Gildan Activewear Publishes Investor Presentation for 2024 Annual Meeting

May 13 2024 - 7:15AM

Gildan Activewear Inc. (GIL; TSX and NYSE) today announced that it

has published an investor presentation, entitled “Successfully

Driving Long-Term Value for All Shareholders”, in connection with

its upcoming 2024 Annual Meeting of Shareholders (the “2024 Annual

Meeting”) to be held on May 28, 2024. The investor presentation

will be available at http://www.futureofgildan.com and on the

Company’s 2024 Annual Meeting page.

Key highlights of the presentation include the

following:

- Why the refreshed Board is

excited about Gildan’s future:

- Gildan is an industry-leading

company with a strategic moat around its business – given its

competitive position and advantageous cost structure, the company

should be a winner.

- Gildan has a clear path to value

creation through EBITDA expansion as delivered through its Gildan

Sustainable Growth (GSG) strategy, based on its key pillars of

Growth, Innovation, and ESG.

- Gildan has a strong leader in Vince

Tyra and a strong management team in place that can deliver value

creation for all shareholders through the execution of his enhanced

GSG plan.

- Gildan’s recently refreshed board

is highly collaborative and will work collegially and

constructively to oversee management’s delivery of the GSG plan and

will hold management accountable.

- Gildan’s recently refreshed board

excels at creating alignment, which will resolve the current

alignment problem between the legacy board, management, and a group

of shareholders being instigated by an opportunistic activist.

- Gildan’s newly refreshed

Board contains the right mix of fresh perspectives, historical

continuity, and investor input.

- Gildan recommends the election of

five newly-appointed independent directors, four incumbent

independent directors, and two independent director nominees from

the dissident’s slate – all with the necessary experience,

expertise, and skills needed to maximize Gildan’s full potential

and mitigate further disruption.

- The newly constituted Board is the

result of a thorough, deliberate process that was rooted in

extensive shareholder engagement, having held 87 meetings,

including across Gildan’s 25 top shareholders and those who

Browning West has deemed as supportive.

- Glenn Chamandy is no longer

the CEO that Gildan needs and there was a clear case for change in

2023 after he irreparably broke the trust of Gildan’s

Board.

- It became apparent to the Board as

early as in 2021 that it was time to prepare for a Gildan without

Mr. Chamandy. The Board discussed succession planning with Mr.

Chamandy for many years. Mr. Chamandy himself agreed that change

was needed when he told the Board in 2021 that he would retire in

3-5 years. Despite this, Mr. Chamandy sabotaged the process when it

came time to execute on the succession plan.

- The case for change in 2023

was clear:

- Mr. Chamandy was gradually more

disengaged in Gildan’s business, averaging only 4 days in the

office per month in the six months prior to his termination and

sending out no more than a handful of work-related emails each

day.

- Mr. Chamandy was distracted by

outside personal pursuits including the development a luxury golf

resort in Barbados.

- Mr. Chamandy never visited Gildan’s

newest manufacturing plant in Bangladesh, a major investment for

the company.

- Mr. Chamandy held few senior

management meetings.

- Mr. Chamandy failed to govern

himself in accordance with acceptable standards of behavior for a

chief executive, such as recording a private and confidential phone

call with former Chair Donald Berg, without Mr. Berg’s

knowledge.

- Instead of putting forward a

compelling strategy, Mr. Chamandy attempted to entrench himself by

giving the Board an ultimatum: approve a high-risk

multi-billion-dollar acquisition strategy predicated on

guaranteeing his role as CEO for several more years to oversee its

integration, or he would leave the Company immediately and sell his

shares.

- Gildan’s business was losing

momentum, growth was stalled, and share price performance had been

stagnating for the past ~10 years.

- While the Board was focused on an

orderly transition, Mr. Chamandy’s sabotage of an agreed succession

plan and his insistence of a risky and dilutive

multi-billion-dollar acquisitions strategy left the Board with no

choice but to terminate him.

- As he left, he also violated

company polices related to the safeguarding of corporate

information by wiping data from his Gildan communication

devices.

- Vince Tyra is exactly the

right CEO to scale Gildan in an increasingly complex and fiercely

competitive global environment.

- The Board undertook a robust and

structured CEO succession planning process and at the conclusion of

this process selected Vince Tyra as CEO.

- Few people have had the opportunity

to demonstrate their leadership skills across such an impressive

range of industries and managerial challenges as Vince Tyra. The

throughline of Vince’s career is using his financial acumen, sound

management and ability to build teams and motivate people around a

shared strategy and vision to improve the companies and

organizations he has led.

