UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

|

Filed by the

Registrant ☒

|

|

Filed by a Party other than the

Registrant ☐

|

|

Check the appropriate box:

|

|

☐ Preliminary

Proxy Statement

|

|

☐

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐ Definitive

Proxy Statement

|

|

☒ Definitive

Additional Materials

|

|

☐ Soliciting

Material under §240.14a-12

|

|

|

|

The Walt Disney Company

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

|

No fee required.

|

|

☐

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

(1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined):

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

|

|

(5)

|

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

|

Fee paid previously with preliminary materials.

|

|

☐

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and

identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

(1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

|

|

(2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

|

|

(3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

|

|

(4)

|

|

Date Filed:

|

|

|

|

|

|

|

2021 Investor Presentation ©

Disney

Key 2020 Updates: Focus on Long-Term

Strategy and Responsiveness to Shareholder Feedback Meaningful strategic advancements and strong performance During the past year we executed an important CEO transition from Bob Iger to Bob Chapek, made significant progress in realigning our media

and entertainment businesses to accelerate our direct-to-consumer strategy, drove strong shareholder returns and took decisive action to address the challenges presented by the COVID-19 pandemic to our employees and our business FY 2020 Shareholder

Engagement 12 of top 20 7 of top 10 Spoke with: Contacted: Continued responsiveness to shareholders on compensation Following multiple years of structural changes and reductions to Mr. Iger’s compensation in response to ongoing shareholder

feedback, the Compensation Committee further responded to direct shareholder feedback in setting Mr. Chapek’s target compensation at a level meaningfully lower than Mr. Iger’s compensation and aligned with the 25th percentile of peers1

Commitment to diversity and inclusion and advancing ESG disclosures As part of the Board and senior management team’s commitment to advancing diversity and inclusion in our workforce and through our creation of content, we established six

strategic pillars to guide our actions in these important areas. We also made meaningful progress in expanding ESG disclosures to include certain SASB metrics and committed to disclose EEO-1 data and sustainability goals 1. See note on slide

5

(See Total Shareholder Return detail below)

Strategic Acquisitions and Forward-Looking Strategy Have Driven Exceptional Shareholder Returns Our Board and leadership team have a long history of overseeing and executing on investments in strategic, market leading content, delivering tremendous

value to our shareholders JAN-24-06 DIS agrees to acquire Pixar AUG-31-09 DIS signs agreement to acquire Marvel Entertainment OCT-30-12 DIS agrees to acquire Lucasfilm AUG-08-17 DIS agrees to acquire majority ownership of BAMTech FEB-24-2020 CEO

transition from Mr. Iger to Mr. Chapek MAR-20-19 DIS closes 21st Century Fox Acquisition APR-11-19 DIS provides overview of new DTC strategy at Investor Day MAY-14-19 DIS announces assumption of full operational control of Hulu FEB-24-20 CEO

transition from Mr. Iger to Mr. Chapek DEC-10-20 DIS updates DTC plans and previews content at Investor Day TOTAL SHAREHOLDER RETURN DETAIL Marks the CEO transition from Mr. Iger to Mr. Chapek TOTAL SHAREHOLDER RETURN1 Outperformance of 505

percentage points vs. the S&P 500 1. Reflects Total Shareholder Return from 9/30/2005 through 12/31/2020; DIS TSR of 824% vs. S&P 500 return of 319% Record breaking performance over the past year despite the impact of the pandemic, driven

by: Bob Chapek’s leadership in driving execution of long-term strategy Bob Iger’s oversight of the significant advancements of our creative endeavors

May 2020: Named new chairs of

Direct-to-Consumer and International and Parks, Experiences and Products, both reporting to Mr. Chapek; restructured leadership team at Parks, Experiences and Products October 2020: Reorganized media and entertainment businesses to align to Mr.

