Walker & Dunlop Survey Highlights Sentiment Around Affordable Housing Policies, Funding and Supply

December 17 2024 - 6:00AM

Business Wire

Survey was conducted among attendees at the

annual AHF Live conference

For the second year in a row, Walker & Dunlop, Inc., one of

the nation’s largest commercial real estate finance and advisory

firms, conducted a survey of top finance executives in affordable

housing to gauge their opinions on a variety of issues impacting

the CRE industry, including government policies, the economy and

funding.

Highlights of the survey results show overwhelming support for

implementing regional changes to zoning policies to serve as a

catalyst for boosting the housing supply. The results also indicate

a bullish outlook by CRE leaders for increased investment in

affordable housing in 2025.

The survey was conducted in November with attendees at the

Affordable Housing Finance (AHF) Live conference, which brings

together affordable housing developers, owners, management firms,

and state housing agencies from across the country to share

insights on the latest strategies and tools to help create and

preserve much-needed housing. The majority of respondents to the

anonymous survey were executives in senior leadership positions at

some of the top firms and agencies involved in affordable housing

development and financing.

Government Policies

- 84% of respondents do not support increasing trade tariffs as a

way to benefit home builders and home buyers. They felt that

international engagement should not be sacrificed for national

self-interest. The 16% of “Yes” respondents believed that the U.S.

should prioritize domestic needs.

- 94% of respondents think regional changes to zoning policies

could help boost housing supply. Respondents were by far in support

of seeing changes made to regional zoning policies, with the

sentiment being that restrictive zoning practices act as barriers

to development and limit the creation of housing supply.

Inflation & Interest Rates

- 55% of respondents feel the Fed was effective in combating

inflation over the last year. "Yes" responses mostly indicated that

recent rate changes, particularly two consecutive cycles of rate

reductions, were beneficial. Those who did not feel the Fed was

effective in stemming inflation reflected a broader, more cautious

view of the entire year, focusing on the Fed’s stance over the long

term.

- In 2023, which didn’t see rate cuts, 93% of survey respondents

didn’t think the Fed was doing enough to increase the supply of

affordable housing. 75% of respondents actually didn’t think the

Fed was done with interest rate hikes.

Housing Prices

- 89% of respondents think an increase in resources and supply

can offset the rising prices for housing. Sentiment around “No”

respondents felt there were better ways to manage pricing or

housing affordability.

Investments in Affordable Housing

- 52% of respondents said they have seen an increase in

investments (debt and equity) in affordable housing in the last

year. There is a mix of optimistic and realistic views on what the

next year will look like under the new administration. While some

respondents were hopeful for improvements, others took a more

cautious stance, anticipating challenges. This reflects the

complexity of the affordable housing issue and the differing

perspectives based on political, economic, regional, and

demographic factors.

- In last year’s survey, only 43% of the respondents said they

had seen an increase in affordable housing investments during

2023.

- 70% of the respondents believe the appetite for investments in

affordable housing will increase in 2025. With a mixed view of the

level of investments seen in affordable housing in 2024,

respondents are bullish that this will increase in 2025.

- In the 2023 survey, 58% of respondents said they expected to

see investments in affordable housing increase in 2024.

Sheri Thompson, executive vice president and head of affordable

housing at Walker & Dunlop, emphasized the importance of

staying connected with clients and gaining insights into the

industry through collaborative efforts.

“The survey is a great tool to foster collaboration with our

colleagues and get a pulse on our industry,” Thompson said.

“Affordable housing deals are inherently complex, requiring

creative solutions from debt to tax credit equity, soft funds to

state agency funds in addition to the full spectrum of capital

resources in between. Our team understands these complexities and

we have built a platform that enables us to adeptly advise and help

developers navigate them.”

Walker & Dunlop’s Affordable Housing Platform brings

together a dedicated group of experienced specialists who provide

our clients with solutions to achieve their unique affordable

housing objectives. Our team has the deep expertise and capability

to provide investment sales and capital advisory services, debt

(HUD, Fannie Mae, Freddie Mac, other capital markets sources) and

equity (LIHTC, conventional, programmatic joint-venture) financing,

as well as opportunities to invest in the preservation and

revitalization of affordable properties. To learn more about our

capabilities and financing options, visit our website.

Methodology

Sample sizes for the 2024 questions ranged from 98-100

respondents.

About Walker & Dunlop

Walker & Dunlop (NYSE: WD) is one of the largest commercial

real estate finance and advisory services firms in the United

States. Our ideas and capital create communities where people live,

work, shop, and play. The diversity of our people, breadth of our

brand and technological capabilities make us one of the most

insightful and client-focused firms in the commercial real estate

industry.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217434429/en/

Nina H. von Waldegg VP, Public Relations Phone: 301.564.3291

info@walkeranddunlop.com

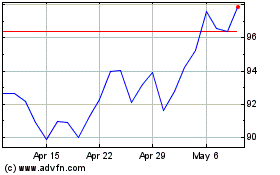

Walker & Dunlop (NYSE:WD)

Historical Stock Chart

From Nov 2024 to Dec 2024

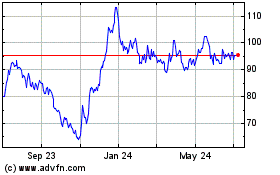

Walker & Dunlop (NYSE:WD)

Historical Stock Chart

From Dec 2023 to Dec 2024