Atrium Mortgage Investment Corporation Achieves Record Q1 Earnings – 9.3% Increase Over Prior Year

April 20 2016 - 5:00PM

Atrium Mortgage Investment Corporation (TSX:AI) today released its

unaudited financial results for the three month period ended March

31, 2016.

Highlights for the quarter

- Record earnings of $6.1 million, up 9.3% from prior

year

- Earnings of $0.23 per share

- Revenues of $10.1 million, up 6.6% from prior

year

- Regular monthly dividend increased to $0.215 for the

quarter (annualized rate of $0.86)

- High quality mortgage portfolio

- 83% of portfolio in first mortgages

- 96% of portfolio is less than 75% loan to

value

- Mortgage portfolio grew to $464 million

- Continued focus on low risk real estate

sectors

Interested parties are invited to participate in a conference

call with management on Thursday, April 21, 2016 at 4:00 p.m. EDT.

Please refer to the call-in information at the end of this news

release.

Results of operations

Atrium achieved record results in the quarter,

as its assets grew to $460 million. For the three months ended

March 31, 2016, mortgage interest and fees revenue aggregated $10.1

million, an increase of 6.6% from the prior year.

Net earnings for the three months ended March

31, 2016 were $6.1 million, an increase of 9.3% from the prior

year. Basic and diluted earnings per common share were $0.23, for

the three months ended March 31, 2016, compared with $0.23 basic

and diluted per common share for the prior year.

The company had $460 million of mortgages

receivable as at March 31, 2016, an increase of 2.7% from the prior

quarter. During the quarter, $59.8 million of gross new mortgages

were advanced, and $49.3 million of gross mortgages were repaid.

Atrium’s focus continues to be on lending in the major metropolitan

areas of Ontario and British Columbia. During the quarter, exposure

to Alberta was reduced from 25 loans constituting 13.5% of the

portfolio at December 31, 2015 to 21 loans and 12.7% of the

portfolio at March 31, 2016.

The weighted average interest rate on the

mortgage portfolio decreased slightly to 8.64% at March 31, 2016,

compared with 8.66% at December 31, 2015 and 8.82% at March 31,

2015. The mortgage portfolio increased by 2.7% from December 31,

2015 to $464.0 million at March 31, 2016.

| Interim

Statements of Earnings and Comprehensive Income |

|

| (Unaudited,

000s, except per share amounts) |

|

| |

|

| |

|

Three months ended March 31 |

|

| |

|

2016 |

|

|

2015 |

|

| Revenue |

$ |

10,116 |

|

$ |

9,492 |

|

| Mortgage servicing and

management fees |

|

(1,066 |

) |

|

(984 |

) |

| Other expenses |

|

(271 |

) |

|

(271 |

) |

| Provision for mortgage

losses |

|

(300 |

) |

|

(362 |

) |

| Income before financing

costs |

|

8,479 |

|

|

7,875 |

|

| Financing costs |

|

(2,357 |

) |

|

(2,273 |

) |

| Earnings and total

comprehensive income |

$ |

6,122 |

|

$ |

5,602 |

|

| |

|

|

|

|

|

|

| Basic earnings per

share |

$ |

0.23 |

|

$ |

0.23 |

|

| Diluted earnings per

share |

$ |

0.23 |

|

$ |

0.23 |

|

| |

|

|

|

|

|

|

| Dividends declared |

$ |

5,781 |

|

$ |

5,138 |

|

| |

|

|

|

|

|

|

| Mortgages receivable, end

of period |

$ |

460,244 |

|

$ |

390,152 |

|

| Total assets, end of

period |

$ |

460,349 |

|

$ |

390,248 |

|

| Shareholder' equity, end

of period |

$ |

276,280 |

|

$ |

249,548 |

|

For further information on the financial results, and analysis

of the company’s mortgage portfolio in addition to that set out

below, please refer to Atrium’s unaudited interim financial

statements and its management’s discussion and analysis for the

three month period ended March 31, 2016, available on SEDAR at

www.sedar.com, and on the company’s website at

www.atriummic.com.

