UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant x |

| |

| Filed by a Party other than the Registrant ¨ |

| |

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting Material under §240.14a-12 |

| |

| United States Steel Corporation |

| (Name of Registrant as Specified In Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following excerpts are from an investor presentation posted

on Nippon Steel Corporation’s website on February 7, 2024.

TYO : 5401 OTC : NPSCY(ADR) Feb. 7 th , 2024 Q3 FY2023 Earnings Summary Notes on this presentation material Unless otherwise noted, all volume figures are presented in metric tons. Unless otherwise noted, all financial figures are on consolidated basis. Unless otherwise noted, net profit represents net profit attributable to owners of the parent.

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 2 Agenda 1. Q3 FY2023 Earnings Summary and FY2023 Earnings Forecast Summary / Additional Line Items, Net Profit / Dividend 2. Establishing an Enduring Business Structure Creating a business framework that maintains consistent profitability even in varying external conditions - Proceeding to Next Phase toward the realization of 100 Mt and 1 Tn. Vision - Strategy / Domestic Steel Business / Overseas Steel Business / Raw Material Business / Other Group Companies / Three Non - steel Segments 3. Progress in Carbon Neutral Vision 2050 4. HR and PR Initiatives to Recruit from and Retain Diverse Talent 5. References(Business Environment & Other T opics ) 6. Supplementary Materials for Financial Results

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 3 Roadmap for Growth Strategy FY2023 FY2024 FY2025 FY2026 ~ Investing Investment in ESS Capacity & Quality Enhancement N ext - G eneration H ot - S trip M ill at Nagoya Works Facility Structural Measures AM/NS India Expansion of U pstream F acilities, H ot - S trip M ill カナダ炭鉱 EVLP 出資 Approx. 10.0 bn. JPY Approx. 40.0 bn. JPY ~ 2023 Cost reduction Approx. 100.0 bn. JPY Total 150.0 bn. JPY H1 2023 Yawata, Hirohata #1 ҩ 2 Full operation H2 2024 Hirohata #3 Full operation H1 2027 Yawata #3, Sakai Full operation Q1 2026 Start of operation The end of H1 2024 Hanshin( Sakai ) Termination of a part of galvanizing lin e The end of 2024 Kashima One series of upstream facilities , Steel plate mill , Large shape mill termination Sophisti - cation of Order Mix Deepen and E xpand O verseas B usiness 213.0 Bn. JPY Approx. 270.0 Bn. JPY 410.0 Bn. INR ( Total JV Investing amount ) Approx. 200.0 Bn. JPY Acquisition of I nterest in EVR JV Nippon Steel Trading Becoming a subsidiary and delisting V ertically - Integrated Business Structure 137.0 Bn. JPY EVR JV Jan. - Mar. results to be consolidated in Nippon Steel Q1 2024 financial results No.2 BF, S teelmaking plant , Hot - strip mill Start of operation 2026 No.3 BF Start of operation Realize synergies Apr. 2023 Becoming subsidiary Acquisition of U. S. Steel 14,126 M$ Jan. 2024 Investment Dec . 2023 Agreement signed Sep. 2022 Decision U. S. Steel Shareholders m eeting , Receipt of regulatory approvals Nov. 2023 Agreement signed Expected to close in the second or third quarter of 2024CY

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 4 * In addition to capacities of 30 - 50% ownership companies as defined by World Steel Association, equity method affiliates less than 30% ownership (AGIS) are both included on a 100% capacity basis. T oward the vision of “ Global Crude Steel Capacity 100Mt ” Downstream Responding to local demand for high - grade steel products from Japanese customers extending their business overseas Global Steel Production Capacity* Total 19 21 43 4 Local mills of JV partners Domestic Overseas Upstream Downstream 47 66 17 80 Unit: Mt/Y As of Mar. 2023 Integrated steel mills Aiming at thoroughly capturing overseas local demand for steel and added - value of the integrated steel - making process 2014 2022 After acquisition of USS Long - term Vision Domestic 52 47 47 Overseas 6 19 39 > 60 Total 58 66 86 > 100 Home market ASEAN Growing India the US Largest market of high - grade steel To expand steel production into : » Markets where steel demand growth is promising » Markets where Nippon Steel’s technologies and products are highly appreciated To acquire brownfield production bases through M&A To expand integrated steel mill and create added value from the upstream Diversify Nippon Steel ’ s global footprint by three primary geographies P rogress toward the vision of Global Crude Steel Capacity 100Mt ● Acquisition of U. S. Steel ● Further capacity expansion in AM/NS India Further vision of M&A, equity participation or expansion of existing steel mills Further capacity expansion in Existing facilities Overseas Steel Business

