FALSE000178339800017833982025-02-262025-02-260001783398us-gaap:CommonClassAMember2025-02-262025-02-260001783398us-gaap:WarrantMember2025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 26, 2025

UWM Holdings Corporation

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39189 | | 84-2124167 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification Number) |

| | | | | | | | | | | |

| | | |

| 585 South Boulevard E. | | |

Pontiac, | Michigan | | 48341 |

(Address of principal executive offices) | | (Zip Code) |

(800) 981-8898

(Registrant’s telephone number, including area code)

| | | | | | | | |

| | ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Class A Common Stock, par value $0.0001 per share | | UWMC | | New York Stock Exchange |

| Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 | | UWMCWS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025, UWM Holdings Corporation, (the “Company”) issued a press release announcing its results for the fourth quarter and full year ended December 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

Item 7.01 Regulation FD Disclosure.

On February 26, 2025, the Company announced that its Board of Directors had declared a cash dividend of $0.10 per share on the outstanding shares of Class A common stock. The dividend is payable on April 10 , 2025, to stockholders of record at the close of business on March 20, 2025. Additionally, the Board approved a proportional distribution to SFS Corp., which is payable on or about April 10 , 2025. To the extent required by law, the Company will post Form 8937, with respect to the U.S. federal income tax characteristics of this dividend, to its website at investors.uwm.com.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

As described in Item 2.02 of this Current Report on Form 8-K, the following exhibits are furnished as part of this Current Report.

| | | | | | | | |

| | |

Exhibit

No. | | Description |

| | |

| 99.1 | | | |

| | |

| 104 | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 26, 2025

| | | | | | | | |

| UWM HOLDINGS CORPORATION |

| |

| By: | | /s/ Andrew Hubacker |

| Name: | | Andrew Hubacker |

| Title: | | Executive Vice President, Chief Financial Officer and Chief Accounting Officer |

Exhibit 99.1

UWM Holdings Corporation Announces

Fourth Quarter & Full Year 2024 Results

Full Year 2024 Loan Origination Volume of $139.4 Billion and Gain Margin of 110 Basis Points

PONTIAC, MI, February 26, 2025 - UWM Holdings Corporation (NYSE: UWMC) (the "Company"), the publicly traded indirect parent of United Wholesale Mortgage (“UWM”), today announced its results for the fourth quarter and full year ended December 31, 2024. Total loan origination volume was $38.7 billion for the fourth quarter 2024 and $139.4 billion for the full year 2024. The Company reported 4Q24 net income of $40.6 million and full year 2024 net income of $329.4 million.

Mat Ishbia, Chairman and CEO of UWMC, said, "It's not by chance that UWM continues to perform at a high level - it's a result of relentless focus, innovation, and putting our mortgage broker partners first, every single day. Our dominance in the mortgage industry comes down to one simple truth: We never stop improving so we can be the best option for our partners and their borrowers. I am particularly proud of our team for delivering a record year of purchase production in 2024, which was the lowest year for existing home sales in the US since 1995. In addition we tripled our refinance volume in 2024 compared to 2023 despite the interest rate environment. We have also continued to invest in our people and technology such that we believe we can do double the volume without adding to our fixed costs. The broker channel is incredibly strong right now, as it continues to post a higher share of the industry. Together, our winning formula coupled with the momentum of the broker channel, will continue to be a championship combination in the future."

Fourth Quarter 2024 Highlights

•Originations of $38.7 billion in 4Q24, compared to $39.5 billion in 3Q24 and $24.4 billion in 4Q23

•Purchase originations of $21.9 billion in 4Q24, compared to $26.2 billion in 3Q24 and $20.7 billion in 4Q23

•Total gain margin of 105 bps in 4Q24 compared to 118 bps in 3Q24 and 92 bps in 4Q23

•Net income of $40.6 million in 4Q24 compared to net income of $31.9 million in 3Q24 and net loss of $461.0 million in 4Q23

•Adjusted EBITDA of $118.2 million in 4Q24 compared to $107.2 million in 3Q24 and $99.6 million in 4Q23

•Total equity of $2.1 billion at December 31, 2024, compared to $2.2 billion at September 30, 2024, and $2.5 billion at December 31, 2023

•Unpaid principal balance of MSRs of $242.4 billion with a WAC of 4.76% at December 31, 2024, compared to $212.2 billion with a WAC of 4.56% at September 30, 2024, and $299.5 billion with a WAC of 4.43% at December 31, 2023

•Ended 4Q24 with approximately $2.5 billion of available liquidity, including $507.3 million of cash and available borrowing capacity under our secured and unsecured lines of credit

Full Year 2024 Highlights

• Originations of $139.4 billion in 2024, compared to $108.3 billion in 2023

• Record purchase originations of $96.1 billion in 2024, compared to $93.9 billion in 2023

• Refinance originations of $43.4 billion in 2024, an increase of 201%, compared to $14.4 billion in 2023

• Net income of $329.4 million in 2024, as compared to a net loss of $69.8 million in 2023

• Gain margin of 110 bps in 2024, an increase of 19%, compared to 92 bps in 2023

Mat Ishbia, Chairman and CEO of UWMC, also said, "It's important for me to point out that while 2024 was certainly another challenging year for the industry, I am particularly proud of our team for delivering an almost 30% year-over-year increase in overall loan production and a nearly 20% increase in gain margin. I am excited to see what we can accomplish together in 2025."

