Company Issues Shareholder Letter

Vertical Aerospace Ltd. (“Vertical” or the "Company") (NYSE:

EVTL; EVTLW), a global aerospace and technology company that is

pioneering zero emission aviation, announces its financial results

for the third quarter ended September 30, 2022. The Company has

also issued a shareholder letter discussing its operating results

and management commentary, which is posted to its investor

relations website at investor.vertical-aerospace.com.

Stephen Fitzpatrick, Vertical Founder and CEO, said: “We

recently celebrated ‘wheels up’ with our VX4 aircraft a few weeks

ago which was an incredibly proud moment for the whole team. As we

ramp up our flight test programme, with a close eye on capital

spend, we are moving onwards and upwards. I look forward to sharing

more news about our flight test programme in the coming

months.”

Third Quarter 2022 and Recent Operational Highlights

- On September 22, 2022, the UK’s Civil Aviation Authority (CAA)

issued a Permit to Fly for the VX4, and on September 24, 2022, the

full-scale VX4 Prototype successfully lifted from the ground under

tethered conditions with pilot Justin ‘Jif’ Paines on board.

- To date, under its CAA Permit to Fly, Vertical has undertaken

14 piloted flight tests and 5.5 hours of continuous propeller

turning test operations.

- Vertical welcomed Amy Round as Chief People Officer, who joined

on October 17, 2022, from OVO Energy where she was Director of

Talent, having previously spent nine years at Google running its

EMEA people division.

- We have continued to progress our joint working group with

American Airlines. A joint Vertical and American team has been

regularly engaging during the third quarter, collaborating on a

framework for exploration of the future of advanced air mobility

and potential markets for eVTOL operations in the United States. As

a result of this workstream, and the increased depth of our joint

operational planning, we have agreed with American to extend the

timeline for entering into a master purchase agreement that will

contain the final terms for the purchase of our aircraft for up to

one year from the date of this release, to ensure it reflects the

final corporate framework and outputs of the detailed operational

planning.

Third Quarter 2022 Financial Highlights

- Vertical reported a net operating loss of £19m for the three

months ended September 30, 2022, compared to a net operating loss

of £8m for the three months ended September 30, 2021.

- As of September 30, 2022, Vertical had cash at bank and

short-term deposits totalling £145m, which will be invested in the

development of the company’s test and certification activities and

in the people, systems and processes that support the company.

- In August 2022, to support ongoing capital requirements,

Vertical established an equity subscription line with Nomura, which

will allow Vertical to issue up to $100 million in new ordinary

shares. This facility is intended to provide flexibility around the

timing of issuing new stock to minimise dilution.

- As of September 30, 2022, Vertical had issued 1,103,863

ordinary shares using the equity subscription line for an aggregate

gross purchase price of $8.9m, and up to $91.1m in aggregate gross

purchase price of ordinary shares remained available for sale under

the equity subscription line.

Financial Outlook

- The 2022 capital plan continues to remain on track, with net

cash outflows to be used in operating activities in the fourth

quarter of the year expected to be between £20m and £25m.

The above forward-looking statements reflect our expectations

for the three months ending December 31, 2022 as of November 9,

2022, and are subject to substantial uncertainty. Our results are

based on assumptions that we believe to be reasonable as of this

date, but may be materially affected by many factors, as discussed

below in “Forward-Looking Statements.”

About Vertical Aerospace

Vertical Aerospace is pioneering electric aviation. The company

was founded in 2016 by Stephen Fitzpatrick, an established

entrepreneur best known as the founder of the OVO Group, a leading

energy and technology group and Europe’s largest independent energy

retailer. Over the past six years, Vertical has focused on building

the most experienced and senior team in the eVTOL industry, who

have over 1,700 combined years of engineering experience, and have

certified and supported over 30 different civil and military

aircraft and propulsion systems. Vertical has forged strong

relationships with industry-leading players to develop the various

components of its aircraft and build a sophisticated eVTOL

ecosystem, creating efficiencies across the manufacturing

processes, aircraft operations and maintenance.

Vertical’s ordinary shares and warrants commenced trading on the

NYSE in December 2021 under the tickers “EVTL” and “EVTLW,”

respectively.