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 5 Realize further growth of U . S . S teel by combining strengths of both companies Robust facilities organically combining iron ore mines, BFs, and EAFs Extensive U.S. Customer bases Well - established history Brand value Excellent Management and employees Strong relationship with unions Good retention ratio Well - developed, customer - oriented R&D system and bases Product Technologies Enhance product qualities of U. S. Steel by sharing cutting - edge technologies of automotive sheets and electric steel sheets Solid financial structure Cf. NSC U. S. Steel Moody’s Baa2 Ba3 S&P BBB+ BB - Decarbonization Technologies Share technologies including BF Hydrogen Reduction Technologies, etc Contribute to benefits for all the stakeholders of U. S. Steel by expanding its cash flow O perational, E quipment T echnologies Strengthening of BF integrated production of U. S. Steel Abundant operational experiences: 6 domestic Steelworks, 11 units of BFs And 51 production sites in 15 countries Honor the history and brand Continuation of the “United States Steel” name, brand, and the Pittsburgh, PA headquarters after acquisition Contribute technologies as well as R&D progress as a wholly - owned subsidiary Bring fresh investment and innovation to U.S. blast - furnace facilities and BRS and to strengthen its current products and services Overseas Steel Business

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 6 Contribute to benefits for all stakeholders Employees Customers Environment /Sustainability Shareholders All - cash offer of 55$/share for U. S. Steel shareholders Enhance Nippon Steel's consolidated profitability and potential for growth, and maximize shareholder value Access to Nippon Steel’s world - leading product technologies and know - hows enabling to provide highest - grade products and service including automotive sheets and electric steel sheet Continuation of supply of products and services to existing customers All of U. S. Steel’s commitments with its employees will continue to be honored. Employment and remuneration will be stabilized by enhancing profitability and financial soundness N o layoffs and no shift from existing production overseas will be conducted as a result of the transaction Becoming the cleanest steelmaker No change to existing manufacturing facilit ies as a result of the acquisition Enhance the whole supply chain resilience in the U.S. including not only the steel industry but primary industries such as automotive Contribute to enhancing competitiveness of U.S. industries Overseas Steel Business

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 7 • Bridge Finance for the transaction has been committed by leading Japanese banking institutions, and, in connection with the closing, these banking institutions may fund the financing in a combination of U.S. dollars and yen • Debt/equity ratio to go to 0.9 (from 0.5 (*) ) due to transaction payment (*) b ased on 9/30/23 balance sheet • Nippon Steel will aim to quickly recover to a debt/equity ratio of 0.7 or less through consolidated earnings and cash flow including U. S. Steel, and appropriate financing. 本体海外事業 MOVING FORWARD TOGETHER AS THE BEST STEELMAKER WITH WORLD - LEADING CAPABILITIES • Dec. 18, 2023 Merger Agreement signed • Establishing a wholly - owned subsidiary of Nippon Steel, merging it with U. S. Steel, which will become the surviving company. U . S . S teel shareholders will receive cash in exchange for U. S. Steel shares. - > U . S . S teel will bec o me a wholly - owned subsidiary of Nippon Steel . Acquisition Scheme Offer price • 40% premium over $39.33 per share on the business day prior to announcement (12/15) $55 per share Equity Value • All - cash offer for U. S. Steel shareholders • Enterprise value of $14.9 bn (approx. 2,120 bn), including the assumption of debt • 744$/one ton of crude steel production capacity ( =$14.9bn / 20 Mnt ) $14.1 bn ( approx. 2 , 01 0 bn ) Financing , Impact on financial strength Overseas Steel Business Acquisition of U. S. Steel ( Released on Dec. 18 th , 2023 ) Exchange rate: 142 yen/$ (as of 12/ 18)