Production and Income Statement Highlights (dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q4 2023 | | FY 2024 | | FY 2023 |

Loan origination volume(1) | | $ | 38,664,357 | | | $ | 39,509,521 | | | $ | 24,372,436 | | | $ | 139,433,406 | | | $ | 108,275,883 | |

Total gain margin(1)(2) | | 1.05 | % | | 1.18 | % | | 0.92 | % | | 1.10 | % | | 0.92 | % |

Net income (loss) | | $ | 40,613 | | | $ | 31,945 | | | $ | (460,956) | | | $ | 329,375 | | | $ | (69,782) | |

Diluted earnings (loss) per share | | 0.02 | | | (0.06) | | | (0.29) | | | 0.13 | | | (0.14) | |

Adjusted diluted earnings (loss) per share(3) | | N/A | | 0.01 | | | (0.23) | | | 0.16 | | | (0.04) | |

Adjusted net income (loss) (3) | | 33,040 | | | 23,334 | | | (361,002) | | | 257,303 | | | (57,142) | |

Adjusted EBITDA(3) | | 118,159 | | | 107,180 | | | 99,566 | | | 459,975 | | | 478,270 | |

| | | | | | | | | | |

(1) Key operational metric (see discussion below) | | | | | | | | |

(2) Represents total loan production income divided by loan origination volume. | | | | | | |

(3) Non-GAAP metric (see discussion and reconciliations below). | | | | | | | | |

Balance Sheet Highlights as of Period-end (dollars in thousands) | | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q4 2023 |

| Cash and cash equivalents | | $ | 507,339 | | | $ | 636,327 | | | $ | 497,468 | |

| Mortgage loans at fair value | | 9,516,537 | | | 10,141,683 | | | 5,449,884 | |

| Mortgage servicing rights | | 3,969,881 | | | 2,800,054 | | | 4,026,136 | |

| Total assets | | 15,671,116 | | | 15,119,798 | | | 11,871,854 | |

Non-funding debt (1) | | 3,401,066 | | | 2,410,714 | | | 2,862,759 | |

| Total equity | | 2,053,848 | | | 2,180,527 | | | 2,474,671 | |

Non-funding debt to equity (1) | | 1.66 | | | 1.11 | | | 1.16 | |

(1) Non-GAAP metric (see discussion and reconciliations below). | | | | | | |

Mortgage Servicing Rights (dollars in thousands) | | | | | | | | | | | | | | | | | | | | |

| | Q4 2024 | | Q3 2024 | | Q4 2023 |

| Unpaid principal balance | | $ | 242,405,767 | | | $ | 212,218,975 | | | $ | 299,456,189 | |

| Weighted average interest rate | | 4.76 | % | | 4.56 | % | | 4.43 | % |

| Weighted average age (months) | | 24 | | | 25 | | | 21 | |

Fourth Quarter Business and Product Highlights

TRAC Lite

•Introduced in select states to offer a low cost title option, potentially saving borrowers thousands of dollars per loan

ChatUWM Enhancements

•Significant enhancements help provide brokers with a faster, easier and more comprehensive loan experience. With these updates, ChatUWM has decreased the time it takes to calculate income from minutes to seconds, and provides brokers with personalized product recommendations for their borrowers in a matter of minutes

Conventional Cash-Out 90

•Created to help homeowners take full advantage of today's record-high home equity by allowing borrowers access to up to 89.99% loan-to-value (LTV) on their homes without incurring mortgage insurance

Net Promoter Score

•Achieved NPS of +82.5

Application to Clear to Close

•Delivered an average App to CTC of 17 business days

Product and Investor Mix - Unpaid Principal Balance of Originations (dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Purchase: | | Q4 2024 | | Q3 2024 | | Q4 2023 | | FY 2024 | | FY 2023 |

| Conventional | | $ | 13,841,424 | | | $ | 15,874,674 | | | $ | 12,033,818 | | | $ | 56,899,265 | | | $ | 58,833,673 | |

| Government | | 6,069,761 | | | 7,786,158 | | | 6,805,530 | | | 29,257,856 | | | 29,640,141 | |

Jumbo and other (1) | | 1,941,420 | | | 2,499,626 | | | 1,842,108 | | | 9,924,433 | | | 5,381,530 | |

| Total Purchase | | $ | 21,852,605 | | | $ | 26,160,458 | | | $ | 20,681,456 | | | $ | 96,081,554 | | | $ | 93,855,344 | |

| | | | | | | | | | |

| Refinance: | | Q4 2024 | | Q3 2024 | | Q4 2023 | | FY 2024 | | FY 2023 |

| Conventional | | $ | 8,898,500 | | | $ | 3,552,067 | | | $ | 1,386,645 | | | $ | 17,300,663 | | | $ | 7,082,401 | |

| Government | | 6,415,421 | | | 8,271,580 | | | 1,389,884 | | | 20,382,191 | | | 5,189,598 | |