Chapek’s strategic goals of accelerating direct-to-consumer (“DTC”) strategy and centralizing distribution and commercialization activities December 2020: Hosted 2020 Investor Day focused on the Company’s DTC streaming

services, with key developments including: Updated subscriber guidance given Disney+ performance post-launch Updates on DTC content, announcing a significant pipeline across numerous franchises resulting from close creative collaboration between

Disney’s content creators and Bob Iger Company’s new management team leading our DTC efforts Significant progress on long-term strategic plan achieved through recent management, organizational and strategic updates driven by Bob Chapek

and supported by the oversight of Bob Iger and the Board Continued Execution of Long-Term Strategy Supported by Leadership of our CEO and Executive Chairman Launched DTC in several key markets and drove unprecedented subscriber growth in the first

year Increased subscribers at ESPN+ and Hulu Released compelling original content for Disney+ Created content for traditional theatrical release and linear networks Recent Management, Organizational and Strategic Updates Key Recent Accomplishments

Throughout the year, Bob Chapek worked closely with each of our business leads to ensure strong execution of strategy across the Company. Bob Iger’s direction of the Company’s creative endeavors, which are the cornerstone of our

strategy, has positioned Disney for long-term success and helped drive creation of shareholder value

The Compensation Committee made changes to

prior CEO pay on multiple occasions between fiscal 2019 and fiscal 2020 as a result of shareholder feedback, including Say-on-Pay votes, and designed the new CEO compensation program with this feedback top of mind History of Shareholder Engagement

and Responsiveness Culminating in Significant Compensation Changes The cumulative effect of shareholder feedback over the past several years has led to direct changes to our CEO compensation structures to meaningfully reduce pay quantum, enhance

performance rigor and reset CEO target compensation levels 2018 2019 2020 SHAREHOLDER FEEDBACK RESPONSIVE ACTIONS TAKEN Enhance Performance Rigor. Mr. Iger’s one-time performance-based equity award should have more rigorous performance

criteria Reduce Pay Quantum. Increases in Mr. Iger’s annual compensation going into effect after the closing of the TFCF transaction were too large Reduce Pay Quantum. Mr. Iger’s overall compensation levels remain high Reduce Target CEO

Compensation upon Succession. New CEO compensation should be reset closer to peer median Nov. 2018: Made several changes to one-time equity award to enhance rigor, including raising target performance to the 65th percentile and capping payouts.

Future performance-based equity awards also capped. Mar. 2019: Made several changes to annual compensation levels that reduced total annual target compensation by $13.5M Dec. 2019: Reduced Mr. Iger’s overall compensation level by eliminating

$5M completion bonus Feb. 25 2020: 15 days before our 2020 annual meeting, Bob Chapek succeeded Bob Iger as CEO and the Compensation Committee reduced target CEO pay by 29% (or $10M), placing him at the 25th percentile of peers1 Reduce Overlapping

Metrics in short- and long-term plan and consider adding a capital return measure to the long-term plan FY 2021: ROIC removed as annual bonus performance metric; included as a PBU* metric in the long-term plan 2021 *PBU = Performance-based

restricted stock units (PBUs) 1. Based on general industry peer group (GOOG, AAPL, T, CHTR, CSCO, CMCSA, DISCA, IBM, INTC, MSFT, NFLX, ORCL, VZ, VIAC) excluding CEOs with de-minimis total target compensation (FB, AMZN)

OVERVIEW OF TARGET CEO COMPENSATION

STRUCTURE EVOLUTION CEO Compensation Structure Remains Highly Performance-Based and Reflective of Business Evolution Changes to bonus metrics reflect importance of driving new and existing revenue growth, focus incentives on the remaining three key

metrics, and remove ROIC duplication in bonus and equity plans Other performance factors will include D&I as the highest weighted factor Enhancements to Structure for FY2021 *PBUs = Performance-based restricted stock units (PBUs) Base Salary

Annual Bonus Annual Equity Awards 3-yr. cum. relative TSR (50% of PBUs) Other Performance Factors (30%) Adj. EPS Paid in cash; reflects job responsibilities and provides competitive fixed pay to balance performance-based risks Adj. Segment Operating

