HEALWELL AI Inc. (“

HEALWELL” or the

“

Company”) (TSX: AIDX) (OTCQX: HWAIF), (formerly

known as MCI Onehealth Technologies Inc.), a healthcare technology

company focused on AI and data science for preventative care, is

pleased to announce its interim consolidated financial results for

the quarter ended March 31, 2024.

Dr. Alexander Dobranowski, HEALWELL’s CEO,

commented, "The first quarter marked an exceptional continuation of

our journey since rebranding as HEALWELL AI last year and embracing

our mission to revolutionize healthcare and enhance lives through

early disease detection, powered by cutting-edge AI and data

science technologies. Just six months after powering our partner

WELL’s first-generation physician co-pilot, which was focused on

rare disease detection, we have launched what we believe is

currently the Canadian market’s only commercially available AI

powered physician co-pilot that is integrated with a major EHR and

assists with chronic disease detection. Given the importance of

chronic disease to our healthcare ecosystem as the leading cause of

death and disability, we couldn’t be prouder to bring this profound

new capability to physicians via our partnership with WELL and our

exclusive role powering their WELL AI Decision Support Tools."

Dr. Dobranowski further adds, “We're incredibly

optimistic about our future trajectory, driven by a combination of

organic growth and strategic mergers and acquisitions. Currently,

our robust acquisition pipeline positions us for substantial

expansion, potentially doubling our current revenue run-rate of

over $20 million to exceed $40 million annually, leveraging our

existing cash reserves. Our key areas of focus include ramping up

physician adoption of the HEALWELL platform, accelerating sales of

our AI tools and technology, broadening Intrahealth's reach, and

deepening our integration within the WELL ecosystem. We're

witnessing an unprecedented opportunity in healthcare data science

and artificial intelligence, and we're poised to capitalize on

it.”

Scott Nirenberski, HEALWELL’s CFO, commented,

“HEALWELL closed the first quarter with a cash balance of $11.3

million. The recent announcement of an upsized bought deal

financing of up to $20 million will, on completion, further

strengthen our financial position, providing a substantial increase

in cash reserves to fuel future M&A endeavors. It's important

to note that our Q1 results do not fully reflect the Company's

current run-rate revenues, as the Intrahealth acquisition,

finalized in February, is anticipated to contribute over $12

million in annualized revenue, as well as positive EBITDA. Looking

forward, we are optimistic about the prospects for both our top and

bottom-line performance.”

A summary of the Company’s financial and

operational results is set out below, and more detailed information

is contained in the interim consolidated financial statements and

related management discussion and analysis, which are available on

the Company’s SEDAR+ page at www.sedarplus.com. Financial measures

described as “Adjusted” in this news release are non-IFRS financial

measures and may not be comparable to other similar measures

disclosed by other companies. Please see Non-IFRS Financial

Measures below for more information.

First Quarter 2024 Financial

Highlights

Significant financial highlights for the

Company’s continuing operations during the three months ended March

31, 2024 included:

- HEALWELL achieved quarterly revenue

from continuing operations of $4.58 million during Q1-2024, an

increase of 132% compared to $1.97 million generated in Q1-2023.

The growth in revenue is primarily attributed to the addition of

Intrahealth Systems Limited (“Intrahealth”).

- HEALWELL achieved Adjusted Gross

Profit(2) of $2.84 million during Q1-2024, an increase of 329%

compared to $0.66 million in Q1-2023. The increase in Gross Profit

is primarily attributed to higher revenue in the quarter from the

acquisition of Intrahealth.

- HEALWELL achieved an Adjusted Gross

Margin(2) percentage of 62% during Q1-2024, compared to 33% in

Q1-2023. The improvement in Adjusted Gross Margin improvement was

due to the contribution of higher margin revenue from

Intrahealth.

- During Q1-2024, HEALWELL reported

Adjusted EBITDA(1) loss of $2.56 million, compared to a loss of

$1.86 million in Q1-2023.

- As at March 31, 2024, HEALWELL had

$11.34 million in cash, compared to $19.16 million as at December

31, 2023. The decrease in cash balance was due to the acquisition

of Intrahealth.

