(NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA)

Michael Thomson, President & CEO, is pleased to report that Rodeo Capital Corp.

(the "Company" or "Rodeo"), a capital pool company, has entered into a

non-binding letter of intent dated December 23, 2009 (the "LOI") with Dundee

Precious Metals Inc. ("DPM"), a Toronto Stock Exchange listed Canadian company,

and PJV Resources Inc. ("PJV Resources"), a privately owned British Columbia

corporation, as financing and acquisition corporation, to complete an arm's

length business combination transaction that will constitute Rodeo's Qualifying

Transaction ("QT"). Approval of the QT by the shareholders of Rodeo is not

expected to be required by the TSX Venture Exchange (the "Exchange"). The

principals of PJV Resources are David Fennell and James Crombie.

PJV Resources was created to acquire DPM's right, title and interest in mineral

licenses related to the Timok project located in Serbia, close to the mining

town of Bor (the "Timok Project") and all other associated assets and

liabilities of the concession holder, Dundee Plemeniti Metali d.o.o. (the "DPM

Subsidiary"), by way of the sale to PJV of DPM's interest in all of the issued

and outstanding securities of the DPM Subsidiary (the "Acquisition") following a

reorganization of the DPM Subsidiary which will be subject to Governmental

approvals and certain other conditions.

Business Combination Transaction - Rodeo, PJV Resources & DPM

The Acquisition is going to be a component of a wider transaction (the

"Transaction") pursuant to which PJV would amalgamate with a newly created

British Columbia subsidiary of Rodeo and all of the securities of PJV would be

exchanged for securities of Rodeo. The material components of the Transaction

are as follows: (1) the acquisition of the DPM Subsidiary (including the Timok

Project) by PJV Resources from DPM, subsequent to the entering into a definitive

agreement specifying the terms of the acquisition (the "Transaction Agreement");

(2) the subsequent amalgamation of PJV Resources with a wholly-owned subsidiary

of Rodeo, upon which all of PJV Resources outstanding common shares shall be

exchanged for common shares in the capital of Rodeo and all of PJV Resources

outstanding warrants will be exchanged for replacement warrants of Rodeo (such

Rodeo warrants will have the same terms as the exchanged PJV Resources

warrants); (3) the definitive structure of the Transaction will be determined by

the parties acting on the advice of legal counsel; (4) each of the parties to

the QT will bear their own costs; and (5) assuming completion of the QT, Rodeo

(the "Resulting Issuer"), post completion of the Transaction and Initial

Financing (as hereinafter defined), will be a mining exploration company focused

on exploration and development of the Timok Project. It is estimated that there

will be approximately 178,125,000 common shares of the Resulting Issuer issued

and outstanding immediately following closing of the QT consisting of: (i) the

5,000,000 shares of Rodeo currently issued and outstanding, (ii) approximately

106,875,000 Rodeo shares (or such other number so that DPM will hold 60% of the

Rodeo shares upon completion of the QT) to be issued in exchange for PJV shares

issued to DPM as part of the Vendor Units (as defined below) issued by PJV as

consideration for the Acquisition, (iii) a minimum of 58,750,000 Rodeo shares to

be issued in exchange for PJV shares issued as part of the financing with Dundee

Securities Corporation, and (iv) up to an additional 7,500,000 common shares of

PJV as part of a non-brokered financing expected to be exchanged for shares of

Rodeo upon completion of the QT, as more particularly described below.

Trading in the common shares of Rodeo has been halted by the Exchange at the

request of the Company. Trading is expected to remain halted until, at the

earliest, the entering into the Transaction Agreement. PJV Resources and DPM

have until January 30, 2010 to complete their due diligence on Rodeo. PJV

Resources and DPM have agreed not to solicit or negotiate with any capital pool

or other companies in regard to a transaction similar to the one proposed. Rodeo

has agreed to not solicit any other transactions. The non-solicitation

provisions are binding terms of the letter of intent and extends to the

termination of the letter of intent.

