- For Fourth Quarter 2022, Zoetis Reports Revenue of $2.0

Billion, Growing 4%, and Net Income of $461 Million, or $0.99 per

Diluted Share, on a Reported Basis

- Delivers 9% Operational Growth in Revenue and 27%

Operational Growth in Adjusted Net Income for Fourth Quarter

2022

- Reports Adjusted Net Income of $539 Million, or Adjusted

Diluted EPS of $1.15, for Fourth Quarter 2022

- For Full Year 2022, Zoetis Reports Revenue of $8.1 Billion,

Growing 4%, and Net Income of $2.1 Billion, or $4.49 per Diluted

Share, on a Reported Basis

- Delivers 8% Operational Growth in Revenue and 11%

Operational Growth in Adjusted Net Income for Full Year

2022

- Reports Adjusted Net Income of $2.3 Billion, or Adjusted

Diluted EPS of $4.88 for Full Year 2022

- Provides Full Year 2023 Revenue Guidance of $8.575 - $8.725

Billion, with Diluted EPS of $5.03 to $5.14 on a Reported Basis, or

$5.34 to $5.44 on an Adjusted Basis

- Expects to Deliver 6% to 8% Operational Growth in

Revenue

Zoetis Inc. (NYSE:ZTS) today reported its financial results for

the fourth quarter and full year 2022 and provided full year

guidance for 2023.

The company reported revenue of $2.0 billion for the fourth

quarter of 2022, which was an increase of 4% compared with the

fourth quarter of 2021. On an operational1 basis, revenue for the

fourth quarter of 2022 increased 9% compared with the fourth

quarter of 2021, excluding the impact of foreign currency. Net

income for the fourth quarter of 2022 was $461 million, or $0.99

per diluted share, an increase of 11% and 14%, respectively, on a

reported basis.

Adjusted net income for the fourth quarter of 2022 was $539

million, or $1.15 per diluted share, an increase of 14% and 15%,

respectively, on a reported basis. Adjusted net income for the

fourth quarter of 2022 excludes the net impact of $78 million for

purchase accounting adjustments, acquisition-related costs and

certain significant items. Adjusted net income2 for the fourth

quarter of 2022 increased 27% operationally, excluding the impact

from foreign currency.

For full year 2022, the company reported revenue of $8.1

billion, an increase of 4% compared with full year 2021. On an

operational basis, revenue for full year 2022 increased 8%,

excluding the impact of foreign currency. Net income for full year

2022 was $2.1 billion, or $4.49 per diluted share, an increase of

4% and 5%, respectively, on a reported basis.

Adjusted net income for full year 2022 was $2.3 billion, or

$4.88 per diluted share, an increase of 3% and 4%, respectively, on

a reported basis. Adjusted net income for full year 2022 excludes

the net impact of $183 million for purchase accounting adjustments,

acquisition-related costs and certain significant items. Adjusted

net income for full year 2022 increased 11% operationally,

excluding the impact of foreign currency.

EXECUTIVE COMMENTARY

“In 2022, Zoetis delivered another strong year of performance

thanks to our diverse portfolio, global scale and talented

colleagues,” said Kristin Peck, Chief Executive Officer of Zoetis.

“We grew revenue 8% operationally, driven by our innovative

companion animal franchises across parasiticides, dermatology and

pain. We also grew our adjusted net income faster than sales for

the year, at 11% operationally, while continuing to support

investments in R&D, manufacturing capacity, and sales and

marketing efforts that will drive future growth."

"Looking ahead, we are well-positioned with the strategy and

capabilities to expand in large and growing product areas like

parasiticides, dermatology products, monoclonal antibodies,

vaccines and diagnostics, while still investing in comprehensive

solutions across the continuum of animal care. We are committed to

continuing our track record of value creation and above-market

performance even in the face of today’s economic uncertainty, and

we are guiding to full-year operational growth of 6% to 8% in

revenue in 2023," said Peck.

QUARTERLY HIGHLIGHTS

Zoetis organizes and manages its commercial operations across

two regional segments: the United States (U.S.) and International.

Within these segments, the company delivers a diverse portfolio of

products for companion animals and livestock tailored to local

trends and customer needs. In the fourth quarter of 2022:

- Revenue in the U.S. segment was $1.112 billion, an

increase of 7% compared with the fourth quarter of 2021. Sales of

companion animal products increased 12%, driven by growth in the

company’s parasiticide portfolio, primarily Simparica Trio® for

dogs. The company’s key dermatology portfolio also contributed to

growth across both the Apoquel® and Cytopoint® brands. Sales of

livestock products declined 6% in the quarter. Sales of cattle

products declined as a result of supply re-stocking in the third

quarter of 2022 and generic competition for Draxxin®. The company’s

poultry portfolio declined due to the expanded use of lower cost

alternatives and generic competition for Zoamix®, the company’s

alternative to antibiotics in medicated feed additives. Sales of

swine products also decreased modestly in the quarter.