Jumbo and other (1) | | 1,497,831 | | | 1,525,416 | | | 914,451 | | | 5,668,998 | | | 2,148,540 | |

| Total Refinance | | $ | 16,811,752 | | | $ | 13,349,063 | | | $ | 3,690,980 | | | $ | 43,351,852 | | | $ | 14,420,539 | |

| Total Originations | | $ | 38,664,357 | | | $ | 39,509,521 | | | $ | 24,372,436 | | | $ | 139,433,406 | | | $ | 108,275,883 | |

| | | | | | | | | | |

| (1) Comprised of non-agency jumbo products, construction loans, and non-qualified mortgage products, including home equity lines of credit ("HELOCs") (which in many instances are second liens). |

First Quarter 2025 Outlook

We anticipate first quarter production to be in the $28 to $35 billion range, with gain margin from 90 to 115 basis points.

Dividend

Subsequent to December 31, 2024, for the seventeenth consecutive quarter, the Company's Board of Directors declared a cash dividend of $0.10 per share on the outstanding shares of Class A common stock. The dividend is payable on April 10, 2025, to stockholders of record at the close of business on March 20, 2025. Additionally, the Board approved a proportional distribution to SFS Corp., which is payable on or around April 10, 2025.

Earnings Conference Call Details

As previously announced, the Company will hold a conference call for financial analysts and investors on Wednesday, February 26, 2025, at 11:00 AM ET to review the results and answer questions. Interested parties may register for a toll-free dial-in number by visiting:

https://registrations.events/direct/Q4I329117

Please dial in at least 15 minutes in advance to ensure a timely connection to the call. Audio webcast, taped replay and a transcript and supporting materials will be available on the Company's investor relations website at https://investors.uwm.com/.

Key Operational Metrics

“Loan origination volume” and “Total gain margin” are key operational metrics that the Company's management uses to evaluate the performance of the business. “Loan origination volume” is the aggregate principal of the residential mortgage loans originated by the Company during a period. “Total gain margin” represents total loan production income divided by loan origination volume for the applicable periods.

Non-GAAP Metrics

The Company's net income does not reflect the income tax provision that would otherwise be reflected if 100% of the economic interest in UWM was owned by the Company. Therefore, for comparison purposes, the Company provides “Adjusted net income (loss),” which is our pre-tax income (loss) together with an adjusted income tax provision (benefit), which is calculated as the provision for income taxes plus the tax effects of net income attributable to non-controlling interest determined using a blended statutory effective tax rate. “Adjusted net income (loss)” is a non-GAAP metric. "Adjusted diluted EPS" is defined as "Adjusted net income (loss)" divided by the weighted average number of shares of Class A common stock outstanding for the applicable period, assuming the exchange and conversion of all outstanding Class D common stock for Class A common stock, and is calculated and presented for periods in which the assumed exchange and conversion of Class D common stock to Class A common stock is anti-dilutive to EPS.

We also disclose Adjusted EBITDA, which we define as earnings before interest expense on non-funding debt, provision for income taxes, depreciation and amortization, stock-based compensation expense, the change in fair value of MSRs due to valuation inputs or assumptions, gains or losses on other interest rate derivatives, the impact of non-cash deferred compensation expense, the change in fair value of the Public and Private Warrants, the non-cash income/expense impact of the change in the Tax Receivable Agreement liability, and the change in fair value of retained investment securities. We exclude the non-cash income/expense impact of the change in the Tax Receivable Agreement liability, the change in fair value of the Public and Private Warrants, the change in fair value of retained investment securities, and the change in fair value of MSRs due to

valuation inputs or assumptions as these represent non-cash, non-realized adjustments to our earnings, which is not indicative of our performance or results of operations. Adjusted EBITDA includes interest expense on funding facilities, which are recorded as a component of interest expense, as these expenses are a direct operating expense driven by loan origination volume. By contrast, interest expense on non-funding debt is a function of our capital structure and is therefore excluded from Adjusted EBITDA.

In addition, we disclose “Non-funding debt” and the “Non-funding debt to equity ratio” as a non-GAAP metric. We define “Non-funding debt” as the total of the Company's senior notes, lines of credit, borrowings against investment securities, and finance leases and the “Non-funding debt-to-equity ratio” as total non-funding debt divided by the Company’s total equity.

Management believes that these non-GAAP metrics provide useful information to investors. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for any other operating performance measure calculated in accordance with GAAP and may not be comparable to a similarly titled measure reported by other companies.