Summary of the Transaction Agreement - Rodeo, PJV Resources & DPM

Pursuant to the non-binding LOI, the Transaction Agreement, to be negotiated by

Rodeo, PJV Resources and DPM by February 28, 2010 is proposed to involve,

amongst others, the following material transaction components: 1. the

reorganization of the DPM Subsidiary including the transfer of certain Serbian

assets and liabilities, not forming part of the Transaction to another

subsidiary of DPM (the "Reorganization"); 2. PJV Resources raising a minimum of

$25,000,000 in the aggregate, to support the development of the Timok Project,

which is currently contemplated to consist of a brokered private placement of at

least 58,750,000 subscription receipts (the "Subscription Receipts"), for total

gross proceeds of at least $23,500,000 (the "Initial Financing") with an

additional $1,500,000 being raised in PJV. Pursuant to the Initial Financing,

each Subscription Receipt shall entitle the holder thereof, upon exchange or

deemed exchange, to receive one PJV Resources common share (the "PJV Financing

Shares") and one-half of one PJV Resources common share purchase warrant (the

"PJV Financing Warrants"); 3. at closing, the payment of a cash payment to DPM

with respect to restricted cash of the DPM Subsidiary held by the Serbian

government as collateral against the Subsidiary's concession obligations,

currently estimated at approximately US $1,400,000; 4. the issuance by PJV

Resources to DPM of such number of units (the "Vendor Units") that will result

in DPM owning 60% of the issued and outstanding capital of the Resulting Issuer,

on a non-fully diluted basis, post closing of the QT. Each Vendor Unit will

consist of one common share and one-half of a share purchase warrant ("DPM

Warrants") - each whole DPM Warrant being exercisable for a term of the greater

of 2 years and the term of the PJV Financing Warrants, at an exercise price

equal to the lesser of the issue price of a unit sold in the Initial Financing

and $0.40 per DPM Warrant; 5. the further issuance by the Resulting Issuer to

DPM of 25,000,000 common shares upon completion of a "feasibility study" (as

defined in NI 43-101) on all or a part of the Timok Project; and 6. an

additional issuance by the Resulting Issuer to DPM of 25,000,000 common shares

upon a positive decision being made by the board of directors of the Resulting

Issuer to bring all or any part of the Timok Project into production (a total of

50,000,000 common shares will be issued to DPM, in total, if a feasibility study

is not prepared, but a production decision is made in any event).

The LOI is non-binding and is subject to the parties negotiating a definitive

Transaction Agreement and the parties satisfying various other conditions.

Therefore, there is no assurance that the Transaction will be contemplated on

the terms proposed above or contemplated at all.

Financing with Dundee Securities Corporation

Dundee Securities Corporation and PJV have entered into an engagement letter

dated January 18, 2010 (the "Engagement Letter") whereby Dundee Securities

Corporation will act as lead agent on a best efforts basis to raise a minimum of

$23,500,000 in Subscription Receipts exchangeable for one PJV Financing Share

and one-half of one PJV Financing Warrant. The PJV Financing Warrants will

entitle the holder thereof to purchase one common of PJV at an exercise price of

$0.40 for a period of 24 months after the escrow release time, being the time

immediately prior to the effective time of the Transaction (the "Escrow Release

Time"). The release from escrow is subject to satisfaction of the following

conditions within 150 days after the closing date of the Initial Financing:

a. the acquisition of the Timok Project shall have been completed on the

terms and conditions set forth in the LOI in all material respects;

b. the agents to the Initial Financing shall have received a title opinion

from Serbian counsel to PJV, Rodeo or DPM with respect to title to the

Timok Project in form and substance satisfactory to Dundee Securities

Corporation, acting reasonably; and

c. all conditions precedent to the completion of the Transaction shall have

been satisfied or waived to the satisfaction of the agents to the

Initial Financing, acting reasonably, including, without limitation, any

required shareholder approval and the conditional approval of the

Exchange for the Transaction and the agents shall be satisfied that the

Transaction will be completed substantially in accordance with the terms

and conditions set forth in the LOI.