- Revenue in the International segment was $901 million,

essentially flat on a reported basis and an increase of 12%

operationally compared with the fourth quarter of 2021. Sales of

companion animal products grew 7% on a reported basis and 21%

operationally. Contributing to growth in the quarter was the

company’s parasiticide portfolio, primarily Revolution® and

Simparica®, as well as key dermatology products including the

recently launched chewable version of Apoquel. Also contributing to

growth in the quarter were the company’s monoclonal antibody

products for osteoarthritis pain, Librela® for dogs and Solensia®

for cats. Sales of livestock products declined 7% on a reported

basis and increased 4% operationally. Growth in the company’s fish

portfolio was the result of increased sales of vaccines across key

salmon markets, including Norway and Chile. Sales of the company’s

poultry portfolio grew due to market expansion and demand

generation efforts in several key geographies, while sales of sheep

products grew due to the acquisition of Jurox in Australia. Growth

in fish, poultry and sheep was partially offset by reduced sales in

the company’s swine and cattle portfolios due primarily to supply

constraints.

INVESTMENTS IN GROWTH

Zoetis continues to grow key product franchises through new

product approvals and incremental claim extensions. On the

companion animal side of the business, Simparica Trio

(sarolaner/moxidectin/pyrantel) received approval in the European

Union (EU) and the U.K. for additional claims related to faster

kill time of ticks. In livestock, Fostera® Gold PCV MH, a

one-shot vaccine for pigs that offers the longest lasting combined

protection against porcine circovirus type 2 (PCV2) and Mycoplasma

hyopneumoniae infections, was approved for use in pregnant gilts

and sows in the U.S., EU and Canada, expanding its original

claims.

In Canada, the company’s fifth largest market by revenue in

2022, Zoetis gained approvals for two key livestock products:

Protivity®, the first modified live vaccine to offer

protection against Mycoplasma bovis, providing cattle producers and

veterinarians with broader overall protection against bovine

respiratory disease (BRD), as well as Poulvac® Procerta®

HVT-IBD-ND, a part of the company’s recombinant vector vaccine

portfolio for poultry, which provides early, robust protection

against Marek’s, infectious bursal and Newcastle disease viruses

with one dose.

In Diagnostics, Zoetis expanded its multi-purpose Vetscan

Imagyst™ platform in the U.S. to include new applications for

artificial intelligence (AI) dermatology and AI equine Fecal Egg

Count (FEC) analysis. These additions broaden the platform’s

testing capabilities for veterinarians, redefining what is possible

for veterinary diagnosis and animal care across species.

FINANCIAL GUIDANCE

Zoetis is providing full year 2023 guidance, which includes:

- Revenue between $8.575 billion to $8.725 billion (operational

growth of 6% to 8%)

- Reported net income between $2.345 billion to $2.400

billion

- Adjusted net income between $2.490 billion to $2.540 billion

(operational growth of 7% to 9%)

- Reported diluted EPS between $5.03 to $5.14

- Adjusted diluted EPS between $5.34 to $5.44

This guidance reflects foreign exchange rates as of late

January. Additional details on guidance are included in the

financial tables and will be discussed on the company's conference

call this morning.

WEBCAST & CONFERENCE CALL

DETAILS

Zoetis will host a webcast and conference call at 8:30 a.m. (ET)

today, during which company executives will review fourth quarter

and full year 2022 results, discuss financial guidance and respond

to questions from financial analysts. Investors and the public may

access the live webcast by visiting the Zoetis website at

http://investor.zoetis.com/events-presentations. A

replay of the webcast will be archived and made available on

February 14, 2023.

About Zoetis

As the world’s leading animal health company, Zoetis is driven

by a singular purpose: to nurture our world and humankind by

advancing care for animals. After innovating ways to predict,

prevent, detect, and treat animal illness for more than 70 years,

Zoetis continues to stand by those raising and caring for animals

worldwide – from veterinarians and pet owners to livestock farmers

and ranchers. The company’s leading portfolio and pipeline of

medicines, vaccines, diagnostics and technologies make a difference

in over 100 countries. A Fortune 500 company, Zoetis generated

revenue of $8.1 billion in 2022 with approximately 13,800

employees. For more information, visit www.zoetis.com.

1 Operational growth (a non-GAAP financial measure) is defined

as growth excluding the impact of foreign exchange.

2 Adjusted net income and its components and adjusted diluted

earnings per share (non-GAAP financial measures) are defined as

reported net income and reported diluted earnings per share,

excluding purchase accounting adjustments, acquisition-related

costs and certain significant items.

DISCLOSURE NOTICES

Forward-Looking Statements: This

press release contains forward-looking statements, which reflect

the current views of Zoetis with respect to: business plans or

prospects, future operating or financial performance, future

guidance, future operating models; disruptions in our global supply

chain; the impact of the coronavirus (COVID-19) global pandemic and

any recovery therefrom on our business, supply chain, customers and

employees; R&D costs; timing and likelihood of success;

expectations regarding products, product approvals or products

under development and expected timing of product launches;

expectations regarding the performance of acquired companies and

our ability to integrate new businesses; expectations regarding the

financial impact of acquisitions; future use of cash, dividend

payments and share repurchases; tax rate and tax regimes and any

changes thereto; and other future events. These statements are not

guarantees of future performance or actions. Forward-looking

statements are subject to risks and uncertainties. If one or more

of these risks or uncertainties materialize, or if management's

underlying assumptions prove to be incorrect, actual results may

differ materially from those contemplated by a forward-looking

statement. Forward-looking statements speak only as of the date on

which they are made. Zoetis expressly disclaims any obligation to

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise. A further list and

description of risks, uncertainties and other matters can be found

in our most recent Annual Report on Form 10-K, including in the

sections thereof captioned “Forward-Looking Statements and Factors

That May Affect Future Results” and “Item 1A. Risk Factors,” in our

Quarterly Reports on Form 10-Q and in our Current Reports on Form

8-K. These filings and subsequent filings are available online at

www.sec.gov, www.zoetis.com, or on request from Zoetis.

