Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

January 24 2024 - 2:27PM

Edgar (US Regulatory)

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK

:

93.4%

Brazil

:

3.5%

24,800

Banco

do

Brasil

SA

$

273,341

0.3

74,053

BB

Seguridade

Participacoes

SA

472,267

0.4

175,631

Cia

Siderurgica

Nacional

SA

588,404

0.6

63,621

Cosan

SA

228,656

0.2

13,965

Equatorial

Energia

SA

96,665

0.1

61,618

(1)(2)

Hapvida

Participacoes

e

Investimentos

S/A

54,457

0.0

56,169

(2)

Natura

&

Co.

Holding

SA

188,864

0.2

42,466

Sendas

Distribuidora

S/A

111,297

0.1

38,664

Telefonica

Brasil

SA

414,915

0.4

108,219

TIM

SA/Brazil

379,708

0.4

12,775

TOTVS

SA

85,988

0.1

29,771

Vale

SA

-

Foreign

447,891

0.4

51,596

WEG

SA

358,506

0.3

3,700,959

3.5

Chile

:

0.4%

160,543

Cencosud

SA

298,205

0.3

2,618,851

Cia

Sud

Americana

de

Vapores

SA

151,939

0.1

450,144

0.4

China

:

26.9%

22,900

37

Interactive

Entertainment

Network

Technology

Group

Co.

Ltd.

-

Class

A

71,194

0.1

116,500

(1)

3SBio,

Inc.

108,203

0.1

201,600

(2)

Alibaba

Group

Holding

Ltd.

1,873,955

1.8

358,000

Aluminum

Corp.

of

China

Ltd.

-

Class

H

176,803

0.2

16,778

Anhui

Yingjia

Distillery

Co.

Ltd.

-

Class

A

176,646

0.2

22,600

Anker

Innovations

Technology

Co.

Ltd.

-

Class

A

279,322

0.3

30,000

ANTA

Sports

Products

Ltd.

313,084

0.3

3,926

Autohome,

Inc.,

ADR

107,219

0.1

249,000

AviChina

Industry

&

Technology

Co.

Ltd.

-

Class

H

112,837

0.1

1,468,000

Bank

of

China

Ltd.

-

Class

H

537,859

0.5

204,600

Bank

of

Jiangsu

Co.

Ltd.

-

Class

A

189,908

0.2

16,000

Beijing

New

Building

Materials

PLC

-

Class

A

52,422

0.0

31,000

BYD

Co.

Ltd.

-

Class

H

833,175

0.8

63,000

By-health

Co.

Ltd.

-

Class

A

161,710

0.2

224,900

CECEP

Solar

Energy

Co.

Ltd.

-

Class

A

175,629

0.2

383,900

CECEP

Wind-Power

Corp.

-

Class

A

165,832

0.2

439,000

China

CITIC

Bank

Corp.

Ltd.

-

Class

H

198,309

0.2

632,000

China

Communications

Services

Corp.

Ltd.

-

Class

H

269,278

0.3

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

1,159,000

China

Construction

Bank

Corp.

-

Class

H

$

670,126

0.6

169,000

China

Longyuan

Power

Group

Corp.

Ltd.

-

Class

H

126,397

0.1

146,000

China

Medical

System

Holdings

Ltd.

280,449

0.3

131,000

China

Merchants

Bank

Co.

Ltd.

-

Class

H

457,192

0.4

7,600

China

National

Medicines

Corp.

Ltd.

-

Class

A

32,560

0.0

250,000

China

Oilfield

Services

Ltd.

-

Class

H

268,642

0.3

45,000

China

Overseas

Property

Holdings

Ltd.

36,675

0.0

482,000

China

Railway

Group

Ltd.

-

Class

H

211,555

0.2

20,000

China

Resources

Beer

Holdings

Co.

Ltd.

90,158

0.1

48,000

China

Resources

Land

Ltd.

175,737

0.2

2,772,000

(1)

China

Tower

Corp.

Ltd.

-

Class

H

287,363

0.3

60,000

Chinasoft

International

Ltd.

51,329

0.0

105,000

CITIC

Securities

Co.

Ltd.

-

Class

H

217,964

0.2

294,000

CMOC

Group

Ltd.

-

Class

H

167,998

0.2

4,400

Contemporary

Amperex

Technology

Co.

Ltd.

-

Class

A

103,051

0.1

90,500

COSCO

SHIPPING

Holdings

Co.

Ltd.

-

Class

H

83,378

0.1

75,360

CSPC

Pharmaceutical

Group

Ltd.

