B2Gold Corp. (TSX: BTO, NYSE AMERICAN: BTG, NSX: B2G) (“B2Gold” or

the “Company”) is pleased to announce that it has entered into a

purchase and sale agreement (the “Agreement”) to sell a portfolio

of 10 precious and base metals royalties (the “Royalties”) to

Sandbox Royalties Corp. (“Sandbox”), a private, returns-focused

metals royalty company (the “Transaction”). In connection with the

Transaction, Sandbox has been renamed Versamet Royalties

Corporation (“Versamet”). All dollar figures are in United States

dollars unless otherwise indicated.

Under the terms of the Agreement, Versamet will

acquire ownership of the Royalties and as consideration will issue

153.2 million common shares to B2Gold at a price of C$0.80 per

share, representing an equity ownership interest in Versamet of

33.0% valued at approximately $90 million. The Royalties are

comprised of the following:

- 2.7% net smelter return (“NSR”)

royalty on the Kiaka Gold Project, owned by West African Resources

Ltd.;

- 2.7% NSR royalty on the Toega Gold

Deposit, owned by West African Resources Ltd.;

- 2.0% net profit royalty on the

Quebradona Project, owned by AngloGold Ashanti Ltd.;

- 2.0% NSR royalty on the Mocoa

Project, owned by Libero Copper & Gold Corp.;

- 1.5% NSR royalty on the Primavera

Project, owned by Calibre Mining Corp.; and

- Five additional exploration stage

royalties.

B2Gold has retained ownership of the 22.5%

silver royalty on Glencore’s Hackett River project (the “B2Gold

Hackett River Royalty”). Separately, Versamet owns a 2.0% NSR

royalty on Glencore’s Hackett River project. B2Gold will continue

to explore value maximizing alternatives for the B2Gold Hackett

River Royalty.

“This strategic partnership provides B2Gold with

an attractive opportunity to unlock the value of our royalties

which have gone largely unrecognized by the market and were not a

core part of our business,” said Clive Johnson, President and CEO

of B2Gold. “As a significant shareholder, B2Gold is pleased to

retain meaningful upside exposure and leverage to Versamet as its

experienced management team stewards its strengthened asset base

and continues executing on its growth strategy to create future

shareholder value.”

The closing of the first phase of the

Transaction occurred on June 5, 2024, and included the royalties on

the Kiaka Gold Project, the Toega Gold Deposit, the Primavera

Project, and two exploration stage royalties. In connection with

the first phase closing, B2Gold received 122.0 million shares of

Versamet valued at approximately $72 million. The remaining

royalties are subject to various right of first refusal or right of

first offer provisions, which are expected to lapse or be exercised

within the next 60 days, at which time the closing of the second

phase of the Transaction is expected to occur.

In connection with the closing of the first

phase of the Transaction, the parties have entered into an Investor

Rights Agreement which, among other customary terms and conditions,

entitles B2Gold to nominate one member to Versamet’s Board of

Directors and pro rata participation rights with respect to future

capital raises. B2Gold’s strategic partnership will provide ongoing

exposure to Versamet’s royalty portfolio, which now includes 28

royalties, two of which are currently cash flowing, and several of

which are expected to be cash flowing in the near term.

B2Gold’s financial advisor in connection with

the Transaction is RBC Capital Markets, and its legal counsel is

McCarthy Tétrault LLP.

About B2Gold

B2Gold is a low-cost international senior gold

producer headquartered in Vancouver, Canada. Founded in 2007,

today, B2Gold has operating gold mines in Mali, Namibia and the

Philippines, the Goose Project under construction in northern

Canada, and numerous development and exploration projects in

various countries including Mali, Colombia and Finland. B2Gold

forecasts total consolidated gold production of between 860,000 and

940,000 ounces in 2024.

ON BEHALF OF B2GOLD CORP.

“Clive T.

Johnson”President and Chief Executive

Officer

The Toronto Stock Exchange and NYSE American LLC

neither approve nor disapprove the information contained in this

news release.

Production results and production guidance

presented in this news release reflect total production at the

mines B2Gold operates on a 100% project basis. Please see our

Annual Information Form dated March 14, 2024, for a discussion of

our ownership interest in the mines B2Gold operates.

This news release includes certain

"forward-looking information" and "forward-looking statements"

(collectively "forward-looking statements") within the meaning of

applicable Canadian and United States securities legislation,

including: the closing of the second phase of the Transaction in

which B2Gold is estimated to receive an additional 31 million

shares of Versamet; and B2Gold total consolidated gold production

of between 860,000 and 940,000 ounces in 2024. All statements in

this news release that address events or developments that we

expect to occur in the future are forward-looking statements.