First Quarter 2024 Business and

Operational Highlights

Significant business and operational highlights

for the Company during the three months ended March 31, 2024

included:

- Intrahealth Acquisition: On

February 1, 2024, the Company announced that it had completed the

acquisition of Intrahealth. Intrahealth is an advanced SaaS based

Electronic Health Records (“EHR”) management platform for small and

medium enterprise healthcare organizations across Canada,

Australia, and New Zealand. Intrahealth is expected to generate

over $12 million in revenues in 2024, which reflects double digit

organic growth. Historically, Intrahealth has achieved over 80%

gross margins, produced positive EBITDA, and positive cashflows.

Over 80% of its revenue is high margin recurring revenue.

- Chairman of the Board Appointment:

On February 27, 2024, the Company announced the appointment of

Hamed Shahbazi as Chairman of the Board of HEALWELL. Mr. Shahbazi

is currently the Chairman and CEO of WELL, Canada's largest owner

operator of outpatient medical clinics and leading digital health

service providing software and services to more than one third of

all Canadian physicians. Mr. Shahbazi has served on the Board of

HEALWELL since its relaunch on October 1, 2023. Concurrent to Mr.

Shahbazi’s appointment, Mr. Kingsley Ward stepped down from

HEALWELL’s Chairman position but continues to serve as an

independent director on HEALWELL’s board.

- WELL USA and Circle Medical

Partnership: On March 14, 2024, the Company announced new

commercial agreements with WELL Health USA and Circle Medical,

expanding into the US market. The agreements will allow HEALWELL to

provide US patients with access to its subsidiaries Pentavere

Research Group Inc. (“Pentavere”) and Khure Health Inc. (“Khure”)

for the purposes of earlier diagnosis and identification of

patients with potential risks of certain conditions.

Events Subsequent to

March 31, 2024

Significant business and operational highlights

for the Company subsequent to March 31, 2024 included:

- HEALWELL AI’s Pentavere’s Landmark

Publication: On April 4, 2024, the Company’s subsidiary, Pentavere,

published a ground-breaking paper validating the use of generative

AI to identify rare lung cancer patients. Through innovative

research and collaboration with industry leaders, Pentavere is

unlocking the potential of AI to drive meaningful improvements in

patient outcomes and advance precision medicine initiatives

globally.

- Launch of Second Generation WELL AI

Decision Support: On May 2, 2024, the Company and WELL introduced

the second generation of the WELL AI Decision Support (“WAIDS”).

This enhanced version features advanced chronic disease screening,

including detection capabilities for chronic kidney disease,

hypertension, and diabetes. WAIDS now identifies over one hundred

diseases, providing actionable clinical insights at the point of

care to aid in patient risk stratification and contribute to the

management of chronic disease-related costs in Canada, estimated at

approximately $190 billion annually.

- Bought Deal Financing: On May 6,

2024, the Company announced it has upsized its previously announced

$16,000,065 bought deal offering to 12,592,600 units of the Company

(the “Units”), on a “bought deal” private placement basis, at a

price of $1.35 per Unit (the “Issue Price”) for gross proceeds

of $17,000,010 (the “Offering”). Each Unit is

comprised of one Class A subordinate voting share of the Company (a

“Subordinate Voting Share”) and one-half of one Subordinate Voting

Share purchase warrant (each whole warrant, a “Warrant”) of the

Company. Each Warrant shall entitle the holder thereof to purchase

one Subordinate Voting Share at an exercise price of $1.80 for a

period of two (2) years. The Company agreed to amend the terms of

the agent's option granted to the underwriters to permit the

underwriters to purchase up to an additional 2,222,400 Units at the

offering price. In the event the option is exercised in full, the

aggregate gross proceeds of the offering will be $20,000,250. The

financing remains subject to the satisfaction of certain conditions

including, but not limited to, the receipt of all necessary

approvals, including the approval of the Toronto Stock

Exchange.

Webcast and Conference Call

Details:

As previously announced, HEALWELL will be

holding a conference call and simultaneous webcast to discuss its

financial results on Tuesday May 14, 2024 at

5:00 pm ET (2:00 pm PT). The call will be hosted

by Dr. Alexander Dobranowski, Chief Executive Officer, and Scott

Nirenberski, Chief Financial Officer. Please dial-in 10 minutes

prior to the start of the call.