The following tables set forth the reconciliations of these non-GAAP financial measures to their most directly comparable financial measure calculated in accordance with GAAP (dollars in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted net income | | Q4 2024 | | Q3 2024 | | Q4 2023 | | FY 2024 | | FY 2023 |

Earnings before income taxes | | $ | 42,332 | | | $ | 32,289 | | | $ | (468,408) | | | $ | 335,957 | | | $ | (76,293) | |

Adjusted income tax (provision) benefit | | (9,292) | | | (8,955) | | | 107,406 | | | (78,654) | | | 19,151 | |

Adjusted net income (loss) | | $ | 33,040 | | | $ | 23,334 | | | $ | (361,002) | | | $ | 257,303 | | | $ | (57,142) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted diluted EPS | | | | Q3 2024 | | Q4 2023 | | FY 2024 | | FY 2023 |

| Diluted weighted average Class A common stock outstanding | | | | 99,801,301 | | | 93,654,269 | | | 111,374,469 | | | 93,245,373 | |

Assumed pro forma conversion of Class D common stock (1) | | | | 1,498,013,741 | | | 1,502,069,787 | | | 1,486,115,849 | | | 1,502,069,787 | |

Adjusted diluted weighted average shares outstanding (1) | | | | 1,597,815,042 | | | 1,595,724,056 | | | 1,597,490,318 | | | 1,595,315,160 | |

| | | | | | | | | | |

Adjusted net income (loss) | | | | $ | 23,334 | | | $ | (361,002) | | | $ | 257,303 | | | $ | (57,142) | |

| Adjusted diluted EPS | | | | 0.01 | | | (0.23) | | | 0.16 | | | (0.04) | |

| (1) Reflects the pro forma exchange and conversion of antidilutive Class D common stock to Class A common stock. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Adjusted EBITDA | | Q4 2024 | | Q3 2024 | | Q4 2023 | | FY 2024 | | FY 2023 |

Net income (loss) | | $ | 40,613 | | | $ | 31,945 | | | $ | (460,956) | | | $ | 329,375 | | | $ | (69,782) | |

| Interest expense on non-funding debt | | 44,882 | | | 31,544 | | | 43,946 | | | 148,620 | | | 172,498 | |

Provision (benefit) for income taxes | | 1,719 | | | 344 | | | (7,452) | | | 6,582 | | | (6,511) | |

| Depreciation and amortization | | 11,094 | | | 11,636 | | | 11,472 | | | 45,474 | | | 46,146 | |

| Stock-based compensation expense | | 8,999 | | | 5,768 | | | 3,961 | | | 24,580 | | | 13,832 | |

Change in fair value of MSRs due to valuation inputs or assumptions | | (456,253) | | | 263,893 | | | 507,686 | | | (295,197) | | | 330,031 | |

Loss (gain) on other interest rate derivatives | | 469,538 | | | (226,936) | | | — | | | 215,436 | | | — | |

| Deferred compensation, net | | 2,191 | | | (11,434) | | | 3,300 | | | (9,349) | | | (7,938) | |

Change in fair value of Public and Private Warrants | | (8,495) | | | 5,829 | | | 4,808 | | | (5,091) | | | 6,060 | |

Change in Tax Receivable Agreement liability | | (110) | | | — | | | 260 | | | 70 | | | (1,575) | |

| Change in fair value of investment securities | | 3,980 | | | (5,409) | | | (7,459) | | | (526) | | | (4,491) | |

| Adjusted EBITDA | | $ | 118,159 | | | $ | 107,180 | | | $ | 99,566 | | | $ | 459,975 | | | $ | 478,270 | |

| | | | | | | | | | | | | | | | | | | | |

| Non-funding debt and non-funding debt to equity | | Q4 2024 | | Q3 2024 | | Q4 2023 |

| Senior notes | | $ | 2,785,326 | | | $ | 1,991,216 | | | $ | 1,988,267 | |

| Secured lines of credit | | 500,000 | | | 300,000 | | | 750,000 | |

| Borrowings against investment securities | | 90,646 | | | 93,662 | | | 93,814 | |

| Finance lease liability | | 25,094 | | | 25,836 | | | 30,678 | |

| Total non-funding debt | | $ | 3,401,066 | | | $ | 2,410,714 | | | $ | 2,862,759 | |

