down by $803,590 compared to June 30,

2023;

- NanoXplore maintains its annual

revenue guidance of $130 million for the year ending June 30,

2024.

OVERVIEW

Pedro Azevedo, Chief Financial Officer, stated:

“The lower sales in the quarter compared to last year were the

result of a six-week strike at one of our major OEMs without which

sales would have been higher. The strike ended at the end of

November and we see a recovery in the second half of our fiscal

year. Moreover, with the start of tooling deliveries related to

contract awards recently announced, we remain confident with our

Fiscal Year 2024 full revenues expectations. Graphene-enhanced

parts volumes continue to increase, and we have lined up new OEM

programs that will begin delivering financial returns in the coming

quarters.”

Soroush Nazarpour, President & Chief

Executive Officer, said: “I am very pleased with the performance of

NanoXplore’s team as we have stayed focused and delivered a good

quarter. Our execution was on point and translated into a solid

performance in our second quarter where our Graphene Enhanced

Composite operations continue to improve on profitability. As a

testament to that, our gross margin increased by more than 150 bps

compared to the second quarter of last year. Our outlook for the

second half is robust, demonstrating strong demand for our

graphene-enhanced products. Case in point, we recently announced

more than $30M of new program wins and expansion of existing

programs.”

A. REPORTING SEGMENTS

RESULTS

NanoXplore reports its financials in two

distinct segments: Advanced materials, plastics and composite

products and Battery cells.

| |

Q2-2024 |

Q2-2023 |

Variation |

YTD 2024 |

YTD 2023 |

Variation |

|

|

$ |

$ |

$ |

% |

$ |

$ |

$ |

% |

| |

|

|

|

|

|

|

|

|

| From

Advanced materials, plastics and composite products |

| Revenues |

29,058,796 |

31,725,122 |

(2,666,326) |

(8%) |

57,972,897 |

58,957,647 |

(984,750) |

(2%) |

| Non-IFRS Measure

* |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

416,000 |

141,300 |

274,700 |

194% |

586,654 |

(1,835,732) |

2,422,386 |

132% |

| |

|

|

|

|

|

|

|

|

| From

Battery cells |

| Revenues |

4,228 |

— |

4,228 |

100% |

26,158 |

— |

26,158 |

100% |

| Non-IFRS Measure

* |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

(508,806) |

— |

(508,806) |

(100%) |

(1,127,792) |

— |

(1,127,792) |

(100%) |

| |

B. RESULTS OF OPERATIONS VARIANCE

ANALYSIS - THREE-MONTH PERIODS

Revenues

|

|

Q2-2024 |

Q2-2023 |

Variation |

Q1-2024 |

Variation |

|

|

$ |

$ |

$ |

% |

$ |

$ |

% |

|

|

|

|

|

|

|

|

|

| Revenues from customers |

28,559,390 |

31,417,369 |

(2,857,979) |

(9%) |

28,706,752 |

(147,362) |

(1%) |

| Other

income |

503,634 |

307,753 |

195,881 |

64% |

229,279 |

274,355 |

120% |

|

Total revenues |

29,063,024 |

31,725,122 |

(2,662,098) |

(8%) |

28,936,031 |

126,993 |

0% |

|

|

|

|

|

|

|

|

|

All revenues are coming from the segment of

advanced materials, plastics and composite products, except for

$4,228 of other income [Q2-2023 – Nil] from the segment battery

cells.

Revenues from customers remained stable, varying

from $28,706,752 in Q1-2024 to $28,559,390 in Q2-2024.

Revenues from customers decreased from

$31,417,369 in Q2-2023 to $28,559,390 in Q2-2024. This decrease is

mainly due to lower volume representing approximately $3,000,000

resulting from a 6-week strike at one of our major customers and to

lower tooling revenues.

Other income increased from $307,753 in Q2-2023

to $503,634 in Q2-2024. It amounted to $229,279 in Q1-2024. The

variation is mainly due to grants received for R&D

programs.

Adjusted EBITDA

1) From Advanced materials,

plastics and composite products

The adjusted EBITDA improved from $141,300 in

Q2-2023 to $416,000 in Q2-2024. The variation is explained as

follows:

- Higher other income of $191,653 due

to grants received for R&D programs; and

- Lower administrative expenses

(SG&A and R&D) of $171,412 mainly due to lower

headcounts.

2) From Battery

cells

The adjusted EBITDA passed from nil in Q2-2023

to -$508,806 in Q2-2024. The variation is explained by the

administrative expenses (G&A and R&D) of $513,034 from this

new segment.

C. RESULTS OF OPERATIONS VARIANCE

ANALYSIS - SIX-MONTH PERIODS

Revenues

|

|

YTD 2024 |

YTD 2023 |

Variation |

|

|

$ |

$ |

$ |

% |

|

|

|

|

|

|

| Revenues from customers |

57,266,142 |

58,564,536 |

(1,298,394) |

(2%) |

| Other

income |

732,913 |

393,111 |

339,802 |

86% |

|

Total revenues |

57,999,055 |

58,957,647 |

(958,592) |

(2%) |

|

|

|

|

|

|

All revenues are coming from the segment of

advanced materials, plastics and composite products, except for

$26,158 of other income [YTD 2023 – Nil] from the segment battery

cells.

Revenues from customers decreased from

$58,564,536 in the last year period to $57,266,142 in the current

period. This decrease is mainly due to lower volume representing

approximately $3,000,000 resulting from a 6-week strike at one of

our major customers and to lower tooling revenues.

Other income increased from $393,111 in the last

year period to $732,913 in the current period. The variation is due

to grants received for R&D programs.