Date: Tuesday May 14, 2024Time: 5:00 pm ET / 2:00 pm PTFor

attendees who wish to join by webcast, the event can be accessed

at: https://edge.media-server.com/mmc/p/iboe8jex

Attendees who wish to join by phone must visit the following

link and

pre-register: https://register.vevent.com/register/BI10befc2e470d4f5c82cbd87e488dee0f

Selected Financial

Information(in thousands of dollars, except percentages

and per share amounts)

| Results of

Operations |

|

|

|

|

|

|

Three months ended |

Period over |

|

|

March 31 |

period Change |

|

|

2024 |

2023 |

$ |

% |

|

|

($ in thousands except percentages) |

|

Continuing operation |

|

|

|

|

|

Revenue |

4,579 |

|

1,974 |

|

2,605 |

|

132 |

|

|

Cost of Revenue |

2,190 |

|

1,471 |

|

719 |

|

49 |

|

|

Gross Profits |

2,389 |

|

503 |

|

1,886 |

|

375 |

|

|

|

|

|

|

|

|

Research and development |

916 |

|

1,850 |

|

(934) |

|

(50) |

|

|

Sales and marketing |

760 |

|

187 |

|

573 |

|

306 |

|

|

General and administrative |

6,149 |

|

2,242 |

|

3,907 |

|

174 |

|

|

|

7,825 |

|

4,279 |

|

3,546 |

|

83 |

|

|

|

|

|

|

|

|

Net financing expenses |

673 |

|

242 |

|

431 |

|

178 |

|

| Share of

comprehensive loss from associate |

- |

|

26 |

|

(26) |

|

(100) |

|

| Changes

in fair value of Call options |

400 |

|

- |

|

400 |

|

- |

|

| Changes

in fair value of contingent consideration |

- |

|

(7) |

|

7 |

|

(100) |

|

|

Gain on settlement of shares-contingent consideration |

- |

|

677 |

|

(677) |

|

(100) |

|

|

Impairment of investment in an associate |

- |

|

2,303 |

|

(2,303) |

|

(100) |

|

|

|

1,073 |

|

3,241 |

|

(2,168) |

|

(67) |

|

|

|

|

|

|

|

|

Loss before taxes |

(6,509) |

|

(7,017) |

|

508 |

|

(7) |

|

|

Income tax (recovery) |

(234) |

|

(218) |

|

(16) |

|

7 |

|

|

Net loss-continuing operation |

(6,275) |

|

(6,799) |

|

1,291 |

|

(19) |

|

| Net loss

on discontinued operations, net of tax |

(1) |

|

(649) |

|

648 |

|

(100) |

|

|

Net loss |

(6,276) |

|

(7,448) |

|

1,172 |

|

(16) |

|

|

|

|

|

|

|

|

Continuing operation |

|

|

|

|

|

Adjusted gross profit(1) |

2,837 |

|

661 |

|

2,176 |

|

329 |

|

|

Adjusted gross margin(1) |

62% |

|

33% |

|

28% |

|

85 |

|

|

Adjusted EBITDA(1) |

(2,562) |

|

(1,860) |

|

(702) |

|

38 |

|

|

Adjusted EBITDA margin(1) |

(56%) |

|

(94%) |

|

38% |

|

(41) |

|

|

|

|

|

|

|

|

Discontinued operation |

|

|

|

|

|

Adjusted gross profit(1) |

62 |

|

2,876 |

|

(2,814) |

|

(98) |

|

|

Adjusted gross margin(1) |

27% |

|

30% |

|

(4%) |

|

(12) |

|

|

Adjusted EBITDA(1) |

- |

|

(536) |

|

536 |

|

(100) |

|

|

Adjusted EBITDA margin(1) |

0% |

|

(6%) |

|

6% |

|

(100) |

|

|

|

|

|

|

|

| Net

income/(loss) attributable to Company shareholders |