| Total equity | | $ | 2,053,848 | | | $ | 2,180,527 | | | $ | 2,474,671 | |

| Non-funding debt to equity | | 1.66 | | | 1.11 | | | 1.16 | |

Cautionary Note Regarding Forward-Looking Statements

This press release and our earnings call include forward-looking statements. These forward-looking statements are generally identified using words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict” and similar words indicating that these reflect our views with respect to future events. Forward-looking statements in this press release and our earnings call include statements regarding: (1) our position amongst our competitors and ability to capture market share; (2) our investment in our people, products and technology, and the benefits of our results; (3) our beliefs regarding opportunities in 2025 for our business and the broker channel; (4) our beliefs regarding operational profitability; (5) growth of the wholesale and broker channels, the impact of our strategies on such growth and the benefits to our business of such growth; (6) our growth and strategies to remain the leading mortgage lender, and the timing and drivers of that growth; (7) the benefits and liquidity of our MSR portfolio; (8) our beliefs related to the amount and timing of our dividend; (9) our expectations for future market environments, including interest rates, levels of refinance activity and the timing of such market changes; (10) our expectations related to production and margin in the first quarter of 2025; (11) the benefits of our business model, strategies and initiatives, and their impact on our results and the industry; (12) our performance in shifting market conditions and the comparison of such performance against our competitors; (13) our ability to produce results in future years at or above prior levels or expectations, and our strategies for producing such results; (14) our position and ability to capitalize on market opportunities and the impacts to our results; (15) our investments in technology and the impact to our operations, ability to scale and financial results and (16) our purchase production and product portfolio. These statements are based on management’s current expectations, but are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to materially differ from those stated or implied in the forward-looking statements, including: (i) UWM’s dependence on macroeconomic and U.S. residential real estate market conditions, including changes in U.S. monetary policies, more specifically caused by changes in Presidential Administration that affect interest rates and inflation; (ii) UWM’s reliance on its warehouse and MSR facilities and the risk of a decrease in the value of the collateral underlying certain of its facilities causing an unanticipated margin call; (iii) UWM’s ability to sell loans in the secondary market; (iv) UWM’s dependence on the government-sponsored entities such as Fannie Mae and Freddie Mac; (v) changes in the GSEs, FHA, USDA and VA guidelines or GSE and Ginnie Mae guarantees; (vi) UWM’s dependence on Independent Mortgage Advisors to originate mortgage loans; (vii) the risk that an increase in the value of the MBS UWM sells in forward markets to hedge its pipeline may result in an unanticipated margin call; (viii) UWM’s inability to continue to grow, or to effectively manage the growth of its loan origination volume; (ix) UWM’s ability to continue to attract and retain its broker relationships; (x) UWM’s ability to implement technological innovation, such as AI in our operations; (xi) the occurrence of a data breach or other failure of UWM’s cybersecurity or information security systems; (xii) the occurrence of data breaches or other cybersecurity failures at our third-party sub-servicers or other third-party vendors; (xiii) UWM’s ability to continue to comply with the complex state and federal laws, regulations or practices applicable to mortgage loan origination and servicing in general; and (xiv) other risks and uncertainties indicated from time to time in our filings with the Securities and Exchange Commission including those under “Risk Factors” therein. We wish to caution readers that certain important factors may have affected and could in the future affect our results and could cause actual results for subsequent periods to differ materially from those expressed in any forward-looking statement made by or on behalf of us. We undertake no obligation to update forward-looking statements to reflect events or circumstances after the date hereof.

About UWM Holdings Corporation and United Wholesale Mortgage

Headquartered in Pontiac, Michigan, UWM Holdings Corporation (UWMC) is the publicly traded indirect parent of United Wholesale Mortgage, LLC (“UWM”). UWM is the nation’s largest home mortgage lender, despite exclusively originating mortgage loans through the wholesale channel. UWM has been the largest wholesale mortgage lender for nine consecutive years and is the largest purchase lender in the nation. With a culture of continuous innovation of technology and enhanced client experience, UWM leads the market by building upon its proprietary and exclusively licensed technology platforms, superior service and focused partnership with the independent mortgage broker community. UWM originates primarily conforming and government loans across all 50 states and the District of Columbia. For more information, visit uwm.com or call 800-981-8898. NMLS #3038.

| | | | | | | | |

| For inquiries regarding UWM, please contact: |

| INVESTOR CONTACT | | MEDIA CONTACT |

| BLAKE KOLO | | NICOLE ROBERTS |

| InvestorRelations@uwm.com | | Media@uwm.com |

UWM HOLDINGS CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands, except shares and per share amounts)

| | | | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 | | |

| Assets | | | | | |

Cash and cash equivalents (includes restricted cash of $16.0 million and $1.0 million, respectively) | $ | 507,339 | | | $ | 497,468 | | | |

| Mortgage loans at fair value | 9,516,537 | | | 5,449,884 | | | |

| Derivative assets | 99,964 | | | 33,019 | | | |

| Investment securities at fair value, pledged | 103,013 | | | 110,352 | | | |

| Accounts receivable, net | 417,955 | | | 512,070 | | | |

| Mortgage servicing rights | 3,969,881 | | | 4,026,136 | | | |

| Premises and equipment, net | 146,199 | | | 146,417 | | | |

Operating lease right-of-use asset (includes $92,553 and $97,596 with related parties) | 93,730 | | | 99,125 | | | |

Finance lease right-of-use asset, net (includes $22,737 and $24,802 with related parties) | 23,193 | | | 29,111 | | | |

| Loans eligible for repurchase from Ginnie Mae | 641,554 | | | 856,856 | | | |

| Other assets | 151,751 | | | 111,416 | | | |

| Total assets | $ | 15,671,116 | | | $ | 11,871,854 | | | |

| Liabilities and Equity | | | | | |

| Warehouse lines of credit | $ | 8,697,744 | | | $ | 4,902,090 | | | |

| Derivative liabilities | 35,965 | | | 40,781 | | | |

| Secured line of credit | 500,000 | | | 750,000 | | | |

| Borrowings against investment securities | 90,646 | | | 93,814 | | | |

| Accounts payable, accrued expenses and other | 580,736 | | | 469,101 | | | |

| Accrued distributions and dividends payable | 159,827 | | | 159,572 | | | |

| | | | | |

| Senior notes | 2,785,326 | | | 1,988,267 | | | |

| | | | | |

Operating lease liability (includes $99,199 and $104,495 with related parties) | 100,376 | | | 106,024 | | | |