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 8 Closing upon receipt of regulatory approvals ق Expected to close in the second or third quarter of 2024 ك Overseas Steel Business Progress Dialogue with U. S. Steel’s Stakeholders Working towards a successful closing of the acquisition U. S. Steel Shareholders Meeting Regulatory process » On January 24 , 2024, U. S. Steel filed its Preliminary Proxy Statement with the SEC for the requisite approval of the acquisition at a shareholders meeting to be held on a future date » We and U. S. Steel are pursuing required regulatory approvals in the United States and other jurisdictions » Our proposed acquisition of U. S. Steel was announced on December 18, 2023 » Since then, we have been engaging with U. S. Steel’s stakeholders through activities led by NSC executives focused on the benefits to all stakeholders » The acquisition will enhance U. S. Steel’s operations, the broader U.S. steel competitive landscape and the many industries that rely on it

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 9 Overview of U. S. Steel U.S. Europe Total Headquarters Pittsburgh, Pennsylvania, USA (remain unchanged after acquisition) Manufacturing bases <Flat - Rolled> : Gary (Indiana ) , Mon Valley (Pennsylvania) , Granite City (Illinois) , Great Lakes (Michigan) , PRO - TEC (Ohio) <Mini - Mill> : Big River Steel (Arkansas) <Tubular> : Fairfield (Alabama) Košice ( Slovakia ) Product types Steel sheets ( Hot - rolled sheets , Cold - rolled sheet s, Galvanized Sheets, Tin plate, Electrical steel sheets ), Pipes and tubes (Seamless pipes) Raw Steel Production Capability 15.8 Mt/Y (17.4Mst/Y) 4.5 Mt/Y (5.0Mst/Y) 20.3 M t /Y (22.4 M st /Y ) Raw Steel Production * 11.7 M t /Y (12.9 M st /Y incl. EAF 3.0Mst, EAF ratio 17 % to be expanded in the future ) 4.0 M t /Y (4.4 M st /Y ) 15.7 M t /Y (17.3 M st /Y ) Steel shipments * 10.5 M t /Y (11.6 M st /Y ) 3.5 M t /Y ( 3.9 M st /Y ) 14.1 M t /Y (15.5 M st /Y ) Iron ore mines owned Minntac , Keetac ( Minnesota ) Pellet Production 20.0 M t /Y ( 22.1 M st /Y ) All iron ore used in the U.S. is procured from in - house mined pellets . Net sales * 14,528 M$/Y 3,525 M$/Y 18,053 M$/Y Earnings before income taxes * 1,047 M$/Y Net earnings * 895 M$/Y Active Employees ** 13,995 7,808 21,803 * End of 2023CY, **2023CY t : metric ton st : short ton » Leading integrated BF and EAF manufacturer in the U.S. mainly Flat - Rolled sheets including for auto » Currently constructing Big River 2, which will increase EAF capacity and capability » Leveraging own iron ore mines, self - sufficient in pellets for BFs and EAFs, and pig iron for EAFs 8 BFs (Including 2 BFs idle) 3 EAFs (+2 EAFs under construction) U. S. Steel Acquisition

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 10 Creating new value by combining the techn ologies of both N ippon Steel and U. S. Steel After acquisition , study the detail of the potential synerg y P roduct T echnologies A uto motive sheets (high - grade), Processing technologies and solutions A uto motive sheets E lectrical steel sheets (high - grade) E lectrical steel sheets Highly corrosion - resistant plated steel sheet for building materials (high - grade) Highly corrosion - resistant steel sheet for building materials N ickel - coated steel sheets O perational, E quipment T echnologies Quality and Cost improvement technologies State - of - the - art thin - slab continuous casting and hot rolling facilities Maintenance technologies for integrated blast furnace facilities Energy - saving technologies Automation Technologies Technologies to recycle Decarbonization Technologies EAF process technologies (Mass production of high - grade steels) EAF Process Technologies BF Hydrogen Reduction Technologies Decarbonized raw material production technologies “ NSCarbolex TM Neutral” steel products CO 2 emissions savings in the steelmaking process are allocated " verdex TM " has a reduced carbon footprint of 70 - 80% U. S. Steel Acquisition