67,869

0.1

42,300

Dong-E-E-Jiao

Co.

Ltd.

-

Class

A

298,323

0.3

23,500

Dongfang

Electric

Corp.

Ltd.

-

Class

A

48,018

0.0

369,000

Far

East

Horizon

Ltd.

270,177

0.3

162,400

Focus

Media

Information

Technology

Co.

Ltd.

-

Class

A

148,858

0.1

63,600

Foxconn

Industrial

Internet

Co.

Ltd.

-

Class

A

134,718

0.1

178,000

Geely

Automobile

Holdings

Ltd.

193,678

0.2

5,284

GoodWe

Technologies

Co.

Ltd.

-

Class

A

79,992

0.1

212,100

GRG

Banking

Equipment

Co.

Ltd.

-

Class

A

363,020

0.3

29,600

Henan

Shenhuo

Coal

&

Power

Co.

Ltd.

-

Class

A

65,383

0.1

41,500

Hengan

International

Group

Co.

Ltd.

151,516

0.1

78,800

Hengdian

Group

DMEGC

Magnetics

Co.

Ltd.

-

Class

A

149,583

0.1

43,600

Hisense

Visual

Technology

Co.

Ltd.

-

Class

A

143,113

0.1

28,200

Hubei

Jumpcan

Pharmaceutical

Co.

Ltd.

-

Class

A

126,204

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

38,200

IEIT

Systems

Co.

Ltd.

-

Class

A

$

188,726

0.2

298,592

Industrial

&

Commercial

Bank

of

China

Ltd.

-

Class

H

142,078

0.1

29,500

JA

Solar

Technology

Co.

Ltd.

-

Class

A

82,333

0.1

4,752

JD.com,

Inc.

-

Class

A

64,818

0.1

28,500

Jiangsu

Yuyue

Medical

Equipment

&

Supply

Co.

Ltd.

-

Class

A

136,591

0.1

76,799

Jiangsu

Zhongtian

Technology

Co.

Ltd.

-

Class

A

139,722

0.1

81,100

Joincare

Pharmaceutical

Group

Industry

Co.

Ltd.

-

Class

A

143,891

0.1

16,500

Kingboard

Holdings

Ltd.

39,723

0.0

76,400

Kingsoft

Corp.

Ltd.

244,004

0.2

146,000

Lenovo

Group

Ltd.

180,181

0.2

46,400

LONGi

Green

Energy

Technology

Co.

Ltd.

-

Class

A

138,078

0.1

1,200

Luzhou

Laojiao

Co.

Ltd.

-

Class

A

34,867

0.0

50,320

(1)(2)

Meituan

-

Class

B

582,530

0.5

2,700

MINISO

Group

Holding

Ltd.,

ADR

68,391

0.1

64,000

Minth

Group

Ltd.

138,637

0.1

39,500

NetEase,

Inc.

891,056

0.8

32,800

(1)

Nongfu

Spring

Co.

Ltd.

-

Class

H

187,084

0.2

66,900

Offshore

Oil

Engineering

Co.

Ltd.

-

Class

A

60,201

0.1

8,560

(2)

PDD

Holdings,

Inc.,

ADR

1,262,086

1.2

1,039,000

People's

Insurance

Co.

Group

of

China

Ltd.

-

Class

H

336,563

0.3

528,000

PetroChina

Co.

Ltd.

-

Class

H

345,510

0.3

326,000

PICC

Property

&

Casualty

Co.

Ltd.

-

Class

H

378,696

0.4

87,500

Ping

An

Insurance

Group

Co.

of

China

Ltd.

-

Class

H

401,332

0.4

6,149

Qifu

Technology,

Inc.,

ADR

95,432

0.1

42,900

Risen

Energy

Co.

Ltd.

-

Class

A

97,111

0.1

72,000

Sany

Heavy

Equipment

International

Holdings

Co.

Ltd.

74,845

0.1

37,900

Shanghai

Aiko

Solar

Energy

Co.

Ltd.

-

Class

A

86,059

0.1

604,300

Shanghai

Construction

Group

Co.

Ltd.

-

Class

A

211,706

0.2

129,100

Shanghai

Pharmaceuticals

Holding

Co.

Ltd.

-

Class

H

187,145

0.2

4,300

Shanxi

Xinghuacun

Fen

Wine

Factory

Co.

Ltd.

-

Class

A

143,941

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

34,700

Shenzhen

Kstar

Science

And

Technology

Co.

Ltd.

