TORONTO, ONTARIO (TSX: DPM.WT) (the "Company" or "DPM")

announced that initial diamond drilling results at the Shahumyan

Mine at Kapan, southeastern Armenia support the potential for bulk

mineable polymetallic open pit mineralization.

"The first diamond drilling results at Shahumyan support our

concept of a bulk mineable open pit at Shahumyan. I am very

encouraged by these drilling results from the 'Vein 5' area at

Shahumyan where we are testing the potential for an initial open

pit," said Jonathan Goodman, President and CEO of DPM.

HIGHLIGHTS

- In-house modelling and pit optimization studies on the historic

(non-National Instrument 43-101 ("NI 43-101") compliant) diamond drill

and underground sampling database for the Shahumyan deposit suggest

potential for a large scale, bulk mineable open pit.

- Diamond drill results from the first two holes in the 'Vein 5' area have

returned wide polymetallic intercepts, providing initial support of

the concept.

MAIN INTERCEPTS

- Key intercepts include:

-- SHDDR0001: 65m at 0.51g/t Au, 30g/t Ag, 0.1% Cu, 0.81% Zn, 0.02% Pb

(2.17g/t AuEq)

-- SHDDR0008: 89m at 1.42g/t Au, 66g/t Ag, 0.11% Cu, 1.13% Zn, 0.03% Pb

(4.12g/t AuEq)

-- Note: In situ gold equivalent(AuEq) grade based on the following metal

prices:

- Au: US$750/oz, Ag: US$15/oz, Cu: US$2.30/lb, Zn: US$1.10/lb, Pb:

US$1.10/lb

BACKGROUND

The Kapan mining area is located in the southeastern corner of

Armenia, 320 km south of the capital city of Yerevan and forms part

of the Tethyan tectonic belt which extends from southeast Asia to

Europe and is one of the most strongly mineralized belts on earth.

The belt contains world class porphyry copper-gold, polymetallic

vein array and epithermal gold-silver deposits, and is host to the

Chelopech deposit in Bulgaria and the Bor deposits in Serbia.

Figure 1 shows the location of the Kapan mine.

The Kapan mine consists of two parts, a copper deposit known as

Centralni and a polymetallic deposit of copper (Cu), gold (Au),

silver (Ag), zinc (Zn) and lead (Pb), known as Shahumyan.

Production from the Centralni deposit started in the 1950s,

initially from underground and then from both underground and an

open pit, and records indicate that more than 30mt at approximately

1.3% Cu have been extracted to date.

The Shahumyan polymetallic vein array was first discovered in

the early part of the 20th century and was briefly exploited on a

small scale during World War II. Detailed exploration of the

Shahumyan deposit commenced in 1976 and to date at least 280,000m

of diamond drilling and over 33,000m of underground access

development from adits on the 700m, 780m, 820m and 860m levels has

been completed. Below the 700 level short exploration drives have

been completed at the 605m and 505m levels. The bulk of the surface

and underground exploration drilling has been conducted to the 550m

mine level which is approximately 370m below the ground

surface.

The mineralization at Shahumyan occurs in altered dacite,

andesite and basaltic host rocks. The main ore minerals are

chalcopyrite, sphalerite and minor galena, along with gold and

silver.

An underground mining operation is currently being carried out

at Shahumyan, based on a reserve estimate, compiled in accordance

with Armenian regulations of 12mt at 0.5% Cu, 2g/t Au, 37g/t Ag and

2.2% Zn. Two clean, readily saleable concentrates are produced, a

Cu-Au and a Zn , which are transported by road and rail to the

Black Sea for export.

In early 2006 an opportunity arose to review the Kapan mining

operation. A large historical database of the Shahumyan deposit was

made available including assays from the +280,000m surface and

underground diamond drilling and also some 33,000m of drive channel

sampling and 32,000m of face sampling. No core remains from any of

the diamond drilling and no reference samples of the channel and

face sampling exist. However, DPM undertook a very careful due

diligence sampling exercise, collecting over 750kg of 30kg samples

chosen from throughout the accessible parts of the Shahumyan mine.

The samples were collected to enable independent metallurgical

studies to be carried out in Canada. In addition, records and

reference samples were available from milling of the Shahumyan ore

during recent years. The due diligence sampling returned grades of

a similar tenor to the historical database and the grades returned

from the current mining operation.

DPM has used the historical database to carry out a series of

in-house resource studies (non NI 43-101 compliant). Figure 2

displays a plan image of the historical database (using a 'gold

equivalent' variable for illustration, wherein composites greater

than 0.5g/t AuEq are rendered visible) which shows an extensive

vein array over 2.5km long, 1.5km wide and at least 500m deep and

shows the location of the Vein 5 Area.