Upon the foregoing conditions being satisfied, the Subscription Receipts will be

deemed to have been exchanged for PJV Financing Shares and PJV Financing

Warrants. The Subscription Receipts, PJV Financing Shares and PJV Financing

Warrants will be subject under applicable securities laws to an indefinite hold

period. The PJV Financing Shares and PJV Financing Warrants will be exchanged on

a one for one basis for common shares and replacement warrants of Rodeo that

will not be subject to hold periods under Canadian securities law.

PJV will pay the agents to the Initial Financing a cash commission equal to 6%

of the gross proceeds of the Initial Financing payable at the Escrow Release

Time. In addition, PJV will grant the agents compensation options equal to 6.0%

of the number of Subscription Receipts sold under the Initial Financing. Each

such options will be exercisable for one common share and one-half of one

warrant of PJV at a price of $0.40 for a period of 24 months after the closing

date of the Initial Financing and will be exchanged upon completion of the QT

for replacement options and warrants. Pursuant to the terms of the Engagement

Letter, the Initial Financing must close no later than February 25, 2010, or

such other date as Dundee Securities Corporation and PJV may agree upon.

About the Timok Project

DPM has been actively exploring in Serbia since 2004 and is the largest holder

of mineral exploration properties in the country. The Timok Project consists of

twelve exploration license agreements and one concession license (the "Coka

Kuruga Concession") amounting to 916 square kilometers in area; a further four

exploration license agreements are located in central western Serbia and are

prospective for sediment-hosted gold mineralization, these licenses amount to

320 square kilometers in area. The Coka Kuruga Concession for exploration and

exploitation was granted in September 2006 for an initial five year exploration

period with allowance for an additional two year period to complete mining

studies, following which the company is entitled to mining rights with an

initial duration of 25 years. The exploration license agreements are currently

renewed on an annual basis. Exploration targets within the licenses include

porphyry copper-gold-molybdenum deposits, porphyry gold deposits, calcareous

sediment-hosted gold deposits and high sulfidation epithermal gold-silver-copper

deposits.

Significant gold assay results returned to date from soil sampling, trenching

and initial diamond drilling has confirmed the existence of a major zone of

calcareous sediment-hosted gold mineralization along the western border of the

Timok Magmatic Complex in northeastern Serbia. This sediment-hosted belt of

strongly anomalous gold, arsenic, antimony, bismuth and tellurium geochemistry

is at least 25 kilometers long and remains open to the west. Numerous targets

have been identified within this trend from soil sampling (up to 5 grams per

tonne gold), geophysical data, trenching and initial scout diamond drilling.

Stream sediment sampling has significantly extended the anomalous area to the

west and appears to have identified a major, previously unrecognized, province

of gold mineralization adjacent to the Timok Magmatic Complex.

Exploration on the Coka Kuruga concession has identified the Timok Diorite

Porphyry Cluster in which six Cu-Au-Mo and/or Au only porphyry centers have been

defined to date. Work to date has included surface trenching, reverse

circulation and diamond drilling on a number of porphyry Au and porphyry

Cu-Au-Mo targets. The most advanced Cu-Au-Mo project, Valja Strz, has been drill

defined over a 700 meter strike length within a 350 meter corridor on a nominal

80 meter by 80 meter drill spacing to an approximate vertical depth of 400

metres. In addition, a shallow reverse circulation drilling program was

completed on a nominal 40 meter by 40 meter spacing to an approximate vertical

depth of 60 metres over the same corresponding area. Also present within the

concession area is the Kuruga high-sulfidation lithocap which has returned

intercepts for gold, copper and silver from initial wide spaced diamond

drilling. Further details on the Timok Project will be available in a future

news release.