-

Class

A

$

123,473

0.1

6,400

Shenzhen

Mindray

Bio-

Medical

Electronics

Co.

Ltd.

-

Class

A

260,690

0.2

14,200

Shenzhen

SC

New

Energy

Technology

Corp.

-

Class

A

140,004

0.1

43,600

Shenzhen

Senior

Technology

Material

Co.

Ltd.

-

Class

A

91,430

0.1

10,200

Shenzhen

Transsion

Holdings

Co.

Ltd.

-

Class

A

158,252

0.1

70,700

Sichuan

Road

and

Bridge

Group

Co.

Ltd.

-

Class

A

76,455

0.1

1,600

Sieyuan

Electric

Co.

Ltd.

-

Class

A

11,119

0.0

66,400

Sinopharm

Group

Co.

Ltd.

-

Class

H

164,556

0.2

160,000

Sinotruk

Hong

Kong

Ltd.

331,910

0.3

12,800

Sungrow

Power

Supply

Co.

Ltd.

-

Class

A

149,173

0.1

6,200

Sunny

Optical

Technology

Group

Co.

Ltd.

58,714

0.1

25,000

Sunresin

New

Materials

Co.

Ltd.

-

Class

A

176,403

0.2

1,400

Suzhou

TFC

Optical

Communication

Co.

Ltd.

-

Class

A

14,421

0.0

102,700

Tencent

Holdings

Ltd.

4,278,396

4.1

52,000

Tingyi

Cayman

Islands

Holding

Corp.

65,445

0.1

18,000

TongFu

Microelectronics

Co.

Ltd.

-

Class

A

57,394

0.1

211,000

(1)

Topsports

International

Holdings

Ltd.

171,486

0.2

89,000

TravelSky

Technology

Ltd.

-

Class

H

149,937

0.1

42,404

Trina

Solar

Co.

Ltd.

-

Class

A

160,325

0.1

145,000

Uni-President

China

Holdings

Ltd.

92,743

0.1

215,900

Western

Mining

Co.

Ltd.

-

Class

A

388,651

0.4

35,900

(1)

WuXi

AppTec

Co.

Ltd.

-

Class

H

419,953

0.4

510,000

Xinyi

Solar

Holdings

Ltd.

292,580

0.3

128,000

(1)

Yadea

Group

Holdings

Ltd.

240,696

0.2

39,000

Yankuang

Energy

Group

Co.

Ltd.

-

Class

H

72,449

0.1

20,920

YongXing

Special

Materials

Technology

Co.

Ltd.

-

Class

A

129,085

0.1

6,701

Yum

China

Holdings,

Inc.

289,349

0.3

182,400

Yutong

Bus

Co.

Ltd.

-

Class

A

344,332

0.3

46,168

Zangge

Mining

Co.

Ltd.

-

Class

A

154,844

0.1

162,000

Zhejiang

Expressway

Co.

Ltd.

-

Class

H

102,584

0.1

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

China

(continued)

9,000

Zhongji

Innolight

Co.

Ltd.

-

Class

A

$

119,899

0.1

60,300

Zhuzhou

CRRC

Times

Electric

Co.

Ltd.

-

Class

H

190,410

0.2

122,000

Zijin

Mining

Group

Co.

Ltd.

-

Class

H

193,202

0.2

58,000

ZTE

Corp.

-

Class

H

126,437

0.1

6,690

ZTO

Express

Cayman,

Inc.,

ADR

149,321

0.1

28,333,866

26.9

Colombia

:

0.2%

61,660

Interconexion

Electrica

SA

ESP

232,769

0.2

Egypt

:

0.2%

309,084

Eastern

Co.

SAE

259,070

0.2

Greece

:

1.3%

237,145

(2)

Alpha

Services

and

Holdings

SA

403,479

0.4

127,725

(2)

Eurobank

Ergasias

Services

and

Holdings

SA

235,444

0.2

12,318

Hellenic

Telecommunications

Organization

SA

180,831

0.2

4,759

Jumbo

SA

124,531

0.1

25,442

OPAP

SA

406,850

0.4

1,351,135

1.3

Hong

Kong

:

0.2%

276,000

Bosideng

International

Holdings

Ltd.

115,735

0.1

153,000

Sino

Biopharmaceutical

Ltd.

75,051

0.1

190,786

0.2

Hungary

:

1.1%

7,403

MOL

Hungarian

Oil

&

Gas

PLC

58,944

0.1

13,686

OTP

Bank

Nyrt

569,474

0.5

20,437

Richter

Gedeon

Nyrt

515,095

0.5

1,143,513

1.1

India

:

15.0%

28,078

Adani

Ports

&

Special

Economic

Zone

Ltd.