Use of Non-GAAP Financial Measures:

We use non-GAAP financial measures, such as adjusted net income,

adjusted diluted earnings per share and operational results (which

exclude the impact of foreign exchange), to assess and analyze our

results and trends and to make financial and operational decisions.

We believe these non-GAAP financial measures are also useful to

investors because they provide greater transparency regarding our

operating performance. The non-GAAP financial measures included in

this press release should not be considered alternatives to

measurements required by GAAP, such as net income, operating

income, and earnings per share, and should not be considered

measures of liquidity. These non-GAAP financial measures are

unlikely to be comparable with non-GAAP information provided by

other companies. Reconciliations of non-GAAP financial measures and

the most directly comparable GAAP financial measures are included

in the tables accompanying this press release and are posted on our

website at www.zoetis.com.

Internet Posting of Information: We

routinely post information that may be important to investors in

the 'Investors' section of our website at www.zoetis.com, on our Facebook page at

http://www.facebook.com/zoetis and on

Twitter@zoetis. We encourage investors

and potential investors to consult our website regularly and to

follow us on Facebook and Twitter for important information about

us.

ZTS-COR

ZTS-IR

ZTS-FIN

ZOETIS INC.

CONDENSED CONSOLIDATED STATEMENTS

OF INCOME(a)

(UNAUDITED)

(millions of dollars, except per

share data)

Three Months Ended December

31,

% Change

Twelve Months Ended December

31,

% Change

2022

2021

2022

2021

Revenue

$ 2,040

$ 1,967

4

$ 8,080

$ 7,776

4

Costs and expenses:

Cost of sales

653

600

9

2,454

2,303

7

Selling, general and administrative

expenses

514

593

(13)

2,009

2,001

—

Research and development expenses

148

138

7

539

508

6

Amortization of intangible assets

35

40

(13)

150

161

(7)

Restructuring charges and certain

acquisition-related costs

2

4

(50)

11

43

(74)

Interest expense

62

54

15

221

224

(1)

Other (income)/deductions–net

34

32

6

40

48

(17)

Income before provision for taxes on

income

592

506

17

2,656

2,488

7

Provision for taxes on income

132

93

42

545

454

20

Net income before allocation to

noncontrolling interests

460

413

11

2,111

2,034

4

Less: Net loss attributable to

noncontrolling interests

(1)

(1)

—

(3)

(3)

—

Net income attributable to Zoetis

$ 461

$ 414

11

$ 2,114

$ 2,037

4

Earnings per share—basic

$ 0.99

$ 0.88

13

$ 4.51

$ 4.29

5

Earnings per share—diluted

$ 0.99

$ 0.87

14

$ 4.49

$ 4.27

5

Weighted-average shares used to calculate

earnings per share

Basic

465.6

473.1

468.9

474.3

Diluted

466.8

475.6

470.4

476.7

(a) The Condensed Consolidated Statements

of Income present the three and twelve months ended December 31,

2022 and 2021. Subsidiaries operating outside the U.S. are included

for the three and twelve months ended November 30, 2022 and

2021.

ZOETIS INC.

RECONCILIATION OF GAAP REPORTED

TO NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars, except per

share data)

Three Months Ended December 31,

2022

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

653

$

(3

)

$

—

$

—

$

650

Gross profit

1,387

3

—

—

1,390

Selling, general and administrative

expenses

514

(7

)

—

—

507

Research and development expenses

148

(1

)

—

—

147

Amortization of intangible assets

35

(29

)

—

—

6

Restructuring charges and certain

acquisition-related costs

2

—

(1

)

(1

)

—

Other (income)/deductions–net

34

—

—

(45

)

(11

)

Income before provision for taxes on

income

592

40

1

46

679

Provision for taxes on income

132

12

—

(3

)

141

Net income attributable to Zoetis

461

28

1

49

539

Earnings per common share attributable to

Zoetis–diluted

0.99

0.06

—

0.10

1.15

Three Months Ended December 31,

2021

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

600

$

(1

)

$

—

$

(1

)

$

598

Gross profit

1,367

1

—

1

1,369

Selling, general and administrative

expenses

593

(7

)

—

—

586

Amortization of intangible assets

40

(34

)

—

—

6

Restructuring charges and certain

acquisition-related costs

4

—

(4

)

—

—

Other (income)/deductions–net

32

—

—

(28

)

4

Income before provision for taxes on

income

506

42

4

29

581

Provision for taxes on income

93

9

1

5

108

Net income attributable to Zoetis

414

33

3

24

474

Earnings per common share attributable to

Zoetis–diluted

0.87

0.07

0.01

0.05

1.00

(a) The Condensed Consolidated Statements

of Income present the three months ended December 31, 2022 and

2021. Subsidiaries operating outside the U.S. are included for the

three months ended November 30, 2022 and 2021.