About the VX4 eVTOL Aircraft

The piloted zero operating emissions four-passenger VX4, is

projected to be capable of travelling distances over 100 miles,

achieving top speeds of up to 200mph, while producing minimal noise

and has a low cost per passenger mile. The VX4 is expected to open

up advanced air mobility to a whole new range of passengers and

transform how we travel. Find out more: vertical-aerospace.com

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Any express or implied statements contained in this press

release that are not statements of historical fact may be deemed to

be forward-looking statements, including, without limitation,

statements regarding the certification and the commercialization of

the VX4 and related timelines, including with respect to the US

market and expectations surrounding pre-orders and commitments,

Vertical’s differential strategy compared to its peer group, the

features and capabilities of the VX4, the transition towards a

net-zero emissions economy, the sufficiency of Vertical’s cash and

cash equivalents to fund operations, the plans and objectives of

management for future operations and capital expenditures, expected

financial performance and operational performance for the quarter

and fiscal year ending December 31, 2022, as well as statements

that include the words “expect,” “intend,” “plan,” “believe,”

“project,” “forecast,” “estimate,” “may,” “should,” “anticipate,”

“will,” “aim,” “potential,” “continue,” “are likely to” and similar

statements of a future or forward-looking nature. Forward-looking

statements are neither promises nor guarantees, but involve known

and unknown risks and uncertainties that could cause actual results

to differ materially from those projected, including, without

limitation: Vertical’s limited operating history without

manufactured non-prototype aircraft or completed eVTOL aircraft

customer order; Vertical’s history of losses and the expectation to

incur significant expenses and continuing losses for the

foreseeable future; the market for eVTOL aircraft being in a

relatively early stage; the potential inability of Vertical to

produce or launch aircraft in the volumes and on timelines

projected; the potential inability of Vertical to obtain the

necessary certifications on the timelines projected; any accidents

or incidents involving eVTOL aircraft could harm Vertical’s

business; Vertical’s dependence on partners and suppliers for the

components in its aircraft and for operational needs; the potential

that certain of Vertical’s strategic partnerships may not

materialize into long-term partnership arrangements; all of the

pre-orders Vertical has received for its aircraft are not legally

binding, conditional and may be terminated without penalty at any

time by either party, and if these orders are cancelled, modified,

delayed or not placed in accordance with the terms agreed with each

party, Vertical’s business, results of operations, liquidity and

cash flow will be materially adversely affected; any potential

failure by Vertical to effectively manage its growth; the impact of

COVID-19 on Vertical’s business; Vertical has identified material

weaknesses in its internal controls over financial reporting and

may be unable to remediate the material weaknesses; Vertical's

dependence on our senior management team and other highly skilled

personnel; as a foreign private issuer Vertical follows certain

home country corporate governance rules, is not subject to U.S.

proxy rules and is subject to Exchange Act reporting obligations

that, to some extent, are more lenient and less frequent than those

of a U.S. domestic public company; and the other important factors

discussed under the caption “Risk Factors” in our Annual Report on

Form 20-F filed with the U.S. Securities and Exchange Commission

(“SEC”) on April 29, 2022, as such factors may be updated from time

to time in Vertical’s other filings with the SEC. Any

forward-looking statements contained in this press release speak

only as of the date hereof and accordingly undue reliance should

not be placed on such statements. Vertical disclaims any obligation

or undertaking to update or revise any forward-looking statements

contained in this press release, whether as a result of new

information, future events or otherwise, other than to the extent

required by applicable law.

Unaudited Condensed Consolidated

Interim Statements of Operations and Comprehensive Loss

(in pounds thousands, except share and

per share data)

3 months ended September

30,

9 months ended September

30,

2022

2021

2022

2021

Revenue

-

66

-

132

Cost of sales

-

(40)

-

(65)

Gross profit

-

26

-

67

Research and development expenses

(9,747)

(5,120)

(29,143)

(11,627)

Administrative expenses

(9,783)

(5,247)

(33,249)

(30,377)

Related party administrative expenses

(15)

12

(15)

(115)

Other operating income

916

1,920

4,323

11,606

Operating loss

(18,629)

(8,409)

(58,084)

(30,446)

Finance income

238

14

238

14

Finance costs

(99,504)

(109)

(77,070)

(146)

Related party finance costs

-

-

-

(483)

Net finance income/(costs)

(99,266)

(95)

(76,832)

(615)

Loss before tax

(117,895)

(8,504)

(134,916)

(31,061)

Income tax expense

-

-

-

-

Net loss for the period

(117,895)

(8,504)

(134,916)

(31,061)

Foreign exchange translation

differences

8,947

-

18,429

-

Total comprehensive loss for the

period

(108,948)

(8,504)

(116,487)

(31,061)

Basic and diluted loss per share

£(0.66)

£(0.07)

£(0.76)

£(0.26)

Number of shares

178,427,999

129,727,235

178,376,519

120,003,967

Unaudited Condensed Consolidated

Interim Statements of Financial Position

(in pounds thousands)

