As

filed with the Securities and Exchange Commission on July 30, 2024

Registration

Number 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Velo3D,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

98-1556965 |

| (State

or other jurisdiction of incorporation or organization) |

|

(I.R.S.

Employer Identification Number) |

2710

Lakeview Court

Fremont,

California 94538

(408)

610-3915

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Bradley

Kreger

Chief

Executive Officer

2710

Lakeview Court

Fremont,

California 94538

(408)

610-3915

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Megan

A. Odroniec, Esq.

John

J. Wolfel, Esq.

Foley

& Lardner LLP

100

N. Tampa Street, Suite 2700

Tampa,

FL 33602

(813)

225-4117

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JULY 30, 2024

PRELIMINARY

PROSPECTUS

Velo3D,

Inc.

1,650,000

Shares of Common Stock

This

prospectus relates to the offer and sale from time to time by the selling stockholders named in this prospectus (the “Selling

Stockholders”) of up to 1,650,000 shares of our common stock, par value $0.00001 per share (our “common stock”),

issuable upon the exercise of the July 2024 Warrants (as defined below).

The

Selling Stockholders may offer, sell or distribute all or a portion of the shares of common stock hereby registered publicly or through

private transactions at prevailing market prices or at negotiated prices. We will not receive any of the proceeds from such sales of

the shares of our common stock. We will bear all costs, expenses and fees in connection with the registration of these shares of common

stock, including with regard to compliance with state securities or “blue sky” laws. The Selling Stockholders will bear all

commissions and discounts, if any, attributable to their sale of shares of our common stock. See “Plan of Distribution”

beginning on page 9 of this prospectus.

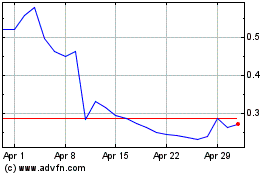

Our

common stock is listed on the New York Stock Exchange (the “NYSE”) under the symbol “VLD.” On July 29,

2024, the last reported sales price of our common stock on the NYSE was $2.89 per share.

We

are an “emerging growth company” and a “smaller reporting company” as these terms are defined under the federal

securities laws and, as such, are subject to certain reduced public company reporting requirements.

Investing

in our common stock involves risks. See the section entitled “Risk Factors” beginning on page 4 of this prospectus, the section

entitled “Risk Factors” beginning on page 19 of our Annual Report on Form 10-K for the year ended December 31, 2023, which

is incorporated by reference in this prospectus, and the section entitled “Risk Factors” beginning on page 53 of our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024, which is incorporated by reference in this prospectus, to read about factors

you should consider before buying our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”)

using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to

time, sell or otherwise distribute the shares of common stock offered by them as described in the section titled “Plan of Distribution”

in this prospectus. We will not receive any proceeds from the sale by such Selling Stockholders of the shares of common stock offered

by them described in this prospectus.

Neither

we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than

those contained or incorporated by reference in this prospectus or any applicable prospectus supplement or, if permitted, any free writing

prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility

for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the Selling

Stockholders will make an offer to sell these shares of common stock in any jurisdiction where the offer or sale is not permitted.

We

may also provide a prospectus supplement or, if required, a post-effective amendment to the registration statement to add information

to, update or change information contained or incorporated by reference in this prospectus. You should read both this prospectus and

any applicable prospectus supplement or post-effective amendment to the registration statement together with the additional information

to which we refer you in the section of this prospectus entitled “Where You Can Find More Information; Incorporation by Reference.” Information incorporated by reference after the date of this prospectus may add, update or change information contained in this

prospectus. Any information in such subsequent filings that is inconsistent with this prospectus will supersede the information in this

prospectus or any earlier prospectus supplement.

Unless

the context otherwise requires, references in this prospectus to:

| ● | “Legacy

Velo3D” refer to Velo3D, Inc., a Delaware corporation, prior to the closing of

the Merger (as defined herein); |

| ● | “Velo3D”

refer to Velo3D, Inc., a Delaware corporation (f/k/a JAWS Spitfire Acquisition Corporation, a Cayman Islands exempted company, prior

to domestication), and its consolidated subsidiaries following the closing of the Merger; and |

| ● | “we,”

“us,” and “our” or the “Company”

refer to Velo3D following the closing of the Merger and to Legacy Velo3D prior to the closing

of the Merger. |

PROSPECTUS

SUMMARY

This

summary may not contain all the information that you should consider before investing in our common stock. You should read the entire

prospectus and the information incorporated by reference in this prospectus carefully, including “Risk Factors” and the financial

statements and related notes incorporated by reference herein, before making an investment decision.

Company

Overview

We

seek to fulfill the promise of additive manufacturing (“AM”), also referred to as three-dimensional printing or 3D

printing, to deliver breakthroughs in performance, cost and lead time in the production of high-value metal parts.

We

produce a fully integrated hardware and software solution based on our proprietary laser powder bed fusion (“L-PBF”)

technology, which greatly reduces and often eliminates the need for support structures. Our technology enables the production of highly

complex, mission-critical parts that existing AM solutions cannot produce without the need for redesign or additional assembly. Our Sapphire

family of systems gives our customers who are in space, aviation, defense, automotive, energy and industrial markets the freedom to design

and produce metal parts with complex internal features and geometries that had previously been considered impossible for AM. We believe

our technology is years ahead of competitors.

Our

technology is novel compared to other AM technologies based on its ability to deliver high-value metal parts that have complex internal

channels, structures and geometries. This affords a wide breadth of design freedom for creating new metal parts and it enables replication

of existing parts without the need to redesign the part to be manufacturable with AM. Because of these features, we believe our technology

and product capabilities are highly valued by our customers. Our customers are primarily original equipment manufacturers (“OEMs”)

and contract manufacturers who look to AM to solve issues with traditional metal parts manufacturing technologies. Those traditional

manufacturing technologies rely on processes, including casting, stamping and forging, that typically require high volumes to drive competitive

costs and have long lead times for production. Our customers look to AM solutions to produce assemblies that are lighter, stronger and

more reliable than those manufactured with traditional technologies. Our customers also expect AM solutions to drive lower costs for

low-volume parts and substantially shorter lead times. However, many of our customers have found that legacy AM technologies failed to

produce the required designs for the high-value metal parts and assemblies that our customers wanted to produce with AM. As a result,

other AM solutions often require that parts be redesigned so that they can be produced and frequently incur performance losses for high-value

applications.