(b) Non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS are not, and should

not be viewed as, substitutes for U.S. GAAP net income and its

components and diluted EPS. Despite the importance of these

measures to management in goal setting and performance measurement,

non-GAAP adjusted net income and its components and non-GAAP

adjusted diluted EPS are non-GAAP financial measures that have no

standardized meaning prescribed by U.S. GAAP and, therefore, have

limits in their usefulness to investors. Because of the

non-standardized definitions, non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS (unlike U.S. GAAP net

income and its components and diluted EPS) may not be comparable to

the calculation of similar measures of other companies. Non-GAAP

adjusted net income and its components, and non-GAAP adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance.

See Notes to Reconciliation of GAAP Reported to Non-GAAP Adjusted

Information for notes (1) and (2).

ZOETIS INC.

RECONCILIATION OF GAAP REPORTED

TO NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars, except per

share data)

Twelve Months Ended December 31,

2022

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

2,454

$

(6

)

$

—

$

(8

)

$

2,440

Gross profit

5,626

6

—

8

5,640

Selling, general and administrative

expenses

2,009

(29

)

—

—

1,980

Research and development expenses

539

(1

)

—

—

538

Amortization of intangible assets

150

(124

)

—

—

26

Restructuring charges and certain

acquisition-related costs

11

—

(5

)

(6

)

—

Other (income)/deductions–net

40

—

—

(42

)

(2

)

Income before provision for taxes on

income

2,656

160

5

56

2,877

Provision for taxes on income

545

40

1

(3

)

583

Net income attributable to Zoetis

2,114

120

4

59

2,297

Earnings per common share attributable to

Zoetis–diluted

4.49

0.26

0.01

0.12

4.88

Twelve Months Ended December 31,

2021

GAAP Reported(a)

Purchase Accounting

Adjustments

Acquisition- Related Costs(1)

Certain Significant Items(2)

Non-GAAP Adjusted(b)

Cost of sales

$

2,303

$

(6

)

$

—

$

(8

)

$

2,289

Gross profit

5,473

6

—

8

5,487

Selling, general and administrative

expenses

2,001

(30

)

—

—

1,971

Research and development expenses

508

(1

)

—

—

507

Amortization of intangible assets

161

(138

)

—

—

23

Restructuring charges and certain

acquisition-related costs

43

—

(12

)

(31

)

—

Other (income)/deductions–net

48

—

—

(34

)

14

Income before provision for taxes on

income

2,488

175

12

73

2,748

Provision for taxes on income

454

39

2

16

511

Net income attributable to Zoetis

2,037

136

10

57

2,240

Earnings per common share attributable to

Zoetis–diluted

4.27

0.29

0.02

0.12

4.70

(a) The Condensed Consolidated Statements

of Income present the twelve months ended December 31, 2022 and

2021. Subsidiaries operating outside the U.S. are included for the

twelve months ended November 30, 2022 and 2021.

(b) Non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS are not, and should

not be viewed as, substitutes for U.S. GAAP net income and its

components and diluted EPS. Despite the importance of these

measures to management in goal setting and performance measurement,

non-GAAP adjusted net income and its components and non-GAAP

adjusted diluted EPS are non-GAAP financial measures that have no

standardized meaning prescribed by U.S. GAAP and, therefore, have

limits in their usefulness to investors. Because of the

non-standardized definitions, non-GAAP adjusted net income and its

components and non-GAAP adjusted diluted EPS (unlike U.S. GAAP net

income and its components and diluted EPS) may not be comparable to

the calculation of similar measures of other companies. Non-GAAP

adjusted net income and its components, and non-GAAP adjusted

diluted EPS are presented solely to permit investors to more fully

understand how management assesses performance.

See Notes to Reconciliation of GAAP

Reported to Non-GAAP Adjusted Information for notes (1) and

(2).

ZOETIS INC.

NOTES TO RECONCILIATION OF GAAP

REPORTED TO NON-GAAP ADJUSTED INFORMATION

CERTAIN LINE ITEMS

(UNAUDITED)

(millions of dollars)

(1) Acquisition-related costs include the following:

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

2021

2022

2021

Transaction costs(a)

$

1

$

—

$

1

$

—

Integration costs(b)

—

4

4

10

Restructuring charges(c)

—

—

—

2

Total acquisition-related

costs—pre-tax

1

4

5

12

Income taxes(d)

—

1

1

2

Total acquisition-related costs—net of

tax

$

1

$

3

$

4

$

10

(a) Represents external costs directly

related to acquiring businesses and primarily includes expenditures

for banking, legal, accounting and other similar services. Included

in Restructuring charges and certain acquisition-related costs.

(b) Integration costs represent external, incremental costs

directly related to integrating acquired businesses and primarily

include expenditures for consulting and the integration of systems

and processes. Included in Restructuring charges and certain

acquisition-related costs.

(c) Represents exit and employee

termination costs, included in Restructuring charges and certain

acquisition-related costs.

(d) Included in Provision for taxes on

income. Income taxes include the tax effect of the associated

pre-tax amounts, calculated by determining the jurisdictional

location of the pre-tax amounts and applying that jurisdiction's

applicable tax rate.