278,342

0.3

57,050

Axis

Bank

Ltd.

736,573

0.7

2,482

Bajaj

Auto

Ltd.

181,611

0.2

7,477

Bajaj

Finance

Ltd.

639,179

0.6

162,619

Bank

of

Baroda

384,945

0.4

38,461

Bharat

Electronics

Ltd.

67,409

0.1

51,676

Bharat

Petroleum

Corp.

Ltd.

270,471

0.3

63,211

CG

Power

&

Industrial

Solutions

Ltd.

340,857

0.3

10,401

Cholamandalam

Investment

and

Finance

Co.

Ltd.

139,613

0.1

2,750

Colgate-Palmolive

India

Ltd.

72,530

0.1

40,283

HCL

Technologies

Ltd.

649,104

0.6

55,360

HDFC

Bank

Ltd.

1,037,856

1.0

76,140

Hindalco

Industries

Ltd.

472,192

0.4

94,377

(2)

Hindustan

Petroleum

Corp.

Ltd.

393,842

0.4

132,074

ICICI

Bank

Ltd.

1,474,967

1.4

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

India

(continued)

283,443

Indian

Oil

Corp.

Ltd.

$

380,531

0.4

99,395

ITC

Ltd.

519,598

0.5

13,227

JSW

Steel

Ltd.

127,310

0.1

30,160

Kotak

Mahindra

Bank

Ltd.

635,820

0.6

29,953

Larsen

&

Toubro

Ltd.

1,118,164

1.1

1,219

Maruti

Suzuki

India

Ltd.

155,203

0.1

33,008

NTPC

Ltd.

103,520

0.1

143,872

Oil

&

Natural

Gas

Corp.

Ltd.

336,203

0.3

10,258

PI

Industries

Ltd.

463,846

0.4

185,493

Power

Finance

Corp.

Ltd.

745,595

0.7

177,055

Power

Grid

Corp.

of

India

Ltd.

444,063

0.4

174,839

REC

Ltd.

731,327

0.7

6,854

Reliance

Industries

Ltd.

195,627

0.2

76,366

Samvardhana

Motherson

International

Ltd.

84,480

0.1

19,942

Shriram

Finance

Ltd.

480,416

0.5

22,346

State

Bank

of

India

151,627

0.1

23,991

Tata

Consultancy

Services

Ltd.

1,005,248

0.9

313,907

Tata

Steel

Ltd.

482,399

0.5

10,369

Torrent

Pharmaceuticals

Ltd.

263,965

0.2

91,918

Vedanta

Ltd.

257,711

0.2

15,822,144

15.0

Indonesia

:

0.8%

1,264,300

Aneka

Tambang

Tbk

141,942

0.1

237,200

Bank

Negara

Indonesia

Persero

Tbk

PT

80,704

0.1

1,669,800

Bank

Rakyat

Indonesia

Persero

Tbk

PT

568,274

0.5

408,000

Sumber

Alfaria

Trijaya

Tbk

PT

75,497

0.1

866,417

0.8

Kuwait

:

0.1%

19,516

Mabanee

Co.

KPSC

53,004

0.1

Malaysia

:

1.9%

368,300

CIMB

Group

Holdings

Bhd

446,611

0.4

379,500

Genting

Bhd

381,362

0.4

722,800

Genting

Malaysia

Bhd

414,376

0.4

378,500

Inari

Amertron

Bhd

237,559

0.2

552,300

Public

Bank

Bhd

506,261

0.5

1,986,169

1.9

Mexico

:

2.5%

37,139

Arca

Continental

SAB

de

CV

378,692

0.3

313,478

Fibra

Uno

Administracion

SA

de

CV

506,806

0.5

36,600

Grupo

Mexico

SAB

de

CV

168,139

0.2

256,982

Grupo

Televisa

SAB

164,530

0.1

152,909

Kimberly-Clark

de

Mexico

SAB

de

CV

-

Class

A

308,222

0.3

176,462

Operadora

De

Sites

Mexicanos

SAB

de

CV

-

Class

1

221,587

0.2

30,363

Promotora

y

Operadora

de

Infraestructura

SAB

de

CV

299,076

0.3

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Mexico

(continued)

153,614

Wal-Mart

de

Mexico

SAB

de

CV

$

604,780

0.6

2,651,832

2.5

Peru

:

0.0%

123

Credicorp

Ltd.