In

contrast, our technology can deliver complex high value metal parts with the design advantages, lower costs and faster lead times associated

with AM, and generally avoids the need to redesign the parts. As a result, our customers have increasingly adopted our technology into

their design and production processes. We believe our value is reflected in our sales patterns, as most customers purchase a single machine

to validate our technology and purchase additional systems over time as they embed our technology in their product roadmap and manufacturing

infrastructure. We consider this approach a “land and expand” strategy, oriented around a demonstration of our value proposition

followed by increasing penetration with key customers.

The

Shares of Common Stock We Are Registering

The

shares of our common stock to which this prospectus relates are issuable upon the exercise of warrants (the “July 2024 Warrants”)

to purchase up to 1,650,000 shares of common stock that were issued to the Selling Stockholders on July 1, 2024 in a private placement

in connection with an amendment to our senior secured notes due 2026 (the “Secured Notes”). The July 2024 Warrants

are currently exercisable at an exercise price of $3.00 per share and will expire on the five-year anniversary of the date on which the

registration statement of which this prospectus forms a part is declared effective by the SEC. The Selling Stockholders may exercise

the July 2024 Warrants by paying the exercise price in cash or by electing to reduce the then outstanding principal amount under the

Secured Notes by an amount equal to the quotient of (A) any or all, at the option of the Selling Stockholders, of the amount of such

aggregate exercise price divided by (B) one and twenty hundredths (1.20). The July 2024 Warrants may also be exercised on an alternative

cashless basis under certain circumstances.

In

order to permit the public offer and resale from time to time of these shares of common stock by the Selling Stockholders, on July 1,

2024, we entered into a letter agreement (the “Letter Agreement”) with the Selling Stockholders. In accordance with

the terms of the Letter Agreement, we are using this prospectus to register up to 1,650,000 shares of common stock to be sold by the

Selling Stockholders from time to time after the date of this prospectus. The Selling Stockholders might not sell any or all of the shares

of common stock offered by this prospectus.

For

additional information, see our Current Report on Form 8-K filed on July 1, 2024, which is incorporated herein by reference.

Corporate

Information

We

were incorporated on September 11, 2020 as a special purpose acquisition company and a Cayman Islands exempted company under the name

JAWS Spitfire Acquisition Corporation (“JAWS Spitfire”). On December 7, 2020, JAWS Spitfire completed its initial

public offering of units. On September 29, 2021, JAWS Spitfire consummated a merger (the “Merger”) with Legacy Velo3D

pursuant to the Business Combination Agreement, dated as of March 22, 2021, by and among JAWS Spitfire, Spitfire Merger Sub, Inc., a

Delaware corporation, and Legacy Velo3D, as amended. In connection with the Merger, JAWS Spitfire’s jurisdiction of incorporation

was changed from the Cayman Islands to the State of Delaware and JAWS Spitfire changed its name to Velo3D, Inc.

Our

address is 2710 Lakeview Court, Fremont, CA 94538. Our telephone number is (408) 610-3915. Our website address is https://www.velo3d.com.

Information contained on our website or connected thereto does not constitute part of, and is not incorporated by reference into, this

prospectus or the registration statement of which it forms a part.

The

Offering

| Issuer |

|

Velo3D,

Inc. |

| |

|

|

| Shares

of common stock offered by the Selling Stockholders |

|

Up

to 1,650,000 shares of our common stock issuable upon the exercise of the July 2024 Warrants

|

| |

|

|

| Terms

of the offering |

|

The

Selling Stockholders will determine when and how they will dispose of the shares of common stock registered under this prospectus

for resale. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale of shares of common stock by the Selling Stockholders. |

| |

|

|

| NYSE

symbol |

|

Our

common stock is listed on the NYSE under the symbol “VLD.” |

| |

|

|

Risk

factors

|

|

Investing

in our shares of common stock involves a high degree of risk. Before buying any of our shares of common stock, you should carefully

read the discussion of material risks of investing in our shares of common stock. Please see the section entitled “Risk Factors”

beginning on page 4 of this prospectus, the section entitled “Risk Factors” beginning on page 19 of our Annual Report

on Form 10-K for the year ended December 31, 2023, which report is incorporated by reference in this prospectus, and the section

entitled “Risk Factors” beginning on page 53 of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024,

which report is incorporated by reference in this prospectus. |

RISK

FACTORS

An

investment in our shares of common stock involves a high degree of risk. You should consider the risk factors discussed below, as well

as the risk factors described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023, which report is incorporated herein by reference, the risk factors described in the “Risk Factors”

section of our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, which report is incorporated herein by reference,

and the factors and other information contained in or incorporated by reference in this prospectus or in any prospectus supplement or

post-effective amendment, if required, before purchasing any of our common stock. We may face additional risks and uncertainties that

are not presently known to us, or that we currently deem immaterial, which may also impair our business or financial condition. The occurrence

of any of these risks might cause you to lose all or part of your investments in the offered securities. See “Where

You Can Find More Information; Incorporation by Reference” and “Cautionary Note Regarding

Forward-Looking Statements.”

If

we are unable to regain compliance with the NYSE’s continued listing standards, the NYSE will delist our common stock, which would

negatively affect our Company, the price of our common stock and your ability to sell our common stock.

On

December 28, 2023, we received written notice from the NYSE that we were below compliance criteria pursuant to the continued listing

standards set forth in Section 802.01C of the NYSE’s Listed Company Manual as the average closing price of our common stock was

less than $1.00 per share over a consecutive 30 trading-day period. On June 13, 2024, we effected a 1-for-35 reverse stock split of our

common stock. On June 28, 2024, the NYSE confirmed that a calculation of our average stock price for the 30 trading days ended June 28,

2024, indicated that our stock price was above the NYSE’s minimum requirement of $1.00 based on a 30 trading-day average. Accordingly,

as of June 28, 2024, we were no longer considered below the $1.00 continued listing criterion. There can be no assurance, however, that

we will be able to maintain compliance with this continued listing standard.