In particular, the potential for a large scale open pit mining

operation has been assessed. In order to undertake the assessment,

intervals with no assays were given a 'zero' grade prior to

compositing. Several resource estimates were carried out during the

due diligence assessment both by DPM staff and independent

consultants using a variety of estimation methods with a range of

parameters and grade restrictions. In addition, numerous pit

optimizations were carried out, both to assess the potential for

very large open pits, capable of supporting a large tonnage mining

operation, and to identify locations for smaller scale 'starter'

pits to supplement underground production in order to fully exploit

the 1.2 million tonne per annum Kapan mill while the drill

assessment of the overall Shahumyan deposit is being carried out.

The DPM studies indicate potential for a large mining operation and

suggest that the current stated reserve is conservative.

As a result of the due diligence studies, DPM purchased a

controlling interest in the Kapan Mine. In order to collect the

data required to complete a NI 43-101 compliant resource estimate,

DPM has purchased three diamond drill rigs and three reverse

circulation ("RC") drill rigs and is in the final stages of

equipping and commissioning a new assay facility, to be

independently managed by SGS. In addition, all the extra equipment

required to support a large drilling program has been put in place

or is being established. The entire process is a major logistical

exercise, involving significant staffing and training

requirements.

A zone in the northwest quadrant of the Shahumyan deposit,

termed the Vein 5 Area, has been chosen for the first 'starter pit'

drilling programme. A 600m long zone is planned to be drilled out,

firstly using an 80m by 80m collar pattern with a follow-up drill

spacing of 40m by 40m. The total of 13,600 metres of diamond and RC

drilling is planned for the phase 1 (4,000m) and phase 2 (9,600m)

programs. Samples are collected using a 1m interval and the full

standard set of DPM sampling and QAQC procedures have been employed

throughout the drilling programme, including the submission of

international standards in the assay sequence.

In addition, a series of drill holes, for the purpose of

collecting metallurgical samples is currently being drilled.

Until the full assay facility is commissioned at Kapan, samples

have been despatched for assay to the SGS laboratory in Perth,

Western Australia.

The Shahumyan deposit occurs within a major 15km by 10km

alteration zone. DPM has been granted a 350 square kilometre

Exploration Licence which has secured coverage of the entire

alteration zone. To date, DPM has flown airborne geophysics over

the Exploration Licence and has undertaken stream sediment

sampling, soil sampling and detailed geological mapping.

RESULTS

Some five batches of assay results have been received,

representing three metallurgical drill holes (SHDDM0001 -SHDDM0003)

and two Vein 5 Area resource definition drill holes (SHDDR0001 and

SHDDR0008). The two Vein 5 Area drill holes are spaced

approximately 100m apart in the central portion of the area to be

drilled. Very encouraging drill intercepts have been returned,

providing support for the concept of a bulk open pit mining

operation, as displayed in Table 1. The intercepts listed for the

two Vein 5 Area holes are in primary mineralization. The upper part

of metallurgical sampling hole SHDDM0002 is oxidized. In order to

calculate in situ 'metal equivalent' grades, a series of metal

price assumptions has been made, as shown in Table 1.

------------------------------------------------------------------

Table 1 Shahumyan

DPM Diamond Drilling Intersection Summary

Consensus Average Metal Prices (2007 to Long Term)

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

METAL PRICE ASSUMPTIONS

------------------------------------------------------------------

------------------------------------------------------------------

Metal $/oz $/gm Metal $/lb

------------------------------------------------------------------

Gold 750 24.1 Cu 2.30

Silver 15 0.48 Pb 1.10

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

Hole From To Int Au Ag Cu

(m) (m) (m) (g/t) (g/t) (ppm)

------------------------------------------------------------------

------------------------------------------------------------------

METALLURGICAL SAMPLE DRILLHOLES

------------------------------------------------------------------

SHDDM0001 (i) 49 54.5 5.5 0.44 27 0.06

SHDDM0002 0 48 48 0.15 7 0.07

SHDDM0003 50 54 4 0.06 3 0.04

SHDDM0003 63 66 3 0.41 20 0.13

SHDDM0003 78 81 3 0.45 12 0.10

------------------------------------------------------------------

VEIN 5 DRILL HOLES

------------------------------------------------------------------

SHDDR0001 115 118 3 2.01 19 0.03

SHDDR0001 124 189 65 0.51 30 0.10

SHDDR0001 196 213 17 0.24 8 0.03

SHDDR0008 87 176 89 1.42 66 0.11

SHDDR0008 196 210 14 0.16 13 0.06

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

------------------------------------------------------------------

METAL PRICE ASSUMPTIONS

------------------------------------------------------------------

------------------------------------------------------------------

$/t $/% Metal $/lb $/t $/%

------------------------------------------------------------------

5071 51 Zn 1.10 2425 24

2425 24

------------------------------------------------------------------

------------------------------------------------------------------

Hole Pb Zn Au_Eq Cu_Eq Pb_Eq Zn_Eq

(ppm) (ppm) (g/t) (%) (%) (%)

