Gildan Activewear Inc. (GIL: TSX and NYSE) today announced results

for the third quarter ended September 29, 2024. The Company

also updated its Fiscal 2024 guidance.

"Gildan's Sustainable Growth Strategy (GSG) is clearly driving

results, underscored by our record third quarter sales, including

strong net sales growth of 6% in Activewear. Through the continued

successful execution of our three strategic pillars— capacity

expansion, innovation and ESG —we are not only further

strengthening our competitive position but also driving top line

growth and enhancing profitability. We remain deeply committed to

delivering long-term value for our stakeholders and are excited

about the opportunities that lie ahead," said Glenn J. Chamandy,

Gildan’s President and CEO.

Q3 2024 Operating Results Net sales were $891

million, up 2.4% over the prior year, at the high end of previously

provided guidance of flat to low single-digit growth. Activewear

sales of $788 million, were up 6% driven by higher sales volumes

reflecting positive POS in the Activewear category across channels

in North America. We continue to see market share gains in key

growth categories and a positive market response to our recently

introduced new products which feature key innovations, including

our new soft cotton technology. Furthermore, we observed continued

momentum with National account customers, driven by our strong

overall competitive positioning and as we further benefit from

recent changes in the industry landscape. These factors were

partially offset by unfavorable product mix, partly due to lower

fleece sales compared to last year's strong performance, which was

largely due to timing differences and which we had anticipated.

International sales increased by 20% year over year. In addition to

higher year over year sell-through in certain international

markets, distributors replenished inventory from suboptimal levels

aided by our ability to better service this market as we ramp up

our Bangladesh facility. Separately, Hosiery and underwear sales

were $103 million, down 18% versus the prior year, as expected,

mainly owing to the phase out of the Under Armour business and to a

lesser extent, due to unfavourable mix and continued broader market

weakness in underwear. Excluding the impact of the Under Armour

phase-out, sales for the Hosiery and underwear category would have

been up low double digits year over year, while consolidated sales

would have been up high single digits in the third quarter.

The Company generated gross profit of $278 million, or 31.2% of

net sales, versus $239 million, or 27.5% of net sales, in the

same period last year representing a 370 basis point improvement

which was primarily driven by lower raw material and manufacturing

input costs.

SG&A expenses of $84 million included $6 million in

carry-over charges related to the proxy contest, leadership changes

and related matters. Excluding these charges, adjusted SG&A

expenses1 were down 5% to $78 million, or 8.8% of net sales,

compared to SG&A expenses of $82 million, or 9.5% of net sales

for the same period last year. The year over year reduction

reflected the positive benefit of the jobs credit introduced by

Barbados.

The Company generated operating income of $193 million, or 21.7%

of net sales including the negative impact of the expenses for the

proxy contest, leadership changes and related matters. This

compares to $155 million, or 17.8% of net sales last year. Adjusted

operating income1 was $200 million or 22.4% of net sales, in

line with guidance provided, and up $43 million or 430 basis points

compared to the prior year.

Net financial expenses of $30 million, were up $10 million over

the prior year due to higher interest rates and higher borrowing

levels. Reflecting the impact of the enactment of Global Minimum

Tax (GMT) in Canada and Barbados, the Company's adjusted effective

income tax rate1 for the quarter was 18.7% versus 5.1% last year,

bringing the year to date adjusted effective income tax rate to

approximately 18.5%. Reflecting the positive benefit of a lower

outstanding share base, GAAP diluted EPS were $0.82, up 12% versus

the prior year, while adjusted diluted EPS1 were $0.85 compared to

$0.74 last year, up 15% year over year.

Cash flows from operating activities totaled $178 million and,

after accounting for capital expenditures totaling $30 million, the

Company generated $149 million of free cash flow1. The Company

continued to execute on its capital allocation priorities during

the quarter returning a quarterly record of $404 million to

shareholders, including dividends and repurchasing 8.8 million

shares under our normal course issuer bid (NCIB). We ended the

third quarter with net debt1 of $1,507 million and a leverage ratio

of 1.9 times net debt to trailing twelve months adjusted EBITDA1,

well within our targeted debt levels.

Year-to-date Operating ResultsNet sales for the

first nine months ended September 29, 2024 were $2,449

million, up 1.5% versus the same period last year. In Activewear,

we generated sales of $2,117 million, up $93 million or 5%,

driven by increased shipments, reflecting positive POS trends in

North America and strong momentum observed at National accounts,

slightly offset by lower net selling prices. International sales of

$188 million were up 9% versus the same period last year,

reflecting demand stabilization and some recovery in POS. In the

Hosiery and underwear category, sales were down 15% versus the

prior year mainly reflecting the phase out of the Under Armour

business, less favourable mix and broader market weakness in the

underwear category. Excluding the impact of the Under Armour

phase-out, sales for the Hosiery and underwear category, as well as

consolidated sales, would have increased by mid-single digits year

over year.

The Company generated gross profit of $751 million, up $107

million versus the prior year, driven by the increase in sales and

gross margin. Gross margin of 30.7% was up by 400 basis points year

over year mainly a result of lower raw material and manufacturing

input costs, partly offset by slightly lower net selling

prices.

SG&A expenses were $312 million, $70 million above prior

year levels. The increase is mainly attributable to expenses for

the proxy contest, leadership changes and related matters, totaling

$82 million. Excluding these charges, adjusted SG&A expenses1

were $230 million, or 9.4% of net sales, compared to 10.0% of

net sales last year, reflecting the benefit of the jobs credit

introduced by Barbados during the second quarter.

The Company generated operating income of $439 million, or 17.9%

of net sales, reflecting the negative impact of the expenses for

the proxy contest, leadership changes and other related matters.

This compares to operating income of $466 million or 19.3% of net

sales last year which included the benefit of a $77 million net

insurance gain and a $25 million gain from the sale and leaseback

of one of our U.S. distribution facilities, partly offset by

restructuring costs of $35 million. Excluding these items as well

as the expenses for the proxy contest, leadership changes and other

related matters, adjusted operating income1 was $521 million

or 21.3% of net sales, up $122 million or 480 basis points

compared to the prior year.

Net financial expenses of $77 million were up $19 million

over the prior year due to higher interest rates and higher

borrowing levels. As communicated in the second quarter, income tax

expenses were significantly higher than the prior year, due to the

enactment of GMT in Canada and Barbados. Cash flows from operating

activities totaled $291 million, compared to $308 million in the

prior year. After accounting for capital expenditures totaling $110

million, the Company generated approximately $182 million of free

cash flow1 compared to $188 million in the prior year. Executing on

capital allocation priorities, capital returned to shareholders

totaled $643 million including dividends and share repurchases.

Reflecting the benefit of a lower outstanding share base, GAAP

diluted EPS and adjusted diluted EPS1 were $1.62 and $2.18

respectively, compared to GAAP diluted EPS and adjusted diluted

EPS1 of $2.14 and $1.82 respectively, in the prior year.

2024 Outlook The strength of our vertically

integrated model, our proven operational excellence and our

unwavering focus on executing our Gildan Sustainable Growth (GSG)

strategy give us confidence in our ability to deliver our full year

2024 guidance and more broadly, our three-year targets outlined

earlier this year. More specifically, we remain pleased with our

performance thus far this year despite a somewhat mixed

macroeconomic backdrop as reflected by weakness in certain retail

end markets. As we move into the final quarter of the year, we are

further narrowing our full year 2024 outlook range.

