The Board of Directors of Gildan Activewear Inc. (GIL: TSX and

NYSE) (“Gildan” or “the Company”) today issued an open letter to

shareholders.

Dear Fellow Gildan Shareholders:

In response to Browning West’s December 29, 2023 letter

articulating its misguided campaign to reinstall Glenn Chamandy as

CEO of Gildan Activewear, the Board of Directors is sharing further

information on recent events. We would have preferred to keep many

of these details private, but the public misinformation tactics by

Mr. Chamandy and Browning West demand a public response.

The Board is unanimous in its conviction that retaining Mr.

Chamandy as CEO would have jeopardized the future of Gildan and

destroyed shareholder value. Mr. Chamandy has attempted to frame

this as a dispute over the Board’s CEO succession process. That is

not what this is about. This is about the future of Gildan.

The Board had gradually lost trust and confidence in Mr.

Chamandy. It had become clear that he had no credible long-term

strategy and no vision for the future. Instead, he attempted to

entrench himself as CEO by giving the Board an ultimatum: Approve a

high-risk multi-billion-dollar acquisitions strategy predicated on

guaranteeing his role as CEO for several more years to oversee its

integration and his eventual succession. If not, he would leave the

company immediately and sell his shares. The Board was left with no

other choice but to remove him as CEO.

Gildan is a company with strong fundamentals. We are optimistic

that with the right leadership and the right long-term strategy,

Gildan can grow, innovate and create sustainable long-term

shareholder value.

Ineffective Leadership

Over the last few years Mr. Chamandy struggled to scale an

increasingly complex organization. In the absence of a cohesive

long-term strategy, Mr. Chamandy jumped from one opportunistic

strategy to another. He tried forays into branded products, retail

distribution, international expansion and yarn production, with

mixed success, resulting in an eight-year annual revenue growth

rate of less than one percent and write-offs and restructurings

over that time period exceeding $450 million.

Against that backdrop it was striking to read Browning West’s

letter of December 14th asserting that under Mr. Chamandy’s

leadership Gildan’s share price was “poised to be worth $60 to $80

a share over the next two years.” That claim is in sharp contrast

to Mr. Chamandy’s 2023 long-range planning (LRP) presentation to

the Board on October 30, 2023 in which he stated that organic

growth would be capped with an intrinsic value of the share price

significantly lower than the range quoted by Browning West.

Mr. Chamandy was chief executive for 20 years, and, in his last

few years he gradually became more disengaged as CEO as he

increasingly focused on outside personal pursuits including the

development of a golf resort in Barbados. His management style was

unstructured, with few senior leadership meetings, and he was

rarely in the office, averaging just a few days a month even long

after the end of the Covid shutdown. Mr. Chamandy never visited the

new Gildan manufacturing plant in Bangladesh, one of our most

significant investments. In fact, he had not traveled to

Bangladesh, an important manufacturing hub for the company, in more

than a decade.

High-Risk Acquisition and Succession

Proposal

In December 2021, the Board and Mr. Chamandy agreed to an

orderly 3-year succession plan. By the fall of 2023, however, Mr.

Chamandy moved to entrench himself as CEO. As the search for a new

CEO advanced according to the process and timeline agreed upon with

Mr. Chamandy, he presented the Board with a plan to make risky and

highly dilutive multi-billion-dollar acquisitions, arguing that he

would then need to remain as CEO for several more years to oversee

the integration. This was not, as Mr. Chamandy now claims, a

routine annual strategy exercise. This was a formal strategy

proposal presented as Mr. Chamandy’s best idea for addressing what

he viewed as Gildan’s limited growth potential.

The Board was dubious about these high-risk acquisitions,

particularly in light of Mr. Chamandy’s inability to answer even

the most basic questions about his strategic proposal. The Board

asked Mr. Chamandy to provide a thorough analysis on his plan,

including risks and mitigation. Instead of providing details on his

plan, Mr. Chamandy gave the Board a simple and clear ultimatum:

Either support his acquisition strategy and resulting succession

plan, or he would immediately leave and sell his stock.

Contrary to his public denials, Mr. Chamandy not only gave the

Board a direct ultimatum, but he also reiterated it in

conversations with the Board Chair and in a letter to the Board

Chair on Saturday, November 25, 2023 demanding an answer before

Monday, November 27.

While the Board had originally proposed a three-year transition

plan whereby Mr. Chamandy would retire by December 31, 2024, the

ultimatums forced the Board to terminate Mr. Chamandy as CEO on

December 10, 2023.

Questionable Behaviors

Recently, the Board has learned of new information regarding

behaviors by Mr. Chamandy that took place around the time of his

departure and are inconsistent with that of a senior

executive. Mr. Chamandy recorded a private and confidential phone

call on November 24, 2023 with the Chair of the Board without the

Chair’s knowledge. Upon his departure he also violated company

policies related to the safeguarding of corporate information. The

Board of Directors is currently investigating these and other

matters, including Mr. Chamandy’s engagement with certain

shareholders prior to his termination.

Time For New Leadership

The Board’s fiduciary duty is to assure that Gildan is

positioned in the strongest way possible for future success. The

business has grown in scale and complexity, and the challenges and

opportunities that lie ahead call for a new leader with fresh

ideas, relevant skills, proven leadership ability and undivided

commitment to the business.

The CEO search process was thorough and professional. The Board

hired a leading firm in January 2022. The external phase of the

search, which began in May 2023, culminated in the Board selecting

Vince Tyra on December 10, 2023.

Mr. Tyra, who joins Gildan from Houchens Industries, a $4

billion revenue employee-owned holding company, is an accomplished

leader with deep experience in the apparel industry spanning

distribution, manufacturing and brand building. His proven track

record involves developing and implementing pragmatic strategies

that have enabled the organizations he led to grow, evolve and

create value. Mr. Tyra’s diverse professional background across

apparel, private equity and NCAA college sports reflects a

consistent theme of effective leadership.

