0001616318false00016163182024-02-022024-02-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 2, 2024

Vista Outdoor Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-36597 | 47-1016855 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

| 1 Vista Way | Anoka | MN | 55303 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (763) 433-1000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $.01 | | VSTO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Items

Attached is a press release for the Revelyst segment (formerly Outdoor Products) of Vista Outdoor Inc. announced on filed on February 2, 2024 that outlines the Revelyst progress on its GEAR Up Transformation Plan.

(d) Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

Forward-Looking Statements

Some of the statements made and information contained in these materials, excluding historical information, are “forward-looking statements,” including those that discuss, among other things: the Company’s plans, objectives, expectations, intentions, strategies, goals, outlook or other non-historical matters; projections with respect to future revenues, income, earnings per share or other financial measures for the Company; and the assumptions that underlie these matters. The words “believe,” “expect,” “anticipate,” “intend,” “aim,” “should” and similar expressions are intended to identify such forward-looking statements. To the extent that any such information is forward-looking, it is intended to fit within the safe harbor for forward-looking information provided by the Private Securities Litigation Reform Act of 1995.

Numerous risks, uncertainties and other factors could cause the Company’s actual results to differ materially from the expectations described in such forward-looking statements, including the following: risks related to the Transaction, including (i) the failure to receive, on a timely basis or otherwise, the required approval of the Transaction by the Company’s stockholders, (ii) the possibility that any or all of the various conditions to the consummation of the Transaction may not be satisfied or waived, including the failure to receive any required regulatory approvals from any applicable governmental entities (or any conditions, limitations or restrictions placed on such approvals), (iii) the possibility that competing offers or acquisition proposals may be made, (iv) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement relating to the Transaction, including in circumstances which would require the Company to pay a termination fee, (v) the effect of the announcement or pendency of the Transaction on the Company’s ability to attract, motivate or retain key executives and employees, its ability to maintain relationships with its customers, vendors, service providers and others with whom it does business, or its operating results and business generally, (vi) risks related to the Transaction diverting management’s attention from the Company’s ongoing business operations and (vii) that the Transaction may not achieve some or all of any anticipated benefits with respect to either business segment and that the Transaction may not be completed in accordance with the Company’s expected plans or anticipated timelines, or at all; impacts from the COVID-19 pandemic on the Company’s operations, the operations of the Company’s customers and suppliers and general economic conditions; supplier capacity constraints, production or shipping disruptions or quality or price issues affecting the Company’s operating costs; the supply, availability and costs of raw materials and components; increases in commodity, energy, and production costs; seasonality and weather conditions; the Company’s ability to complete acquisitions, realize expected benefits from acquisitions and integrate acquired businesses; reductions in or unexpected changes in or the Company’s inability to accurately forecast demand for ammunition, accessories, or other outdoor sports and recreation products; disruption in the service or significant increase in the cost of the Company’s primary delivery and shipping services for the Company’s products and components or a significant disruption at shipping ports; risks associated with diversification into new international and commercial markets, including regulatory compliance; the Company’s ability to take advantage of growth opportunities in international and commercial markets; the Company’s ability to obtain and maintain licenses to third-party technology; the Company’s ability to attract and retain key personnel; disruptions caused by catastrophic events; risks associated with the Company’s sales to significant retail customers, including unexpected cancellations, delays, and other changes to purchase orders; the Company’s competitive environment; the Company’s ability to adapt the Company’s products to changes in technology, the marketplace and customer preferences, including the Company’s ability to respond to shifting preferences of the end consumer from brick and mortar retail to online retail; the Company’s ability to maintain and enhance brand recognition and reputation; others’ use of social media to disseminate negative commentary about us, the Company’s products, and boycotts; the outcome of contingencies, including with respect to litigation and other proceedings relating to intellectual property, product liability, warranty liability, personal injury, and environmental remediation; the Company’s ability to comply with extensive federal, state and international laws, rules and regulations; changes in laws, rules and regulations relating to the Company’s business, such as federal and state ammunition regulations; risks associated with cybersecurity and other industrial and physical security threats; interest rate risk; changes in the current tariff structures; changes in tax rules or pronouncements; capital market volatility and the availability of financing; foreign currency exchange rates and fluctuations in those rates; general economic