Consequently, for 2024, we expect the following:

- Revenue growth for the full year to be up low-single digits,

compared to our previous guidance of flat to up low-single digits.

Our revenue guidance reflects the expiration of the Under Armour

sock license agreement on March 31, 2024, which has had minimal

impact on our profitability. Excluding the impact of this

agreement, full year revenue growth in 2024 would be in the

mid-single digit range;

- Adjusted operating margin1 to be slightly above 21%, compared

to our previous guidance of slightly above the high end of our 18%

to 20% target range for 2024;

- Capex to come in at approximately 5% of net sales, maintaining

previous guidance;

- Adjusted diluted EPS1 in the range of $2.97 to $3.02, up

significantly between 15.5% and 17.5% year over year, compared to

our previous guidance of $2.92 to $3.07; and

- Free cash flow1 still expected to be above 2023 levels, driven

by increased profitability, lower working capital investments and

lower capital expenditures than in 2023.

The assumptions underpinning our 2024 guidance include the

following:

- Ongoing improvement in POS through the final quarter of 2024 as

well as growth opportunities in all our channels.

- The continued benefit of the refundable jobs credit recently

introduced by Barbados, where our Sales and Marketing operations

are headquartered. This credit, which became applicable in the

second quarter, was retroactive to January 1, 2024, and flows

through SG&A.

- The estimated impact of the recently enacted GMT legislation in

Canada and Barbados on our effective tax rate, retroactive to

January 1, 2024. The Company's adjusted effective income tax1 rate

is expected to be approximately 18% for the full year.

- Continued share repurchases under our NCIB program, given the

strength of our balance sheet, our expected strong free cash flow

and our leverage framework target of 1.5x to 2.5x net debt to

adjusted EBITDA1.

ESGThe Company was recently recognized as one

of Canada’s Most Responsible Companies by Newsweek. In its

inaugural year, Newsweek, in partnership with Statista, recognized

150 companies selected from Canada’s 700 largest private and public

companies, and across 13 industries, for their commitment to

responsible practices. Gildan ranked 14th overall and secured the

top spot in the Retail and Consumer Goods industry, an achievement

which is a testament to our fundamental commitment to ESG.

Declaration of Quarterly DividendThe Board of

Directors has declared a cash dividend of $0.205 per share, payable

on December 16, 2024 to shareholders of record as of November 21,

2024. This dividend is an “eligible dividend” for the purposes of

the Income Tax Act (Canada) and any other applicable provincial

legislation pertaining to eligible dividends.

Renewal of Normal Course Issuer Bid

(NCIB)During the third quarter, the Company completed

share repurchases under its NCIB ending August 8, 2024 and

following the renewal of the Company's NCIB, effective August 9,

2024, the Company continued to repurchase shares under the NCIB. A

total of 8,830,265 common shares were repurchased for cancellation

during the third quarter at a total cost of approximately $372

million.

Gildan’s management and the Board of Directors believe the

repurchase of common shares represents an appropriate use of

Gildan’s financial resources and that share repurchases under the

NCIB will not preclude Gildan from continuing to pursue organic

growth and complementary acquisitions.

Disclosure of Outstanding Share DataAs at

October 25, 2024, there were 154,422,137 common shares issued

and outstanding along with 282,737 stock options and 42,289

dilutive restricted share units (Treasury RSUs) outstanding. Each

stock option entitles the holder to purchase one common share at

the end of the vesting period at a predetermined exercise price.

Each Treasury RSU entitles the holder to receive one common share

from treasury at the end of the vesting period, without any

monetary consideration being paid to the Company.

Conference Call InformationGildan Activewear

will hold a conference call to discuss the Company's third quarter

2024 results today at 8:30 AM ET. The conference call can be

accessed by dialing (800) 715-9871 (Canada & U.S.) or (646)

307-1963 (international) and entering passcode 7966565#. A replay

will be available for 7 days starting at 12:30 PM EST by dialing

(800) 770-2030 (Canada & U.S.) or (609) 800-9909

(international) and entering the same passcode. A live audio

webcast of the conference call, as well as the replay, will be

available at the following link: Gildan Q3 2024 audio webcast.

This release should be read in conjunction with Gildan’s

Management’s Discussion and Analysis and its unaudited condensed

interim consolidated financial statements as at and for the three

and nine months ended September 29, 2024, which will be filed by

Gildan with the Canadian securities regulatory authorities and with

the U.S. Securities and Exchange Commission and which will be

available on Gildan’s corporate website.

Certain minor rounding variances may exist between the condensed

consolidated financial statements and the table summaries contained

in this press release.

Supplemental Financial Data

CONSOLIDATED FINANCIAL DATA (UNAUDITED)

|

(in $ millions, except per share amounts or otherwise

indicated) |

Q3 2024 |

|

Q3 2023 |

|

Variation (%) |

|

|

YTD 2024 |

|

YTD 2023 |

|

Variation (%) |

|

|

Net sales |

891.1 |

|

869.9 |

|

2.4 % |

|

|

2,449.1 |

|

2,413.2 |

|

1.5 % |

|

| Gross profit |

277.6 |

|

239.2 |

|

16.1 % |

|

|

750.7 |

|

643.5 |

|

16.7 % |

|

| Adjusted gross profit(1) |

277.6 |

|

239.2 |

|

16.1 % |

|

|

750.7 |

|

640.4 |

|

17.2 % |

|

| SG&A expenses |

83.6 |

|

82.2 |

|

1.7 % |

|

|

312.5 |

|

242.1 |

|

29.1 % |

|

| Adjusted SG&A

expenses(1) |

78.1 |

|

82.2 |

|

(5.0) % |

|

|

230.2 |

|

242.1 |

|

(4.9)% |

|

| Gain on sale and

leaseback |

— |

|

— |

|

n.m. |

|

|

— |

|

(25.0 |

) |

n.m. |

|

| Net insurance gains |

— |

|

— |

|

n.m. |

|

|

— |

|

(74.2 |

) |

n.m. |

|

| Restructuring and

acquisition-related costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(recovery) |