(2) Certain significant items include the

following:

Three Months Ended December

31,

Twelve Months Ended December

31,

2022

2021

2022

2021

Other restructuring charges and

cost-reduction/productivity initiatives(a)

$

1

$

2

$

8

$

24

Certain asset impairment charges(b)

41

27

47

46

Net loss on sale of assets(c)

—

—

—

3

Other

4

—

1

—

Total certain significant

items—pre-tax

46

29

56

73

Income taxes(d)

(3

)

5

(3

)

16

Total certain significant items—net of

tax

$

49

$

24

$

59

$

57

(a) For the twelve months ended December

31, 2022, primarily represents employee termination and exit costs

associated with cost-reduction and productivity initiatives in

certain international markets, included in Restructuring charges

and certain acquisition-related costs, as well as product transfer

costs, included in Cost of sales.

For the twelve months ended December 31,

2021, primarily represents employee termination costs associated

with the realignment of our international operations and other

costs associated with cost-reduction and productivity initiatives,

included in Restructuring charges and certain acquisition-related

costs.

(b) For the three and twelve months ended

December 31, 2022, primarily represents asset impairment charges

related to customer relationships, developed technology rights and

property, plant and equipment in our diagnostics, poultry, cattle

and swine businesses included in Other (income)/deductions-net.

For the twelve months ended December 31,

2022, also includes inventory and certain asset impairment charges

related to the consolidation of manufacturing sites in China,

included in Cost of sales and Restructuring charges and certain

acquisition related costs.

For the three months ended December 31,

2021, represents asset impairment charges related to developed

technology rights and trademarks in our dairy cattle, diagnostics

and aquatic health businesses, included in Other

(income)/deductions-net.

For the twelve months ended December 31,

2021, primarily represents asset impairment charges related to:

- Developed technology rights and trademarks in our dairy cattle,

diagnostics and aquatic health businesses, included in Other

(income)/deductions-net;

- The consolidation of manufacturing sites in China, included in

Restructuring charges and certain acquisition related costs;

and

- Property, plant and equipment and inventory related to a dairy

product termination included in Other (income)/deductions-net and

Cost of sales.

(c) Represents a net loss related to the

sale of certain assets of our poultry automation business located

in the U.S. and Canada, included in Other

(income)/deductions-net.

(d) Included in Provision for taxes on

income. Income taxes include the tax effect of the associated

pre-tax amounts, calculated by determining the jurisdictional

location of the pre-tax amounts and applying that jurisdiction's

applicable tax rate. For the twelve months ended December 31, 2022,

also includes a tax charge related to changes in valuation

allowances related to impairment of certain assets and changes in

uncertain tax positions.

ZOETIS INC.

ADJUSTED SELECTED COSTS AND

EXPENSES(a)

(UNAUDITED)

(millions of dollars)

Three Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(b)

Adjusted cost of sales

$

650

$

598

9

%

(2

) %

11

%

As a percent of revenue

31.9

%

30.4

%

NA

NA

NA

Adjusted SG&A expenses

507

586

(13

) %

(4

) %

(9

) %

Adjusted R&D expenses

147

138

7

%

(3

) %

10

%

Adjusted net income attributable to

Zoetis

539

474

14

%

(13

) %

27

%

Twelve Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(b)

Adjusted cost of sales

$

2,440

$

2,289

7

%

(1

) %

8

%

As a percent of revenue

30.2

%

29.4

%

NA

NA

NA

Adjusted SG&A expenses

1,980

1,971

—

%

(3

) %

3

%

Adjusted R&D expenses

538

507

6

%

(2

) %

8

%

Adjusted net income attributable to

Zoetis

2,297

2,240

3

%

(8

) %

11

%

(a) Adjusted cost of sales, adjusted

selling, general, and administrative (SG&A) expenses, adjusted

research and development (R&D) expenses, and adjusted net

income (non-GAAP financial measures) are defined as the

corresponding reported U.S. GAAP income statement line items

excluding purchase accounting adjustments, acquisition-related

costs, and certain significant items. These adjusted income

statement line item measures are not, and should not be viewed as,

substitutes for the corresponding U.S. GAAP line items. The

corresponding GAAP line items and reconciliations of reported to

adjusted information are provided in Condensed Consolidated

Statements of Income and Reconciliation of GAAP Reported to

Non-GAAP Adjusted Information.

(b) Operational growth (a non-GAAP

financial measure) is defined as growth excluding the impact of

foreign exchange.

ZOETIS INC.

2023 GUIDANCE

Selected Line Items

(millions of dollars, except per share

amounts)

Full Year 2023

Revenue

$8,575 to $8,725

Operational growth(a)

6% to 8%

Adjusted cost of sales as a percentage of

revenue(b)

29.5% to 30.0%

Adjusted SG&A expenses(b)

$2,060 to $2,100

Adjusted R&D expenses(b)

$635 to $660

Adjusted interest expense and other

(income)/deductions-net(b)

Approximately $170

Effective tax rate on adjusted

income(b)

20.0% to 21.0%

Adjusted diluted EPS(b)

$5.34 to $5.44

Adjusted net income(b)

$2,490 to $2,540

Operational growth(a)(c)

7% to 9%

Certain significant items and

acquisition-related costs(d)

$20 - $25

The guidance reflects foreign exchange

rates as of late January.