| Analysis of

mortgage portfolio |

|

|

|

|

|

|

| |

| |

|

March 31, 2016 |

|

|

December 31, 2015 |

|

| |

|

|

|

|

Outstanding |

|

|

% of |

|

|

|

|

|

Outstanding |

|

|

% of |

|

| Mortgage

category |

|

Number |

|

|

amount |

|

|

Portfolio |

|

|

Number |

|

|

amount |

|

|

Portfolio |

|

| (outstanding amounts in

000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Low-rise residential |

|

22 |

|

$ |

105,745 |

|

|

|

22.8 |

% |

|

|

23 |

|

$ |

110,034 |

|

|

|

24.3 |

% |

|

| House and apartment |

|

109 |

|

|

92,365 |

|

|

|

19.9 |

% |

|

|

110 |

|

|

84,755 |

|

|

|

18.8 |

% |

|

| Construction |

|

8 |

|

|

39,365 |

|

|

|

8.5 |

% |

|

|

9 |

|

|

44,701 |

|

|

|

9.9 |

% |

|

| High-rise residential |

|

7 |

|

|

37,990 |

|

|

|

8.2 |

% |

|

|

9 |

|

|

42,245 |

|

|

|

9.4 |

% |

|

| Mid-rise residential |

|

7 |

|

|

16,259 |

|

|

|

3.5 |

% |

|

|

7 |

|

|

14,662 |

|

|

|

3.2 |

% |

|

| Condominium

corporation |

|

17 |

|

|

3,978 |

|

|

|

0.8 |

% |

|

|

18 |

|

|

4,111 |

|

|

|

0.9 |

% |

|

| Residential portfolio |

|

170 |

|

|

295,702 |

|

|

|

63.7 |

% |

|

|

176 |

|

|

300,508 |

|

|

|

66.5 |

% |

|

| Commercial/mixed use |

|

34 |

|

|

168,302 |

|

|

|

36.3 |

% |

|

|

31 |

|

|

151,083 |

|

|

|

33.5 |

% |

|

| Mortgage portfolio |

|

204 |

|

|

464,004 |

|

|

|

100.0 |

% |

|

|

207 |

|

|

451,591 |

|

|

|

100.0 |

% |

|

| |

|

March 31, 2016 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

Weighted |

|

| |

|

Number of |

|

|

Outstanding |

|

|

Percentage |

|

|

average |

|

|

average |

|

|

Location of underlying property |

|

mortgages |

|

|

amount |

|

|

outstanding |

|

|

loan to value |

|

|

interest rate |

|

| (outstanding amounts in

000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Greater Toronto Area |

|

155 |

|

$ |

305,000 |

|

|

|

65.7 |

% |

|

|

|

63.6 |

% |

|

|

|

8.50 |

% |

|

| Non-GTA Ontario |

|

14 |

|

|

8,222 |

|

|

|

1.8 |

% |

|

|

|

66.8 |

% |

|

|

|

9.17 |

% |

|

| Saskatchewan |

|

1 |

|

|

11,444 |

|

|

|

2.5 |

% |

|

|

|

71.1 |

% |

|

|

|

8.50 |

% |

|

| Alberta |

|

21 |

|

|

58,822 |

|

|

|

12.7 |

% |

|

|

|

59.9 |

% |

|

|

|

9.04 |

% |

|

| British Columbia |

|

13 |

|

|

80,516 |

|

|

|

17.3 |

% |

|

|

|

60.4 |

% |

|

|

|

8.88 |

% |

|

| |

|

204 |

|

$ |

464,004 |

|

|

|

100.0 |

% |

|

|

|

62.8 |

% |

|

|

|

8.64 |

% |

|

| |

|

December 31, 2015 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

Weighted |

|

| |

|

Number of |

|

|

Outstanding |

|

|

Percentage |

|

|

average |

|

|

average |

|

|

Location of underlying property |

|

mortgages |

|

|

amount |

|

|

outstanding |

|

|

loan to value |

|

|

interest rate |

|

| (outstanding amounts in

000s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Greater Toronto Area |

|

152 |

|

$ |

292,547 |

|

|

|

64.8 |

% |

|

|

|

66.1 |

% |

|

|

|

8.61 |

% |

|

| Non-GTA Ontario |

|

15 |

|

|

11,436 |

|

|

|

2.5 |

% |

|

|

|

67.3 |

% |

|

|

|

8.99 |

% |

|

| Saskatchewan |

|

1 |

|

|

10,822 |

|

|

|

2.4 |

% |

|

|

|

71.1 |

% |

|

|

|

8.50 |

% |

|

| Alberta |

|

25 |

|

|

61,078 |

|

|

|

13.5 |

% |

|

|

|

59.7 |

% |

|

|

|

8.68 |

% |

|

| British Columbia |

|

14 |

|

|

75,708 |

|

|

|

16.8 |

% |

|

|

|

62.6 |

% |

|

|

|

8.83 |

% |

|

| |

|

207 |

|

$ |

451,591 |

|

|

|

100.0 |

% |

|

|

|

64.7 |

% |

|

|

|

8.66 |

% |

|

Conference call

Interested parties are invited to participate in

a conference call with management on Thursday, April 21, 2016 at

4:00 p.m. EDT. To participate or listen to the conference call

live, please call 1 (888) 241-0551 or (647) 427-3415. For a replay

of the conference call (available until May 4, 2016) please call 1

(855) 859-2056, Conference ID 95322486.

About Atrium

Canada’s Premier Non-Bank

Lender™Atrium is a non-bank provider of residential and

commercial mortgages that lends in major urban centres in Canada

where the stability and liquidity of real estate are high. Atrium’s

objectives are to provide its shareholders with stable and secure

dividends and preserve shareholders’ equity by lending within

conservative risk parameters.

Atrium is a Mortgage Investment Corporation

(MIC) as defined in the Canada Income Tax Act, so is not taxed on

income provided that its taxable income is paid to its shareholders

in the form of dividends within 90 days after December 31 each

year. Such dividends are generally treated by shareholders as

interest income, so that each shareholder is in the same position

as if the mortgage investments made by the company had been made

directly by the shareholder. For further information, please

refer to regulatory filings available at www.sedar.com or Atrium’s

website at www.atriummic.com.

For additional information, please contact

Robert G. Goodall

President and Chief Executive Officer

Jeffrey D. Sherman

Chief Financial Officer

(416) 607-4200

ir@atriummic.com

www.atriummic.com

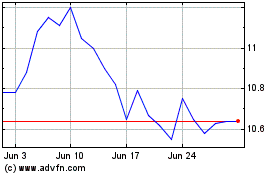

Atrium Mortgage Investment (TSX:AI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Atrium Mortgage Investment (TSX:AI)

Historical Stock Chart

From Feb 2024 to Feb 2025