1.1 |

|

2.0 |

|

(45.0) % |

|

|

(1.0 |

) |

34.9 |

|

n.m. |

|

| Operating income |

192.9 |

|

155.0 |

|

24.5 % |

|

|

439.3 |

|

465.7 |

|

(5.7)% |

|

| Adjusted operating

income(1) |

199.5 |

|

157.0 |

|

27.1 % |

|

|

520.6 |

|

398.3 |

|

30.7 % |

|

| Adjusted EBITDA(1) |

236.1 |

|

188.3 |

|

25.4 % |

|

|

625.4 |

|

489.2 |

|

27.8 % |

|

| Financial expenses |

30.2 |

|

20.7 |

|

45.6 % |

|

|

77.2 |

|

58.4 |

|

32.1 % |

|

| Income tax expense |

31.3 |

|

6.9 |

|

n.m. |

|

|

93.5 |

|

27.0 |

|

n.m. |

|

| Adjusted income tax

expense(1) |

31.6 |

|

6.9 |

|

n.m. |

|

|

81.8 |

|

16.5 |

|

n.m. |

|

| Net earnings |

131.5 |

|

127.4 |

|

3.2 % |

|

|

268.5 |

|

380.3 |

|

(29.4)% |

|

| Adjusted net earnings(1) |

137.8 |

|

129.4 |

|

6.5 % |

|

|

361.5 |

|

323.4 |

|

11.8% |

|

|

Basic EPS |

0.82 |

|

0.73 |

|

12.3 % |

|

|

1.62 |

|

2.14 |

|

(24.3)% |

|

| Diluted EPS |

0.82 |

|

0.73 |

|

12.3 % |

|

|

1.62 |

|

2.14 |

|

(24.3)% |

|

| Adjusted diluted EPS(1) |

0.85 |

|

0.74 |

|

14.9 % |

|

|

2.18 |

|

1.82 |

|

19.8 % |

|

|

Gross margin(2) |

31.2 % |

|

27.5 % |

|

3.7 pp |

|

|

30.7 % |

|

26.7 % |

|

4.0 pp |

|

| Adjusted gross margin(1) |

31.2 % |

|

27.5 % |

|

3.7 pp |

|

|

30.7 % |

|

26.5 % |

|

4.2 pp |

|

| SG&A expenses as a

percentage of net sales(3) |

9.4 % |

|

9.5 % |

|

(0.1) pp |

|

|

12.8 % |

|

10.0 % |

|

2.8 pp |

|

| Adjusted SG&A expenses as

a percentage of net sales(1) |

8.8 % |

|

9.5 % |

|

(0.7) pp |

|

|

9.4 % |

|

10.0 % |

|

(0.6) pp |

|

| Operating margin(4) |

21.7 % |

|

17.8 % |

|

3.9 pp |

|

|

17.9 % |

|

19.3 % |

|

(1.4) pp |

|

| Adjusted operating

margin(1) |

22.4 % |

|

18.1 % |

|

4.3 pp |

|

|

21.3 % |

|

16.5 % |

|

4.8 pp |

|

|

Cash flows from (used in) operating activities |

178.2 |

|

305.1 |

|

(41.6) % |

|

|

290.9 |

|

307.5 |

|

(5.4)% |

|

| Capital expenditures |

(29.5 |

) |

(42.5 |

) |

(30.5) % |

|

|

(109.8 |

) |

(172.4 |

) |

(36.3)% |

|

| Free

cash flow(1) |

148.9 |

|

264.6 |

|

(43.7) % |

|

|

181.6 |

|

188.4 |

|

(3.6)% |

|

|

As at (in $ millions, or otherwise indicated) |

Sep 29,2024 |

Dec 31,2023 |

|

Inventories |

1,096.7 |

1,089.4 |

| Trade accounts receivable |

612.9 |

412.5 |

| Net debt(1) |

1,506.9 |

993.5 |

| Net

debt leverage ratio(1) |

1.9 |

1.5 |

(1) This is a non-GAAP financial measure or ratio. Please refer

to "Non-GAAP Financial Measures" in this press release.(2) Gross

margin is defined as gross profit divided by net sales. (3)

SG&A expenses as a percentage of net sales is defined as

SG&A expenses divided by net sales.(4) Operating margin is

defined as operating income divided by net sales.n.m. = not

meaningfulDISAGGREGATION OF REVENUE

Net sales by major product group were as follows:

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

Q3 2023 |

Variation (%) |

|

YTD 2024 |

YTD 2023 |

Variation (%) |

|

|

Activewear |

788.3 |

744.4 |

5.9 % |

|

2,117.0 |

2,024.0 |

4.6 % |

|

| Hosiery

and underwear |

102.8 |

125.5 |

(18.1)% |

|

332.1 |

389.2 |

(14.7)% |

|

|

|

891.1 |

869.9 |

2.4 % |

|

2,449.1 |

2,413.2 |

1.5 % |

|

Net sales were derived from customers located in the following

geographic areas:

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

Q3 2023 |

Variation (%) |

|

YTD 2024 |

YTD 2023 |

Variation (%) |

|

|

United States |

798.8 |

787.7 |

1.4 % |

|

2,180.4 |

2,158.7 |

1.0 % |

|

| Canada |

28.2 |

28.9 |

(2.4)% |

|

81.1 |

82.7 |

(2.0)% |

|

|

International |

64.1 |

53.3 |

20.4 % |

|

187.6 |

171.8 |

9.2 % |

|

|

|

891.1 |

869.9 |

2.4 % |

|

2,449.1 |

2,413.2 |

1.5 % |

|

INCOME TAX EXPENSE AND IMPACT OF GLOBAL MINIMUM TAX

(GMT)

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

| Income tax expense: |

|

|

|

|

|

Tax expense excluding impact of GMT and other items below |

7.4 |

|

6.9 |

|

18.6 |

|

16.5 |

|

|

Impact of GMT |

24.2 |

|

— |

|

63.3 |

|

— |

|

|

Income tax (recovery) expense relating to restructuring charges and

other adjustments |

(0.3 |

) |

— |

|

0.2 |

|

10.5 |

|

|

Tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities |

— |

|

— |

|

11.5 |

|

— |

|

|

Total income tax expense |

31.3 |

|

6.9 |

|

93.6 |

|

27.0 |

|

|

Adjustments for: |

|

|

|

|

|

Income tax recovery (expense) relating to restructuring charges and

other adjustments |

0.3 |

|

— |

|

(0.2 |

) |

(10.5 |

) |

|

Tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities |

— |

|

— |

|

(11.5 |

) |

— |

|

|

Adjusted income tax expense(3) |

31.6 |

|

6.9 |

|

81.9 |

|

16.5 |

|

| Earnings before income

taxes |

162.7 |

|

134.3 |

|

362.0 |

|

407.3 |

|

|

Adjustments(1)(4) |

6.6 |

|

2.0 |

|

81.3 |

|

(67.4 |

) |

|

Adjusted earnings before income taxes(3) |

169.3 |

|

136.3 |

|

443.3 |

|

339.9 |

|

| Average effective income tax

rate(2) |

19.2 % |

|

5.1 % |

|

25.8 % |

|

6.6 % |

|

|

Adjusted effective income tax rate(3) |

18.7 % |

|

5.1 % |

|

18.5 % |

|

4.9 % |

|

(1) Adjustments are detailed in section entitled "Certain

adjustments to non-GAAP measures" in this press release. (2)

Average effective income tax rate is calculated as income tax

expense divided by earnings before income taxes. (3) Adjusted

income tax expense and adjusted earnings before income taxes are

non-GAAP financial measures, and adjusted effective income tax rate

is a non-GAAP ratio calculated as adjusted income tax expense

divided by adjusted earnings before income taxes. Refer to the

section "Non-GAAP financial measures and related ratios" in this

press release. (4) Adjustments for the three and nine months ended

September 29, 2024 of $6.6 million and $81.3 million,

respectively, include costs relating to proxy contest and

leadership changes and related matters and restructuring and

acquisition-related costs (recoveries). Adjustments for the three

months ended October 1, 2023 include $2.0 million (loss) for

restructuring and acquisition related costs, and for the nine

months ended October 1, 2023, includes $67.4 million (gain),

consisting of $77.3 million of net insurance gains and a $25

million pretax gain on sale and leaseback, partially offset by

$34.9 million for restructuring and acquisition-related costs.