Income Adj. ROIC Adj. After-Tax FCF Financial Performance (70%) PBUs* (50%) Stock Options (50%) Bob Iger as CEO1 3-yr. cum. relative TSR (50% of PBUs) 3-yr. relative Adj. EPS growth (50% of PBUs) 4-year ratable vest Bob Chapek as CEO1 Paid in cash;

reflects job responsibilities and provides competitive fixed pay to balance performance-based risks Other Performance Factors (30%) Adj. Segment Operating Income Financial Performance (70%) 3-yr. ROIC (50% of PBUs) PBUs* (50%) Stock Options (25%)

Time-Vested RSUs (25%) 3-year ratable vest 3-year ratable vest Adj. After-Tax FCF Target Compensation Reduction $4.5M (38%) $500k (17%) $5M (25%) Revenue $10M (29%) target compensation reduction, aligning Mr. Chapek’s target with the 25th

percentile of industry peers2 1. Reflects Bob Iger’s Fiscal 2019 annual target compensation structure and Bob Chapek’s Fiscal 2021 annual target compensation structure 2. See note 1 on slide 5

With thoughtful consideration of ongoing

shareholder feedback and the impact of the COVID-19 pandemic on our businesses, the Compensation Committee made meaningful adjustments to CEO and NEO pay in FY2020 The Compensation Committee thoughtfully evaluated CEO compensation as part of the

succession planning process Mr. Chapek’s target compensation was set considerably below Mr. Iger’s compensation, aligning it with the 25th percentile of industry peers1 The Compensation Committee set Mr. Chapek’s LTI mix so that

50% of the award is comprised of PBUs In connection with his promotion to CEO, Mr. Chapek was granted a mix of PBUs*, restricted stock units and options (with majority in PBUs) to further align his target equity value with shareholder interests CEO

Compensation Structure Compensation Committee Decisions Reflect Shareholder Feedback and COVID-19 Business Impact The Committee made several adjustments to executive pay in light of the impact of COVID-19, including a temporary reduction to NEO base

salaries (or in the case of Mr. Iger, $0 salary through the end of the fiscal year)2 and awarding $0 bonuses to NEOs for fiscal 2020 despite achievement of certain performance metrics 38% of the performance-based restricted stock grant vesting in

December 2020 was forfeited based on three-year TSR and EPS, as compared to the S&P 500 Performance-based restricted stock units granted in fiscal 2020 also resulted in no value related to the first year of the ROIC portion of the grant NEO

Compensation Results *PBU = Performance-based restricted stock units (PBUs) 1. See note 1 on slide 5 2. Effective with the payroll period commencing April 5, 2020

Highly Qualified Board of Directors

Provides Strong Oversight Our Directors bring a diverse range of knowledge, perspective and experience from renowned global organizations Robert A. Iger Chairman of the Board and Executive Chairman The Board maintains an active dialogue with

management and plays an integral role in oversight of the strategic direction of our business Our Directors assess major risk factors relating to the Company and its performance, such as cybersecurity and data privacy, and review measures to

mitigate identified risks Each of the Board’s committees also addresses risks that fall within its areas of responsibility Robert A. Chapek Chief Executive Officer, The Walt Disney Company Susan E. Arnold Independent Lead Director, Gov. and

Nom. Committee Chair Op. Executive, The Carlyle Group Mary T. Barra Chairman and Chief Executive Officer, General Motors Safra A. Catz Audit Committee Chair Chief Executive Officer, Oracle Francis A. deSouza President and Chief Executive Officer,

Illumina, Inc. Michael B. G. Froman Vice Chairman and President, Strategic Growth, Mastercard, Inc. Maria Elena Lagomasino Compensation Committee Chair CEO and Managing Partner, WE Family Offices Mark G. Parker Executive Chairman, Nike, Inc. Derica

W. Rice Former President, CVS Caremark and former EVP, CVS Health Diverse Perspectives 60% Of Directors are gender or racially/ethnically diverse; all four committee chairs are women1 Strategy & Risk Oversight 30% of Directors are racially /

ethnically diverse Asian & Black Black Latina 6 years Average Director Tenure Active Refreshment 1. Susan Arnold also chairs the Executive Committee