Browning West has falsely attacked Mr. Tyra’s record,

specifically during his time at Fruit of the Loom, and it is

important to set the record straight. In 1999, as Fruit of the Loom

faced financial challenges, its Board removed the Chairman and CEO

and asked both Mr. Tyra, then President of its Activewear division,

and his colleague, the President of Retail, to submit plans to

restructure the company. The Board embraced Mr. Tyra’s plan and

named him the sole President of Fruit of the Loom. Mr. Tyra then

worked with the new CEO to implement a plan to focus on the core

retail business. Those steps laid the foundation needed to

stabilize the company and contributed to its eventual sale to

Berkshire Hathaway. Far from being part of the problem at Fruit of

the Loom, Mr. Tyra was a key part of the solution. The Board is

resolute in its belief that he will be part of the solution at

Gildan as well.

Conclusion

The past does not equal the future. Glenn Chamandy was chief

executive of Gildan for two decades. He was the right leader for

much of his tenure, building a successful public company and

creating a platform on which to expand. But the true promise of

Gildan remains largely unfulfilled, and the Board, which has worked

with Mr. Chamandy for years, is clear that he is out of the ideas

and vision to take Gildan into the future.

Over the last year, Mr. Chamandy repeatedly said that he would,

in his words, “go gracefully” whenever the Board decided the time

was right for the company. However, when that time came, Mr.

Chamandy did not “go gracefully.” He admitted he never intended to

leave and, blatantly putting his own interests ahead of those of

Gildan, orchestrated his departure to maximize disruption to the

company.

Mr. Chamandy has spent weeks telling a false and misleading

story about recent events at Gildan. Many well-intentioned

investors have bought into that false story. The Board will

continue to patiently, yet firmly, set the record straight. We look

forward to continuing our conversations with shareholders.

Sincerely,

Gildan Activewear Board of Directors

Caution Concerning Forward-Looking

Statements

Certain statements included in this press release constitute

“forward-looking statements” within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and Canadian securities

legislation and regulations and are subject to important risks,

uncertainties, and assumptions. This forward-looking information

includes, amongst others, information with respect to our

objectives and strategies. Forward-looking statements generally can

be identified by the use of conditional or forward-looking

terminology such as “may”, “will”, “expect”, “intend”, “estimate”,

“project”, “assume”, “anticipate”, “plan”, “foresee”, “believe”, or

“continue”, or the negatives of these terms or variations of them

or similar terminology. We refer you to the Company’s filings with

the Canadian securities regulatory authorities and the U.S.

Securities and Exchange Commission, as well as the risks described

under the “Financial risk management”, “Critical accounting

estimates and judgments”, and “Risks and uncertainties” sections of

our most recent Management’s Discussion and Analysis for a

discussion of the various factors that may affect these

forward-looking statements. Material factors and assumptions that

were applied in drawing a conclusion or making a forecast or

projection are also set out throughout such document.

Forward-looking information is inherently uncertain and the

results or events predicted in such forward-looking information may

differ materially from actual results or events. Material factors,

which could cause actual results or events to differ materially

from a conclusion or projection in such forward-looking

information, include, but are not limited to changes in general

economic and financial conditions globally or in one or more of the

markets we serve and our ability to implement our growth strategies

and plans. These factors may cause the Company’s actual performance

in future periods to differ materially from any estimates or

projections of future performance expressed or implied by the

forward-looking statements included in this press release.

There can be no assurance that the expectations represented by

our forward-looking statements will prove to be correct. The

purpose of the forward-looking statements is to provide the reader

with a description of management’s expectations regarding the

Company’s future financial performance and may not be appropriate

for other purposes. Furthermore, unless otherwise stated, the

forward-looking statements contained in this press release are made

as of the date hereof, and we do not undertake any obligation to

update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events,

or otherwise unless required by applicable legislation or

regulation. The forward-looking statements contained in this press

release are expressly qualified by this cautionary statement.

About Gildan

Gildan is a leading manufacturer of everyday basic apparel. The

Company’s product offering includes activewear, underwear and

socks, sold to a broad range of customers, including wholesale

distributors, screenprinters or embellishers, as well as to

retailers that sell to consumers through their physical stores

and/or e-commerce platforms and to global lifestyle brand

companies. The Company markets its products in North America,

Europe, Asia Pacific, and Latin America, under a diversified

portfolio of Company-owned brands including Gildan®, American

Apparel®, Comfort Colors®, GOLDTOE®, Peds®, in addition to the

Under Armour® brand through a sock licensing agreement providing

exclusive distribution rights in the United States and Canada.

Gildan owns and operates vertically integrated, large-scale

manufacturing facilities which are primarily located in Central

America, the Caribbean, North America, and Bangladesh. Gildan

operates with a strong commitment to industry-leading labour,

environmental and governance practices throughout its supply chain

in accordance with its comprehensive ESG program embedded in the

Company's long-term business strategy. More information about the

Company and its ESG practices and initiatives can be found at

www.gildancorp.com.

Investor inquiries:

Jessy Hayem, CFA

Vice-President, Head of Investor Relations

(514) 744-8511

jhayem@gildan.com

Media inquiries:

Genevieve Gosselin

Director, Global Communications and Corporate Marketing

(514) 343-8814

ggosselin@gildan.com

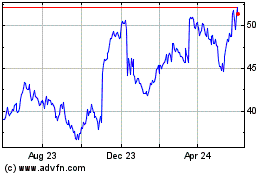

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Feb 2025 to Mar 2025

Gildan Activewear (TSX:GIL)

Historical Stock Chart

From Mar 2024 to Mar 2025