|

|

|

|

|

- Continuing operation |

(5,926) |

|

(6,778) |

|

852 |

|

(13) |

|

|

- Discontinued operation |

(1) |

|

(649) |

|

19 |

|

(3) |

|

|

|

(5,927) |

|

(7,427) |

|

1,500 |

|

(20) |

|

|

Weighted average number of |

|

|

|

|

| Of Share

outstanding: Basic and diluted |

104,000 |

|

51,930 |

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share -Basic and diluted |

|

|

|

|

|

- Continuing operation |

(0.06) |

|

(0.13) |

|

|

|

|

- Discontinued operation |

- |

|

(0.01) |

|

|

|

|

|

(0.06) |

|

(0.14) |

|

|

|

| |

|

|

|

|

|

|

(1) Adjusted Gross Profit,

Adjusted Gross Margin, Adjusted EBITDA and Adjusted EBITDA Margin

are non-IFRS measures. Please see “Non-IFRS Measures” above for an

explanation of the composition of these measures and their

usefulness, and “Reconciliation of Non-IFRS Measures” below for a

reconciliation of these measures to the IFRS measures found in the

Financial Statements.

Selected Statement of Financial Position

Data

|

|

March 31, |

December 31, |

|

|

2024 |

2023 |

|

|

$ in thousands |

|

|

|

|

|

Cash |

11,340 |

|

19,162 |

|

|

Accounts receivable |

2,580 |

|

1,115 |

|

|

Call options |

1,100 |

|

1,500 |

|

|

Net investment in subleases |

335 |

|

375 |

|

|

Investments |

410 |

|

410 |

|

|

Other assets |

3,573 |

|

1,440 |

|

|

Assets classified as held for sale |

1,248 |

|

1,150 |

|

|

Liabilities associated with assets classified as held for sale |

(834 |

) |

(897 |

) |

|

Accounts payable and accrued liabilities |

(9,145 |

) |

(6,421 |

) |

|

Bank loan |

(1,552 |

) |

(1,541 |

) |

|

Debenture payable |

(2,876 |

) |

(2,932 |

) |

|

Related party loan |

(16,753 |

) |

(11,181 |

) |

|

Lease liabilities |

(5,025 |

) |

(5,274 |

) |

|

Other liabilities |

(3 |

) |

(86 |

) |

|

Non-controlling interest redeemable liability |

(1,296 |

) |

(1,282 |

) |

|

Liability for contingent consideration |

(260 |

) |

(260 |

) |

| |

|

|

|

|

Non-IFRS Financial Measures

The terms Adjusted EBITDA, Adjusted EBITDA

Margin, Adjusted Gross Profit and Adjusted Gross Margin used in

this document do not have any standardized meaning under IFRS, may

not be comparable to similar financial measures disclosed by other

companies and should not be considered a substitute for, or

superior to, IFRS financial measures. Readers are advised to review

the section entitled “Non-IFRS Financial Measures” in the Company’s

management discussion and analysis for the quarter ended March 31,

2024, available on the Company’s SEDAR+ page at www.sedarplus.com,

for a detailed explanation of the composition of these measures and

their uses.

(1) The following table reconciles Adjusted

EBITDA and Adjusted EBITDA Margin to net income (loss) for the

three-months ended March 31, 2024 and March 31, 2023:

|

|

Three months ended |

|

|

March 31 |

|

|

2024 |

2023 |

|

|

$ in thousands |

|

Total Revenue |

|

|

|

- Continuing operation |

4,579 |

|

1,974 |

|

| -

Discontinued operation |

235 |

|

9,560 |

|

|

|

4,814 |

|

11,534 |

|

| Net

(loss) income |

|

|

| -

Continuing operation |

(6,275) |

|

(6,799) |

|

| -

Discontinued operation |

(1) |

|

(649) |

|

|

|

(6,276) |

|

(7,448) |

|

| Add back

(deduct) |

|

|

|

Continuing operation |

|

|

|

Depreciation and amortization |

1,882 |

|

1,261 |

|

| Net

finance charges |

673 |

|

242 |

|

| Share of

comprehensive loss (income) from associate |

- |

|

26 |

|

| Gain/

Loss on settlement of shares-contingent consideration |

- |

|

677 |

|

|

Impairment of investment in associate |

- |

|

2,303 |

|

| Changes

in fair value of Call options |

400 |

|

- |

|

| Changes

in fair value of contingent consideration |

- |

|

(7) |

|

| Changes

in fair value of investments |

|

|

|

Share-based payment expense |

481 |

|

714 |

|

|

Acquisition related expenses |

525 |

|

- |

|

| Expected

credit losses |

(14) |

|

(76) |

|

| Income

taxes recovery |

(234) |

|

(201) |

|

|

Discontinued operation |

|

|

| Net

finance charges |

1 |

|

113 |

|

|

Adjusted EBITDA |

|

|

| -

Continuing operation |

(2,562) |

|

(1,860) |

|

| -

Discontinued operation |

- |

|

(536) |

|

|

Adjusted EBITDA Margin |

|

|

| -

Continuing operation |

(56%) |

|

(94%) |

|

| -

Discontinued operation |

0% |

|

(6%) |

|

| |

|

|

|

|

(2) The following table reconciles Adjusted

Gross Profit and Adjusted Gross Margin to revenue and cost of

revenue for the three-months ended March 31, 2024 and March 31,

2023:

|

|

Three months ended |

Period over |

|

|

March 31 |

period Change |

|

|

2024 |

2023 |

$ |

% |

|

|

($ in thousands except percentages) |

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

- Continuing operation |

4,579 |

|

1,974 |

|

2,605 |

|

132% |

|

| -

Discontinued operation |

235 |

|

9,560 |

|

(9,325) |

|

(98%) |

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

|

|

| -

Continuing operation |

2,190 |

|

1,471 |

|

719 |

|

49% |

|

| -

Discontinued operation |

173 |

|

6,684 |

|

(6,511) |

|

(97%) |

|

|

|

|

|

|

|

|

Less: |

|

|

|

|

|

Depreciation and amortization |

|

|

|

|

| -

Continuing operation |

448 |

|

158 |

|

290 |

|

184% |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

gross profit |

2,837 |

|

661 |

|

2,176 |

|

329% |

|

| Adjusted

gross margin |

62% |

|

33% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

gross profit |

62 |

|

2,876 |

|

(2,814) |

|

(98%) |

|

| Adjusted

gross margin |

27% |

|

30% |

|

|

|

| |

|

|

|

|

|

|

Dr. Alexander Dobranowski

Chief Executive OfficerHEALWELL AI Inc.

About HEALWELL

HEALWELL is a healthcare technology company

focused on AI and data science for preventative care. Its mission

is to improve healthcare and save lives through early

identification and detection of disease. Using its own proprietary

technology, the Company is developing and commercializing advanced

clinical decision support systems that can help healthcare

providers detect rare and chronic diseases, improve efficiency of

their practice and ultimately help improve patient health outcomes.

HEALWELL is executing a strategy centered around developing and

acquiring technology and clinical sciences capabilities that

complement the Company's road map. HEALWELL is publicly traded on

the Toronto Stock Exchange (the “TSX”) under the symbol “AIDX” and

on the OTC Exchange under the symbol “HWAIF”. To learn more about

HEALWELL, please visit https://healwell.ai/.

Forward Looking Statements

Certain statements in this press release,

constitute “forward-looking information” and “forward looking

statements” (collectively, “forward looking statements”) within the

meaning of applicable Canadian securities laws and are based on

assumptions, expectations, estimates and projections as of the date

of this press release. Forward-looking statements include

statements with respect to the Company’s acquisition pipeline, its

plans and strategies for achieving organic growth, the anticipated

performance of the Company and its subsidiaries in 2024, including

potential revenue growth and changes to cashflow and EBITDA, and

the anticipated terms and completion of the Company’s recently

announced bought deal-financing for up to $20 million of gross

proceeds. The words “ “improve”, “grow”, “position”, “implement”,

“continuing to”, “potential”, “future”, “anticipated”, “expect”,

“revolutionize”, “outlook”, “believe”, “opportunity”, “prospect”,

“looking forward”, “is unlocking” or variations of such words and

phrases or statements that certain future conditions, actions,

events or results “will”, “may”, “could”, “would”, “should”,

“might” or “can”, or negative versions thereof, “occur”, “continue”