Media and Entertainment Businesses Parks,

Experiences and Products Accelerated Disney+ debuts of Disney’s Frozen II, Pixar's Onward, Star Wars: The Rise of Skywalker; added Mulan, Hamilton and Soul In the absence of live sports, released ESPN’s 10-part docuseries The Last Dance

2 months early and rolled out 3 new films as part of the 30 for 30 series Continued to deliver virtual viewings of park experiences directly into people’s homes and responsibly reopened parks in accordance with CDC guidelines Leveraged our

properties for various purposes, including use by sporting leagues such as the NBA and MLS Disneyland parking lot used as Orange County’s first mass vaccination site, with more than 100,000 doses administered to date In the midst of a global

pandemic, Disney’s leadership team took steps to protect the Company’s long-term interests, continued to deliver entertainment and news when people needed it the most and made decisions important to our Company’s future success

Decisive Actions Taken to Support Ongoing Operations Throughout COVID-19 Significant increase of cash balances through issuance of senior notes; entered additional $5B credit facility Suspension of certain capital projects and reduction of certain

discretionary expenditures Decision to forgo fiscal 2020 dividends given limited visibility and prioritization of DTC investments Innovative and disciplined decisions made across business lines (see below)

COVID-19: Prioritizing Employees, Guests

and Communities Our primary concern throughout the COVID-19 pandemic has been, and continues to be, the health, safety and well-being of our employees, guests and local communities PROTECTING EMPLOYEES AND GUESTS Throughout the pandemic, we have

offered training, tools and resources to support our employees including: Coverage of all testing and treatment under all medical plans at no cost to employees/dependents Bolstered and enhanced free mental and behavioral resources for employees and

their families, including on-demand access to the Employee Assistance Program Expanded child and elder care support programs and provided a variety of tools and educational resources for parents Implemented policies to address employee pay, leave

and benefits for those directly affected by COVID-19 Constructed reopening strategies and practices to implement science-based, responsible health and safety protocols for employees, productions and guests Promoted health and safety of employees as

follows: Transitioned to a remote working environment at the onset of the pandemic Provided extensive training on new safety measures and policies Increased frequency of cleaning in work areas and new protocols for temperature checks and face

coverings Implemented innovative technology solutions to minimize contact and promote physical distancing SUPPORTING OUR LOCAL COMMUNITIES Provided almost $27 million of in-kind support for communities with donations of PPE, food and consumables

Donated more than 270 tons of excess food to local food banks following temporary park closures Donated 100,000+ N95 masks to hospitals and communities Provided on-air content and PSAs on our media networks to raise awareness of health and safety

guidelines and the rising issue of food insecurity Partnered with MedShare to distribute face masks to children and families in vulnerable communities across the US Focused on providing over 150 interns the opportunity to work virtually, creating a

strong pipeline of diverse talent with over 50% of the interns receiving a Disney employment offer

Overview of Disney’s Holistic ESG

Governance An ongoing area of Board focus is oversight of the Company’s corporate social responsibility strategy and the Company’s efforts to promote a long-term sustainable business Our CSR report will be published in fiscal Q2 2021

Direct leadership by C-Suite, including CFO, CHRO, and General Counsel in close coordination with CEO and business segment leaders in executing on our ESG priorities Regular reporting to full Board and committees from relevant members of the

management team on priority issues and specific inquiries Ongoing assessments of priority ESG issues that consider internal and external stakeholder views, business impact and evaluate opportunities to support our communities Committed to

measureable goals for 2030 across Greenhouse Gas Emissions, Water, Waste, Materials and Sustainable Design to maintain accountability against our sustainability strategy The Board delegated oversight of workforce equity matters to the Compensation

Committee and the Company intends to disclose EEO-1 data for calendar years 2019 and 2020 Enhanced transparency by providing certain disclosures aligned with the SASB framework NEW NEW NEW Disney’s approach to ESG Governance promotes

thoughtful representation of stakeholder interests and is responsive to investor feedback

Fostering a Diverse & Inclusive

Workplace Six Aspirational Pillars of our Approach to Diversity & Inclusion Committed to increasing available data regarding diverse representation across the company, and urging business leaders to deliver this information to their teams

