Vapotherm Announces $23 Million Private Placement

February 08 2023 - 6:50AM

Business Wire

Vapotherm, Inc. (NYSE: VAPO), (“Vapotherm” or the “Company”), a

global medical technology company focused on the development and

commercialization of its proprietary Vapotherm high velocity

therapy® products, which are used to treat patients of all ages

suffering from respiratory distress, today announced that it has

entered into a securities purchase agreement (the “Purchase

Agreement”) with a select group of institutional and accredited

investors through a private placement financing (“PIPE”) for gross

proceeds of approximately $23.0 million, before deducting fees to

the placement agent and other offering expenses. Pursuant to the

Purchase Agreement, the Company agreed to issue 17,502,244 shares

of its common stock and pre-funded warrants to purchase up to

4,402,508 shares of its common stock. The pre-funded warrants will

have a term of 30 years and an exercise price of $0.001 per share.

In addition, the Company agreed to issue accompanying warrants to

purchase one share of common stock for each share of common stock

or pre-funded warrant to be purchased by the investors. The

warrants will be exercisable immediately upon issuance, in whole or

in part, at an exercise price of $1.17 per share and will have a

5-year life. The closing is expected to occur on February 10, 2023,

subject to the satisfaction of customary closing conditions.

The Company intends to use the net proceeds from the offering

primarily for sales and marketing, working capital, and other

general corporate purposes.

William Blair & Company, L.L.C. acted as the sole placement

agent for this offering.

The securities to be issued and sold in the PIPE have not been

registered under the Securities Act of 1933, as amended, or the

securities laws of any state or other jurisdiction, and may not be

offered or sold in the United States except pursuant to an

effective registration statement or an applicable exemption from

the registration requirements. Pursuant to the terms of Purchase

Agreement, Vapotherm has agreed to file a registration statement

with the Securities and Exchange Commission registering the resale

of the securities sold in the PIPE.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or other jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of

any such state or other jurisdiction.

About Vapotherm

Vapotherm, Inc. (NYSE: VAPO) is a publicly traded developer and

manufacturer of advanced respiratory technology based in Exeter,

New Hampshire, USA. The Company develops innovative, comfortable,

non-invasive technologies for respiratory support of patients with

chronic or acute breathing disorders. Over 3.6 million patients

have been treated with the use of Vapotherm high velocity therapy®

systems.

Vapotherm high velocity therapy is mask-free non-invasive

respiratory support and is a front-line tool for relieving

respiratory distress—including hypercapnia, hypoxemia, and dyspnea.

It allows for the fast, safe treatment of undifferentiated

respiratory distress with one tool. The HVT 2.0 and Precision Flow

systems’ mask-free interfaces deliver optimally conditioned

breathing gases, making it comfortable for patients and reducing

the risks and care complexities associated with mask therapies.

While being treated, patients can talk, eat, drink and take oral

medication.

Legal Notice Regarding Forward-Looking Statements

This press release contains forward-looking statements under the

Private Securities Litigation Reform Act of 1995, including

statements regarding the timing and expectation of the closing of

the PIPE, the satisfaction of customary closing conditions related

to the PIPE and the expected use of proceeds from the PIPE. In some

cases, you can identify forward-looking statements by terms such as

‘‘expect,’’ “continue,” “plan,” “intend,” “will,” “outlook,”

“guidance,” or “typically,” or the negative of these terms or other

similar expressions, although not all forward-looking statements

contain these words, and the use of future dates. Each

forward-looking statement is subject to risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied in such statement. Applicable risks and

uncertainties include, but are not limited to the following:

Vapotherm has incurred losses in the past and may be unable to

achieve or sustain profitability in the future or achieve its 2022

or 2023 financial guidance; risks associated with the move of its

manufacturing operations to Mexico; Vapotherm’s ability to raise

additional capital to fund its existing commercial operations,

develop and commercialize new products, and expand its operations;

Vapotherm’s ability to comply with its $5 million minimum cash

covenant, execute on its path-to-profitability initiative, convert

$17 million of excess inventory into cash, fund its business

through 2023 and get it to Adjusted EBITDA positive in the fourth

quarter of 2023; Vapotherm’s dependence on sales generated from its

Precision Flow systems, competition from multi-national

corporations who have significantly greater resources than

Vapotherm and are more established in the respiratory market; the

ability for Precision Flow systems to gain increased market

acceptance; Vapotherm’s inexperience directly marketing and selling

its products; the potential loss of one or more suppliers and

dependence on its new third party manufacturer; Vapotherm’s

susceptibility to seasonal fluctuations; Vapotherm’s failure to

comply with applicable United States and foreign regulatory

requirements; the failure to obtain U.S. Food and Drug

Administration or other regulatory authorization to market and sell

future products or its inability to secure, maintain or enforce

patent or other intellectual property protection for its products;

the impact of the COVID-19 pandemic on its business, including its

supply chain, and the other risks and uncertainties included under

the heading “Risk Factors” in Vapotherm’s Annual Report on Form

10-K for the fiscal year ended December 31, 2021, as filed with the

Securities and Exchange Commission on February 24, 2022 and

Vapotherm’s most recent Quarterly Report on Form 10-Q for the

quarter ended September 30, 2022 as filed with the Securities and

Exchange Commission on November 2, 2022, and in any subsequent

filings with the Securities and Exchange Commission. The

forward-looking statements contained in this press release reflect

Vapotherm’s views as of the date hereof, and Vapotherm does not

assume and specifically disclaims any obligation to update any

forward-looking statements whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230208005374/en/

Investor Relations: Mark Klausner or Mike Vallie,

Westwicke, an ICR Company, ir@vtherm.com, +1 (603) 658-0011

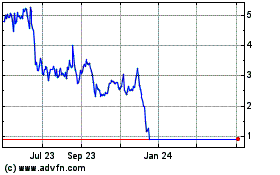

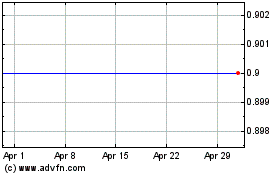

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From Aug 2024 to Sep 2024

Vapotherm (NYSE:VAPO)

Historical Stock Chart

From Sep 2023 to Sep 2024