September 30, 2022

December 31, 2021

Non-current assets

Property, plant and equipment

1,712

1,834

Right of use assets

2,007

1,969

Intangible assets

3,776

4,208

7,495

8,011

Current assets

Trade and other receivables

18,397

12,658

Short term deposits

61,076

-

Cash at bank

83,686

212,660

163,159

225,318

Total assets

170,654

233,329

Equity

Share capital

16

16

Other reserve

90,047

63,314

Share premium

256,837

248,354

Accumulated deficit

(384,980)

(250,123)

Total equity

(38,080)

61,561

Non-current liabilities

Long term lease liabilities

1,588

1,580

Provisions

99

95

Derivative financial liabilities

179,459

112,799

Trade and other payables

7,210

5,975

188,356

120,449

Current liabilities

Short term lease liabilities

430

362

Warrant liabilities

12,764

10,730

Trade and other payables

7,184

40,227

20,378

51,319

Total liabilities

208,734

171,768

Total equity and liabilities

170,654

233,329

Unaudited Condensed Consolidated

Interim Statements of Cash Flows

(in pounds thousands)

9 months ended September

30,

2022

2021

Cash flows from operating

activities

Net loss for the period

(134,916)

(31,061)

Adjustments to cash flows from non-cash

items

Depreciation and amortization

1,320

565

Depreciation on right of use assets

294

105

Finance (income)/costs

76,832

56

Related party finance costs

-

483

Share based payment transactions

8,025

16,815

Income tax expense/(benefit)

-

-

(48,445)

(13,037)

Working capital adjustments

Decrease/(Increase) in trade and other

receivables

1,652

(9,778)

(Decrease)/increase in trade and other

payables

(31,808)

5,972

Net cash flows used in operating

activities

(78,601)

(16,843)

Cash flows from investing

activities

Increase in short term deposits

(60,835)

-

Acquisitions of property plant and

equipment

(256)

(620)

Acquisition of intangible assets

(464)

(1,001)

Net cash flows used in investing

activities

(61,555)

(1,621)

Cash flows from financing

activities

Proceeds from secured convertible

notes

-

25,000

Proceeds from the issuance of share

capital

215

-

Proceeds from related party borrowings

-

2,208

Payments to lease creditors

(358)

(132)

Net cash flows (used)/generated from

financing activities

(143)

27,076

Net (decrease)/increase in cash at

bank

(140,299)

8,612

Cash at bank, beginning of the

period

212,660

839

Effect of foreign exchange rate

changes

11,325

52

Cash at bank, end of the period

83,686

9,503

Selected Notes and Supplemental

Disclosures

(in pounds thousands)

Other operating income

3 months ended September

30,

9 months ended September

30,

2022

2021

2022

2021

Government grants

187

891

1,401

9,890

R&D tax credit

729

1,029

2,922

1,716

916

1,920

4,323

11,606

Expenses by nature

3 months ended September

30,

9 months ended September

30,

2022

2021

2022

2021

Research and development staff costs

3,589

2,241

10,278

5,268

Research and development consultancy

3,608

692

11,544

1,744

Research and development components, parts

and tooling

2,550

2,187

7,321

4,615

Total research and development

9,747

5,120

29,143

11,627

Staff costs excluding share-based payment

expenses

2,556

1,871

8,284

4,390

Share based payment expenses

732

-

8,025

16,815

Consultancy costs

1,144

355

2,135

1,195

Legal and financial advisory costs

746

676

2,221

3,339

HR advisory and recruitment costs

538

837

1,682

1,422

IT Hardware and software costs

1,145

496

2,810

1,008

Related party administrative expenses

15

(12)

15

115

Insurance expenses

916

20

2,646

28

Marketing costs

621

529

1,376

1,019

Other administrative expenses

206

102

1,471

238

Premises expenses

587

91

985

208

Depreciation expense

163

96

423

258

Amortization expense

324

139

897

307

Depreciation on right of use property

assets

105

35

294

105

Total administrative costs

9,798

5,235

33,264

30,492

Total administrative and research and

development expenses

19,545

10,355

62,407

42,119

Share based payments In March 2022 the extant Vertical

Aerospace Group Ltd Enterprise Management Incentive (“EMI”) was

modified whereby all option holders exchanged their existing

options for newly issued options in the Company resulting in

23,213,933 replacement options being granted. A total credit of

£7,276 thousand has been recognised within other reserves during

the nine months ending September 30, 2022 relating to equity

settled share-based payment transactions in relation to employees

(September 30, 2021: £117 thousand). An additional £749 thousand

was recognised with respect to third parties (September 30, 2021:

£16,815 thousand).