The increase in the income tax expense and effective tax rate

for the three and nine months ended September 29, 2024, compared to

the same period last year, is mainly due to the impact of the

enactment of the Global Minimum Tax Act in Canada and the enactment

of legislation in Barbados introducing certain tax measures in

response to the Global implementation of the Pillar Two global

minimum Tax regime. More specifically, during the second quarter of

fiscal 2024, the Government of Barbados increased its domestic

corporate tax rate applicable to the Company from a sliding scale

of 5.5% to 1% to a flat rate of 9%, effective January 1, 2024. In

addition, the Company also became subject to the OECD’s Pillar Two

global minimum tax regime, effective January 1, 2024, which results

in an additional top-up tax levied on the Company’s subsidiaries in

Barbados under Barbados’ domestic top-up tax legislation. These

events combined to result in an effective tax rate of 15% in

Barbados. For the three and nine months ended September 29, 2024,

the Company recognized a current tax expense of $24.2 million

and $63.3 million, respectively related to the increase in the

Barbados corporate tax rate and the top-up tax on the Company’s

earnings in Barbados. In addition the Company recorded a deferred

income tax charge of nil and $11.5 million for the three and nine

months ended September 29, 2024, for the revaluation of deferred

tax assets and liabilities in Barbados as a result of the increase

in the Barbados corporate tax rate to 9%.

The Company's adjusted effective income tax rate for the nine

months ended September 29, 2024 was 18.5%, as noted in the above

table, which is in line with the Company's expected adjusted

effective income tax rate for the full year.

Non-GAAP financial measures and related

ratiosThis press release includes references to certain

non-GAAP financial measures, as well as non-GAAP ratios as

described below. These non-GAAP measures do not have any

standardized meanings prescribed by International Financial

Reporting Standards (IFRS) and are therefore unlikely to be

comparable to similar measures presented by other companies.

Accordingly, they should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. The terms and definitions of the non-GAAP measures used in

this press release and a reconciliation of each non-GAAP measure to

the most directly comparable IFRS measure are provided below.

Certain adjustments to non-GAAP measuresAs noted above certain

of our non-GAAP financial measures and ratios exclude the variation

caused by certain adjustments that affect the comparability of the

Company's financial results and could potentially distort the

analysis of trends in its business performance. Adjustments which

impact more than one non-GAAP financial measure and ratio are

explained below:

Restructuring and acquisition-related costs

(recovery)Restructuring and acquisition-related costs are comprised

of costs directly related to significant exit activities, including

the closure of business locations and sale of business locations or

the relocation of business activities, significant changes in

management structure, as well as transaction, exit, and integration

costs incurred pursuant to business acquisitions. Restructuring and

acquisition-related costs are included as an adjustment in arriving

at adjusted operating income, adjusted operating margin, adjusted

net earnings, adjusted earnings before income taxes, adjusted

diluted EPS, and adjusted EBITDA. For the three and nine months

ended September 29, 2024, restructuring and acquisition-related

costs of $1.1 million and recoveries of $1.0 million were

recognized, respectively (2023 - $2.0 million costs and $34.9

million costs). Refer to subsection 5.5.5 entitled “Restructuring

and acquisition-related costs (recovery)” in our interim MD&A

for a detailed discussion of these costs.

Net insurance gainsDuring fiscal year 2023, the Company

recognized net insurance gains of nil and $77.3 million for the

three and nine months ended October 1, 2023, respectively, which

related to the two hurricanes which impacted the Company’s

operations in Central America in November 2020. Net insurance gains

related to the recognition of insurance recoveries for business

interruption losses and insurance recoveries for damaged equipment

as follows:

- Insurance gains relating to recoveries for business

interruption losses for the three and nine months ended October 1,

2023 were nil and $74.2 million, respectively, and were recorded in

insurance gains, and included as an adjustment in arriving at

adjusted operating income, adjusted operating margin, adjusted

earnings before income taxes, adjusted net earnings, adjusted

diluted EPS, and adjusted EBITDA.

- Net insurance gains relating to recoveries for damaged

equipment for the three and nine months ended October 1, 2023, were

nil and $3.1 million, respectively, were recorded in cost of sales

and included as an adjustment in arriving at adjusted gross profit

and adjusted gross margin, adjusted operating income, adjusted

operating margin, adjusted earnings before income taxes, adjusted

net earnings, adjusted diluted EPS, and adjusted EBITDA.

Gain on sale and leasebackDuring the first quarter of 2023, the

Company recognized a gain of $25.0 million ($15.5 million after

reflecting $9.5 million of income tax expense) on the sale and

leaseback of one of our distribution centres located in the U.S.

The impact of this gain was included as an adjustment in arriving

at adjusted operating income, adjusted operating margin, adjusted

earnings before income taxes, adjusted income tax expense, adjusted

net earnings, adjusted diluted EPS, and adjusted EBITDA.

Costs relating to proxy contest and leadership

changes and related mattersOn December 11, 2023, the Company’s then

Board of Directors (the “Previous Board”) terminated the Company’s

President and Chief Executive Officer, Glenn Chamandy. On such

date, the Previous Board appointed Vince Tyra as President and

Chief Executive Officer, and Mr. Tyra took office in the first

quarter of fiscal 2024, effective on January 15, 2024. Following

the termination of Mr. Chamandy, dissenting shareholder Browning

West and others initiated an activist campaign and proxy contest

against the Previous Board, proposing a new slate of Directors and

requesting the reinstatement of Mr. Chamandy as President and Chief

Executive Officer. In the second quarter of 2024, on April 28,

2024, in advance of the May 28, 2024 Annual General Meeting of

Shareholders (“Annual Meeting”), the Previous Board announced a

refreshed Board of Directors (“Refreshed Board”) that resulted in

the immediate replacement of five Directors, with two additional

Directors staying on temporarily but not standing for re-election

at the Annual Meeting. On May 23, 2024, five days prior to the

Annual Meeting, the Refreshed Board and Mr. Tyra resigned, along

with Arun Bajaj, the Company’s Executive Vice-President, Chief

Human Resources Officer (CHRO) and Legal Affairs. The Refreshed

Board appointed Browning West's nominees to the Board of Directors

(the “New Board”), effective as of that date. On May 24, 2024, the

New Board reinstated Mr. Chamandy as President and Chief Executive

Officer. On May 28, 2024, the New Board was elected by shareholders

at the Annual Meeting. During the past 10 months, the Company

incurred significant expenses primarily at the direction of the

Previous Board and the Refreshed Board, including: (i) legal,

communication, proxy advisory, financial and other advisory fees

relating to the proxy contest and related matters and the

termination and subsequent reinstatement of Mr. Chamandy; (ii)

legal, financial and other advisory fees with respect to a review

process initiated by the Previous Board following receipt of a

confidential non-binding expression of interest to acquire the

Company; (iii) special senior management retention awards; (iv)

severance and termination benefits relating to outgoing executives;

and (v) incremental director meeting fees and insurance premiums.

In addition, subsequent to the Annual Meeting, the Corporate

Governance and Social Responsibility Committee (the "CGSRC")

recommended to the New Board, and the New Board approved, back-pay

compensation for Mr. Chamandy (who did not receive any severance

payment following his termination on December 11, 2023), relating

to his reinstatement, including the reinstatement of share-based

awards that were canceled by the Previous Board. In light of the

strong shareholder support received for its successful campaign and

the fact that the Refreshed Board resigned in advance of the Annual

Meeting, the CGSRC also recommended to the New Board, and the New

Board approved, the reimbursement of Browning West’s legal and

other advisory expenses relating to the proxy contest, in the

amount of $9.4 million in the second quarter of 2024.