On

July 8, 2024, we received written notice (the “Notice”) from the NYSE that we are not in compliance with the NYSE’s

continued listing standards set forth in Section 802.01B of the NYSE’s Listed Company Manual due to the fact that our average total

market capitalization over a consecutive 30 trading-day period was less than $50 million and, at the same time, our stockholders’

equity was less than $50 million. As set forth in the Notice, as of July 5, 2024, our 30 trading-day average market capitalization was

approximately $36.6 million and our last reported stockholders’ deficit, as of March 31, 2024, was approximately ($45.5) million.

In

accordance with applicable NYSE procedures, within 45 days from receipt of the Notice, we intend to submit a plan to the NYSE advising

it of the definitive action(s) we have taken, are taking, or plan to take that would bring us into compliance with the continued listing

standards within 18 months of receipt of the Notice (the “Cure Period”). The NYSE will review our plan and, within 45 days,

make a determination as to whether we have made a reasonable demonstration of our ability to come into conformity with the listing standards

within the Cure Period. If our plan is not accepted, the NYSE will initiate suspension and delisting procedures. If the NYSE accepts

our plan, our common stock will continue to be listed and traded on the NYSE during the Cure Period, subject to our compliance with the

other continued listing standards and continued periodic review by the NYSE of our progress with respect to our plan. If we fail to comply

with our plan or do not meet the continued listing standards at the end of the Cure Period, the NYSE will initiate suspension and delisting

procedures.

There

can be no assurance that the NYSE will accept our plan, that we will be able to comply with the plan, that we will be able to regain

compliance with this continued listing standard, or that will be able to maintain compliance with the other continued listing standards

of the NYSE. A delisting of our common stock would negatively impact us by, among other things, reducing the liquidity and market price

of our common stock; reducing the number of investors willing to hold or acquire our common stock, which could negatively impact

our ability to raise equity financing; and limiting our ability to issue additional securities or obtain additional financing in

the future. In addition, delisting from the NYSE may negatively impact our reputation and, consequently, our business.

Servicing

the Notes requires a significant amount of cash, and we may not have sufficient cash flow from our business to pay our obligations under

the Notes or our other permitted indebtedness.

Our

ability to make scheduled payments of principal or to pay interest on or to refinance the Secured Notes, the up to $35.0 million of additional

senior secured convertible notes due 2026, if issued (the “Additional Secured Convertible Notes” and collectively with the

Secured Notes, the “Notes”), or our other permitted indebtedness depends on our future performance and our ability to obtain

future financing, which are subject to economic, financial, competitive and other factors, some of which are beyond our control. As of

July 1, 2024, we had outstanding $27.9 million of Secured Notes, and the terms of the Secured Notes require us to pay approximately $33.5

million (or 120% of the outstanding principal amount of the Secured Notes) to repay the full principal amount of the Secured Notes. Unless

the holders of the Secured Notes (who are also referred to herein as the Selling Stockholders) cancel such redemptions, we are required

to redeem the entire outstanding amount of the Secured Notes, plus accrued and unpaid interest, between August 1, 2024 and

April 1, 2025, with redemption payments being made on the first day of each month in varying amounts.

Further,

if we issue any Additional Secured Convertible Notes, unless the holders (who are also referred to herein as the Selling

Stockholders) agree to further modify the redemption schedule or cancel such redemption payments, the terms of such Additional

Secured Convertible Notes would require us to pay 120% of the outstanding principal amount of such Additional Secured Convertible

Notes to repay the full principal amount of such Additional Secured Convertible Notes, with quarterly redemption payments, plus

accrued and unpaid interest, beginning on the first day of the first calendar month after such Notes are issued and continuing each

quarter until maturity in August 2026.

Our

business may not generate cash flow from operations in the future sufficient to satisfy our obligations under the Notes or our other

permitted indebtedness and, in particular, we expect that we will need to engage in additional financings to fund our operations in the

near term, the terms of which may be onerous or highly dilutive. If we are unable to generate such cash flow and obtain such additional

financing, we may be required to adopt one or more alternatives, such as reducing or delaying investments or capital expenditures, selling

assets, or refinancing or restructuring our indebtedness on terms that may be unfavorable. We may not prepay the Notes without the consent

of the holders, and our ability to refinance the Notes or our other permitted indebtedness will also depend on the capital markets and

our financial condition at such time. We may not be able to engage in any of these activities or engage in these activities on desirable

terms, which could result in a default on the Notes or our other indebtedness.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

matters discussed in this prospectus and the documents incorporated by reference in this prospectus may constitute forward-looking statements

for purposes of the Securities Act of 1933, as amended (the “Securities Act”), and the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and involve known and unknown risks, uncertainties and other factors that may

cause our actual results, performance or achievements to be materially different from the future results, performance or achievements

expressed or implied by such forward-looking statements. The words “anticipate,” “believe,” “estimate,”

“may,” “expect” and similar expressions are generally intended to identify forward-looking statements. Our actual

results may differ materially from the results anticipated in these forward-looking statements due to a variety of factors, including,

without limitation, those discussed in the section entitled “Risk Factors,” and elsewhere in this prospectus and the

documents incorporated by reference herein, where such forward-looking statements appear. All written or oral forward-looking statements

attributable to us are expressly qualified in their entirety by these cautionary statements. Such forward-looking statements include,

but are not limited to, statements about:

| ● |

our

market opportunity; |

| ● |

the

ability to maintain the listing of our common stock on the NYSE, and the potential liquidity and trading of our common stock; |

| ● |

our

ability to execute our business plan, which may be affected by, among other things, competition, and our ability to grow and manage

growth profitably, maintain relationships with customers and retain our key employees; |

| ● |

changes

in applicable laws or regulations; |

| ● |

the

inability to develop and maintain effective internal control over financial reporting; |

| ● |

our

ability to service and comply with our indebtedness; |

| ● |

our

ability to raise financing in the future; |

| ● |

our

success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| ● |

the

period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital

expenditure requirements and our ability to continue as a going concern; |

| ● |

the

potential for our business development efforts to maximize the potential value of our portfolio; |

| ● |

regulatory

developments in the United States and foreign countries; |

| ● |

the

impact of laws and regulations; |

| ● |

our

expectations regarding our strategic realignment and related initiatives, and our strategic business review process; |

| ● |

our

estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| ● |

our

financial performance; |

| ● |

the

macroeconomic conditions, including economic downturns or recessions, inflation, interest rate fluctuations, supply chain shortages

and any lingering effects of the COVID-19 pandemic on the foregoing; and |

| ● |

other

factors detailed under the section entitled “Risk Factors”. |

The

forward-looking statements contained in this prospectus and the documents incorporated by reference herein reflect our views and assumptions

only as of the date of this prospectus or such document, as applicable. Except as required by law, we assume no responsibility for updating

any forward-looking statements.