Adjusted EBITDA

1) From Advanced

materials, plastics and composite products

The adjusted EBITDA improved from -$1,835,732 in

the last year period to $586,654 in the current period. The

variation is explained as follows:

- Gross margin on revenues from

customers increased by $2,446,730 compared to the last year period

due to favourable product mix, improved productivity and cost

control;

- Higher other income of $313,644 as

described above; and

- Partially offset by higher

administrative expenses (SG&A and R&D) of $341,988 mainly

due to higher wages, including higher accrued variable

compensation.

2) From Battery cells

The adjusted EBITDA passed from nil in the last

year period to -$1,127,792 in the current period. The variation is

explained by the administrative expenses (G&A and R&D) of

$1,153,950 from this new segment.

D. OTHER

Additional information about the Corporation,

including the Corporation’s Interim Management Discussion and

Analysis for the three and six-month periods ended December 31,

2023 and 2022 (“MD&A”) and the Corporation’s unaudited

condensed interim consolidated financial statements for the three

and six-month periods ended December 31, 2023 and 2022 (the

“financial statements”) can be found at www.nanoxplore.ca.

* Non-IFRS Measures

Results of operations may include certain

unusual and other items which have been separately disclosed, where

appropriate, in order to provide a clear assessment of the

underlying Corporation results.

The financial statements and MD&A were

prepared using results and financial information determined under

IFRS. However, the Corporation considers certain non-IFRS financial

measures as useful additional information in measuring the

financial performance and condition of the Corporation. These

measures, which the Corporation believes are widely used by

investors, securities analysts and other interested parties in

evaluating the Corporation’s performance, do not have a

standardized meaning prescribed by IFRS and therefore may not be

comparable to similarly titled measures presented by other publicly

traded companies, nor should they be construed as an alternative to

financial measures determined in accordance with IFRS. Non-IFRS

measures include "Adjusted EBITDA”.

WEBCAST

NanoXplore will hold a webcast tomorrow,

February 14, 2024, at 8:30 am EDT to review its Q2-2024. Soroush

Nazarpour, CEO and President of NanoXplore, and Pedro Azevedo,

Chief Financial Officer, will host the event. To access the webcast

please click on the link

https://edge.media-server.com/mmc/p/zzuperi8 or you can access

through our website in the Investors section under Events and

Presentations. A replay of this event can be accessed via the above

link or on our website.

ABOUT NANOXPLORE

NanoXplore is a graphene company, a manufacturer

and supplier of high-volume graphene powder for use in

transportation and industrial markets. Also, the Corporation

provides standard and custom graphene-enhanced plastic and

composite products to various customers in transportation,

packaging, electronics, and other industrial sectors. The

Corporation is also a silicon-graphene-enhanced Li-ion battery

manufacturer for the Electric Vehicle and grid storage markets.

NanoXplore is headquartered in Montreal, Quebec with manufacturing

facilities in Canada, the United States and Europe.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking

statements and forward-looking information (together,

“forward-looking statements”) within the meaning of applicable

securities laws. All statements, other than statements of

historical facts, are forward-looking statements, and subject to

risks and uncertainties. All forward-looking statements are based

on our beliefs as well as assumptions based on information

available at the time the assumption was made and on management’s

experience and perception of historical trends, current conditions

and expected future developments, as well as other factors deemed

appropriate in the circumstances. No assurance can be given that

these assumptions and expectations will prove to be correct.

Forward-looking statements are not facts, but only predications and

can generally be identified by the use of statements that include

phrases such as “anticipate”, “believe”, “continue”, “could”,

“estimate”, “foresee”, “grow”, “expect”, “plan”, “intend”,

“forecast”, “future”, “guidance”, “may”, “predict”, “project”,

“should”, “strategy”, “target”, “will” or similar expressions

suggesting future outcomes.

Forward-looking information is not a guarantee

of future performance and involves a number of risks and

uncertainties. Such forward-looking information necessarily

involves known and unknown risks and uncertainties, including the

relevant assumptions and risks factors set out in NanoXplore’s most

recent annual management discussion and analysis filed on SEDAR+

at www.sedarplus.ca, which may cause NanoXplore’s actual

results to differ materially from any projections of future results

expressed or implied by such forward-looking information. These

risks, uncertainties and other factors include, among others, the

uncertain and unpredictable condition of global economy, notably as

a consequence of the Covid-19 pandemic. Any forward-looking

information is made as of the date hereof and, except as required

by law, NanoXplore does not undertake any obligation to update or

revise any forward–looking statement as a result of new

information, subsequent events or otherwise.

Forward-looking statements reflect management's

current beliefs, expectations and assumptions and are based on

information currently available to management. Readers are

cautioned not to place undue reliance on forward-looking

statements, as there can be no assurance that the future

circumstances, outcomes or results anticipated or implied by such

forward-looking statements will occur or that plans, intentions or

expectations upon which the forward-looking statements are based

will occur. By their nature, forward-looking statements involve

known and unknown risks and uncertainties and other factors that

could cause actual results to differ materially from those

contemplated by such statements.

No securities regulatory authority has either

approved or disapproved the contents of this press release.

For further information, please

contact:

Pierre Yves TerrisseVice-President Corporate

Development py.terrisse@nanoxplore.caTel: 1

438 476-1965

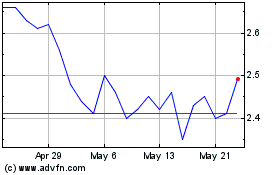

NanoXplore (TSX:GRA)

Historical Stock Chart

From Oct 2024 to Nov 2024

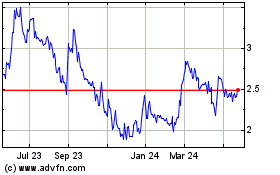

NanoXplore (TSX:GRA)

Historical Stock Chart

From Nov 2023 to Nov 2024