The total costs relating to these non-recurring events (“Costs

relating to proxy contest and leadership changes and related

matters”) amounted to $5.5 million and $82.3 million, respectively,

for the three and nine months ended September 29, 2024, as itemized

in the table below with corresponding footnotes. Such costs are

included in selling, general and administrative expenses. The

impact of the below charges are included as adjustments in arriving

at adjusted SG&A expenses, adjusted SG&A expenses as a

percentage of net sales, adjusted operating income, adjusted

operating margin, adjusted earnings before income taxes, adjusted

net earnings, adjusted diluted EPS, and adjusted EBITDA.

|

(in $ millions) |

Q3 2024 |

Q3 2023 |

|

YTD 2024 |

YTD 2023 |

| Advisory fees on shareholder

matters(1) |

2.5 |

— |

|

35.8 |

— |

| Severance and other

termination benefits(2) |

— |

— |

|

21.6 |

— |

| Compensation expenses relating

to Glenn Chamandy’s termination and subsequent reinstatement as

President and Chief Executive Officer(3) |

— |

— |

|

8.9 |

— |

| Incremental costs relating to

the previous Board and refreshed Board(4) |

1.4 |

— |

|

8.8 |

— |

| Costs relating to assessing

external interests in acquiring the Company(5) |

— |

— |

|

3.0 |

— |

| Special

retention awards(6) |

1.6 |

— |

|

4.2 |

— |

|

Costs relating to proxy contest and leadership changes and related

matters |

5.5 |

— |

|

82.3 |

— |

(1) Relates to advisory, legal and other expenses for the proxy

contest and shareholder matters. Charges incurred during the three

and nine months ended September 29, 2024 of $2.5 million and $35.8

million, respectively, include:

- $2.5 million and $26.4 million for the three and nine months

ended September 29, 2024 respectively, of advisory, legal and other

fees and expenses related to the proxy contest and related matters;

and

- nil and $9.4 million of expenses, respectively, for the

reimbursement of advisory, legal and other fees and expenses

incurred by Browning West in relation to the proxy contest (refer

to note 8(c)) of the condensed interim consolidated financial

statements for additional information).

(2) Relates to the payout of severance and other termination

benefits to Mr. Tyra and Mr. Bajaj pursuant to existing severance

arrangements approved and made by the Refreshed Board in the

context of the proxy contest, just prior to its conclusion in May

2024. The cash payouts in the second quarter of 2024 for severance

and termination benefits totaled $24.4 million, of which $15.3

million was for Mr. Tyra and $9.1 million was for Mr. Bajaj. The

respective charges included in selling, general and administrative

expenses during the second quarter of 2024 totaled

$21.6 million (of which $14.1 million was for Mr. Tyra and

$7.5 million was for Mr. Bajaj), and include $12.3 million for

accelerated vesting of share-based awards as well $9.3 million in

other termination benefits for these executives.

(3) Compensation expenses relating to Mr. Chamandy include

back-pay as part of his reinstatement by the New Board, and the

reinstatement of share-based awards which had been canceled by the

Previous Board. Net charges incurred during three and nine months

ended September 29, 2024 of nil and $8.9 million, respectively,

include:

- nil and $1.7 million, respectively, for backpay and accruals

for short-term incentive plan benefits;

- nil and $14.6 million, respectively, of stock-based

compensation expense for past service costs related to the

reinstatement of Mr. Chamandy’s 2022 and 2023 long-term

incentive program (LTIP) grants (for which a reversal of

compensation expense of approximately $6 million was recorded in

the fourth quarter of fiscal 2023);

- nil and $2.4 million, respectively, of stock-based compensation

expense adjustments relating to Mr. Chamandy’s 2021 LTIP

share-based grant which vested in 2024; and

- The reversal of a $9.8 million accrual for severance in the

second quarter of 2024 (which had been accrued for in the fourth

quarter of 2023), as Mr. Chamandy forfeited any termination benefit

entitlement in connection with the award of back-pay and

reinstatement of canceled share-based awards as noted above.

(4) The Company incurred $1.4 million in the third quarter of

fiscal 2024 ($8.8 million year-to-date), of incremental costs

relating to the Previous Board and Refreshed Board. These charges

include nil and $4.8 million, respectively, for a Directors and

Officers run off insurance policy, $0.2 million and $0.6 million,

respectively, for special board meeting fee payments, and $1.2

million and $3.4 million, respectively, for the increase in value

of the deferred share units (DSU) liability.

(5) Relates to advisory, legal and other expenses with respect

to the announced review process initiated by the Previous Board

following receipt of a confidential non-binding expression of

interest to acquire the Company. The Company incurred nil and $3.0

million for the three and nine months ended September 29, 2024,

respectively, of expenses related to this matter.

(6) Stock-based compensation expenses relating to special

retention awards, granted in the first quarter of fiscal 2024,

includes $1.6 million in the third quarter of fiscal 2024, and $4.2

million for fiscal 2024 year-to-date. At the grant date, these

special retention awards had a total fair value of $8.6 million.

The stock-based compensation expense relating to these awards is

being recognized over the respective vesting periods, with most of

the awards originally vesting at the end of 2024. In connection

with the departure of Mr. Bajaj, $2.5 million of these awards

were fully paid out in cash to him during the second quarter of

2024, as part of the $9.1 million payout in note 2 above.

Adjusted net earnings and adjusted diluted EPSAdjusted net

earnings are calculated as net earnings before restructuring and

acquisition-related costs, impairment (impairment reversal) of

intangible assets, net insurance gains, gain on sale and leaseback,

costs relating to proxy contest and leadership changes and related

matters, and income tax expense or recovery relating to these

items. Adjusted net earnings also excludes income taxes related to

the re-assessment of the probability of realization of previously

recognized or de-recognized deferred income tax assets, and income

taxes relating to the revaluation of deferred income tax assets and

liabilities as a result of statutory income tax rate changes in the

countries in which we operate. Adjusted diluted EPS is calculated

as adjusted net earnings divided by the diluted weighted average

number of common shares outstanding. The Company uses adjusted net

earnings and adjusted diluted EPS to measure its net earnings

performance from one period to the next, and in making decisions

regarding the ongoing operations of its business, without the

variation caused by the impacts of the items described above. The

Company excludes these items because they affect the comparability

of its net earnings and diluted EPS and could potentially distort

the analysis of net earnings trends in its business performance.

The Company believes adjusted net earnings and adjusted diluted EPS

are useful to investors because they help identify underlying

trends in our business that could otherwise be masked by certain

expenses, write-offs, charges, income or recoveries that can vary

from period to period. Excluding these items does not imply they

are non-recurring. These measures do not have any standardized

meanings prescribed by IFRS and are therefore unlikely to be

comparable to similar measures presented by other companies.

|

(in $ millions, except per share amounts) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

Net earnings |

131.5 |

|

127.4 |

|

268.5 |

|

380.3 |

|

| Adjustments for: |

|

|

|

|

|

|

Restructuring and acquisition-related costs (recovery) |

1.1 |

|

2.0 |

|

(1.0 |

) |

34.9 |

|

|

Net insurance gains |

— |

|

— |

|

— |

|

(77.3 |

) |

|

Gain on sale and leaseback |

— |

|

— |

|

— |

|

(25.0 |

) |

|

Costs relating to proxy contest and leadership changes and related

matters |

5.5 |

|

— |

|

82.3 |

|

— |

|

|

Income tax (recovery) expense relating to restructuring charges and

other items above |

(0.3 |

) |

— |

|

0.2 |

|

10.5 |

|

|

Income tax expense related to the revaluation of deferred income

tax assets and liabilities |

— |

|

— |

|

11.5 |

|

— |

|

|

Adjusted net earnings |

137.8 |

|

129.4 |

|

361.5 |

|

323.4 |

|

|

Basic EPS |

0.82 |

|

0.73 |

|

1.62 |

|

2.14 |

|

| Diluted EPS |

0.82 |

|

0.73 |

|

1.62 |

|

2.14 |

|

|

Adjusted diluted EPS(1) |

0.85 |

|

0.74 |

|

2.18 |

|

1.82 |

|

(1) This is a non-GAAP ratio. It is calculated as adjusted net

earnings divided by the diluted weighted average number of common

shares outstanding.