We

qualify all of our forward-looking statements by these cautionary statements. In addition, with respect to all of our forward-looking

statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation

Reform Act of 1995.

USE

OF PROCEEDS

All

of the shares of common stock offered by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders

for their respective accounts. We will not receive any of the proceeds from these sales.

The

Selling Stockholders will pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage,

accounting, tax or legal services or any other expenses incurred by the Selling Stockholders in disposing of the shares of common stock.

We will bear the costs, fees and expenses incurred in effecting the registration of the shares of common stock covered by this prospectus,

including all registration and filing fees, NYSE listing fees and fees and expenses of our counsel and our independent registered public

accounting firm.

SELLING

STOCKHOLDERS

The

Selling Stockholders may offer and sell, from time to time, any or all of the shares of common stock being offered for resale by this

prospectus, which consists of up to 1,650,000 shares of common stock issuable upon the exercise of the July 2024 Warrants.

The

term “Selling Stockholders” includes the stockholders listed in the table below and their permitted affiliate transferees

who later come to hold any of the Selling Stockholders’ interest in the shares of common stock in accordance with the terms of

the Letter Agreement.

The

following tables provide, as of July 16, 2024, information regarding the beneficial ownership of our common stock of each Selling Stockholder,

the number of shares of common stock that may be sold by each Selling Stockholder under this prospectus and the number of shares of common

stock that each Selling Stockholder will beneficially own after this offering.

Because

each Selling Stockholder may dispose of all, none or some portion of their shares of common stock, if and to the extent such Selling

Stockholder exercises its July 2024 Warrant, no estimate can be given as to the number of shares of common stock that will be beneficially

owned by a Selling Stockholder upon termination of this offering. For purposes of the table below, however, we have assumed that after

termination of this offering none of the shares of common stock covered by this prospectus will be beneficially owned by the Selling

Stockholders and further assumed that the Selling Stockholders will not acquire beneficial ownership of any additional securities during

the offering. In addition, the Selling Stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise

dispose of, at any time and from time to time, our common stock in transactions exempt from the registration requirements of the Securities

Act after the date on which the information in the table is presented.

Under

the terms of the July 2024 Warrants, the Selling Stockholders may not receive any shares of our common stock otherwise deliverable upon

exercise of the July 2024 Warrants to the extent, but only to the extent, that such receipt would cause the Selling Stockholder (together

with the Selling Stockholder’s Affiliates and Attribution Parties (as such terms are defined in the July 2024 Warrants)) to become,

directly or indirectly, the beneficial owner of more than 4.99% of the shares of our common stock outstanding at such time.

We

may amend or supplement this prospectus from time to time in the future to update or change this Selling Stockholders list and the shares

of common stock that may be resold.

Please

see the section titled “Plan of Distribution” for further information regarding the Selling Stockholders’ method

of distributing these shares.

| |

|

Shares

of Common Stock |

|

| Name |

|

Number

Beneficially Owned Prior to Offering(1) |

|

|

Number

Registered for Sale Hereby |

|

|

Number

Beneficially Owned After Offering |

|

|

Percent

Owned After Offering(2) |

|

| High

Trail Investments ON LLC(3)(4) |

|

|

1,025,133 |

|

|

|

660,000 |

|

|

|

365,133 |

|

|

|

3.8 |

% |

| HB

SPV I Master Sub LLC(3)(4) |

|

|

1,537,699 |

|

|

|

990,000 |

|

|

|

547,699 |

|

|

|

5.4 |

% |

| (1) |

Figures

in this column consist of (i) shares of our common stock issuable upon exercise of the July 2024 Warrants and (ii) shares of our

common stock issuable upon exercise of the warrants previously issued to the Selling Stockholders on April 1, 2024 and December 29,

2023 (the “Prior Warrants”). |

| (2) |

The

percentage of shares to be beneficially owned after completion of the offering is calculated on the basis of 8,616,428 shares of

common stock outstanding as of July 16, 2024 and assumes (i) the issuance of all shares of common stock issuable upon the exercise

of the July 2024 Warrants held by such Selling Stockholder and the sale of all such common stock by such Selling Stockholder and

(ii) the issuance of all shares of common stock issuable upon the exercise of the Prior Warrants held by such Selling Stockholder,

in each case, without taking account of any limitation on exercise pursuant to the terms of the July 2024 Warrants and Prior Warrants,

as applicable. |

| (3) |

Hudson

Bay Capital Management LP, the investment manager of the Selling Stockholders, has voting and investment power over these securities.

Sander Gerber is the managing member of Hudson Bay Capital GP LLC, which is the general partner of Hudson Bay Capital Management

LP. Each of the Selling Stockholders and Sander Gerber disclaims beneficial ownership over these securities. The address of each

Selling Stockholder is c/o Hudson Bay Capital Management LP, 28 Havemeyer Place, 2nd Floor, Greenwich, CT 06830. |

| (4) |

In

addition to the entry into the Letter Agreement and the issuance of the July 2024 Warrants pursuant thereto, we have entered into

the following transactions with the Selling Stockholders: |

| |

● |

On

August 14, 2023, pursuant to a Securities Purchase Agreement, dated August 14, 2023, as amended (the “Securities Purchase

Agreement”), with the Selling Stockholders, we issued to the Selling Stockholders $70,000,000 aggregate principal amount

of our senior secured convertible notes due 2026 (the “Initial Secured Convertible Notes”). Pursuant to the Securities

Purchase Agreement, the Selling Stockholders have the right to purchase up to an additional $35.0 million in aggregate principal

amount of our senior secured convertible notes due 2026. |

| |

● |

On

November 28, 2023, pursuant to a Securities Exchange Agreement, dated November 27, 2023, with the Selling Stockholders, (i) we made

a cash payment to the Selling Stockholders of $15.0 million to repay $12.5 million of aggregate principal amount of the Initial Secured