Finance income/(costs)

3 months ended September

30,

9 months ended September

30,

2022

2021

2022

2021

In-kind interest on convertible loan

notes

(4,522)

-

(11,527)

-

Interest on loans from related parties

-

-

-

(483)

Foreign exchange loss

(17,861)

-

(30,842)

-

Fair value movements

-

(2)

-

(5)

Interest expense on leases

(35)

(17)

(102)

(51)

Fair value movements on convertible loan

notes

(71,260)

-

(33,167)

-

Fair value movements on warrant

liabilities

(5,795)

-

(1,422)

-

Other

(31)

(90)

(4)

(90)

Total finance costs

(99,504)

(109)

(77,070)

(629)

3 months ended September

30,

9 months ended September

30,

2022

2021

2022

2021

Interest on loans to related parties

238

-

238

-

Foreign exchange gain

-

14

-

14

Fair value movements on convertible loan

notes

-

-

-

-

Fair value movements on warrant

liabilities

-

-

-

Total finance income

238

14

238

14

Share capital and reserves

Allotted, called up and fully paid

shares

September 30, 2022

December 31, 2021

No.

£

No.

£

Ordinary of $0.0001 each

210,389,355

15,915

209,135,382

15,804

210,389,355

15,915

209,135,382

15,804

In addition, 101,350,465 shares had been authorised for

allotment at September 30, 2022.

Other reserves During the nine months ended September 30,

2022 other reserves increased by £1,010 thousand as a result of the

reclassification of warrants; £7,276 thousand in respect of share

based payments as a result of the modification of the EMI scheme;

and £18,429 thousand reflecting cumulative translation

differences.

Share Premium On June 5, 2022, a total of 150,000 shares

were issued to third parties resulting in increase in share premium

of £749 thousand. Following the establishment of an equity

subscription line, during the three months ended September 30, 2022

a total of 1,103,863 shares were issued resulting in an increase in

share premium of £7,734 thousand.

Warrant Liability As at September 30, 2022 and December

31, 2021, the following warrants were issued but not exercised and

therefore recorded as a liability:

September 30,

December 31,

2022

2021

Public Warrants

15,265,146

15,265,146

Mudrick Warrants

4,000,000

4,000,000

Outstanding, end of period

19,265,146

19,265,146

The following table shows the change in fair value of the

warrants during the period ended September 30, 2022:

£ 000

December 31, 2021

10,730

Addition/(Disposal) of private placement

warrants

-

Reclassification of options to equity

(1,010)

Change in fair value

1,422

Exchange differences on translation

1,622

As at September 30, 2022

12,764

Each public warrant entitles the registered holder to purchase

one share of common stock at a price of $11.50 per share. Once

exercisable, the Company may redeem public warrants at a price of

$0.01 per warrant if the closing price of common stock equals or

exceeds $18.00 per share for any 20 trading days within a 30

trading day period.

Derivative financial liabilities Convertible Senior

Secured Notes consists of the following:

Mudrick

£ 000

As at December 31, 2021

112,799

Fair value movements

33,167

In-kind interest accrued

11,527

Exchange differences on translation

21,996

As at September 30, 2022

179,459

On December 16, 2021, Mudrick Capital Management purchased

Convertible Senior Secured Notes of an aggregate principal amount

of £151,000 thousand ($200,000 thousand) for an aggregate purchase

price of £145,000 thousand ($192,000 thousand). The Convertible

Senior Secured Notes are initially convertible into up to

18,181,820 ordinary shares at an initial conversion rate of 90.9091

ordinary shares per £824 ($1,000).

In accordance with International Financial Reporting Standards

9: Financial Instruments, this is treated as a hybrid instrument

and is designated in its entirety as fair value through profit or

loss.

The Company has elected to pay interest in-kind at 9% per annum.

Interest is paid semi-annually in arrears and on June 15, 2022 the

Company authorised the payment of interest by increasing the

nominal amount of the outstanding Convertible Senior Secured Notes

by £7,005 thousand ($8,950 thousand).

Several covenants exist including retention of $10 million cash.

Accordingly, cash at bank includes £8,953 thousand deemed to be

restricted as at September 30, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221109005188/en/

For more information: Vertical Media Victoria Madden (Head of

Communications) Victoria.madden@vertical-aerospace.com +44 7885

571989 Ambika Sharma nepeanverticalteam@nepean.co.uk +44 7596 474

020 Vertical Investors Eduardo Royes

investors@vertical-aerospace.com +1 (646) 200-8871

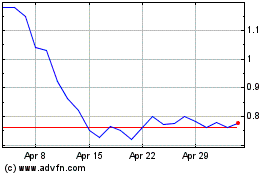

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Dec 2023 to Dec 2024