Adjusted earnings before income taxes, adjusted income tax

expense, and adjusted effective income tax rateAdjusted effective

income tax rate is defined as adjusted income tax expense divided

by adjusted earnings before income taxes. Adjusted earnings before

income taxes excludes restructuring and acquisition-related costs,

impairment (impairment reversal) of intangible assets, net

insurance gains, gain on sale and leaseback, and costs relating to

proxy contest and leadership changes and related matters. Adjusted

income tax expense is defined as income tax expense excluding tax

rate changes resulting in the revaluation of deferred income tax

assets and liabilities, income taxes relating to the re-assessment

of the probability of realization of previously recognized or

de-recognized deferred income tax assets, and income tax expense

relating to restructuring charges and other pretax adjustments

noted above. The Company excludes these adjustments because they

affect the comparability of its effective income tax rate. The

Company believes the adjusted effective income tax rate provides a

clearer understanding of our normalized effective tax rate and

financial performance for the current period and for purposes of

developing its annual financial budgets. The Company believes that

adjusted effective income tax rate is useful to investors in

assessing the Company's future effective income tax rate as it

identifies certain pre-tax expenses and gains and income tax

charges and recoveries which are not expected to recur on a regular

basis (in particular, non-recurring costs such as proxy contest and

leadership changes and related matters incurred in the Company’s

Canadian legal entity which do not result in tax recoveries, and

tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities).

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

| Earnings before income

taxes |

162.7 |

|

134.3 |

|

362.0 |

|

407.3 |

|

| Adjustments for: |

|

|

|

|

|

Restructuring and acquisition-related costs (recovery) |

1.1 |

|

2.0 |

|

(1.0 |

) |

34.9 |

|

|

Net insurance gains |

— |

|

— |

|

— |

|

(77.3 |

) |

|

Gain on sale and leaseback |

— |

|

— |

|

— |

|

(25.0 |

) |

|

Costs relating to proxy contest and leadership changes and related

matters |

5.5 |

|

— |

|

82.3 |

|

— |

|

|

Adjusted earnings before income taxes |

169.3 |

|

136.3 |

|

443.3 |

|

339.9 |

|

| Income tax expense |

31.3 |

|

6.9 |

|

93.5 |

|

27.0 |

|

| Adjustments for: |

|

|

|

|

|

Income tax expense relating to restructuring charges and other

adjustments above |

0.3 |

|

— |

|

(0.2 |

) |

(10.5 |

) |

|

Tax rate changes resulting in the revaluation of deferred income

tax assets and liabilities |

— |

|

— |

|

(11.5 |

) |

— |

|

|

Adjusted income tax expense |

31.6 |

|

6.9 |

|

81.8 |

|

16.5 |

|

|

Average effective income tax rate(1) |

19.2 |

% |

5.1 |

% |

25.8 |

% |

6.6 |

% |

|

Adjusted effective income tax rate(2) |

18.7 |

% |

5.1 |

% |

18.5 |

% |

4.9 |

% |

(1) Average effective income tax rate is calculated as income

tax expense divided by earnings before income taxes.(2) This is a

non-GAAP ratio. It is calculated as adjusted income tax expense

divided by adjusted earnings before income taxes.

Adjusted gross profit and adjusted gross marginAdjusted gross

profit is calculated as gross profit excluding the impact of net

insurance gains in fiscal 2023. The Company uses adjusted gross

profit and adjusted gross margin to measure its performance at the

gross margin level from one period to the next, without the

variation caused by the impacts of the item described above. The

Company excludes this item because it affects the comparability of

its financial results and could potentially distort the analysis of

trends in its business performance. Excluding this item does not

imply that it is non-recurring. The Company believes adjusted gross

profit and adjusted gross margin are useful to management and

investors because they help identify underlying trends in our

business in how efficiently the Company uses labor and materials

for manufacturing goods to our customers that could otherwise be

masked by the impact of net insurance gains in prior years. These

measures do not have any standardized meanings prescribed by IFRS

and are therefore unlikely to be comparable to similar measures

presented by other companies.

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

Gross profit |

277.6 |

|

239.2 |

|

750.7 |

|

643.5 |

|

| Adjustment for: |

|

|

|

|

|

Net insurance gains |

— |

|

— |

|

— |

|

(3.1 |

) |

|

Adjusted gross profit |

277.6 |

|

239.2 |

|

750.7 |

|

640.4 |

|

|

Gross margin |

31.2 % |

|

27.5 % |

|

30.7 % |

|

26.7 % |

|

|

Adjusted gross margin(1) |

31.2 % |

|

27.5 % |

|

30.7 % |

|

26.5 % |

|

(1) This is a non-GAAP ratio. It is calculated

as adjusted gross profit divided by net sales.

Adjusted SG&A expenses and adjusted SG&A expenses as a

percentage of net salesAdjusted SG&A expenses is calculated as

selling, general and administrative expenses excluding the impact

of costs relating to proxy contest and leadership changes and

related matters. The Company uses adjusted SG&A expenses and

adjusted SG&A expenses as a percentage of net sales to measure

its performance from one period to the next, without the variation

caused by the impact of the items described above. Excluding these

items does not imply they are non-recurring. The Company believes

adjusted SG&A expenses and adjusted SG&A expenses as a

percentage of net sales are useful to investors because they help

identify underlying trends in our business that could otherwise be

masked by costs relating to the proxy contest and leadership

changes and related matters, which the Company believes are unusual

and non-recurring in nature. These measures do not have any

standardized meanings prescribed by IFRS and are therefore unlikely

to be comparable to similar measures presented by other

companies.

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

| SG&A expenses |

83.6 |

|

82.2 |

|

312.5 |

|

242.1 |

|

| Adjustment for: |

|

|

|

|

|

Costs relating to proxy contest and leadership changes and related

matters |

5.5 |

|

— |

|

82.3 |

|

— |

|

|

Adjusted SG&A expenses |

78.1 |

|

82.2 |

|

230.2 |

|

242.1 |

|

|

SG&A expenses as a percentage of net sales |

9.4 % |

|

9.5 % |

|

12.8 % |

|

10.0 % |

|

|

Adjusted SG&A expenses as a percentage of net sales(1) |

8.8 % |

|

9.5 % |

|

9.4 % |

|

10.0 % |

|

(1) This is a non-GAAP ratio. It is calculated as adjusted

SG&A expenses divided by net sales.

Adjusted operating income and adjusted operating marginAdjusted

operating income is calculated as operating income before

restructuring and acquisition-related costs, and also excludes

impairment (impairment reversal) of intangible assets, net

insurance gains, gain on sale and leaseback, and costs relating to

proxy contest and leadership changes and related matters.