Convertible Notes, together with accrued and unpaid interest (which interest rate was at the Default Interest rate provided in the

Initial Secured Convertible Notes and accrued as of October 1, 2023), (ii) the remaining Initial Secured Convertible Notes were exchanged

for (A) $57.5 million aggregate principal amount of Secured Notes and (B) 10,000,000 shares of common stock, and (iii) we made a

cash payment to the Selling Stockholders of accrued and unpaid interest (which interest rate was at the Default Interest rate provided

in the Initial Secured Convertible Notes and accrued as of October 1, 2023) on the remaining Initial Secured Convertible Notes so

exchanged. |

| |

|

|

| |

● |

On

December 29, 2023, (i) pursuant to a securities purchase agreement, dated December 27, 2023, with the Selling Stockholders, we sold

the Selling Stockholders 10,000,000 shares of common stock and warrants to purchase 10,000,000 shares of common stock for an aggregate

purchase price of $5.0 million, and (ii) pursuant to a note amendment to the Secured Notes, dated December 27, 2023, with the Selling

Stockholders, we made a cash payment to the Selling Stockholders of $25.0 million to repay approximately $20.8 million of aggregate

principal amount of the Secured Notes, together with accrued and unpaid interest, and made certain amendments to the Secured Notes.

In connection with the reverse stock split effected by the Company on June 13, 2024, the number of shares issuable upon exercise

of these warrants was decreased to 285,715 shares. |

| |

|

|

| |

● |

On

April 1, 2024, pursuant to a note amendment to the Secured Notes, dated March 31, 2024, with

the Selling Stockholders, we made a cash payment of $5.5 million to the Selling Stockholders

to repay approximately $4.2 million of aggregate principal amount of the Secured Notes, together

with accrued and unpaid interest, and on April 15, 2024, we made a cash payment of $5.5 million

to the Selling Stockholders to repay approximately $4.6 million of principal of the Secured

Note, together with accrued and unpaid interest. In connection with this note amendment,

on April 1, 2024, we also entered into a letter agreement, dated as of March 31, 2024, with

the Selling Stockholders pursuant to which we issued to the Selling Stockholders warrants

to purchase 21,949,079 shares of common stock. In connection with the reverse stock split

effected by the Company on June 13, 2024, the number of shares issuable upon exercise of

these warrants was decreased to 627,117 shares.

|

| |

|

|

| |

● |

On July 1, 2024, pursuant to a note amendment to the Secured Notes, dated July 1, 2024, with the Selling Stockholders, the parties

agreed to defer the July 1, 2024 partial redemption payment of $10.5 million over a period of ten equal monthly payments commencing

August 1, 2024 in consideration for the July 2024 Warrants. |

PLAN

OF DISTRIBUTION

The

Selling Stockholders, which as used herein includes permitted affiliate transferees, pledgees or other successors-in-interest selling

shares of our common stock or interests in our common stock received after the date of this prospectus from the Selling Stockholders

as a transfer, may, from time to time, sell, transfer, distribute or otherwise dispose of certain of their shares of common stock or

interests in our common stock on any stock exchange, market or trading facility on which shares of our common stock are traded or in

private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to

the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The

Selling Stockholders may use any one or more of the following methods when disposing of their shares of common stock or interests therein:

| ● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| ● |

block

trades (which may involve crosses) in which the broker-dealer will attempt to sell the shares of common stock as agent, but may position

and resell a portion of the block as principal to facilitate the transaction; |

| ● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its accounts; |

| ● |

an

exchange distribution and/or secondary distribution in accordance with the rules of the applicable exchange; |

| ● |

privately

negotiated transactions; |

| ● |

distributions

to their affiliates; |

| ● |

short

sales (including short sales “against the box”) effected after the date of the registration statement of which this prospectus

is a part is declared effective by the SEC; |

| ● |

through

the writing or settlement of standardized or over-the-counter options or other hedging transactions, whether through an options exchange

or otherwise; |

| ● |

in

market transactions, including transactions on a national securities exchange or quotations service or over-the-counter market; |

| ● |

by

pledge to secure debts and other obligations; |

| ● |

directly

to purchasers, including our affiliates and stockholders, in a rights offering or otherwise; |

| ● |

broker-dealers

may agree with the Selling Stockholders to sell a specified number of such shares of common stock at a stipulated price per share;

and |

| ● |

through

a combination of any of these methods or any other method permitted by applicable law. |

The

Selling Stockholders may effect the distribution of our common stock from time to time in one or more transactions either:

| ● |

at

a fixed price or prices, which may be changed from time to time; |

| ● |

at

market prices prevailing at the time of sale; |

| ● |

at

prices relating to the prevailing market prices; or |

The

Selling Stockholders may, from time to time, pledge or grant a security interest in some shares of our common stock owned by them and,

if a Selling Stockholder defaults in the performance of its secured obligations, the pledgees or secured parties may offer and sell such

shares of common stock, as applicable, from time to time, under this prospectus, or under an amendment or supplement to this prospectus

under Rule 424(b)(3) or other applicable provision of the Securities Act amending the list of the Selling Stockholders to include the

pledgee or other successors in interest as the Selling Stockholders under this prospectus.

The

Selling Stockholders may agree to indemnify a broker-dealer or agent against certain liabilities related to the sale of our common stock,

including liabilities under the Securities Act. The Selling Stockholders have advised us that they have not entered into any agreements,

understandings or arrangements with any underwriters or broker-dealers regarding the sale of their common stock. Upon our notification

by a Selling Stockholder that any material arrangement has been entered into with a broker-dealer for the sale of common stock through

a block trade, special offering, exchange distribution, secondary distribution or a purchase by a broker-dealer, we will file a supplement

to this prospectus, if required, pursuant to Rule 424(b) under the Securities Act, disclosing certain material information, including:

| ● |

the

name of the Selling Stockholder; |

| ● |

the

number of shares of common stock being offered; |

| ● |

the

terms of the offering; |

| ● |

the

names of the participating broker-dealers or agents; |

| ● |

any

discounts, commissions or other compensation paid to broker-dealers and any discounts, commissions or concessions allowed or reallowed

or paid by any dealers; |

| ● |

the

public offering price; |

| ● |

any

delayed delivery arrangements; and |

| ● |

other

material terms of the offering. |

In

addition, upon being notified by a Selling Stockholder that a permitted affiliate transferee, pledgee or other successor-in-interest

intends to sell common stock, we will, to the extent required, promptly file a supplement to this prospectus to name specifically such

person as a Selling Stockholder.