Reconciliations of 2023 reported guidance

to 2023 adjusted guidance follows:

(millions of dollars, except per

share amounts)

Reported

Certain significant items and

acquisition-related costs(d)

Purchase accounting

Adjusted(b)

Cost of sales as a percentage of

revenue

29.7% to 30.2%

~ (0.1%)

~ (0.1%)

29.5% to 30.0%

SG&A expenses

$2,090 to $2,130

~ $(30)

$2,060 to $2,100

R&D expenses

$636 to $661

~ $(1)

$635 to $660

Interest expense and other

(income)/deductions

~ $170

~ $170

Effective tax rate

20.0% to 21.0%

20.0% to 21.0%

Diluted EPS

$5.03 to $5.14

$0.04 - $0.05

~ $0.26

$5.34 to $5.44

Net income attributable to Zoetis

$2,345 to $2,400

$20 - $25

~ $120

$2,490 to $2,540

(a) Operational growth (a non-GAAP

financial measure) excludes the impact of foreign exchange.

(b) Adjusted net income and its components

and adjusted diluted EPS are defined as reported U.S. GAAP net

income and its components and reported diluted EPS excluding

purchase accounting adjustments, acquisition-related costs and

certain significant items. Adjusted cost of sales, adjusted

SG&A expenses, adjusted R&D expenses, and adjusted interest

expense and other (income)/deductions-net are income statement line

items prepared on the same basis, and, therefore, components of the

overall adjusted income measure. Despite the importance of these

measures to management in goal setting and performance measurement,

adjusted net income and its components and adjusted diluted EPS are

non-GAAP financial measures that have no standardized meaning

prescribed by U.S. GAAP and, therefore, have limits in their

usefulness to investors. Because of the non-standardized

definitions, adjusted net income and its components and adjusted

diluted EPS (unlike U.S. GAAP net income and its components and

diluted EPS) may not be comparable to the calculation of similar

measures of other companies. Adjusted net income and its components

and adjusted diluted EPS are presented solely to permit investors

to more fully understand how management assesses performance.

Adjusted net income and its components and adjusted diluted EPS are

not, and should not be viewed as, substitutes for U.S. GAAP net

income and its components and diluted EPS.

(c) We do not provide a reconciliation of

forward-looking non-GAAP adjusted net income operational growth to

the most directly comparable U.S. GAAP reported financial measure

because we are unable to calculate with reasonable certainty the

foreign exchange impact of unusual gains and losses,

acquisition-related expenses, potential future asset impairments

and other certain significant items, without unreasonable effort.

The foreign exchange impacts of these items are uncertain, depend

on various factors, and could have a material impact on U.S. GAAP

reported results for the guidance period.

(d) Primarily includes certain

nonrecurring costs related to acquisitions and other charges.

ZOETIS INC.

CONSOLIDATED REVENUE BY

SEGMENT(a) AND SPECIES

(UNAUDITED)

(millions of dollars)

Three Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(b)

Revenue:

Companion Animal

$

1,303

$

1,182

10

%

(5

) %

15

%

Livestock

710

760

(7

) %

(7

) %

—

%

Contract Manufacturing & Human

Health

27

25

8

%

(4

) %

12

%

Total Revenue

$

2,040

$

1,967

4

%

(5

) %

9

%

U.S.

Companion Animal

$

853

$

763

12

%

—

%

12

%

Livestock

259

277

(6

) %

—

%

(6

) %

Total U.S. Revenue

$

1,112

$

1,040

7

%

—

%

7

%

International

Companion Animal

$

450

$

419

7

%

(14

) %

21

%

Livestock

451

483

(7

) %

(11

) %

4

%

Total International Revenue

$

901

$

902

—

%

(12

) %

12

%

Companion Animal:

Dogs and Cats

$

1,224

$

1,107

11

%

(4

) %

15

%

Horses

79

75

5

%

(6

) %

11

%

Total Companion Animal Revenue

$

1,303

$

1,182

10

%

(5

) %

15

%

Livestock:

Cattle

$

377

$

413

(9

) %

(5

) %

(4

) %

Swine

138

155

(11

) %

(8

) %

(3

) %

Poultry

115

118

(3

) %

(6

) %

3

%

Fish

61

55

11

%

(14

) %

25

%

Sheep and other

19

19

—

%

(14

) %

14

%

Total Livestock Revenue

$

710

$

760

(7

) %

(7

) %

—

%

(a) For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b) Operational revenue growth (a non-GAAP

financial measure) is defined as revenue growth excluding the

impact of foreign exchange.

ZOETIS INC.

CONSOLIDATED REVENUE BY

SEGMENT(a) AND SPECIES

(UNAUDITED)

(millions of dollars)

Twelve Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(b)

Revenue:

Companion Animal

$

5,203

$

4,689

11

%

(3

) %

14

%

Livestock

2,791

3,005

(7

) %

(5

) %

(2

) %

Contract Manufacturing & Human

Health

86

82

5

%

(2

) %

7

%

Total Revenue

$

8,080

$

7,776

4

%

(4

) %

8

%

U.S.