Board of Directors & Officers

Concurrent with the closing of the QT, all of the Directors and Officers of

Rodeo will resign and the following persons are expected to be appointed as the

Directors and Officers of the Resulting Issuer:

Executive Chairman: David Fennell received his law degree in 1979 from the

University of Alberta and practiced in the areas of corporate and resource law

until 1983, when he founded Golden Star Resources. During his term as President

& CEO, Golden Star became a TSE 300 company and one of the largest and most

successful exploration companies. In 1998, Mr. Fennell left Golden Star to

become Chairman and CEO of Cambiex Explorations Ltd, which became Hope Bay Gold

Corporation. He held this position until the merger of Hope Bay and Miramar

Mining Corporation where he continued as Executive Vice-Chairman and director

for the combined entity until its takeover, in January 2008, by Newmont Mining

Corporation, a leading gold producer. He was Chairman of Ariane Gold Corp. from

August 2002 until its acquisition by Cambior Inc. in November 2003, and was a

director of Palmarejo Silver and Gold Corporation until the merger with Coeur

d'Alene Mines Corporation, one of the world's leading silver companies, in

December 2007. He was Chairman of Maximus Ventures Ltd. until the business

combination with NFX Gold Inc. to form Bear Lake Gold Inc. Mr. Fennell is

currently a director of Sabina Gold and Silver Corp., Major Drilling Group

International Inc. and Sutter Gold as well as the Chairman and director of

Reunion Gold Corporation, Bear Lake Gold Ltd. and Queensland Minerals Ltd. and

Executive Chairman and director of Odyssey Resources Limited.

Vice Chairman, President & CEO: James Crombie graduated from the Royal School of

Mines, London, in 1980 with a B.Sc. (Hons) in Mining Engineering, having been

awarded an Anglo American scholarship. Mr. Crombie held various positions with

DeBeers Consolidated Mines and the Anglo American Corporation in South Africa

and Angola between 1980 and 1986. He spent the next thirteen years as a mining

analyst and investment banker with Shepards, Merrill Lynch, James Capel & Co.

and finally with Yorkton Securities. Mr. Crombie was the Vice President,

Corporate Development of Hope Bay Mining Corporation Inc. from February 1999

through May 2002 and President and CEO of Ariane Gold Corp. from August 2002 to

November 2003. Mr. Crombie was President, CEO and a director of Palmarejo Silver

and Gold Corporation until the merger with Coeur d'Alene Mines Corporation, one

of the world's leading silver companies, in December 2007. He was a director of

Sherwood Copper Corporation until its business combination with Capstone Mining

Corp. in November 2008. Currently, Mr. Crombie is the President, CEO and a

director of Reunion Gold Corporation, CEO and Executive Vice-Chairman of

Queensland Minerals Ltd. and President, CEO and director of Odyssey Resources

Ltd. He is also a director of Arian Silver Corporation and Sutter Gold.

Director, Special Consultant: Julian Barnes is Executive Vice President of DPM.

He has obtained his Bachelor of Science Honours Geology degree from the

University College Swansea of Wales, UK and his PhD Philosophy from the

University of Leeds, UK. He has extensive experience in major

exploration/development project management, technical computing applications,

due diligence studies, structural analysis, exploration and mining geology,

technical audits, valuations, resource evaluations, ore reserve modeling and pit

optimization. In 1987 he founded Resource Service Group, an Australian based

consulting firm, where Dr. Barnes was involved in all technical and professional

aspects including project generation, exploration geochemistry, project

scheduling and budgeting, exploration and resource computing and quality control

programs. He has also worked on numerous bankable feasibility studies, mergers

and acquisitions, and bankable due diligence studies for the majority of major

international lending institutions throughout the world. From RSG's Perth office

he has undertaken major projects throughout the globe for a wide variety of

commodities, including precious metals, mineral sands, industrial minerals,

nickel and copper-lead-zinc.

