Dundee Precious Metals Enters Into Agreement With Weatherly International for the Purchase of Namibian Smelter Assets

January 14 2010 - 8:30AM

Marketwired

Dundee Precious Metals Inc. (TSX: DPM)(TSX: DPM.WT)(TSX: DPM.WT.A)

("DPM" or "the Company") is pleased to announce it has entered into

a binding letter of intent (the "LOI") with Weatherly International

plc ("WTI") for the purchase of WTI's Tsumeb smelter assets and

related business. The acquisition includes all land, plant and

other assets used by or in connection with or which benefit or

pertain to WTI's smelter business (the "Transaction").

The consideration to be provided to WTI by DPM upon completion

of the Transaction will be:

i. US$33 million, consisting of:

a. US$18 million in cash (less any amounts drawn under a US$2 million

working capital loan to be provided to WTI, as outlined below); and

b. the issuance of approximately 4,446,420 fully paid common shares of

DPM; and

ii. the assumption by DPM of all third party obligations of Namibia Custom

Smelters (Pty) Limited ("NCS"), a subsidiary of WTI.

Under the LOI, DPM will (subject to any necessary exchange

control consents being obtained) provide: (i) a working capital

loan facility to WTI of up to US$2 million, and (ii) a working

capital loan facility to NCS of up to US$4 million. The loans shall

be made on the same terms as the current loan agreement between

Chelopech Mining EAD ("CME") and NCS.

"DPM's purchase of the Tsumeb smelter will secure value-added,

downstream processing capacity for the Company" said Jonathan

Goodman, President and CEO of DPM. "This is a very important

consideration as we work to double concentrate production at our

Chelopech Mine. We see great opportunity as a custom smelter for

complex concentrates and look forward to developing this asset and

its related business opportunities."

The LOI is conditional inter alia upon:

i. the parties entering into a detailed sale and purchase agreement

containing the warranties, indemnities and other terms provided for in

the LOI;

ii. WTI shareholder approval;

iii. WTI's agreement not to exercise its remaining rights under its

subscription agreement with DPM dated July 31, 2009 and DPM release of

all such obligations;

iv. there having been no material adverse change in the physical assets,

licences, permits, waivers, consents or approvals that benefit the

smelter operations;

v. WTI's convertible noteholders consent and agreement to the full

settlement of their notes (and discharge of security for such notes);

and

vi. Toronto Stock Exchange approvals.

As of today, DPM has received irrevocable undertakings from

approximately 44% of WTI shareholders to support the Transaction.

The outstanding conditions of the LOI are to be satisfied by

February 28, 2010 or such other date as the parties may agree. In

the event the Transaction is not completed by June 30, 2010, any

amounts drawn down under the loan to NCS would become due to DPM on

demand.

CONFERENCE CALL

DPM will hold a conference call to discuss the Transaction with

analysts on Thursday, January 14, 2010 at 11:00 a.m. (EST). The

call will be hosted by Jonathan Goodman, President and Chief

Executive Officer, and will be webcast live (audio only) at:

http://events.digitalmedia.telus.com/dundee/011410/index.php. The

audio webcast of this call will be archived and available on the

Company's website at www.dundeeprecious.com.

Dundee Precious Metals Inc. is a Canadian based, international

mining company engaged in the acquisition, exploration, development

and mining of precious metals. DPM owns the Chelopech Mine, a

producing gold/copper mine, and the Krumovgrad Gold Project, a

mining development project, both located in Bulgaria, as well as a

95% interest in the Kapan Mine in Armenia. In addition, it is

engaged in mineral exploration activities in Serbia.

FORWARD-LOOKING STATEMENTS

This news release may contain certain information that

constitutes forward-looking statements. Forward-looking statements

are frequently characterized by words such as "plan," "expect,"

"project," "intend," "believe," "anticipate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur. Forward-looking statements are based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements.

These factors include the inherent risks involved in the

exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological data, fluctuating metal prices and other factors

described above and in the Company's most recent annual information

form under the heading "Risk Factors" which has been filed

electronically by means of the Canadian Securities Administrators'

website located at www.sedar.com. The Company disclaims any

obligation to update or revise any forward-looking statements if

circumstances or management's estimates or opinions should change.

The reader is cautioned not to place undue reliance on

forward-looking statements.

Contacts: Dundee Precious Metals Inc. Jonathan Goodman President

& Chief Executive Officer (416) 365-2408 Email:

jgoodman@dundeeprecious.com Dundee Precious Metals Inc. Stephanie

E. Anderson Executive Vice President & CFO (416) 365-2852

Email: sanderson@dundeeprecious.com Dundee Precious Metals Inc.

Lori Beak Vice President, Investor Relations & Corporate

Secretary (416) 365-5165 Email: lbeak@dundeeprecious.com

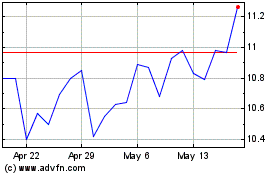

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jun 2024 to Jul 2024

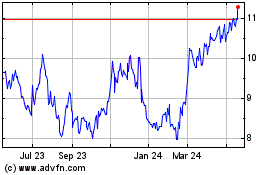

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024