Dundee Precious Metals Enters Into Letter of Intent with PJV Resources and Rodeo Capital to Sell Its Timok Gold Project

January 25 2010 - 7:15AM

Marketwired Canada

Dundee Precious Metals Inc. (TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) ("DPM" or "the

Company") is pleased to announce it has entered into a letter of intent with PJV

Resources Inc. ("PJV"), a private company, and Rodeo Capital Corp. ("Rodeo"), a

capital pool corporation listed on the TSX Venture Exchange ("TSXV"), for the

sale of its Timok gold project located in Serbia through the sale of DPM's

Serbian subsidiary, Dundee Plemeniti Metali d.o.o. ("Metali"). Prior to the

closing of the Transaction (as defined below), DPM will cause, subject to

government approvals, a reorganization (the "Reorganization") of its Serbian

subsidiaries, as a result of which certain assets and liabilities not forming

part of the Timok project, will be transferred by Metali to another Serbian

subsidiary of DPM.

As consideration for the sale, DPM shall receive approximately US$1.4 million in

the return of cash held to secure certain concession obligations, a number of

units ("Vendor Units") in the capital of PJV, such that, upon the completion of

the Business Combination (as defined below) component of the Transaction, DPM

will hold 60% of the issued and outstanding capital of the issuer resulting from

the Business Combination (the "Resulting Issuer"), on a non-diluted basis, with

the remaining 40% representing holdings of shares outstanding as of the closing

of the Transaction, including the shares that will be sold as part of an initial

financing of PJV. The initial financing of PJV will generate gross proceeds of a

minimum of $25,000,000 (the "Minimum Financing") with respect to which PJV has

entered into an engagement letter with Dundee Securities Corporation. Each

Vendor Unit will be comprised of one PJV common share and one half of a warrant.

Each whole warrant will be exercisable for one common share for a period of not

less than two years and at an exercise price not greater than $0.40 per warrant.

In addition, upon completion of a feasibility study (as defined in NI 43-101) on

all or part of the Timok Project, DPM shall be issued 25,000,000 common shares

in the capital of the Resulting Issuer, and an additional 25,000,000 common

shares of the Resulting Issuer upon a positive decision being made by the

Resulting Issuer to bring all or any part of the Timok project into production

(a total of 50,000,000 common shares if the Resulting Issuer proceeds directly

to a mining decision without a feasibility study).

"We view this transaction as a very positive step forward in the continued

development of the Timok prospect", said Jonathan Goodman, President and CEO of

DPM. "It is a step that facilitates DPM's continued participation in Serbia

while it pursues its mine/mill expansion and new mine development opportunities

in Bulgaria."

The PJV acquisition of Metali will be a component of a wider transaction (the

"Transaction") whereby, as a subsequent step to the acquisition, a

three-cornered amalgamation ("Business Combination") will be effected pursuant

to which PJV (as financing and acquisition corporation) will amalgamate with a

wholly-owned subsidiary of Rodeo, and all of the securities of PJV (including

those issued to DPM as part of the sale of its Timok project), will be exchanged

for securities of Rodeo. The Transaction shall constitute a Qualifying

Transaction (as defined in the policies of the TSXV) for Rodeo.

The Transaction is subject to various conditions, including among other things,

approval of the Reorganization and the Transaction by the Serbian government,

completion of satisfactory due diligence, entering into definitive agreements,

all applicable regulatory approvals and completion of the Minimum Financing. The

letter of intents will terminate at the earliest of (i) January 30, 2010 if

either DPM or PJV has not completed satisfactory due diligence in respect of

Rodeo, (ii) on April 30, 2010 or (iii) the date of execution of a definitive

agreement in respect of the Transaction.

Dundee Precious Metals Inc. is a Canadian based, international mining company

engaged in the acquisition, exploration, development and mining of precious

metals. DPM owns the Chelopech Mine, a producing gold/copper mine, and the

Krumovgrad Gold Project, a mining development project, both located in Bulgaria,

as well as a 95% interest in the Kapan Mine in Armenia. In addition, it is

engaged in mineral exploration activities in Serbia.

FORWARD-LOOKING STATEMENTS

This news release may contain certain information that constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan," "expect," "project," "intend," "believe,"

"anticipate" and other similar words, or statements that certain events or

conditions "may" or "will" occur. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are made, and

are subject to a variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those projected in the

forward-looking statements. These factors include the inherent risks involved in

the exploration and development of mineral properties, the uncertainties

involved in interpreting drilling results and other geological data, fluctuating

metal prices and other factors described above and in the Company's most recent

annual information form under the heading "Risk Factors" which has been filed

electronically by means of the Canadian Securities Administrators' website

located at www.sedar.com. The Company disclaims any obligation to update or

revise any forward-looking statements if circumstances or management's estimates

or opinions should change. The reader is cautioned not to place undue reliance

on forward-looking statements.

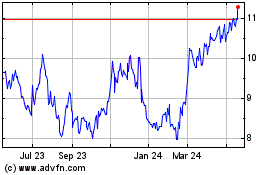

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

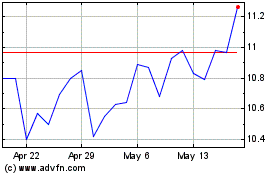

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024