Accord Announces Record Second Quarter and First Half Earnings, 15% Increase in Quarterly Dividend and Renewal of Normal Course

July 27 2010 - 12:26PM

PR Newswire (Canada)

TORONTO, July 27 /CNW/ -- TORONTO, July 27 /CNW/ - Accord Financial

Corp. (TSX - ACD), a leading North American provider of factoring

and other asset-based financial services to businesses, today

released its interim unaudited consolidated financial results for

the three and six months ended June 30, 2010. The financial results

presented in this release are reported in Canadian dollars and have

been prepared in accordance with Canadian generally accepted

accounting principles.

-------------------------------------------------------------------------

SUMMARY OF FINANCIAL RESULTS ---------------------------- Three

Months Ended Six Months Ended June 30 June 30 2010 2009 2010 2009

---- ---- ---- ---- Factoring volume (millions) $ 500 $ 380 $ 1,005

$ 782 Revenue $ 8,069,232 $ 5,677,356 $ 15,048,156 $ 11,748,251 Net

earnings $ 2,311,864 $ 494,183 $ 3,922,609 $ 1,774,344 Earnings per

share Basic $ 0.25 $ 0.05 $ 0.42 $ 0.19 Diluted $ 0.25 $ 0.05 $

0.42 $ 0.19 Weighted average number of shares Basic 9,408,695

9,408,027 9,408,833 9,418,288 Diluted 9,408,695 9,408,027 9,408,833

9,426,276

-------------------------------------------------------------------------

Net earnings for the quarter ended June 30, 2010 were a second

quarter record $2,311,864, 368% higher than the depressed $494,183

last year. Earnings rose due to higher revenue and, to a lesser

extent, a lower provision for credit and loan losses. Diluted

earnings per share increased to 25 cents, five times the 5 cents

last year. Factoring volume rose 31% to a second quarter record

$500 million compared to $380 million last year. Revenue increased

42% to $8,069,232, another second quarter record, compared to

$5,677,356 last year on a combination of higher factoring volume

and funds employed, as well as improved yields and lower

non-earning accounts. Net earnings for the first six months of 2010

rose 121% to a first half record $3,922,609 compared with

$1,774,344 in 2009 for the same reasons noted above. Diluted

earnings per share also rose 121% to 42 cents compared to 19 cents

last year. Factoring volume for the first half of 2010 was a record

$1,005 million. Total revenue, a first half record, increased 28%

to $15,048,156 compared to $11,748,251 last year. Commenting on the

second quarter and first half 2010 results, Mr. Tom Henderson, the

Company's President and CEO stated: "all three of the Company's

operating units have shown improved performance this year. Second

quarter net earnings exceeded those of our excellent first quarter

by 44% and, as noted above, represented our best ever second

quarter. First half net earnings were also a record, exceeding the

previous best in 2008 by 21%. The results reflect weakened

competition and our intensified marketing efforts." The Company's

Board of Directors today declared a 15% increase in its quarterly

dividend. A dividend of $0.075 per share was declared, payable

September 1, 2010 to shareholders of record of August 13, 2010. The

Board also resolved, subject to regulatory approval, to renew its

normal course issuer bid which expires August 7, 2010. %SEDAR:

00001979E Stuart Adair, Vice President, Chief Financial Officer,

Accord Financial Corp., 77 Bloor Street West, 18th floor, Toronto,

ON, M5S 1M2, (416) 961-0304 Ext. 207, sadair@accordfinancial.com

Copyright

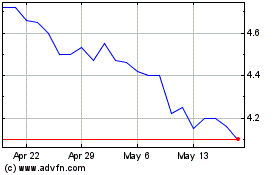

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jul 2023 to Jul 2024