Agents,

broker-dealers or their affiliates may engage in transactions with, or perform services for, the Selling Stockholders (or their affiliates)

in the ordinary course of business. The Selling Stockholders may also use other third parties with whom such Selling Stockholders have

a material relationship.

The

Selling Stockholders (or their affiliates) will describe the nature of any such relationship in the applicable prospectus supplement.

There

can be no assurances that the Selling Stockholders will sell, nor are the Selling Stockholders required to sell, any or all of the common

stock offered under this prospectus.

In

connection with the sale of shares of our common stock or interests therein, the Selling Stockholders may enter into hedging transactions

with broker-dealers or other financial institutions, which may in turn engage in short sales of our common stock in the course of hedging

the positions they assume. The Selling Stockholders may also sell shares of our common stock short and deliver these securities to close

out their short positions, or loan or pledge shares of our common stock to broker-dealers that in turn may sell these securities. The

Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation

of one or more derivative securities that require the delivery to such broker-dealer or other financial institution of shares of our

common stock offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus

(as supplemented or amended to reflect such transaction).

The

aggregate proceeds to the Selling Stockholders from the sale of shares of our common stock offered by them will be the purchase price

of such shares of our common stock less discounts or commissions, if any. The Selling Stockholders reserve the right to accept and, together

with their agents from time to time, to reject, in whole or in part, any proposed purchase of shares of our common stock or warrants

to be made directly or through agents. We will not receive any of the proceeds from any offering by the Selling Stockholders.

The

Selling Stockholders also may in the future resell a portion of our common stock in open market transactions in reliance upon Rule 144

under the Securities Act, provided that they meet the criteria and conform to the requirements of that rule, or pursuant to other available

exemptions from the registration requirements of the Securities Act.

The

Selling Stockholders and any broker-dealers or agents that participate in the sale of shares of our common stock or interests therein

may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions

or profit they earn on any resale of shares of our common stock may be underwriting discounts and commissions under the Securities Act.

If any Selling Stockholder is an “underwriter” within the meaning of Section 2(11) of the Securities Act, then such Selling

Stockholder will be subject to the prospectus delivery requirements of the Securities Act. Dealers and agents may be entitled, under

agreements entered into with the Selling Stockholders, to indemnification against and contribution toward specific civil liabilities,

including liabilities under the Securities Act.

To

the extent required, our common stock to be sold, the respective purchase prices and public offering prices, the names of any agent or

dealer, and any applicable discounts, commissions, concessions or other compensation with respect to a particular offer will be set forth

in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this

prospectus. To facilitate the offering of shares of our common stock offered by the Selling Stockholders, certain persons participating

in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of our common stock. This may include

over-allotments or short sales, which involve the sale by persons participating in the offering of more shares of common stock than were

sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open

market or by exercising their over-allotment option, if any. In addition, these persons may stabilize or maintain the price of our common

stock by bidding for or purchasing shares of common stock in the open market or by imposing penalty bids, whereby selling concessions

allowed to dealers participating in the offering may be reclaimed if shares of common stock sold by them are repurchased in connection

with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of our common stock

at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time. These transactions

may be effected on any exchange on which the shares of common stock are traded, in the over-the-counter market or otherwise.

Under

the Letter Agreement, we have agreed to indemnify the applicable Selling Stockholders party thereto against certain liabilities that

they may incur in connection with the sale of the shares of common stock registered hereunder, including liabilities under the Securities

Act, and to contribute to payments that the Selling Stockholders may be required to make with respect thereto. In addition, the Selling

Stockholders may agree to indemnify any broker-dealer or agent against certain liabilities related to the selling of the shares of common

stock, including liabilities arising under the Securities Act.

Under

the Letter Agreement, we have agreed to maintain the effectiveness of the registration statement of which this prospectus forms a part

pursuant to such agreement until the earliest of (i) the one year anniversary of the expiration date of the July 2024 Warrants and (ii)

with respect to any Selling Stockholder, the date on which such Holder ceases to own any Registrable Securities (as defined in the Letter

Agreement). Pursuant to the Letter Agreement, the shares of common stock issued or issuable upon the exercise of the July 2024 Warrants

will cease to be Registrable Securities upon the earliest of (A) when they are sold by a Selling Stockholder (other than a sale to an

affiliate of the Selling Stockholder), whether pursuant to an effective registration statement under the Securities Act, pursuant to

Rule 144 under the Securities Act or otherwise, (B) when they shall have ceased to be outstanding, and (C) when they may be sold pursuant

to Rule 144 under the Securities Act without restriction on the basis of volume or manner of sale limitations.

We

have agreed to pay all expenses in connection with this offering, other than selling commissions, stock transfer taxes and certain legal

expenses. Selling Stockholders may use this prospectus in connection with resales of shares of our common stock. This prospectus and

any accompanying prospectus supplement will identify the Selling Stockholders, the terms of our common stock and any material relationships

between us and the Selling Stockholders. Selling Stockholders may be deemed to be underwriters under the Securities Act in connection

with shares of our common stock they resell and any profits on the sales may be deemed to be underwriting discounts and commissions under

the Securities Act. Unless otherwise set forth in a prospectus supplement, the Selling Stockholders will receive all the net proceeds

from the resale of shares of our common stock.

A

Selling Stockholder that is an entity may elect to make an in-kind distribution of common stock to its members, partners or stockholders

pursuant to the registration statement of which this prospectus is a part by delivering a prospectus, as amended or supplemented. To

the extent that such transferees are not affiliates of ours, such transferees will receive freely tradable shares of common stock pursuant

to the distribution effected through this registration statement.

LEGAL

MATTERS

The

validity of the shares of common stock offered hereby has been passed upon for us by Foley & Lardner LLP.