Intending to disclose EEO-1 data for calendar years 2019 and 2020 Transparency 1 Sponsored several initiatives to support increased representation of people of color Leveraged The Black Employee Experience, led by Mr. Chapek, to evaluate how we are

meeting career needs for Black and African American employees Representation 3 Created the CEO Diversity & Inclusion Council, chaired by Mr. Chapek, that is charged with implementing our action plans and evaluating their effectiveness Delegated

oversight of workforce equity issues to the Compensation Committee Accountability 2 Pledged $5 million to existing and new nonprofit organizations, including the NAACP, that support Black communities, advance social justice, and create access and

opportunities for underrepresented youth Created a new goal for our charitable giving such that 50% or more of our charitable giving will be directed to programs serving underrepresented communities Community 4 Launched a Creative Inclusion Council,

championed by Mr. Iger, to scale our Company's best practices and inclusive content practices across our businesses, increase cultural competency and connection in our storytelling and drive long-term market relevancy Content 5 Harness a unifying

brand - Reimagine Tomorrow - and conversation series to drive brave, meaningful change across the Company and support leaders and employees in navigating complex issues in our communities and workplace Champion 75+ Business Employee Resource Groups

for employees to network and connect with peers, acquire new skills and drive cross-cultural business innovation Culture 6

Unparalleled Commitment to Our Employees

We prioritize the health and well-being of our employees and their families so that they can bring their best to work each day. Through the challenges of the global pandemic and social unrest that occurred in 2020, Disney leaders and employees

showed incredible resilience and dedication, helping one another bring their full selves to work and deliver the magic of Disney in new and innovative ways. Offer leading, affordable, and customizable benefits for full-time employees Provide onsite

physical and mental health facilities and pharmacies Deliver competitive family planning and behavioral health benefits and resources Offer market-competitive pay and reward outstanding performance Provide all U.S. Disney Parks & Resorts hourly

employees with a minimum of $15/hour by the end of calendar year 2021 Competitive Pay Well-being Provide care time, parental and medical leave to accommodate family needs Reimagine flexible, remote-working environments Support parents with access to

childcare centers, enhanced back-up care choices, and a variety of parenting resources Contribute to and care for the community through various social impact programs, including VoluntEARS, employee matching gifts, and Heroes Work Here Flexibility

& Family Support Community & Social Impact Innovate our approach around virtual learning environments Develop leaders through unique development experiences Invest in US hourly employees to obtain an education at no-cost through Disney

Aspire Professional & Personal Development Unlock opportunities for underrepresented storytellers and business leaders across our family of brands Foster and fuel representation, understanding, and a sense of belonging for our workforce

Diversity & Inclusion

https://www.thewaltdisneycompany.com/about/#policies https://thewaltdisneycompany.com/app/uploads/2020/07/Political-Disclosure-Archive-2020.pdf

https://thewaltdisneycompany.com/app/uploads/2020/07/Political-Giving-and-Participation-in-the-Formulation-of-Public-Policy-2020.pdf https://thewaltdisneycompany.com/app/uploads/2020/07/2019_US-Trade-Associations.pdf Shareholder Proposal on Lobbying

Policies and Activities Disclosure is Unnecessary and Would Create Redundancies The Board recommends that you vote AGAINST this proposal. We believe additional disclosures in this regard would not be an efficient use of resources in light of our

existing lobbying policies and disclosures Shareholder proposal: Requests the Company prepare an annually-updated report disclosing additional information regarding lobbying activities The Company provides significant disclosure regarding political

and lobbying activities and maintains a strict internal review and oversight process Discloses details of contributions to candidates for office on a semi-annual basis, available on the Company’s website Provides reports detailing issues the

Company lobbied on, the houses of Congress and federal agencies lobbied and total amounts expended during each calendar quarter on federal lobbying activities and the portion of trade association payments that are used for federal lobbying as

disclosed to the Company Disclosure of payments to trade associations are bucketed by contribution increment levels in order to provide a more granular level of detail to shareholders All political contributions have been approved by the

