Athabasca Oil Announces Renewal of Normal Course Issuer Bid

March 14 2024 - 7:00AM

Athabasca Oil Corporation (TSX: ATH) (“Athabasca” or the “Company”)

is pleased to announce that the Toronto Stock Exchange (“TSX”) has

approved the renewal of the Corporation’s normal course issuer bid

(“NCIB”) to purchase up to 55,423,786 common shares during the

12-month period commencing March 18, 2024 and ending March 17, 2025

or such earlier time as the NCIB is completed or terminated at the

option of Athabasca. The Company’s current NCIB is scheduled to

expire on March 15, 2024.

Athabasca’s renewal of its NCIB is based on the

strength of the balance sheet and the Company’s commitment to

augmenting shareholder returns through a buyback program. The

Company’s capital allocation framework balances material near-term

return of capital initiatives for shareholders, with a multi-year

growth trajectory of cash flow per share. Athabasca sees intrinsic

value not reflected in the current share price and in 2024 is

planning to allocate 100% of Free Cash Flow to shareholders through

buybacks.

Pursuant to the NCIB, the maximum number of

common shares to be purchased represents 10% of the public float,

as defined by the TSX. As of March 12, 2024, the Company had a

public float of 554,237,864 common shares and 564,438,104 common

shares issued and outstanding. Purchases will be made on the open

market through the facilities of the TSX and/or alternative trading

systems in Canada at market prices prevailing at the time of the

acquisition. The number of common shares that can be purchased

pursuant to the NCIB is subject to a daily maximum of 746,829

common shares (which is equal to 25% of the average daily trading

volume on the TSX of 2,987,317 from September 1, 2023 to February

29, 2024), with the exception that one block purchase in excess of

the daily maximum is permitted per calendar week. Common shares

acquired under the NCIB will be cancelled.

In connection with the NCIB, Athabasca will

enter into an automatic share purchase plan (“ASPP”) with its

designated broker to allow for purchases of its common shares under

the NCIB during blackout periods. Such purchases would be at the

discretion of the broker based on parameters established by the

Company prior to any blackout period or any period when it is in

possession of material undisclosed information. Outside of these

blackout periods, common shares will be repurchased in accordance

with management's discretion, subject to applicable law.

Under the Company’s current NCIB that is

scheduled to expire on March 15, 2024, the Company was approved by

the TSX to repurchase up to 57,967,098 common shares, being 10% of

the public float. As of March 12, 2024, the Company has repurchased

55,467,400 common shares through market purchases on the TSX and

other alternative Canadian securities trading platforms, at a

volume-weighted average purchase price of approximately $3.82 per

common share. The Company expects to fully execute the annual NCIB

allotment before termination.

About Athabasca Oil

Corporation

Athabasca Oil Corporation is a Canadian energy

company with a focused strategy on the development of thermal and

light oil assets. Situated in Alberta’s Western Canadian

Sedimentary Basin, the Company has amassed a significant land base

of extensive, high quality resources. Athabasca’s light oil assets

are held in a private subsidiary (Duvernay Energy Corporation) in

which Athabasca owns a 70% equity interest. Athabasca’s common

shares trade on the TSX under the symbol “ATH”. For more

information, visit www.atha.com.

| For more

information, please contact: |

|

Matthew Taylor |

Robert Broen |

| Chief Financial Officer |

President and CEO |

| 1-403-817-9104 |

1-403-817-9190 |

| mtaylor@atha.com |

rbroen@atha.com |

| |

|

Reader Advisory:

This News Release contains forward-looking

information that involves various risks, uncertainties and other

factors. All information other than statements of historical fact

is forward-looking information. The use of any of the words

“anticipate”, “plan”, “project”, “continue”, “maintain”,

“estimate”, “expect”, “will”, “target”, “forecast”, “could”,

“intend”, “potential”, “guidance”, “outlook” and similar

expressions suggesting future outcome are intended to identify

forward-looking information. The forward-looking information is not

historical fact, but rather is based on the Company’s current

plans, objectives, goals, strategies, estimates, assumptions and

projections about the Company’s industry, business and future

operating and financial results. This information involves known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. No assurance can

be given that these expectations will prove to be correct and such

forward-looking information included in this News Release should

not be unduly relied upon. This information speaks only as of the

date of this News Release. In particular, this News Release

contains forward-looking information pertaining to, but not limited

to, the following: our strategic plans; repayment plans; the

allocation of future capital; timing and quantum for shareholder

returns including share buybacks; the terms of our NCIB program and

ASPP; and other matters.

The actual number of common shares that will be

repurchased under the NCIB, and the timing of any such purchases,

will be determined by the Company on management's discretion,

subject to applicable securities laws. There cannot be any

assurances as to how many common shares, if any, will ultimately be

acquired by the Company.

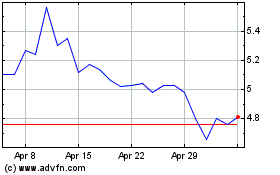

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Nov 2024 to Dec 2024

Athabasca Oil (TSX:ATH)

Historical Stock Chart

From Dec 2023 to Dec 2024