15,440

0.0

Philippines

:

0.7%

148,500

Ayala

Land,

Inc.

83,535

0.1

21,774

BDO

Unibank,

Inc.

52,420

0.0

44,780

International

Container

Terminal

Services,

Inc.

174,278

0.2

215,220

Metropolitan

Bank

&

Trust

Co.

193,733

0.2

6,770

PLDT,

Inc.

156,413

0.1

100,800

SM

Prime

Holdings,

Inc.

58,674

0.1

719,053

0.7

Poland

:

0.4%

39,571

Powszechny

Zaklad

Ubezpieczen

SA

450,733

0.4

Qatar

:

1.2%

165,139

Commercial

Bank

PSQC

241,744

0.2

932,740

Mesaieed

Petrochemical

Holding

Co.

430,852

0.4

69,968

Ooredoo

QPSC

197,740

0.2

69,340

Qatar

Electricity

&

Water

Co.

QSC

321,595

0.3

10,085

Qatar

Islamic

Bank

SAQ

52,627

0.1

1,244,558

1.2

Romania

:

0.5%

79,197

NEPI

Rockcastle

NV

487,334

0.5

Russia

:

—%

354,185

(3)

Alrosa

PJSC

—

—

10,144,776

(3)

Inter

RAO

UES

PJSC

—

—

15,442

(3)

Lukoil

PJSC

—

—

9,459

(3)

Magnit

PJSC

—

—

116,758

(3)

Mobile

TeleSystems

PJSC

—

—

4,585

(2)(3)

Severstal

PAO

—

—

130,134

(3)

Surgutneftegas

PJSC

—

—

125,422

(3)

Tatneft

PJSC

—

—

—

—

Saudi

Arabia

:

2.4%

15,277

Arab

National

Bank

97,760

0.1

29,695

Banque

Saudi

Fransi

296,306

0.3

58,331

Etihad

Etisalat

Co.

718,350

0.7

24,577

Riyad

Bank

175,030

0.2

41,053

Sahara

International

Petrochemical

Co.

354,751

0.3

39,848

Saudi

Awwal

Bank

369,454

0.3

6,594

Saudi

Basic

Industries

Corp.

139,394

0.1

27,493

Saudi

Electricity

Co.

132,413

0.1

28,670

Saudi

Telecom

Co.

294,248

0.3

2,577,706

2.4

Singapore

:

0.3%

49,800

(1)

BOC

Aviation

Ltd.

358,309

0.3

South

Africa

:

2.9%

60,851

Absa

Group

Ltd.

561,220

0.5

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

South

Africa

(continued)

14,845

Exxaro

Resources

Ltd.

$

148,081

0.1

181,018

FirstRand

Ltd.

647,517

0.6

450,335

Growthpoint

Properties

Ltd.

253,222

0.2

12,854

Harmony

Gold

Mining

Co.

Ltd.

80,575

0.1

62,164

Impala

Platinum

Holdings

Ltd.

252,772

0.2

13,348

MTN

Group

Ltd.

72,922

0.1

5,345

Nedbank

Group

Ltd.

60,620

0.1

25,263

Sasol

Ltd.

279,088

0.3

35,428

Shoprite

Holdings

Ltd.

483,273

0.5

203,151

Sibanye

Stillwater

Ltd.

223,559

0.2

3,062,849

2.9

South

Korea

:

10.2%

2,319

BGF

retail

Co.

Ltd.

242,217

0.2

4,507

DB

Insurance

Co.

Ltd.

290,798

0.3

9,471

Doosan

Bobcat,

Inc.

333,290

0.3

165

Ecopro

Co.

Ltd.

95,186

0.1

607

GS

Holdings

Corp.

19,354

0.0

5,641

Hankook

Tire

&

Technology

Co.

Ltd.

197,440

0.2

1,110

Hanmi

Pharm

Co.

Ltd.

263,566

0.3

5,660

Hanmi

Semiconductor

Co.

Ltd.

277,759

0.3

35,809

Hanon

Systems

200,383

0.2

3,397

Hanwha

Aerospace

Co.

Ltd.

332,231

0.3

6,197

HD

Hyundai

Co.

Ltd.

288,840

0.3

3,446

Hyundai

Mobis

Co.

Ltd.

609,460

0.6

4,884

Hyundai

Motor

Co.

695,405

0.7

2,609

JYP

Entertainment

Corp.

193,727

0.2

7,915

KB

Financial

Group,

Inc.

320,026

0.3

11,609

Kia

Corp.

771,281

0.7

1,158

LG

Chem

Ltd.