Forward-looking statements are statements that are not historical

facts and are generally, although not always, identified by words

such as "expect", "plan", "anticipate", "project", "target",

"potential", "schedule", "forecast", "budget", "estimate", "intend"

or "believe" and similar expressions or their negative

connotations, or that events or conditions "will", "would", "may",

"could", "should" or "might" occur. All such forward-looking

statements are based on the opinions and estimates of management as

of the date such statements are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

B2Gold's control, including risks associated with or related to:

the volatility of metal prices and B2Gold's common shares; changes

in tax laws; the dangers inherent in exploration, development and

mining activities; the uncertainty of reserve and resource

estimates; not achieving production, cost or other estimates;

actual production, development plans and costs differing materially

from the estimates in B2Gold's feasibility and other studies; the

ability to obtain and maintain any necessary permits, consents or

authorizations required for mining activities; environmental

regulations or hazards and compliance with complex regulations

associated with mining activities; climate change and climate

change regulations; the ability to replace mineral reserves and

identify acquisition opportunities; the unknown liabilities of

companies acquired by B2Gold; the ability to successfully integrate

new acquisitions; fluctuations in exchange rates; the availability

of financing; financing and debt activities, including potential

restrictions imposed on B2Gold's operations as a result thereof and

the ability to generate sufficient cash flows; operations in

foreign and developing countries and the compliance with foreign

laws, including those associated with operations in Mali, Namibia,

the Philippines and Colombia and including risks related to changes

in foreign laws and changing policies related to mining and local

ownership requirements or resource nationalization generally;

remote operations and the availability of adequate infrastructure;

fluctuations in price and availability of energy and other inputs

necessary for mining operations; shortages or cost increases in

necessary equipment, supplies and labour; regulatory, political and

country risks, including local instability or acts of terrorism and

the effects thereof; the reliance upon contractors, third parties

and joint venture partners; the lack of sole decision-making

authority related to Filminera Resources Corporation, which owns

the Masbate Project; challenges to title or surface rights; the

dependence on key personnel and the ability to attract and retain

skilled personnel; the risk of an uninsurable or uninsured loss;

adverse climate and weather conditions; litigation risk;

competition with other mining companies; community support for

B2Gold's operations, including risks related to strikes and the

halting of such operations from time to time; conflicts with small

scale miners; failures of information systems or information

security threats; the ability to maintain adequate internal

controls over financial reporting as required by law, including

Section 404 of the Sarbanes-Oxley Act; compliance with

anti-corruption laws, and sanctions or other similar measures;

social media and B2Gold's reputation; risks affecting Calibre

having an impact on the value of the Company's investment in

Calibre, and potential dilution of our equity interest in Calibre;

as well as other factors identified and as described in more detail

under the heading "Risk Factors" in B2Gold's most recent Annual

Information Form, B2Gold's current Form 40-F Annual Report and

B2Gold's other filings with Canadian securities regulators and the

U.S. Securities and Exchange Commission (the "SEC"), which may be

viewed at www.sedar.com and www.sec.gov, respectively (the

"Websites"). The list is not exhaustive of the factors that may

affect B2Gold's forward-looking statements.

B2Gold's forward-looking statements are based on

the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors

include, but are not limited to, assumptions and factors related to

B2Gold's ability to carry on current and future operations,

including: development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; B2Gold's ability to meet or achieve

estimates, projections and forecasts; the availability and cost of

inputs; the price and market for outputs, including gold; foreign

exchange rates; taxation levels; the timely receipt of necessary

approvals or permits; the ability to meet current and future

obligations; the ability to obtain timely financing on reasonable

terms when required; the current and future social, economic and

political conditions; and other assumptions and factors generally

associated with the mining industry.

B2Gold's forward-looking statements are based on

the opinions and estimates of management and reflect their current

expectations regarding future events and operating performance and

speak only as of the date hereof. B2Gold does not assume any

obligation to update forward-looking statements if circumstances or

management's beliefs, expectations or opinions should change other

than as required by applicable law. There can be no assurance that

forward-looking statements will prove to be accurate, and actual

results, performance or achievements could differ materially from

those expressed in, or implied by, these forward-looking

statements. Accordingly, no assurance can be given that any events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do, what benefits or liabilities B2Gold

will derive therefrom. For the reasons set forth above, undue

reliance should not be placed on forward-looking statements.

For more information on B2Gold please visit the Company website at www.b2gold.com or contact:

Michael McDonald

VP, Investor Relations & Corporate Development

+1 604-681-8371

investor@b2gold.com

Cherry DeGeer

Director, Corporate Communications

+1 604-681-8371

investor@b2gold.com

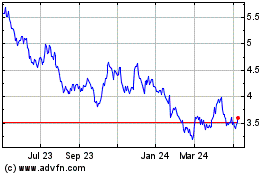

B2Gold (TSX:BTO)

Historical Stock Chart

From Nov 2024 to Dec 2024

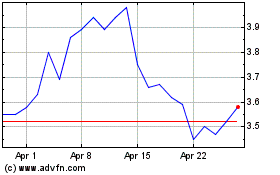

B2Gold (TSX:BTO)

Historical Stock Chart

From Dec 2023 to Dec 2024