Director: Anthony Walsh (Head of Audit Committee) graduated from Queen's

University (Canada) in 1973 and became a member of The Canadian Institute of

Chartered Accountants in 1976. Mr. Walsh has over 20 years experience in the

field of exploration, mining and development. Prior to joining Sabina Silver

Corporation, Mr. Walsh was President and CEO of Miramar Mining Corporation

(1995-2007), was the Senior Vice-President and CFO of a computer leasing company

(1993-1995) and the CFO and Senior Vice-President, Finance of International

Corona Mines Ltd., a major North American gold producer (1989-1992). From 1985

to 1989 he was Vice-President, Finance of International Corona Mines Ltd., and

from 1973 to 1985 Mr. Walsh held various positions at Deloitte, Haskins & Sells,

a firm of Chartered Accountants. Mr. Walsh is currently the President, CEO and a

director of Sabina Gold and Silver Corp.

Director: Jonathan Goodman is the President and Chief executive Officer of DPM.

He has over 20 years experience in the resource and investment industry, working

as a geologist, senior analyst, portfolio manager and senior executive. Mr.

Goodman joined Goodman & Company, Investment Counsel Ltd. in 1990, where he was

responsible for the selection of Canadian equities and played a major role in

developing asset allocation strategies, before becoming the company's President.

He is also a founder of Goepel Shields and Partners, an investment firm. Mr.

Goodman graduated from the Colorado School of Mines as a Professional Engineer

and holds a Master of Business Administration from the University of Toronto. He

is also a Chartered Financial Analyst, and is a director of several

publicly-traded resource companies.

Director: Ian Hanks has over 30 years project development experience related to

the mining, mineral processing and metal production industries. Mr. Hanks has

held senior project and construction management positions with Dundee Precious

Metals, Barrick Gold Corporation, Flour Daniel Wright, and Cominco. During his

tenure at Barrick, Ian was responsible for construction management of the

Bulyanhulu Gold Project in Tanzania, the feasibility stage through to start of

construction of the Veladero Gold Project in Argentina and the feasibility stage

of the Pascua-Lama Gold Project straddling the Argentinean-Chilean border. Mr.

Hanks holds a degree in Civil Engineering from City University, London, England

and is a member of the Association of Professional Engineers and Geoscientists

of British Columbia, Canada.

Director: John Wakeford is the Senior Vice-President, Corporate Development, of

Sabina Gold and Silver Corp. Mr. Wakeford has more than 30 years in worldwide

exploration with extensive experience in Archean greenstone deposits, including

the Hemlo and Timmins gold camps. His experience includes fourteen years with

Noranda, where, among other things, he played a key role in the discovery and

evaluation of the Holloway gold deposit. On the creation of Hemlo Gold Mines,

Mr. Wakeford was appointed Director of International Exploration and led Hemlo's

international gold exploration activities. Following the merger of Hemlo with

Battle Mountain, he was appointed Director of Exploration, and eventually became

responsible for Battle Mountain's exploration efforts. Most recently John was

the Vice-President of Exploration at Miramar Mining during which time his

experience and knowledge of Archean greenstone belts enabled the company to grow

the Hope Bay resource to over 10 million ounces of gold.

Officer - Chief Financial Officer: Alain Krushnisky graduated from the

University of Ottawa in 1983 with a B.Com. and is a member of the Canadian

Institute of Chartered Accountants. Mr. Krushnisky has twenty years of

experience in the mining sector including 10 years with Cambior Inc. in various

capacities, including Vice-President and Controller. Since 2004, Mr. Krushnisky

has been doing consulting work for various mining companies. He currently is the

Chief Financial Officer of various public companies, including Reunion Gold

Corporation, Queensland Minerals Ltd., Odyssey Resources Limited and Bear Lake

Gold Ltd. He is also a director of Orezone Resources Inc., Cogitore Resources

Inc. and Majescor Resources Inc.