EXPERTS

The

financial statements incorporated in this prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2023

have been so incorporated in reliance on the report (which contains an explanatory paragraph relating to the Company’s ability

to continue as a going concern as described in Note 1 to the financial statements) of PricewaterhouseCoopers LLP, an independent registered

public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available

Information

We

file reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy and information

statements and other information about issuers, such as us, who file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

website address is www.velo3d.com. The information on our website, however, is not, and should not be deemed to be, a part of this prospectus.

This

prospectus and any applicable prospectus supplement are part of a registration statement that we filed with the SEC and do not contain

all of the information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided

below. Statements in this prospectus or any prospectus supplement about these documents are summaries, and each statement is qualified

in all respects by reference to the document to which it refers. You should refer to the actual documents for a more complete description

of the relevant matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation

by Reference

The

SEC’s rules allow us to “incorporate by reference” information into this prospectus, which means that we can disclose

important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference

is deemed to be part of this prospectus, and subsequent information that we file with the SEC will automatically update and supersede

that information. Any statement contained in this prospectus or a previously filed document incorporated by reference will be deemed

to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or a subsequently

filed document incorporated by reference modifies or replaces that statement.

This

prospectus incorporates by reference the documents set forth below that have previously been filed with the SEC:

| ● |

our

Current Reports on Form 8-K filed with the SEC on January 4, 2024 (but only with respect to Item 3.01), January 30, 2024, January 31, 2024, April 2, 2024, April 11, 2024 (but only with respect to Item 1.01 and Exhibits 4.1, 4.2, 5.1, 10.1, 10.2 and 23.1 thereto),

April 22, 2024 (but only with respect to Item 5.02 and Exhibits 10.1 and 10.2 thereto), June 12, 2024 (but only with respect to Items

3.03, 5.07 and 8.01 and Exhibits 3.1, 99.1, 99.2, 99.3, 99.4, 99.5, 99.6, and 99.7 thereto), June 17, 2024 (but only with respect

to Item 5.02) as amended by the Form 8-K/A filed on July 2, 2024, July 1, 2024, and July 12, 2024 (but only with respect to Item

3.01); |

| ● |

our

Definitive Proxy Statement on Schedule 14A filed with the SEC on April 29, 2024 (but only with respect to information required by

Part III of our Annual Report on Form 10-K for the year ended December 31, 2023); and |

| ● |

the

description of our common stock contained in our Registration Statement on Form 8-A filed with the SEC on December 2, 2020, as updated

by the description of our common stock contained in Exhibit 4.6 to our Annual Report on Form 10-K for the year ended December 31,

2022, including any subsequent amendments or reports filed for the purpose of updating such description. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination

of this offering, including all such documents we may file with the SEC after the date of filing of the initial registration statement

and prior to the effectiveness of the registration statement, but excluding any information furnished to, rather than filed with, the

SEC, will also be incorporated by reference into this prospectus and deemed to be part of this prospectus from the date of the filing

of such reports and documents.

We

will provide, without charge, to each person, including any beneficial owner, to whom a copy of this prospectus is delivered, upon written

or oral request of such person, a copy of any or all of the documents incorporated by reference in this prospectus, other than exhibits

to such documents unless such exhibits are specifically incorporated by reference into such documents. Requests may be made by telephone

at 1 (408)-610-3915, or by sending a written request to Velo3D, Inc., 2710 Lakeview Court, Fremont, CA 94538, Attention: Investor Relations.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution

The

following table sets forth the costs and expenses payable in connection with the offering of the securities being registered, all of

which will be paid by the registrant (except any underwriting discounts and commissions and expenses incurred by the Selling Stockholders

in disposing of the securities):

| SEC registration fee | |

$ | 735.50 | |

| Legal fees and expenses* | |

| * | |

| Accounting fees and expenses* | |

| * | |

| Printer fees and Miscellaneous expenses* | |

| * | |

| Total* | |

| * | |

| * |

Estimated

fees and expenses not currently known. |

Item

15. Indemnification of Officers and Directors

Section

145 of the Delaware General Corporation Law authorizes a court to award, or a corporation’s board of directors to grant, indemnity

to directors and officers under certain circumstances and subject to certain limitations. The terms of Section 145 of the Delaware General

Corporation Law are sufficiently broad to permit indemnification under certain circumstances for liabilities, including reimbursement

of expenses incurred, arising under the Securities Act of 1933, as amended (the “Securities Act”).

As

permitted by the Delaware General Corporation Law, the Registrant’s certificate of incorporation (as amended, the “Certificate

of Incorporation”), contains provisions that eliminate the personal liability of its directors and officers for monetary damages

for any breach of fiduciary duties as a director or officer, except liability for the following:

| ● |

any

breach of the director’s or officer’s duty of loyalty to the Registrant or its stockholders; |

| ● |

acts

or omissions not in good faith or that involve intentional misconduct or a knowing violation of law; |

| ● |

under

Section 174 of the Delaware General Corporation Law (regarding liability of directors for unlawful dividends and stock purchases);

or |

| ● |

any

transaction from which the director or officer derived an improper personal benefit. |

In

addition, the exculpation provision of the Certificate of Incorporation would not shield officers from liability for claims brought by

or in the right of the corporation, such as derivative claims.

As

permitted by the Delaware General Corporation Law, the Registrant’s amended and restated bylaws (the “Bylaws”) provide

that:

| ● |

the

Registrant is required to indemnify its directors and officers to the fullest extent permitted by the Delaware General Corporation

Law, subject to very limited exceptions; |

| ● |

the

Registrant is required to advance expenses, as incurred, to its directors and officers in connection with a legal proceeding to the

fullest extent permitted by the Delaware General Corporation Law, subject to limited exceptions; and |

| ● |

the

rights conferred in the Bylaws are not exclusive. |

The

Registrant has entered into indemnification agreements with its directors and executive officers, which provide for indemnification and

advancements by the Registrant of certain expenses and costs under certain circumstances. At present, there is no pending litigation

or proceeding involving a director or executive officer of the Registrant for which indemnification is sought. The indemnification provisions

in the Registrant’s Certificate of Incorporation, Bylaws and the indemnification agreements entered into between the Registrant

and each of its directors and executive officers may be sufficiently broad to permit indemnification of the Registrant’s directors

and executive officers for liabilities arising under the Securities Act.