Finance lease liability (includes $24,608 and $26,260 with related parties) | 25,094 | | | 30,678 | | | |

| Loans eligible for repurchase from Ginnie Mae | 641,554 | | | 856,856 | | | |

| Total liabilities | 13,617,268 | | | 9,397,183 | | | |

| Equity: | | | | | |

Preferred stock, $0.0001 par value - 100,000,000 shares authorized, none issued and outstanding as of December 31, 2024 or December 31, 2023 | — | | | — | | | |

Class A common stock, $0.0001 par value - 4,000,000,000 shares authorized, 157,940,987 and 93,654,269 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | 16 | | | 10 | | | |

Class B common stock, $0.0001 par value - 1,700,000,000 shares authorized, none issued and outstanding as of December 31, 2024 or December 31, 2023 | — | | | — | | | |

Class C common stock, $0.0001 par value - 1,700,000,000 shares authorized, none issued and outstanding as of December 31, 2024 or December 31, 2023 | — | | | — | | | |

Class D common stock, $0.0001 par value - 1,700,000,000 shares authorized, 1,440,332,098 and 1,502,069,787 shares issued and outstanding as of December 31, 2024 and December 31, 2023, respectively | 144 | | | 150 | | | |

| Additional paid-in capital | 3,523 | | | 1,702 | | | |

| Retained earnings | 157,837 | | | 110,690 | | | |

| Non-controlling interest | 1,892,328 | | | 2,362,119 | | | |

| Total equity | 2,053,848 | | | 2,474,671 | | | |

| Total liabilities and equity | $ | 15,671,116 | | | $ | 11,871,854 | | | |

UWM HOLDINGS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except shares and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three months ended | | For the year ended |

| December 31,

2024 | | September 30,

2024 | | December 31,

2023 | | December 31,

2024 | | December 31,

2023 |

| Revenue | (Unaudited) | | (Unaudited) | | (Unaudited) | | | | |

| Loan production income | $ | 407,229 | | | $ | 465,548 | | | $ | 225,436 | | | $ | 1,528,840 | | | $ | 1,000,547 | |

| Loan servicing income | 173,300 | | | 134,753 | | | 206,498 | | | 636,665 | | | 818,703 | |

| Change in fair value of mortgage servicing rights | 309,149 | | | (446,100) | | | (634,418) | | | (294,999) | | | (854,148) | |

Gain (loss) on other interest rate derivatives | (469,538) | | | 226,936 | | | — | | | (215,436) | | | — | |

| Interest income | 140,067 | | | 145,297 | | | 87,901 | | | 508,621 | | | 346,225 | |

| Total revenue, net | 560,207 | | | 526,434 | | | (114,583) | | | 2,163,691 | | | 1,311,327 | |

| Expenses | | | | | | | | | |

| Salaries, commissions and benefits | 193,155 | | | 181,453 | | | 142,515 | | | 689,160 | | | 530,231 | |

| Direct loan production costs | 54,958 | | | 58,398 | | | 27,977 | | | 190,277 | | | 104,262 | |

| Marketing, travel, and entertainment | 30,771 | | | 22,462 | | | 25,600 | | | 96,782 | | | 84,515 | |

| Depreciation and amortization | 11,094 | | | 11,636 | | | 11,472 | | | 45,474 | | | 46,146 | |

| General and administrative | 60,314 | | | 53,664 | | | 38,209 | | | 209,838 | | | 170,423 | |

| Servicing costs | 29,866 | | | 25,009 | | | 29,632 | | | 110,986 | | | 131,792 | |

| Interest expense | 142,342 | | | 141,102 | | | 80,811 | | | 490,763 | | | 320,256 | |

Other expense (income) | (4,625) | | | 421 | | | (2,391) | | | (5,546) | | | (5) | |

| Total expenses | 517,875 | | | 494,145 | | | 353,825 | | | 1,827,734 | | | 1,387,620 | |

Earnings (loss) before income taxes | 42,332 | | | 32,289 | | | (468,408) | | | 335,957 | | | (76,293) | |

Provision (benefit) for income taxes | 1,719 | | | 344 | | | (7,452) | | | 6,582 | | | (6,511) | |

Net income (loss) | 40,613 | | | 31,945 | | | (460,956) | | | 329,375 | | | (69,782) | |

Net income (loss) attributable to non-controlling interest | 31,694 | | | 38,240 | | | (433,878) | | | 314,971 | | | (56,552) | |

| Net income (loss) attributable to UWMC | $ | 8,919 | | | $ | (6,295) | | | $ | (27,078) | | | $ | 14,404 | | | $ | (13,230) | |

| | | | | | | | | |

Earnings (loss) per share of Class A common stock: | | | | | | | | | |

| Basic | $ | 0.06 | | | $ | (0.06) | | | $ | (0.29) | | | $ | 0.13 | | | $ | (0.14) | |

| Diluted | $ | 0.02 | | | $ | (0.06) | | | $ | (0.29) | | | $ | 0.13 | | | $ | (0.14) | |

| Weighted average shares outstanding: | | | | | | | | | |

| Basic | 155,584,329 | | | 99,801,301 | | | 93,654,269 | | | 111,374,469 | | | 93,245,373 | |

| Diluted | 1,598,241,235 | | | 99,801,301 | | | 93,654,269 | | | 111,374,469 | | | 93,245,373 | |

Addendum to Exhibit 99.1

This addendum includes the Company's Consolidated Balance Sheets as of December 31, 2024, and the preceding four quarters and Statements of Operations for the quarter ended December 31, 2024, and the preceding four quarters for purposes of providing historical quarterly trending information to investors.