Officer - Corporate Secretary: Carole Plante received a law degree in 1983 from

the University of Montreal and is a member of the Quebec Bar. Ms. Plante has

over 15 years experience in the mining sector. Ms. Plante has been the Corporate

Secretary of Reunion Gold Corporation since 2004. She also acts as General

Counsel and Corporate Secretary of Queensland Minerals Ltd., Odyssey Resources

Limited and Bear Lake Gold Ltd. Previously, Ms. Plante acted as Legal counsel

and Corporate Secretary for Palmarejo Silver and Gold Corporation, Ariane Gold

Corp., Hope Bay Gold Corporation and Golden Star Resources Ltd.

Grant of Additional Stock Options

As part of the QT, the Resulting Issuer will issue additional incentive stock

options (the "Additional Stock Options") to incoming Directors and Officers, at

an exercise price equal to the price of the securities issued under the Initial

Financing or otherwise in accordance with the policies of the Exchange. The

terms and conditions of the Additional Stock Options will be determined by the

Board of Directors of the Resulting Issuer, but will not exceed 10% of the

issued and outstanding shares of the Resulting Issuer, post completion of the

QT.

Sale and Purchase Within Escrow

As part of the proposed QT, the five escrow shareholders of Rodeo have agreed in

principle to the sale and purchase within escrow of an aggregate of 2,550,000

shares of the 3,000,000 shares held in escrow, at a price of $0.085 per share,

for a total purchase price of $216,750. The sale and purchase within escrow is

being made pursuant to exemptions from the take-over bid requirements of

applicable securities legislation and will close concurrent with the closing of

the QT. The persons purchasing escrow shares are: David Fennell, James Crombie,

Julian Barnes, Ian Hanks, John Wakeford, Anthony Walsh and Jonathan Goodman

(collectively, the "Escrow Share Purchasers"). The Escrow Share Purchasers will

be subject to escrow requirements, as determined by the Exchange as part of the

approval of the QT.

Closing of the Qualifying Transaction

The closing of the QT is subject to a number of terms and conditions including:

a. DPM obtaining Serbian government approval for the Reorganization and the

Transaction, and DPM completing the Reorganization prior to closing of

the Transaction;

b. execution of the Transaction Agreement by all parties by February 28,

2010 (or such later date as the parties may agree upon in writing) and

Rodeo, PJV Resources and DPM closing the Transaction Agreement;

c. absence of material adverse change, material litigation, claims,

investigations or other matters affecting Rodeo, PJV Resources or DPM;

d. completion of aggregate financing by PJV of at least $25,000,000 that

includes the Initial Financing;

e. approval by the Board of Directors of Rodeo, PJV Resources and DPM and

by the shareholders of Rodeo, if required by the Exchange;

f. the entering into of certain ancillary agreements as contemplated in the

LOI, more particularly: an agreement whereby DPM will have a

participation right to maintain its pro-rata ownership of the Resulting

Issuer; a standstill agreement relating to certain conduct of DPM,

dependent upon its ownership position in the Resulting Issuer, relating

to take-over bids; and the grant by the Resulting Issuer to DPM of

qualification rights pursuant to which DPM will be entitled to request

the qualification for distribution by prospectus in all provinces of

Canada (other than Quebec) of DPM's shares of the Resulting Issuer, at

DPM's expense, and as long as DPM holds more than 20% of the outstanding

shares of the Resulting Issuer;

g. PJV Resources shall be responsible for and at its expense to (i) prepare

an Information Circular or Filing Statement which after having been

reviewed and approved by Rodeo will be submitted to the Exchange for its

review in accordance with its policies, (ii) prepare and submit for

filing with the Exchange and securities commissions a current and

compliant National Instrument 43-101 - Standards of Disclosure for

Mineral Projects technical report relating to the Timok Project, (iii)

prepare and submit necessary audited and reviewed financial statements

for PJV Resources and the DPM Subsidiary or any other entity other than

Rodeo, as required by the Exchange, and (iv) to arrange sponsorship or

an exemption from the sponsorship requirements of the Exchange; and

h. in addition to the approval contemplated above, all parties obtaining

all requisite regulatory, stock exchange or governmental authorizations

and consents, including the Exchange.