The

Registrant has directors’ and officers’ liability insurance for securities matters.

Item

16. Exhibits

| |

|

|

|

Incorporated

by Reference |

| Exhibit

Number |

|

Exhibit

Title |

|

Form |

|

Exhibit |

|

Filing

Date |

|

Filed

Herewith |

| 2.1 |

|

Business Combination Agreement, dated as of March 22, 2021, by and among JAWS Spitfire Acquisition Corporation, Spitfire Merger Sub, Inc., and Velo3D, Inc. |

|

8-K |

|

2.1 |

|

03/23/2021 |

|

|

| 2.2 |

|

Amendment No. 1 to the Business Combination Agreement, dated July 20, 2021, by and among JAWS Spitfire Acquisition Corporation, Spitfire Merger Sub, Inc., and Velo3D, Inc. |

|

S-4/A |

|

Annex

AA |

|

07/20/2021 |

|

|

| 3.1 |

|

Certificate of Incorporation of Velo3D, Inc. |

|

8-K |

|

3.1 |

|

10/05/2021 |

|

|

| 3.1.1 |

|

Certificate of Amendment to the Certificate of Incorporation of Velo3D, Inc. |

|

8-K |

|

3.1 |

|

06/09/2023 |

|

|

| 3.1.2 |

|

Certificate of Amendment to the Certificate of Incorporation of Velo3D, Inc. |

|

8-K |

|

3.1 |

|

06/12/2024 |

|

|

| 3.3 |

|

Amended and Restated Bylaws of Velo3D, Inc. |

|

8-K |

|

3.1 |

|

02/22/2023 |

|

|

| 4.1 |

|

Specimen Ordinary Share Certificate |

|

S-1 |

|

4.2 |

|

11/27/2020 |

|

|

| 4.2 |

|

Certificate of Corporate Domestication of JAWS Spitfire Acquisition Corporation |

|

8-K |

|

4.4 |

|

10/05/2021 |

|

|

| 5.1 |

|

Legal Opinion of Foley & Lardner LLP |

|

|

|

|

|

|

|

X |

| 23.1 |

|

Consent of PricewaterhouseCoopers LLP, independent registered public accounting firm for Velo3D, Inc. |

|

|

|

|

|

|

|

X |

| 23.2 |

|

Consent of Foley & Lardner LLP (included as part of Exhibit 5.1) |

|

|

|

|

|

|

|

X |

| 24.1 |

|

Power of attorney (included on the signature page hereto) |

|

|

|

|

|

|

|

X |

Item

17. Undertakings

| (a) |

The

undersigned Registrant hereby undertakes: |

| (1) |

To

file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement: |

| (i) |

to

include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) |

to

reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate,

the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the “Calculation

of Filing Fee Tables” in the effective registration statement; and |

| (iii) |

to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement; |

provided,

however, that subparagraphs (i),(ii), and (iii) do not apply if the information required to be included in a post-effective amendment

by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the Registrant pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, that are incorporated by reference

in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration

statement.

| (2) |

That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a

new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be

deemed to be the initial bona fide offering thereof. |

| (3) |

To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering. |

| (4) |

That,

for the purpose of determining liability under the Securities Act to any purchaser: |

| (i) |

Each

prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date

the filed prospectus was deemed part of and included in the registration statement; and |

| (ii) |

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule

430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required

by Section 10(a) of the Securities Act shall be deemed to be part of and included in the registration statement as of the earlier of

the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering

described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter,

such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement

to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering

thereof. |

Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document

incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement

will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made

in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior

to such effective date.

| (b) |

The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of

an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the

registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof. |

| (c) |

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers, and controlling persons

of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities

and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred

or paid by a director, officer, or controlling person of the Registrant in the successful defense of any action, suit, or proceeding)

is asserted by such director, officer, or controlling person in connection with the securities being registered, the Registrant will,

unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction

the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the

final adjudication of such issue. |

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form S-3 and has duly caused this registration statement on Form S-3 to be signed on its behalf by

the undersigned, thereunto duly authorized, in the City of Fremont, State of California, on July 30, 2024.

| VELO3D,

INC. |

|

| |

|

|

| By: |

/s/

Bradley Kreger |

|

| |

Bradley

Kreger |

|

| |

Chief

Executive Officer |

|

| |

(Principal

Executive Officer) |

|

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Bradley Kreger and Hull

Xu, and each of them, as his or her true and lawful attorneys-in-fact, proxies and agents, each with full power of substitution and resubstitution

and full power to act without the other, for him or her in any and all capacities, to sign any and all amendments to this registration

statement (including post-effective amendments or any abbreviated registration statement and any amendments thereto filed pursuant to

Rule 462(b) increasing the number of securities for which registration is sought), and to file the same, with all exhibits thereto and

other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact, proxies and

agents full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith,

as fully for all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact,

proxies and agents, or their or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement on Form S-3 has been signed by the following

persons in the capacities and on the dates indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/

Bradley Kreger |

|

Chief

Executive Officer and Director

|

|

July

30, 2024 |

| Bradley

Kreger |

|

(Principal

Executive Officer) |

|

|

| |

|

|

|

|

| /s/

Hull Xu |

|

Chief

Financial Officer

|

|

July

30, 2024 |

| Hull

Xu |

|

(Principal

Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| /s/

Carl Bass |

|

Chairman

and Director |

|

July

30, 2024 |

| Carl

Bass |

|

|

|

|

| |

|

|

|

|

| /s/

Benyamin Buller |

|

Director |

|

July

30, 2024 |

| Benyamin

Buller |

|

|

|

|

| |

|

|

|

|

| /s/

Michael Idelchik |

|

Director |

|

July

30, 2024 |

| Michael

Idelchik |

|

|

|

|

| |

|

|

|

|

| /s/

Adrian Keppler |

|

Director |

|

July

30, 2024 |

| Adrian

Keppler |

|

|

|

|

| |

|

|

|

|

| /s/

Ellen Smith |

|

Director |

|

July

30, 2024 |

| Ellen

Smith |

|

|

|

|

| |

|

|

|

|

| /s/

Gabrielle Toledano |

|

Director |

|

July

30, 2024 |

| Gabrielle

Toledano |

|

|

|

|

| |

|

|