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 11 U. S. Steel : Volume, Price Trend 24.2 23.6 22.5 21.8 16.0 15.7 15.9 16.9 15.3 12.7 18.0 16.0 17.3 0 5 10 15 20 25 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Mon Valley Fairfield Europe ( Košice ) Graet Lakes Gary Lake Erie Tubular ( Fairfield ) Granite City Big River Granite City MSt /Y Crude steel production 22.3 21.7 20.4 19.8 15.5 15.0 15.2 15.7 15.1 12.2 16.0 14.9 15.5 0 5 10 15 20 25 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Flat - Rolled Mini Mill Tubular Europe 0 500 1000 1500 2000 2500 3000 3500 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Flat - Rolled Mini Mill Tubular Europe $/St Shipment Sales price Source : 10 - K MSt /Y U. S. Steel Acquisition

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 12 U. S. Steel : Financial Indicator Trends 265 247 (1,900) 413 (1,202) (201) 669 1,124 (230) (1,075) 4,946 3,160 799 (3,000) (2,000) (1,000) 0 1,000 2,000 3,000 4,000 5,000 6,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 M $/ Y Flat - Rolled Mini Mill Tubular Europe EBIT 946 908 (1,216) 1,040 (655) 306 1,170 1,645 386 (432) 5,737 3,951 1,715 (3,000) (2,000) (1,000) 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 M $/ Y Flat - Rolled Mini Mill Tubular Europe EBITDA 848 723 468 480 500 306 505 521 616 725 863 1,769 2,576 0 500 1,000 1,500 2,000 2,500 3,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 M$/Y Flat - Rolled Mini Mill Tubular Europe CAPEX (53) (124) (1,645) 102 (1,642) (440) 387 1,115 (630) (1,165) 4,174 2,524 895 (2,000) (1,000) 0 1,000 2,000 3,000 4,000 5,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 M$/Y Net earnings * Source : 10 - K U. S. Steel Acquisition

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 13 (5,130) 156 (20,000) (15,000) (10,000) (5,000) 0 5,000 10,000 15,000 2011 2013 2015 2017 2019 2021 2023 Units : M$ Benefit obligations Funded status Pension Benefits Plan assets Other Benefits U. S. Steel : Balance Sheet, Cash Flows ( The end of Dec. 2023 ) Units : M$ Cash 2,948 Inventories 2,128 Accounts Receivable 1,548 Machinery& Equipment , Lands 10,393 Current assets 6,943 Noncurrent assets 13,508 Other 319 Goodwill 920 Other 2,195 Current liabilities 3,948 Noncurrent Liabilities 5,363 Shareholders' Equity 11,047 Accounts Payable 3,028 Other 920 Other 1,283 Interest - bearing debt 4,080 Total assets : 20,451 Liabilities : 9,311 Shareholders' Equity : 11,047 Minority Interest : 93 Cash Flows Balance Sheet (3,000) (2,500) (2,000) (1,500) (1,000) (500) 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Operating CFs Investment CFs Units : M$/Y Operating CFs +Investment CFs Pension Benefits and Other Benefits Source : 10 - K U. S. Steel Acquisition

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 14 This presentation does not constitute an offer or invitation to subscribe for or purchase any securities and nothing containe d h erein shall form the basis of any contract or commitment whatsoever. This presentation is being furnished to you solely for your information and may not be re pro duced or redistributed to any other person. No warranty is given as to the accuracy or completeness of the information contained herein. Investors and pr osp ective investors in securities of any issuer mentioned herein are required to make their own independent investigation and appraisal of the business and financial con dition of such company and the nature of the securities. Any decision to purchase securities in the context of a proposed offering, if any, should be made sol ely on the basis of information contained in an offering circular published in relation to such an offering. By participating in this presentation, you agre e t o be bound by the foregoing limitations. This presentation contains statements that constitute forward looking statements. These statements appear in a number of pla ces in this presentation and include statements regarding the intent, belief or current expectations of Nippon Steel Corp. or its officers with respect to its fin anc ial condition and results of operations, including, without limitation, future loan loss provisions and financial support to certain borrowers. Such forward looking sta tements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in such forward looking statements as a result of various factors. The information contained in this presentation, is subject to change, including but not limited, to change of economic conditions , f inancial market conditions, and change of legislation / government directives. Any statements in this document. other than those of historical facts, are forward - looking statements about future performance o f Nippon Steel Corporation and its group companies, which are based on management’s assumptions and beliefs in light of information currently available, and inv olv e risks and uncertainties. Actual results may differ materially from these forecasts.