Companion Animal

$

3,341

$

2,990

12

%

—

%

12

%

Livestock

972

1,052

(8

) %

—

%

(8

) %

Total U.S. Revenue

$

4,313

$

4,042

7

%

—

%

7

%

International

Companion Animal

$

1,862

$

1,699

10

%

(9

) %

19

%

Livestock

1,819

1,953

(7

) %

(7

) %

—

%

Total International Revenue

$

3,681

$

3,652

1

%

(8

) %

9

%

Companion Animal:

Dogs and Cats

$

4,939

$

4,426

12

%

(3

) %

15

%

Horses

264

263

—

%

(4

) %

4

%

Total Companion Animal Revenue

$

5,203

$

4,689

11

%

(3

) %

14

%

Livestock:

Cattle

$

1,440

$

1,557

(8

) %

(5

) %

(3

) %

Swine

565

659

(14

) %

(4

) %

(10

) %

Poultry

476

507

(6

) %

(4

) %

(2

) %

Fish

212

187

13

%

(9

) %

22

%

Sheep and other

98

95

3

%

(9

) %

12

%

Total Livestock Revenue

$

2,791

$

3,005

(7

) %

(5

) %

(2

) %

(a) For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b) Operational revenue growth (a non-GAAP

financial measure) is defined as revenue growth excluding the

impact of foreign exchange.

ZOETIS INC.

CONSOLIDATED REVENUE BY KEY

INTERNATIONAL MARKETS

(UNAUDITED)

(millions of dollars)

Three Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(a)

Total International

$

901.3

$

902.3

—

%

(12

) %

12

%

Australia

64.2

62.8

2

%

(13

) %

15

%

Brazil

96.2

84.1

14

%

4

%

10

%

Canada

65.2

63.0

3

%

(8

) %

11

%

Chile

34.8

36.1

(4

) %

(5

) %

1

%

China

91.4

68.4

34

%

(14

) %

48

%

France

35.1

34.7

1

%

(16

) %

17

%

Germany

44.0

48.0

(8

) %

(14

) %

6

%

Italy

25.6

27.9

(8

) %

(14

) %

6

%

Japan

36.1

46.3

(22

) %

(21

) %

(1

) %

Mexico

35.6

34.8

2

%

3

%

(1

) %

Spain

21.3

31.1

(32

) %

(12

) %

(20

) %

United Kingdom

60.3

61.2

(1

) %

(18

) %

17

%

Other Developed

114.6

117.1

(2

) %

(16

) %

14

%

Other Emerging

176.9

186.8

(5

) %

(14

) %

9

%

Twelve Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(a)

Total International

$

3,680.8

$

3,651.9

1

%

(8

) %

9

%

Australia

288.7

258.8

12

%

(9

) %

21

%

Brazil

329.5

311.5

6

%

3

%

3

%

Canada

237.5

231.5

3

%

(3

) %

6

%

Chile

141.1

136.3

4

%

(4

) %

8

%

China

382.4

357.3

7

%

(4

) %

11

%

France

126.1

132.4

(5

) %

(12

) %

7

%

Germany

176.3

183.0

(4

) %

(12

) %

8

%

Italy

111.2

115.2

(3

) %

(11

) %

8

%

Japan

173.1

186.2

(7

) %

(16

) %

9

%

Mexico

136.2

132.6

3

%

—

%

3

%

Spain

117.8

127.7

(8

) %

(11

) %

3

%

United Kingdom

234.5

234.4

—

%

(11

) %

11

%

Other Developed

468.4

467.0

—

%

(11

) %

11

%

Other Emerging

758.0

778.0

(3

) %

(12

) %

9

%

(a) Operational revenue growth (a non-GAAP

financial measure) is defined as revenue growth excluding the

impact of foreign exchange.

ZOETIS INC.

SEGMENT(a) EARNINGS

(UNAUDITED)

(millions of dollars)

Three Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(b)

U.S.:

Revenue

$

1,112

$

1,040

7

%

—

%

7

%

Cost of sales

216

213

1

%

—

%

1

%

Gross profit

896

827

8

%

—

%

8

%

Gross margin

80.6

%

79.5

%

Operating expenses

187

197

(5

) %

—

%

(5

) %

Other (income)/deductions-net

(12

)

2

*

*

*

U.S. Earnings

$

721

$

628

15

%

—

%

15

%

International:

Revenue

$

901

$

902

—

%

(12

) %

12

%

Cost of sales

274

273

—

%

(8

) %

8

%

Gross profit

627

629

—

%

(13

) %

13

%

Gross margin

69.6

%

69.7

%

Operating expenses

155

173

(10

) %

(10

) %

—

%

Other (income)/deductions-net

2

—

*

*

*

International Earnings

$

470

$

456

3

%

(14

) %

17

%

Total Reportable Segments

$

1,191

$

1,084

10

%

(6

) %

16

%

Other business activities(c)

(109

)

(105

)

4

%

Reconciling Items:

Corporate(d)

(302

)

(308

)

(2

) %

Purchase accounting

adjustments(e)

(40

)

(42

)

(5

) %

Acquisition-related costs(f)

(1

)

(4

)

(75

) %

Certain significant items(g)

(46

)

(29

)

59

%

Other unallocated(h)

(101

)

(90

)

12

%

Total Earnings(i)

$

592

$

506

17

%

(a) For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b) Operational growth (a non-GAAP

financial measure) is defined as growth excluding the impact of

foreign exchange.