447,990

0.4

4,940

LG

Electronics,

Inc.

391,697

0.4

593

LG

H&H

Co.

Ltd.

153,196

0.1

668

LG

Innotek

Co.

Ltd.

122,919

0.1

14,198

LG

Uplus

Corp.

115,327

0.1

832

Meritz

Financial

Group,

Inc.

35,674

0.0

2,464

NAVER

Corp.

396,073

0.4

32,448

NH

Investment

&

Securities

Co.

Ltd.

257,275

0.2

860

Orion

Corp./Republic

of

Korea

77,764

0.1

1,262

POSCO

Holdings,

Inc.

471,288

0.4

3,911

Posco

International

Corp.

172,806

0.2

4,448

Samsung

C&T

Corp.

410,131

0.4

2,022

Samsung

Fire

&

Marine

Insurance

Co.

Ltd.

406,408

0.4

704

Samsung

SDI

Co.

Ltd.

256,345

0.2

18,821

Samsung

Securities

Co.

Ltd.

570,575

0.5

10,418

SK

Hynix,

Inc.

1,080,987

1.0

470

(2)

SK

Innovation

Co.

Ltd.

52,031

0.1

1,457

SK,

Inc.

184,334

0.2

10,733,783

10.2

Taiwan

:

15.9%

314,000

Acer,

Inc.

354,209

0.3

20,897

Advantech

Co.

Ltd.

236,081

0.2

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

Taiwan

(continued)

73,000

ASE

Technology

Holding

Co.

Ltd.

$

298,105

0.3

38,000

Asustek

Computer,

Inc.

479,127

0.5

156,000

China

Airlines

Ltd.

105,431

0.1

285,000

Compal

Electronics,

Inc.

281,925

0.3

60,000

Delta

Electronics,

Inc.

606,859

0.6

4,000

eMemory

Technology,

Inc.

320,748

0.3

243,000

Eva

Airways

Corp.

243,480

0.2

72,000

Gigabyte

Technology

Co.

Ltd.

573,472

0.5

242,000

Hon

Hai

Precision

Industry

Co.

Ltd.

786,035

0.7

203,000

Inventec

Corp.

275,184

0.3

146,000

Lite-On

Technology

Corp.

513,227

0.5

35,000

MediaTek,

Inc.

1,056,983

1.0

74,000

Micro-Star

International

Co.

Ltd.

434,438

0.4

39,000

Novatek

Microelectronics

Corp.

637,044

0.6

111,000

Quanta

Computer,

Inc.

718,520

0.7

4,000

Realtek

Semiconductor

Corp.

57,516

0.1

406,962

Taiwan

Semiconductor

Manufacturing

Co.

Ltd.

7,444,197

7.1

486,000

United

Microelectronics

Corp.

759,988

0.7

162,000

Wistron

Corp.

471,990

0.4

2,000

Wiwynn

Corp.

112,215

0.1

16,766,774

15.9

Thailand

:

2.6%

480,700

Bangkok

Dusit

Medical

Services

PCL

-

Foreign

-

Class

F

358,965

0.3

31,100

Bumrungrad

Hospital

PCL

-

Foreign

197,128

0.2

78,600

Charoen

Pokphand

Foods

PCL

44,422

0.0

49,400

Delta

Electronics

Thailand

PCL

109,375

0.1

465,400

Indorama

Ventures

PCL

-

Foreign

324,188

0.3

79,800

Kasikornbank

PCL

-

Foreign

290,345

0.3

356,300

Krung

Thai

Bank

PCL

184,432

0.2

40,100

Krungthai

Card

PCL

53,313

0.0

448,300

Land

&

Houses

PCL

-

Foreign

98,171

0.1

224,400

Osotspa

PCL

145,869

0.1

19,300

PTT

Exploration

&

Production

PCL

-

Foreign

Shares

82,849

0.1

436,600

PTT

Global

Chemical

PCL

478,842

0.5

135,100

SCB

X

PCL

-

Foreign

381,306

0.4

2,749,205

2.6

Turkey

:

0.1%

21,433

KOC

Holding

AS

104,889

0.1

15,672

(2)

Turkcell

Iletisim

Hizmetleri

AS

31,398

0.0

136,287

0.1

Shares

RA

Value

Percentage

of

Net

Assets

COMMON

STOCK:

(continued)

United

Arab

Emirates

:

2.1%

151,541

Abu

Dhabi

Commercial

Bank

PJSC

$

346,611

0.3

174,287

Aldar

Properties

PJSC

271,477

0.3

198,450

Dubai

Islamic

Bank

PJSC

298,221

0.3

314,292

Emaar

Properties

PJSC

649,217

0.6

134,772

Emirates

NBD

Bank

PJSC

645,869

0.6

2,211,395

2.1

Total

Common

Stock

(Cost

$97,473,410)

98,555,234

93.4

EXCHANGE-TRADED

FUNDS

:

1.0%

27,229

iShares

MSCI

Emerging

Markets

ETF

1,077,179

1.0

Total

Exchange-Traded

Funds

(Cost

$1,033,876)

1,077,179

1.0

PREFERRED

STOCK

:

4.4%

Brazil

:

1.5%

247,238

Cia

Energetica

de

Minas

Gerais

555,049

0.5

145,775

Petroleo

Brasileiro

SA

1,054,059

1.0

1,609,108

1.5

Chile

:

0.2%

3,362

Sociedad

Quimica

y

Minera

de

Chile

SA

170,770

0.2

South

Korea

:

2.7%

62,577

Samsung

Electronics

Co.

Ltd.

2,807,294

2.7

Total

Preferred

Stock

(Cost

$3,660,565)

4,587,172

4.4

RIGHT

:

—%

Taiwan

:

—%

130

Wistron

Corp.

—

—

Total

Right

(Cost

$–)

—

—

Total

Long-Term

Investments

(Cost

$102,167,851)

104,219,585

98.8

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Shares

RA

Value

Percentage

of

Net

Assets

SHORT-TERM

INVESTMENTS

:

1.2%

Mutual

Funds

:

1.2%

1,314,000

(4)

Morgan

Stanley

Institutional

Liquidity

Funds

-

Government

Portfolio

(Institutional

Share

Class),

5.260%

(Cost

$1,314,000)

$

1,314,000

1.2

Total

Short-Term

Investments

(Cost

$1,314,000)

$

1,314,000

1.2

Total

Investments

in

Securities

(Cost

$103,481,851)

$

105,533,585

100.0

Liabilities

in

Excess

of

Other

Assets

(1,319)

0.0

Net

Assets

$

105,532,266

100.0

ADR

American

Depositary

Receipt

(1)

Securities

with

purchases

pursuant

to

Rule

144A

or

section

4(a)(2),

under

the

Securities

Act

of

1933

and

may

not

be

resold

subject

to

that

rule

except

to

qualified

institutional

buyers.

(2)

Non-income

producing

security.

(3)

For

fair

value

measurement

disclosure

purposes,

security

is

categorized

as

Level

3,

whose

value

was

determined

using

significant

unobservable

inputs.

(4)

Rate

shown

is

the

7-day

yield

as

of

November

30,

2023.

Sector

Diversification

Percentage

of

Net

Assets

Information

Technology

24.6

%

Financials

20.8

Consumer

Discretionary

10.5

Communication

Services

9.1

Materials

8.0

Industrials

7.5

Consumer

Staples

4.8

Energy

4.0

Health

Care

3.8

Real

Estate

2.5

Utilities

2.2

Exchange-Traded

Funds

1.0

Short-Term

Investments

1.2

Liabilities

in

Excess

of

Other

Assets

0.0

Net

Assets

100.0%

Portfolio

holdings

are

subject

to

change

daily.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

Fair

Value

Measurements

The

following

is

a

summary

of

the

fair

valuations

according

to

the

inputs

used

as

of

November

30,

2023

in

valuing

the

assets

and

liabilities:

Quoted

Prices

in

Active

Markets

for

Identical

Investments

(Level

1)

Significant

Other

Observable

Inputs

#

(Level

2)

Significant

Unobservable

Inputs

(Level

3)