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 15 Additional Information and Where to Find It This presentation relates to the proposed transaction between the United States Steel Corporation (“U. S. Steel”) and Nippon Ste el Corporation (“NSC”). In connection with the proposed transaction, U. S. Steel has filed and will file relevant materials with the United Sta tes Securities and Exchange Commission (“SEC”), including U. S. Steel’s proxy statement on Schedule 14A (the “Proxy Statement”), a preliminary v ers ion of which was filed with the SEC on January 24, 2024. The information in the preliminary Proxy Statement is not complete and may be changed . T he definitive Proxy Statement will be filed with the SEC and delivered to stockholders of U. S. Steel. U. S. Steel may also file other docu men ts with the SEC regarding the proposed transaction. This presentation is not a substitute for the Proxy Statement or for any other document t hat may be filed with the SEC in connection with the proposed transaction. The proposed transaction will be submitted to U. S. Steel’s stockholders fo r their consideration. BEFORE MAKING ANY VOTING DECISION, U. S. STEEL’S STOCKHOLDERS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED O R TO BE FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT (A PRELIMINARY FILING OF WHICH HAS BEEN MADE WITH THE SEC), AS WELL A S ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT U. S. STEEL, NSC AND THE PROPOSED TRANSACTION. U. S. Steel’s stockholders will be able to obtain free copies of the preliminary Proxy Statement and the definitive Proxy Sta tem ent (the latter if and when it is available), as well as other documents containing important information about U. S. Steel, NSC and the proposed tr ans action once such documents are filed with the SEC, without charge, at the SEC’s website (www.sec.gov). Copies of the Proxy Statement and the o the r documents filed with the SEC by U. S. Steel can also be obtained, without charge, by directing a request to United States Steel Corpora tio n, 600 Grant Street, Pittsburgh, Pennsylvania 15219, Attention: Corporate Secretary; telephone 412 - 433 - 1121, or from U. S. Steel’s website www.usstee l.com.

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 16 Participants in the Solicitation NSC, U. S. Steel and their directors, and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from U. S. Steel’s stockholders in respect of the proposed transaction. Information regarding the directors and execu tiv e officers of U. S. Steel who may, under the rules of the SEC, be deemed participants in the solicitation of U. S. Steel’s stockholders in connec tio n with the proposed transaction, including a description of their direct or indirect interests, by security holdings or otherwise, will be set fo rth in the Proxy Statement, a preliminary version of which was filed with the SEC on January 24, 2024. Information about these persons is included in each com pany’s annual proxy statement and in other documents subsequently filed with the SEC, and was included in the preliminary version of the Pr oxy Statement filed with the SEC. Free copies of the Proxy Statement and such other materials may be obtained as described in the preceding parag rap h.