Company’s Government Relations team, and the full scope of political contributions activity is reviewed by the Governance and Nominating Committee of the Board annually The Company has been responsive to shareholder suggestions for enhanced

disclosure In response to shareholder feedback after the 2018 Annual Meeting, the Board enhanced the Company’s lobbying disclosure by expanding its scope and disclosing the expanded policy which includes: Annual disclosure of information

regarding our membership in U.S.-based industry and trade associations Annual dues the Company paid to these trade associations The percentage each trade association has indicated to us was used for lobbying activities The Company continues to be

recognized as a leader in political disclosure and practices In 2020 and 2019, the Center for Political Accountability’s Zicklin Index of Corporate Political Disclosure and Accountability ranked Disney among the First Tier of S&P 500

companies In January, the Company committed not to make political contributions in 2021 to members of Congress who objected to certification of state electoral college votes immediately following violence associated with the January 6 insurrection

at the Capitol Shareholders have not expressed support for this proposal, despite appearing on our ballot multiple consecutive years This is the sixth year this proposal has been submitted; it has continuously failed to obtain majority support

Sources of Policies and Additional Policies

https://thewaltdisneycompany.com/about/#policies https://thewaltdisneycompany.com/app/uploads/2020/02/Corporate-Governance-Guidelines-2020.pdf Shareholder Proposal on the Inclusion of Non-Management Employees on Director Nominee Candidate Lists is

Unnecessary and Would Undermine Independence The Board recommends that you vote AGAINST this proposal as the Governance and Nominating Committee’s thorough process of evaluating potential director candidates already ensures a diversity of

perspectives, and the addition of non-management employees would decrease the level of independence on the Board Shareholder proposal: Requests the initial list of candidates from which new director nominees are chosen to include non-management

employees The Governance and Nominating Committee follows a thorough process of evaluating potential director candidates to ensure diversity of perspectives The Committee’s criteria takes into account a variety of factors, including the range

of talents, experiences and skills to reflect the diversity of the Company’s shareholders, employees, customers and communities The proposal would supersede the careful judgement of the Board as to the criteria that should be reflected in a

director candidate pool and undermine the Committee’s flexibility, which is particularly important in light of the scope and complexity of the business A substantial majority of independent Directors has always been an important policy of the

Board of Directors Non-management employee directors would decrease the proportion of independent Directors and thereby make it more challenging for the Company to meet applicable NYSE Listed Company Rules and SEC rules The proposal would also

decrease the proportion of external, independent perspectives on the Board The proposal is misleadingly couched in terms of achieving greater diversity At present, the Company’s current Board already offers diverse skillsets and professional

backgrounds, as well as gender and ethnic and racial diversity Sources of Policies and Additional Policies

Cautionary Note on Forward Looking

Statements Certain statements in this communication may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include expectations

regarding future business or financial performance, goals, future programs or disclosures and other statements that are not historical in nature. These statements are made on the basis of management’s views and assumptions regarding future

events and business performance as of the time the statements are made. Management does not undertake any obligation to update these statements. Actual events may differ materially from those expressed or implied. Such differences may result from

actions taken by the Company, as well as from developments beyond the Company’s control, including changes in competitive conditions; consumer preferences; international, political, regulatory, health concern and military developments; and

changes in domestic and global economic conditions that may affect our businesses generally. Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended October 3, 2020 under Item 1A, “Risk

Factors”, Item 7, “Management’s Discussion and Analysis,” Item 1, “Business,” and in subsequent reports.

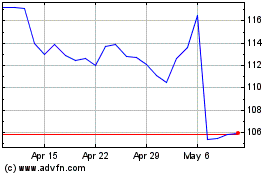

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Aug 2024 to Sep 2024

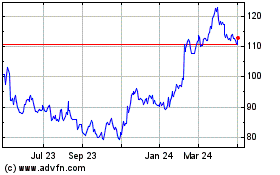

Walt Disney (NYSE:DIS)

Historical Stock Chart

From Sep 2023 to Sep 2024