Management uses adjusted operating income and adjusted operating

margin to measure its performance at the operating income level as

we believe it provides a better indication of our operating

performance and facilitates the comparison across reporting

periods, without the variation caused by the impacts of the items

described above. The Company excludes these items because they

affect the comparability of its operating results and could

potentially distort the analysis of trends in its operating income

and operating margin performance. The Company believes adjusted

operating income and adjusted operating margin are useful to

investors because they help identify underlying trends in our

business in how efficiently the Company generates profit from its

primary operations that could otherwise be masked by the impact of

the items noted above that can vary from period to period.

Excluding these items does not imply they are non-recurring. These

measures do not have any standardized meanings prescribed by IFRS

and are therefore unlikely to be comparable to similar measures

presented by other companies.

|

(in $ millions, or otherwise indicated) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

Operating income |

192.9 |

|

155.0 |

|

439.3 |

|

465.7 |

|

| Adjustments for: |

|

|

|

|

|

Restructuring and acquisition-related costs (recovery) |

1.1 |

|

2.0 |

|

(1.0 |

) |

34.9 |

|

|

Net insurance gains |

— |

|

— |

|

— |

|

(77.3 |

) |

|

Gain on sale and leaseback |

— |

|

— |

|

— |

|

(25.0 |

) |

|

Costs relating to proxy contest and leadership changes and related

matters |

5.5 |

|

— |

|

82.3 |

|

— |

|

|

Adjusted operating income |

199.5 |

|

157.0 |

|

520.6 |

|

398.3 |

|

|

Operating margin |

21.7 % |

|

17.8 % |

|

17.9 % |

|

19.3 % |

|

|

Adjusted operating margin(1) |

22.4 % |

|

18.1 % |

|

21.3 % |

|

16.5 % |

|

(1) This is a non-GAAP ratio. It is calculated

as adjusted operating income divided by net sales.

Adjusted EBITDAAdjusted EBITDA is calculated as earnings before

financial expenses net, income taxes, and depreciation and

amortization, and excludes the impact of restructuring and

acquisition-related costs. Adjusted EBITDA also excludes impairment

(impairment reversal) of intangible assets, net insurance gains,

gain on sale and leaseback, and costs relating to proxy contest and

leadership changes and related matters. Management uses

adjusted EBITDA, among other measures, to facilitate a comparison

of the profitability of its business on a consistent basis from

period-to-period and to provide a more complete understanding of

factors and trends affecting our business. The Company also

believes this measure is commonly used by investors and analysts to

assess profitability and the cost structure of companies within the

industry, as well as measure a company’s ability to service debt

and to meet other payment obligations, or as a common valuation

measurement. The Company excludes depreciation and amortization

expenses, which are non-cash in nature and can vary significantly

depending upon accounting methods or non-operating factors.

Excluding these items does not imply they are non-recurring. This

measure does not have any standardized meanings prescribed by IFRS

and is therefore unlikely to be comparable to similar measures

presented by other companies.

|

(in $ millions) |

Q3 2024 |

Q3 2023 |

YTD 2024 |

|

YTD 2023 |

|

|

Net earnings |

131.5 |

127.4 |

268.5 |

|

380.3 |

|

| Restructuring and

acquisition-related costs (recovery) |

1.1 |

2.0 |

(1.0 |

) |

34.9 |

|

| Net insurance gains |

— |

— |

— |

|

(77.3 |

) |

| Gain on sale and

leaseback |

— |

— |

— |

|

(25.0 |

) |

| Costs relating to proxy

contest and leadership changes and related matters |

5.5 |

— |

82.3 |

|

— |

|

| Depreciation and

amortization |

36.5 |

31.3 |

104.9 |

|

90.9 |

|

| Financial expenses, net |

30.2 |

20.7 |

77.2 |

|

58.4 |

|

| Income

tax expense |

31.3 |

6.9 |

93.5 |

|

27.0 |

|

|

Adjusted EBITDA |

236.1 |

188.3 |

625.4 |

|

489.2 |

|

Free cash flow Free cash flow is defined as cash flow from

operating activities, less cash flow used in investing activities

excluding cash flows relating to business acquisitions. The Company

considers free cash flow to be an important indicator of the

financial strength and liquidity of its business, and it is a key

metric used by management in managing capital as it indicates how

much cash is available after capital expenditures to repay debt, to

pursue business acquisitions, and/or to redistribute to its

shareholders. Management believes that free cash flow also provides

investors with an important perspective on the cash available to us

to service debt, fund acquisitions, and pay dividends. In addition,

free cash flow is commonly used by investors and analysts when

valuing a business and its underlying assets. This measure does not

have any standardized meanings prescribed by IFRS and is therefore

unlikely to be comparable to similar measures presented by other

companies.

|

(in $ millions) |

Q3 2024 |

|

Q3 2023 |

|

YTD 2024 |

|

YTD 2023 |

|

|

Cash flows from (used in) operating activities |

178.2 |

|

305.1 |

|

290.9 |

|

307.5 |

|

| Cash flows from (used in)

investing activities |

(29.3 |

) |

(40.5 |

) |

(109.3 |

) |

(119.1 |

) |

| Adjustment for: |

|

|

|

|

|

Business acquisitions |

— |

|

— |

|

— |

|

— |

|

|

Free cash flow |

148.9 |

|

264.6 |

|

181.6 |

|

188.4 |

|

Total debt and net debtTotal debt is defined as the

total bank indebtedness, long-term debt (including any current

portion), and lease obligations (including any current portion),

and net debt is calculated as total debt net of cash and cash

equivalents. The Company considers total debt and net debt to be

important indicators for management and investors to assess the

financial position and liquidity of the Company, and measure its

financial leverage. These measures do not have any standardized

meanings prescribed by IFRS and are therefore unlikely to be

comparable to similar measures presented by other companies.

|

(in $ millions) |

Sep 29, 2024 |

|

Dec 31, 2023 |

|

|

Long-term debt (including current portion) |

1,479.0 |

|

985.0 |

|

| Bank indebtedness |

— |

|

— |

|

| Lease

obligations (including current portion) |

106.4 |

|

98.1 |

|

|

Total debt |

1,585.4 |

|

1,083.1 |

|

| Cash

and cash equivalents |

(78.5 |

) |

(89.6 |

) |

|

Net debt |

1,506.9 |

|

993.5 |

|

Net debt leverage ratio The net debt leverage ratio is defined

as the ratio of net debt to pro-forma adjusted EBITDA for the

trailing twelve months, all of which are non-GAAP measures. The

pro-forma adjusted EBITDA for the trailing twelve months reflects

business acquisitions made during the period, as if they had

occurred at the beginning of the trailing twelve month period. The

Company has currently set a net debt leverage target ratio of 1.5

to 2.5 times pro-forma adjusted EBITDA for the trailing twelve

months (previously 1.5 to 2.0 times). The net debt leverage ratio

serves to evaluate the Company's financial leverage and is used by

management in its decisions on the Company's capital structure,

including financing strategy. The Company believes that certain

investors and analysts use the net debt leverage ratio to measure

the financial leverage of the Company, including our ability to pay

off our incurred debt. The Company's net debt leverage ratio

differs from the net debt to EBITDA ratio that is a covenant in our

loan and note agreements, and therefore the Company believes it is

a useful additional measure. This measure does not have any

standardized meanings prescribed by IFRS and is therefore unlikely

to be comparable to similar measures presented by other

companies.

|

(in $ millions, or otherwise indicated) |

Sep 29, 2024 |

Dec 31, 2023 |

|

Adjusted EBITDA for the trailing twelve months |

810.9 |

674.5 |

| Adjustment for: |

|

|

|

Business acquisitions |

— |

— |

|

Pro-forma adjusted EBITDA for the trailing twelve months |

810.9 |

674.5 |

|

Net debt |

1,506.9 |

993.5 |

| Net

debt leverage ratio(1) |

1.9 |

1.5 |

(1) The Company's total net debt to EBITDA ratio for purposes of

its loan and note agreements was 2.0 at September 29,

2024.