© 2024 NIPPON STEEL CORPORATION All Rights Reserved. 17 Forward - Looking Statements This presentation contains information regarding U. S. Steel and NSC that may constitute “forward - looking statements,” as that t erm is defined under the Private Securities Litigation Reform Act of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward - looking stateme nts to be covered by the safe harbor provisions for forward - looking statements in those sections. Generally, we have identified such forward - looking statements by using the words “ believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,” “future,” “will,” “may” and similar expressions or by using fu ture dates in connection with any discussion of, among other things, statements expressing general views about future operating or financial results, operating or financial performance, tre nds, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and operational cash improvements and changes in the gl oba l economic environment, the construction or operation of new or existing facilities or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction, including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that a sta tement is not forward - looking. Forward - looking statements include all statements that are not historical facts, but instead represent only U. S. Steel’s beliefs regarding f utu re goals, plans and expectations about our prospects for the future and other events, many of which, by their nature, are inherently uncertain and outside of U. S. Steel’s or NSC’s contr ol. It is possible that U. S. Steel’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these for ward - looking statements. Management of U. S. Steel or NSC, as applicable, believes that these forward - looking statements are reasonable as of the time made. However, caution should be tak en not to place undue reliance on any such forward - looking statements because such statements speak only as of the date when made. In addition, forward looking statements are s ubj ect to certain risks and uncertainties that could cause actual results to differ materially from U. S. Steel's or NSC’s historical experience and our present expectations or project ion s. Risks and uncertainties include without limitation: the ability of the parties to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and con ditions of any required governmental and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise to the te rmination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”); the possibility that U. S. Steel’s stockholders may not ap prove the proposed transaction; the risks and uncertainties related to securing the necessary stockholder approval; the risk that the parties to the Merger Agreement may n ot be able to satisfy the conditions to the proposed transaction in a timely manner or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions during the pendency of the proposed transaction that may impact U. S. Steel’s ability to pursue certain business opportunities or st rat egic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market price of U. S. Steel’s common stock or NSC’s co mmo n stock or American Depositary Receipts; the risk of any unexpected costs or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed tr ansaction; the risk that the proposed transaction and its announcement could have an adverse effect on the ability of U. S. Steel or NSC to retain customers and retain and hire key pe rso nnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships and on its operating results and business generally; and the risk the pending proposed transaction could distract management of U. S. Steel. U. S. Steel directs readers to its Quarterly Report on Form 10 - Q for the quarter ended September 30, 2023 and Form 10 - K for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated with U. S. Steel’s future performance. These d ocu ments contain and identify important factors that could cause actual results to differ materially from those contained in the forward - looking statements. Risks related to NSC’s forward - looking statements include, but are not limited to, changes in regional and global macroeconomic conditions, particularly in Japan, China and the United States; excess capacity and oversupply in the steel industry; unfair trade and pricing practices in NSC’s regional markets; the possibility of low steel prices or excess iron ore supply; the possibility o f s ignificant increases in market prices of essential raw materials; the possibility of depreciation of the value of the Japanese yen against the U.S. dollar and other major foreign currencies; the loss of market share to substitute materials; NSC’s ability to reduce costs and improve operating efficiency; the possibility of not completing planned alliances, acquisitions or investmen ts, or such alliances, acquisitions or investments not having the anticipated results; natural disasters and accidents or unpredictable events which may disrupt NSC’s supply chain as well as other events that may negatively impact NSC’s business activities; risks relating to CO2 emissions and NSC’s challenge for carbon neutrality; the economic, political, social and le gal uncertainty of doing business in emerging economies; the possibility of incurring expenses resulting from any defects in our products or incurring additional costs and reputational h arm due to product defects of other steel manufacturers; the possibility that we may be unable to protect our intellectual property rights or face intellectual property infringement clai ms by third parties; changes in laws and regulations of countries where we operate, including trade laws and tariffs, as well as tax, environmental, health and safety laws; and the pos sibility of damage to our reputation and business due to data breaches and data theft. All information in this presentation is as of the date above. Neither U. S. Steel nor NSC under tak es any duty to update any forward - looking statement to conform the statement to actual results or changes in U. S. Steel’s or NSC’s expectations whether as a result of new informat ion , future events or otherwise, except as required by law.

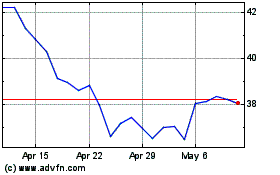

US Steel (NYSE:X)

Historical Stock Chart

From Apr 2024 to May 2024

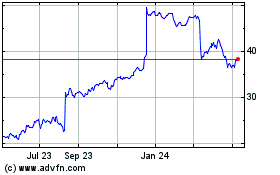

US Steel (NYSE:X)

Historical Stock Chart

From May 2023 to May 2024