Fair

Value

at

November

30,

2023

Asset

Table

Investments,

at

fair

value

Common

Stock

Brazil

$

3,700,959

$

—

$

—

$

3,700,959

Chile

450,144

—

—

450,144

China

2,267,929

26,065,937

—

28,333,866

Colombia

232,769

—

—

232,769

Egypt

259,070

—

—

259,070

Greece

124,531

1,226,604

—

1,351,135

Hong

Kong

—

190,786

—

190,786

Hungary

574,039

569,474

—

1,143,513

India

463,846

15,358,298

—

15,822,144

Indonesia

75,497

790,920

—

866,417

Kuwait

—

53,004

—

53,004

Malaysia

—

1,986,169

—

1,986,169

Mexico

2,651,832

—

—

2,651,832

Peru

15,440

—

—

15,440

Philippines

252,407

466,646

—

719,053

Poland

—

450,733

—

450,733

Qatar

492,111

752,447

—

1,244,558

Romania

487,334

—

—

487,334

Russia

—

—

—

—

Saudi

Arabia

718,350

1,859,356

—

2,577,706

Singapore

—

358,309

—

358,309

South

Africa

797,115

2,265,734

—

3,062,849

South

Korea

—

10,733,783

—

10,733,783

Taiwan

—

16,766,774

—

16,766,774

Thailand

—

2,749,205

—

2,749,205

Turkey

31,398

104,889

—

136,287

United

Arab

Emirates

992,480

1,218,915

—

2,211,395

Total

Common

Stock

14,587,251

83,967,983

—

98,555,234

Exchange-Traded

Funds

1,077,179

—

—

1,077,179

Preferred

Stock

1,779,878

2,807,294

—

4,587,172

Short-Term

Investments

1,314,000

—

—

1,314,000

Total

Investments,

at

fair

value

$

18,758,308

$

86,775,277

$

—

$

105,533,585

Liabilities

Table

Other

Financial

Instruments+

Forward

Foreign

Currency

Contracts

$

—

$

(6)

$

—

$

(6)

Written

Options

—

(462,665)

—

(462,665)

Total

Liabilities

$

—

$

(462,671)

$

—

$

(462,671)

#

The

earlier

close

of

the

foreign

markets

gives

rise

to

the

possibility

that

significant

events,

including

broad

market

moves,

may

have

occurred

in

the

interim

and

may

materially

affect

the

value

of

those

securities.

To

account

for

this,

the

Fund

may

frequently

value

many

of

its

foreign

equity

securities

using

fair

value

prices

based

on

third

party

vendor

modeling

tools

to

the

extent

available.

Accordingly,

a

portion

of

the

Fund’s

investments

are

categorized

as

Level

2

investments.

+

Other

Financial

Instruments

may

include

open

forward

foreign

currency

contracts,

futures,

centrally

cleared

swaps,

OTC

swaps

and

written

options.

Forward

foreign

currency

contracts,

futures

and

centrally

cleared

swaps

are

fair

valued

at

the

unrealized

appreciation

(depreciation)

on

the

instrument.

OTC

swaps

and

written

options

are

valued

at

the

fair

value

of

the

instrument.

PORTFOLIO

OF

INVESTMENTS

as

of

November

30,

2023

(Unaudited)

(continued)

Voya

Emerging

Markets

High

Dividend

Equity

Fund

At

November

30,

2023,

the

following

forward

foreign

currency

contracts

were

outstanding

for

Voya

Emerging

Markets

High

Dividend

Equity

Fund:

Currency

Purchased

Currency

Sold

Counterparty

Settlement

Date

Unrealized

Appreciation

(Depreciation)

USD

2,993

EGP

92,671

The

Bank

of

New

York

Mellon

12/05/23

$

(6)

$

(6)

At

November

30,

2023,

the

following

OTC

written

equity

options

were

outstanding

for

Voya

Emerging

Markets

High

Dividend

Equity

Fund:

Description

Counterparty

Put/

Call

Expiration

Date

Exercise

Price

Number

of

Contracts

Notional

Amount

Premiums

Received

Fair

Value

iShares

MSCI

Emerging

Markets

ETF

UBS

AG

Call

12/01/23

USD

38.460

262,610

USD

10,388,852

$

191,495

$

(290,491)

iShares

MSCI

Emerging

Markets

ETF

UBS

AG

Call

12/15/23

USD

39.360

266,768

USD

10,553,342

203,811

(172,174)

$

395,306

$

(462,665)

Currency

Abbreviations:

EGP

—

Egyptian

Pound

USD

—

United

States

Dollar

Net

unrealized

appreciation

consisted

of:

Gross

Unrealized

Appreciation

$

15,761,324

Gross

Unrealized

Depreciation

(13,709,590)

Net

Unrealized

Appreciation

$

2,051,734

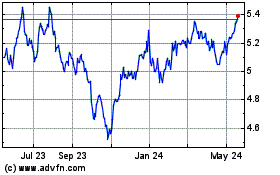

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Nov 2024 to Dec 2024

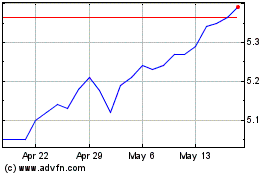

Voya Emerging Markets Hi... (NYSE:IHD)

Historical Stock Chart

From Dec 2023 to Dec 2024