CONSOLIDATED BALANCE SHEETS

(in thousands, except shares and per share amounts)

| | | | | | | | | | | | | | | | | |

| December 31,

2024 | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 |

| Assets | | (Unaudited) | (Unaudited) | (Unaudited) | |

| Cash and cash equivalents, including restricted cash | $ | 507,339 | | $ | 636,327 | | $ | 680,153 | | $ | 605,639 | | $ | 497,468 | |

| Mortgage loans at fair value | 9,516,537 | | 10,141,683 | | 8,236,183 | | 7,338,135 | | 5,449,884 | |

| Derivative assets | 99,964 | | 66,977 | | 54,962 | | 34,050 | | 33,019 | |

| Investment securities at fair value, pledged | 103,013 | | 108,964 | | 105,593 | | 108,323 | | 110,352 | |

| Accounts receivable, net | 417,955 | | 561,901 | | 516,838 | | 554,443 | | 512,070 | |

| Mortgage servicing rights | 3,969,881 | | 2,800,054 | | 2,650,090 | | 3,191,803 | | 4,026,136 | |

| Premises and equipment, net | 146,199 | | 147,981 | | 146,750 | | 145,265 | | 146,417 | |

| Operating lease right-of-use asset | 93,730 | | 95,123 | | 96,474 | | 97,801 | | 99,125 | |

| Finance lease right-of-use asset, net | 23,193 | | 24,020 | | 25,061 | | 26,890 | | 29,111 | |

| Loans eligible for repurchase from Ginnie Mae | 641,554 | | 391,696 | | 279,290 | | 577,487 | | 856,856 | |

| Other assets | 151,751 | | 145,072 | | 130,247 | | 117,498 | | 111,416 | |

| Total assets | $ | 15,671,116 | | $ | 15,119,798 | | $ | 12,921,641 | | $ | 12,797,334 | | $ | 11,871,854 | |

| Liabilities and Equity | | | | | |

| Warehouse lines of credit | $ | 8,697,744 | | $ | 9,207,746 | | $ | 7,429,591 | | $ | 6,681,917 | | $ | 4,902,090 | |

| Derivative liabilities | 35,965 | | 93,599 | | 26,171 | | 26,918 | | 40,781 | |

| Secured line of credit | 500,000 | | 300,000 | | — | | 200,000 | | 750,000 | |

| Borrowings against investment securities | 90,646 | | 93,662 | | 91,406 | | 94,064 | | 93,814 | |

| Accounts payable, accrued expenses and other | 580,736 | | 573,865 | | 486,138 | | 477,765 | | 469,101 | |

| Accrued distributions and dividends payable | 159,827 | | 159,818 | | 159,766 | | 159,702 | | 159,572 | |

| | | | | |

| Senior notes | 2,785,326 | | 1,991,216 | | 1,990,233 | | 1,989,250 | | 1,988,267 | |

| Operating lease liability | 100,376 | | 101,833 | | 103,247 | | 104,637 | | 106,024 | |

| Finance lease liability | 25,094 | | 25,836 | | 26,787 | | 28,536 | | 30,678 | |

| Loans eligible for repurchase from Ginnie Mae | 641,554 | | 391,696 | | 279,290 | | 577,487 | | 856,856 | |

| Total liabilities | 13,617,268 | | 12,939,271 | | 10,592,629 | | 10,340,276 | | 9,397,183 | |

| Equity: | | | | | |

Preferred stock, $0.0001 par value - 100,000,000 shares authorized, none issued and outstanding as of each of the periods presented | — | | — | | — | | — | | — | |

Class A common stock, $0.0001 par value - 4,000,000,000 shares authorized; shares issued and outstanding - 157,940,987 as of December 31, 2024, 113,150,968 as of September 30, 2024, 95,587,806 as of June 30, 2024, 94,945,635 as of March 31, 2024 and 93,654,269 as of December 31, 2023 | 16 | | 11 | | 10 | | 9 | | 10 | |

Class B common stock, $0.0001 par value - 1,700,000,000 shares authorized, none issued and outstanding as of each of the periods presented | — | | | | | — | |

Class C common stock, $0.0001 par value - 1,700,000,000 shares authorized, none issued and outstanding as of each of the periods presented | — | | | | | — | |

