Calibre Continues Strong Progress at the Fully Funded Valentine Gold Mine; Construction 64% Complete, Engineering 98% Complete, Operational Leadership Hired, Pre-Commissioning Underway, On Track For Q2 2025 Gold Production

May 14 2024 - 5:00PM

Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF) (“Calibre” or the

“Company”) is pleased to announce a construction and capital cost

update on the Valentine Gold Mine (“Valentine” or “VGM”), located

in the central region of Newfoundland & Labrador, Canada. All

figures in Canadian Dollars (“C$”) unless otherwise stated.

Darren Hall, President and Chief

Executive Officer of Calibre, stated: “I am pleased to

announce that construction of our fully funded Valentine Gold Mine

is 64% complete and we have progressed detailed engineering to 98%

from 60%, with the later having formed the basis of the previously

disclosed Marathon Gold capital estimates. With the first gold pour

scheduled in Q2 2025, the delivery of Valentine is a paradigm shift

for Calibre as we transition to a quality mid-tier gold producer

unlocking significant value for all stakeholders.

Since acquiring Valentine in January 2024 we

have re-baselined the project schedule, significantly progressed

detailed engineering, awarded all major contracts, connected site

to permanent power, delivered critical path items including mills

and motors, employed the operations leadership team, and commenced

pre-commissioning and commissioning activities.

Our project optimization and derisking efforts,

combined with accelerating a portion of Phase 2 expansion capital,

results in an initial capital cost of C$653 million, a C$145

million increase over Marathon Gold’s Q3 2023 update. With a C$279

million cost to complete as of April 30, 2024 and approximately

C$400 million of cash and restricted cash, we are fully funded. In

addition, the Company has substantial cash flows from

operations.

I am confident the Valentine gold property has

district-scale potential, and we anticipate accelerating our

exploration efforts in the near term. The Valentine Gold Mine and

surrounding property offers a robust resource base and significant

discovery opportunities with an extremely prospective array of

exploration targets with similar geology to the prolific Val-d’Or

and Timmins camps in the Abitibi gold belt.”

Initial Capital Cost Update

- First gold

production scheduled for Q2 2025;

- Updated initial

capital cost estimate of C$653 million, an increase of C$145

million versus last reported C$508 million by Marathon Gold

Corporation (“Marathon”) in Q3 2023;

- The updated

estimate is consistent with Calibre’s pre-acquisition due diligence

and consists of three primary components:

- Marathon’s Schedule

and Cost Underestimation of C$70 million;

- Calibre’s Project

Optimization & Derisking of C$40 million; and

- Calibre Advancing

Operations & Phase 2 Expansion Capital of C$35 million

- With a C$279

million cost to complete as of April 30, 2024 and approximately

C$400 million of cash and restricted cash, we are fully funded. In

addition, the company has substantial cash flows from

operations.

Construction and Operational Readiness

Highlights

- Overall

construction progress 64% complete;

- Detailed

engineering progressed to 98%;

- Tailings Management

Facility starter dam embankment complete and approved by the

Engineer of Record and liner placement has commenced;

- Critical path

items, including mills and motors, delivered to Newfoundland;

- Site connected to

permanent hydroelectric power;

- Mill building

enclosed;

- Structural

Mechanical Piping (“SMP”) and Electrical and Instrumentation

(“E&I”) contracts awarded;

- Pre-commissioning

and commissioning contract awarded; and

- Operations

leadership team employed.

Exploration Highlights

- 50,000 metre RC

drilling completed at Leprechaun pit and underway at the Marathon

pit;

- Diamond drilling

recently completed at the Leprechaun SW discovery (see news release

dated April 3, 2024);

- Significant

district scale exploration potential across 64 km shear zones;

- Target delineation

drilling across the shear zones commencing this summer;

- Exceptional

exploration potential over the 250 km2 property with similar

geology to the prolific Val-d’Or and Timmins camps in the Abitibi

gold belt; and

- Strong potential

down plunge of existing open pits demonstrates an additional

underground mining opportunity outside of the current open pit mine

plan.

Marathon Initial Capital Cost Estimate

History

|

Updated Feasibility Study (1)

|

C$463 million |

- First gold in January 2025

|

|

Q2 2023 Construction Report

(2) |

C$504 million |

- C$41 million increase

- C$113 million spent as of June 30,

2023

- C$391 million cost to complete

- First gold Q1 2025

|

|

Q3 2023 Construction Report

(3) |

C$508 million |

- C$4 million increase

- C$190 million spent as of September

30, 2023

- C$318 million cost to complete

- First gold Q1 2025

|

Calibre Initial Capital Cost

Estimate

|

May 14, 2024 Initial Capital Cost |

C$653 million |

- Overall project completion at

64%

- Detailed engineering at 98%

- C$374 million spent as of April 30,

2024

- C$279 million cost to complete

- Fully funded with ~C$400 million in

cash, and restricted cash

- First gold Q2 2025

|

C$145 million increase vs Marathon’s Q3

2023 estimate due to:

|

Marathon’s Schedule and Cost Underestimation |

C$70 million |

- First gold shift to Q2 2025

- Labour costs due to the schedule extension

- Engineering progressed from 60% to 98%

- Scope definition increases to major contracts including the SMP

and E&I

- Increased volumes of concrete, steel, etc

- Inflationary pressures on consumables

- Increased camp services and related costs

|

|

Calibre’s Project Optimization and Derisking |

C$40million |

- Pre commissioning & commissioning contract awarded, and

activities commenced

- Site access upgrade and maintenance

- Process plant & site infrastructure modifications

- Employed the operations leadership team

|

|

Calibre Advancing Operations and Phase 2 Expansion

Capital |

C$35 million |

- Advanced Phase 2 CIL & cyanide destruct tanks in

preparation of the increase from 2.5 to 4.0Mtpa

- Advanced process plant effluent treatment plant

- Advanced permanent mobile equipment maintenance and associated

facilities

- Accommodation upgrades; including air conditioning and

telecommunications

- Advanced critical spares

|

Calibre will also increase working capital over

the next 12 months to materially de-risk the execution of the

production ramp-up. Areas of focus for working capital include:

- Critical inventory

of consumables and critical spares for mining and processing;

and

- Development of open

pit ore stockpiles to provide consistent and uninterrupted feed to

the process plant.

Qualified Person

Mr. Paolo Toscano, P. Eng (Ont.), SVP

Engineering, Projects and Construction, is a “qualified person” as

set out under NI 43-101 and has reviewed and approved the

scientific and technical information in this press release.

About Calibre

Calibre is a Canadian-listed, Americas focused,

growing mid-tier gold producer with a strong pipeline of

development and exploration opportunities across Newfoundland &

Labrador in Canada, Nevada and Washington in the USA, and

Nicaragua. Calibre is focused on delivering sustainable value for

shareholders, local communities and all stakeholders through

responsible operations and a disciplined approach to growth. With a

strong balance sheet, a proven management team, strong operating

cash flow, accretive development projects and district-scale

exploration opportunities Calibre will unlock significant

value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please contact:

Ryan KingSVP Corporate Development & IRT:

604.628.1012E: calibre@calibremining.comW:

www.calibremining.com

Calibre’s head office is located at Suite 1560,

200 Burrard St., Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed

nor accepts responsibility for the adequacy or accuracy of this

news release.

Cautionary Note Regarding Forward

Looking Information

This news release includes certain

“forward-looking information” and “forward-looking statements”

(collectively “forward-looking statements”) within the meaning of

applicable Canadian securities legislation, including statements

regarding the plans, intentions, beliefs and current expectations

of Calibre with respect to future business activities and operating

performance. All statements in this news release that address

events or developments that Calibre expects to occur in the future

are forward-looking statements. Forward-looking statements are

statements that are not historical facts and are often identified

by words such as "expect", "plan", "anticipate", "project",

"target", "potential", "schedule", "forecast", "budget",

"estimate", "intend" or "believe" and similar expressions or their

negative connotations, or that events or conditions "will",

"would", "may", "could", "should" or "might" occur, and include

information regarding: (i) expectations regarding the ability of

the Company to successfully achieve business objectives, including

the effects of unexpected costs, liabilities or delays, (ii)

expectations regarding future exploration and development, growth

potential for Calibre’s operations, and (iv) expectations for other

economic, business, and/or competitive factors. For a listing of

risk factors applicable to the Company, please refer to Calibre's

annual information form for the year ended December 31, 2023, and

its management discussion and analysis for the year ended December

31, 2023, all available on the Company’s SEDAR+ profile at

www.sedarplus.ca. This list is not exhaustive of the factors that

may affect Calibre's forward-looking statements such as potential

sanctions implemented as a result of the United States Executive

Order 13851 dated October 24, 2022.

Calibre’s forward-looking statements are based

on the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management of Calibre at such time. Calibre does not

assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable securities laws.

There can be no assurance that forward-looking statements will

prove to be accurate, and actual results, performance or

achievements could differ materially from those expressed in, or

implied by, these forward-looking statements. Accordingly, undue

reliance should not be placed on forward-looking statements.

Footnotes:

- See Marathon Gold

press release dated December 7, 2022, available at

www.calibremining.com or www.sedarplus.ca

- See Marathon Gold press release

dated August 2, 2023, available at www.calibremining.com or

www.sedarplus.ca

- See Marathon Gold press release

dated October 23, 2023, available at www.calibremining.com or

www.sedarplus.ca

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5880d528-e9f7-4c73-9080-905232e16f55

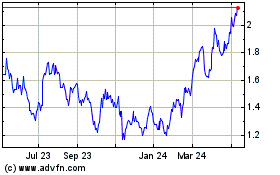

Calibre Mining (TSX:CXB)

Historical Stock Chart

From Nov 2024 to Dec 2024

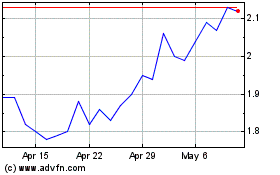

Calibre Mining (TSX:CXB)

Historical Stock Chart

From Dec 2023 to Dec 2024