------------------------------------------------------------------

METALLURGICAL SAMPLE DRILLHOLES

------------------------------------------------------------------

SHDDM0001 0.50 2.62 4.24 2.02 4.22 4.22

SHDDM0002 0.05 0.54 1.05 0.50 1.04 1.04

SHDDM0003 0.04 0.45 0.69 0.33 0.69 0.69

SHDDM0003 0.19 0.82 2.10 1.00 2.09 2.09

SHDDM0003 0.10 0.88 1.89 0.90 1.88 1.88

------------------------------------------------------------------

VEIN 5 DRILL HOLES

------------------------------------------------------------------

SHDDR0001 0.03 0.87 3.36 1.60 3.34 3.34

SHDDR0001 0.02 0.81 2.17 1.03 2.15 2.15

SHDDR0001 0.01 0.40 0.87 0.41 0.86 0.86

SHDDR0008 0.03 1.13 4.12 1.96 4.10 4.10

SHDDR0008 0.00 0.98 1.54 0.73 1.53 1.53

------------------------------------------------------------------

------------------------------------------------------------------

Note (i) End of Hole

(ii) 3m minimum intersection length

(iii) 4m maximum contiguous waste

(iv) No upper cuts

(v) True widths approximately 90% of intersection widths

Dr. Julian F. H. Barnes, a qualified person under NI 43-101 and

Executive Vice President of DPM, has supervised the preparation of

the technical data included in this press release.

All resource estimates quoted herein are based on prior data and

reports obtained and prepared by previous operators and information

provided by the State. The Company has not yet completed the work

necessary to verify the classification of the mineral resource

estimates. The Company is not treating the mineral resource

estimates as NI 43-101 defined resources verified by a qualified

person. The historical estimates should not be relied upon. These

properties will require considerable further evaluation which DPM's

management and consultants are carrying out.

Dundee Precious Metals Inc. is a Canadian based, international

mining company engaged in the acquisition, exploration, development

and mining of precious metals. It currently owns the Chelopech

Mine, a producing gold/copper mine, and the Krumovgrad Gold

Project, a mining development project, both located in Bulgaria,

and is engaged in mineral exploration activities in Serbia. In

addition, DPM owns the Back River gold exploration project in

Nunavut, Canada and a 95% interest in the Kapan Mine in Armenia.

The Company also holds a significant and strategic portfolio of

investments in the precious metals and mineral related sector.

FORWARD LOOKING STATEMENTS

This news release may contain certain information that

constitutes forward-looking statements. Forward-looking statements

are frequently characterized by words such as "plan," "expect,"

"project," "intend," "believe," "anticipate" and other similar

words, or statements that certain events or conditions "may" or

"will" occur. Forward-looking statements are based on the opinions

and estimates of management at the date the statements are made,

and are subject to a variety of risks and uncertainties and other

factors that could cause actual events or results to differ

materially from those projected in the forward-looking statements.

These factors include the inherent risks involved in the

exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological data, fluctuating metal prices and other factors

described above and in the Company's most recent annual information

form under the heading "Risk Factors" which has been filed

electronically by means of the Canadian Securities Administrators'

website located at www.sedar.com. The Company disclaims any

obligation to update or revise any forward-looking statements if

circumstances or management's estimates or opinions should change.

The reader is cautioned not to place undue reliance on

forward-looking statements.

To view Figure 1, please visit the following link:

http://media3.marketwire.com/docs/dpmfig1.pdf

To view Figure 2, please visit the following link:

http://media3.marketwire.com/docs/dpmfig2.pdf

Contacts: DUNDEE PRECIOUS METALS INC. Jonathan Goodman President

& Chief Executive Officer (416) 365-2408 Email:

jgoodman@dundeeprecious.com DUNDEE PRECIOUS METALS INC. Gabriela M.

Sanchez Vice President Investor Relations (416) 365-2549 Email:

gsanchez@dundeeprecious.com

Dundee Precious Metals (TSX:DPM)

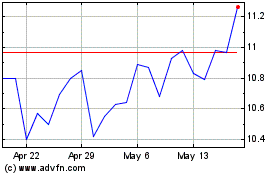

Historical Stock Chart

From Jun 2024 to Jul 2024

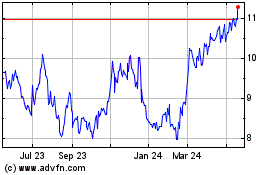

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024