Class D common stock, $0.0001 par value - 1,700,000,000 shares authorized; shares issued and outstanding - 1,440,332,098 as of December 31, 2024, 1,485,027,775 as of September 30, 2024 and 1,502,069,787 as each of the rest of periods presented | 144 | | 149 | | 150 | | 150 | | 150 | |

| Additional paid-in capital | 3,523 | | 2,644 | | 2,305 | | 2,085 | | 1,702 | |

| Retained earnings | 157,837 | | 116,561 | | 111,021 | | 111,980 | | 110,690 | |

| Non-controlling interest | 1,892,328 | | 2,061,162 | | 2,215,526 | | 2,342,834 | | 2,362,119 | |

| Total equity | 2,053,848 | | 2,180,527 | | 2,329,012 | | 2,457,058 | | 2,474,671 | |

| Total liabilities and equity | $ | 15,671,116 | | $ | 15,119,798 | | $ | 12,921,641 | | $ | 12,797,334 | | $ | 11,871,854 | |

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except shares and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | |

| For the three months ended |

| December 31,

2024 | September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 |

| Revenue | | | | | |

| Loan production income | $ | 407,229 | | $ | 465,548 | | $ | 357,109 | | $ | 298,954 | | $ | 225,436 | |

| Loan servicing income | 173,300 | | 134,753 | | 143,910 | | 184,702 | | 206,498 | |

| Change in fair value of mortgage servicing rights | 309,149 | | (446,100) | | (142,485) | | (15,563) | | (634,418) | |

Gain (loss) on other interest rate derivatives | (469,538) | | 226,936 | | 27,166 | | — | | — | |

| Interest income | 140,067 | | 145,297 | | 121,394 | | 101,863 | | 87,901 | |

| Total revenue, net | 560,207 | | 526,434 | | 507,094 | | 569,956 | | (114,583) | |

| Expenses | | | | | |

| Salaries, commissions and benefits | 193,155 | | 181,453 | | 160,311 | | 154,241 | | 142,515 | |

| Direct loan production costs | 54,958 | | 58,398 | | 45,485 | | 31,436 | | 27,977 | |

| Marketing, travel, and entertainment | 30,771 | | 22,462 | | 24,438 | | 19,111 | | 25,600 | |

| Depreciation and amortization | 11,094 | | 11,636 | | 11,404 | | 11,340 | | 11,472 | |

| General and administrative | 60,314 | | 53,664 | | 55,051 | | 40,809 | | 38,209 | |

| Servicing costs | 29,866 | | 25,009 | | 25,787 | | 30,324 | | 29,632 | |

| Interest expense | 142,342 | | 141,102 | | 108,651 | | 98,668 | | 80,811 | |

| Other expense (income) | (4,625) | | 421 | | (1,105) | | (237) | | (2,391) | |

| Total expenses | 517,875 | | 494,145 | | 430,022 | | 385,692 | | 353,825 | |

| Earnings (loss) before income taxes | 42,332 | | 32,289 | | 77,072 | | 184,264 | | (468,408) | |

| Provision (benefit) for income taxes | 1,719 | | 344 | | 786 | | 3,733 | | (7,452) | |

| Net income (loss) | 40,613 | | 31,945 | | 76,286 | | 180,531 | | (460,956) | |

| Net income (loss) attributable to non-controlling interest | 31,694 | | 38,240 | | 73,236 | | 171,801 | | (433,878) | |

| Net income (loss) attributable to UWMC | $ | 8,919 | | $ | (6,295) | | $ | 3,050 | | $ | 8,730 | | $ | (27,078) | |

| | | | | |

| Earnings (loss) per share of Class A common stock: | | | | | |

| Basic | $ | 0.06 | | $ | (0.06) | | $ | 0.03 | | $ | 0.09 | | $ | (0.29) | |

| Diluted | $ | 0.02 | | $ | (0.06) | | $ | 0.03 | | $ | 0.09 | | $ | (0.29) | |

| Weighted average shares outstanding: | | | | | |

| Basic | 155,584,329 | | 99,801,301 | | 95,387,609 | | 94,365,991 | | 93,654,269 | |

| Diluted | 1,598,241,235 | | 99,801,301 | | 95,387,609 | | 1,598,647,205 | | 93,654,269 | |

Cover

|

Feb. 26, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 26, 2025

|

| Entity Registrant Name |

UWM Holdings Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39189

|

| Entity Tax Identification Number |

84-2124167

|

| Entity Address, Address Line One |

585 South Boulevard E.

|

| Entity Address, City or Town |

Pontiac,

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48341

|

| City Area Code |

(800

|

| Local Phone Number |

981-8898

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001783398

|

| Amendment Flag |

false

|

| Class A Common Stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

UWMC

|

| Security Exchange Name |

NYSE

|

| Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50

|

| Trading Symbol |

UWMCWS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

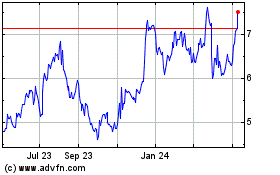

UWM (NYSE:UWMC)

Historical Stock Chart

From Feb 2025 to Mar 2025

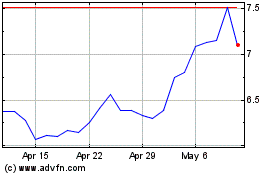

UWM (NYSE:UWMC)

Historical Stock Chart

From Mar 2024 to Mar 2025