- Houchens Industries: As Senior

Vice-President of Corporate Strategy and M&A, Vince led the

strategic growth of this $4 billion revenue employee-owned holding

company through investments in sectors including consumer products

and retail.

- University of Louisville: In

perhaps the most challenging turnaround of his career, Vince fixed

the scandal-plagued Athletics Program at the NCAA powerhouse. Under

his leadership, Vince established a new culture of excellence and

compliance while rebuilding the sports program.

- Southfield Capital: As an Operating

Partner and Investment Committee Member at Southfield, Vince helped

achieve industry leading returns by positively impacting many

portfolio companies in various leadership positions. At Southfield,

Vince’s portfolio produced strong returns, with an internal rate of

return of 27% and a multiple of invested capital of 3.2x.

- Broder Bros.: As CEO of Broder,

Vince spearheaded a successful series of acquisitions, including

Alpha Shirts – later named Alphabroder, tripling EBITDA – the basis

for value creation at private equity firms. Under Vince’s

leadership, Broder successfully executed Bain Capital’s levered

roll-up strategy and transformed itself into the market

leader.

- Fruit of the Loom: Vince joined

Fruit of the Loom from 1997 to 2000 where the board of directors

promoted him to President during a tumultuous time where he

developed and implemented a successful restructuring plan ahead of

its eventual sale to Berkshire Hathaway.

- In addition, Vince invested in and

grew his own activewear business early in his career, while

utilizing Gildan as a key supplier.

- Vince has served on the board of

directors at 10 companies and stepped in as interim CEO at three

companies.

- Vince hit the ground running in his

role as President & CEO of Gildan and has prioritized

consistent engagement with the various stakeholders of Gildan,

including:

- Visiting 18 offices and

manufacturing sites to get immersed in Gildan’s processes and

cultures,

- Attending various trade shows to

reinforce his presence and reconnect with customers,

- Holding town halls and interacting

with approximately 94% of Gildan’s global leadership base as well

as over 2,000 employees to create a two-way dialogue,

- Kicking off dialogue with major

partners to better understand challenges and opportunities,

and

- Putting forward an enhanced GSG

strategy that reflects the input of shareholders and leverages

Gildan’s manufacturing strength by growing its commercial

capability.

- After Mr. Chamandy’s termination,

the Board retained renowned independent corporate governance

expert, Dr. Richard Leblanc to evaluate Gildan’s CEO succession

planning process. His report concluded that the Board took a series

of “reasonable steps” that would be expected of a Canadian public

company board. Among his key findings, Leblanc stated: “Based on my

review, it is my opinion that the Board acted in a manner

consistent with prevailing standards of corporate governance for

CEO succession planning, and the duties and obligations owed by

directors to Gildan, during the time from May 2021 to the

letter of termination of the former CEO, dated December 10,

2023.”

- Gildan has a thoughtful,

long-term plan in place and is successfully executing its strategic

priorities. Conversely, Browning West and Glenn Chamandy’s plan

puts shareholders at risk.

- The Company’s enhanced GSG

strategy, which reflects feedback received from shareholders and

their desire for us to continue sustainably growing Gildan is an

actionable, realistic plan that enables the Company to leverage its

strengths and accelerate value creation for shareholders and other

stakeholders.

- Unlike Gildan’s thoughtful plan,

Browning West and Mr. Chamandy’s strategy is an unrealistic

“marketing” plan fueled by improbable operating projections with

the sole purpose of gaining votes and winning the proxy fight.

Further, Mr. Chamandy’s strategy has recently evolved into a “bait

and switch” strategy that lacks credibility and conviction. Mr.

Chamandy’s plan which was presented to Gildan’s Board in October

2023 was a risky strategy with limited organic growth prospects and

presented a value cap on Gildan without any acquisitions.

Drastically, only 5 months later, Browning West and Mr. Chamandy’s

new strategy has completely shifted to growing sales through market

share gains and boosting short-term returns via aggressive and

risky financial engineering – all with highly aggressive,

unrealistic financial projections.

- Browning West has and

continues to repeatedly ignore Gildan’s good faith efforts to find

common ground – and ultimately – a resolution for the benefit of

all shareholders.

- Gildan’s Board has attempted to

engage Browning West on multiple occasions to end this costly,

disruptive proxy fight and reach a settlement, but Browning West

continues to refuse to engage constructively.

- Browning West is solely focused on

taking control of Gildan without paying a premium and is not acting

in the best interests of all shareholders.