Caution Concerning Forward-Looking

Statements

Certain statements included in this press release constitute

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations and are subject to important risks,

uncertainties, and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and the strategies to achieve these objectives, as well

as information with respect to our beliefs, plans, expectations,

anticipations, estimates, and intentions, including, without

limitation, our expectation with regards to net sales, gross

margin, SG&A expenses, restructuring and acquisition-related

costs, operating margin, adjusted operating margin, adjusted

EBITDA, diluted earnings per share, adjusted diluted earnings per

share, income tax rate, free cash flow, return on adjusted average

net assets, net debt to adjusted EBITDA leverage ratios, capital

return and capital investments or expenditures, including our

financial outlook set forth in this press release under the section

“2024 Outlook”. Forward-looking statements generally can be

identified by the use of conditional or forward-looking terminology

such as “may”, “will”, “expect”, “intend”, “estimate”, “project”,

“assume”, “anticipate”, “plan”, “foresee”, “believe”, or

“continue”, or the negatives of these terms or variations of them

or similar terminology.

We refer you to the Company’s filings with the Canadian

securities regulatory authorities and the U.S. Securities and

Exchange Commission, as well as the risks described under the

“Financial risk management”, “Critical accounting estimates and

judgments”, and “Risks and uncertainties” sections of our most

recent Management’s Discussion and Analysis for a discussion of the

various factors that may affect the Company’s future results.

Material factors and assumptions that were applied in drawing a

conclusion or making a forecast or projection are also set out

throughout such document and this press release.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion, forecast, or projection in such forward-looking

information, include, but are not limited to:

- changes in general economic, financial or geopolitical

conditions globally or in one or more of the markets we serve;

- our ability to implement our growth strategies and plans,

including our ability to bring projected capacity expansion

online;

- the intensity of competitive activity and our ability to

compete effectively;

- our reliance on a small number of significant customers,

including our largest distributor;

- the fact that our customers do not commit to minimum quantity

purchases;

- our ability to anticipate, identify, or react to changes in

consumer preferences and trends;

- our ability to manage production and inventory levels

effectively in relation to changes in customer demand;

- fluctuations and volatility in the prices of raw materials and

energy related inputs, from current levels, used to manufacture and

transport our products;

- our reliance on key suppliers and our ability to maintain an

uninterrupted supply of raw materials, intermediate materials, and

finished goods;

- the impact of climate, political, social, and economic risks,

natural disasters, epidemics, pandemics and endemics, such as the

COVID-19 pandemic, in the countries in which we operate or sell to,

or from which we source production;

- disruption to manufacturing and distribution activities due to

such factors as operational issues, disruptions in transportation

logistic functions, labour disruptions, political or social

instability, weather-related events, natural disasters, epidemics

and pandemics, such as the COVID-19 pandemic, and other unforeseen

adverse events;

- compliance with applicable trade, competition, taxation,

environmental, health and safety, product liability, employment,

patent and trademark, corporate and securities, licensing and

permits, data privacy, bankruptcy, anti-corruption, and other laws

and regulations in the jurisdictions in which we operate;

- the imposition of trade remedies, compliance with or changes to

duties and tariffs, international trade legislation, bilateral and

multilateral trade agreements and trade preference programs that

the Company is currently relying on in conducting its manufacturing

operations or the application of safeguards thereunder;

- elimination of government subsidies and credits that we

currently benefit from, and the non-realization of anticipated new

subsidies and credits;

- factors or circumstances that could increase our effective

income tax rate, including the outcome of any tax audits or changes

to applicable tax laws or treaties;

- changes to and failure to comply with consumer product safety

laws and regulations;

- changes in our relationship with our employees or changes to

domestic and foreign employment laws and regulations;

- our reliance on key management and our ability to attract

and/or retain key personnel;

- negative publicity as a result of actual, alleged, or perceived

violations of human rights, labour and environmental laws or

international labour standards, or unethical labour or other

business practices by the Company or one of its third-party

contractors;

- our ability to protect our intellectual property rights;

- operational problems with our information systems or those of

our service providers as a result of system failures, viruses,

security and cyber security breaches, disasters, and disruptions

due to system upgrades or the integration of systems;

- an actual or perceived breach of data security;

- rapid developments in artificial intelligence;

- our ability to successfully integrate acquisitions and realize

expected benefits and synergies;

- changes in accounting policies and estimates; and

- exposure to risks arising from financial instruments, including

credit risk on trade accounts receivables and other financial

instruments, liquidity risk, foreign currency risk, and interest

rate risk, as well as risks arising from commodity prices.

These factors may cause the Company’s actual performance and

financial results in future periods to differ materially from any

estimates or projections of future performance or results expressed

or implied by such forward-looking statements. Forward-looking

statements do not take into account the effect that transactions or

non-recurring or other special items announced or occurring after

the statements are made may have on the Company’s business. For

example, they do not include the effect of business dispositions,

acquisitions, other business transactions, asset write-downs, asset

impairment losses, or other charges announced or occurring after

forward-looking statements are made. The financial impact of such

transactions and non-recurring and other special items can be

complex and necessarily depends on the facts particular to each of

them.

There can be no assurance that the expectations represented by

our forward-looking statements will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management’s expectations regarding the

Company’s future financial performance and may not be appropriate

for other purposes. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date hereof, and we do not undertake any obligation to

update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events,

or otherwise unless required by applicable legislation or

regulation. The forward-looking statements contained in this press

release, including our updated financial outlook for the 2024

fiscal year under the section "2024 Outlook", are expressly

qualified by this cautionary statement.

About Gildan

Gildan is a leading manufacturer of everyday basic apparel. The

Company’s product offering includes activewear, underwear and

socks, sold to a broad range of customers, including wholesale

distributors, screenprinters or embellishers, as well as to

retailers that sell to consumers through their physical stores

and/or e-commerce platforms and to global lifestyle brand

companies. The Company markets its products in North America,

Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American

Apparel®, Comfort Colors®, GOLDTOE® and Peds®.

Gildan owns and operates vertically integrated, large-scale

manufacturing facilities which are primarily located in Central

America, the Caribbean, North America, and Bangladesh. Gildan

operates with a strong commitment to industry-leading labour,

environmental and governance practices throughout its supply chain

in accordance with its comprehensive ESG program embedded in the

Company's long-term business strategy. More information about the

Company and its ESG practices and initiatives can be found at

www.gildancorp.com.

|

Investor inquiries: Jessy Hayem, CFA Senior

Vice-President, Head of Investor Relations and Global

Communications(514) 744-8511 jhayem@gildan.com

|

Media inquiries:Genevieve GosselinDirector, Global

Communications and Corporate Marketing(514)

343-8814communications@gildan.com |

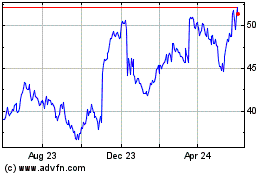

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Mar 2024 to Mar 2025