and business conditions in the United States and the Company’s markets outside the United States, including as a result of the war in Ukraine and the imposition of sanctions on Russia, the COVID-19 pandemic, conditions affecting employment levels, consumer confidence and spending, conditions in the retail environment, and other economic conditions affecting demand for the Company’s products and the financial health of the Company’s customers.

You are cautioned not to place undue reliance on any forward-looking statements we make, which are based only on information currently available to the Company and speak only as of the date hereof. A more detailed description of risk factors that may affect the Company’s operating results can be found in Part 1, Item 1A, Risk Factors, of the Company’s Annual Report on Form 10-K for fiscal year 2023, in Part II, Item 1A, Risk Factors, of the Company’s Quarterly Report on Form 10-Q for the third quarter of fiscal year 2024, and in the filings we make with Securities and Exchange Commission from time to time. We undertake no obligation to update any forward-looking statements, except as otherwise required by law.

No Offer or Solicitation

This communication is neither an offer to sell, nor a solicitation of an offer to buy any securities, the solicitation of any vote, consent or approval in any jurisdiction pursuant to or in connection with the Transaction (as defined below) or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

These materials may be deemed to be solicitation material in respect of the transaction among Vista Outdoor, Revelyst, Inc. (“Revelyst”), CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK Group a.s. (the “Transaction”). In connection with the Transaction, Revelyst, a subsidiary of the Company, filed with the SEC on January 16, 2024 a registration statement on Form S-4 in connection with the proposed issuance of shares of common stock of Revelyst to the Company stockholders pursuant to the Transaction, which Form S-4 includes a proxy statement of the Company that also constitutes a prospectus of Revelyst (the “proxy statement/prospectus”). INVESTORS AND STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE COMPANY’S PROXY STATEMENT/PROSPECTUS, BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION AND THE PARTIES TO THE TRANSACTION. After the Registration Statement is declared effective, Vista Outdoor will mail the definitive proxy statement/prospectus to each Vista Outdoor stockholder entitled to vote at the meeting relating to the approval of the Transaction. Investors and stockholders may obtain the proxy statement/ prospectus and any other documents free of charge through the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s website at www.vistaoutdoor.com.

Participants in Solicitation

The Company, Revelyst, CSG Elevate II Inc., CSG Elevate III Inc. and CZECHOSLOVAK GROUP a.s. and their respective directors, executive officers and certain other members of management and employees, under SEC rules, may be deemed to be “participants” in the solicitation of proxies from the Company’s stockholders in respect of the Transaction. Information about the Company’s directors and executive officers is set forth in the Company’s proxy statement on Schedule 14A for its 2023 Annual Meeting of Stockholders, which was filed with the SEC on June 12, 2023 and subsequent statements of changes in beneficial ownership on file with the SEC. These documents are available free of charge through the SEC’s website at www.sec.gov. Additional information regarding the interests of potential participants in the solicitation of proxies in connection with the Transaction, which may, in some cases, be different than those of the Company’s stockholders generally, is also included in the proxy statement/prospectus relating to the Transaction.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | February 2, 2024 | | VISTA OUTDOOR INC. |

| | | |

| | By: | Jung Choi |

| | Name: | /s/ Jung Choi |

| | Title: | Co-General Counsel & Secretary |

Exhibit 99.1

Revelyst Outlines Progress on GEAR Up Transformation Plan

The leading house of outdoor brands provides an update on the program designed to drive profitability and growth.