(c) Other business activities reflect the

research and development costs managed by our Research and

Development organization as well as our contract manufacturing

business and human health business.

(d) Corporate includes, among other

things, certain costs associated with information technology,

administration expenses, interest expense, certain compensation

costs, certain procurement costs, and other costs not charged to

our operating segments.

(e) Purchase accounting adjustments

include certain charges related to the amortization of fair value

adjustments to inventory, intangible assets and property, plant and

equipment not charged to our operating segments.

(f) Acquisition-related costs include

costs associated with acquiring and integrating newly acquired

businesses, such as transaction costs and integration costs.

(g) Certain significant items includes

substantive, unusual items that, either as a result of their nature

or size, would not be expected to occur as part of our normal

business on a regular basis. Such items primarily include

restructuring charges and implementation costs associated with a

shift in our organizational structure and

cost-reduction/productivity initiatives that are not associated

with an acquisition, certain asset impairment charges, costs

associated with the operational efficiency initiative and supply

network strategy, and the impact of divestiture-related gains and

losses.

(h) Includes overhead expenses associated

with our manufacturing and supply operations not directly

attributable to an operating segment, as well as certain

procurement costs.

(i) Defined as income before provision for

taxes on income.

* Calculation not meaningful.

ZOETIS INC.

SEGMENT(a) EARNINGS

(UNAUDITED)

(millions of dollars)

Twelve Months Ended December

31,

% Change

2022

2021

Total

Foreign Exchange

Operational(b)

U.S.:

Revenue

$

4,313

$

4,042

7

%

—

%

7

%

Cost of sales

803

788

2

%

—

%

2

%

Gross profit

3,510

3,254

8

%

—

%

8

%

Gross margin

81.4

%

80.5

%

Operating expenses

765

681

12

%

—

%

12

%

Other (income)/deductions-net

(18

)

4

*

*

*

U.S. Earnings

$

2,763

$

2,569

8

%

—

%

8

%

International:

Revenue

$

3,681

$

3,652

1

%

(8

) %

9

%

Cost of sales

1,083

1,106

(2

) %

(5

) %

3

%

Gross profit

2,598

2,546

2

%

(10

) %

12

%

Gross margin

70.6

%

69.7

%

Operating expenses

611

602

1

%

(8

) %

9

%

Other (income)/deductions-net

(3

)

(4

)

(25

) %

28

%

(53

) %

International Earnings

$

1,990

$

1,948

2

%

(10

) %

12

%

Total Reportable Segments

$

4,753

$

4,517

5

%

(5

) %

10

%

Other business activities(c)

(424

)

(406

)

4

%

Reconciling Items:

Corporate(d)

(1,073

)

(1,052

)

2

%

Purchase accounting adjustments(e)

(160

)

(175

)

(9

) %

Acquisition-related costs(f)

(5

)

(12

)

(58

) %

Certain significant items(g)

(56

)

(73

)

(23

) %

Other unallocated(h)

(379

)

(311

)

22

%

Total Earnings(i)

$

2,656

$

2,488

7

%

(a) For a description of each segment, see

Zoetis' most recent Annual Report on Form 10-K.

(b) Operational growth (a non-GAAP

financial measure) is defined as growth excluding the impact of

foreign exchange.

(c) Other business activities reflect the

research and development costs managed by our Research and

Development organization as well as our contract manufacturing

business and human health business.

(d) Corporate includes, among other things, certain costs

associated with information technology, administration expenses,

interest expense, certain

(e) Purchase accounting adjustments

include certain charges related to the amortization of fair value

adjustments to inventory, intangible assets and property, plant and

equipment not charged to our operating segments.

(f) Acquisition-related costs include

costs associated with acquiring and integrating newly acquired

businesses, such as transaction costs and integration costs.

(g) Certain significant items includes

substantive, unusual items that, either as a result of their nature

or size, would not be expected to occur as part of our normal

business on a regular basis. Such items primarily include certain

asset impairment charges, restructuring charges and implementation

costs associated with a shift in our organizational structure and

cost-reduction/productivity initiatives that are not associated

with an acquisition, costs associated with the operational

efficiency initiative and supply network strategy, and the impact

of divestiture-related gains and losses.

(h) Includes overhead expenses associated

with our manufacturing and supply operations not directly

attributable to an operating segment, as well as certain

procurement costs.

(i) Defined as income before provision for

taxes on income.

* Calculation not meaningful.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230213005363/en/

Media: Bill Price 1-973-443-2742

(o) william.price@zoetis.com Kristen

Seely 1-973-443-2777 (o) kristen.seely@zoetis.com

Investor: Steve Frank

1-973-822-7141 (o) steve.frank@zoetis.com Nick Soonthornchai

1-973-443-2792 (o) nick.soonthornchai@zoetis.com

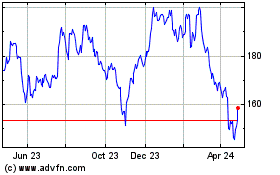

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Aug 2024 to Sep 2024

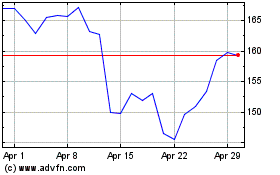

Zoetis (NYSE:ZTS)

Historical Stock Chart

From Sep 2023 to Sep 2024