About Rodeo Capital Corp.: Rodeo is a junior capital pool company that

completed its initial public offering and obtained a listing on the TSX Venture

Exchange in July of 2009. Prior to entering into the LOI, Rodeo did not carry on

any active business activity other than reviewing potential transactions that

would qualify as Rodeo's Qualifying Transaction.

About PJV Resources Inc.: PJV Resources is a privately owned corporation with a

head office in Vancouver, B.C., created for the purpose of completing the

acquisition of the Timok Project. The principals of PJV Resources are David

Fennell and James Crombie. Mr. Fennell and Mr. Crombie have extensive experience

in the Canadian capital markets and are directors and officers of a number of

publicly traded corporations.

About Dundee Precious Metals Inc.: DPM is a Canadian based, international mining

company engaged in the acquisition, exploration, development and mining of

precious metal properties. Its common shares and share purchase warrants

(Symbol: DPM; DPM.WT; DPM.WT.A) are traded on the Toronto Stock Exchange (TSX).

DPM owns the Chelopech Mine, a gold/copper concentrate producer and the

Krumovgrad gold project, a mining development project, both located in Bulgaria,

and 95% of the Kapan Mine, a gold/copper/zinc concentrate producer in southern

Armenia. In addition, DPM holds significant exploration and exploitation

concessions in some of the larger gold-copper-silver mining regions in Serbia.

ON BEHALF OF THE BOARD OF DIRECTORS:

Michael G. Thomson, President & CEO

This press release contains forward-looking information. More particularly, this

press release contains statements concerning the prospective qualifying

transaction of the Company and the Timok Project. The information about the

Timok Project contained in the press release has not been independently verified

by the Company. Although the Company believes in light of the experience of its

officers and directors, current conditions and expected future developments and

other factors that have been considered appropriate that the expectations

reflected in this forward-looking information are reasonable, undue reliance

should not be placed on them because the Company can give no assurance that they

will prove to be correct. Forward-looking information involves known and unknown

risks, uncertainties, assumptions (including, but not limited to, assumptions on

the exploration potential of the Timok Project and the indentified targets) and

other factors that may cause actual results or events to differ materially from

those anticipated in such forward-looking information. The terms and conditions

of the prospective qualifying transaction may change based on the Company's due

diligence on the respective companies and properties (which is going to be

limited as the Company intends largely to rely on the due diligence of other

parties of the Transaction to contain its costs, among other things), the

entering into a binding agreement for the qualifying transaction and

Transaction, the success of the initial financing, regulatory and third party

comments, consents and approvals and the ability to meet the conditions of the

qualifying transaction in the required timeframes. The forward-looking

statements contained in this press release are made as of the date hereof and

the Company undertakes no obligations to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

Completion of the transaction is subject to a number of conditions, including

but not limited to, Exchange acceptance and if applicable pursuant to Exchange

Requirements, majority of the minority shareholder approval. Where applicable,

the transaction cannot close until the required shareholder approval is

obtained. There can be no assurance that the transaction will be completed as

proposed or at all.

Investors are cautioned that, except as disclosed in the management information

circular or filing statement to be prepared in connection with the transaction,

any information released or received with respect to the transaction may not be

accurate or complete and should not be relied upon. Trading in the securities of

a capital pool company should be considered highly speculative.

Julian Barnes is the Qualified Person under NI 43-101 who has reviewed the

technical disclosure with respect to the Timok Project contained in this press

release. DPM has provided all information on the Timok Project in this news

release without any further review by the Company or PJV. Julian Barnes is

employed by DPM.

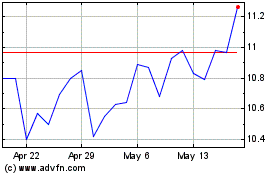

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

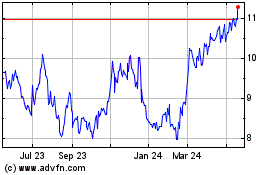

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024