VOTE THE BLUE

PROXY CARD TODAY

The Board urges all shareholders to protect

their investment by voting “FOR” all the nominees recommended by

Gildan– all ten of Gildan’s director nominees and as well as Karen

Stuckey and J.P. Towner on the BLUE Proxy Card. We encourage

shareholders to disregard any gold proxy card sent to you by

Browning West. Only the latest dated proxy card will count at the

2024 Annual Meeting. As Gildan is using a “universal” proxy

containing all the Gildan nominees as well as the other nominees

proposed by Browning West, there is no need to use any other proxy

regardless of how you propose to vote.

To view the presentation, or for more

information about the 2024 Annual Meeting, please visit:

www.futureofgildan.com. Shareholders who have any questions or need

assistance voting may contact the Company’s proxy solicitor,

Kingsdale Advisors, toll-free at 1-888-518-6813.

Caution Concerning Forward-Looking

StatementsCertain statements included in this press

release constitute “forward-looking statements” within the meaning

of the U.S. Private Securities Litigation Reform Act of 1995 and

Canadian securities legislation and regulations and are subject to

important risks, uncertainties, and assumptions. This

forward-looking information includes, amongst others, information

with respect to our objectives and strategies to achieve these

objectives. Forward-looking statements generally can be identified

by the use of conditional or forward-looking terminology such as

“may”, “will”, “expect”, “intend”, “estimate”, “project”, “assume”,

“anticipate”, “plan”, “foresee”, “believe”, or “continue”, or the

negatives of these terms or variations of them or similar

terminology. We refer you to the Company’s filings with the

Canadian securities regulatory authorities and the U.S. Securities

and Exchange Commission, as well as the risks described under the

“Financial risk management”, “Critical accounting estimates and

judgments”, and “Risks and uncertainties” sections of the Company’s

Management’s Discussion and Analysis for the year ended December

31, 2023 (“FY2023 MD&A”) for a discussion of the various

factors that may affect these forward-looking statements. Material

factors and assumptions that were applied in drawing a conclusion

or making a forecast or projection are also set out throughout such

document.

Forward-looking information is inherently

uncertain and the results or events predicted in such

forward-looking information may differ materially from actual

results or events. Material factors, which could cause actual

results or events to differ materially from a conclusion or

projection in such forward-looking information, include, but are

not limited to changes in general economic, financial or

geopolitical conditions globally or in one or more of the markets

we serve, including the pricing and inflationary environment, and

our ability to implement our growth strategies and plans, as well

as those factors listed in the FY2023 MD&A under the “Risks and

uncertainties” section and “Caution regarding forward-looking

statements” sections. These factors may cause the Company’s actual

performance in future periods to differ materially from any

estimates or projections of future performance expressed or implied

by the forward-looking statements included in this press

release.

There can be no assurance that the expectations

represented by our forward-looking statements will prove to be

correct. The purpose of the forward-looking statements is to

provide the reader with a description of management’s expectations

regarding the Company’s future financial performance and may not be

appropriate for other purposes. Furthermore, unless otherwise

stated, the forward-looking statements contained in this press

release are made as of the date of this press release, and we do

not undertake any obligation to update publicly or to revise any of

the included forward-looking statements, whether as a result of new

information, future events, or otherwise unless required by

applicable legislation or regulation. The forward-looking

statements contained in this press release are expressly qualified

by this cautionary statement.

About GildanGildan is a leading

manufacturer of everyday basic apparel. The Company’s product

offering includes activewear, underwear and socks, sold to a broad

range of customers, including wholesale distributors,

screenprinters or embellishers, as well as to retailers that sell

to consumers through their physical stores and/or e-commerce

platforms and to global lifestyle brand companies. The Company

markets its products in North America, Europe, Asia Pacific, and

Latin America, under a diversified portfolio of Company-owned

brands including Gildan®, American Apparel®, Comfort Colors®,

GOLDTOE® and Peds®.

Gildan owns and operates vertically integrated,

large-scale manufacturing facilities which are primarily located in

Central America, the Caribbean, North America, and Bangladesh.

Gildan operates with a strong commitment to industry-leading

labour, environmental and governance practices throughout its

supply chain in accordance with its comprehensive ESG program

embedded in the Company’s long-term business strategy. More

information about the Company and its ESG practices and initiatives

can be found at www.gildancorp.com.

Gildan Media Relations

+1 514 343-8814

communications@gildan.com

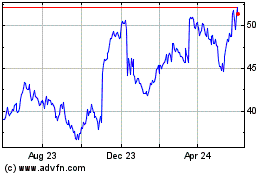

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Dec 2023 to Dec 2024