ANOKA, Minn. — Revelyst, a collective of world-class maker brands that design and manufacture performance gear and precision technologies, today announced an update on its GEAR Up transformation initiative. Revelyst, a segment of Vista Outdoor Inc. (NYSE: VSTO), is in the process of separating into a standalone public company, with an expected execution date later this year. As part of this process, Revelyst is working to unlock its potential by directing resources to better meet consumer demand, synergizing and prioritizing strength in supply chain, and doubling down on the equity and innovation of the company’s industry-leading brands.

Revelyst launched GEAR Up in the fiscal third quarter, quickly actioning the plan to simplify the company’s business model, deliver increased efficiency and profitability from that simplified structure, and reinvest in its highest potential brands to accelerate growth and transformation. These actions are in motion and will have an estimated $100 million of realized annual cost savings by fiscal year 2027. This is in addition to the previously announced $50 million cost restructuring program, of which $25 million in savings was specifically related to Revelyst, for a total of $125 million in expected run-rate cost savings.

The company continues to make progress on GEAR Up and is executing against the previously outlined goals. GEAR Up actions announced today include:

•Expanding select roles to take on cross-brand scope as the company identifies synergies across each platform.

•Bringing together teams at dedicated platform locations to drive the culture necessary to achieve brand goals.

•Eliminating duplicative roles as the platforms consolidate.

As part of these measures, the company will close offices in Petaluma, California; Overland Park, Kansas; Eagle, Colorado; and Madison, Mississippi. Revelyst is consolidating teams across core locations, including:

•The Adventure Sports platform, led by Jeff McGuane, will consolidate in Irvine, California.

•The Outdoor Performance platform, led by Jordan Judd, will consolidate in Bozeman, Montana.

•And the Precision Sports and Technology platform, led by Jon Watters and Scott Werbelow, will consolidate in San Diego.

“While our business is stable, headwinds exist, and we need to make changes to grow and meet the financial plans we’ve established and believe in,” said Eric Nyman, CEO of Revelyst. “Our

bold and decisive actions to unlock the potential for Revelyst have us on the right path. Previous ways of working need to be challenged and adjusted to position us to where we aspire to be.

“The decisions to close offices and reduce headcount aren’t taken lightly, and though they are intended to position us for the future, we understand that they are difficult in the immediate,” Nyman continued. “I have incredible confidence in our ability to transition through this and gain strength because of it. GEAR Up is an integral component for transforming Revelyst into the world’s No. 1 house of brands.”

Platform Overview

•Precision Sports and Technology: Foresight Sports and Bushnell Golf

•Adventure Sports: Fox Racing, Bell Helmets, Giro Sport Design, CamelBak, QuietKat Electric Bikes, Blackburn and more.

•Outdoor Performance: Simms Fishing Products, Bushnell, Blackhawk, Stone Glacier, Camp Chef, Primos and more.

###

About Revelyst

Revelyst, a segment of Vista Outdoor Inc. (NYSE: VSTO), is a collective of world-class maker brands that design and manufacture performance gear and precision technologies. Our category-defining brands leverage meticulous craftsmanship and cross-collaboration to pursue new innovations that redefine what is humanly possible in the outdoors. Portfolio brands include Foresight Sports, Bushnell Golf, Fox, Bell, Giro, CamelBak, Bushnell, Simms Fishing and more. For more information, visit our website at www.revelyst.com.

Media Contact:

Media Contact:

Eric Smith

Phone: 720-772-0877

Email: media.relations@vistaoutdoor.com

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

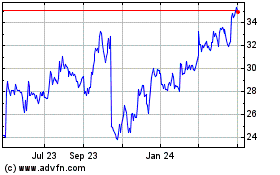

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From Apr 2024 to May 2024

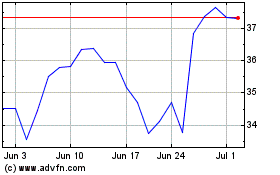

Vista Outdoor (NYSE:VSTO)

Historical Stock Chart

From May 2023 to May 2024