or “be achieved”, and other similar expressions, identify

forward-looking statements. Forward-looking statements are

necessarily based upon management’s perceptions of historical

trends, current conditions and expected future developments, as

well as a number of specific factors and assumptions that, while

considered reasonable by the Company as of the date of such

statements, are outside of the Company's control and are inherently

subject to significant business, economic and competitive

uncertainties and contingencies which could result in the

forward-looking statements ultimately being entirely or partially

incorrect or untrue. Forward looking statements contained in this

press release are based on various assumptions, including, but not

limited to, the following: the Company's ability to maintain its

relationships with its commercial partners and to successfully

implement its strategic alliance with WELL; the Company's future

access to debt and equity financing; the Company’s ability to

satisfy the conditions precedent to completing its bought-deal

financing and the terms and timelines on which it will be

completed; the Company's plans for future cost reduction; the

availability of working capital and sources of liquidity; the

Company's ability to achieve its growth and revenue strategies; the

availability of potential acquisition targets, the Company’s

ability to complete acquisitions successfully, and the terms on

which acquisitions may be completed; the demand for the Company's

products and fluctuations in future revenues; the availability of

future business ventures, commercial arrangements and acquisition

targets or opportunities and the Company's ability to consummate

them and to effectively integrate future acquisition targets into

its platform; the Company's ability to grow its customer base; the

effects of competition in the industry; the requirement for

increasingly innovative product solutions and service offerings;

trends in customer growth; the stability of general economic and

market conditions; currency exchange rates and interest rates; the

Company's ability to comply with applicable laws and regulations;

the Company's continued compliance with third party intellectual

property rights; and that the risk factors noted below,

collectively, do not have a material impact on the Company's

business, operations, revenues and/or results. By their nature,

forward-looking statements are subject to inherent risks and

uncertainties that may be general or specific and which give rise

to the possibility that expectations, forecasts, predictions,

projections or conclusions will not prove to be accurate, that

assumptions may not be correct, and that objectives, strategic

goals and priorities will not be achieved. Past performance is not

indicative of future results.

Readers are encouraged to review the “Liquidity

and Capital Resources” section of the Company’s MD&A, together

with Note 2(b) of the Company’s inteirm financial statements, for

the period ended March 31, 2024, which indicate the existence of

material uncertainties that cast significant doubt on the Company’s

ability to continue as a going concern. The Company’s ability to

continue as a going concern was, as at March 31, 2024, dependent

on, among other things, its ability to meet its financing

requirements on a continuing basis, to continue to have access to

financing, and to generate positive operating results. The

Company’s ability to satisfy its financing requirements and

ultimately achieve necessary levels of profitability and positive

cash flows from operations, to raise additional funds, and to

improve operating results were and are dependent on a number of

factors outside the Company’s control, and while the Company has

raised significant financing during the year ended December 31,

2023 and the first quarter of 2024, there can be no assurance that

the Company will continue to be successful in these endeavors in

the future.

Known and unknown risk factors, many of which

are beyond the control of the Company, could cause the actual

results of the Company to differ materially from the results,

performance, achievements or developments expressed or implied by

such forward-looking statements. Such risk factors include but are

not limited to those factors which are discussed under the section

entitled “Risk Factors” in the Company’s annual information form

dated April 1, 2024, which is available under the Company's SEDAR+

profile at www.sedarplus.com. The risk factors are not intended to

represent a complete list of the factors that could affect the

Company and the reader is cautioned to consider these and other

factors, uncertainties and potential events carefully and not to

put undue reliance on forward-looking statements. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements.

Forward-looking statements are provided for the purpose of

providing information about management’s expectations and plans

relating to the future. The Company disclaims any intention or

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

or to explain any material difference between subsequent actual

events and such forward-looking statements, except to the extent

required by applicable law. All of the forward-looking statements

contained in this press release are qualified by these cautionary

statements.

For more information:

Pardeep S. SanghaInvestor Relations, HEALWELL AI

Inc.Phone: 604-572-6392ir@healwell.ai

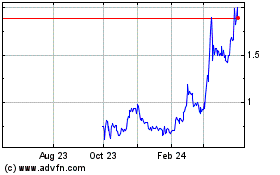

HealWell AI (TSX:AIDX)

Historical Stock Chart

From Oct 2024 to Nov 2024

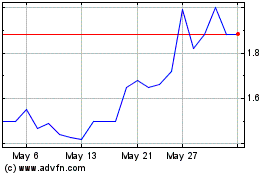

HealWell AI (TSX:AIDX)

Historical Stock Chart

From Nov 2023 to Nov 2024